| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Feminine Hygiene Products Market Size 2023 |

USD 1,546.38 Million |

| Germany Feminine Hygiene Products Market, CAGR |

7.78% |

| Germany Feminine Hygiene Products Market Size 2032 |

USD 3,039.12 Million |

Market Overview

Germany Feminine Hygiene Products Market size was valued at USD 1,546.38 million in 2023 and is anticipated to reach USD 3,039.12 million by 2032, at a CAGR of 7.78% during the forecast period (2023-2032).

Several factors are propelling the growth of the feminine hygiene products market in Germany. There is a growing consumer preference for organic and sustainable products, such as period panties, organic tampons, and biodegradable sanitary pads. This shift is influenced by increased awareness of environmental issues and personal health concerns. Educational campaigns, including Menstrual Hygiene Day initiated by WASH United, have played a significant role in destigmatizing menstruation and promoting menstrual health awareness. Additionally, the expansion of e-commerce platforms has made feminine hygiene products more accessible, catering to the convenience sought by modern consumers. Rising investments in product research and innovation by major players are further intensifying market competitiveness. The emphasis on user safety and transparency in ingredient labeling is also driving trust and loyalty among health-conscious consumers. Moreover, collaborations between manufacturers and advocacy groups are fostering inclusive product development that addresses the diverse needs of women across different age groups and lifestyles.

Within Germany, urban areas exhibit higher adoption rates of innovative and sustainable feminine hygiene products, driven by greater environmental consciousness and higher disposable incomes. The availability of products through various distribution channels, including supermarkets, pharmacies, and online retailers, ensures widespread accessibility across the country. While specific regional consumption data is limited, the overall market benefits from Germany’s robust infrastructure and consumer base that values quality and sustainability. Government-backed initiatives aimed at promoting gender equity and menstrual hygiene education are also enhancing regional market development. In rural and semi-urban regions, awareness campaigns and subsidized product schemes are gradually improving access and affordability. As a result, the regional market is witnessing a more balanced growth trajectory, supported by both policy initiatives and evolving consumer behavior.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Germany Feminine Hygiene Products size was valued at USD 1,546.38 million in 2023 and is anticipated to reach USD 3,039.12 million by 2032, at a CAGR of 7.78% during the forecast period (2023-2032).

- The global feminine hygiene products market, valued at USD 23,490.00 million in 2023, is projected to reach USD 43,917.35 million by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

- Demand for organic and sustainable products such as menstrual cups, period panties, and organic tampons is rising rapidly, driven by environmental and health awareness.

- E-commerce is reshaping the market by enhancing product accessibility and offering personalized, discreet shopping experiences for a broad consumer base.

- Leading companies are focusing on innovation in materials, design, and packaging, introducing ultra-thin, hypoallergenic, and fragrance-free product lines.

- Environmental concerns related to disposable products are prompting regulatory scrutiny, encouraging brands to adopt biodegradable and plastic-free alternatives.

- High product costs for organic and reusable options remain a barrier for widespread adoption, especially among lower-income consumers.

- Urban regions dominate the market due to higher disposable incomes and awareness, while rural areas are witnessing gradual growth through targeted campaigns and improved access.

Market Drivers:

Rising Awareness of Menstrual Hygiene and Health

The growing awareness regarding menstrual hygiene and overall female health plays a pivotal role in driving the demand for feminine hygiene products in Germany. Public health campaigns and educational initiatives have significantly contributed to changing societal perceptions around menstruation, reducing stigma and promoting open conversations. For instance, Menstrual Hygiene Day, celebrated annually on May 28th and initiated by the German nonprofit WASH United in 2013, has become a key event for raising awareness and challenging stigmas related to menstruation. Programs led by both governmental and non-governmental organizations, such as Menstrual Hygiene Day, have made substantial progress in educating women and girls about the importance of menstrual health and hygiene practices. As awareness levels rise, there is a corresponding increase in demand for a wide range of high-quality, safe, and effective feminine hygiene products, including sanitary pads, tampons, panty liners, and menstrual cups.

Growing Preference for Sustainable and Organic Products

Consumer preferences in Germany are shifting towards sustainable and environmentally friendly hygiene solutions. Increasing concern over the ecological impact of disposable sanitary products has led to the growth of biodegradable alternatives. Consumers are now more conscious of the ingredients and materials used in hygiene products, showing a strong inclination toward organic, chemical-free options. Products such as reusable menstrual cups, organic cotton tampons, and washable period underwear are gaining popularity among eco-conscious consumers. This growing trend aligns with the broader national commitment to sustainability and supports the expansion of the organic and reusable product segments within the market.

