| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Water Pump Market Size 2023 |

USD 3,650.62 Million |

| Germany Water Pump Market, CAGR |

4.77% |

| Germany Water Pump Market Size 2032 |

USD 5,557.18 Million |

Market Overview:

Germany Water Pump Market size was valued at USD 3,650.62 million in 2023 and is anticipated to reach USD 5,557.18 million by 2032, at a CAGR of 4.77% during the forecast period (2023-2032).

Several factors are propelling the growth of the Germany water pump market. The country’s strong industrial sector, encompassing manufacturing, chemicals, and power generation, necessitates advanced pumping solutions for fluid handling and wastewater treatment. Additionally, Germany’s commitment to renewable energy projects, particularly offshore wind farms, drives the demand for specialized pumps in marine and desalination applications. Government initiatives and EU policies, such as the European Green Deal, are promoting the adoption of energy-efficient and environmentally friendly pumping technologies. Furthermore, the increasing focus on smart infrastructure and automation is leading to the integration of IoT-enabled pumps, enhancing operational efficiency and predictive maintenance capabilities.

Germany’s water pump market is influenced by its central location within Europe, serving as a hub for industrial activities and infrastructure development. The country’s well-established manufacturing base and technological expertise position it as a leader in the European market. Proximity to other major European markets facilitates cross-border trade and collaboration, further enhancing Germany’s market presence. The emphasis on sustainability and compliance with stringent environmental regulations aligns with broader European trends, ensuring continued demand for advanced water pumping solutions. Germany’s strategic investments in renewable energy and infrastructure projects are expected to sustain the growth trajectory of its water pump market in the coming years. The country’s central location within Europe also enables easy access to other key markets, strengthening its position as a regional hub for water pump manufacturing and trade.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Water Pump Market was valued at USD 3,650.62 million in 2023 and is projected to reach USD 5,557.18 million by 2032, growing at a CAGR of 4.77% during the forecast period.

- The global water pump market was valued at USD 55,454.00 million in 2023 and is projected to reach USD 80,304.96 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Germany’s industrial sector, including manufacturing, chemicals, and power generation, drives significant demand for advanced water pumps for fluid handling, wastewater treatment, and cooling systems.

- Government policies and EU regulations, such as the European Green Deal, encourage the adoption of energy-efficient water pumps, boosting market growth.

- The country’s commitment to renewable energy, particularly offshore wind farms, is increasing the demand for specialized pumps used in marine and desalination applications.

- Technological advancements, particularly the integration of IoT-enabled pumps, are enhancing operational efficiency, predictive maintenance, and reducing costs for industrial applications.

- While high initial investment costs for advanced pumping systems remain a challenge, long-term energy savings make these pumps attractive for large-scale industries.

- Germany’s strategic location in Europe strengthens its position as a hub for cross-border trade and collaboration, further propelling the water pump market.

Market Drivers:

Industrial Demand for Water Pumps

The industrial sector in Germany is a key driver for the water pump market. Germany is home to a vast range of manufacturing industries, including chemical production, power generation, and machinery manufacturing. These industries require efficient water pumps for various applications such as fluid transfer, cooling systems, and wastewater treatment. For example, Germany’s emphasis on wastewater management has led to a substantial demand for specialized pumps designed to meet stringent environmental standards. Industrial water pumps are essential for maintaining operational efficiency and complying with environmental regulations, such as wastewater management standards. The need for reliable, durable, and energy-efficient water pumps is therefore integral to the continued growth of these industries, contributing to the expansion of the German water pump market.

Government Initiatives and Environmental Regulations

Government policies and regulations play a significant role in driving the demand for water pumps in Germany. The country is known for its stringent environmental regulations, which mandate the use of energy-efficient and environmentally friendly technologies. The adoption of sustainable practices, such as water conservation, energy efficiency, and waste management, is encouraged by both federal and local governments. The European Green Deal, which aims to reduce carbon emissions and improve resource efficiency, is particularly influential in shaping the market. As industries comply with these regulations, they increasingly turn to advanced water pumps that meet these criteria, fueling the market’s growth.

Renewable Energy Projects and Infrastructure Development

Germany’s commitment to renewable energy projects significantly impacts the demand for specialized water pumps. With an increasing focus on renewable energy sources, such as wind and solar power, there is a rising need for pumps used in various stages of energy generation, including cooling systems for power plants and desalination processes for water supply. In particular, the expansion of offshore wind farms in the North Sea requires specialized pumps for cooling and seawater treatment. For instance, seawater pumps play a critical role in supporting offshore energy projects and industrial applications requiring saline water management. Infrastructure development projects aimed at enhancing water management systems, including flood control, sewage treatment, and irrigation systems, further drive the demand for high-performance water pumps. These projects are expected to continue growing in the coming years, creating new opportunities for water pump manufacturers.

