Market Overview

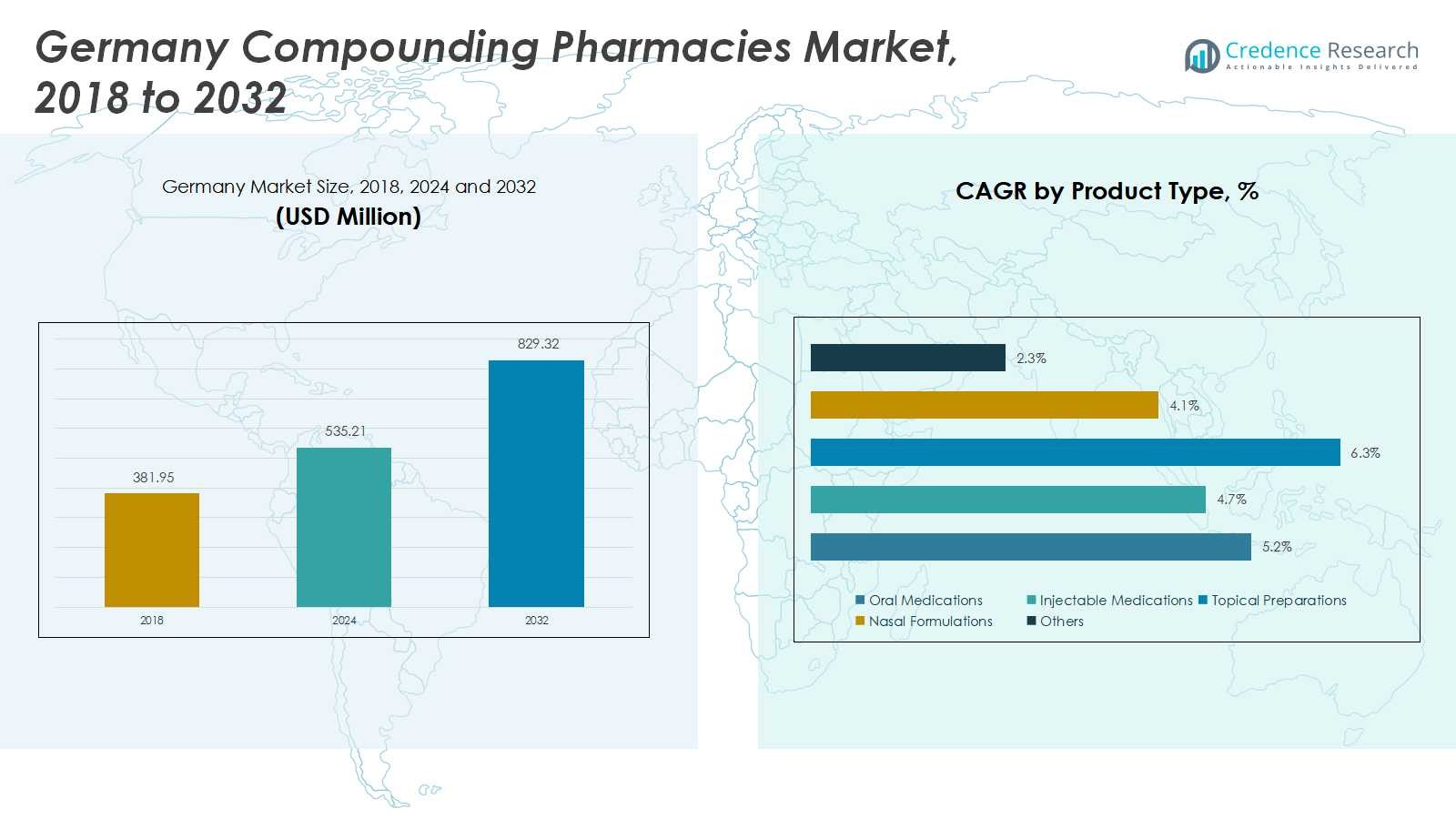

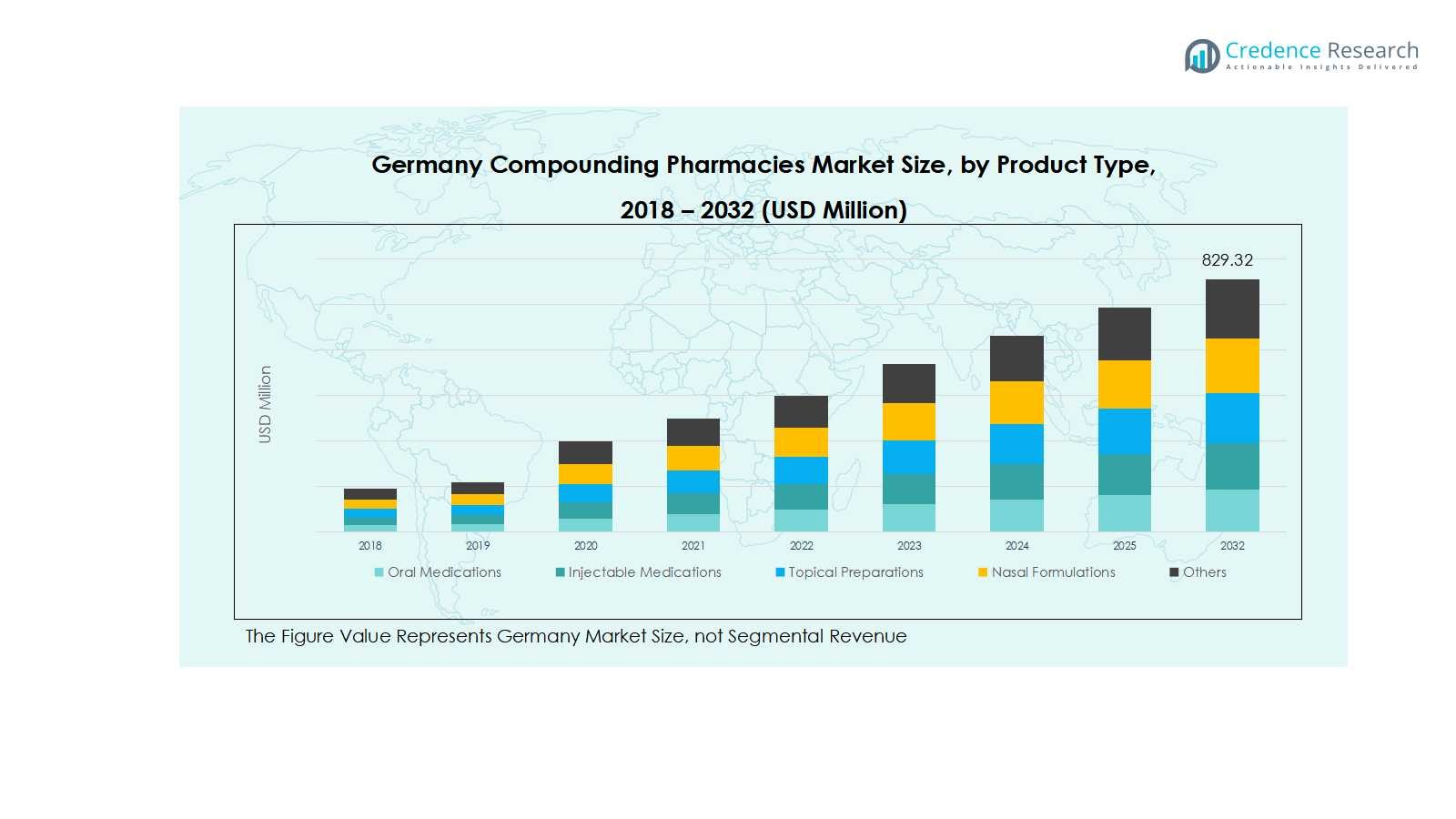

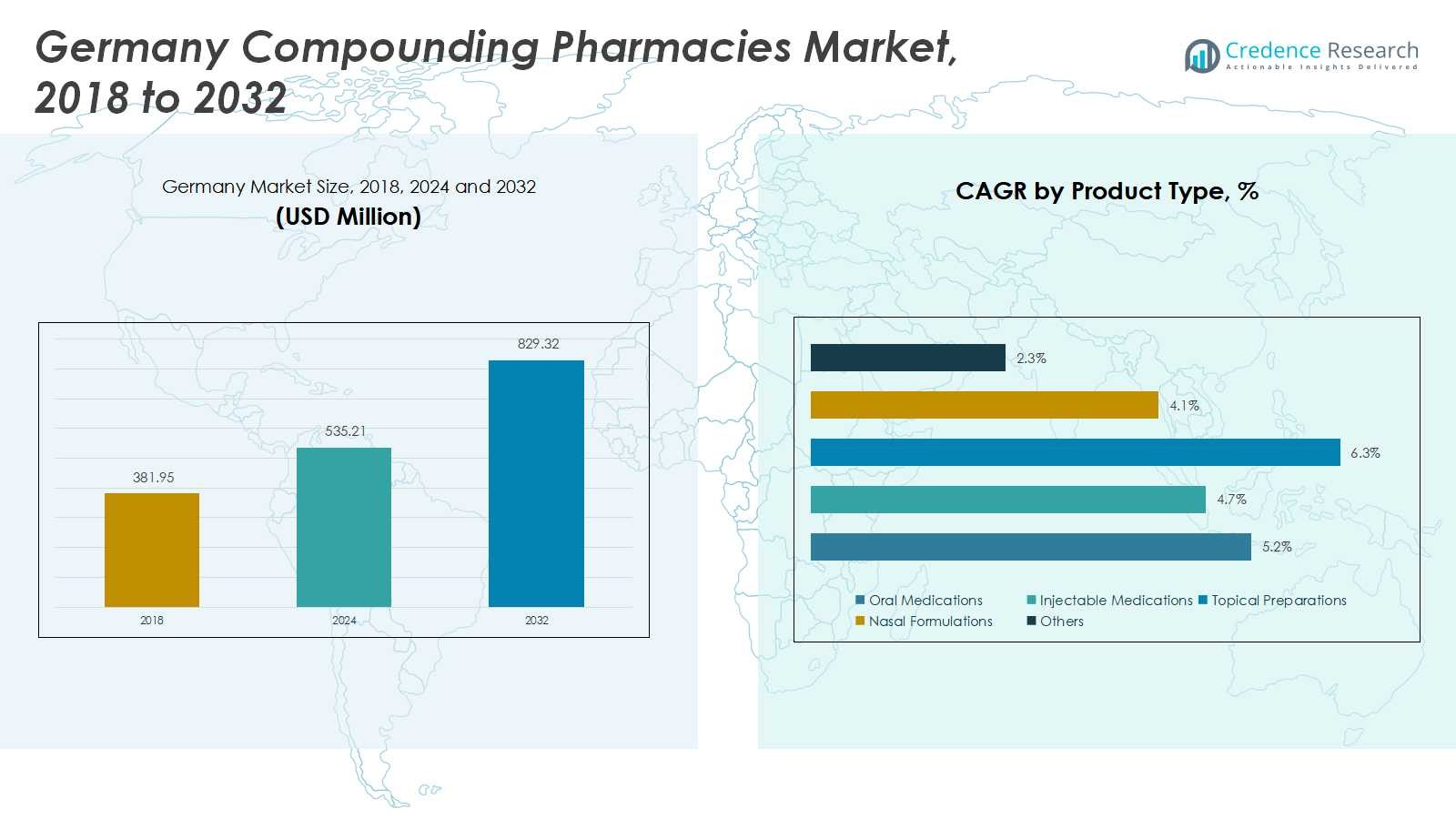

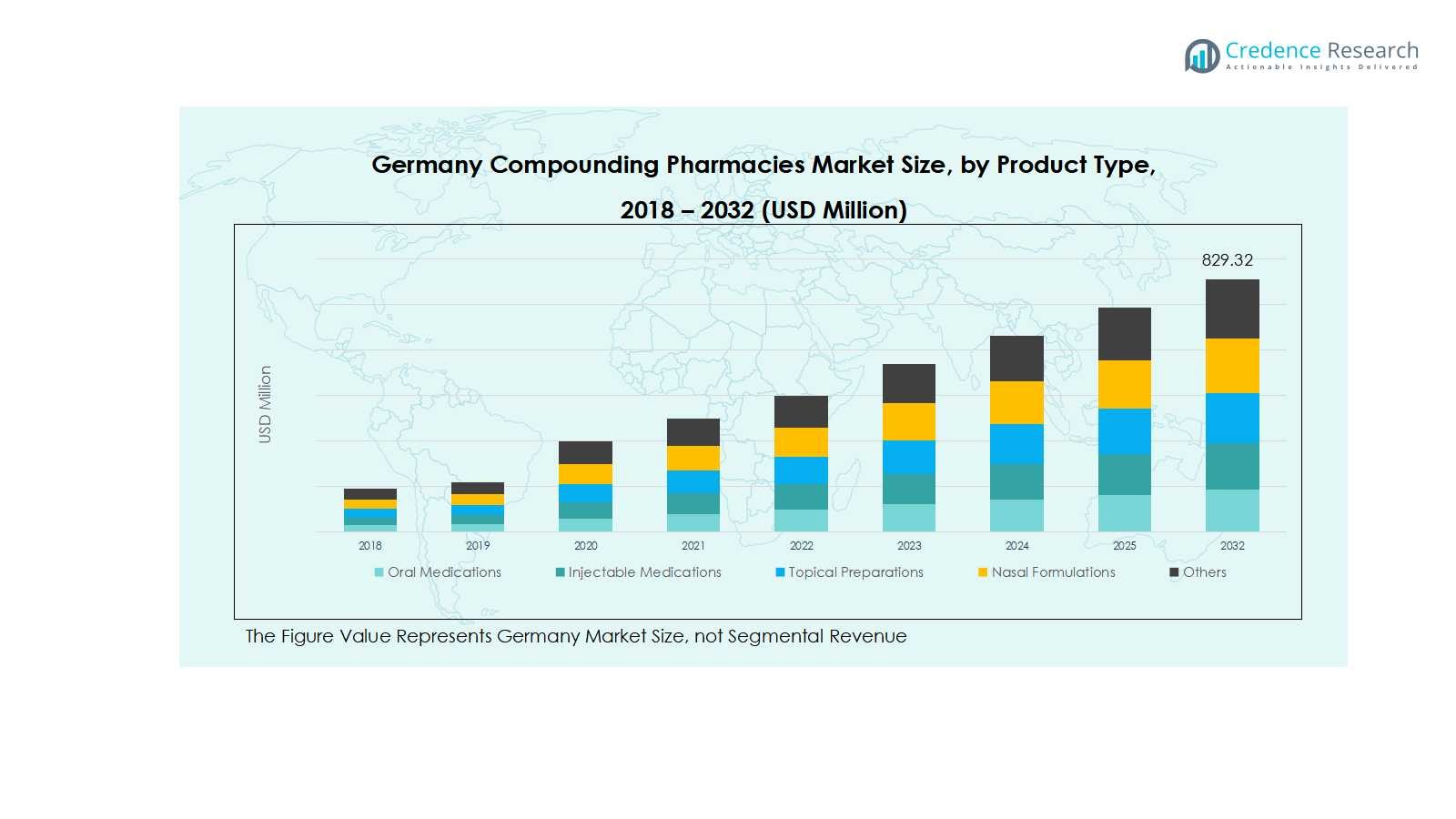

Germany Compounding Pharmacies Market size was valued at USD 381.95 Million in 2018, growing to USD 535.21 Million in 2024, and is anticipated to reach USD 829.32 Million by 2032, at a CAGR of 5.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Compounding Pharmacies Market Size 2024 |

USD 535.21 Million |

| Germany Compounding Pharmacies Market, CAGR |

5.24% |

| Germany Compounding Pharmacies Market Size 2032 |

USD 829.32 Million |

The Germany Compounding Pharmacies Market is highly competitive, with key players including Fresenius Kabi AG, B. Braun Melsungen AG, Fagron N.V., McKesson Europe, MediGroup GmbH, Morbus Pharma, Pharmaserv GmbH, Sanacorp Pharmahandel GmbH, TÜV Rheinland Pharma, and Bayer AG. These companies focus on expanding product portfolios, enhancing sterile and non-sterile compounding capabilities, and adopting advanced technologies to improve efficiency and ensure regulatory compliance. Strategic partnerships, mergers, and research-driven innovations