Market Overview

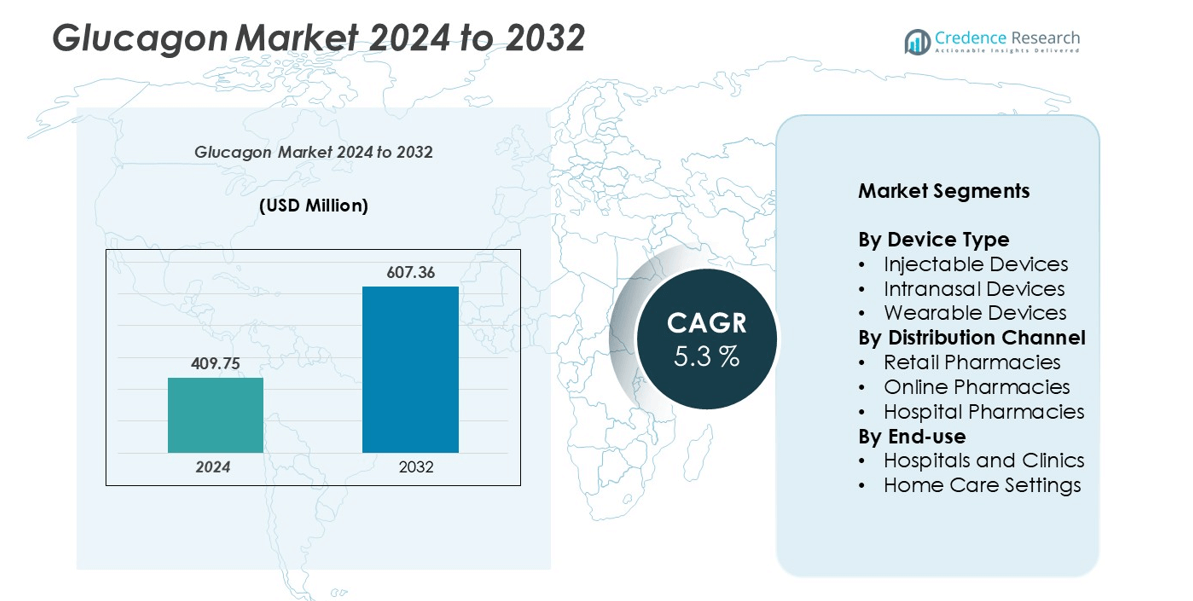

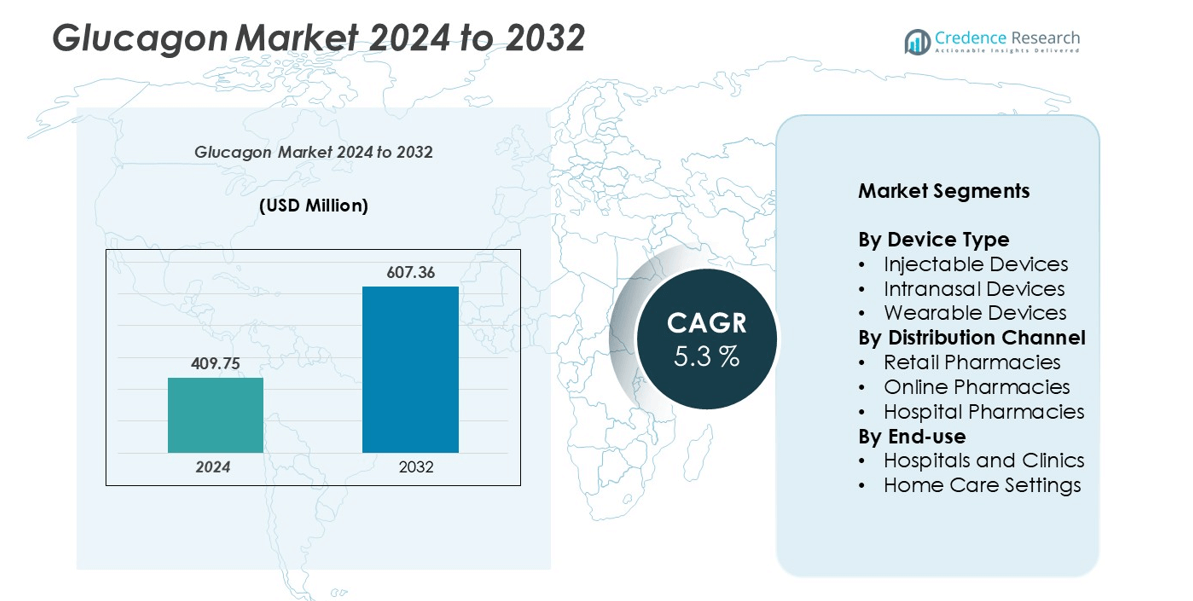

The glucagon market size was valued at USD 409.75 million in 2024 and is anticipated to reach USD 607.36 million by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glucagon Market Size 2024 |

USD 409.75 million |

| Glucagon Market, CAGR |

5.3% |

| Glucagon Market Size 2032 |

USD 607.36 million |

The global glucagon market is dominated by leading players such as Eli Lilly and Company, Novo Nordisk A/S, Xeris Pharmaceuticals, Boehringer Ingelheim, Tandem Diabetes Care, Fresenius Kabi, Zealand Pharma, and Amphastar Pharmaceuticals, who drive innovation through advanced glucagon delivery systems, including ready-to-use, intranasal, and wearable devices. North America leads the market with a 40% share, supported by advanced healthcare infrastructure, high diabetes prevalence, and strong adoption of emergency glucagon therapies. Europe follows with 25% market share, driven by robust healthcare systems, regulatory support, and growing patient awareness. Asia-Pacific, holding 20%, is emerging rapidly due to increasing diabetic populations and expanding home care adoption. Latin America (10%) and the Middle East & Africa (5%) are steadily growing, supported by healthcare expansion and rising awareness. Strategic R&D, partnerships, and patient-centric innovations position these companies for continued global market leadership

Market Insights

- The global glucagon market was valued at USD 409.75 million in 2024 and is projected to reach USD 607.36 million by 2032, growing at a CAGR of 5.3%.

- Market growth is driven by the rising prevalence of diabetes, increasing hypoglycemia incidents, and growing adoption of ready-to-use and intranasal glucagon devices for emergency care.