E-commerce Expansion and Improved Accessibility

The rapid expansion of e-commerce platforms has enhanced product accessibility across Germany, contributing to the market’s overall growth. Online retail channels offer consumers the convenience of discreet, at-home shopping, which is particularly important for personal care items like feminine hygiene products. The availability of subscription-based services, customized product bundles, and exclusive online-only offerings further attract a broad consumer base. Additionally, digital platforms enable brands to engage directly with customers, providing education, reviews, and comparative information that support informed purchasing decisions. As internet penetration deepens and digital literacy improves, e-commerce will continue to serve as a critical driver in expanding market reach, especially among younger, tech-savvy consumers.

Innovation and Product Diversification by Key Players

Product innovation and diversification have become essential strategies for leading brands to maintain competitiveness in the German feminine hygiene products market. Manufacturers are introducing novel product lines that cater to specific consumer needs, such as ultra-thin pads, fragrance-free tampons, and products designed for sensitive skin. For instance, Vyld’s seaweed-based tampons have been independently lab-tested for safety and microbiome-friendliness, and their introduction at large public events has been met with strong consumer enthusiasm. Many brands are also incorporating features like odor control, enhanced absorbency, and ergonomic design to improve user experience. Furthermore, innovations in packaging and sustainability are being emphasized to align with consumer expectations. These advancements not only meet rising health and comfort standards but also support brand differentiation in a mature and competitive market landscape. Continuous investment in research and development ensures that product offerings remain relevant and appealing to evolving consumer preferences.

Market Trends:

Emergence of Reusable and Hybrid Products

One of the most notable trends in the German feminine hygiene products market is the rise in popularity of reusable and hybrid menstrual solutions. For example, Thinx, Inc. has introduced a new product line featuring LeakSafe™ Barrier technology, which provides up to 12 hours of leak protection through a patent-pending 4-layer gusset, offering comfort and absorbency while reducing the need for disposable products. Consumers are increasingly exploring alternatives such as menstrual cups, reusable cloth pads, and absorbent period underwear as long-term, cost-effective, and environmentally responsible choices. These products appeal particularly to the environmentally conscious demographic that seeks to reduce waste and carbon footprint associated with disposable sanitary products. The hybrid category—products that combine disposable and reusable features—has also gained traction, offering both convenience and sustainability. This shift is contributing to a gradual transformation of the product landscape, encouraging innovation in materials and designs tailored to long-term use.

Technological Advancements in Product Design

Advancements in product technology are also reshaping the German feminine hygiene market. For instance, Henkel, for instance, supplies materials for sanitary napkins focused on high absorptive properties, strong core strength, and flexibility, with their TECHNOMELT® ADVANCE adhesive line specifically designed for feminine care application. Manufacturers are focusing on enhancing product comfort, absorption efficiency, and skin compatibility through new material compositions and ergonomic designs. Features such as breathable layers, moisture-locking cores, and anti-bacterial treatments are now common in premium sanitary pads and tampons. The incorporation of smart technology, such as app-enabled reminders and tracking for menstrual cycles, has also emerged in tandem with product usage. These innovations align with consumer expectations for performance, safety, and personalization, positioning brands that invest in R&D at a competitive advantage in the mature German market.

Focus on Inclusive Branding and Gender-Neutral Marketing

A significant cultural shift in the market is the growing emphasis on inclusive branding and gender-neutral marketing strategies. German consumers are responding positively to campaigns that represent diverse body types, skin tones, and gender identities. Brands are gradually moving away from traditional, gender-specific imagery and messaging, instead adopting inclusive language that resonates with a broader audience. This trend reflects a societal move towards equality and representation, particularly among Gen Z and millennial consumers who value authenticity and diversity in brand communication. Companies that align their brand identity with these values are likely to foster deeper connections with modern consumers and build long-term brand loyalty.

Retail Transformation and Omnichannel Presence

Retail dynamics in Germany are evolving, with a pronounced shift toward omnichannel strategies in the feminine hygiene sector. While brick-and-mortar stores such as drugstores and supermarkets remain essential, digital platforms are expanding their influence. Many consumers prefer the convenience, discretion, and variety offered by online retailers, prompting brands to enhance their digital presence. Subscription-based models and direct-to-consumer offerings have grown significantly, supported by personalized shopping experiences and bundled products. This trend indicates a transformation in consumer purchasing behavior, where convenience and value-added services are becoming as important as product quality, shaping how brands approach distribution and customer engagement.

