Market Overview

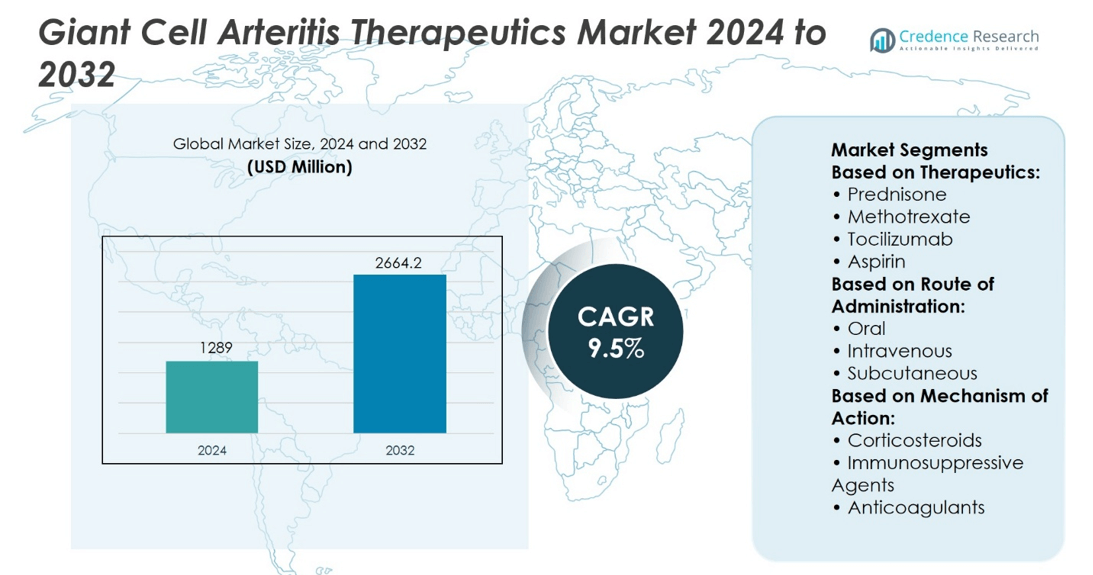

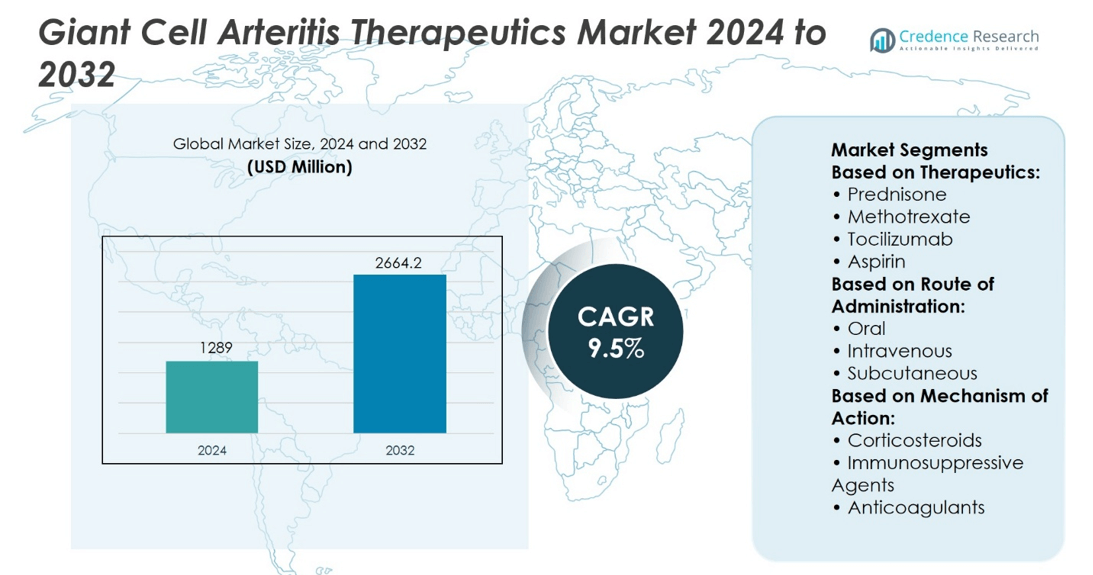

Giant Cell Arteritis Therapeutics Market size was valued at USD 1289 million in 2024 and is anticipated to reach USD 2664.2 million by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Giant Cell Arteritis Therapeutics Market Size 2024 |