- Key trends include the expansion of needle-free glucagon products, integration with wearable and automated insulin delivery systems, and technological advancements in patient-friendly, home-administered devices.

- The competitive landscape is dominated by companies such as Eli Lilly, Novo Nordisk, Xeris Pharmaceuticals, Boehringer Ingelheim, Tandem Diabetes Care, Fresenius Kabi, Zealand Pharma, and Amphastar Pharmaceuticals, focusing on innovation, strategic partnerships, and regional expansion.

- North America leads with 40% market share, followed by Europe (25%), Asia-Pacific (20%), Latin America (10%), and the Middle East & Africa (5%), with injectable devices being the dominant segment, and retail pharmacies capturing the largest distribution channel share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Device Type:

The glucagon market by device type is segmented into injectable, intranasal, and wearable devices. Injectable devices dominate the market, accounting for the largest share in 2024. Their dominance is attributed to wide clinical acceptance, cost-effectiveness, and ease of administration during emergency hypoglycemia management. These devices have established reliability in delivering accurate doses, making them a preferred choice among healthcare professionals. Meanwhile, intranasal glucagon is gaining momentum due to its needle-free convenience and patient compliance, while wearable devices represent an emerging segment driven by advances in continuous glucose monitoring and automated delivery systems.

- For instance, Eli Lilly’s BAQSIMI, a needle-free nasal glucagon, was approved by the FDA in 2019. In mid-2023, Amphastar Pharmaceuticals acquired BAQSIMI from Eli Lilly. The product continues to hold a significant role in emergency hypoglycemia treatment.

