| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Digital Oilfield Solutions Market Size 2024 |

USD 2,078.63 Million |

| Germany Digital Oilfield Solutions Market, CAGR |

7.83% |

| Germany Digital Oilfield Solutions Market Size 2032 |

USD 3,798.94 Million |

Market Overview

The Germany Digital Oilfield Solutions Market is projected to grow from USD 2,078.63 million in 2024 to an estimated USD 3,798.94 million by 2032, with a compound annual growth rate (CAGR) of 7.83% from 2025 to 2032. The market’s expansion is driven by increasing demand for advanced digital technologies and automation in the oil and gas industry, focusing on enhanced operational efficiency and reduced costs.

Key drivers fueling this growth include the increasing need for real-time data analytics, predictive maintenance, and optimized resource management. The rising focus on operational safety, regulatory compliance, and energy efficiency also contributes to market growth. Moreover, emerging trends such as the integration of artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) in digital oilfield solutions are enhancing asset management and decision-making processes, further accelerating market demand.

Geographically, Germany holds a strategic position in the European oil and gas industry, providing a robust market for digital oilfield solutions. The country’s strong infrastructure, coupled with its commitment to energy transition and sustainability, drives the adoption of advanced technologies. Key players in the market include Siemens AG, SAP SE, ABB Ltd., Honeywell International Inc., and Schlumberger Limited, which are actively contributing to the innovation and growth of digital oilfield solutions in the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Digital Oilfield Solutions Market is projected to grow from USD 2,078.63 million in 2024 to USD 3,798.94 million by 2032, at a CAGR of 7.83% from 2025 to 2032. The growth is driven by the increasing demand for automation and advanced digital technologies in the oil and gas industry.

- The Global Digital Oilfield Solutions Market is projected to grow from USD31,374.00 million in 2024 to USD 54,897.18 million by 2032, with a CAGR of 7.24% from 2025 to 2032.

- Key drivers include the adoption of real-time data analytics, predictive maintenance, and operational optimization technologies. The growing focus on efficiency and safety in operations further accelerates market demand.

- The integration of AI, machine learning, and IoT plays a pivotal role in enhancing decision-making processes, improving asset management, and streamlining resource allocation in digital oilfield solutions.

- Increasing pressure to meet sustainability goals and reduce carbon emissions is driving the adoption of digital solutions that optimize energy usage and promote environmental compliance.

- High implementation costs and integration challenges with legacy systems hinder the widespread adoption of digital oilfield solutions, especially for small to medium-sized companies.

- Germany dominates the market in Europe, accounting for a significant share due to its advanced infrastructure, commitment to energy transition, and strong presence in the global oil and gas industry.

- Leading players in the market include Siemens AG, SAP SE, ABB Ltd., Honeywell International Inc., and Schlumberger Limited, contributing to technological innovation and market growth.

Market Drivers

Focus on Enhanced Safety, Regulatory Compliance, and Sustainability

Safety and regulatory compliance have always been a priority in the oil and gas industry, but there has been an increased focus on these aspects in recent years. Digital oilfield solutions are helping companies improve safety protocols by offering real-time monitoring of operations, detecting potential hazards, and automating emergency responses. These systems allow operators to intervene early in case of any irregularities, such as leaks, pressure fluctuations, or equipment failures, preventing major accidents and minimizing the risk to personnel. Furthermore, regulatory compliance is becoming more complex, with stringent rules surrounding environmental protection and safety standards. Digital oilfield solutions assist companies in staying compliant by ensuring that all processes adhere to local and international regulations. Additionally, the push for sustainability within the oil and gas sector is driving the adoption of digital tools that help reduce energy consumption and emissions. Digital solutions optimize resource utilization and enhance the overall sustainability of operations by integrating energy-efficient technologies and providing real-time energy consumption data, enabling companies to make informed decisions to lower their carbon footprint.