Technological Advancements and Automation

Advancements in pump technology and automation are transforming the German water pump market. The integration of Internet of Things (IoT) and smart technologies has enabled water pumps to become more efficient, reliable, and easier to maintain. Pumps equipped with sensors and monitoring systems can provide real-time data on performance, detect potential failures, and optimize energy consumption. This allows industries to reduce downtime, lower operational costs, and increase the lifespan of their equipment. As a result, the demand for IoT-enabled water pumps is on the rise in Germany, with companies looking to adopt smarter, more efficient solutions. Additionally, the growing trend toward automation across various sectors further supports the need for advanced water pumps capable of operating seamlessly within automated systems.

Market Trends:

Technological Advancements in Pump Efficiency

The German water pump market is experiencing a significant shift towards technological innovations aimed at enhancing efficiency and sustainability. Manufacturers are investing in research and development to produce pumps that consume less energy and offer improved performance. For instance, the integration of variable frequency drives (VFDs) allows pumps to adjust their speed according to demand, resulting in substantial energy savings. Additionally, the adoption of smart pumps equipped with IoT sensors enables real-time monitoring and predictive maintenance, minimizing downtime and extending equipment lifespan. These advancements are not only reducing operational costs but also aligning with Germany’s commitment to environmental sustainability.

Expansion in Renewable Energy Applications

Germany’s dedication to renewable energy is fostering growth in the water pump sector, particularly in applications like offshore wind energy. The country’s investment in offshore wind farms in the Baltic Sea has led to increased demand for specialized seawater pumps designed to operate efficiently in harsh marine environments. These pumps are crucial for cooling systems and ensuring the longevity of offshore installations. The focus on renewable energy sources is driving the development of pumps that can withstand the unique challenges of marine applications, thereby supporting Germany’s transition to a low-carbon economy.

Growth in Industrial and Municipal Applications

The German water pump market is witnessing robust growth in both industrial and municipal sectors. In industrial applications, pumps are essential for processes such as chemical manufacturing, power generation, and food processing, where precise fluid handling is critical. For example, centrifugal pumps are widely used due to their reliability and high efficiency in fluid handling applications. Municipally, there is a heightened focus on wastewater treatment and efficient water supply systems to cater to urban populations. This trend is driven by stringent environmental regulations and the need to upgrade aging infrastructure. The government’s commitment to enhancing water management systems is leading to increased investments in pump technologies that ensure safe and reliable water distribution and treatment.

Regional Disparities Influencing Market Dynamics

Germany’s diverse regional landscape significantly impacts the distribution and demand for water pumps.Regions with a strong industrial presence, such as North Rhine-Westphalia, exhibit high demand for pumps used in manufacturing and chemical processing.In contrast, areas like Bavaria, with its emphasis on agriculture, see increased use of pumps for irrigation and livestock management.Additionally, coastal regions involved in maritime activities require pumps for shipbuilding and offshore operations.These regional variations necessitate tailored pump solutions that address specific local needs, thereby influencing market strategies and product offerings across the country.

Market Challenges Analysis:

High Initial Investment Costs

One of the key restraints in the Germany water pump market is the high initial investment required for advanced pumping systems. While energy-efficient and technologically advanced pumps offer long-term cost savings, the upfront cost of purchasing and installing these systems can be substantial. This financial burden can deter small and medium-sized enterprises (SMEs) from adopting modern pump technologies, especially in regions with limited access to capital. The high initial investment remains a significant challenge for industries looking to upgrade their existing infrastructure to more efficient, sustainable water pumping solutions.

Maintenance and Operational Costs

Although water pumps are essential for various industrial, agricultural, and municipal applications, their maintenance and operational costs can also present challenges. For example, operational costs account for 38% of a pump’s TCO, while energy consumption contributes another 32%, making these ongoing expenses a significant portion of the overall cost structure. Regular maintenance is crucial to ensure optimal performance and prevent unexpected failures, which can lead to costly repairs or replacements. Additionally, while energy-efficient pumps help reduce energy consumption, the overall operational costs, including the need for specialized parts and skilled technicians, can be burdensome for certain sectors. These ongoing costs impact the overall profitability for organizations and may limit the adoption of newer pump technologies.