enable them to cater to growing demand for personalized oral, injectable, topical, and nasal medications. Bavaria emerges as the leading region in the market, commanding a 22% share in 2024, driven by its robust healthcare infrastructure, high hospital density, and strong pharmaceutical presence, which collectively support the widespread adoption of compounded therapies across diverse patient segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Compounding Pharmacies Market was valued at USD 535.21 Million in 2024 and is projected to reach USD 829.32 Million by 2032, growing at a CAGR of 5.24%.

- Rising demand for personalized medications, increasing prevalence of chronic diseases, and expansion in hospital and clinical applications are driving growth across oral, injectable, and topical formulations.

- Market trends include technological advancements in automated compounding, outsourcing of compounding services by healthcare providers, and increasing focus on niche therapeutic areas such as hormone replacement therapy, dermatology, and pain management.

- The competitive landscape is dominated by key players including Fresenius Kabi AG, B. Braun Melsungen AG, Fagron N.V., McKesson Europe, and Bayer AG, who focus on product innovation, regulatory compliance, and strategic collaborations to expand market presence.

- Regionally, Bavaria leads with a 22% market share, followed by North Rhine-Westphalia (20%), Baden-Württemberg (18%), and Hesse (12%), while other regions collectively account for 28%, reflecting strong adoption across diverse patient segments.

Market Segmentation Analysis:

By Product Type

Oral medications dominate the Germany Compounding Pharmacies Market, capturing approximately 38% of the product type revenue share in 2024. Their prevalence is driven by growing patient preference for customized oral therapies, rising chronic disease incidence, and the need for personalized dosing regimens. Injectable medications follow closely, benefiting from expanding hospital and clinical applications. Topical preparations, nasal formulations, and other niche products collectively account for the remaining share, supported by demand in dermatology, pain management, and targeted therapeutic interventions. The trend toward personalized healthcare continues to fuel product diversification in this segment.

- For instance, Fresenius Kabi expanded its injectable production capacity in 2024 to meet rising clinical demand for compounded sterile preparations used in oncology and critical care, reflecting institutional reliance on customized injectables.

By Pharmacy Type

503A pharmacies lead the market with a 62% share, primarily due to their ability to provide patient-specific compounded medications with high customization flexibility. These pharmacies cater to individual prescriptions, ensuring precise formulations and quality control. 503B pharmacies, while smaller in market share at 38%, are gaining traction by offering large-scale sterile and non-sterile compounding solutions, particularly for hospitals and clinics. Increasing regulatory support, rising demand for specialty drugs, and the shift toward outsourcing compounding services are driving overall market growth across both pharmacy types.

- For instance, 503B facilities produce bulk sterile prefilled syringes, which hospitals rely on for surgeries and intensive care, minimizing contamination risks and ensuring dosage accuracy under strict FDA Current Good Manufacturing Practices (CGMP).