Market Challenges Analysis:

Environmental Concerns over Disposable Waste

Despite the growing demand for feminine hygiene products, environmental concerns associated with disposable variants present a significant challenge in the German market. Conventional sanitary pads and tampons often contain plastic-based components and chemical additives that contribute to long-term waste and pollution. As environmental awareness intensifies across Germany, consumers are increasingly scrutinizing the ecological footprint of hygiene products. This has led to criticism and regulatory pressure on manufacturers to reduce plastic usage and improve product biodegradability. Companies that fail to adopt sustainable practices may face reputational risks and declining consumer trust, particularly among environmentally conscious buyers.

Price Sensitivity and Affordability Issues

Affordability remains a critical restraint, especially for sustainable and organic feminine hygiene products that often come at a premium price point. While eco-friendly options are gaining traction, their higher cost limits widespread adoption, particularly among low-income consumers. This pricing gap can hinder market expansion and create inequality in access to safer and more sustainable alternatives. Additionally, inflationary pressures and rising production costs are compelling manufacturers to balance product innovation with cost-efficiency, posing challenges in maintaining competitive pricing without compromising quality.

Regulatory Compliance and Product Safety Standards

The German market operates under stringent health, safety, and environmental regulations, requiring manufacturers to meet high standards for product ingredients, labeling, and performance. For instance, the European Union’s General Product Safety Directive 2001/95/EC and REACH regulation require continuous testing and documentation of product ingredients, with ongoing discussions about further tightening restrictions on chemicals of concern, such as endocrine disruptors and carcinogens. Adhering to these regulatory frameworks involves continuous testing, certification, and compliance costs, which can be burdensome for smaller or new entrants. Furthermore, any lapses in safety standards or product recalls can significantly damage brand reputation and consumer confidence. The constant need to stay updated with evolving regulations and consumer safety expectations adds operational complexity and restricts rapid product diversification.

Cultural Taboos and Social Barriers

Although awareness is growing, cultural taboos and discomfort surrounding menstruation still exist in certain demographic segments. These social stigmas may prevent open discussion and inhibit the full adoption of available hygiene solutions, particularly in conservative communities or among older consumers.

Market Opportunities:

The Germany feminine hygiene products market presents substantial growth opportunities driven by evolving consumer preferences, technological advancements, and an expanding base of health-conscious individuals. The increasing shift towards organic, biodegradable, and reusable products creates a lucrative space for brands that prioritize sustainability and innovation. As consumers become more informed about menstrual health and environmental impact, demand for safer and eco-friendly alternatives continues to rise. This trend opens new avenues for product development, including the integration of skin-sensitive materials, fragrance-free options, and reusable menstrual solutions such as cups and period underwear. Companies that invest in research and development to meet these expectations stand to capture a growing share of the evolving market.

Additionally, the digital transformation of retail channels offers further opportunity for growth. With the rise of e-commerce, subscription-based services, and direct-to-consumer models, brands can establish stronger, more personalized relationships with their customers. Omnichannel strategies can help reach a wider audience, including younger consumers who value convenience and digital accessibility. Moreover, increasing government and NGO-led efforts to normalize menstrual discussions and promote equitable access to hygiene products may further expand the consumer base, especially in underrepresented or lower-income groups. As Germany continues to foster progressive social attitudes and green consumerism, the feminine hygiene market remains poised for long-term opportunity, particularly for brands that align with values of inclusivity, transparency, and environmental stewardship.

Market Segmentation Analysis:

