| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Single Use Assemblies Market Size 2023 |

USD 163.32 Million |

| Germany Single Use Assemblies Market, CAGR |

12.8% |

| Germany Single Use Assemblies Market Size 2032 |

USD 483.79 Million |

Market Overview:

Germany Single Use Assemblies Market size was valued at USD 163.32 million in 2023 and is anticipated to reach USD 483.79 million by 2032, at a CAGR of 12.8% during the forecast period (2023-2032).

Several factors are propelling the growth of the single-use assemblies market in Germany. The escalating demand for biologics and biosimilars necessitates efficient and scalable manufacturing solutions, which single-use assemblies provide. These systems offer advantages such as reduced risk of cross-contamination, lower operational costs, and enhanced flexibility in production processes. Additionally, the growing emphasis on sustainability and regulatory compliance in the biopharmaceutical industry further drives the adoption of single-use technologies. Strategic investments by leading companies in expanding their single-use technology capabilities also contribute to market growth. The increased focus on minimizing production downtime and optimizing operational efficiency is pushing more manufacturers to adopt single-use solutions. Moreover, the ability of single-use assemblies to streamline manufacturing processes for high-quality biologic drugs further supports their widespread adoption across the market.

Germany stands as the largest market for single-use assemblies in Europe, holding a significant share of the regional market. The country’s leadership position is supported by its strong pharmaceutical and biotechnology infrastructure, significant research and development activities, and high demand for single-use technologies. Germany’s dominance in the European market is further reinforced by its well-established medical technology sector, which is one of the most lucrative in the world, accounting for a substantial portion of the overall European market. The German government’s continued focus on innovation, digitalization, and sustainability in healthcare manufacturing also plays a crucial role in fostering the growth of single-use technologies. Additionally, Germany’s highly developed healthcare system and access to advanced manufacturing capabilities create a favorable environment for the adoption of single-use assemblies across various biopharmaceutical applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Single Use Assemblies Market was valued at USD 163.32 million in 2023 and is projected to reach USD 483.79 million by 2032, growing at a CAGR of 12.8%.

- The Global Single-Use Assemblies Market was valued at USD 2,480.91 million in 2023 and is expected to reach USD 6,991.12 million by 2032, growing at a CAGR of 12.2% from 2023 to 2032.

- The escalating demand for biologics and biosimilars is driving the adoption of single-use systems, offering scalable and efficient production solutions.

- Cost-effectiveness is a key factor, as single-use assemblies reduce cleaning, validation, and maintenance costs, benefiting smaller biopharmaceutical companies.

- Technological innovations, including automation and integration of sensors, are enhancing the performance and efficiency of single-use systems.

- Germany’s strong pharmaceutical infrastructure and regulatory frameworks promote the use of single-use technologies for compliance and quality assurance.

- Sustainability concerns drive the preference for single-use assemblies, reducing water and chemical usage in cleaning and sterilization processes.

- High initial investment costs for setting up single-use systems remain a barrier to entry for smaller biopharmaceutical companies in the market.

Market Drivers:

Growing Demand for Biologics and Biosimilars

The increasing demand for biologics and biosimilars is one of the primary drivers propelling the growth of the single-use assemblies market in Germany. For instance, companies such as Sartorius AG and Merck KGaA, both headquartered in Germany, have reported that the growing prevalence of biologics, including monoclonal antibodies and recombinant proteins, is significantly influencing their product development and market strategies. The pharmaceutical industry is experiencing a paradigm shift as biologics, which include monoclonal antibodies and recombinant proteins, become more prevalent in treating chronic diseases and cancers. The complexity of biologic drug manufacturing, coupled with the need for flexibility and scalability, positions single-use assemblies as a vital component. These systems enable manufacturers to streamline the production process, reduce cross-contamination risks, and enhance process flexibility. The expansion of biosimilars, which offer cost-effective alternatives to biologics, further intensifies the need for high-quality, efficient production systems, fueling the demand for single-use assemblies in Germany.