By Distribution Channel:

Based on distribution channel, the glucagon market is categorized into retail pharmacies, online pharmacies, and hospital pharmacies. Retail pharmacies hold the dominant market share, supported by strong patient accessibility and the availability of a wide range of glucagon products. Their role in prescription fulfillment and patient counseling further strengthens their market position. However, online pharmacies are expanding rapidly due to increasing digitalization, home delivery services, and patient preference for convenience. Hospital pharmacies continue to play a key role in acute care settings, particularly for severe hypoglycemia cases requiring immediate medical supervision.

- For instance, a May 2024 Kaiser Family Foundation (KFF) survey indicates that 11% of patients who have taken GLP-1 receptor agonists obtained them from online providers. The survey also found that the majority, 79%, still received their prescriptions from a primary care doctor or specialist.

By End-use:

By end-use, the glucagon market is divided into hospitals and clinics, and home care settings. Hospitals and clinics account for the largest market share, driven by the high volume of emergency treatments and professional supervision required for severe hypoglycemia. The availability of trained personnel and advanced infrastructure supports the safe administration of injectable and intranasal glucagon formulations. In contrast, the home care segment is projected to grow steadily, fueled by the rising prevalence of diabetes, patient education on self-management, and the growing adoption of user-friendly, ready-to-use glucagon delivery devices.

Key Growth Drivers

Rising Prevalence of Diabetes and Hypoglycemia Incidence

The increasing global prevalence of diabetes is one of the primary factors driving growth in the glucagon market. A significant proportion of insulin-dependent diabetic patients experience hypoglycemic episodes, necessitating the use of glucagon as an emergency treatment. With the growing diabetic population, particularly in aging demographics and urbanized regions, the demand for reliable glucagon formulations continues to rise. Additionally, increasing awareness of hypoglycemia management and the availability of user-friendly glucagon delivery systems are supporting wider adoption. The rising focus on home-based and self-administered treatments is further propelling market expansion, as patients and caregivers seek quick-response, convenient therapeutic options.

- For instance, in 2024, the International Diabetes Federation reported that, approximately 589 million adults aged 20–79 were living with diabetes globally in 2024, a number that is projected to increase to 853 million by 2050.

Advancements in Drug Delivery Technologies

Technological innovation in glucagon delivery systems is a major growth catalyst for the market. The development of ready-to-use formulations, intranasal sprays, and wearable glucagon pumps has enhanced treatment accessibility and patient compliance. Traditional injectable glucagon required reconstitution before use, which posed challenges during emergencies. However, the introduction of stable liquid formulations and needle-free devices has transformed glucagon administration into a simpler and faster process. These innovations reduce dosing errors and improve user safety, driving adoption in both clinical and home care settings. Furthermore, the integration of smart delivery technologies compatible with continuous glucose monitors (CGMs) and automated insulin delivery systems is expanding glucagon’s therapeutic scope.

Growing Awareness and Access to Emergency Glucagon Products

Increasing patient and healthcare professional awareness of the importance of rapid hypoglycemia management is boosting glucagon utilization. Governments and health organizations are emphasizing diabetes education programs that include glucagon use for emergency preparedness. Wider insurance coverage and inclusion of glucagon in essential drug lists in several regions have improved affordability and accessibility. In addition, partnerships between pharmaceutical companies and patient advocacy groups are helping to destigmatize glucagon use and promote training for caregivers and patients. The growing availability of over-the-counter and ready-to-administer glucagon formulations in developed markets further supports demand growth across hospital, retail, and home care channels.

Key Trends & Opportunities

Expansion of Intranasal and Ready-to-Use Glucagon Products

A key trend shaping the glucagon market is the rapid adoption of intranasal and prefilled glucagon products. These formulations eliminate the complexity associated with traditional injectable kits, offering ease of use during emergencies. The needle-free design appeals to both children and adults, improving treatment compliance and accessibility. Pharmaceutical companies are investing heavily in developing stable, room-temperature glucagon formulations with longer shelf lives and simplified administration. This trend presents substantial growth opportunities in home care and outpatient settings. As patient-centric drug delivery continues to advance, intranasal and ready-to-use glucagon products are expected to capture a growing share of the market.

