Market Overview

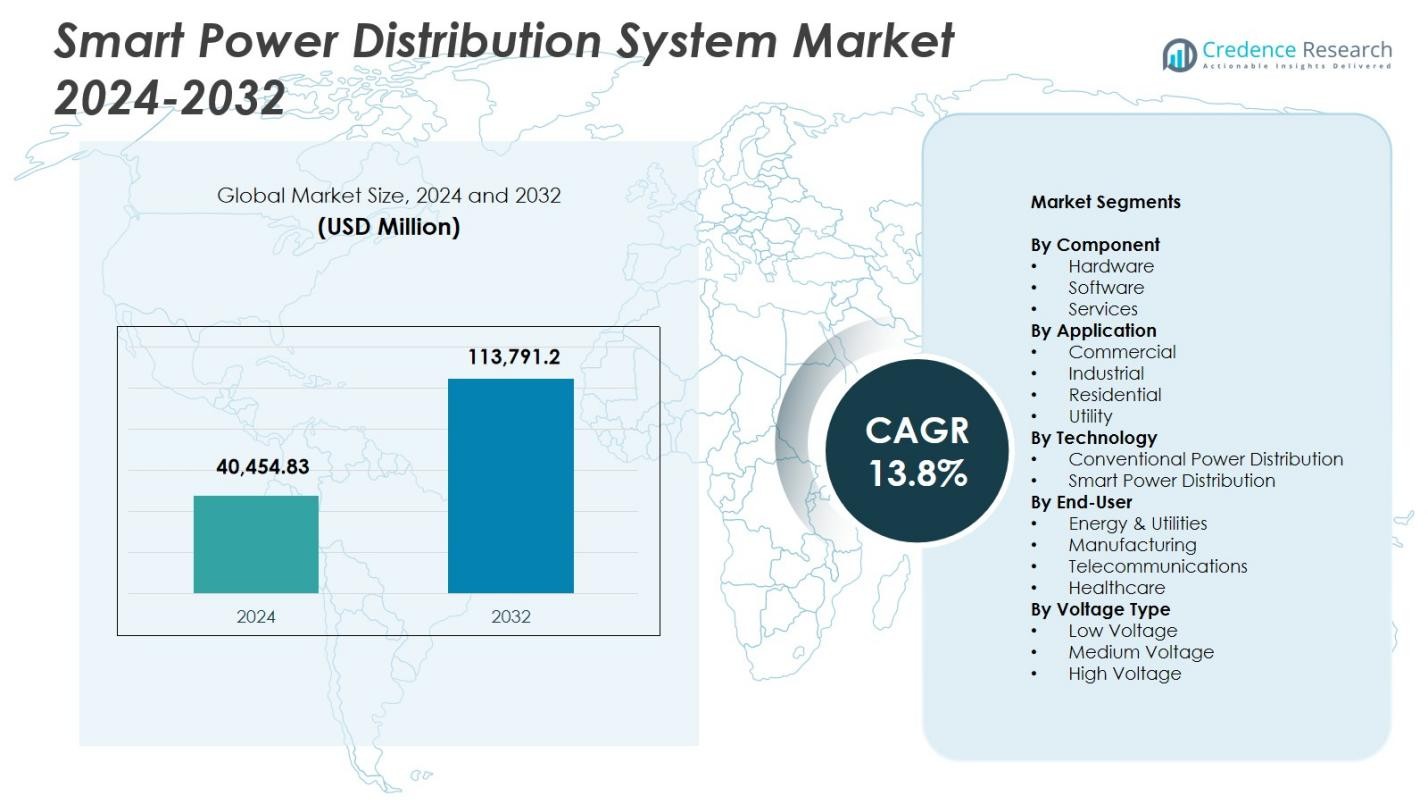

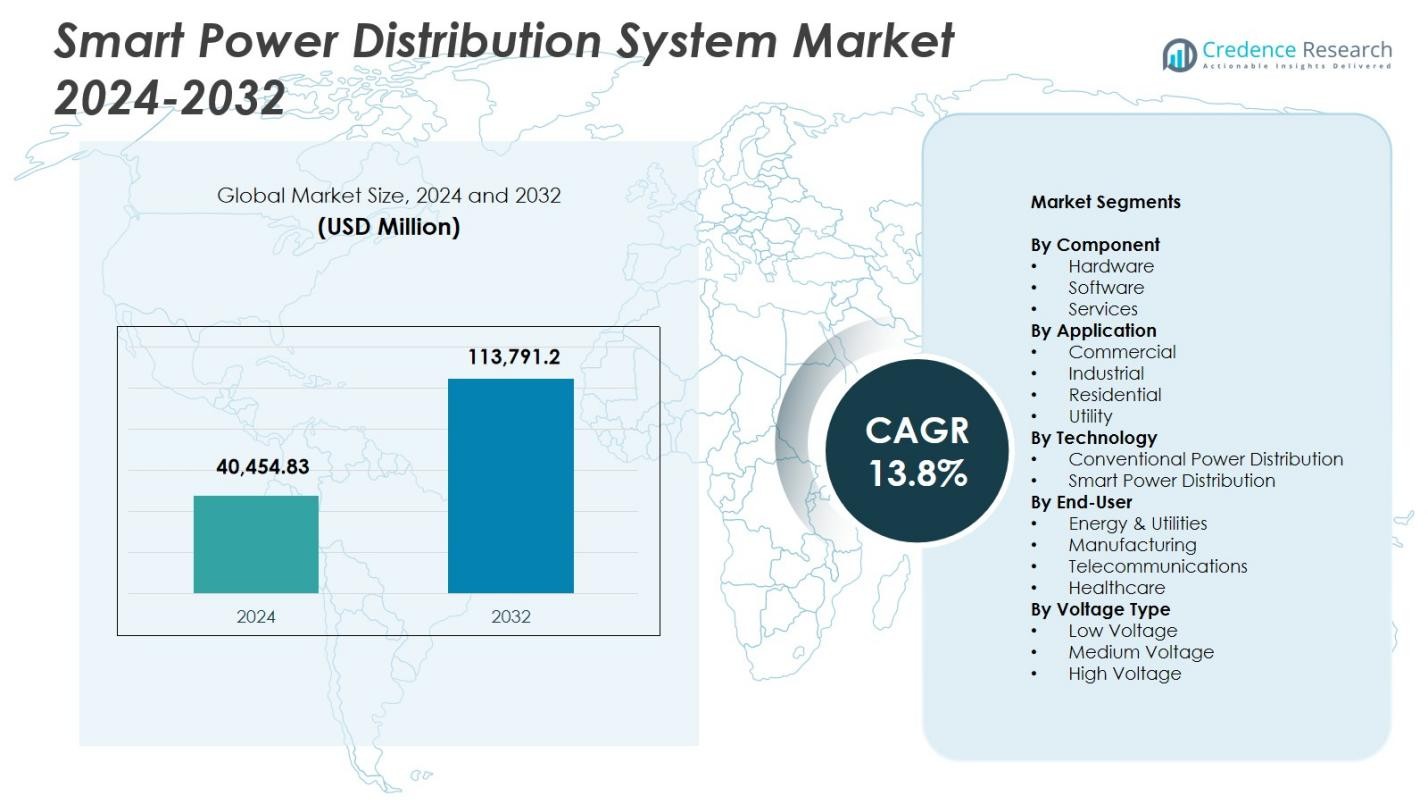

Smart Power Distribution System Market size was valued at USD 40,454.83 Million in 2024 and is anticipated to reach USD 113,791.2 Million by 2032, at a CAGR of 13.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Power Distribution System Market Size 2024 |

USD 40,454.83 Million |

| Smart Power Distribution System Market, CAGR |

13.8% |

| Smart Power Distribution System Market Size 2032 |

USD 113,791.2 Million |

Smart Power Distribution System Market features leading players such as Schneider Electric SE, Siemens AG, ABB, General Electric, Cisco Systems Inc., Eaton Corporation, Landis+Gyr AG, Oracle Corporation, Itron, and Aclara Technologies LLC, all of whom strengthen their presence through advancements in automation, digital substations, and smart metering solutions. These companies focus on expanding intelligent grid infrastructure and integrating AI-driven analytics to enhance reliability and energy efficiency. North America held the largest regional share at 37.4% in 2024, driven by extensive modernization programs, followed by Europe with 28.1% and Asia-Pacific with a rising 24.6% share supported by rapid urbanization and large-scale smart grid initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Smart Power Distribution System Market reached USD 40,454.83 Million in 2024 and will grow at a CAGR of 13.8% through 2032.

- Rising investments in grid modernization and automation act as major drivers, with hardware holding a 56.7% share due to strong adoption of intelligent switchgear and smart meters.

- Key trends include rapid integration of AI, IoT sensors, and digital substations, enabling utilities to deploy self-healing grids and enhance real-time monitoring and fault management.