Regulatory Compliance Challenges

While stringent environmental regulations in Germany encourage the adoption of energy-efficient water pumps, they also pose challenges for market players. The need to comply with evolving regulations related to energy consumption, emissions, and sustainability requires companies to continuously update their systems to meet new standards. This can involve significant investments in retrofitting existing infrastructure or purchasing new equipment that adheres to regulatory requirements. As regulations become more stringent, companies may face difficulties in keeping pace with compliance, which can hinder market growth and innovation.

Supply Chain and Raw Material Shortages

The water pump market in Germany, like many other industries, faces challenges related to supply chain disruptions and raw material shortages. The global shortage of essential components, such as semiconductors and specific metals, can delay production timelines and increase costs. Additionally, logistical challenges and increased transportation costs can impact the timely delivery of pumps, further straining the market’s growth potential. These supply chain issues create uncertainty for manufacturers and end-users, hindering the smooth operation of the water pump market in Germany.

Market Opportunities:

Germany’s commitment to renewable energy presents significant growth opportunities for the water pump market. The nation’s investment in offshore wind farms in the Baltic Sea has increased the demand for specialized seawater pumps designed for harsh marine environments. These pumps are essential for cooling systems and ensuring the longevity of offshore installations. The focus on renewable energy sources drives the development of pumps capable of withstanding the unique challenges of marine applications, supporting Germany’s transition to a low-carbon economy. As Germany continues to expand its renewable energy infrastructure, the demand for these specialized pumps will remain strong, further driving market growth.

The integration of digital technologies and automation in water management systems offers substantial market opportunities. Initiatives like WATER 4.0 emphasize the intelligent networking of water users across agriculture, industry, and households. This approach enhances resource efficiency and competitiveness. The adoption of smart pumps equipped with IoT sensors enables real-time monitoring and predictive maintenance, reducing operational costs and improving system reliability. These technological advancements position Germany’s water pump market for growth, aligning with the country’s sustainability objectives. Moreover, the ongoing trend toward digitalization will likely encourage further adoption of smart solutions across various sectors, bolstering the market’s development.

