Market Overview

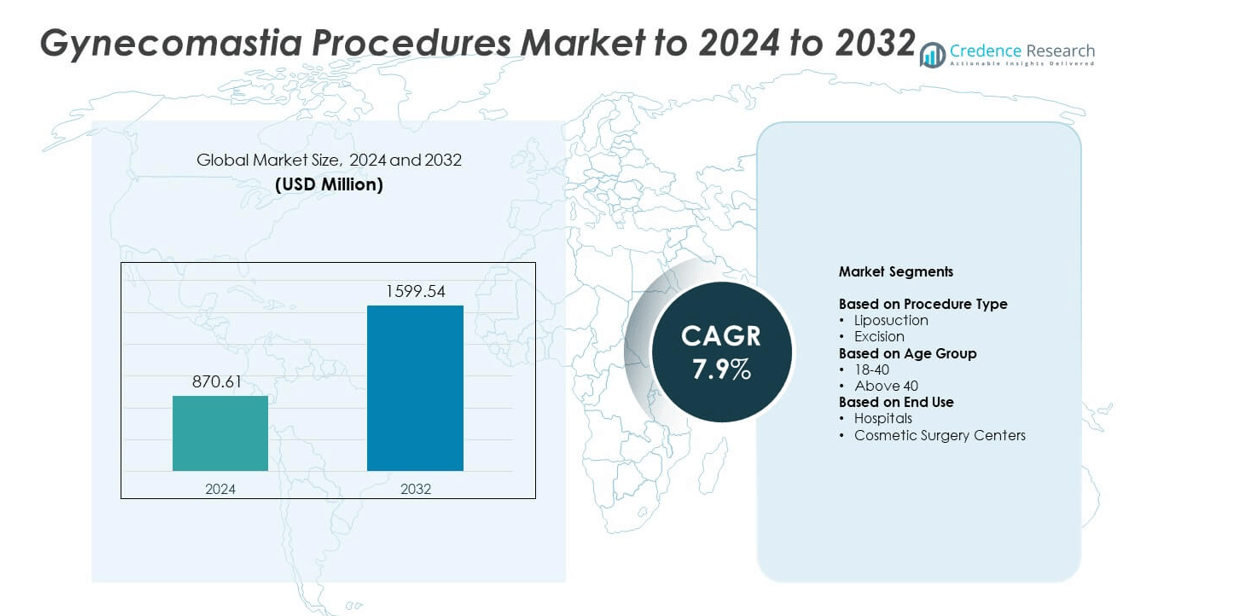

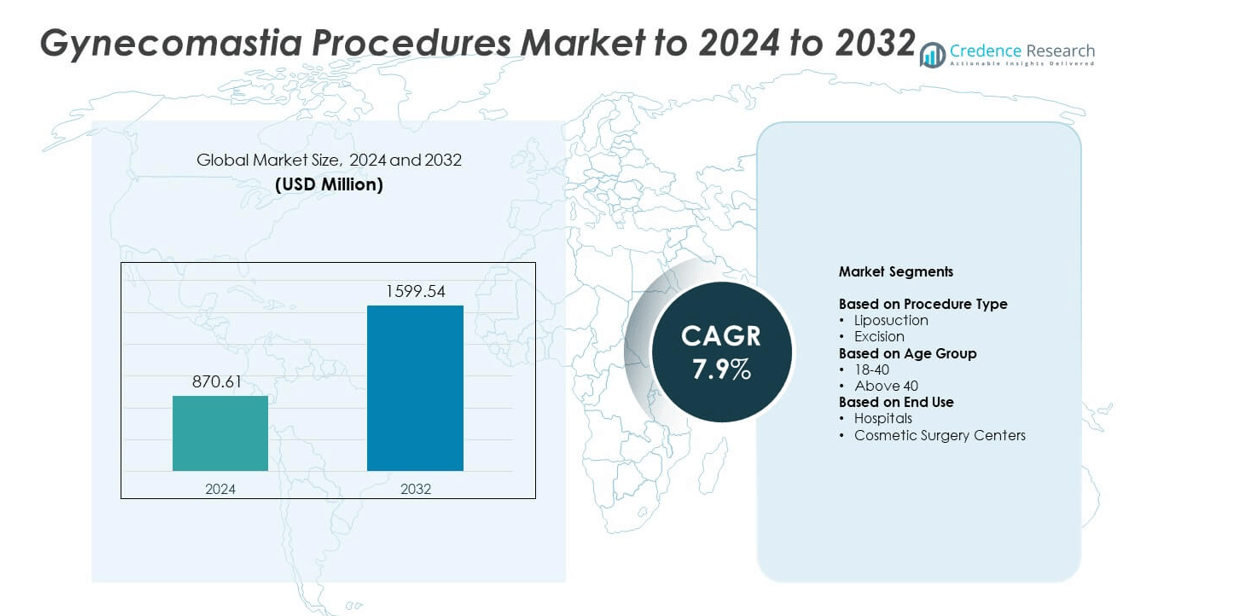

Gynecomastia Procedures Market size was valued at USD 870.61 million in 2024 and is anticipated to reach USD 1599.54 million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gynecomastia Procedures Market Size 2024 |

USD 870.61 million |

| Gynecomastia Procedures Market, CAGR |

7.9% |

| Gynecomastia Procedures Market Size 2032 |

USD 1599.54 million |

The Gynecomastia Procedures Market includes major participants such as Medtronic, Kee Pharma Ltd, Cynosure, Sun Pharmaceuticals Industries Ltd, Cadila Pharmaceuticals Ltd, Micro Nova Pharmaceuticals Ltd, and Zydus Cadila Healthcare Ltd. These companies strengthen the market through advanced surgical devices, refined liposuction technologies, and growing support for minimally invasive chest-contouring solutions. Their focus on precision tools and improved recovery outcomes increases adoption across cosmetic centers and hospitals. North America leads the global market with about 38% share due to strong awareness, high procedure volumes, and wide access to specialized aesthetic facilities, making it the most influential regional contributor.

Market Insights

- The Gynecomastia Procedures Market was valued at USD 870.61 million in 2024 and is projected to reach USD 1599.54 million by 2032, growing at a CAGR of 7.9%.

- Market growth is driven by rising male aesthetic awareness, increasing obesity-related cases, and strong demand for minimally invasive liposuction, which holds about 61% share.

- Key trends include wider adoption of energy-assisted contouring systems, growth of outpatient cosmetic centers, and rising use of digital imaging tools for treatment planning.

- Competition intensifies as leading companies enhance device precision, expand training programs, and integrate advanced technologies to improve patient outcomes across cosmetic facilities.

- North America leads with around 38% share, followed by Europe at 27%, while Asia Pacific grows fastest at about 23% due to expanding cosmetic hubs and rising procedure

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Procedure Type

