Market Overview

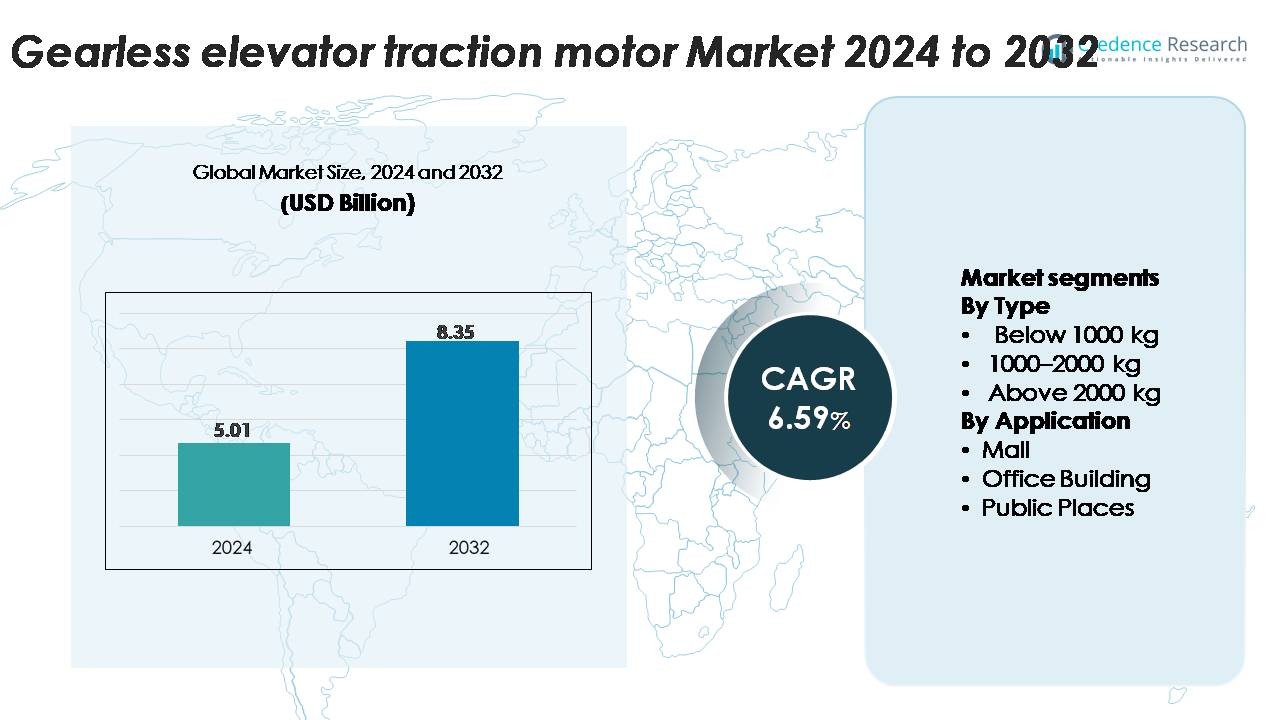

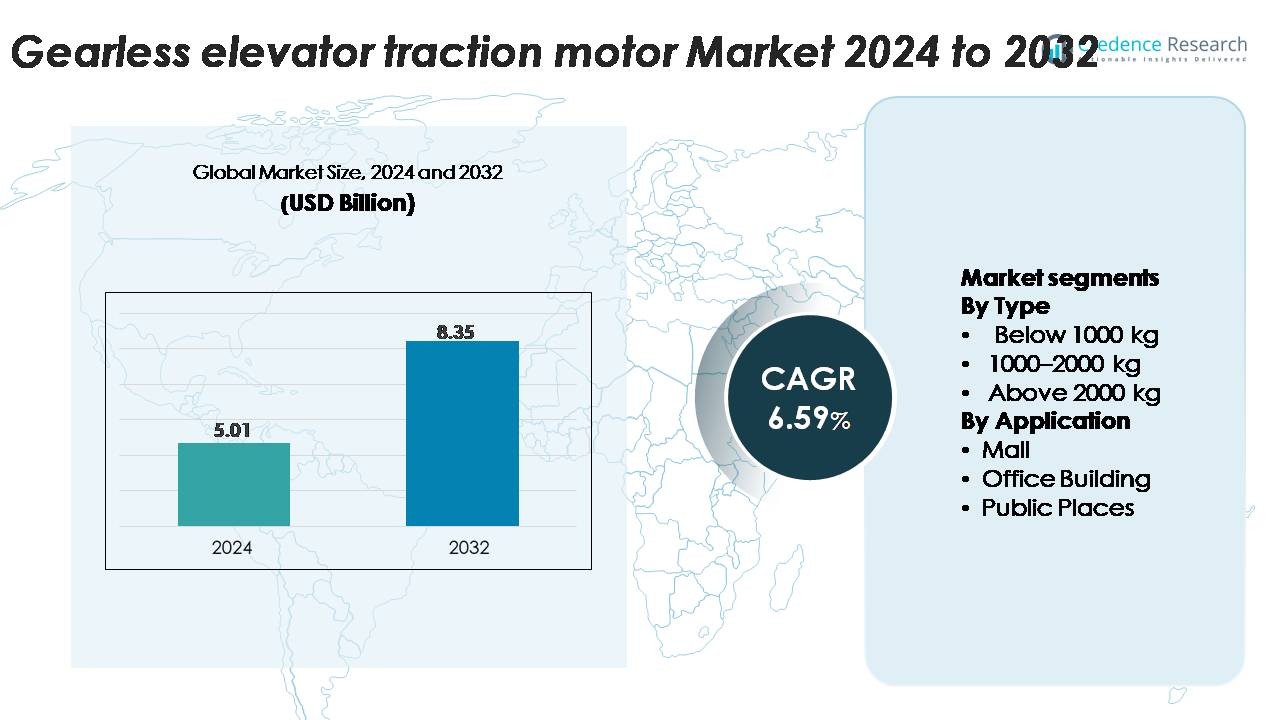

The global gearless elevator traction motor market was valued at USD 5.01 billion in 2024 and is projected to reach USD 8.35 billion by 2032, reflecting a CAGR of 6.59% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gearless Elevator Traction Motor Market Size 2024 |

USD 5.01 Billion |

| Gearless Elevator Traction Motor Market, CAGR |

6.59% |

| Gearless Elevator Traction Motor Market Size 2032 |

USD 8.35 Billion |

The gearless elevator traction motor market is shaped by strong competition among global leaders such as Kone, Otis, Mitsubishi Electric, Yaskawa, Imperial Electric, Ningbo Xinda Elevator Traction Technology, Suzhou Torin Drive Equipment Co. Ltd, Xizi Forvorda, Kinetek, Hiwin, and Shenyang Bluelight. These companies compete on high-efficiency motor designs, digital control integration, and modernization-focused product lines. Asia-Pacific remains the leading regional market with approximately 60% share, supported by aggressive high-rise construction, rapid urbanization, and large elevator manufacturing bases in China, Japan, and South Korea. North America and Europe follow with sizable modernization-driven demand, while the Middle East and Latin America continue to expand gradually through commercial and public-infrastructure projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The gearless elevator traction motor market reached USD 5.01 billion in 2024 and is projected to hit USD 8.35 billion by 2032, advancing at a 6.59% CAGR over the forecast period.