By Sterility

Sterile compounding holds the dominant position with a 55% market share, propelled by increasing requirements for injectable medications, ophthalmic solutions, and intravenous therapies. The segment’s growth is further driven by hospital demand and stringent regulatory standards for sterile preparation to ensure patient safety. Non-sterile compounding, accounting for 45% of the share, focuses on oral, topical, and nasal formulations, catering to outpatient and homecare patients. Rising awareness of personalized therapies and expanding applications in hormone replacement and pain management continue to support both sterile and non-sterile segments.

Key Growth Drivers

Rising Demand for Personalized Medications

The increasing prevalence of chronic diseases and complex health conditions in Germany has intensified the demand for personalized medications. Compounding pharmacies allow tailored formulations, precise dosing, and customized drug combinations that address individual patient needs. This trend is particularly prominent in hormone replacement therapy, pain management, and pediatric care. Growing patient awareness, coupled with a shift toward personalized healthcare solutions, drives higher adoption of compounding services. Pharmaceutical providers are responding with innovative offerings, expanding the market and reinforcing its critical role in patient-centered care.

- For instance, in pediatric care, Pace Pharmacy offers medically tailored formulations such as flavored syrups, topical gels, and suppositories, ensuring that medications for children are both effective and easier to administer, addressing unique pediatric needs and allergies.

Expansion of Hospital and Clinical Applications

Hospitals and specialized clinics are increasingly relying on compounding pharmacies to meet the demand for sterile and non-sterile medications. Injectable therapies, intravenous solutions, and complex formulations require precise compounding to ensure safety and efficacy. Rising hospital admissions and advancements in treatment protocols have fueled demand, particularly for 503B pharmacies capable of large-scale production. This institutional reliance ensures steady market growth, while also encouraging investment in automation, quality control, and regulatory compliance to maintain high standards in compounding services.

- For instance, B. Braun, a leading company, integrates advanced pharmaceutical compounding solutions to support hospitals globally, enhancing patient care with tailored sterile therapies.

Technological Advancements in Compounding Practices

Innovation in compounding technologies, including automated dispensing, sterile preparation systems, and quality monitoring solutions, has significantly improved efficiency and safety. These advancements reduce human error, enhance formulation accuracy, and allow pharmacies to scale operations while maintaining compliance with stringent German regulations. As technology adoption increases, pharmacies can offer a broader range of products and reduce production timelines, meeting growing patient and institutional demand. This driver not only strengthens operational capacity but also supports market expansion across oral, injectable, topical, and specialty therapies.

Key Trends & Opportunities

Trend of Outsourcing Compounding Services

Healthcare providers in Germany are increasingly outsourcing compounding requirements to specialized pharmacies, allowing hospitals and clinics to focus on core medical services. This trend is driven by cost-efficiency, quality assurance, and access to advanced formulation expertise. Outsourcing ensures consistent supply of sterile and non-sterile medications, reducing the burden of in-house production. As more providers recognize the operational benefits, the market sees greater collaboration opportunities and the potential for specialized pharmacies to expand service portfolios, supporting sustainable growth and higher patient satisfaction.

- For instance, pharmaceutical companies like Fresenius Kabi have expanded their outsourcing services to hospitals, offering high-quality compounded formulations tailored to patient needs.

Growing Focus on Niche Therapeutic Areas

The Germany compounding pharmacies market is witnessing expansion in niche therapeutic areas such as dermatology, hormone replacement therapy, and pediatric formulations. Rising patient awareness and demand for customized treatments in these areas present significant opportunities for market players. By developing specialized products, pharmacies can differentiate offerings, enhance patient outcomes, and capture higher market share. This focus encourages innovation in formulation, packaging, and delivery systems while promoting partnerships with healthcare providers to address emerging therapeutic needs efficiently.

- For instance, Dermapharm AG, a well-known pharmaceutical manufacturer, also plays a key role by developing dermatology-focused compounded products within their extensive portfolio. They emphasize quality and innovation in formulations, offering targeted solutions for skin conditions and contributing to custom therapy advancements in the German market.

Key Challenges

Regulatory Compliance and Quality Standards

Stringent German and EU regulations ensure that compounding pharmacies maintain high-quality standards, yet meeting these requirements can be challenging. Compliance with sterility protocols, labeling, documentation, and safety guidelines is mandatory, necessitating investment in training, technology, and quality monitoring systems. While these standards safeguard patient safety and enhance market credibility, smaller pharmacies may struggle with operational costs and resource allocation, limiting expansion potential. Balancing regulatory adherence with growth ambitions remains a critical challenge for market participants.

Limited Awareness and Adoption Among Patients

Despite growing demand, a significant portion of patients remains unaware of the benefits of compounded medications, particularly for non-traditional therapies. Limited education on personalized dosing, specialized formulations, and alternative delivery methods reduces adoption rates. Market players must invest in awareness campaigns, physician collaboration, and patient education initiatives to bridge this gap. Overcoming this challenge is essential for expanding the consumer base, increasing market penetration, and ensuring that compounding pharmacies fully capitalize on the rising need for personalized healthcare solutions.

