Market Overview:

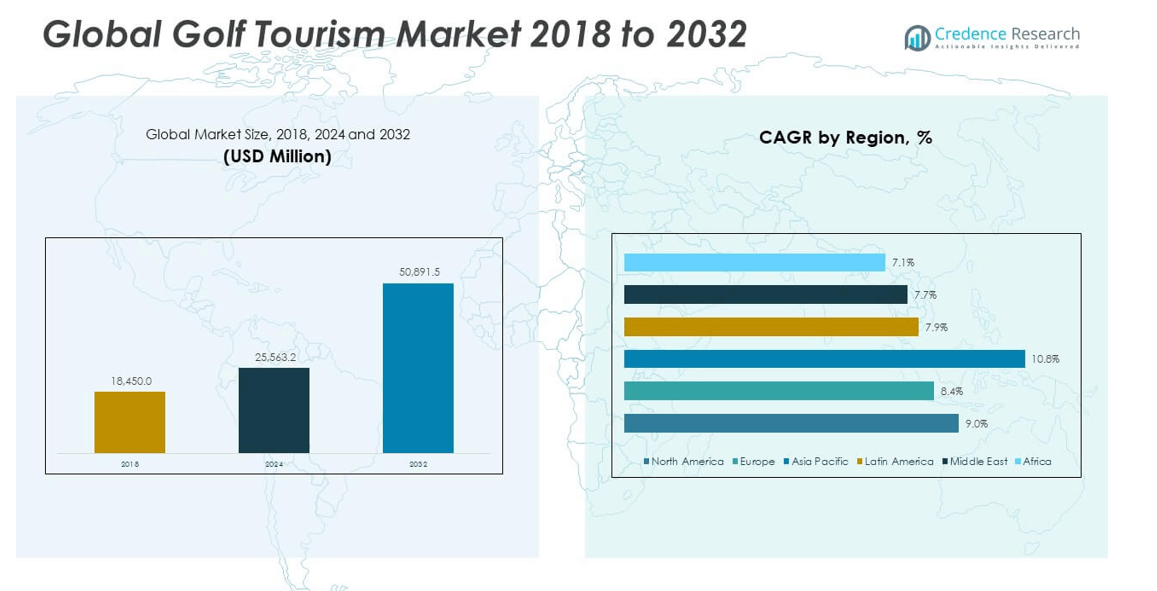

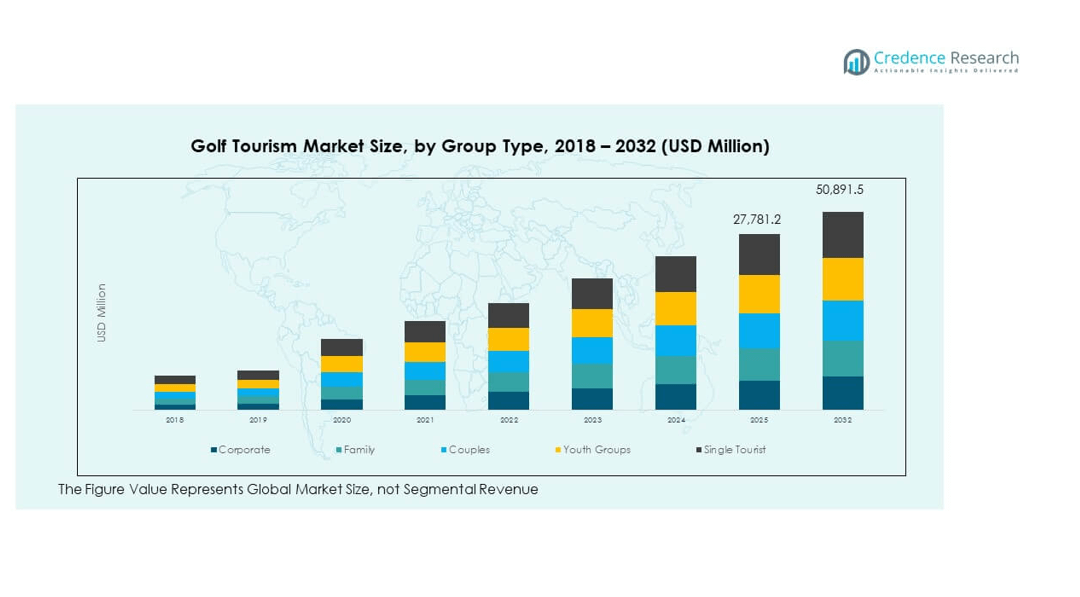

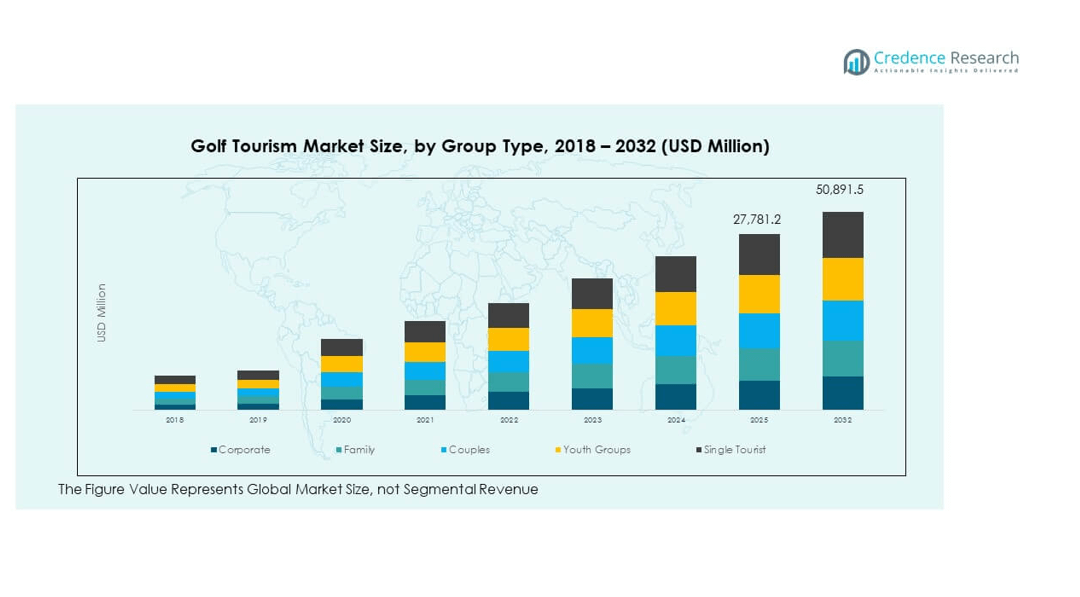

The Global Golf Tourism Market size was valued at USD 18,450.00 million in 2018 to USD 25,563.2 million in 2024 and is anticipated to reach USD 50,891.5 million by 2032, at a CAGR of 9.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Golf Tourism Market Size 2024 |

USD 25,563.2 million |

| Golf Tourism Market, CAGR |

9.00% |

| Golf Tourism Market Size 2032 |

USD 50,891.5 million |

The growth of the golf tourism market is driven by rising disposable incomes, increasing interest in luxury travel, and the expansion of golf courses worldwide. Governments and tourism boards actively promote golf tourism by integrating high-end hospitality services and hosting international tournaments, which attract both professional players and leisure travelers. In addition, the growing popularity of experiential travel, where tourists seek unique sporting and lifestyle experiences, continues to strengthen the demand for golf tourism across various destinations.

From a regional perspective, North America and Europe lead the market due to the presence of prestigious golf courses, strong sporting culture, and well-established tourism infrastructure. Emerging regions such as Asia Pacific and the Middle East are witnessing rapid growth, fueled by investments in luxury resorts, rising interest among high-net-worth individuals, and the promotion of golf as a premium leisure activity. Countries like China, Thailand, and the UAE are positioning themselves as attractive golf tourism hubs, supported by strong government initiatives and international collaborations.

Market Insights

- The Global Golf Tourism Market was valued at USD 25,563.2 million in 2024 and is projected to reach USD 50,891.5 million by 2032, at a CAGR of 0%.

- Rising disposable incomes and demand for premium leisure travel are strengthening growth across diverse consumer segments.

- Expansion of world-class golf courses and luxury resorts is creating new opportunities for domestic and international travelers.

- High operational costs and seasonal demand fluctuations remain key restraints impacting profitability.