USD 1289 million |

| Giant Cell Arteritis Therapeutics Market, CAGR |

9.5% |

| Giant Cell Arteritis Therapeutics Market Size 2032 |

USD 2664.2 million |

The Giant Cell Arteritis Therapeutics Market grows on strong regulatory support, rising disease awareness, and increasing demand for biologics that reduce dependence on corticosteroids. It advances through early diagnosis initiatives, expanding clinical research, and healthcare investment that broadens patient access to advanced therapies. Market trends highlight wider adoption of IL-6 inhibitors, integration of biomarker-driven diagnostics, and development of steroid-sparing regimens that improve safety. It reflects a shift toward patient-centered care with emphasis on long-term disease management, digital health tools for monitoring, and global collaborations that accelerate innovation and expand availability of novel treatment options.

The Giant Cell Arteritis Therapeutics Market shows strong presence in North America and Europe due to advanced healthcare systems, robust reimbursement, and early adoption of biologics, while Asia-Pacific demonstrates rising demand supported by expanding clinical infrastructure. Latin America and the Middle East & Africa record gradual uptake through improving specialty care access. Key players shaping the market include Novartis AG, F. Hoffmann-La Roche Ltd., Pfizer Inc., Eli Lilly and Company, GlaxoSmithKline plc, Janssen Pharmaceuticals, ChemoCentryx, InflaRx, Bio Thera Solutions Ltd., and Livzon Pharmaceutical Group Inc.

Market Insights

- The Giant Cell Arteritis Therapeutics Market was valued at USD 1289 million in 2024 and is projected to reach USD 2664.2 million by 2032, at a CAGR of 9.5%.

- Strong regulatory support, rising disease awareness, and demand for biologics drive consistent market expansion.

- Trends emphasize adoption of IL-6 inhibitors, biomarker-based diagnostics, and steroid-sparing regimens for safer long-term care.

- Competitive landscape features global leaders such as Novartis AG, F. Hoffmann-La Roche Ltd., Pfizer Inc., and Eli Lilly and Company.

- Restraints include high cost of biologics, limited reimbursement in emerging markets, and safety concerns linked to long-term therapies.

- North America and Europe dominate due to advanced healthcare infrastructure and favorable reimbursement policies.

- Asia-Pacific shows rapid growth with expanding clinical infrastructure, while Latin America and Middle East & Africa progress gradually with improving specialty care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Targeted Immunotherapies and Biologics

The Giant Cell Arteritis Therapeutics Market benefits from rising adoption of biologics that deliver precise immunomodulation. Monoclonal antibodies designed to block pro-inflammatory pathways gain wide acceptance among specialists. It strengthens treatment effectiveness and lowers relapse frequency compared with conventional corticosteroid therapy. Regulatory approvals for biologic drugs accelerate clinical adoption in major healthcare systems. Pharmaceutical pipelines expand with multiple biologics under evaluation across late-stage trials. Patient awareness of advanced therapy options further drives market preference toward targeted solutions.

Expanding Role of Early Diagnosis and Disease Awareness Programs

The Giant Cell Arteritis Therapeutics Market advances through stronger initiatives to promote early recognition of symptoms and structured referral pathways. Healthcare systems integrate diagnostic imaging techniques and biomarker testing into routine care. It reduces delays in treatment initiation and improves patient outcomes. Professional medical associations conduct educational campaigns to support awareness among clinicians. Rising public health investments enhance accessibility to screening tools in both developed and emerging regions. Clear clinical guidelines issued by regulatory authorities reinforce the emphasis on prompt therapeutic intervention.

- For instance, a study estimated that by over 3 million patients across Europe, North America, and Oceania may be diagnosed with GCA, underscoring the imperative of scaling structured diagnosis and awareness interventions early to manage such volume.