Regional Analysis

Bavaria

Bavaria leads the Germany Compounding Pharmacies Market, holding a 22% share in 2024. The region benefits from a robust healthcare infrastructure, high concentration of hospitals, and strong pharmaceutical presence. Growing demand for personalized medications, particularly in hormone replacement therapy and pain management, drives market growth. Advanced research facilities and collaborations between healthcare providers and compounding pharmacies further support the expansion of oral, injectable, and topical formulations. Additionally, the region’s emphasis on quality and regulatory compliance ensures the adoption of sterile and non-sterile compounding services, reinforcing Bavaria’s dominance within the national market.

North Rhine-Westphalia

North Rhine-Westphalia captures a 20% share of the Germany Compounding Pharmacies Market. The region’s dense population and high prevalence of chronic diseases contribute to strong demand for customized therapies. Hospitals and specialized clinics rely on 503A and 503B pharmacies for sterile and non-sterile formulations, especially injectable medications. Investment in automation and compounding technologies enhances efficiency and safety, enabling pharmacies to meet growing patient and institutional requirements. North Rhine-Westphalia’s strategic focus on research-driven healthcare solutions and partnerships between pharmaceutical companies and clinical institutions further accelerates market adoption and overall regional growth.

Baden-Württemberg

Baden-Württemberg accounts for 18% of the market share in Germany’s compounding pharmacies sector. The region exhibits strong demand for personalized therapies, driven by high patient awareness and rising chronic conditions. Compounding pharmacies provide oral, topical, and injectable medications tailored to specific patient needs, supporting widespread adoption. Collaboration between hospitals, clinics, and specialized pharmacies enhances access to sterile and non-sterile formulations. The region also benefits from advanced pharmaceutical manufacturing capabilities, skilled healthcare professionals, and a focus on regulatory compliance, making it a critical contributor to the overall growth of the German compounding pharmacies market.

Hesse

Hesse holds 12% of the Germany Compounding Pharmacies Market, driven by increasing patient demand for individualized treatments and specialty medications. Hospitals and outpatient clinics rely on sterile and non-sterile compounding services to manage complex therapeutic requirements. The region’s pharmaceutical sector emphasizes technology adoption, enabling precise dosing, automation, and quality monitoring. Growth in hormone replacement therapy, dermatology, and pain management applications further supports market expansion. Hesse’s strong healthcare infrastructure, combined with regulatory compliance and rising patient awareness of personalized healthcare solutions, positions it as a key contributor to Germany’s overall compounding pharmacies market.

Other Regions

Other regions, including Lower Saxony, Saxony, and Schleswig-Holstein, collectively account for 28% of the Germany Compounding Pharmacies Market. These areas are witnessing growing demand for oral, injectable, and topical compounded medications across hospitals, clinics, and outpatient care settings. Expansion is driven by increased awareness of personalized healthcare, investments in pharmacy technology, and rising adoption of 503A and 503B compounding services. Despite varying regional healthcare capacities, these areas are increasingly integrating specialized therapies, including pain management and hormone replacement treatments, contributing steadily to national market growth and offering opportunities for further expansion in underserved locations.