- Demand grows steadily as high-rise construction, elevator modernization, and energy-efficient mobility systems accelerate adoption of gearless motors, with the 1000–2000 kg segment holding the largest share due to its suitability for commercial and mixed-use buildings.

- Trends center on IoT-integrated motors, regenerative drive compatibility, and smart elevator ecosystems, supporting predictive maintenance and enhanced ride comfort across premium urban infrastructure.

- Competitive activity remains strong among Kone, Otis, Mitsubishi Electric, Yaskawa, Ningbo Xinda, Torin Drive, Xizi Forvorda, and Imperial Electric, each advancing efficiency, noise reduction, and lifecycle-cost improvements.

- Asia-Pacific leads with ~60% of global share, followed by North America (~15–20%) and Europe (~10–15%), while office buildings remain the dominant application segment across all major regions.

Market Segmentation Analysis:

By Type

The 1000–2000 kg segment holds the largest market share, driven by its suitability for mid- to high-rise commercial buildings that require high-torque, smooth, and energy-efficient operation. Gearless traction motors in this range support higher cabin capacities without compromising ride comfort, making them the preferred choice for new urban infrastructure and modernization programs. The Below 1000 kg category remains important for residential and low-rise deployments, while the Above 2000 kg segment serves heavy-duty passenger and freight elevators but occupies a smaller share due to its specialized use cases.

- For instance, KONE’s EcoDisc® MX18 gearless machine supports a rated load of up to 2,000 kg at speeds up to 2.5 m/s (with 2:1 roping), enabling high-duty performance in commercial towers.