Cost-Effectiveness and Operational Efficiency

Another critical driver of the Germany single-use assemblies market is the increasing focus on reducing manufacturing costs and improving operational efficiency. Single-use systems are particularly advantageous in terms of cost savings compared to traditional stainless-steel equipment, as they reduce cleaning, validation, and maintenance requirements. These cost-saving benefits are especially important for small to medium-sized biopharmaceutical companies that seek efficient manufacturing solutions with lower upfront investments. Moreover, single-use assemblies allow for faster changeovers between production runs, which significantly shortens lead times and increases the overall capacity of manufacturing facilities. This enhanced operational efficiency is appealing to companies seeking to maximize throughput while minimizing production downtime, thus further driving market growth.

Technological Advancements in Single-Use Systems

Technological innovations in single-use systems are revolutionizing the biopharmaceutical manufacturing landscape in Germany. The development of more advanced and customized single-use technologies, such as pre-sterilized systems and advanced filtration modules, is expanding the scope and capabilities of these solutions. These advancements enhance the performance of single-use assemblies, making them even more efficient and reliable for various biopharmaceutical applications. For instance, the integration of sensors and automation technologies into single-use systems is improving process control and data collection, ensuring consistent product quality. As the technology continues to evolve, single-use assemblies become increasingly versatile, driving their adoption among biopharmaceutical manufacturers in Germany.

Regulatory Compliance and Sustainability

Germany’s stringent regulatory environment, coupled with a growing emphasis on sustainability, is also playing a significant role in accelerating the adoption of single-use assemblies. The country has stringent regulatory frameworks governing pharmaceutical manufacturing, and companies are under pressure to ensure compliance with Good Manufacturing Practices (GMP). Single-use systems offer a distinct advantage by minimizing the risk of cross-contamination, thus improving product safety and compliance with regulatory standards. Furthermore, the environmental impact of manufacturing processes is becoming increasingly important. Single-use assemblies, being disposable, help reduce the need for extensive cleaning and sterilization processes, which contributes to a lower carbon footprint and less water usage. The combination of regulatory compliance and sustainability concerns is driving the preference for single-use technologies in Germany’s biopharmaceutical industry, further expanding the market for these solutions.

Market Trends:

Adoption of Advanced Manufacturing Solutions

A significant trend in the Germany single-use assemblies market is the increasing adoption of advanced manufacturing solutions that leverage automation and digitalization. For example, Merck launched Ultimus, a single-use process container film in April 2023, designed to provide enhanced strength and leakage resistance for single-use assemblies, directly addressing process reliability and product integrity needs. As the demand for high-quality biologics and biosimilars continues to rise, manufacturers are investing in cutting-edge technologies to improve process efficiency, consistency, and product quality. Single-use assemblies, integrated with digital sensors and data analytics tools, are helping manufacturers enhance production monitoring, ensure product quality, and streamline operations. This trend toward digitalization not only increases the reliability of single-use systems but also optimizes production processes, making them more cost-effective. With Industry 4.0 concepts gaining traction, the integration of automation into single-use systems is set to grow, further strengthening the role of these technologies in biopharmaceutical production.

Growing Preference for Disposable Systems in Commercial Manufacturing

Another prevailing trend is the growing preference for disposable systems in large-scale commercial manufacturing. Single-use assemblies are gaining prominence as the biopharmaceutical industry in Germany shifts toward commercial-scale production, especially for monoclonal antibodies and other biologics. Traditional multi-use systems, which require extensive cleaning and sterilization between production batches, are being replaced by disposable systems, which eliminate these time-consuming and costly steps. The ability of single-use assemblies to improve throughput and reduce downtime in large-scale manufacturing environments is pushing more companies to adopt these solutions. The trend is especially evident among contract development and manufacturing organizations (CDMOs) that require flexible and efficient systems for producing biologics at scale.

Customization and System Integration

The demand for customized single-use assemblies and integrated systems is another notable trend in Germany’s market. For instance, SaniSure, for example, offers custom single-use assemblies tailored to specific bioprocessing applications, utilizing a wide range of engineered components and advanced materials such as polypropylene, PVDF, and polysulfone to deliver purpose-built solutions. As biopharmaceutical companies strive for more efficient and tailored manufacturing processes, there is a growing need for single-use technologies that can be adapted to specific production requirements. This trend is leading to the development of more specialized systems that include custom configurations and combinations of various components such as filters, connectors, and sensors. Additionally, the integration of single-use systems with existing manufacturing lines is becoming increasingly important to ensure seamless operations. Companies are focusing on creating modular solutions that can easily be integrated with current infrastructure, offering manufacturers greater flexibility and reducing the need for extensive system overhauls.