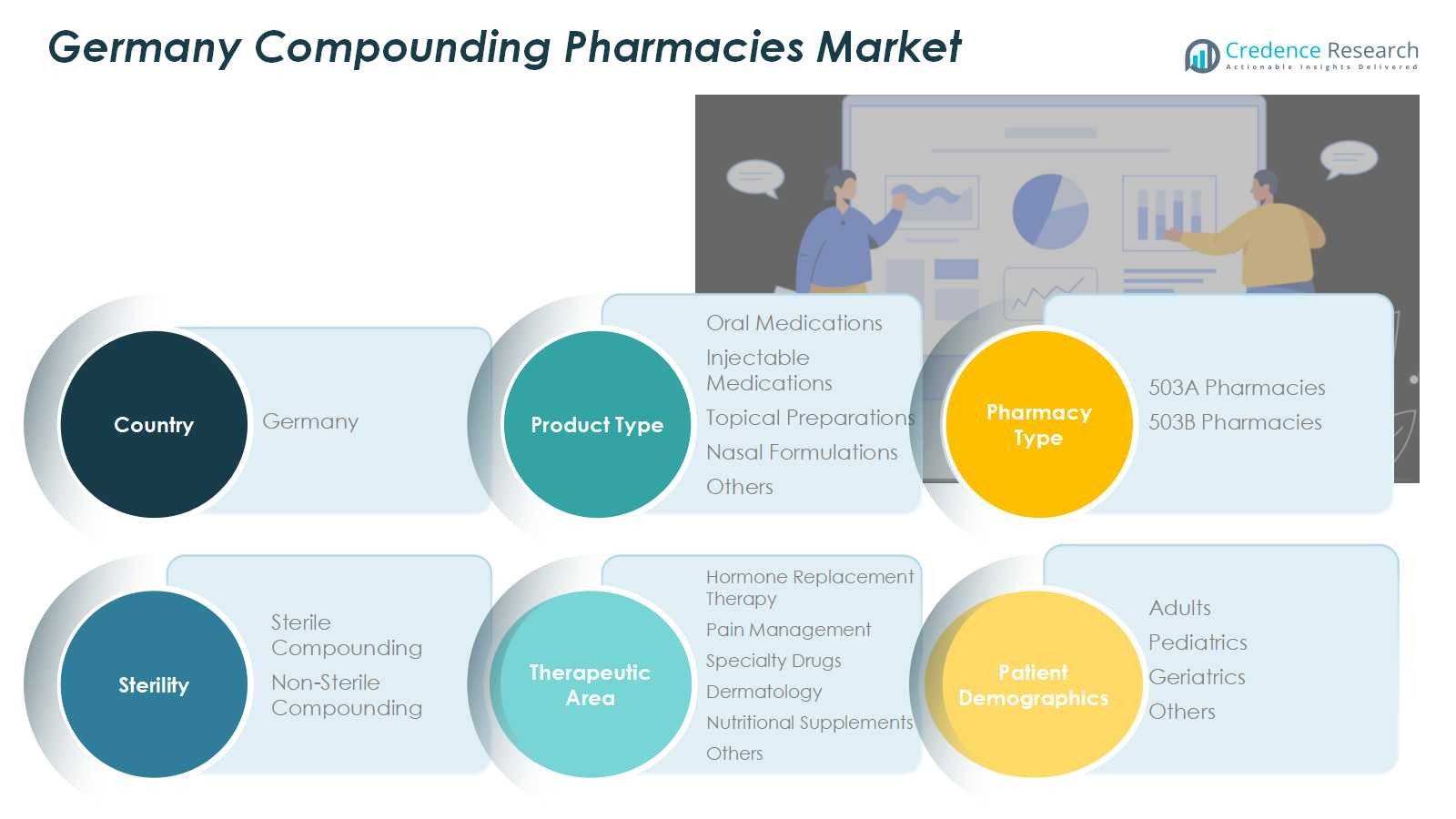

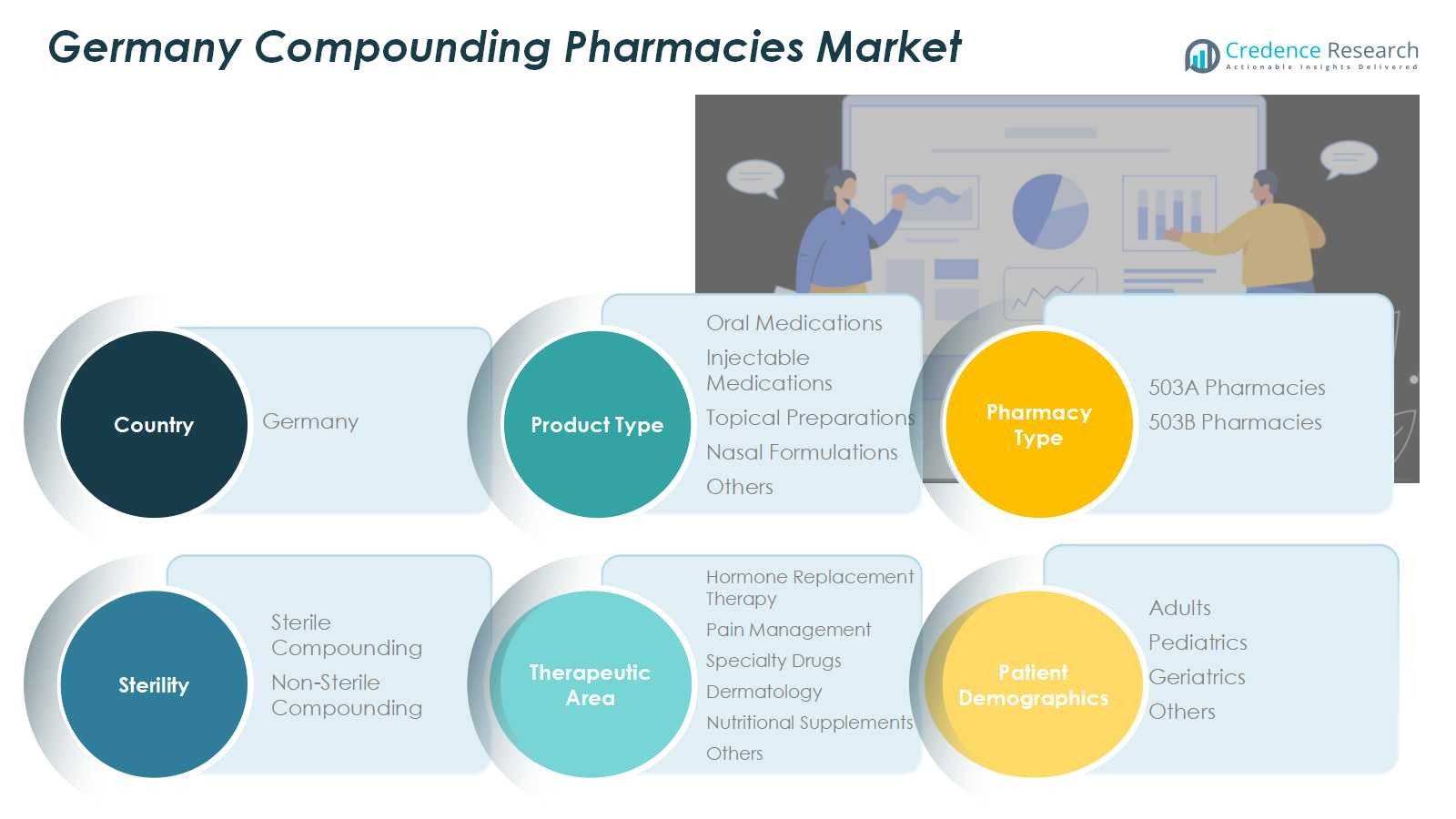

Market Segmentations:

By Product Type

- Oral Medications

- Injectable Medications

- Topical Preparations

- Nasal Formulations

- Others

By Pharmacy Type

- 503A Pharmacies

- 503B Pharmacie

By Sterility

- Sterile Compounding

- Non-Sterile Compounding

By Therapeutic Area

- Hormone Replacement Therapy

- Pain Management

- Specialty Drugs

- Dermatology

- Nutritional Supplements

- Others

By Patient Demographics

- Adults

- Pediatrics

- Geriatrics

- Others

By Region

- Bavaria

- North Rhine-Westphalia

- Baden-Württemberg

- Hesse

- Other Regions

Competitive Landscape

The competitive landscape of the Germany Compounding Pharmacies Market features key players such as Fresenius Kabi AG, B. Braun Melsungen AG, Fagron N.V., McKesson Europe, MediGroup GmbH, Morbus Pharma, Pharmaserv GmbH, Sanacorp Pharmahandel GmbH, TÜV Rheinland Pharma, and Bayer AG. These companies focus on expanding product portfolios, enhancing sterile and non-sterile compounding capabilities, and adopting advanced technologies to improve efficiency and quality. Strategic partnerships, mergers, and acquisitions strengthen market presence and geographic reach. Leading players also invest in research and development to introduce innovative oral, injectable, topical, and nasal formulations tailored to patient-specific needs. Regulatory compliance, high-quality standards, and increasing collaboration with hospitals and clinics are key differentiators. The market remains highly competitive, with players striving to capture growth opportunities in personalized therapies, niche therapeutic areas, and specialized compounding services across Germany.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fresenius Kabi AG

- Braun Melsungen AG

- Fagron N.V.

- McKesson Europe

- MediGroup GmbH

- Morbus Pharma

- Pharmaserv GmbH

- Sanacorp Pharmahandel GmbH