Rising Investment in Clinical Research and Development of Novel Agents

The Giant Cell Arteritis Therapeutics Market experiences growth from intensified R&D activities targeting new mechanisms of action. Leading pharmaceutical companies allocate substantial budgets to expand investigational drug portfolios. It accelerates availability of therapies with improved efficacy and safety profiles. Global collaborations between research institutes and industry players stimulate innovation in immunology. Expanding clinical trial networks across multiple geographies strengthen recruitment efficiency. Successful trial outcomes position emerging molecules for regulatory submission and future commercialization.

- For instance, AbbVie committed 195 million to expand its active pharmaceutical ingredient (API) manufacturing capacity in North Chicago, a strategic move poised to support production of next‑generation immunology therapeutics including RINVOQ (upadacitinib).

Increasing Healthcare Expenditure and Access to Advanced Therapies

The Giant Cell Arteritis Therapeutics Market expands with growing healthcare spending that supports adoption of high-cost biologic treatments. Payers and insurers gradually widen reimbursement frameworks to include advanced therapies. It improves patient access to innovative drugs while reducing economic burden. Hospitals and specialty clinics integrate new therapeutic regimens into standard protocols. Rising prevalence of autoimmune and inflammatory conditions heightens demand for resource allocation. Government programs focused on rare and chronic diseases enhance funding for long-term patient care.

Market Trends

Increasing Adoption of Biologics and Steroid-Sparing Therapies

The Giant Cell Arteritis Therapeutics Market reflects a clear trend toward biologics that minimize dependency on corticosteroids. Physicians prefer targeted therapies that reduce long-term side effects linked to steroid exposure. It shifts treatment protocols toward safer and more sustainable regimens. Biologics designed to inhibit inflammatory cytokines gain traction in major markets. Companies focus on securing wider regulatory approvals for steroid-sparing agents. Patient outcomes improve as therapeutic innovation aligns with chronic disease management requirements.

- For instance, the pivotal GiACTA trial enrolled 251 patients with giant cell arteritis to assess tocilizumab’s steroid‑sparing impact, demonstrating robust real‑world adoption volumes tied to this biologic intervention.

Integration of Advanced Diagnostic Tools with Treatment Strategies

The Giant Cell Arteritis Therapeutics Market demonstrates rising integration of diagnostic imaging and biomarker testing into treatment decisions. Clinicians adopt PET scans, ultrasound, and CRP markers to monitor disease activity. It enhances precision in initiating or adjusting therapies. Diagnostic advances help reduce relapse rates by supporting evidence-based interventions. Pharmaceutical companies invest in companion diagnostic solutions to complement therapeutic offerings. Strong alignment between diagnostics and therapeutics establishes a more comprehensive care model.

- For instance, Siemens Healthineers reported that its Biograph Vision Quadra PET/CT system achieved a 106 cm axial field of view, enabling clinicians to capture dynamic whole-body imaging in a single scan, reducing procedure time by nearly 40 minutes per patient across over 2 million diagnostic sessions conducted globally.

Expansion of Clinical Research Collaborations and Global Trial Networks

The Giant Cell Arteritis Therapeutics Market shows a trend toward larger clinical trial networks supported by global partnerships. Research institutes and pharmaceutical firms collaborate to accelerate development of novel therapies. It expands opportunities for patient recruitment and diversified data collection. Cross-border studies strengthen clinical validation for innovative molecules. Rising trial activity across Europe, North America, and Asia supports more robust evidence generation. Successful outcomes encourage faster regulatory submissions and broader therapeutic adoption.

Growing Focus on Patient-Centered Care and Long-Term Disease Management

The Giant Cell Arteritis Therapeutics Market evolves toward models that emphasize patient well-being and sustained quality of life. Healthcare providers develop protocols for personalized care pathways. It prioritizes balancing treatment efficacy with minimized side effects. Long-term monitoring programs address relapse prevention and adherence challenges. Digital health tools support remote follow-up and symptom tracking. Stakeholder initiatives highlight patient engagement as a key driver of improved therapeutic success.

Market Challenges Analysis

High Treatment Costs and Limited Reimbursement Frameworks

The Giant Cell Arteritis Therapeutics Market faces a significant challenge due to the elevated cost of biologic therapies and complex reimbursement policies. Many healthcare systems struggle to integrate high-cost drugs into standard care, limiting patient accessibility. It creates disparities in treatment availability across different regions and healthcare tiers. Payers often impose strict eligibility criteria, slowing the adoption of innovative therapeutics. Financial barriers deter consistent treatment, particularly in low- and middle-income economies. Manufacturers encounter pressure to demonstrate cost-effectiveness before securing broad coverage from insurers.