- North America led the market in 2024 with 9% share, supported by a strong golfing culture and established infrastructure.

- Asia Pacific is expected to grow fastest with a CAGR of 8%, driven by rising middle-class demand and government support.

- Strong participation from both corporate travelers and families highlights the widening appeal of golf tourism globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Affluence and Rising Preference for Premium Leisure Travel Experiences

The Global Golf Tourism Market is benefiting from a steady increase in global disposable incomes and an expanding middle-class population that actively seeks premium leisure travel. It appeals to tourists who value exclusivity, luxury, and lifestyle-oriented vacations. High-net-worth individuals and corporate travelers are particularly inclined toward golf tourism packages that combine sporting experiences with five-star hospitality. The integration of world-class resorts with championship golf courses adds further appeal. It has positioned itself as a symbol of status, lifestyle, and exclusivity. Travelers increasingly value destinations that combine recreational sport with cultural immersion and high-end amenities. Demand for premium, curated travel itineraries has fueled momentum across multiple destinations. It continues to evolve into a high-value travel segment with consistent growth potential.

Expanding Global Presence of Golf Courses and Infrastructure Investments

The expansion of golf courses across both developed and emerging economies has played a central role in supporting demand in the Global Golf Tourism Market. Governments and private developers have invested significantly in building new resorts and upgrading facilities to international standards. These developments create attractive destinations that appeal to both professionals and recreational players. It has improved accessibility by situating golf resorts near airports, hotels, and popular tourist attractions. Partnerships between golf associations, tourism boards, and hospitality groups further strengthen promotional efforts. It benefits from a growing portfolio of destinations that cater to both domestic and international travelers. Resorts offering modern designs, advanced technology, and sustainability features attract wider audiences. Golf courses integrated with luxury services provide a unique blend of sport and leisure, ensuring lasting appeal.

- For example, Troon Golf is the world’s largest golf management company, providing services at more than 940 locations across over 40 countries, including management of more than 575 18-hole equivalent golf courses. The company focuses on delivering premium golf experiences through professional course management, hospitality integration, and sustainability-driven practices that enhance course conditions and traveler appeal.

Hosting of Prestigious International Tournaments and Sporting Events

The Global Golf Tourism Market has seen strong growth through the regular hosting of prestigious golf tournaments and events. These events draw global attention, attract sponsorships, and bring tourists to host regions. International sporting calendars boost travel demand during peak tournament seasons. It provides opportunities for destinations to showcase hospitality, culture, and infrastructure to a global audience. Events generate media exposure that highlights courses as must-visit destinations for enthusiasts. It creates lasting brand value for both established and emerging golf hubs. Tourist inflows increase significantly when tournaments are coupled with entertainment and cultural programs. Players and spectators alike seek extended stays, boosting revenue across hospitality, retail, and transportation sectors. The prominence of world-class competitions ensures sustainable visibility for host destinations.

Rising Influence of Experiential Travel and Lifestyle-Oriented Tourism Choices

The growing importance of experiential travel has significantly shaped demand in the Global Golf Tourism Market. Travelers increasingly prefer meaningful journeys that combine sport, wellness, and lifestyle activities. It aligns with preferences for unique leisure experiences beyond conventional sightseeing. Resorts that integrate spas, fine dining, and cultural experiences alongside golf are in high demand. It appeals to tourists looking for well-rounded packages that deliver memorable and immersive stays. Younger travelers are also showing interest in golf tourism when it is linked with adventure, luxury, and cultural experiences. Travel companies have responded with personalized itineraries designed for diverse customer profiles. The blending of golf with broader lifestyle and wellness elements expands the appeal of destinations. It secures a stronger position within the luxury travel ecosystem worldwide.

- For example, Topgolf attracted around 30 million visitors to its venues in 2024, offering interactive golf-entertainment experiences using RFID-enabled golf balls and Toptracer technology to provide real-time scoring and feedback.