- Leading players such as Schneider Electric, Siemens AG, ABB, General Electric, and Cisco Systems focus on advanced ADMS platforms, cybersecurity enhancements, and long-term utility partnerships to expand their presence.

- Regionally, North America leads with a 37.4% share, followed by Europe at 28.1%, while APAC grows quickly with a 24.6% share; the utility segment dominates applications with 47.8% supported by strong adoption of ADMS and AMI across major markets.

Market Segmentation Analysis:

By Component:

Hardware dominated the Smart Power Distribution System Market in 2024 with a 56.7% share, driven by the extensive deployment of intelligent switchgear, smart meters, reclosers, and automated feeders that enhance reliability and grid stability. Utilities increasingly prioritize hardware upgrades to support real-time monitoring and reduce outage durations, accelerating adoption of digital substations and advanced distribution automation systems. Software held a 28.4% share, supported by rising demand for grid analytics, SCADA platforms, and predictive maintenance tools, while services accounted for 14.9%, propelled by system integration, remote diagnostics, and lifecycle management requirements across modernized grids.

- For instance, Tata Power implemented a digital substation pilot at its Powai Substation, utilizing interoperable Intelligent Electronic Devices (IEDs) compliant with IEC 61850 protocols for protection, interlocking, and remote communication to enable real-time monitoring.

By Application:

The utility segment led the Smart Power Distribution System Market with a 47.8% share in 2024, attributed to widespread investments in grid digitalization, peak-load management, and automated fault detection capabilities. Utilities integrate advanced distribution management systems (ADMS) and AMI networks to optimize power flows, reduce technical losses, and support large-scale renewable integration. The industrial segment held a 28.6% share, driven by smart factory expansion and energy optimization initiatives, while the commercial and residential segments accounted for 14.1% and 9.5% respectively, supported by growing adoption of intelligent energy-management systems.

- For instance, Austin Energy’s ADMS rollout included integrated voltage/var control and fault location/isolation/service restoration, leveraging AMI meters across its 437-square-mile service area for over 435,000 customers.

By Technology:

Smart Power Distribution dominated the market with a 63.2% share in 2024, driven by rapid deployment of automated switching, digital substations, IoT-enabled grid devices, and real-time analytics that enhance resilience and minimize downtime. Utilities accelerate adoption of self-healing grid technologies to optimize fault location, isolation, and service restoration. Conventional power distribution held a 36.8% share, sustained by its presence in legacy infrastructure, but continues to decline as governments emphasize grid modernization, renewable integration, and advanced monitoring systems to support evolving energy demand patterns.

Key Growth Drivers

Rapid Grid Modernization and Digital Transformation

Grid modernization initiatives strongly propel the Smart Power Distribution System Market as utilities transition from aging infrastructure to digital, automated, and data-driven networks. Governments prioritize investments in intelligent switchgear, smart meters, and automated distribution management systems to minimize outages and enhance grid stability. Advanced sensors, IoT devices, and self-healing grid technologies enable real-time monitoring and faster fault isolation. These developments support higher energy efficiency, reduce operational losses, and improve reliability, driving widespread adoption across utilities and large industrial power users.

- For instance, Rhode Island Energy selected Landis+Gyr’s Revelo metering platform for 530,000 electric customers, incorporating grid-edge sensing and edge computing on an RF Wi-SUN network to enhance load balancing and distributed energy resource integration.

Expansion of Renewable Energy and Distributed Generation

Rising penetration of solar, wind, and distributed energy resources significantly accelerates demand for smart distribution systems capable of managing variable and bidirectional power flows. Smart grids provide advanced visibility, forecasting, and load-balancing capabilities essential for integrating decentralized energy assets. Utilities deploy digital substations, edge analytics, and adaptive protection systems to maintain system resilience while accommodating rapid growth in renewables. The shift toward clean energy policies and grid decarbonization further strengthens adoption of smart power distribution technologies across global markets.

- For instance, Copenhagen employs a smart grid to handle variable wind turbine output by converting excess electricity into heat for its district heating network, enabling predictive balancing of supply and demand through weather data analytics.

Increasing Focus on Energy Efficiency and Reliability

The growing need to reduce technical losses, optimize peak load, and enhance electricity reliability fuels adoption of intelligent distribution systems. Smart power distribution technologies provide utilities with high-resolution consumption data, predictive maintenance tools, and automated fault detection, enabling significant improvement in service continuity. Commercial and industrial users adopt smart energy-management platforms to lower operational costs and achieve sustainability goals. Aging grid infrastructure and rising power demand make efficiency-enhancing solutions essential, positioning smart distribution systems as critical investments in modern energy networks.

