| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Cloud Services Market Size 2024 |

USD 1,781.59 Million |

| Germany Cloud Services Market, CAGR |

17.48% |

| Germany Cloud Services Market Size 2032 |

USD 6,463.21 Million |

Market Overview

The Germany Cloud Services Market is projected to grow from USD 1,781.59 million in 2024 to an estimated USD 6,463.21 million by 2032, with a compound annual growth rate (CAGR) of 17.48% from 2025 to 2032. This growth reflects the increasing demand for scalable, cost-effective, and flexible cloud solutions across various industries in Germany.

Key drivers of this market include the rise in demand for scalable IT infrastructure, cost optimization, and data security. Additionally, the shift toward hybrid and multi-cloud strategies, along with advancements in AI, machine learning, and automation, is further fueling the adoption of cloud services. Businesses in sectors like finance, healthcare, retail, and manufacturing are increasingly leveraging cloud technologies to streamline operations and gain a competitive edge. These trends highlight the growing reliance on cloud solutions for digital transformation and process optimization.

Geographically, Germany is a leading market in Europe for cloud services, with major hubs in cities like Berlin, Munich, and Frankfurt. These urban areas host a concentration of large enterprises, SMEs, and tech startups that are driving demand for advanced cloud offerings. Key players in the market include SAP SE, Amazon Web Services (AWS), Google Cloud, IBM Corporation, and Skaylink, each providing tailored cloud solutions to cater to the diverse needs of the German market, from enterprise resource planning to data security and AI-driven applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Cloud Services Market is projected to grow from USD 1,781.59 million in 2024 to USD 6,463.21 million by 2032, with a CAGR of 17.48% from 2025 to 2032.

- Businesses in sectors like finance, healthcare, and retail are increasingly adopting cloud services to enhance operational efficiency and support digital transformation.

- The growing need for flexible, scalable IT solutions is a major driver, as businesses seek cost-effective ways to manage increasing data and fluctuating workloads.

- The need to ensure data security and meet regulatory requirements, such as GDPR, remains a key challenge in the adoption of cloud services across Germany.

- Many German enterprises are moving toward hybrid and multi-cloud strategies to optimize their IT infrastructure, balancing control with scalability.

- Major urban hubs like Berlin, Munich, and Frankfurt are driving demand, with these areas hosting a high concentration of large enterprises, SMEs, and tech startups.

- Leading companies such as SAP SE, AWS, Google Cloud, and IBM Corporation are providing a variety of cloud solutions tailored to meet industry-specific needs across Germany.

Report Scope:

Market Drivers

Increased Demand for Scalable IT Infrastructure

One of the most significant drivers of the Germany Cloud Services Market is the rising demand for scalable IT infrastructure. As businesses face the need to manage growing data volumes, fluctuating workloads, and dynamic business requirements, traditional on-premises infrastructure often falls short. Cloud services offer the flexibility to scale resources up or down in real-time, ensuring that companies can efficiently manage peak loads and optimize their IT infrastructure costs. The pay-as-you-go model that cloud services offer allows organizations to avoid hefty upfront investments in hardware, while only paying for the resources they use. This not only reduces capital expenditures but also enhances operational efficiency by aligning infrastructure costs with actual usage patterns. The ability to scale quickly and efficiently is particularly vital for small and medium-sized enterprises (SMEs) in Germany, which often face resource constraints but still need robust IT infrastructure to stay competitive in the market.

Digital Transformation Across Industries

Another major driver of the cloud services market in Germany is the ongoing digital transformation across various industries, including manufacturing, healthcare, retail, and finance. Companies are increasingly adopting cloud solutions to improve business processes, streamline operations, and enhance customer experiences. The cloud serves as a foundation for integrating new technologies such as Artificial Intelligence (AI), Internet of Things (IoT), and Big Data analytics, enabling organizations to innovate and become more agile. For instance, manufacturers in Germany can leverage cloud-based IoT platforms to monitor and manage production processes in real-time, while retailers can use cloud services to personalize customer experiences and optimize supply chains. As businesses continue to realize the potential of digital transformation, the demand for cloud-based solutions is expected to grow exponentially. This trend is further supported by Germany’s highly developed IT infrastructure, which provides a conducive environment for implementing advanced cloud technologies.