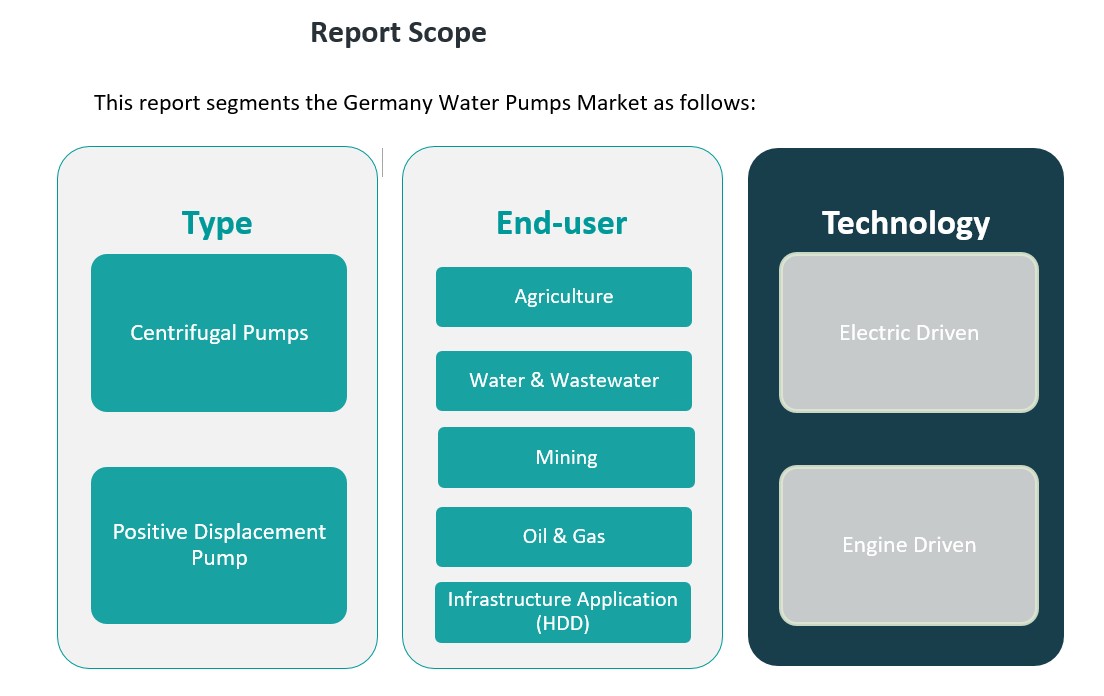

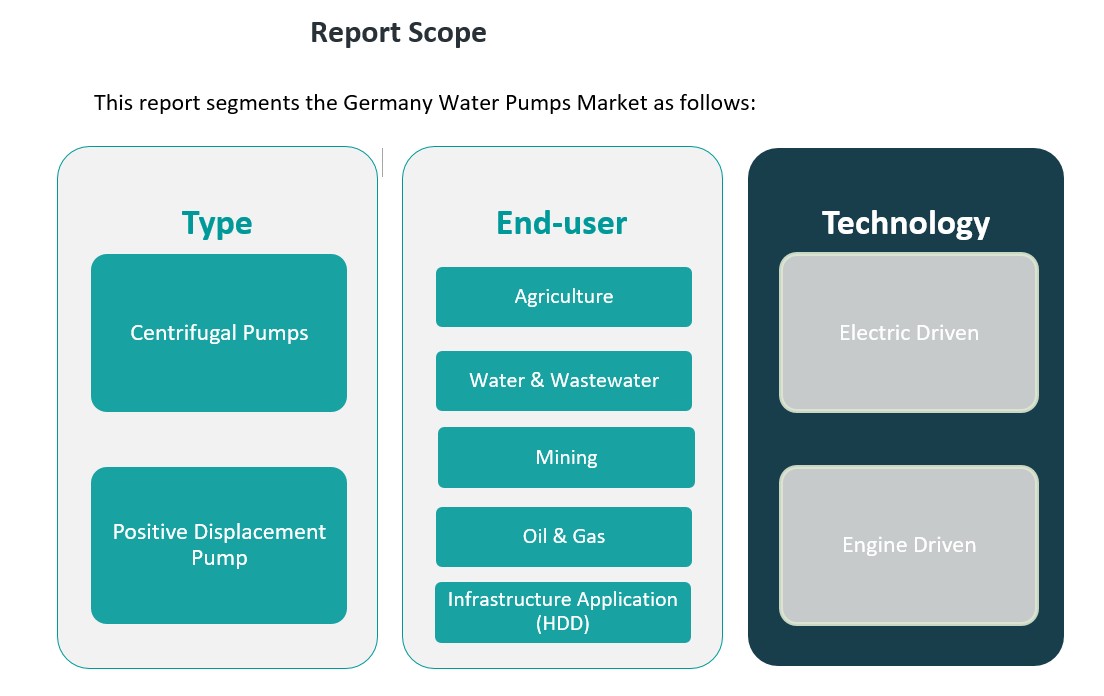

Market Segmentation Analysis:

The Germany water pump market is segmented based on type, end-user application, and technology, offering distinct insights into the evolving demand for water pumping solutions.

By Type Segment

The two primary types of pumps driving the market are centrifugal pumps and positive displacement pumps. Centrifugal pumps dominate the market due to their widespread application in industries requiring continuous fluid flow, such as water and wastewater management, agriculture, and industrial processing. They are preferred for their efficiency, simplicity, and lower maintenance requirements. Positive displacement pumps, on the other hand, find their niche in applications requiring precise flow control and higher pressures, such as oil and gas, and mining. This type of pump is used for transferring viscous fluids and ensuring consistent flow in challenging environments.

By End-User Segment

The end-user segment highlights key industries where water pumps are crucial. Agriculture remains a significant driver, with pumps used for irrigation and livestock management. Water and wastewater management, including municipal and industrial wastewater treatment, forms a large portion of demand. Mining and oil & gas industries also rely on pumps for fluid transfer and resource extraction. Infrastructure applications, such as horizontal directional drilling (HDD) for underground pipeline installation, are also emerging as critical areas for water pump deployment, driven by Germany’s infrastructure development projects.

By Technology Segment

In terms of technology, electric-driven pumps lead the market due to their efficiency, lower operating costs, and reduced environmental impact. However, engine-driven pumps are used in areas where mobility and autonomy are essential, such as remote locations in mining and construction. The growing preference for energy-efficient, electric-driven solutions aligns with Germany’s sustainability goals and regulatory frameworks.

Segmentation:

By Type Segment:

- Centrifugal Pumps

- Positive Displacement Pumps

By End-User Segment:

- Agriculture

- Water & Wastewater

- Mining

- Oil & Gas

- Infrastructure Application (HDD)

By Technology Segment:

- Electric Driven

- Engine Driven

Regional Analysis:

Germany’s water pump market is characterized by its robust industrial base, advanced infrastructure, and a strong emphasis on sustainability. The market is predominantly influenced by regions with significant industrial activities, each contributing uniquely to the nation’s water pump demand.

North Rhine-Westphalia (NRW)

As Germany’s industrial powerhouse, NRW houses numerous manufacturing and chemical processing plants. This concentration drives substantial demand for water pumps used in cooling systems, wastewater treatment, and process management. The region’s extensive industrial activities position it as a primary consumer of advanced water pumping solutions.