Key Trends & Opportunities

Integration of AI, IoT, and Advanced Analytics

A major trend shaping the Smart Power Distribution System Market is the increasing integration of AI algorithms, IoT-enabled devices, and real-time analytics. Utilities deploy AI-driven load forecasting, anomaly detection, and automated switching to enhance operational decision-making. Smart sensors, digital twins, and cloud platforms provide deeper grid visibility and predictive insights, reducing downtime and maintenance costs. The expanding use of edge computing and interoperable communication protocols creates strong opportunities for next-generation intelligent distribution networks capable of autonomous grid management.

- For instance, GE Vernova’s GridOS Data Fabric unifies operational data from smart meters, solar, and EVs to enable AI/ML applications for real-time predictions and grid orchestration.

Growth of Smart Cities and Infrastructure Electrification

The global shift toward smart cities and widespread electrification of transportation and infrastructure drives substantial opportunities for smart power distribution solutions. As EV charging networks, connected buildings, and energy-efficient commercial zones expand, cities require digitally controlled grids to manage rising and dynamic loads. Governments increasingly invest in ADMS platforms, AMI rollouts, and automated energy-management solutions to support urban sustainability goals. This trend creates a large demand pool for smart transformers, self-healing networks, and integrated control systems that enhance flexibility and long-term energy planning.

- For instance, Virta’s platform connects over 100,000 charging stations across 36 countries in Europe and Southeast Asia, integrating with more than 450 charger models via its Charge Point Management System for real-time energy management and roaming services.

Key Challenges

High Initial Investment and Infrastructure Upgrade Costs

A significant challenge for the Smart Power Distribution System Market is the high upfront cost associated with deploying smart meters, digital substations, advanced communication networks, and automation hardware. Many utilities operate on constrained budgets, making large-scale modernization financially difficult. Upgrading legacy infrastructure, integrating new systems, and ensuring interoperability add further complexity and expense. These financial barriers slow down adoption, particularly in developing regions where utilities must balance modernization needs with limited capital availability and long investment cycles.

Cybersecurity Risks and Data Management Complexity

As power distribution systems become increasingly digital and connected, cybersecurity risks pose a critical challenge. Smart grids generate extensive real-time data and rely on interconnected sensors, communication networks, and cloud platforms, creating vulnerabilities to cyberattacks. Utilities must invest heavily in secure architectures, encryption, threat detection, and regulatory compliance to protect grid integrity. Additionally, managing large volumes of data requires sophisticated analytics, storage systems, and skilled personnel. These challenges increase operational complexity and hinder rapid deployment of fully digital distribution infrastructures.

Regional Analysis

North America

North America led the Smart Power Distribution System Market with a 37.4% share in 2024, supported by robust investments in grid modernization, digital substations, and large-scale deployment of advanced metering infrastructure. The United States accelerates adoption of ADMS platforms, outage management systems, and self-healing grid technologies to improve resilience against extreme weather events. Utilities across the region focus on integrating renewable power, enhancing real-time monitoring, and reducing technical losses. Rising EV adoption, expanding smart city programs, and strong regulatory support further strengthen demand for intelligent power distribution solutions across North America.

Europe

Europe captured a 28.1% share of the Smart Power Distribution System Market in 2024, driven by ambitious decarbonization targets, renewable integration mandates, and advanced digital grid initiatives. Countries such as Germany, the U.K., France, and the Nordics invest heavily in distributed energy management, digital substations, and cross-border energy flow optimization. The region advances adoption of smart meters, grid automation platforms, and high-efficiency distribution hardware to enhance sustainability and grid reliability. Strong policy frameworks, innovation in smart city infrastructure, and increasing electrification across transportation significantly boost market growth across Europe.

Asia-Pacific

Asia-Pacific accounted for a 24.6% share in 2024, expanding rapidly due to large-scale urbanization, rising electricity demand, and aggressive government-led smart grid programs. China, Japan, South Korea, and India invest extensively in digital control systems, grid automation, and renewable energy integration. Utilities deploy smart meters, IoT-enabled monitoring devices, and predictive analytics to reduce outages and strengthen operational efficiency. Industrial expansion and expanding EV charging networks also drive adoption. The region’s focus on energy security, infrastructure digitalization, and advanced distribution technologies positions Asia-Pacific as one of the fastest-growing smart grid markets.