Market Trends

Adoption of Digital Booking Platforms and Technology Integration in Golf Travel

Digital innovation has become a defining feature shaping the Global Golf Tourism Market. Travel platforms now offer tailored golf packages, virtual course previews, and real-time booking options. It benefits from technology that simplifies itinerary planning for international tourists. Mobile apps provide features such as tee-time reservations, GPS-enabled navigation, and instant customer support. It leverages digital marketing strategies that target younger demographics with interactive content. Resorts are adopting smart technologies to enhance the customer journey, from AI-based recommendations to seamless online check-ins. Integration of data analytics allows tour operators to understand consumer behavior more effectively. Digital transformation has strengthened accessibility while increasing transparency and convenience for travelers. It enhances engagement and creates a modernized tourism experience aligned with evolving expectations.

Expansion of Wellness and Sustainable Tourism Concepts within Golf Travel Packages

The Global Golf Tourism Market is increasingly shaped by sustainability and wellness-focused tourism. Resorts and destinations have started offering eco-friendly accommodations, locally sourced cuisine, and sustainable golf course management practices. It attracts environmentally conscious travelers who prioritize responsible tourism choices. Golf destinations are integrating wellness activities such as yoga, meditation, and spa treatments alongside traditional sporting packages. It combines physical activity with relaxation, offering a holistic travel experience. Tour operators highlight eco-certifications and community initiatives to differentiate offerings in a competitive landscape. Golfers prefer destinations where sustainability commitments are visible and measurable. The combination of sport, wellness, and sustainability has broadened the appeal of golf tourism. It ensures long-term relevance by aligning with global consumer trends focused on responsible travel.

Emergence of New Golf Destinations in Asia Pacific and Middle Eastern Regions

The Global Golf Tourism Market has seen the rise of new golf hubs in Asia Pacific and the Middle East. Governments in these regions actively invest in positioning golf as part of their premium tourism portfolios. It benefits from strategic partnerships between tourism boards and international golf associations. Countries such as Thailand, Vietnam, and the UAE are building state-of-the-art facilities to attract global players. It creates competition with established Western markets by offering exotic landscapes and luxury resorts. Infrastructural growth ensures convenient access through improved transport and hospitality services. Golf tourism in these regions is marketed as a luxury leisure experience linked to culture and heritage. Investment inflows highlight the strategic importance of golf tourism in diversifying local economies. It positions new entrants as attractive alternatives for international travelers seeking fresh experiences.

- For example, Jumeirah Golf Estates hosted the prestigious DP World Tour Championship in 2024, recognized as a flagship Rolex Series tournament on the DP World Tour. The venue’s Earth Course continues to be a highlight on the international golf calendar.

Growing Integration of Golf with Family-Oriented and Multi-Activity Travel Packages

The Global Golf Tourism Market has expanded its appeal through the integration of family-friendly and multi-activity tourism options. Resorts increasingly provide entertainment, childcare, and leisure activities that attract entire families rather than individual golfers. It supports higher visitor numbers and longer stays, boosting revenues across sectors. Packages combine golf with cultural tours, adventure activities, and shopping experiences. It appeals to travelers who seek diverse recreational opportunities within a single destination. Hospitality providers emphasize inclusivity by creating experiences tailored for both players and non-players. The diversification of offerings supports strong growth across segments of varying demographics. It transforms golf tourism from a niche luxury sport into a broader leisure category. The appeal of blended packages ensures long-term stability and inclusivity within the market.

- For example, Troon International operates over 60 golf courses across more than 20 countries and integrates sustainability best practices, including water conservation strategies and efficient irrigation, at multiple facilities. Several of these venues such as Al Mouj Golf and Costa Navarino have achieved GEO certification in recognition of their water-efficient operations and environmental stewardship.

Market Challenges Analysis

High Operational Costs and Limited Accessibility Across Certain Destinations

The Global Golf Tourism Market faces challenges due to the high operational costs involved in maintaining world-class golf courses and resorts. It requires substantial investments in infrastructure, maintenance, and staffing. Destinations with limited financial resources often struggle to compete with established hubs. It is further hindered by accessibility issues in remote or less-connected regions, where international travelers face logistical difficulties. Seasonal fluctuations in demand create inconsistent revenue streams for service providers. It complicates long-term planning and sustainability strategies for tourism operators. Golf tourism also demands significant water and land resources, which may not be feasible in all geographies. The cost-intensive nature of operations limits opportunities for smaller players. It reinforces the dominance of only a few well-established destinations globally.

