Market Overview:

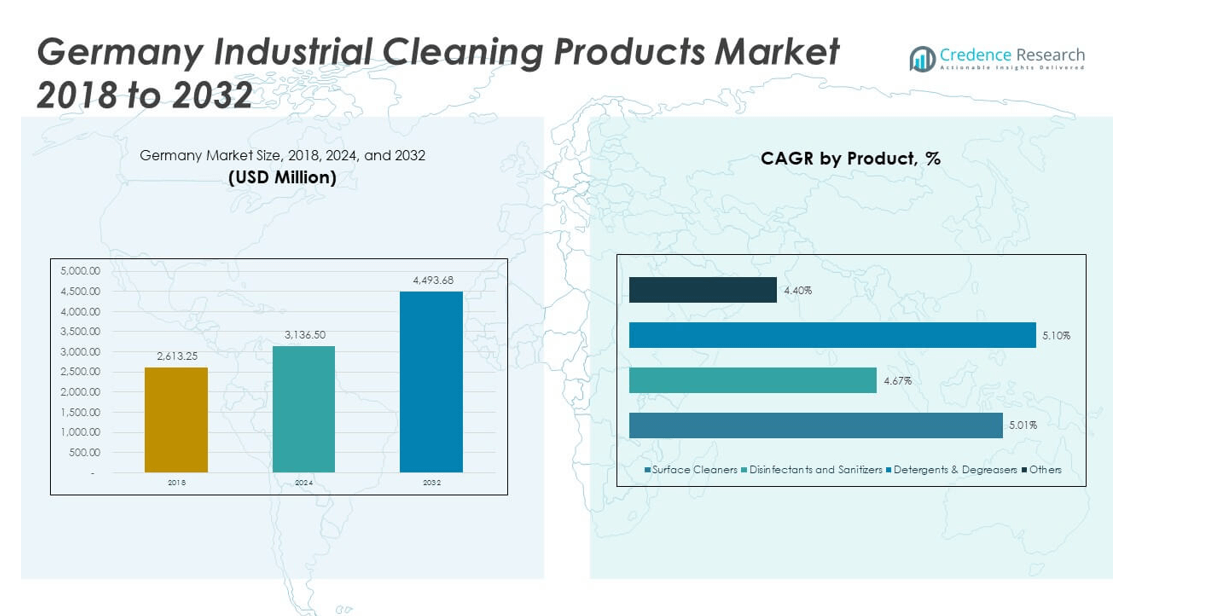

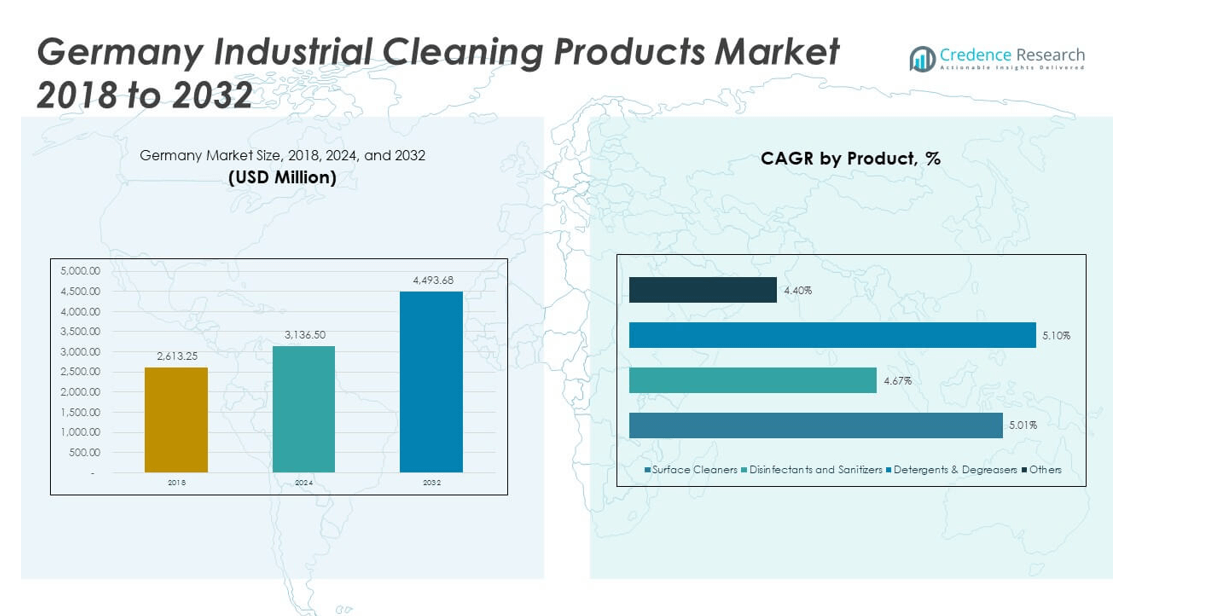

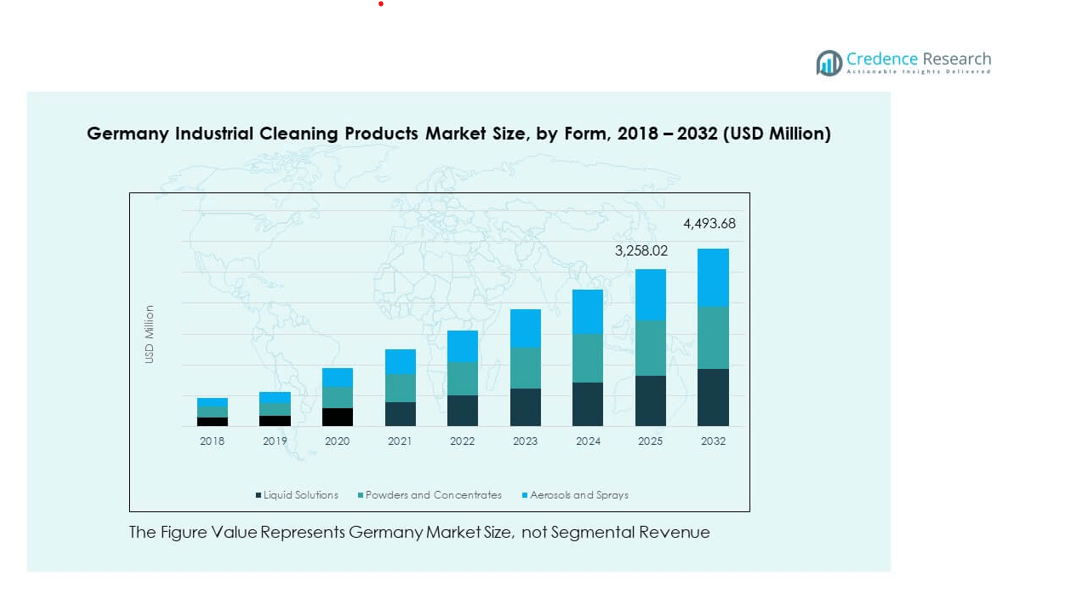

The Germany Industrial Cleaning Products Market size was valued at USD 2,613.25 million in 2018, reaching USD 3,136.50 million in 2024, and is anticipated to reach USD 4,493.68 million by 2032, at a CAGR of 4.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Industrial Cleaning Products Market Size 2024 |

USD 3,136.50 million |

| Germany Industrial Cleaning Products Market, CAGR |

4.60% |

| Germany Industrial Cleaning Products Market Size 2032 |

USD 4,493.68 million |

The growth of the Germany Industrial Cleaning Products Market is driven by increasing industrialization and the need for enhanced hygiene and maintenance standards across manufacturing facilities. Industries like automotive, food processing, and healthcare demand high-quality cleaning solutions to comply with stringent regulations and maintain operational efficiency. Additionally, the shift toward eco-friendly cleaning products, driven by sustainability goals and regulatory pressures, is contributing to market growth. Businesses are increasingly adopting products that provide high performance while being environmentally responsible.