- For instance, While BAQSIMI was approved by the FDA in 2019 and is a major player in the market, the claim that it held a 35% market share in 2024 is questionable. Several other easy-to-use glucagon products have entered the market and become major competitors since BAQSIMI’s launch.

Integration with Artificial Pancreas and Automated Insulin Systems

The integration of glucagon delivery into automated insulin systems represents a transformative opportunity for market growth. Bihormonal artificial pancreas systems that combine insulin and glucagon delivery are being developed to closely mimic natural pancreatic function. These systems automatically regulate blood glucose levels, reducing the frequency of hypoglycemic episodes. Advances in sensor technology, AI-driven glucose monitoring, and miniaturized infusion devices are enabling seamless glucagon administration in real time. This innovation not only enhances patient safety and quality of life but also opens new commercial opportunities for pharmaceutical and medtech collaborations in diabetes management technology.

- For instance, in April 2025, the FDA approved a 15-day Dexcom G7 Continuous Glucose Monitor (CGM) sensor for adults. However, the original Dexcom G7, which received FDA clearance in December 2022, was the model with a 10-day wear period and a 12-hour grace period.

Key Challenges

High Cost and Limited Reimbursement Policies

One of the major challenges hindering glucagon market expansion is the high cost of advanced formulations and delivery devices. Ready-to-use glucagon sprays and auto-injectors, while convenient, are often priced higher than traditional reconstitutable kits, limiting their adoption in cost-sensitive markets. Moreover, inconsistent reimbursement policies across regions restrict patient access, particularly in low- and middle-income countries. Healthcare systems with limited diabetes funding struggle to cover emergency glucagon therapies, creating affordability gaps. To address this challenge, manufacturers must focus on pricing strategies, local partnerships, and policy engagement to improve coverage and ensure equitable access.

Product Stability and Supply Chain Constraints

Glucagon’s inherent instability in aqueous solutions has historically limited its shelf life and formulation options. Although technological advancements have improved stability, ensuring consistent product quality remains a key challenge, especially under varied storage conditions. Supply chain disruptions, cold chain requirements, and stringent regulatory standards further complicate global distribution. Additionally, dependence on a limited number of suppliers for glucagon active pharmaceutical ingredients (API) can lead to shortages or price fluctuations. Overcoming these hurdles requires continuous innovation in formulation science, manufacturing scalability, and supply chain resilience to ensure reliable global access to glucagon therapies.

Regional Analysis

North America

North America dominates the global glucagon market, holding approximately 40% market share in 2024. The region’s growth is driven by advanced healthcare infrastructure, high diabetes prevalence, and established emergency care protocols. The U.S. leads in adoption of ready-to-use glucagon formulations, intranasal sprays, and auto-injectors in both hospital and home care settings. Strong patient awareness, favorable reimbursement policies, and continuous investment in diabetes management technologies further support market expansion. Canada contributes to regional growth through increasing demand for user-friendly glucagon devices. Active R&D in drug delivery innovation strengthens North America’s leadership position in the global market.

Europe

Europe accounts for around 25% market share in the glucagon market. Growth is supported by strong healthcare systems, rising diabetes incidence, and increasing awareness of hypoglycemia management. Countries such as Germany, the U.K., and France are witnessing strong demand for intranasal and ready-to-use glucagon products due to ease of use and patient compliance. Government initiatives, comprehensive insurance coverage, and adoption of digital healthcare solutions further boost market expansion. The region benefits from active pharmaceutical research, clinical trials, and strategic partnerships aimed at developing innovative glucagon delivery systems, strengthening Europe’s position as a significant contributor to the global market.

Asia-Pacific

Asia-Pacific holds an estimated 20% market share, emerging as a high-growth region due to the rapidly increasing diabetic population and rising awareness of hypoglycemia management. China, India, and Japan are leading demand growth for both injectable and intranasal glucagon formulations. Expanding healthcare infrastructure, government initiatives promoting diabetes care, and rising adoption of home care treatments support market growth. Although price sensitivity in certain countries remains a challenge, increasing accessibility to ready-to-use glucagon devices and educational programs for patients and caregivers create significant opportunities, positioning Asia-Pacific as a key growth driver globally.