Rising Exploration and Production (E&P) Activities in Unconventional Reserves

As conventional oil reserves become more challenging to exploit, oil and gas companies are increasingly turning to unconventional reserves such as shale, deepwater, and tight oil reservoirs. These reserves often require advanced technologies and enhanced operational capabilities to extract resources efficiently. Digital oilfield solutions play a critical role in this shift by improving exploration and production (E&P) activities in such reserves. Real-time data acquisition, reservoir simulation, and enhanced oil recovery (EOR) techniques are vital to maximizing recovery rates from these unconventional reserves. For example, digital oilfield technologies help in optimizing hydraulic fracturing processes, managing wellbore integrity, and improving reservoir performance. Additionally, the complexity of operating in remote and harsh environments calls for robust monitoring and control systems, which digital oilfield solutions provide. By ensuring that operators can manage these challenging conditions with greater accuracy and efficiency, digital oilfield solutions are facilitating the development of unconventional oil and gas reserves, further boosting market demand in Germany.

Increased Demand for Operational Efficiency and Cost Reduction

The Germany Digital Oilfield Solutions Market is driven by a growing need for operational efficiency and cost reduction across the oil and gas industry. Companies face increasing pressure to optimize production while minimizing expenses, leading to the adoption of digital oilfield solutions. These solutions provide real-time data analytics, automation, and advanced monitoring tools that help operators streamline their operations, reduce downtime, and enhance productivity. For instance, companies like Schlumberger and Halliburton have implemented digital tools that enable predictive maintenance, allowing for the early detection of equipment failure, thereby reducing maintenance costs and avoiding unplanned shutdowns. The ability to integrate advanced automation systems and remote monitoring allows companies to optimize drilling, production, and reservoir management processes while lowering operational costs. With rising exploration and production (E&P) activities, the oil and gas industry is turning to digital technologies to improve efficiency, extend the lifespan of assets, and ensure sustainable operations.

Technological Advancements in AI, Machine Learning, and IoT Integration

The integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) in digital oilfield solutions is transforming the oil and gas industry. These technologies enable more intelligent, data-driven decision-making processes by analyzing large datasets from sensors and monitoring systems to provide actionable insights. AI and ML algorithms predict equipment failure, optimize production rates, and determine the best drilling locations. IoT devices connect sensors, machinery, and field equipment, offering real-time monitoring and facilitating automated responses. For instance, companies like SLB and Aker BP are co-developing AI-driven virtual platforms to enhance innovation and efficiency in E&P operations, resulting in significant improvements. With continuous advancements in these technologies, operators can achieve a more holistic view of their operations, ensuring efficient management of resources, improved asset performance, and greater safety. These technologies help operators reduce operational risks and enhance the accuracy of decision-making, contributing significantly to the market’s growth.

Market Trends

Enhanced Automation and Remote Operations for Efficiency and Safety

Automation in the oil and gas industry is another key trend driving the growth of digital oilfield solutions in Germany. The need for improved operational efficiency, reduced human intervention, and enhanced safety measures is pushing companies to adopt automated solutions. Digital oilfield systems now allow for the automation of a variety of processes, including drilling, production, and maintenance. Remote-controlled operations, powered by digital technologies, enable companies to monitor and manage operations from a distance, ensuring better resource allocation and faster decision-making. Remote operations are particularly valuable in hazardous or difficult-to-reach areas where human presence is minimal or impractical. Automation also plays a vital role in improving safety by eliminating or reducing human error, which can lead to accidents and operational inefficiencies. Advanced control systems, sensor networks, and autonomous robots can carry out tasks that were once performed manually, significantly improving both the speed and safety of operations. These technologies contribute to more efficient exploration, drilling, and production processes, ensuring that oilfield operators can meet production targets while adhering to safety standards and reducing environmental impact.