Increasing Focus on Sustainability

Sustainability continues to be a strong trend influencing the adoption of single-use assemblies in Germany. The biopharmaceutical industry is under increasing pressure to adopt environmentally friendly practices, and single-use systems are seen as an eco-friendly alternative to traditional equipment. By eliminating the need for complex cleaning and sterilization processes, which consume large amounts of water and chemicals, single-use assemblies contribute to a reduction in resource consumption. Additionally, advancements in material science are enabling the development of more sustainable and recyclable single-use systems, further aligning with the growing emphasis on environmental responsibility. This trend is particularly appealing to manufacturers who are striving to meet stringent sustainability targets set by both government regulations and industry standards.

Market Challenges Analysis:

High Initial Investment Costs

One of the primary challenges faced by the Germany single-use assemblies market is the high initial investment cost associated with the implementation of single-use systems. While these systems offer long-term savings through reduced maintenance and operational costs, the upfront expenses for setting up single-use technologies can be significant. This includes the cost of acquiring pre-sterilized components, specialized equipment, and customized solutions tailored to specific production needs. For small and medium-sized biopharmaceutical companies, these high initial costs may pose a barrier to entry, limiting the widespread adoption of single-use assemblies.

Waste Disposal and Environmental Impact

Despite their environmental benefits in reducing the need for cleaning and sterilization, single-use assemblies generate a considerable amount of waste. The disposal of used components, including bags, filters, and tubing, raises concerns about the sustainability of disposable systems. As the adoption of single-use technologies increases, so does the volume of waste produced, which could have a significant environmental impact if not managed properly. Moreover, while the materials used in single-use assemblies are often recyclable, the lack of widespread recycling infrastructure and proper waste management systems in place could hinder the overall sustainability of these solutions.

Regulatory Compliance and Standardization

Regulatory compliance and the need for standardization present another challenge in the market. Although single-use assemblies are increasingly accepted within the biopharmaceutical industry, regulatory bodies across different regions may have varying standards and requirements for their use. In Germany, strict regulatory frameworks governing biopharmaceutical manufacturing must be adhered to, and ensuring that single-use systems meet these standards can be complex. Additionally, the lack of universal standards for single-use components and their integration into existing manufacturing lines can create compatibility issues, leading to inefficiencies in production and a potential slowdown in the adoption of these technologies.

Supply Chain and Quality Control Issues

Supply chain disruptions and quality control concerns also pose challenges to the single-use assemblies market. As demand for single-use components increases, ensuring a consistent and reliable supply of high-quality materials becomes crucial. For example, common materials like silicone are used by multiple vendors but can become single points of failure if shortages occur. Shortages or delays in the supply of essential components can lead to production downtime, impacting manufacturers’ ability to meet market demand. Additionally, maintaining stringent quality control in the production of single-use assemblies is essential to prevent contamination and ensure product safety.

Market Opportunities:

The Germany single-use assemblies market presents significant opportunities driven by the increasing adoption of biologics and biosimilars. As the demand for more cost-effective and scalable manufacturing solutions intensifies, single-use systems offer biopharmaceutical companies a clear advantage. With growing production requirements for biologics such as monoclonal antibodies, the ability to scale up manufacturing with minimal setup time and reduced risk of contamination creates a favorable environment for single-use assemblies. This trend is further amplified by the rising number of biopharmaceutical contract manufacturers (CMOs) and contract development organizations (CDOs) seeking flexible production capabilities to meet diverse client needs. Therefore, there is a substantial opportunity for growth in both large-scale commercial manufacturing and small-batch, high-quality biologic production.

Moreover, sustainability concerns and regulatory pressure are pushing the industry towards greener and more efficient production practices. Single-use assemblies, with their reduced water and chemical consumption in cleaning and sterilization processes, offer an eco-friendly alternative to traditional systems. As sustainability becomes a greater focus for both regulators and consumers, the demand for single-use technologies in Germany is likely to increase. Additionally, innovations in the design of more sustainable, recyclable single-use systems present new market avenues for companies aiming to address environmental concerns while maintaining high production standards. With these dual drivers of demand—biologic production growth and sustainability—Germany’s single-use assemblies market is well-positioned to benefit from continued investments in advanced technologies and production practices.