Latin America

Latin America represents roughly 10% market share of the global glucagon market. Growth is driven by rising diabetes prevalence and expanding healthcare access in countries like Brazil and Mexico. Urban healthcare facilities are increasingly adopting both injectable and intranasal glucagon products. However, challenges such as high costs, limited insurance coverage, and uneven distribution networks limit penetration in rural areas. Ongoing government initiatives focused on diabetes education, patient training, and healthcare infrastructure development are gradually increasing glucagon adoption. This region offers opportunities for cost-effective and user-friendly solutions to enhance market growth and patient compliance.

Middle East & Africa

The Middle East & Africa accounts for approximately 5% market share in 2024. Market growth is driven by rising diabetes prevalence, particularly in GCC countries, and increasing awareness of hypoglycemia management. Expansion of hospital networks, healthcare modernization, and introduction of advanced glucagon delivery devices support regional demand. Challenges include high product costs, limited reimbursement policies, and uneven healthcare accessibility. Strategic partnerships, local manufacturing, and educational initiatives targeting patients and caregivers are creating opportunities for growth. Gradual improvements in infrastructure and awareness are expected to strengthen market penetration in this region over the forecast period.

Market Segmentations:

By Device Type

- Injectable Devices

- Intranasal Devices

- Wearable Devices

By Distribution Channel

- Retail Pharmacies

- Online Pharmacies

- Hospital Pharmacies

By End-use

- Hospitals and Clinics

- Home Care Settings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The glucagon market is highly competitive and characterized by the presence of major multinational pharmaceutical and medical device companies focusing on innovation, strategic partnerships, and market expansion. Key players such as Eli Lilly and Company, Novo Nordisk A/S, Xeris Pharmaceuticals, Boehringer Ingelheim, Tandem Diabetes Care, Fresenius Kabi, Zealand Pharma, and Amphastar Pharmaceuticals actively compete by developing advanced glucagon delivery systems, including ready-to-use, intranasal, and wearable devices. Companies are also investing in clinical trials, R&D, and digital integration to enhance patient convenience and compliance. Strategic collaborations, mergers, and acquisitions are common to strengthen geographic presence and diversify product portfolios. Additionally, competitive pricing, marketing initiatives, and patient education programs are being employed to capture both hospital and home care markets. Continuous technological innovation, coupled with a focus on patient-centric solutions, is intensifying competition and driving growth in the global glucagon market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, Eli Lilly committed USD 3 billion to expand injectable-drug output capacity for metabolic treatments that interact with glucagon signalling.

- In June 2024, Novo Nordisk unveiled a USD 4.1 billion expansion of its North Carolina plant to boost injectable production, including glucagon lines.

- In May 2024, Xeris Biopharma formed an exclusive partnership with Beta Bionics to co-develop pump-ready liquid glucagon for dual-hormone systems

Report Coverage

The research report offers an in-depth analysis based on Device Type, Distribution Channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The glucagon market is expected to grow steadily due to increasing global diabetes prevalence.

- Adoption of ready-to-use and intranasal glucagon formulations will rise for improved patient compliance.

- Integration of glucagon with wearable and automated insulin delivery systems will enhance emergency hypoglycemia management.

- Technological innovations will focus on stable, user-friendly, and long-shelf-life glucagon products.

- Home care settings will see higher adoption as patients and caregivers become more educated on self-administration.

- North America and Europe will continue to lead the market, while Asia-Pacific will emerge as a high-growth region.

- Strategic collaborations, partnerships, and mergers among key players will strengthen market presence globally.

- Digital healthcare solutions and mobile applications will support better monitoring and timely glucagon administration.

- Increased government awareness programs and insurance coverage will improve accessibility in emerging markets.

- The focus on patient-centric solutions will drive innovation and expand market opportunities across segments.