Impact of Economic Volatility and Shifting Travel Priorities Among Consumers

The Global Golf Tourism Market encounters risks from economic volatility, currency fluctuations, and changing consumer travel priorities. It is highly sensitive to macroeconomic conditions that influence consumer spending on luxury leisure. During downturns, discretionary travel spending is often the first to decline. It also faces challenges from growing competition with alternative luxury travel experiences. Travelers may prioritize cultural or adventure tourism over golf when financial resources are constrained. International travel disruptions, visa policies, and geopolitical tensions further add to uncertainty. It makes the sector vulnerable to sudden changes that affect tourist arrivals. Health-related concerns such as pandemics also impact international movement significantly. It must adapt quickly to changing market dynamics to sustain long-term growth.

Market Opportunities

Rising Demand for Personalized Travel Packages and Customized Golf Experiences

The Global Golf Tourism Market offers strong opportunities through growing demand for personalized travel experiences. Tourists increasingly value packages designed to match individual preferences and lifestyles. It encourages operators to introduce flexible itineraries, unique course selections, and exclusive hospitality services. The integration of luxury transportation, curated dining, and cultural immersion within packages enhances appeal. It allows providers to differentiate themselves in a competitive landscape. Younger generations show interest in combining golf with other recreational pursuits such as adventure and wellness. Technology-driven personalization further elevates customer satisfaction levels. It ensures that destinations offering tailored experiences strengthen their global reputation and attract diverse segments of tourists.

Expansion of Emerging Destinations and Strong Government Support for Sports Tourism

The Global Golf Tourism Market is gaining new opportunities through the expansion of emerging destinations backed by government initiatives. Authorities in Asia Pacific, Latin America, and the Middle East actively promote golf as part of tourism diversification strategies. It benefits from infrastructure investments, promotional campaigns, and partnerships with global golf associations. New destinations leverage cultural heritage and natural landscapes to attract international attention. It creates competitive alternatives to traditional golf hubs in Europe and North America. Governments view golf tourism as a tool for boosting foreign exchange earnings and employment. Resorts in emerging regions provide cost-effective options while maintaining international standards. It enhances global competitiveness and broadens the geographic scope of the market.

Market Segmentation Analysis:

The Global Golf Tourism Market is segmented by booking method, demographic, nationality, and group type, offering a diverse view of consumer preferences and travel behavior.

By booking method, travel agents continue to hold relevance due to their ability to provide personalized packages, secure exclusive deals, and manage complex itineraries, while online direct bookings gain traction from tech-savvy travelers seeking flexibility and cost transparency. It reflects a balance between traditional service-driven channels and modern digital adoption.

- For example, JD Golf Tours specializes in creating custom European golf vacations across Ireland, Scotland, England, Wales, Spain, and Portugal. The company arranges pre-booked tee times, selects luxury accommodations, and organizes ground transport including luxury cars, coaches, and self-drive options supported by official approvals from national tourism bodies.

By demographic, male travelers represent a significant share given the historical dominance of men in the sport, yet female participation is rising steadily due to inclusivity campaigns, women’s tournaments, and luxury offerings tailored for female golfers. This demographic diversification strengthens demand across regions and contributes to higher overall market engagement.

- For example, Female participation at Monarch Beach Golf Links has risen notably, especially in lessons and group events, reflecting a broader industry shift toward inclusivity and demand for social, wellness-oriented experiences among women.

By nationality, the domestic segment remains vital for short-haul tourism, frequent visits, and cost-conscious consumers, while the international segment drives premium growth with travelers pursuing iconic courses, global tournaments, and cultural exploration. It demonstrates the dual importance of both local repeat business and inbound international arrivals for revenue stability.

By group type, corporate travel drives consistent demand through incentive tours and business-leisure combinations, while families and couples increasingly view golf tourism as a shared luxury activity. Youth groups bring long-term potential by expanding interest among younger players, and single tourists prefer curated packages emphasizing community and networking. This wide segmentation illustrates how the market attracts varied consumer profiles, sustaining growth through multiple participation channels.