- TÜV Rheinland Pharma

- Bayer AG

Recent Developments

- In February 2025, Recipharm introduced a fully operational modular sterile filling system at its Wasserburg, Germany facility, featuring a Grade A isolator and full GMP compliance to enhance aseptic compounding capabilities.

- In March 2024, Medios AG acquired Ceban Pharmaceuticals B.V., a Netherlands-based leader in pharmaceutical compounding, to expand its European footprint across Germany, Belgium, and Spain.

- In August 2024, InterCure Ltd. expanded its strategic alliance with Cookies to establish “Cookies Corners” in eight licensed pharmacies across Germany for the distribution of premium cannabis-based formulations.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pharmacy Type, Sterility, Therapeutic Area, Patient Demographics and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising demand for personalized medications.

- Hospitals and clinics will increasingly rely on compounding pharmacies for sterile and non-sterile formulations.

- Technological advancements in automated compounding and quality monitoring will enhance efficiency and safety.

- Expansion in niche therapeutic areas such as hormone replacement therapy, dermatology, and pain management will drive growth.

- 503A pharmacies will continue to dominate, with 503B pharmacies gaining traction through large-scale sterile production.

- Regulatory compliance and adherence to quality standards will remain a critical factor for market players.

- Patient awareness and adoption of customized medications are projected to increase, boosting market penetration.

- Outsourcing of compounding services by healthcare providers will grow, supporting operational efficiency.

- Investment in research and development will lead to innovative oral, injectable, and topical formulations.

- Collaboration between pharmaceutical companies and hospitals will strengthen market presence and service delivery.