Data Security and Compliance Requirements

Data security and compliance are critical drivers of cloud adoption in Germany. Given the stringent regulations under the European Union’s General Data Protection Regulation (GDPR), businesses in Germany are under constant pressure to ensure that their data management practices are secure and compliant. Cloud service providers that adhere to these strict standards provide businesses with the necessary tools and certifications to meet these regulatory requirements. For example, leading cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud ensure that their services are GDPR-compliant, offering data encryption, access controls, and audit trails that help businesses maintain security and privacy standards. As data security continues to be a top priority for organizations, the need for secure cloud services grows, making it a key driver in the expansion of the Germany Cloud Services Market.

Cost Efficiency and Operational Flexibility

The cost-efficiency and operational flexibility provided by cloud services are crucial in driving the market’s growth. Businesses in Germany, especially small and medium-sized enterprises (SMEs), are increasingly opting for cloud-based services to reduce their IT overhead costs. Unlike traditional IT infrastructure, which requires significant upfront investment in hardware and software, cloud services operate on a subscription model, with no large capital expenditures required. This model enables companies to only pay for what they use, resulting in significant cost savings. Additionally, cloud services offer enhanced operational flexibility, allowing businesses to adjust their resources in real-time based on demand fluctuations. For instance, during seasonal peaks or project-based increases in demand, businesses can scale their cloud services instantly, avoiding overprovisioning and underutilization of resources. This operational agility not only reduces costs but also helps organizations focus on their core competencies rather than managing complex IT infrastructures.

Market Trends

Growth in Hybrid Cloud Adoption

One of the most prominent trends in the Germany Cloud Services Market is the increasing adoption of hybrid cloud models. While public cloud services continue to grow, many businesses in Germany are moving towards hybrid cloud environments, which combine on-premises infrastructure with public and private cloud services. This approach offers the flexibility to keep sensitive data on private clouds, while leveraging the scalability and cost-efficiency of public clouds for non-sensitive workloads. Companies are increasingly opting for hybrid cloud strategies to achieve a balance between security, control, and cost optimization. For instance, businesses in highly regulated industries, such as finance and healthcare, are adopting hybrid clouds to ensure compliance with data protection laws such as the EU’s General Data Protection Regulation (GDPR), while also benefiting from the scalability of public clouds. The hybrid cloud model is gaining traction because it enables organizations to manage their workloads more efficiently, ensure continuity in case of data breaches, and mitigate risks while keeping costs in check.

Increase in Cloud-Native Applications and Microservices

Another significant trend in the German cloud services sector is the growing adoption of cloud-native applications and microservices architectures. Cloud-native applications are built to leverage the scalability, elasticity, and agility of cloud platforms, allowing organizations to deploy, manage, and scale applications in a more efficient and resilient manner. Microservices, a key component of cloud-native architecture, allow businesses to break down complex applications into smaller, independent services that can be developed, deployed, and scaled independently. This modular approach enhances flexibility and ensures that applications can be quickly adapted to changing business needs. As organizations in Germany embrace digital transformation, many are shifting towards cloud-native technologies to foster innovation, reduce time to market, and enhance system resilience. For example, major German tech companies and startups are increasingly adopting containerization technologies like Kubernetes to streamline application deployment and management across hybrid and multi-cloud environments. This trend is expected to continue, with more enterprises migrating to cloud-native architectures to stay competitive in the rapidly evolving market.