Bavaria

Bavaria’s strong manufacturing sector, particularly in automotive and machinery, necessitates efficient fluid handling systems. The demand for water pumps in this region is closely linked to its industrial growth, with applications spanning cooling, heating, and process management.

Baden-Württemberg

Known for its high-tech industries and automotive giants, Baden-Württemberg’s emphasis on precision engineering extends to its water pump requirements. The region favors pumps that offer reliability and efficiency, aligning with its technological advancements.

Hesse

Hesse’s role as a financial hub is complemented by its industrial activities, including chemical and pharmaceutical sectors. These industries rely on specialized water pumps for various applications, from chemical processing to wastewater management.

Saxony and Saxony-Anhalt

These eastern regions are experiencing industrial revitalization, with growing demand for water pumps in manufacturing and energy sectors. Investments in infrastructure and industrial projects are driving the need for efficient water pumping solutions.

Key Player Analysis:

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation

- ITT INC.

- EBARA CORPORATION

- GEA Group AG

Competitive Analysis:

The Germany water pump market is highly competitive, with both global and regional players vying for market share. Leading international companies such as Grundfos, KSB AG, and Sulzer dominate the market, offering a wide range of water pumps known for their efficiency, reliability, and innovation. These companies focus on developing advanced pump solutions that cater to diverse industries, including wastewater treatment, agriculture, and industrial applications. In addition to these global giants, regional manufacturers like Wilo SE and EBARA Pumps Europe are strong contenders, leveraging their local presence and expertise to meet the specific needs of the German market. Competitive strategies in the market are largely centered around technological advancements, with an increasing focus on energy-efficient and IoT-enabled pumps that support real-time monitoring and predictive maintenance. Price competitiveness, product differentiation, and customer service are key factors influencing market positioning among these players.

Recent Developments:

- In January 2023, Grundfos launched a new range of energy-efficient seawater pumps, demonstrating its commitment to sustainability and innovation in the marine and industrial sectors.

- In 2023, Andritz introduced corrosion-resistant pumps specifically designed for offshore wind farms, aligning with Germany’s renewable energy goals and increasing offshore infrastructure needs.

- In September 2024, Grundfos expanded its European water treatment market presence by acquiring Culligan’s commercial and industrial business in Italy, France, and the UK.

- In October 2024, Sulzer Ltd launched the ZF-RO end-suction pump to meet the technical requirements of energy recovery device booster pump services in hydrocarbon and desalination industries.

- On February 3, 2025, Ingersoll Rand acquired SSI Aeration, Inc., a leader in wastewater treatment equipment manufacturing. This acquisition strengthens Ingersoll Rand’s presence in the wastewater treatment market by integrating SSI’s innovative aeration systems with its existing technologies

Market Concentration & Characteristics:

The Germany water pump market is moderately concentrated, with a mix of global and regional players competing for market share. The market is dominated by well-established companies such as Grundfos, KSB AG, and Wilo SE, which account for a significant portion of the market. These industry leaders are known for their advanced technological solutions and extensive product portfolios, catering to a broad range of sectors, including agriculture, wastewater treatment, and industrial applications. However, regional manufacturers also play a critical role, offering specialized products and customized solutions to meet local market needs. The market is characterized by a high level of technological innovation, with companies focusing on energy-efficient, IoT-enabled, and environmentally sustainable pump solutions. Additionally, the market is marked by moderate competition, with firms differentiating themselves through product quality, customer service, and innovation. Price sensitivity remains an important factor in market dynamics, particularly in industrial sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, End-User Segment and Technology Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for energy-efficient water pumps is expected to rise due to Germany’s sustainability initiatives.

- Increased investments in renewable energy projects, especially offshore wind farms, will drive the need for specialized pumps.

- Technological advancements, including IoT integration and smart pumps, will enhance efficiency and reduce operational costs.

- The growing focus on wastewater treatment and water recycling will expand opportunities for water pump manufacturers.

- Automation and digitalization trends will propel the adoption of intelligent water pumping systems across industries.

- The industrial sector, including chemicals and manufacturing, will remain a key driver of pump demand.

- Germany’s emphasis on upgrading aging infrastructure will lead to higher investments in water pump solutions.

- The agricultural sector’s shift towards more efficient irrigation systems will increase water pump sales.

- Regional disparities will influence the demand for specific types of pumps, with industrial areas seeing higher demand.

- Competitive pressure will drive innovations, resulting in continuous product improvements and cost reductions.