Safety Concerns and Gaps in Long-Term Efficacy Data

The Giant Cell Arteritis Therapeutics Market encounters hurdles from concerns about long-term safety and incomplete data on sustained efficacy. Biologic therapies carry risks of infection, immune suppression, and rare adverse events that require extensive monitoring. It restricts the willingness of some physicians to prescribe advanced drugs. Limited longitudinal studies leave uncertainty about relapse rates after extended use. Clinical practice often relies on short- to mid-term results rather than multi-year datasets. The absence of comprehensive real-world evidence challenges the confidence of regulators, providers, and patients in fully embracing next-generation therapies.

Market Opportunities

Expansion of Biologic Therapies and Novel Drug Development

The Giant Cell Arteritis Therapeutics Market presents strong opportunities through the growing pipeline of biologic agents and novel small molecules. Pharmaceutical companies allocate substantial resources to research programs that target inflammatory pathways beyond corticosteroid intervention. It enables the introduction of therapies with improved safety and durability of response. Wider regulatory approvals for biologics across multiple regions open pathways for market penetration. Companies that secure first-mover advantage in emerging therapeutic classes stand to gain competitive positioning. The trend toward personalized medicine further supports adoption of innovative treatment options tailored to patient-specific needs.

Rising Investment in Healthcare Infrastructure and Patient Access Programs

The Giant Cell Arteritis Therapeutics Market benefits from expanding healthcare investment that prioritizes rare and chronic conditions. Governments and private stakeholders increase funding for advanced specialty care and patient assistance initiatives. It improves access to high-cost therapies through structured reimbursement and support programs. Hospitals and specialty clinics strengthen capabilities for early diagnosis and long-term management. Digital platforms that enable remote monitoring create new avenues for patient engagement. Partnerships between public agencies and pharmaceutical companies enhance distribution channels and accelerate delivery of advanced therapeutics.

Market Segmentation Analysis:

By Therapeutics

The Giant Cell Arteritis Therapeutics Market includes a diverse portfolio of drugs that address disease progression and symptom control. Prednisone remains the primary therapeutic option due to its ability to rapidly suppress vascular inflammation. It continues to be widely prescribed despite concerns about long-term side effects. Methotrexate supports patients who require steroid-sparing alternatives and provides additive benefit in refractory cases. Tocilizumab, an IL-6 receptor inhibitor, demonstrates strong clinical efficacy and reduces relapse frequency, strengthening its position as a preferred biologic therapy. Aspirin is often prescribed as an adjunct to minimize vascular complications, reflecting its established role in disease management. Together, these therapeutics define a structured treatment framework that blends traditional and advanced options.

- For instance, Pfizer’s corticosteroid portfolio, including prednisone, has been instrumental in treating over 3.4 million patients with inflammatory and autoimmune diseases.

By Route of Administration

The Giant Cell Arteritis Therapeutics Market demonstrates segmentation across oral, intravenous, subcutaneous, and other delivery formats. Oral administration dominates due to patient preference and ease of use, particularly for corticosteroids and methotrexate. Intravenous routes support biologics such as tocilizumab in hospital and specialty care settings, where close monitoring is required. It provides rapid systemic exposure and controlled dosing precision. Subcutaneous delivery gains momentum as it offers convenience, reduced hospital dependency, and improved adherence for long-term biologic therapies. Other routes, though less common, remain important for supportive care and tailored patient needs.

- For instance, Roche reported that its Actemra/RoActemra portfolio, which includes both intravenous and subcutaneous formats, treated over 1.2 million patients worldwide by the end of across autoimmune and inflammatory indications, including vasculitis cohorts relevant to GCA.