Emphasis on Cloud Security and Compliance

Security remains a paramount concern for businesses adopting cloud services in Germany. As the number of cloud-based solutions grows, organizations are placing more emphasis on ensuring robust cloud security frameworks and compliance with regional regulations. Germany, being a part of the European Union, is subject to the GDPR, which imposes strict data privacy and protection requirements. To address these concerns, cloud service providers are enhancing their security offerings with advanced encryption techniques, multi-factor authentication (MFA), and continuous monitoring to protect sensitive data. Furthermore, organizations are increasingly looking for cloud services that offer built-in compliance tools to ensure that they meet GDPR and other legal requirements. For instance, major cloud providers like AWS, Microsoft Azure, and Google Cloud are offering specialized compliance certifications to cater to German businesses, particularly in highly regulated sectors such as finance, healthcare, and government. The growing demand for cloud services that meet stringent security standards is driving innovation in the cloud security space, leading to the development of more sophisticated tools and frameworks for data protection.

Rise of Artificial Intelligence and Machine Learning Integration

Cloud service providers in Germany are increasingly integrating Artificial Intelligence (AI) and Machine Learning (ML) capabilities into their offerings to provide businesses with enhanced data analytics, automation, and decision-making capabilities. AI and ML tools are being incorporated into cloud platforms to help companies automate processes, gain deeper insights into customer behavior, optimize supply chains, and enhance overall operational efficiency. For instance, German manufacturers are leveraging AI-powered cloud services to implement predictive maintenance, reducing downtime and extending the lifespan of equipment. Similarly, retailers in Germany are utilizing AI-driven cloud analytics to personalize their customer interactions and optimize inventory management. By providing access to advanced AI and ML tools without the need for heavy upfront investment in infrastructure, cloud providers are empowering businesses of all sizes to harness the potential of these technologies. The integration of AI and ML with cloud services is also driving the development of smarter, more intuitive cloud platforms that can automatically adjust resources based on demand, leading to improved cost efficiency and scalability.

Market Challenges

Integration with Legacy Systems

Another challenge businesses face in Germany’s cloud services market is the complexity of integrating cloud solutions with existing legacy systems. Many German enterprises, particularly in sectors like manufacturing, finance, and healthcare, rely on long-established IT infrastructures that were not initially designed for cloud environments. Migrating these systems to the cloud can be costly, time-consuming, and complex, requiring significant customization and careful planning. Compatibility issues, data migration challenges, and the need for specialized skills to manage hybrid cloud environments can create barriers to seamless cloud adoption. Furthermore, organizations may face disruptions in their day-to-day operations as they transition from legacy systems to modern cloud solutions. As such, finding efficient ways to integrate cloud services with existing infrastructure while minimizing downtime and operational risks remains a critical challenge for businesses looking to leverage the benefits of the cloud in Germany.

Data Security and Privacy Concerns

One of the major challenges in the Germany Cloud Services Market is ensuring robust data security and privacy, especially in light of stringent regulations such as the EU’s General Data Protection Regulation (GDPR). For instance, sectors like healthcare are subject to additional compliance requirements, such as Section 393 of the German Social Code, which mandates that health-related data must be processed within Germany, the EU, or countries with adequate data protection standards. This regulation also requires cloud providers to obtain certifications like the C5 certificate from Germany’s Federal Office for Information Security (BSI) to ensure compliance with security standards. Similarly, industries such as finance and government face heightened scrutiny due to the sensitivity of their data. Financial institutions rely on advanced encryption and real-time threat detection to meet regulatory expectations, while government agencies implement multi-layered security architectures to safeguard classified information. Despite these measures, concerns about data breaches and unauthorized access persist. For example, a recent study revealed that attacks on cloud services are among the most common cyber threats faced by German companies. These challenges highlight the critical need for secure and compliant cloud solutions tailored to the unique regulatory landscape in Germany.

Market Opportunities

Expansion of Cloud Adoption in Small and Medium-Sized Enterprises (SMEs)

One of the key opportunities in the Germany Cloud Services Market lies in the increasing adoption of cloud solutions by small and medium-sized enterprises (SMEs). While large enterprises have already capitalized on the scalability and cost-efficiency of cloud services, SMEs in Germany are now recognizing the benefits of cloud technology. These businesses are looking for flexible, affordable solutions that enable them to compete with larger counterparts without the burden of heavy upfront investments in IT infrastructure. Cloud services offer SMEs the ability to access advanced technologies such as artificial intelligence (AI), machine learning (ML), and data analytics, which were traditionally only accessible to larger organizations with vast resources. With the German government’s push for digital transformation and the availability of various cloud models (public, private, and hybrid), SMEs are increasingly able to leverage these services to enhance their operational efficiency, improve customer experiences, and drive innovation. Cloud service providers can tap into this growing segment by offering tailored solutions that meet the unique needs of SMEs.