Germany’s industrial cleaning products market is highly concentrated in regions like North Rhine-Westphalia and Bavaria, which are key industrial hubs. The Western and Southern parts of Germany lead the market due to their strong manufacturing and automotive sectors. Eastern and Northern regions are emerging, with growing demand for cleaning solutions driven by the expansion of manufacturing, logistics, and food industries. The market is poised for steady growth across these regions as more industries adopt modern cleaning technologies and eco-friendly products to meet regulatory standards.

Market Insights

- The Germany Industrial Cleaning Products Market size was valued at USD 2,613.25 million in 2018, reaching USD 3,136.50 million in 2024, and is expected to reach USD 4,493.68 million by 2032, at a CAGR of 4.60% during the forecast period.

- Western Germany holds the largest market share at approximately 45%, driven by key industrial hubs such as North Rhine-Westphalia and Hesse. Southern Germany follows with a 30% share, led by automotive and machinery manufacturing industries. Eastern and Northern Germany represent 25% of the market, growing due to expanding industrial sectors.

- The fastest-growing region is Southern Germany, with increasing demand driven by advancements in manufacturing technologies and the expansion of automotive production.

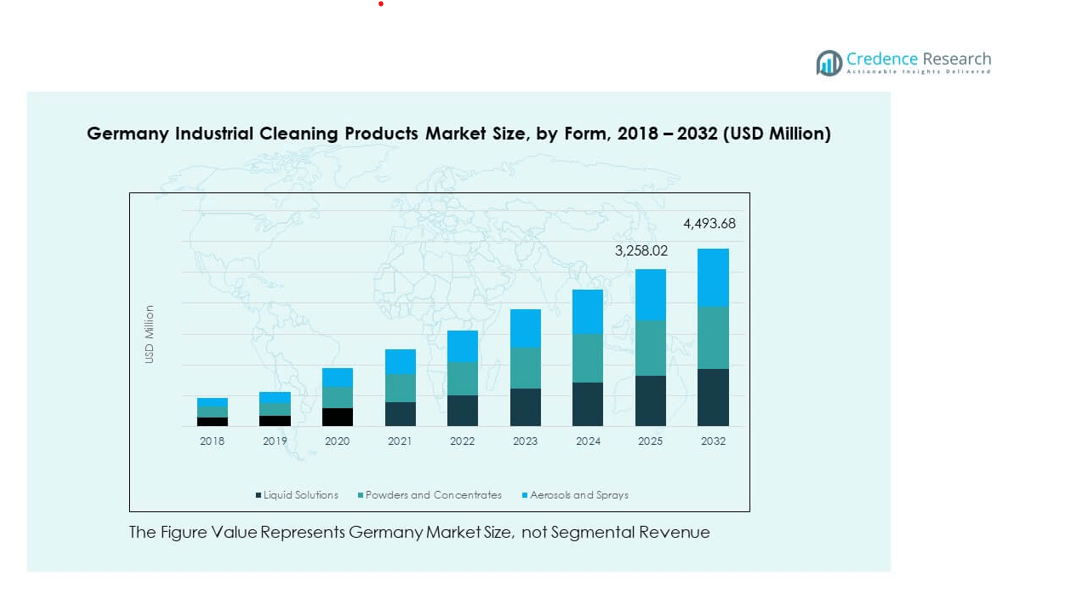

- Liquid solutions dominate the market with the largest share of around 50%, accounting for the highest revenue throughout 2018-2032. Powders and concentrates hold about 30% of the market share, gradually increasing with their versatility in heavy-duty applications.

- Aerosols and sprays represent a growing segment, holding around 20% of the market share, with increasing use in quick and spot cleaning applications across various industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Industrialization and Manufacturing Activities

The growth of the Germany Industrial Cleaning Products Market is closely linked to the increasing industrialization in the country. As industries expand, the need for industrial cleaning products to maintain operational efficiency rises. Manufacturing activities, particularly in sectors like automotive, chemicals, and food processing, drive the demand for effective cleaning solutions. These industries require regular maintenance of machinery, equipment, and facilities, thus promoting the use of industrial cleaning products. It is essential to maintain cleanliness and hygiene to ensure the smooth functioning of operations and compliance with safety standards.