Segmentation:

By Booking Method

- Travel Agent

- Online Direct

By Demographic

By Nationality

By Group Type

- Corporate

- Family

- Couples

- Youth Groups

- Single Tourist

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America

The North America Global Golf Tourism Market size was valued at USD 7,623.5 million in 2018 to USD 10,450.1 million in 2024 and is anticipated to reach USD 20,775.3 million by 2032, at a CAGR of 9.0% during the forecast period. North America accounts for 40.9% of the global market share in 2024. The region benefits from its strong golfing culture, iconic championship courses, and extensive travel infrastructure. It attracts international visitors who seek premium golfing experiences in destinations such as the United States and Canada. Hosting of PGA TOUR events continues to enhance global visibility and strengthen tourism inflows. It enjoys strong demand from both domestic and international travelers, with a steady rise in corporate golf tourism. Leading hospitality brands have expanded integrated resorts that combine leisure, luxury, and golf. Partnerships between golf associations and tourism boards keep the region at the forefront of market growth. It remains a dominant player with consistent innovation and premium experiences.

Europe

The Europe Global Golf Tourism Market size was valued at USD 5,581.1 million in 2018 to USD 7,471.4 million in 2024 and is anticipated to reach USD 14,160.7 million by 2032, at a CAGR of 8.4% during the forecast period. Europe holds 29.2% of the global market share in 2024. The region is known for its rich golfing heritage, cultural attractions, and well-established tourism infrastructure. Countries such as the UK, Spain, and France remain top destinations for both domestic and international travelers. It is supported by diverse offerings ranging from historic golf courses to luxury resorts and lifestyle experiences. Cross-border travel within Europe enhances demand, as golfers prefer multi-country travel itineraries. It benefits from hosting international tournaments, including the Ryder Cup, which elevate brand recognition. Seasonal travel demand remains strong, particularly during spring and summer. The market outlook is reinforced by continuous investment in sustainable tourism practices. It is well-positioned to maintain long-term growth across mature and emerging segments.

Asia Pacific

The Asia Pacific Global Golf Tourism Market size was valued at USD 3,099.6 million in 2018 to USD 4,571.9 million in 2024 and is anticipated to reach USD 10,403.8 million by 2032, at a CAGR of 10.8% during the forecast period. Asia Pacific captures 17.9% of the global market share in 2024. The region is witnessing rapid growth due to rising disposable incomes, expanding middle-class populations, and government investments in luxury tourism. It is strongly supported by emerging golf destinations in China, Thailand, and Vietnam. Japan, South Korea, and Australia also contribute to strong regional demand through established courses and international tournaments. It has benefited from partnerships between hospitality groups and sports associations that promote integrated leisure packages. Rising interest in lifestyle-oriented tourism has made golf attractive for both domestic and international travelers. Resorts have invested in premium amenities to compete with established global hubs. It demonstrates high potential for expansion across both inbound and outbound travel segments.

Latin America

The Latin America Global Golf Tourism Market size was valued at USD 1,070.1 million in 2018 to USD 1,467.1 million in 2024 and is anticipated to reach USD 2,691.1 million by 2032, at a CAGR of 7.9% during the forecast period. Latin America holds 5.8% of the global market share in 2024. The region benefits from favorable climates, scenic landscapes, and rising investments in premium resorts. Countries such as Brazil and Argentina lead demand, supported by international events and growing domestic interest in golf. It is gradually emerging as a niche luxury tourism segment, attracting travelers seeking unique sporting destinations. Infrastructure improvements have supported accessibility to resorts in coastal and heritage-rich locations. It is gaining visibility through targeted promotions by regional tourism boards. Partnerships with international golf associations create opportunities for brand-building and exposure. While growth is steady, expansion depends on continued investment and stability across key markets.

Middle East

The Middle East Global Golf Tourism Market size was valued at USD 701.1 million in 2018 to USD 909.9 million in 2024 and is anticipated to reach USD 1,633.9 million by 2032, at a CAGR of 7.7% during the forecast period. The Middle East contributes 3.6% of the global market share in 2024. The region leverages luxury tourism, world-class resorts, and strong government initiatives to attract international travelers. Countries such as the UAE, Qatar, and Saudi Arabia are investing heavily in championship golf courses integrated with premium hospitality services. It benefits from a strong calendar of global events, including the DP World Tour. High-net-worth individuals and international business travelers drive consistent demand. It emphasizes exclusivity, modern infrastructure, and luxury branding to differentiate from other regions. Regional airports and connectivity improvements further enhance accessibility. It is expected to strengthen its global positioning through sustained investments in sports tourism.