Growth in Industry-Specific Cloud Solutions

Another significant market opportunity for cloud services providers in Germany is the development and deployment of industry-specific cloud solutions. As industries such as healthcare, finance, manufacturing, and retail continue to digitize and modernize their operations, the demand for cloud platforms that are tailored to specific industry needs is rising. Industry-specific cloud solutions offer businesses more than just basic infrastructure—they provide specialized tools for regulatory compliance, data analytics, process optimization, and customer management. For example, the healthcare sector in Germany requires cloud services that comply with strict data privacy laws, while manufacturers are looking for cloud solutions that support the Internet of Things (IoT) and predictive maintenance. Providers that develop and offer these niche, industry-specific solutions have the opportunity to capture a significant share of the market by addressing the precise needs of these verticals.

Market Segmentation Analysis

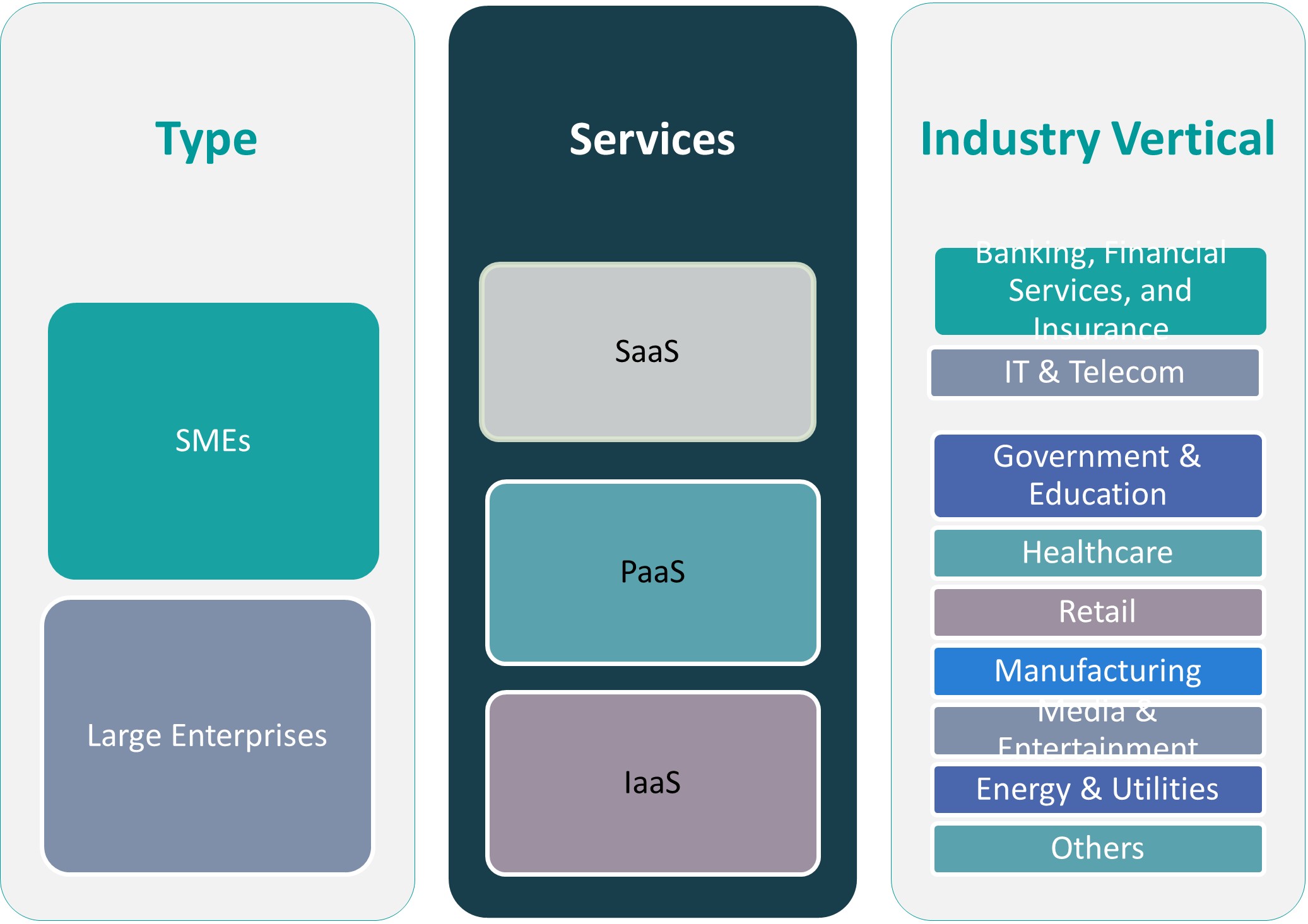

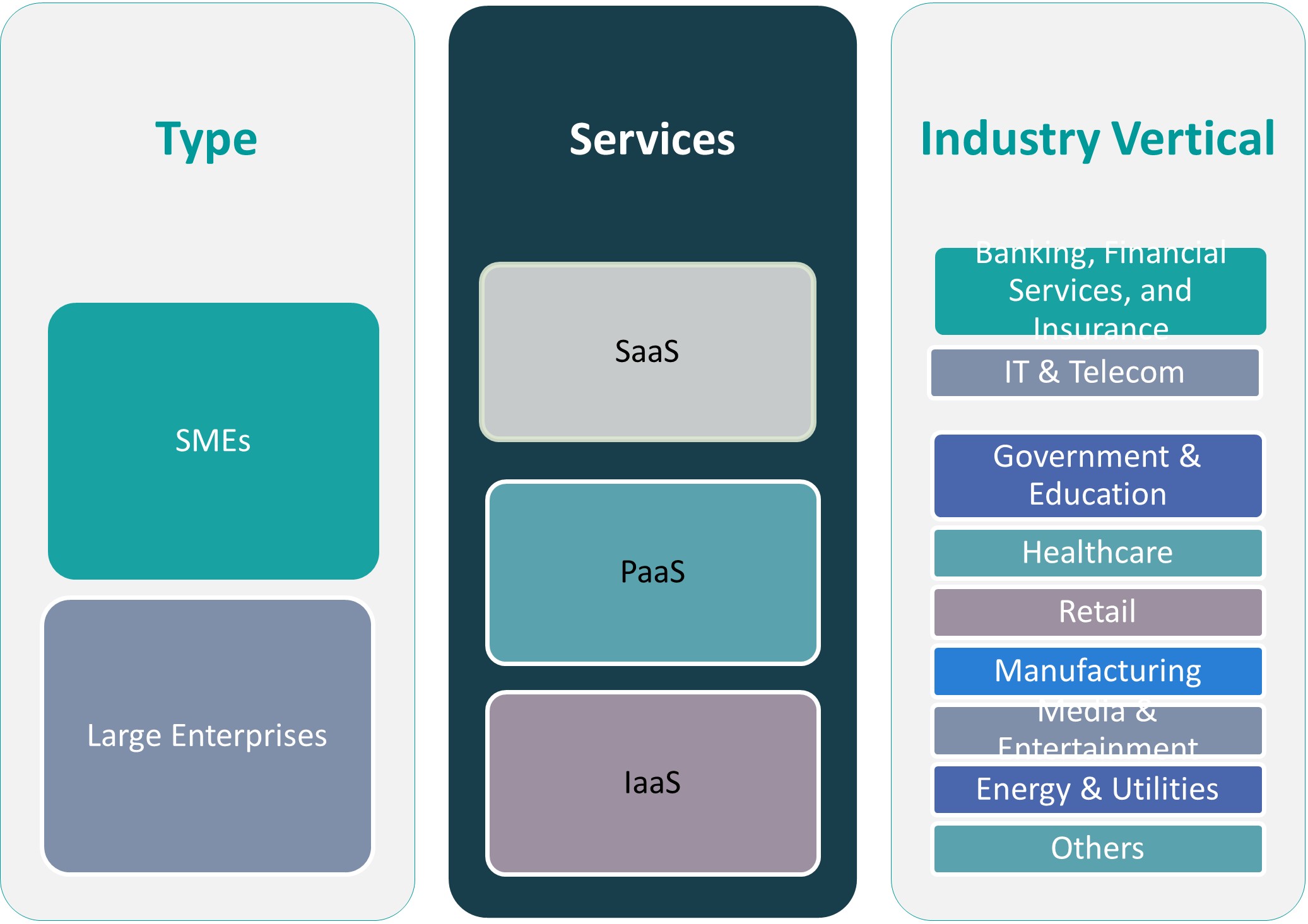

By Type

The market can be divided into Large Enterprises and Small and Medium Enterprises (SMEs). Large enterprises represent the dominant share of the market as they continue to move their operations to the cloud to enhance efficiency, scalability, and innovation. These organizations require robust cloud solutions that can support complex and large-scale operations, including extensive data management, enterprise resource planning (ERP), and supply chain