- For instance, Henkel’s BONDERITE metal cleaning solution enabled Rittal, a major German manufacturer, to lower energy consumption in its metal pretreatment processes by 60% by switching to low-temperature cleaning technology (40˚C instead of 60˚C) at its Rittershausen facility, which processes around 13 million square meters of metal annually.

Stringent Regulatory Requirements

The German government has stringent regulations governing industrial hygiene, environmental standards, and worker safety. These regulations push industries to adopt effective cleaning products that meet the required standards. The Germany Industrial Cleaning Products Market benefits from regulations that mandate the use of certified and eco-friendly cleaning solutions. Industries are required to minimize contamination risks and adhere to quality and safety protocols, thus creating demand for products that ensure compliance with these regulations. The trend toward regulatory compliance is one of the key factors driving market growth.

Growing Demand for Sustainable and Eco-Friendly Solutions

There is a growing emphasis on sustainability in Germany’s industrial sector. Industries are increasingly adopting eco-friendly cleaning solutions to reduce their environmental impact. The demand for biodegradable and non-toxic cleaning products is rising, driven by the need to comply with environmental regulations and corporate sustainability goals. The Germany Industrial Cleaning Products Market is witnessing an uptick in the adoption of green and sustainable cleaning products. These solutions help industries maintain cleanliness while minimizing their carbon footprint, thereby aligning with broader environmental goals.

Technological Advancements in Cleaning Products

The development of advanced cleaning technologies has significantly impacted the Germany Industrial Cleaning Products Market. Innovations in formulations, packaging, and application techniques have made cleaning products more efficient and user-friendly. The introduction of automated cleaning systems and smart cleaning technologies is further propelling market growth. These advancements increase the efficiency of cleaning operations, reduce labor costs, and improve productivity. Industries are now seeking products that offer better performance and faster cleaning solutions, thus boosting demand for technologically advanced industrial cleaning products.

- For instance, the autonomous Kärcher KIRA B 50 scrubber dryer won the 2024 iF Design Award in the industry category. The machine cleans up to 2,300 square meters per hour without human intervention, combining robotics with advanced cleaning know-how. Its performance, design, and functionality were formally validated by the international jury of the iF Design Award from over 11,000 entries in March 2024.

Market Trends:

Rise of Automation and Smart Cleaning Solutions

Automation in industrial cleaning is becoming increasingly popular in Germany. Industries are adopting automated cleaning systems that reduce human intervention and improve operational efficiency. These systems, often integrated with smart technologies, can monitor and adjust cleaning processes in real-time. The Germany Industrial Cleaning Products Market is being influenced by these trends, with products designed for robotic and automated cleaning solutions gaining traction. These advancements reduce labor costs and improve consistency in cleaning, particularly in large-scale industrial environments.

Growing Shift Toward Multi-Use Cleaning Products

The demand for multi-use industrial cleaning products is on the rise. Many companies are opting for versatile products that can be used across various cleaning applications, reducing the need for different specialized cleaners. This trend is driven by cost-efficiency, as businesses seek to streamline their inventory and reduce overheads. The Germany Industrial Cleaning Products Market reflects this shift, with manufacturers focusing on developing products that serve multiple functions. Multi-purpose cleaning products are particularly popular in industries like manufacturing, automotive, and food processing, where versatility is highly valued.

- For example, Henkel’s LOCTITE SF 7840 is a water-based, biodegradable industrial cleaner designed for multiple surface types, including metal, glass, wood, and concrete. It is formulated for applications such as engine, machinery, and equipment cleaning across various industrial environments. The cleaner’s composition supports eco-friendly and safe use in manufacturing and maintenance operations.