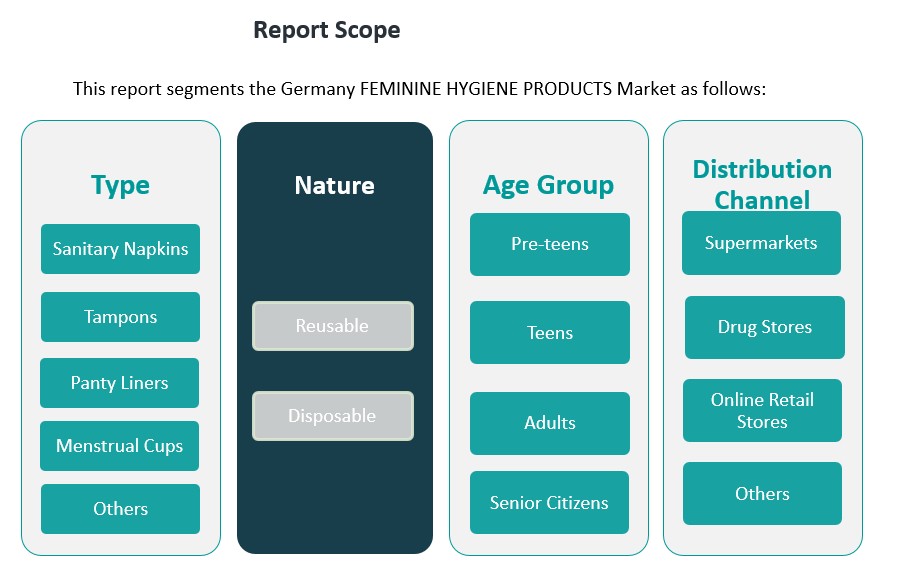

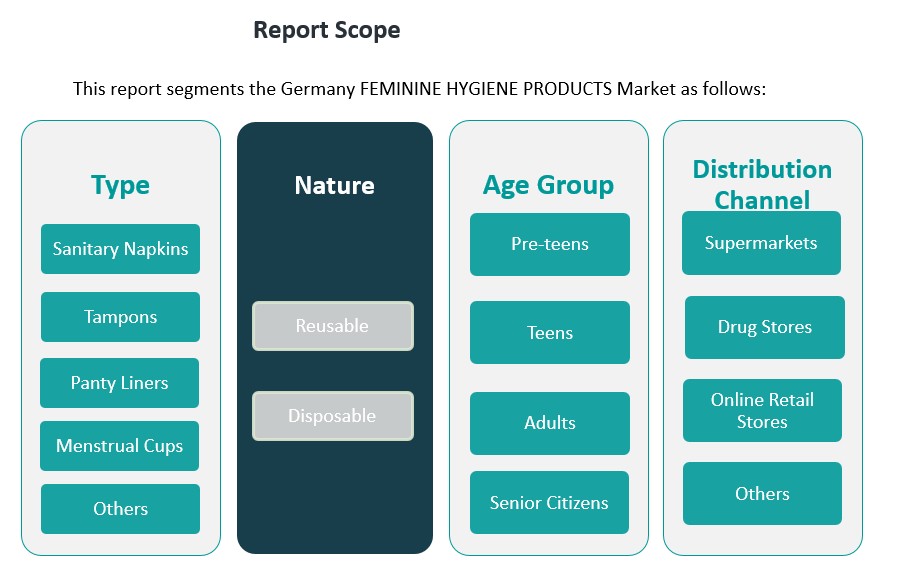

The Germany feminine hygiene products market is segmented into several key categories based on product type, nature, age group, and distribution channel.

By type, sanitary napkins represent the most widely used category, favored for their convenience and availability. Tampons and panty liners follow, offering discreet and versatile options for everyday and active use. Menstrual cups, although still emerging, are gaining popularity due to their reusability and cost-efficiency. The “Others” segment includes new and niche products such as organic pads and period underwear, reflecting ongoing innovation and diversification.

By nature, the market is divided into reusable and disposable products. Disposable products continue to dominate due to their convenience and widespread accessibility; however, reusable options are gaining momentum as consumers become more environmentally conscious. Reusable menstrual cups and cloth pads are witnessing steady growth, supported by sustainability-focused marketing and increasing awareness about long-term cost benefits.

By age group, adult women constitute the largest consumer base, followed by teens. The demand among pre-teens and senior citizens remains relatively low but presents future growth potential with tailored product innovations and targeted awareness campaigns.

By Distribution channels are led by supermarkets and drug stores, which offer ease of access and brand variety. Online retail stores are rapidly expanding, driven by demand for privacy, convenience, and personalized subscriptions. Other channels, including specialty health stores and direct-to-consumer platforms, are also contributing to the market’s growth. The diversification across these segments reflects the evolving needs and behaviors of German consumers, offering ample opportunities for brands to tailor their strategies.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

The feminine hygiene products market in Germany exhibits regional variations influenced by factors such as population density, income levels, consumer awareness, and access to retail infrastructure. The country is commonly segmented into four key regions: Western, Southern, Eastern, and Northern Germany.

Western Germany

Western Germany holds the largest share of the feminine hygiene products market, accounting for approximately 35% of the national revenue. This dominance is attributed to the presence of major urban centers like Cologne, Düsseldorf, and Frankfurt, which boast higher population densities and greater purchasing power. The region benefits from a well-established retail network, including supermarkets, pharmacies, and specialty stores, facilitating easy access to a wide range of feminine hygiene products. Additionally, Western Germany has seen a significant uptake in eco-friendly and organic products, driven by heightened environmental consciousness among consumers.