management. In contrast, SMEs are increasingly recognizing the advantages of cloud services, especially for cost efficiency and scalability. As SMEs continue to embrace digital transformation, they are seeking more flexible cloud solutions, primarily for customer relationship management (CRM), human capital management (HCM), and collaboration tools. The growing interest of SMEs in cloud services presents a significant opportunity for providers to tailor affordable and user-friendly cloud solutions to this segment.

By Services

The Germany Cloud Services Market is further segmented by the type of cloud services offered: Software as a Service (SaaS) is widely adopted across industries due to its ability to offer scalable, on-demand software solutions. Key SaaS solutions include CRM, Enterprise Resource Management (ERM), HCM, content management, collaboration and productivity suites, and supply chain management (SCM). These tools enhance operational efficiency by streamlining business processes and improving customer and employee engagement.Platform as a Service (PaaS) is increasingly in demand for application development, testing, quality assurance, and data management. Organizations use PaaS solutions to accelerate application development and integrate new technologies more efficiently.Infrastructure as a Service (IaaS) focuses on offering core infrastructure services like storage, disaster recovery, backup, and compute resources. These services provide businesses with flexibility and reliability while reducing the need for extensive capital investments in on-premise infrastructure.

Segments

Based on Type

Based on Services

- Software as a Service (SaaS)

- Customer Relationship Management (CRM)

- Enterprise Resource Management (ERM)

- Human Capital Management (HCM)

- Content Management

- Collaboration and Productive Suites

- Supply Chain Management (SCM)

- Others

- Platform as a Service (PaaS)

- Application Development and Platforms

- Application Testing and Quality

- Analytics and Reporting

- Integration and Orchestration

- Data Management

- Infrastructure as a Service (IaaS)

- Primary Storage

- Disaster Recovery and Backup

- Archiving

- Compute

Based on Industry Vertical

- Banking, Financial Services, and Insurance

- IT & Telecom 62 8.4. Government & Education

- Healthcare 64 8.6. Retail& Manufacturing

- Media & Entertainment

- Energy & Utilities

- Others

Based on Region

Regional Analysis

Southern Germany (40%)

Southern Germany, encompassing cities such as Munich, Stuttgart, and Nuremberg, holds the largest share of the cloud services market. This region is home to several major industries, including automotive, manufacturing, and technology, making it a key driver of cloud adoption. Large enterprises in the automotive and manufacturing sectors rely on cloud solutions for supply chain management, data storage, and enterprise resource planning (ERP). Additionally, the region’s robust IT infrastructure and presence of leading tech companies like SAP make it a central hub for cloud-based innovation. The strong presence of both multinational corporations and small and medium-sized enterprises (SMEs) further contributes to the region’s significant market share.