Liposuction leads the procedure type segment with about 61% share in 2024. This technique dominates because surgeons prefer minimally invasive fat removal for mild to moderate gynecomastia. Liposuction offers shorter recovery, fewer scars, and reduced complication risk, which increases patient acceptance across cosmetic clinics. Excision grows in complex or gland-dominant cases, but demand stays lower due to longer downtime and higher surgical intensity. Rising preference for quick outpatient procedures and wider adoption of power-assisted and ultrasound-assisted liposuction support the leadership of this segment.

- For instance, Solta Medical confirms that its VASER ultrasonic system operates at a frequency of 36 kHz, a specification published in its official product manual.

By Age Group

The 18 to 40 group holds the dominant share at nearly 67% in 2024. This age bracket drives demand because hormonal imbalance, obesity, and fitness-related body contouring trends are more common in younger males. Many patients also seek early correction for psychological comfort and improved physical appearance, increasing procedure volumes. The above-40 group grows steadily as awareness rises, but adoption remains lower due to health constraints and reduced aesthetic priority. Social media influence and rising acceptance of male cosmetic procedures strengthen the dominance of the younger segment.

- For instance, clinical studies and product information for the InMode BodyTite device indicate that the device’s efficacy is based on achieving a target internal temperature of up to 70°C within the subcutaneous fat layer to induce tissue contraction.

By End Use

Cosmetic surgery centers account for the largest share at roughly 58% in 2024. These centers lead because they provide specialized surgeons, advanced contouring tools, and shorter wait times designed for aesthetic procedures. Patients prefer dedicated cosmetic facilities for privacy, flexible scheduling, and tailored post-operative care. Hospitals handle medically complex cases, but contribute a smaller share due to higher costs and longer administrative processes. Growing investment in outpatient cosmetic centers and wider availability of minimally invasive technologies support the continued dominance of cosmetic surgery centers.