Focus on Sustainable and Energy-Efficient Technologies

A significant current trend in the Germany Digital Oilfield Solutions Market is the increasing focus on sustainability and energy efficiency. As the global energy landscape continues to evolve and calls for greener technologies grow louder, oil and gas companies are under greater pressure to reduce their carbon footprint. Digital oilfield solutions are being leveraged to address these sustainability concerns by optimizing resource utilization and minimizing waste. Technologies such as real-time data monitoring, predictive maintenance, and energy-efficient asset management are helping operators achieve higher levels of sustainability. For instance, advanced data analytics can optimize the energy consumption of equipment, while IoT sensors track energy use in real-time and provide insights that lead to better energy management decisions. Additionally, digital solutions assist in reducing emissions by identifying areas where energy use can be minimized and operations can be optimized. The transition toward energy-efficient practices is further encouraged by regulatory pressures, as governments and environmental agencies impose stricter rules on the oil and gas industry to reduce environmental impact. The use of renewable energy sources and low-carbon technologies in combination with digital solutions is also a growing trend in the industry, driving greater efficiency and helping oil and gas operators align with global sustainability goals.

Increasing Adoption of Cloud-Based Digital Oilfield Solutions

The Germany Digital Oilfield Solutions Market is witnessing a significant shift towards cloud-based solutions, driven by the need for enhanced operational efficiency and cost savings. Cloud technology plays a crucial role in the digital transformation of the oil and gas sector, allowing companies to store and analyze vast amounts of data in real-time. For instance, more than 70% of German IT decision-makers are adopting or interested in cloud-native solutions, highlighting the growing demand for scalable and flexible data management systems3. Cloud-based platforms offer oil and gas operators flexibility, scalability, and remote access to critical data, reducing the reliance on physical infrastructure and enabling smoother integration with other technologies like IoT and AI. These solutions help manage complex workflows, real-time analytics, and remote monitoring more effectively, which is particularly beneficial for companies with operations spread across large geographical areas.

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Exploration and Production

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is gaining significant traction in the Germany Digital Oilfield Solutions Market. AI and ML are being applied to analyze large volumes of data generated from various sources in oilfield operations, providing valuable insights that enhance decision-making. For instance, companies like Siemens AG and IBM Corporation are leveraging AI to optimize reservoir modeling, well performance analysis, and production forecasting, maximizing hydrocarbon recovery rates and minimizing production costs4. ML algorithms can analyze historical data to identify patterns and make real-time recommendations for optimizing well performance, managing reservoir behavior, and improving overall efficiency. Furthermore, AI-powered systems are enhancing the monitoring of complex reservoirs by processing geological, geophysical, and operational data to optimize exploration strategies. This trend is helping operators reduce operational costs, improve asset utilization, and extend the lifecycle of assets.

Market Challenges

Data Security and Privacy Concerns

One of the major challenges facing the Germany Digital Oilfield Solutions Market is the increasing concern over data security and privacy. With the growing reliance on digital technologies, large volumes of sensitive operational data are generated and transmitted across various platforms, making them vulnerable to cyberattacks, data breaches, and unauthorized access. Oil and gas companies in Germany are particularly concerned about the protection of intellectual property, financial data, and operational insights that are integral to maintaining a competitive advantage. For instance, a recent cyber attack against Germany’s Oiltanking affected 13 distribution terminals, highlighting the potential impact of such incidents on operational continuity. The integration of technologies such as cloud computing, IoT, and AI introduces additional layers of complexity in securing data, as these systems involve multiple interconnected devices and external storage solutions. Any breach could lead to significant financial losses, regulatory penalties, and damage to the company’s reputation. As the adoption of digital oilfield solutions accelerates, addressing cybersecurity risks through robust encryption, secure data protocols, and proactive monitoring will be essential. This challenge necessitates a balanced approach, where technological advancements are combined with stringent security measures to protect the valuable data driving operational efficiencies and innovation in the market.

High Implementation Costs and Integration Complexity

Another significant challenge for the Germany Digital Oilfield Solutions Market is the high initial costs associated with the implementation and integration of digital technologies. The adoption of advanced digital solutions often requires substantial upfront investments in infrastructure, hardware, software, and specialized training for personnel. For small and medium-sized enterprises (SMEs) in the oil and gas sector, these costs can be prohibitive, limiting the widespread adoption of digital solutions. Furthermore, integrating new technologies with existing legacy systems can be complex and time-consuming. Oil and gas operators often struggle with compatibility issues, as older systems may not support newer digital solutions, requiring additional customization or upgrades. This integration complexity can delay the realization of the full benefits of digital transformation, such as enhanced operational efficiency and cost savings. Additionally, the need for specialized technical expertise and ongoing maintenance further raises the total cost of ownership for digital oilfield solutions. Consequently, while digital transformation promises significant advantages, the financial burden and technical challenges of implementation remain barriers to rapid adoption for many companies.