Increasing Focus on Hygiene in Food Processing

The food processing industry in Germany places a high premium on hygiene, given the strict food safety standards in the region. This trend is influencing the demand for industrial cleaning products, particularly disinfectants and sanitizers. The Germany Industrial Cleaning Products Market is experiencing growth in this segment as food and beverage companies strive to maintain cleanliness and prevent contamination. The need for high-quality cleaning products that ensure the safety of food products is driving innovation and boosting product demand in this segment.

- For example, Ecolab’s Sirafan Speed and Skinman Soft Protect FF disinfectants are officially certified under EN 14476 for full virucidal efficacy within 30 seconds. Both products are validated by Ecolab and independent testing as effective against a wide range of viruses, including enveloped and non-enveloped strains, in professional and food-processing environments.

Growing E-commerce and Online Sales Platforms

The shift towards online sales platforms has been a notable trend in the Germany Industrial Cleaning Products Market. Many cleaning product manufacturers are expanding their presence on e-commerce platforms to cater to both large enterprises and small businesses. Online platforms offer convenience, competitive pricing, and wider product availability, making it easier for customers to access industrial cleaning products. This trend is particularly significant as more companies adopt online purchasing, making e-commerce an important channel for distributing industrial cleaning products in Germany.

Market Challenges Analysis:

High Competition and Price Sensitivity

The Germany Industrial Cleaning Products Market faces intense competition from numerous local and international players. Companies must constantly innovate to differentiate themselves, which can increase costs. Price sensitivity among customers is a significant challenge, particularly in price-conscious industries like manufacturing. Customers often seek affordable yet high-performance cleaning products, creating pressure on suppliers to balance cost and quality. This competitive landscape can limit profitability for manufacturers, especially as businesses increasingly demand both high-quality and cost-effective solutions.

Sustainability Concerns and Regulatory Compliance

While sustainability is a driver for the market, it also presents a challenge. Meeting stringent environmental regulations and consumer demands for green products requires significant investment in research and development. Manufacturers must ensure that their products are not only effective but also environmentally friendly. This often means higher production costs, which can be passed on to the consumer. Companies in the Germany Industrial Cleaning Products Market face the dual challenge of adhering to sustainability requirements while maintaining competitiveness and meeting customer expectations.

Market Opportunities:

Expansion of Eco-Friendly Product Lines

There is a significant opportunity for growth in the eco-friendly segment of the Germany Industrial Cleaning Products Market. With increasing regulatory pressure and consumer demand for green solutions, manufacturers can capitalize on developing sustainable and biodegradable cleaning products. These products can meet both environmental standards and the growing trend of corporate responsibility. Companies focusing on innovation in eco-friendly formulations are likely to see greater demand, as businesses look to improve their sustainability practices.

Growth in Industrial Cleaning for Emerging Sectors

The expansion of emerging industries such as renewable energy, electric vehicles, and biotechnology presents new opportunities for the Germany Industrial Cleaning Products Market. These sectors require specialized cleaning products that meet specific safety and regulatory standards. As these industries continue to grow, they will increase their demand for industrial cleaning products. Manufacturers have the opportunity to develop targeted solutions for these emerging industries, further diversifying their product offerings and capturing new market segments.