Key Growth Drivers

Rising Male Aesthetic Awareness

Growing acceptance of male cosmetic enhancement drives strong demand for gynecomastia procedures. Younger adults seek body contouring to improve confidence, while social media amplifies awareness about corrective options. Increasing openness toward surgical solutions and a shift in beauty standards push more men to pursue treatment. The market benefits from rising discussions around hormonal imbalance and fitness concerns, which encourage early medical consultation and procedure adoption.

- For instance, Galderma reports that its Restylane hyaluronic acid filler portfolio has been used in over 77 million treatments worldwide, according to a recent company communication from late 2025.

Advancements in Minimally Invasive Techniques

Modern liposuction technologies, including power-assisted and energy-based systems, reduce pain, downtime, and scarring. These improvements increase patient satisfaction and encourage adoption among individuals seeking rapid recovery. Surgeons also use refined tools that enhance precision, leading to better chest contouring outcomes. As innovations continue to improve safety and efficiency, clinics experience higher procedure volumes across both cosmetic centers and hospitals.

- For instance, MicroAire Surgical Instruments lists in its official PAL-650 documentation that the device operates at 4,000 oscillations per minute, ensuring efficient power-assisted liposuction.

Growing Prevalence of Obesity and Hormonal Disorders

Higher obesity rates and endocrine-related issues contribute to increasing male breast enlargement cases. Lifestyle changes, stress, medications, and metabolic disorders further accelerate the incidence. With more men experiencing glandular tissue growth or fat accumulation, demand for corrective surgery rises steadily. Rising diagnosis rates and improved patient education also support market expansion across regions with growing healthcare access.

Key Trends & Opportunities

Expansion of Outpatient and Ambulatory Cosmetic Centers

The shift toward outpatient care accelerates due to faster recovery, cost benefits, and enhanced privacy. Clinics invest in advanced devices, skilled specialists, and personalized treatment plans to attract a growing male population. These centers offer streamlined procedures, flexible scheduling, and focused post-surgery support. As patient preference for specialized environments grows, opportunities expand for centers adopting modern aesthetic technologies.

- For instance, Cutera Inc. confirms in its technical file that the truSculpt iD monopolar RF system operates at 2 MHz, supporting quick outpatient fat-reduction treatments.

Integration of Imaging and Simulation Tools

High-resolution imaging and digital chest-contouring simulations help surgeons predict outcomes with greater accuracy. These tools improve consultation quality, support informed decisions, and enhance patient trust. Clinics adopting digital planning gain competitive advantage through better communication and tailored surgical strategies. As visualization systems become more accessible, demand for technology-driven procedure planning grows across global markets.

- For instance, Canfield Scientific specifies that its VECTRA XT platform uses 6 high-resolution, calibrated cameras (when configured for body imaging) and produces 3D body scans.

Rising Medical Tourism for Aesthetic Procedures

Affordable pricing, expert surgeons, and modern facilities attract international patients to emerging markets. Regions with strong cosmetic surgery ecosystems see rising inbound travel for gynecomastia correction. Enhanced service packages, seamless travel support, and improved safety standards expand opportunities for clinics. This trend strengthens procedure volume and boosts global market visibility.

Key Challenges

High Cost and Limited Insurance Coverage

Gynecomastia surgery often falls under elective cosmetic procedures, leaving most patients without insurance support. The high cost of advanced technologies, surgeon fees, and post-operative care limits accessibility for many individuals. This financial burden reduces adoption in low-income groups and slows market growth. Expanding financing options and awareness programs remains critical for broader reach.

Post-Surgical Risks and Complexity in Severe Cases

Complications such as asymmetry, scarring, and recurrence remain concerns for patients. Severe glandular enlargement or mixed-type gynecomastia often requires complex excision, increasing surgical difficulty and recovery time. These risks deter some candidates and demand highly skilled specialists. Ensuring consistent training and technology adoption is essential to manage complexities and improve surgical outcomes.

Regional Analysis

North America

North America holds the largest share at about 38% in 2024. Strong demand comes from high awareness of male aesthetic procedures and wide access to advanced liposuction and excision technologies. The region benefits from skilled cosmetic surgeons, strong healthcare infrastructure, and higher disposable income. Rising cases linked to obesity, medications, and hormonal imbalance also support procedure growth. Increasing acceptance of male cosmetic enhancement and active promotional efforts by clinics further strengthen the regional market.