Market Opportunities

Growth of Unconventional Oil and Gas Exploration

The increasing exploration and production of unconventional oil and gas reserves presents a significant opportunity for the Germany Digital Oilfield Solutions Market. As conventional oil fields face depletion, there is a growing emphasis on tapping into unconventional reserves such as shale oil, tight gas, and deepwater fields. These resources often require advanced technological solutions to enhance extraction efficiency and maximize recovery rates. Digital oilfield solutions, including real-time monitoring, reservoir modeling, and automated drilling systems, are essential for managing the complexity of unconventional resource development. As Germany continues to explore these reserves, there will be a rising demand for digital tools that optimize exploration strategies, enhance operational safety, and reduce environmental impacts. This shift toward unconventional resources represents a substantial growth opportunity for digital oilfield solutions providers, offering a competitive edge in an evolving market.

Government Push for Energy Transition and Sustainability

Germany’s commitment to sustainability and energy transition, as part of its broader environmental goals, presents a valuable market opportunity for digital oilfield solutions. As the country moves toward a low-carbon future, oil and gas companies are under increasing pressure to reduce emissions and improve the energy efficiency of their operations. Digital solutions that enable real-time monitoring, predictive maintenance, and optimization of energy use are vital in supporting these sustainability objectives. By integrating energy-efficient practices and reducing operational waste, digital technologies help companies comply with strict regulatory standards and contribute to Germany’s climate targets. As these sustainability efforts intensify, the demand for advanced digital solutions that help optimize production while minimizing environmental footprints will continue to rise, creating new growth avenues for market players.