Latin America

Latin America held a 6.9% share of the Smart Power Distribution System Market in 2024, supported by modernization needs in aging grids and increasing renewable energy deployment. Brazil, Mexico, and Chile lead initiatives for AMI rollout, automated fault detection, and improved grid reliability. Investments target reducing system losses, enhancing power quality, and integrating distributed solar generation. The region also strengthens regulatory frameworks to encourage private-sector participation in smart grid infrastructure. Growing urban development, rising industrial activity, and digital transformation across utilities contribute to steady adoption of smart distribution technologies.

Middle East & Africa

The Middle East & Africa region captured a 3.0% share in 2024, driven by infrastructure expansion, grid automation initiatives, and rising reliance on renewable energy projects. Gulf countries prioritize smart grid development to support large-scale solar integration, improve load management, and enhance system reliability. Africa’s initiatives focus on modernizing distribution networks, improving electrification rates, and deploying smart metering systems to reduce non-technical losses. Ongoing digital transformation, coupled with increasing investment in distribution automation and advanced monitoring solutions, supports gradual but promising market growth across the region.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Application

- Commercial

- Industrial

- Residential

- Utility

By Technology

- Conventional Power Distribution

- Smart Power Distribution

By End-User

- Energy & Utilities

- Manufacturing

- Telecommunications

- Healthcare

By Voltage Type

- Low Voltage

- Medium Voltage

- High Voltage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Smart Power Distribution System Market includes major players such as Schneider Electric SE, Siemens AG, ABB, General Electric, Cisco Systems Inc., Eaton Corporation, Landis+Gyr AG, Oracle Corporation, Itron, and Aclara Technologies LLC. These companies actively expand portfolios in smart grid automation, intelligent switchgear, smart metering, ADMS platforms, and digital substations to strengthen market presence. Vendors focus on integrating AI-driven analytics, IoT-enabled monitoring, and cloud-based grid management solutions to support utilities transitioning toward digital, self-healing networks. Strategic initiatives including product innovation, technology upgrades, and long-term utility partnerships enhance differentiation and customer reach. Companies also invest heavily in cybersecurity frameworks, interoperability standards, and end-to-end grid modernization services to address rising demand for resilient and energy-efficient distribution systems. Continuous R&D efforts, expansion into emerging markets, and collaborations with government-led smart grid programs further intensify competition across the global landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Itron

- Schneider Electric SE

- Landis+Gyr AG

- Cisco Systems Inc

- Oracle Corporation

- Aclara Technologies LLC

- ABB

- Eaton Corporation

- General Electric

- Siemens AG

Recent Developments

- In August 2025, Eaton Corporation completed acquisition of Resilient Power Systems Inc., expanding its portfolio to include solid-state transformer technology and boosting capabilities for EV charging infrastructure and energy-storage power distribution.

- In November 2025, Landis+Gyr AG was recognized as a Leader in the latest global Utility Meter Data Management Systems vendor assessment, reflecting continued strength in advanced metering infrastructure and AMI software offerings.

- In March 2025, Itron and Schneider Electric SE began collaboration to integrate Itron’s Grid Edge Intelligence with Schneider Electric’s Digital Grid solutions and Microsoft data & AI tools to enhance grid visibility and control.

- In December 2025, ABB Ltd. completed acquisition of the power-electronics business of Gamesa Electric in Spain, expanding ABB’s renewables-focused converter and storage offerings a strategic move to enhance its portfolio relevant for smart distribution systems.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Technology, End-User, Voltage Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance as utilities accelerate adoption of digital substations and automated distribution networks.

- AI-driven analytics will gain wider use for predictive maintenance, outage prevention, and intelligent load forecasting.

- IoT-enabled sensors and edge devices will strengthen real-time grid visibility and control capabilities.

- Renewable energy expansion will increase the need for smart systems that manage bidirectional and variable power flows.

- Smart city development will drive deployment of intelligent distribution infrastructure and integrated energy platforms.

- EV charging growth will push utilities to adopt flexible, high-capacity smart distribution solutions.

- Cybersecurity investments will rise as digital grid architectures become more interconnected.

- Cloud-based ADMS, AMI, and grid-control platforms will achieve stronger integration across utility operations.

- Developing regions will accelerate grid modernization to reduce energy losses and enhance reliability.

- Vendors will expand partnerships with utilities to deliver scalable, interoperable, and future-proof smart distribution solutions.