Western Germany (25%)

Western Germany, particularly cities like Frankfurt, Düsseldorf, and Cologne, holds a substantial portion of the market due to its strategic location as a financial and economic center. Frankfurt, in particular, is a financial powerhouse, housing many of Germany’s banking institutions and insurance companies, which heavily rely on cloud services for secure data management, compliance with regulations such as GDPR, and improving customer experience. The region’s financial services sector, along with its IT and telecom industries, drives the demand for cloud solutions, particularly Infrastructure as a Service (IaaS) and Platform as a Service (PaaS).

Key players

- SAP SE

- Amazon Web Services (AWS)

- Google Cloud

- Skaylink

- IBM Corporation

Competitive Analysis

The Germany Cloud Services Market is highly competitive, with key players offering a wide range of solutions to meet the growing demand for cloud services. SAP SE, a leader in enterprise software, dominates with its cloud offerings focused on enterprise resource planning (ERP), data analytics, and customer relationship management (CRM), tailored primarily for large enterprises. Amazon Web Services (AWS) remains a strong contender with its robust Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) offerings, providing scalable and secure cloud solutions for diverse industries. Google Cloud focuses on delivering advanced data analytics and AI-powered services, making it a preferred choice for businesses leveraging big data and machine learning. Skaylink offers specialized cloud solutions, particularly for mid-market and SME clients, focusing on data center and cloud infrastructure integration. IBM Corporation combines its hybrid cloud solutions with AI and analytics, targeting large enterprises, especially in regulated industries. Each player differentiates through unique service offerings, targeting various sectors and business sizes, while competition remains strong in terms of innovation, security, and pricing.

Recent Developments

In March 2025, SAP surpassed Novo Nordisk to become Europe’s most valuable company, with a market value of nearly €313.70 billion. This achievement is attributed to CEO Christian Klein’s strategy of shifting from software license sales to subscription-based cloud services, offering more predictable and profitable recurring revenue.

Market Concentration and Characteristics

The Germany Cloud Services Market exhibits moderate to high concentration, with several dominant players, such as SAP SE, Amazon Web Services (AWS), Google Cloud, IBM Corporation, and Skaylink, leading the industry. These key players offer a broad range of cloud solutions, from Infrastructure as a Service (IaaS) to Software as a Service (SaaS), catering to large enterprises as well as small and medium-sized enterprises (SMEs). While large enterprises, particularly in sectors like finance, manufacturing, and IT, drive the majority of demand, the increasing adoption of cloud services by SMEs is contributing to a more competitive landscape. The market is characterized by a high degree of innovation, particularly in AI, data analytics, and hybrid cloud solutions, as providers strive to offer tailored solutions that address industry-specific needs. Additionally, stringent data security and compliance regulations, such as the GDPR, add complexity and differentiation among providers, influencing customer choices and shaping the overall market structure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Services, Industry Vertical and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Enterprises across sectors such as healthcare, manufacturing, and finance will increasingly adopt cloud services to drive digital transformation and operational efficiency.

- Organizations will continue shifting toward hybrid and multi-cloud models to enhance flexibility, mitigate vendor lock-in, and manage sensitive workloads securely.

- Small and medium-sized enterprises will increasingly adopt cloud solutions to access scalable infrastructure and enterprise-grade tools at lower costs.

- Cloud providers will embed advanced AI and ML capabilities into platforms, enabling German businesses to automate processes and gain deeper data insights.

- Providers will prioritize local data centers and offer GDPR-compliant solutions to address rising concerns over data sovereignty and regulatory adherence.

- The growing demand for real-time processing and low-latency applications will drive the integration of edge computing with cloud platforms in Germany.

- Environmental regulations and corporate sustainability goals will prompt cloud providers to invest in energy-efficient infrastructure and green data centers.

- Tailored cloud services designed for specific industries—such as healthcare, finance, and manufacturing—will gain momentum and support niche business needs.

- Businesses will invest more in cloud-based security solutions, including threat detection, encryption, and identity management, to combat evolving cyber threats.

- Continuous innovation, strategic partnerships, and investment in cloud infrastructure will sustain the robust growth trajectory of the Germany Cloud Services Market.