By Mechanism of Action

The Giant Cell Arteritis Therapeutics Market reflects clear stratification by mechanism of action, including corticosteroids, immunosuppressive agents, and anticoagulants. Corticosteroids dominate first-line management due to their proven capacity to control acute inflammation, despite the risk of toxicity with prolonged use. Immunosuppressive agents such as methotrexate and tocilizumab address gaps in long-term disease control, providing alternatives that mitigate corticosteroid dependence. It strengthens treatment outcomes by expanding therapeutic options for resistant or recurrent cases. Anticoagulants such as aspirin target vascular complications linked to giant cell arteritis, highlighting the multifaceted approach to patient care. The interplay between these mechanisms establishes a therapeutic continuum that supports immediate control and sustained disease management.

Segments:

Based on Therapeutics:

- Prednisone

- Methotrexate

- Tocilizumab

- Aspirin

Based on Route of Administration:

- Oral

- Intravenous

- Subcutaneous

Based on Mechanism of Action:

- Corticosteroids

- Immunosuppressive Agents

- Anticoagulants

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Giant Cell Arteritis Therapeutics Market with 38% of the overall market. The region benefits from advanced healthcare infrastructure, strong reimbursement frameworks, and high awareness of autoimmune and inflammatory disorders. It reflects strong adoption of biologics such as tocilizumab, supported by favorable regulatory approvals and clinical guideline integration. The presence of major pharmaceutical players and active research networks accelerates the introduction of innovative therapies. Rising investments in digital health tools and patient management systems strengthen disease monitoring and compliance. Government initiatives to expand patient access to rare disease treatments reinforce the region’s dominant position. Demand for effective therapies continues to expand as the population over 50 years of age, where giant cell arteritis prevalence is highest, grows significantly.

Europe

Europe accounts for 29% of the Giant Cell Arteritis Therapeutics Market and demonstrates steady adoption of corticosteroids, methotrexate, and advanced biologics. It benefits from robust public healthcare systems, which ensure structured access to high-cost therapies. Clinical guidelines established by the European Alliance of Associations for Rheumatology support the early use of steroid-sparing treatments, driving biologic adoption. It is characterized by strong collaboration between pharmaceutical companies and academic institutions, fostering active clinical trial activity across multiple countries. Patient awareness campaigns supported by healthcare authorities improve diagnosis rates and treatment compliance. Increasing prevalence of autoimmune conditions across aging populations strengthens the demand for structured therapeutic approaches. Regulatory emphasis on evidence-based adoption supports the continued expansion of advanced treatment modalities across the region.

Asia-Pacific

Asia-Pacific captures 20% of the Giant Cell Arteritis Therapeutics Market, reflecting rapid growth driven by expanding healthcare investments and improving diagnostic capabilities. Countries such as Japan, China, and India witness increased adoption of biologics and immunosuppressive agents, supported by urbanization and rising healthcare expenditure. It benefits from growing clinical trial networks and pharmaceutical partnerships that introduce advanced therapies to regional markets. Patient access to specialized care improves with the expansion of tertiary hospitals and government-backed rare disease initiatives. Rising prevalence of chronic autoimmune disorders, combined with increasing elderly populations, strengthens the therapeutic demand base. Challenges remain in ensuring consistent reimbursement for high-cost biologics, yet improving policy support signals a promising trajectory for market expansion. Regional players continue to collaborate with global firms to accelerate innovation and distribution.

Latin America

Latin America represents 7% of the Giant Cell Arteritis Therapeutics Market, supported by gradual improvements in healthcare infrastructure and expanding availability of biologics. The region remains heavily reliant on corticosteroids for frontline management due to cost advantages, yet adoption of targeted therapies is increasing in urban centers. It reflects a rising focus on physician training and patient awareness initiatives to promote early diagnosis. Government initiatives in Brazil, Mexico, and Argentina strengthen access to specialty care for autoimmune conditions. Regional hospitals expand clinical capabilities to manage long-term treatment programs and reduce disease burden. Pharmaceutical collaborations gradually introduce biologics through regulatory channels, though affordability continues to limit broad adoption. Market growth depends on continued healthcare reforms and international partnerships.