By Application

The Office Building segment dominates the market, supported by steady installation demand in corporate towers, IT parks, and mixed-use commercial complexes where high-speed, low-noise, and long-life gearless motors are essential for traffic management. Malls continue to adopt gearless systems to enhance operational reliability under high footfall. Public Places, including transit hubs and hospitals, show rising traction as infrastructure upgrades prioritize low-maintenance and energy-optimized elevator systems. The Other category—comprising hotels, educational institutions, and leisure facilities—remains steadily relevant but represents a smaller share overall.

- For instance, Otis equips its Gen2 and Gen3 office-grade elevators with permanent-magnet gearless machines capable of lifting 1,350 kg at speeds of 1.75 m/s with ReGen™ drives returning up to 30 kW of regenerative energy.

Key Growth Drivers

Rising Urbanization and High-Rise Construction Demand

Rapid urban population expansion and the shift toward vertical city planning significantly accelerate the installation of high-performance elevator systems, directly boosting demand for gearless elevator traction motors. High-rise commercial, residential, and mixed-use developments increasingly require motors that deliver high torque, energy efficiency, and low maintenance to support continuous vertical mobility. Governments are prioritizing infrastructure modernization, smart city programs, and transit-oriented development, all of which require reliable elevator systems capable of handling heavier loads and higher travel distances. Gearless motors are preferred due to their compact construction, reduced vibration, and enhanced lifecycle performance. Additionally, redevelopment of aging buildings and elevator modernization initiatives in mature markets strengthen replacement demand. As urban density grows, developers prioritize ride comfort, noise reduction, and sustainability—areas where gearless motors excel. These combined structural and technological factors make urbanization one of the most influential long-term drivers of market expansion.

- For instance, KONE’s EcoDisc® MX20 traction machine supports a rated load of up to 2,000 kg at speeds up to 3.0 m/s, making it suitable for high-rise commercial towers.

Shift Toward Energy-Efficient and Low-Maintenance Elevator Systems

Building owners and facility operators increasingly adopt gearless elevator traction motors to meet stringent energy efficiency requirements and reduce operational expenditure. Gearless technology eliminates mechanical gears, resulting in lower friction losses, reduced heat generation, and significantly lower energy consumption compared with geared systems. The long service life and minimal maintenance needs enhance suitability for commercial complexes, public institutions, and high-traffic areas. Sustainability certifications such as LEED and regional efficiency norms also encourage the adoption of regenerative drives paired with gearless motors to feed surplus energy back into the grid. Facility managers prioritize motors that deliver smoother acceleration, quieter operation, and improved passenger comfort, further steering preference toward gearless solutions. Modernization of older elevators to reduce lifetime energy costs continues to strengthen demand. As smart buildings expand, integrated monitoring and control features increase the appeal of gearless systems equipped for predictive maintenance and digital optimization.

- For instance, Otis equips its Gen2 and Gen3 elevators with compact permanent-magnet gearless traction machines (such as the GEB series). While specific power ratings vary by elevator capacity and speed, these systems typically use a power rate around 9 kW for many standard configurations, significantly lower than conventional geared machines.

Increasing Emphasis on Ride Comfort, Safety, and Advanced Motion Control

End users and building operators place growing importance on ride smoothness, noise reduction, and safety standards—factors that gearless traction motors naturally support. The direct-drive configuration enables precise speed control, superior stopping accuracy, and smoother acceleration, making them ideal for premium commercial towers, airports, hospitals, and luxury residential structures. Modern control algorithms and vector-controlled drive systems enhance torque stability and eliminate jerks during start and stop cycles, improving the passenger experience. Safety regulations mandating enhanced braking, overload protection, and reliable emergency operation also fuel demand for gearless motors integrated with advanced control electronics. Premium building segments increasingly require silent operation and minimal vibration to meet comfort benchmarks, reinforcing the shift away from traditional geared units. As building automation systems evolve, gearless motors optimized for digital diagnostics, condition monitoring, and remote control gain strong preference across new installations and upgrade projects.

Key Trends & Opportunities

Integration of Smart Elevator Systems and IoT-Enabled Motor Technologies

Digitalization is reshaping the elevator ecosystem, creating new opportunities for IoT-enabled gearless traction motors designed with embedded sensors and real-time monitoring capabilities. Smart elevator solutions rely on predictive maintenance insights generated by vibration, temperature, and torque sensors integrated directly into the motor assembly. These insights help facility managers reduce downtime, optimize service schedules, and improve passenger safety. With the growth of cloud-based control platforms, gearless motors can now be connected to centralized monitoring systems, enabling remote diagnostics and performance optimization. Manufacturers are also introducing regenerative drive-compatible motors that optimize energy use during peak traffic conditions. This transition toward smart, connected elevator infrastructure expands revenue potential in both new installations and modernization markets. As IoT adoption rises across commercial real estate, hospitals, and metro stations, gearless motors supporting intelligent control functionality will benefit from increased long-term demand.