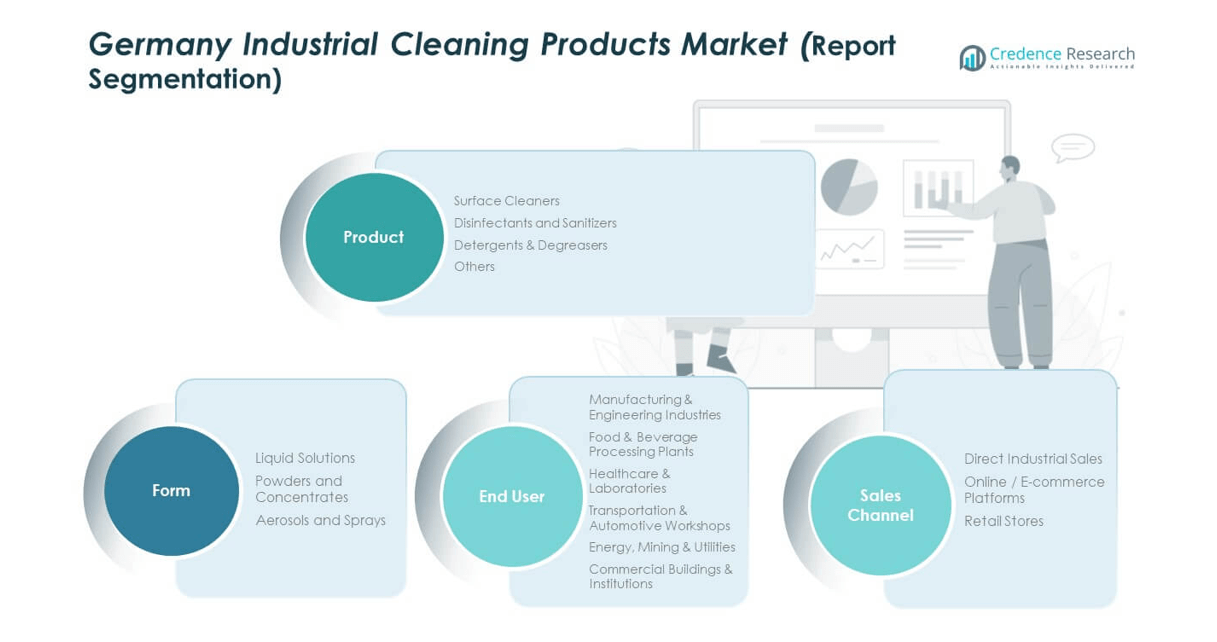

Market Segmentation Analysis

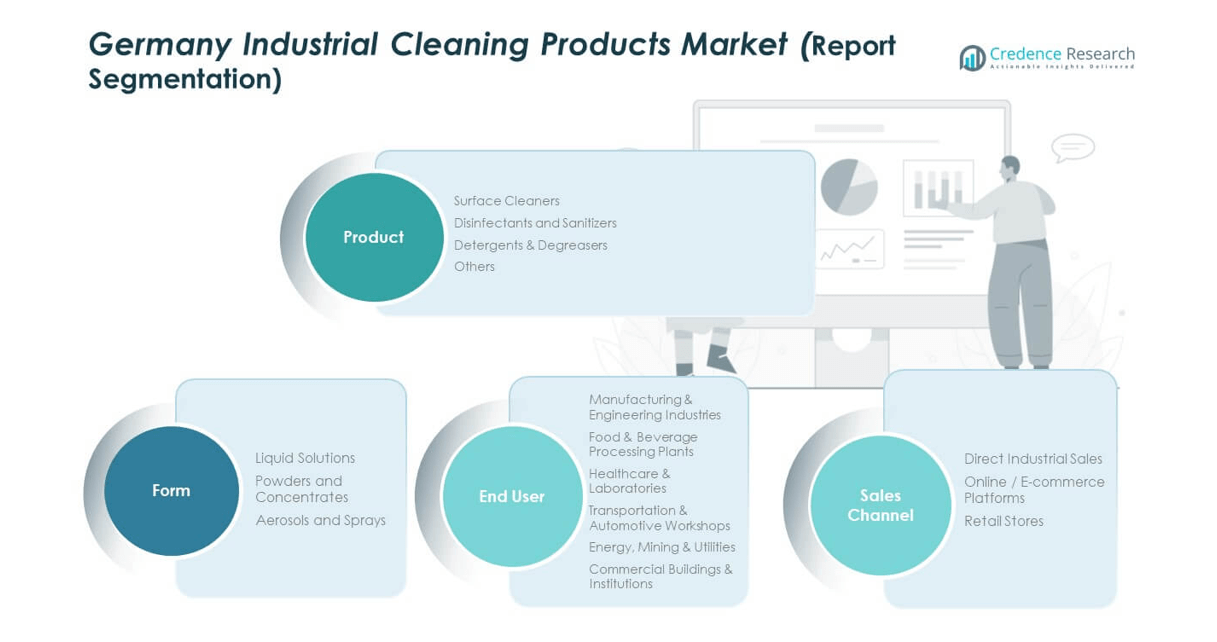

By Product Type:

The Germany Industrial Cleaning Products Market is divided into surface cleaners, disinfectants and sanitizers, detergents and degreasers, and other categories. Surface cleaners are widely used across industries for maintaining cleanliness on various surfaces. Disinfectants and sanitizers are in high demand due to hygiene requirements, particularly in the food and beverage and healthcare sectors. Detergents and degreasers cater to heavy-duty cleaning needs in manufacturing and automotive industries, where grease and industrial residues are common. Other cleaning products, such as floor cleaners and window cleaners, also serve specific applications across various industries.

- For example, Dussmann Group, a leading facility management and cleaning services provider in Germany, reported record consolidated sales of €3.3 billion in 2024 according to its official financial statement. The company’s operations include professional cleaning, building maintenance, and hygiene management across industrial and commercial facilities nationwide, reinforcing its strong position in Germany’s cleaning services industry.

By Form:

Industrial cleaning products in Germany come in liquid solutions, powders and concentrates, and aerosols and sprays. Liquid solutions are the most commonly used form, offering easy application for general cleaning needs. Powders and concentrates are often preferred for industrial applications requiring more powerful formulations. Aerosols and sprays are convenient for quick and spot cleaning, often used in office spaces or automotive workshops. These forms cater to the diverse needs of different industries, with each offering unique advantages depending on the cleaning application.

- For example, Metro AG reported a 7.1% year-on-year sales increase in local currency during Q1 2024/25, supported by strong performance in its delivery business, which rose by 15.3%. According to Metro AG’s official financial release in February 2025, the growth was driven by expanded delivery services and stronger demand across multiple product categories within its German operations.

By End User:

The market caters to various end-user industries, including manufacturing and engineering industries, food and beverage processing plants, healthcare and laboratories, transportation and automotive workshops, energy, mining and utilities, and commercial buildings and institutions. Manufacturing and engineering industries are major consumers of industrial cleaning products due to their need for regular cleaning of equipment and facilities. The food and beverage sector places high demand on sanitizers and disinfectants to meet hygiene standards. Healthcare and laboratory facilities require specialized cleaning products to ensure sterile environments, while transportation and automotive workshops rely on heavy-duty cleaners for vehicles and machinery.

By Sales Channel:

Sales channels for industrial cleaning products in Germany include direct industrial sales, online platforms, and retail stores. Direct industrial sales remain prominent due to large-volume purchases by manufacturers and other industrial buyers. Online platforms are increasingly popular, offering convenience and competitive pricing, and are expected to grow rapidly as e-commerce continues to gain traction. Retail stores cater to smaller businesses and individual consumers who require cleaning products for office or small-scale industrial use. The growing trend of online purchases, combined with the continued strength of direct industrial sales, shapes the market’s distribution channels.

Segmentation

By Product Type

- Surface Cleaners

- Disinfectants and Sanitizers

- Detergents & Degreasers

- Others

By Form

- Liquid Solutions

- Powders and Concentrates

- Aerosols and Sprays

By End User

- Manufacturing & Engineering Industries

- Food & Beverage Processing Plants

- Healthcare & Laboratories

- Transportation & Automotive Workshops

- Energy, Mining & Utilities

- Commercial Buildings & Institutions

By Sales Channel

- Direct Industrial Sales

- Online / E-commerce Platforms

- Retail Stores

Regional Analysis

Western Germany

Western Germany dominates the Germany Industrial Cleaning Products Market, accounting for approximately 45% of the market share. This region includes key industrial hubs such as North Rhine-Westphalia and Hesse, which are home to large-scale manufacturing, chemical, and automotive industries. These sectors drive high demand for industrial cleaning products, particularly for heavy-duty cleaners, degreasers, and surface disinfectants. The region’s well-established infrastructure and high concentration of manufacturing facilities ensure that it continues to lead the market. As industries grow, so does the demand for products that ensure equipment maintenance, hygiene, and compliance with safety standards.