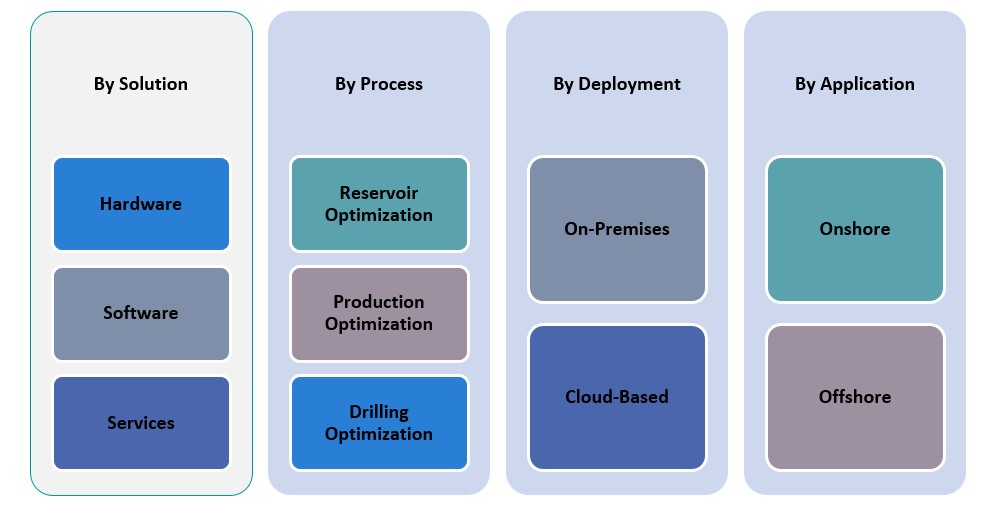

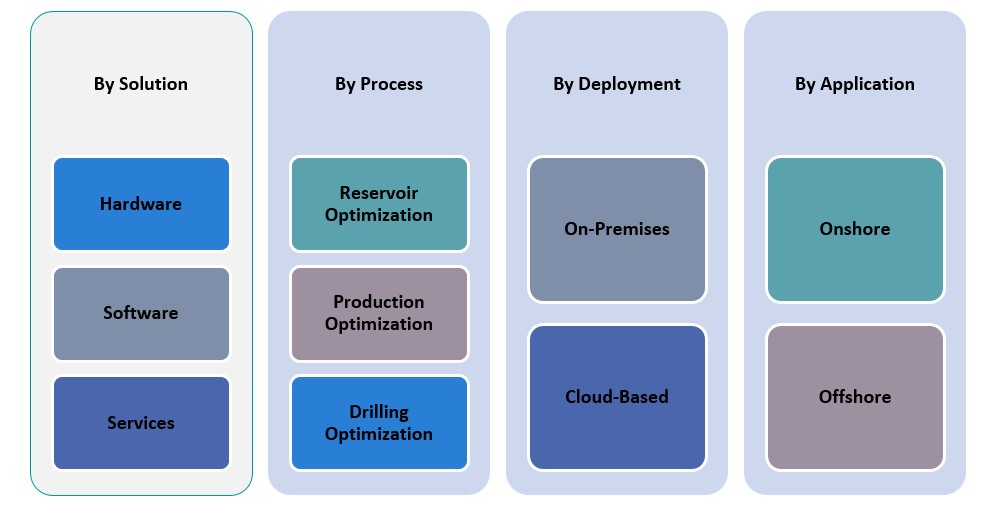

Market Segmentation Analysis

By Solution Type

The market is primarily divided into three categories: hardware, software, and services. Hardware solutions account for a significant portion of the market, providing essential equipment such as sensors, monitoring systems, and automation devices. These solutions enable real-time data collection, analysis, and control of operations. Software solutions, including data analytics platforms, reservoir modeling, and management tools, are increasingly sought after for their ability to process large datasets and provide actionable insights. Services, including consulting, maintenance, and training, also form a crucial segment. These services support the deployment, integration, and ongoing optimization of digital oilfield technologies, ensuring seamless operation and long-term value for clients.

By Application

The market is divided into onshore and offshore applications, each with distinct needs and challenges. Onshore oilfields dominate the market, driven by advancements in automation and digital monitoring systems to improve production efficiency. These applications benefit from technologies such as real-time data analytics, predictive maintenance, and reservoir modeling. Offshore applications, while a smaller segment, are growing rapidly due to the complexity and high operational costs associated with offshore drilling. Digital solutions in offshore oilfields enhance operational efficiency, improve safety, and reduce downtime through advanced monitoring, control, and optimization systems.

Segments

Based on Solution

- Hardware

- Software

- Services

Based on Application

Based on Process

- Reservoir Optimization

- Production Optimization

- Drilling Optimization

Based on Deployment

Based on Region

- Northern Germany

- Central Germany

- Southern Germany

Regional Analysis

Northern Germany (40%)

Northern Germany leads the market, accounting for approximately 40% of the national share. This dominance is attributed to the region’s proximity to the North Sea, facilitating offshore drilling activities. The presence of major ports and logistics hubs, such as Hamburg, supports the integration of advanced digital solutions in oilfield operations. Companies in this region are increasingly adopting real-time monitoring and automation technologies to enhance operational efficiency and safety.

Central Germany (35%)

Central Germany holds a 35% share of the market, serving as the country’s industrial and technological heartland. The region benefits from a concentration of research institutions and technology firms specializing in software development, data analytics, and IoT applications. These capabilities enable the implementation of sophisticated digital oilfield solutions, such as predictive maintenance and reservoir optimization, contributing to improved productivity and cost savings.

Key players

- ABB Ltd.

- Schneider Electric SE

- Kongsberg Gruppen ASA

- TechnipFMC plc

- Wipro Limited

- Rockwell Automation, Inc.