- For instance, Otis’ ONE IoT platform processes data from over 350 operating parameters including motor vibration, brake response time, and start-current readings to enable predictive maintenance for its gearless Gen3 systems.

Strong Momentum in Modernization of Aging Elevator Installations

A substantial portion of global elevator infrastructure—especially in Europe, East Asia, and North America—has exceeded its optimal operational lifecycle, creating strong demand for modernization programs. Older geared motors consume more power, require frequent maintenance, and struggle to meet updated safety regulations. Gearless traction motors offer a compelling upgrade path due to their lower energy consumption, compact size, and compatibility with advanced digital control systems. Manufacturers are designing retrofit-friendly solutions to streamline installation with minimal structural changes, accelerating adoption in high-traffic commercial buildings, hotels, shopping centers, and public institutions. Modernization also enables properties to comply with evolving safety, accessibility, and environmental standards. As building owners seek long-term reliability, improved ride quality, and reduced operation costs, modernization programs emerge as a major commercial opportunity for gearless motor suppliers. This trend is expected to intensify as more regions enforce stricter compliance guidelines.

- For instance, Otis’ Gen2-Mod modernization package replaces outdated geared machines with a permanent-magnet gearless unit rated up to 6.7 kW and compatible with travel speeds of 1.75 m/s, significantly reducing motor heat output and brake wear.

Key Challenges

High Initial Installation Costs and Budget Constraints in Emerging Markets

Despite long-term efficiency benefits, the upfront cost of gearless traction motors remains a major barrier to adoption, particularly in price-sensitive residential projects and emerging economies. These motors require advanced components, precision engineering, and specialized installation processes, raising initial capital expenditure compared with conventional geared options. Small developers often prioritize short-term cost savings, limiting adoption in low- to mid-rise residential buildings. Additionally, modernization of older elevators with gearless systems requires electrical upgrades, control system replacements, and structural adjustments, further increasing initial investment. Public infrastructure authorities may defer modernization due to funding limitations, slowing market penetration. While lifecycle savings and energy efficiency eventually offset the cost, budget constraints continue to hinder broader adoption. Manufacturers need to introduce cost-optimized models, modular designs, and financing solutions to overcome this challenge and drive wider market uptake.

Technical Complexity and Skilled Workforce Shortages

Gearless elevator traction motors require precise installation, calibration, and maintenance procedures, which demand specialized technical expertise. Many regions face shortages of trained elevator technicians capable of handling advanced motor-control systems, sensor integrations, and digital diagnostic tools. Incorrect installation or poor calibration can compromise ride quality, reduce efficiency, and increase maintenance costs. The complexity of integrating gearless motors with modern elevator controllers, regenerative drives, and IoT platforms further heightens skill requirements. Smaller service providers may struggle to adopt advanced training and certification programs, creating inconsistencies in after-sales support and operational reliability. Workforce gaps are particularly challenging in developing regions experiencing rapid infrastructure growth. Addressing this issue requires industry-wide investment in technical training centers, standardized certification programs, and manufacturer-led skill development initiatives to ensure safe and efficient deployment of gearless elevator traction motors.

Regional Analysis

Asia-Pacific (APAC)

The Asia-Pacific region dominates the global gearless elevator traction motor market, accounting for an estimated around 60 % share in 2024. Rapid urbanization in China, India and Southeast Asia, combined with large-scale high-rise residential and commercial construction, drives demand for high-capacity, energy-efficient gearless motors. Additionally, infrastructure modernization, smart city initiatives and elevator replacements in dense urban cores underpin growth. Manufacturers benefit from cost-competitive production bases and increasing adoption of premium elevator systems in the region. With continued expansion of skyscraper development and retrofit projects, Asia-Pacific is expected to maintain its leading position.

North America

In North America, the market holds an estimated ~15-20 % share of global gearless elevator traction motor sales. The region benefits from mature infrastructure, strict energy-efficiency and building-safety regulations, and a strong replacement/modernization market in commercial towers. Many building owners are upgrading older geared systems to gearless variants to improve ride comfort, reduce maintenance and meet green-building credentials. The presence of advanced elevator OEMs, integration with IoT and controls and retrofit demand form the backbone of market stability, though slower new-construction growth limits acceleration.