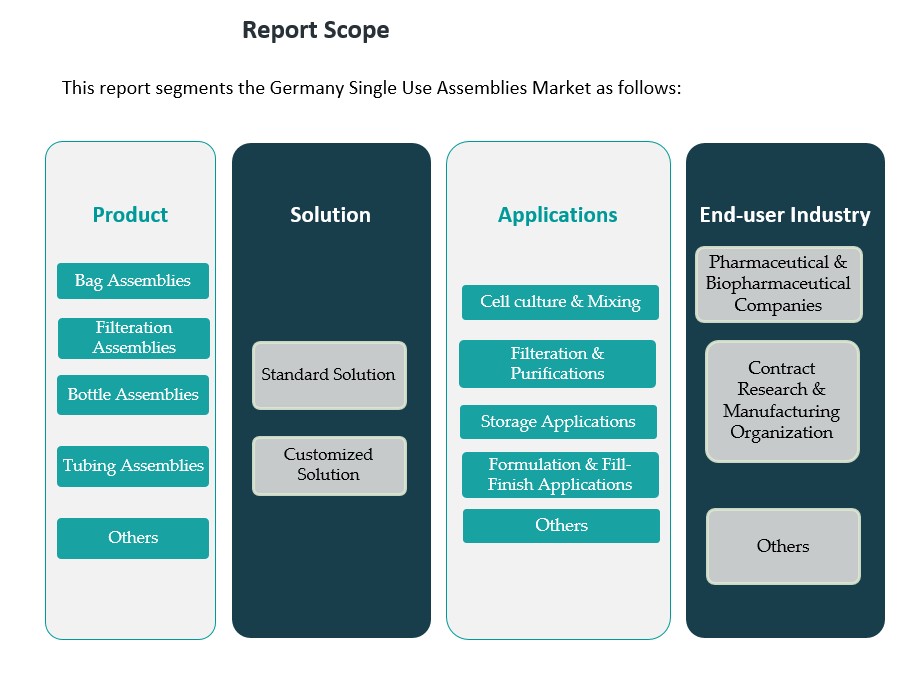

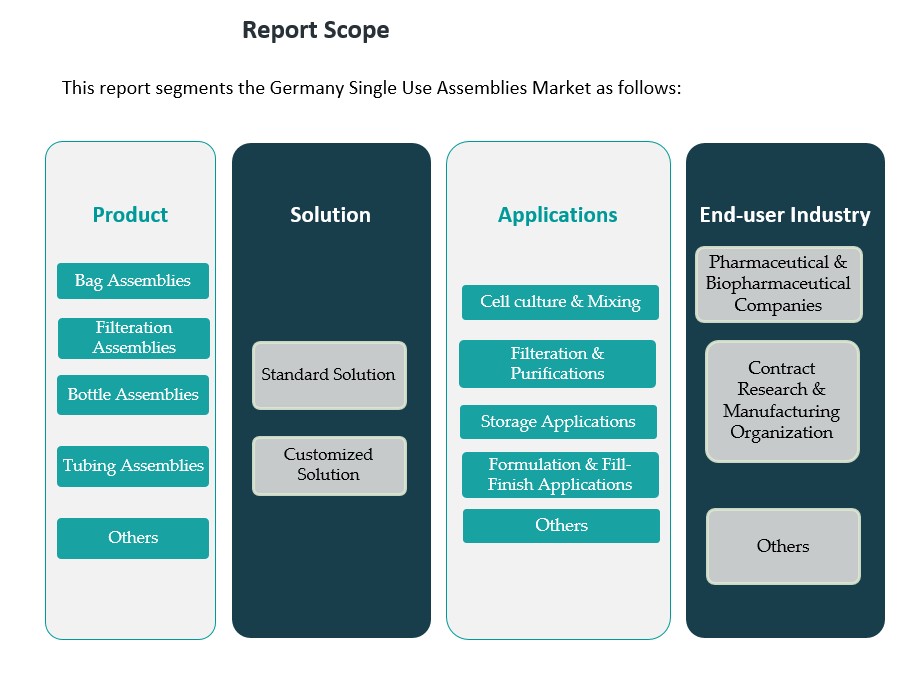

Market Segmentation Analysis:

The Germany single-use assemblies market is segmented across various dimensions, each contributing to the growth and diversification of the industry.