Africa

The Africa Global Golf Tourism Market size was valued at USD 374.5 million in 2018 to USD 692.9 million in 2024 and is anticipated to reach USD 1,226.6 million by 2032, at a CAGR of 7.1% during the forecast period. Africa holds 3.5% of the global market share in 2024. The region is driven by destinations such as South Africa and Egypt, which combine cultural heritage with premium golfing experiences. It attracts international tourists looking for unique landscapes, wildlife tourism, and adventure alongside golf. The market is still in a developmental stage but holds significant potential for growth. Investment in resorts and supporting infrastructure remains critical for expansion. It benefits from government support for tourism diversification in key countries. International exposure from tournaments hosted in South Africa has raised visibility. It remains a promising but underdeveloped region that will strengthen its position with sustained international interest.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Marriott International

- Club Med

- Hilton Worldwide

- PGA TOUR

- Ritz-Carlton

- Aramco Team Series

- com

- Your Golf Travel

- International Golf Travel Market (IGTM)

- BCD Sports

- TUI Group

- com

Competitive Analysis:

The Global Golf Tourism Market is highly competitive with a mix of global hospitality groups, travel operators, and specialized golf tour agencies driving growth. Leading players such as Marriott International, Hilton Worldwide, and Ritz-Carlton dominate through integrated luxury resorts and strategic partnerships with golf associations. Travel-focused firms like Golfbreaks.com, Your Golf Travel, and TUI Group strengthen market presence with curated packages and international reach. It is shaped by continuous innovation, with companies investing in sustainability, technology-driven booking platforms, and premium customer experiences. Strategic mergers, acquisitions, and regional expansions enhance competitiveness. Emerging players focus on niche offerings such as youth golf programs, family-oriented packages, and women-centric golf tours. The competitive environment is dynamic, with strong emphasis on branding, customer loyalty, and differentiated services.

Recent Developments:

- In August 2025, Marriott International strengthened its presence in the global golf tourism sector by signing a partnership with Brigade Group to develop six new hotels across India. This initiative is designed to accelerate Marriott’s hospitality portfolio in emerging markets and enhance offerings for leisure travelers seeking golf and luxury experiences.

- In July 2025, IGTM (International Golf Travel Market) and the PGA Show announced a strategic partnership aimed at boosting global golf tourism. This collaboration is designed to connect golf travel professionals and industry leaders, enhance travel opportunities, and foster innovation within the golf tourism sector.

Market Concentration & Characteristics:

The Global Golf Tourism Market demonstrates moderate concentration with established multinational brands holding significant influence while regional players cater to niche segments. It features high entry barriers due to capital-intensive infrastructure requirements and reliance on strong tourism ecosystems. Market growth depends on integration of hospitality, transportation, and event management services. It is characterized by premium positioning, strong brand associations, and reliance on affluent demographics. International events and partnerships with tourism boards create competitive differentiation. It continues to expand through digital booking platforms, sustainability-driven strategies, and destination marketing, shaping an evolving yet resilient market structure.

Report Coverage:

The research report offers an in-depth analysis based on booking method, demographic, nationality, and group type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Golf Tourism Market is expected to expand with rising interest in luxury travel experiences that integrate sport, leisure, and culture.

- Growing investments in new golf courses and premium resorts will strengthen its appeal in both developed and emerging destinations.

- Digital booking platforms and personalized travel packages will drive customer engagement and improve global accessibility.

- Hosting of international tournaments will continue to boost destination visibility and attract high-value tourists.

- Expanding participation of women and younger demographics will diversify the customer base and enhance inclusivity.

- Sustainable tourism practices and eco-friendly course management will shape long-term competitiveness.

- Strategic partnerships between hospitality brands, airlines, and tour operators will enhance integrated offerings.

- Emerging regions such as Asia Pacific and the Middle East will see faster adoption due to infrastructure growth and government support.

- Corporate and incentive travel demand will remain strong, driven by business-leisure combinations.

- Continuous innovation in travel experiences will ensure it sustains relevance in the evolving global tourism landscape.