Europe

Europe captures approximately around 10-15 % of the market share for gearless elevator traction motors. The region’s emphasis on sustainability, energy-efficient buildings and strict codes spurs adoption of gearless technologies in both new installations and modernization projects. Germany, the UK and France lead demand for premium elevator systems, while modernization of aging elevator fleets provides a steady growth base. Challenges include varying economic cycles across EU states and budget constraints in some public-sector buildings, but the push toward digital control and smart elevators supports ongoing demand.

Middle East & Africa / Latin America (MEA & LATAM)

Combined, the Middle East & Africa and Latin America regions currently account for roughly 5-10 % of the global market. Rapid urbanization and infrastructure investment—particularly in Middle East city-states and select African metro zones—are driving gearless traction motor adoption. However, slower retrofit cycles, lower penetration of premium elevator systems and higher import-cost barriers moderate growth. Latin America’s residential and commercial high-rise growth offers opportunity, yet regulatory and maintenance ecosystem gaps limit acceleration at present. As funding and regulation mature, these regions hold potential for expansion especially in public-infrastructure and commercial sectors.

Market Segmentations:

By Type

- Below 1000 kg

- 1000–2000 kg

- Above 2000 kg

By Application

- Mall

- Office Building

- Public Places

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the gearless elevator traction motor market is characterised by a mature set of global players vying for dominance through innovation, geographic reach and service integration. Leading companies such as KONE Corporation, Otis Elevator Company, Schindler Group and Thyssenkrupp AG each leverage comprehensive elevator system portfolios to cross-sell gearless traction motors, service contracts and retrofit solutions. These OEMs invest heavily in R&D to enhance motor efficiency, noise and vibration reduction, IoT connectivity and predictive maintenance capabilities, enabling them to differentiate in premium commercial and high-rise applications. Meanwhile, regional and component-specialist manufacturers target emerging markets and cost-sensitive segments, intensifying pricing pressure and localised manufacture. Strategic partnerships, acquisitions and technology licensing sustain competitive dynamics—for example, Indian firm Bharat Bijlee Ltd. obtained exclusive rights for gearless lift-machines in its region, reflecting localisation strategies. As demand continues to rise for energy-efficient, low-maintenance traction systems in vertical transport, market players must balance global scale-advantages with agile local execution to maintain share and margin.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kone

- Hiwin

- Mitsubishi Electric

- Kinetek

- Otis

- Xizi Forvorda

- Imperial Electric

- Ningbo Xinda Elevator Traction Technology

- Shenyang Bluelight

- Yaskawa

Recent Developments

- In June 2025, Otis Elevator Company (Otis): Otis expanded its Gen3 Core elevator platform, introducing a compact gearless permanent-magnet traction machine paired with its ReGen™ drive system, which for instance enables cab sizes up to 10 ft 1 in deep with larger lifting capacity.

- In February 2005, Zhejiang Xizi Forvorda Electrical Machinery Co., Ltd. (Xizi Forvorda) re-located its manufacturing base to the Lin’an Economic Development Zone. The company offers the existing GETM 3.0H model gearless traction machine with a common rated capacity of approximately 630 kg (though the company’s product lines cover up to 1,000 kg and beyond) and speeds typically ranging from 1.0-1.75 m/s (with the overall product range reaching 2.0 m/s or more), exemplifying a compact, high-efficiency design suited for various elevators.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience sustained growth as urban densification increases the need for high-performance vertical mobility solutions.

- Adoption of gearless motors will rise with expanding high-rise commercial, residential, and public-infrastructure development.

- Modernization of aging elevator fleets will accelerate, driving strong replacement demand for efficient, low-maintenance gearless systems.

- Integration of IoT, smart controls, and predictive maintenance technologies will become standard across new installations.

- Regenerative drive-compatible motors will gain wider acceptance as buildings prioritize energy optimization.

- Manufacturers will focus on compact, lighter, and quieter motor designs to improve installation flexibility and ride comfort.

- Regional players in Asia-Pacific will strengthen export capabilities, intensifying global competition.

- Safety and accessibility regulations will continue to tighten, increasing the need for advanced motion-control systems.

- Digital service models, including remote diagnostics and lifecycle monitoring, will shape aftersales strategies.

- Sustainable materials and eco-efficient manufacturing practices will influence next-generation motor development.