Southern Germany

Southern Germany contributes around 30% to the national market share. Cities such as Munich and Stuttgart are economic hubs with affluent populations that prioritize premium and innovative feminine hygiene products. The region has witnessed a growing demand for reusable products like menstrual cups and period panties, reflecting a shift towards sustainable consumption patterns. The presence of several universities and a young demographic further fuel the adoption of modern and diverse feminine hygiene solutions.

Eastern Germany

Eastern Germany accounts for approximately 20% of the market share. The region encompasses cities like Leipzig and Dresden, where the market is gradually expanding. While disposable products remain prevalent, there is a noticeable increase in awareness campaigns promoting menstrual health and hygiene. Government initiatives and non-profit organizations are actively working to improve access to feminine hygiene products, particularly in rural and underserved areas. The growth potential in Eastern Germany is significant, provided there is continued investment in education and infrastructure.

Northern Germany

Northern Germany holds the remaining 15% of the market share. The region includes cities such as Hamburg and Bremen, where consumers exhibit a balanced preference for both traditional and innovative feminine hygiene products. The maritime economy and diverse population contribute to a unique market dynamic, with a steady demand for both disposable and reusable products. Online retail channels are gaining prominence in Northern Germany, offering consumers convenient access to a broad spectrum of feminine hygiene options.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Hygiene Oederan

Competitive Analysis:

The Germany feminine hygiene products market is highly competitive, featuring a mix of global corporations and emerging local brands striving for consumer loyalty and market share. Key players such as Procter & Gamble, Johnson & Johnson, Kimberly-Clark, and Essity dominate the landscape through well-established product lines, widespread distribution networks, and strong brand recognition. These companies continuously invest in research and development to introduce innovative, sustainable, and skin-friendly solutions that align with evolving consumer expectations. In addition to established names, several niche and eco-conscious brands are gaining traction by offering organic, reusable, and biodegradable alternatives. The growing emphasis on sustainability, coupled with rising consumer awareness, has intensified competition, prompting all players to enhance product quality, diversify offerings, and strengthen digital marketing strategies. E-commerce platforms and direct-to-consumer channels have further fueled brand visibility and accessibility, enabling newer entrants to disrupt traditional retail dynamics and carve out distinct market positions.

Recent Developments:

- In February 2025, Vyld, a Berlin-based profit-for-purpose company, launched the Kelpon, Germany’s first tampon made from regenerative seaweed. This patented product is designed and produced in Germany, and represents a significant innovation in the feminine hygiene market. Vyld’s Kelpon has been widely adopted in various settings, including office restrooms, fitness studios, coworking spaces, and at large-scale events, thanks to its strong sustainability credentials and proven safety.

- In April 2024, Thinx introduced a new product line in Germany featuring LeakSafe™ Barrier technology, which provides up to 12 hours of leak protection. This patent-pending 4-layer gusset design reduces reliance on disposable products by offering superior comfort and absorbency. Thinx’s new range is approved for quality and safety, and aims to set new standards in period care by ensuring all-day comfort and dryness for users.

Market Concentration & Characteristics:

The Germany feminine hygiene products market exhibits a moderately concentrated structure, dominated by a few multinational corporations that hold significant market share. Companies such as Procter & Gamble, Kimberly-Clark, and Essity maintain a strong presence through their diverse product portfolios, extensive retail partnerships, and brand loyalty built over decades. Despite this dominance, the market is witnessing growing participation from niche and eco-friendly brands, which are leveraging sustainability and product innovation to capture consumer interest. This evolving competitive environment reflects a shift in consumer values toward health, transparency, and environmental responsibility. The market is characterized by high product awareness, consistent demand, and a strong preference for quality and safety. Innovation in materials, design, and packaging plays a crucial role in influencing consumer choice. Additionally, the integration of online retail and subscription-based models is reshaping purchasing behavior, contributing to a dynamic and adaptable market landscape that supports both legacy brands and emerging players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is projected to experience steady growth driven by increasing awareness of menstrual hygiene and wellness.

- Rising demand for organic and biodegradable products will reshape product development and packaging strategies.

- E-commerce and direct-to-consumer models will play a larger role in expanding product accessibility and brand engagement.

- Investment in product innovation will accelerate, focusing on comfort, sustainability, and personalization.

- Reusable menstrual solutions such as cups and washable pads will gain broader acceptance across age groups.

- Growing environmental regulations may encourage manufacturers to adopt more sustainable production practices.

- Inclusive marketing and gender-neutral branding will become essential to appeal to diverse consumer segments.

- Expansion of private-label and local eco-friendly brands will intensify competition in the mid and premium segments.

- Educational initiatives and social campaigns will continue to destigmatize menstruation and improve product uptake.

- The integration of digital tools and mobile apps will enhance user experience and foster brand loyalty.