Southern Germany

Southern Germany holds around 30% of the market share in the industrial cleaning products sector. Bavaria and Baden-Württemberg, known for their automotive and machinery manufacturing, have a significant demand for cleaning products. The region’s growing focus on technological innovations and sustainable practices is influencing the demand for eco-friendly cleaning solutions. With several global automotive companies headquartered here, the region is critical for cleaning products that meet specific industry standards. Demand for high-performance cleaning solutions in sectors such as food processing and pharmaceuticals also contributes to the steady market growth in this region.

Eastern and Northern Germany

Eastern and Northern Germany represent a smaller portion of the Germany Industrial Cleaning Products Market, accounting for approximately 25%. These regions are emerging markets for industrial cleaning products, with growing manufacturing and healthcare sectors. Cities like Leipzig and Hamburg are expanding their industrial bases, driving demand for cleaning products. However, these areas are still developing in terms of infrastructure and industrial activity compared to Western and Southern Germany. As industries in these regions grow, particularly in logistics, healthcare, and food production, the demand for industrial cleaning products is expected to rise steadily.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Germany Industrial Cleaning Products Market is highly competitive, with several global and local players vying for market share. Key players include multinational companies such as Procter & Gamble, Diversey Holdings, and Reckitt Benckiser, which offer a broad range of industrial cleaning solutions. These companies focus on product innovation, sustainability, and meeting regulatory standards to cater to diverse industries, including automotive, food processing, and healthcare. Local players like Henkel and Ecolab have established a strong presence, particularly with their specialized cleaning products tailored for various industrial applications. Henkel, for example, focuses on both traditional and eco-friendly cleaning solutions, capitalizing on the demand for sustainable products. Ecolab is known for providing comprehensive cleaning and hygiene solutions for the food and beverage sector, which is a critical market in Germany. Competition in the market is driven by the growing emphasis on hygiene, safety, and environmental responsibility. Companies are increasingly investing in product development, particularly in biodegradable and non-toxic formulations, to align with market demands for sustainability. The market’s future growth will likely depend on how well companies adapt to these trends, innovate their product lines, and expand their regional presence.

Recent Developments

- In November 2025, BASF Beauty Care Solutions France S.A.S., a key player in France’s industrial cleaning products market, received recognition for its innovation and sustainability efforts across its Care Chemicals division. BASF continues to expand its product offerings with a strong focus on sustainable, eco-friendly ingredients tailored to industrial and institutional cleaning, aligning with strict national and European regulatory standards.

- In October 2025, Nouryon introduced a new suite of sustainable cleaning‑ingredient technologies at the SEPAWA Congress, including surfactants and chelates for industrial cleaning applications. These innovations support more environmentally friendly formulations in the Europe‑based industrial cleaning sector.

- In September 2025, Ecolab Inc. launched its Ecolab® CIP IQ™ platform and announced a strategic partnership with 4T2 Sensors. This solution targets food and beverage industry clean‑in‑place operations with AI‑enabled fluid sensing technology. The move strengthens Ecolab’s digital hygiene offerings in France and beyond.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness significant growth as industries adopt more sustainable cleaning solutions to meet environmental standards.

- Automation in industrial cleaning processes will create opportunities for advanced, efficient products tailored for smart systems.

- Demand for eco-friendly cleaning solutions will rise, driven by stricter environmental regulations and the growing focus on sustainability.

- The healthcare and food processing sectors will continue to be major contributors to market expansion due to hygiene requirements.

- Increasing industrialization and manufacturing activities will fuel demand for heavy-duty cleaning products, particularly in automotive and chemical industries.

- Growing e-commerce platforms for industrial cleaning products will enhance accessibility and contribute to market growth.

- Technological advancements in cleaning formulations will lead to the development of high-performance, multi-use products.

- Local players will increasingly compete with multinational companies by introducing niche, specialized products to meet local market needs.

- The automotive industry will remain a key driver, especially in Southern Germany, where manufacturing activity continues to expand.

- Market competition will intensify as businesses focus on both cost-effective and sustainable product innovations to capture a larger share of the market.