By Product Segment, the market is primarily divided into bag assemblies, filtration assemblies, bottle assemblies, tubing assemblies, and others. Bag assemblies hold a significant share due to their widespread use in fluid handling and storage during biopharmaceutical production. Filtration assemblies are also crucial, providing vital functions in the purification process. Tubing assemblies are integral in connecting various system components, ensuring the smooth flow of liquids in production systems. Bottle assemblies are commonly used in both laboratory and manufacturing settings for the storage and transportation of biopharmaceutical products.

By Solution Segment, the market is divided into standard solutions and customized solutions. Customized solutions are increasingly in demand due to the specific needs of biopharmaceutical companies, which require tailored assemblies to meet production demands and regulatory standards.

By Application Segment, the market is categorized into cell culture & mixing, filtration & purifications, storage applications, formulation and fill-finish applications, and others. Cell culture & mixing is a dominant application as it is essential for the production of biologics. Filtration & purification processes are vital in ensuring the quality and safety of biopharmaceutical products. Storage applications are growing in importance, driven by the increasing need for safe and reliable storage solutions in drug development and manufacturing.

By End-User Segment, the market serves pharmaceutical & biopharmaceutical companies, contract research & manufacturing organizations (CROs & CMOs), and academic & research institutes. Pharmaceutical and biopharmaceutical companies are the largest end-users, driving the demand for efficient and scalable manufacturing solutions. CROs & CMOs benefit from the flexibility and cost-efficiency offered by single-use assemblies. Academic and research institutions also contribute to market growth by requiring single-use solutions for research and development processes.

Segmentation:

By Product Segment:

- Bag Assemblies

- Filtration Assemblies

- Bottle Assemblies

- Tubing Assemblies

- Others

By Solution Segment:

- Standard Solutions

- Customized Solutions

By Applications Segment:

- Cell Culture & Mixing

- Filtration & Purifications

- Storage Applications

- Formulation and Fill-Finish Application

- Others

By End-User Segment:

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research & Contract Manufacturing Organizations

- Academics & Research Institutes

Regional Analysis:

Germany remains a dominant player in the European single-use assemblies market, holding the largest share within the region. The market in Germany is poised for robust growth, driven by the country’s strong pharmaceutical and biopharmaceutical sectors, which are increasingly adopting single-use technologies to improve manufacturing flexibility and efficiency. The adoption of single-use assemblies in Germany is being fueled by the need for scalable solutions in biologic production, particularly monoclonal antibodies, and the growing focus on sustainability within the industry. Germany’s regulatory environment also supports the use of single-use systems due to their ability to minimize the risks of contamination, ensuring high standards of production quality.

Germany’s single-use assemblies market accounts for approximately 35% of the European market share. The country’s pharmaceutical industry, one of the largest in Europe, is a key driver behind this market share, as pharmaceutical and biopharmaceutical companies seek to optimize their production processes. In particular, the demand for single-use solutions in biologics manufacturing and biosimilars production is accelerating the market growth. German manufacturers are increasingly focusing on increasing the flexibility and efficiency of their production lines to cater to evolving market demands, contributing significantly to the country’s dominance in the regional market.

In addition, Germany’s highly developed healthcare infrastructure and well-established research and development capabilities provide a conducive environment for the growth of single-use assemblies. The country’s commitment to innovation, backed by substantial investments in healthcare and biopharmaceutical technologies, further strengthens its market position. Furthermore, with increasing collaborations between research institutes, contract manufacturing organizations (CMOs), and pharmaceutical companies, Germany is positioned as a hub for the adoption of advanced single-use technologies in Europe.

Other European countries, such as the United Kingdom, France, and Switzerland, also contribute to the overall growth of the market, but they hold a smaller market share compared to Germany. The adoption of single-use assemblies in these regions is similarly driven by the rising demand for biologics and biosimilars, but Germany’s central role in the European biopharmaceutical industry places it at the forefront of this market. The country’s focus on research, sustainability, and regulatory compliance further enhances its market leadership position in the European single-use assemblies market.