- IBM Corporation

- SAP SE

- Yokogawa Electric Corporation

Competitive Analysis

The Germany Digital Oilfield Solutions Market is highly competitive, with several key players leading technological advancements and shaping the industry. Companies such as ABB Ltd., Schneider Electric SE, and Yokogawa Electric Corporation offer comprehensive automation and control solutions that enhance operational efficiency in oil and gas operations. These companies leverage their expertise in industrial automation, control systems, and smart analytics to optimize drilling, production, and reservoir management processes. Wipro Limited and IBM Corporation focus on AI, cloud computing, and data analytics to provide innovative, scalable solutions for the oil and gas sector. SAP SE’s strong software solutions and integration capabilities help improve real-time monitoring and predictive analytics. Meanwhile, TechnipFMC plc and Kongsberg Gruppen ASA continue to push the envelope in providing advanced offshore solutions, while Rockwell Automation enhances the automation and digitalization of production systems. Their collective focus on digital transformation and operational optimization drives the market forward.

Recent Developments

- In March 2025, Schneider Electric unveiled the One Digital Grid Platform, an AI-powered platform designed to enhance grid resiliency and efficiency. This platform is set to be available later in 2025. The company announced a $700 million investment plan in the U.S. to enhance energy infrastructure and AI capabilities.

- In April 2025, ABB India delivered integrated automation and digital solutions for IndianOil’s cross-country pipeline network, enhancing efficiency and safety through real-time monitoring and robust cybersecurity.

- In March 2025, Kongsberg Digital participated in the IPTC 2025, focusing on digital transformation in the oil and gas sector.

- In January 2025, SAP S/4HANA Cloud was highlighted as a key enabler for a smarter, more efficient energy ecosystem in the oil and gas industry.

- In April 2025, Schlumberger (SLB) announced a partnership with Shell to deploy Petrel™ subsurface software across Shell’s global assets. This collaboration aims to enhance digital capabilities and operational efficiencies through advanced AI-driven seismic interpretation workflows. This development underscores SLB’s ongoing commitment to advancing subsurface digital technology and fostering strategic partnerships in the energy sector.

Market Concentration and Characteristics

The Germany Digital Oilfield Solutions Market is characterized by moderate to high market concentration, with a few key players dominating the landscape. Companies such as ABB Ltd., Schneider Electric SE, and Yokogawa Electric Corporation lead the market by offering a comprehensive range of automation, control systems, and software solutions. These players maintain a competitive edge through strong technological expertise, continuous innovation, and strategic partnerships. Despite the dominance of major players, the market also sees participation from mid-sized companies, particularly those focused on AI, machine learning, and cloud-based solutions, which are gaining traction due to their scalability and cost-effectiveness. The market is also marked by rapid technological advancements, increasing demand for real-time data analytics, and a growing emphasis on operational efficiency, safety, and sustainability. The entry of new players with specialized solutions further intensifies the competition, driving the continuous evolution of digital technologies within the sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Solution, Application, Process, Deployment and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Artificial intelligence and machine learning will see widespread integration in oilfield operations, enabling more efficient decision-making and predictive analytics for better asset management.

- Cloud-based digital oilfield solutions will dominate the market, offering enhanced scalability, flexibility, and reduced infrastructure costs for oil and gas companies.

- Automation will become a core component in digital oilfields, improving operational efficiency and reducing human error in drilling, production, and maintenance processes.

- There will be greater emphasis on digital solutions that help reduce energy consumption, emissions, and environmental impact, aligning with Germany’s sustainability goals.

- IoT will play a key role in real-time data monitoring, enhancing operational visibility and enabling remote monitoring of oilfield assets for improved decision-making.

- Remote monitoring and control of operations will rise, especially in offshore and challenging environments, reducing the need for onsite personnel and improving safety.

- Advanced data analytics will continue to evolve, offering more precise reservoir modeling, optimizing resource extraction, and increasing production yields.

- Digital twin technology will expand, providing virtual replicas of physical assets to simulate and optimize the performance of oilfield operations in real-time.

- Digital solutions will increasingly support regulatory compliance, improving safety measures and operational standards through real-time monitoring and data-driven insights.

- The market will see a rise in mergers and acquisitions as companies seek to acquire new technologies and enhance their product portfolios to stay competitive in the evolving digital landscape.