Europe

Europe accounts for roughly 27% share in 2024. The region shows steady demand due to high acceptance of cosmetic surgery, strong clinical standards, and expanding availability of minimally invasive techniques. Countries such as Germany, the UK, and France drive volumes because of advanced surgical facilities and rising male interest in body contouring. Growing obesity-related conditions also increase consultation rates. Medical tourism within Eastern Europe supports procedural growth through competitive pricing and modern aesthetic centers.

Asia Pacific

Asia Pacific holds about 23% share in 2024 and represents the fastest-growing region. Rising awareness, increasing income levels, and strong demand for appearance enhancement drive higher procedure adoption. Countries such as India, China, South Korea, and Thailand see rapid growth due to expanding cosmetic surgery hubs and rising male body-image concerns. Medical tourism boosts volumes through affordable package offerings and skilled surgeons. Greater openness toward aesthetic treatments and improved healthcare access support long-term regional expansion.

Latin America

Latin America captures nearly 7% share in 2024. The region benefits from a strong cosmetic culture, with Brazil and Mexico leading in surgical procedures. Clinics offer competitive pricing and modern techniques, attracting both local and international patients. Rising popularity of aesthetic enhancement among young males supports procedural growth. Increased social media influence and growing visibility of cosmetic results further strengthen demand across urban areas. Economic fluctuations remain a factor but do not significantly hinder market expansion.

Middle East & Africa

The Middle East and Africa region holds around 5% share in 2024. Growth is supported by rising disposable income, expanding private healthcare facilities, and increasing adoption of male aesthetic procedures in Gulf countries. Modern cosmetic centers in the UAE and Saudi Arabia attract patients seeking advanced gynecomastia correction. Awareness continues to rise as clinics promote minimally invasive solutions. Africa shows slower but steady growth due to improving healthcare access and growing aesthetic preferences among younger populations.

Market Segmentations:

By Procedure Type

By Age Group

By End Use

- Hospitals

- Cosmetic Surgery Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gynecomastia Procedures Market features key players such as Medtronic, Kee Pharma Ltd, Cynosure, Sun Pharmaceuticals Industries Ltd, Cadila Pharmaceuticals Ltd, Micro Nova Pharmaceuticals Ltd, and Zydus Cadila Healthcare Ltd. These companies focus on stronger technology adoption and improved surgical tools that support safer male chest contouring. Clinics rely on advanced energy-based systems and refined liposuction platforms that enhance accuracy during treatment. Manufacturers invest in research to improve device efficiency and reduce post-procedure risks for patients seeking faster recovery. Many firms expand training programs that help surgeons use modern equipment with greater precision. Product portfolios grow as companies introduce updated systems for minimally invasive correction. Strategic partnerships allow wider access to cosmetic technologies across hospitals and dedicated aesthetic centers. Marketing efforts highlight improved outcomes that appeal to younger men seeking body enhancement. Technology upgrades and geographic expansion support stronger competition across both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic

- Kee Pharma Ltd

- Cynosure

- Sun Pharmaceuticals Industries Ltd

- Cadila Pharmaceuticals Ltd

- Micro Nova Pharmaceuticals Ltd

- Zydus Cadila Healthcare Ltd

Recent Developments

- In 2024, Cynosure and Hahn & Company, which had recently acquired Lutronic, announced a definitive merger agreement to combine the two entities. This strategic combination aimed to create a global leader in medical aesthetic systems with a diversified product portfolio and expanded research and development (R&D) capabilities

- In 2024, Medtronic expanded its minimally invasive surgical (MIS) platform aimed at enhancing accuracy in general surgery and improving patient outcomes

- In 2023, Cadila Pharmaceuticals signed an MoU with the Gujarat government for a total investment of ₹1,000 crore to expand facilities and set up new plants across the state.

Report Coverage

The research report offers an in-depth analysis based on Procedure Type, Age Group, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for minimally invasive liposuction techniques will rise due to shorter recovery.

- More men aged 18 to 40 will seek corrective procedures for body contouring.

- Clinics will invest in advanced imaging tools for precise pre-surgical planning.

- Medical tourism will grow as emerging markets offer cost-effective treatments.

- Cosmetic surgery centers will expand their share with specialized outpatient services.

- Surgeons will adopt improved energy-assisted devices for better contouring outcomes.

- Awareness campaigns will increase early consultation and diagnosis rates.

- Hormonal and obesity-related cases will continue driving steady procedure demand.

- Digital marketing will boost clinic visibility and patient engagement.

- Recovery-focused care protocols will improve satisfaction and long-term results.