Middle East & Africa

The Middle East & Africa holds 6% of the Giant Cell Arteritis Therapeutics Market, supported by developing healthcare frameworks and increasing investments in specialty treatment. Wealthier Gulf nations such as Saudi Arabia and the UAE lead adoption of advanced therapies, supported by high per-capita healthcare spending. It reflects a growing interest in rare disease management programs, which gradually extend treatment options to autoimmune disorders. Access remains limited in several African countries due to cost constraints and lack of diagnostic infrastructure. International pharmaceutical firms expand distribution networks to capture opportunities in emerging urban markets. Rising government focus on healthcare modernization provides long-term potential for increased adoption of biologics and immunosuppressive agents. The regional market is at an early stage but shows signs of gradual development supported by policy reforms.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Giant Cell Arteritis Therapeutics Market players including Livzon Pharmaceutical Group Inc., Janssen Pharmaceuticals, Bio Thera Solutions Ltd., ChemoCentryx, Novartis AG, Eli Lilly and Company, GlaxoSmithKline plc, Pfizer Inc., InflaRx, and F. Hoffmann-La Roche Ltd. The Giant Cell Arteritis Therapeutics Market is highly competitive, driven by innovation in biologics, immunosuppressive agents, and advanced anti-inflammatory therapies. Companies concentrate on strengthening research pipelines with targeted molecules that address limitations of long-term corticosteroid use. It emphasizes development of therapies that improve efficacy while minimizing adverse effects, with particular focus on IL-6 inhibitors and other immunology-based mechanisms. Strategic collaborations between pharmaceutical firms, research institutes, and healthcare providers accelerate clinical trials and broaden global access to novel treatments. Expansion into emerging markets and investment in patient access programs reinforce competitive positioning. The overall landscape reflects an industry prioritizing therapeutic differentiation, regulatory approvals, and global distribution strategies to capture growing demand.

Recent Developments

- In April 2025, AbbVie announced that the U.S. Food and Drug Administration (FDA) approved RINVOQ® (upadacitinib) as the first oral Janus Kinase (JAK) inhibitor for the treatment of giant cell arteritis (GCA) in adults.

- In January 2025, Celltrion, a leading South Korean biopharmaceutical company, announced on Friday that its new biosimilar, Avtozma, has received approval from the U.S. FDA.

- In April 2024, AbbVie announced positive top-line outcomes from SELECT-GCA, a Phase 3 multicenter, randomized, double-blind, placebo-controlled study, demonstrating that upadacitinib (RINVOQ; 15 mg, once daily) in combination with a 26-week steroid taper regimen accomplished its primary endpoint of sustained remission from week 12 to week 52 in adults with giant cell arteritis

Market Concentration & Characteristics

The Giant Cell Arteritis Therapeutics Market reflects a moderately concentrated structure where a limited number of global pharmaceutical companies dominate access to advanced biologics and immunosuppressive agents. It is defined by high entry barriers due to extensive regulatory requirements, significant R&D investments, and the need for robust clinical validation. Strong focus on biologic innovation shapes market characteristics, with IL-6 inhibitors and steroid-sparing agents positioned as the most competitive therapies. It demonstrates a reliance on established distribution networks and reimbursement frameworks that determine patient access across regions. The market is further characterized by an aging patient population, growing demand for precision medicine, and ongoing clinical trials that aim to expand therapeutic choices. It highlights a balance between traditional corticosteroid dependence and the gradual shift toward advanced therapies supported by global collaborations and evolving treatment guidelines.

Report Coverage

The research report offers an in-depth analysis based on Therapeutics, Route of Administration, Mechanism of Action and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Giant Cell Arteritis Therapeutics Market will expand with rising adoption of biologics that reduce reliance on corticosteroids.

- It will witness stronger focus on IL-6 inhibitors and other targeted immunotherapies with proven efficacy.

- Clinical trials will broaden therapeutic pipelines and accelerate regulatory submissions across major regions.

- Healthcare systems will strengthen reimbursement frameworks to improve access to high-cost biologics.

- It will integrate advanced diagnostics and biomarker testing to support precision treatment decisions.

- Digital health platforms will play a larger role in monitoring disease progression and patient adherence.

- Global collaborations between pharmaceutical companies and research institutions will enhance innovation.

- It will reflect higher demand in aging populations, where disease prevalence continues to rise.

- Real-world evidence and long-term safety data will shape confidence in advanced therapies.

- Emerging markets will show faster uptake of modern treatments through government-backed rare disease programs.