Key Player Analysis:

- Thermo Fisher Scientific Inc.

- Sartorius AG

- Danaher Corporation

- Merck KGaA

- Avantor, Inc.

- Parker-Hannifin Corporation

- Saint-Gobain S.A.

- GE Healthcare Life Sciences

- Lonza

- Pall Corporation

- Waters Corporation

- Meissner Filtration Products

- Entegris

- Merck Millipore

Competitive Analysis:

Germany’s single-use assemblies market is characterized by a competitive landscape dominated by both domestic and international players. Leading companies such as Sartorius AG, Merck KGaA, Thermo Fisher Scientific, and Danaher Corporation maintain significant market shares through continuous innovation, strategic partnerships, and extensive product portfolios. These firms leverage Germany’s robust pharmaceutical and biotechnology infrastructure to cater to the growing demand for efficient and scalable manufacturing solutions in the biopharmaceutical sector. The market is witnessing increased competition as companies focus on developing advanced single-use technologies that offer enhanced performance, customization, and integration capabilities. Additionally, the emphasis on sustainability and regulatory compliance is prompting manufacturers to adopt eco-friendly materials and processes, further intensifying the competitive dynamics. Collaborations between industry leaders and research institutions are also fostering innovation and expanding the application scope of single-use assemblies in various bioprocessing stages.

Recent Developments:

- In April 2025, Sartorius AG announced the acquisition of MatTek Corp, including Visikol Inc. This acquisition is significant for the single-use assemblies market because MatTek is a leading developer and manufacturer of advanced 3D microtissue models, which are widely used in cell culture and drug discovery.

- Thermo Fisher Scientific Inc.’s February 2025 agreement to acquire Solventum’s Purification & Filtration business is relevant to the single-use assemblies market. The acquisition will expand Thermo Fisher’s capabilities in purification and filtration, which are core components of single-use assembly systems for biomanufacturing. By broadening its bioproduction portfolio, Thermo Fisher is positioned to meet the increasing demand for modular, flexible, and contamination-reducing single-use solutions in biologics manufacturing.

Market Concentration & Characteristics:

The Germany single-use assemblies market is characterized by moderate to high concentration, with several leading global players dominating the market share. Companies such as Sartorius AG, Merck KGaA, Thermo Fisher Scientific, and Cytiva are key contributors, leveraging their technological advancements, strong research capabilities, and robust distribution networks to maintain competitive advantages. These players are actively engaged in expanding their product portfolios, offering a wide range of single-use components and solutions designed to meet the growing demands of the biopharmaceutical industry. The market is highly competitive, with a focus on product innovation, customization, and scalability to cater to the diverse needs of pharmaceutical manufacturers, contract research organizations (CROs), and contract manufacturing organizations (CMOs). The presence of well-established global and regional players, coupled with strategic partnerships and acquisitions, has intensified competition, driving continuous advancements in the market. Additionally, the shift towards sustainable manufacturing practices is influencing product development and market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Solution Segment, Applications Segment and End User Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany single-use assemblies market is expected to experience sustained growth, driven by the increasing demand for biologics and biosimilars.

- Advancements in automation and digitalization will enhance operational efficiency and scalability in biopharmaceutical manufacturing.

- The market will witness rising adoption of sustainable and recyclable single-use technologies, aligning with environmental goals.

- Growing investments in research and development will lead to more customized solutions tailored to specific biopharmaceutical processes.

- Germany’s strong pharmaceutical infrastructure will continue to foster innovation, positioning the country as a key hub in the European market.

- Increased regulatory pressure will drive the adoption of single-use systems, ensuring safer and more compliant production practices.

- Strategic partnerships between market leaders and research institutions will accelerate the development of advanced single-use technologies.

- Demand for flexible manufacturing solutions in contract development and manufacturing organizations (CMOs) will rise.

- The market will see further fragmentation with the entry of smaller players offering specialized single-use systems.

- Expansion of production capacities in response to global biopharmaceutical demand will increase the adoption of single-use assemblies in large-scale manufacturing.