Market Overview

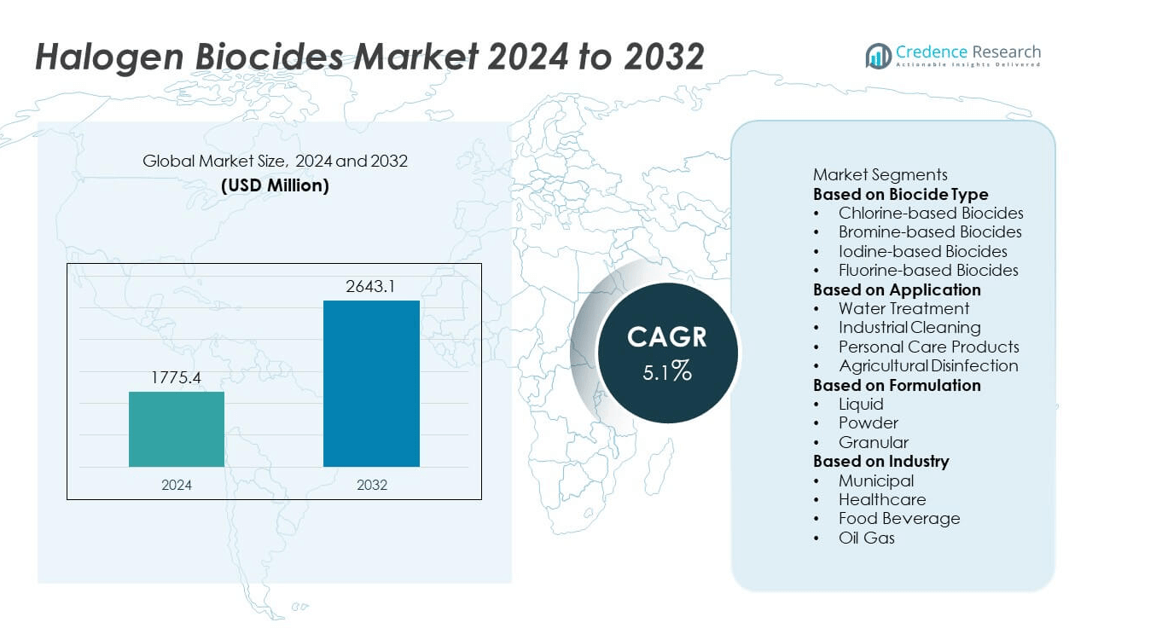

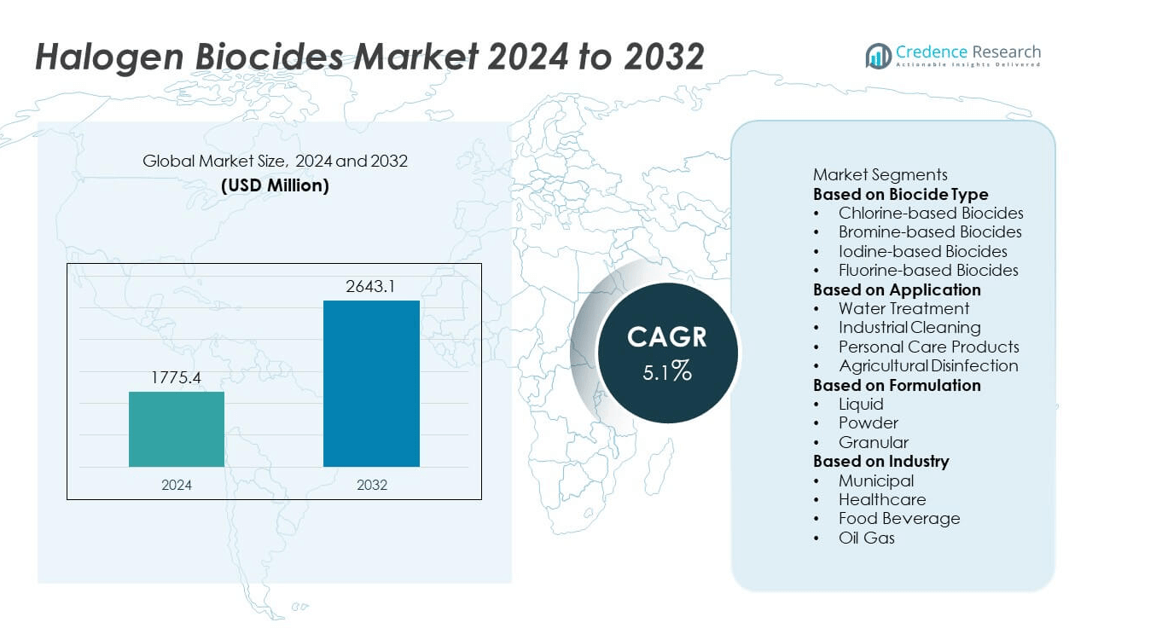

The Halogen Biocides market was valued at USD 1,775.4 million in 2024 and is projected to reach USD 2,643.1 million by 2032, reflecting a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Halogen Biocides Market Size 2024 |

USD 1,775.4 million |

| Halogen Biocides Market, CAGR |

5.1% |

| Halogen Biocides Market Size 2032 |

USD 2,643.1 million |

The Halogen Biocides market grows on the back of rising demand for effective microbial control in water treatment, healthcare, and industrial processes. Stringent hygiene regulations and the need to prevent biofouling in sectors such as oil and gas, pulp and paper, and food processing drive consistent adoption. It benefits from advancements in eco-friendly formulations and smart dosing technologies that improve efficiency and compliance.

The Halogen Biocides market demonstrates strong regional presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with growth driven by diverse industrial applications and evolving environmental regulations. North America shows high adoption in municipal water treatment, oil and gas, and food processing, while Europe emphasizes eco-compliant formulations under strict chemical safety frameworks. Asia-Pacific experiences rapid expansion due to industrialization, urbanization, and rising investments in sanitation infrastructure. Latin America and the Middle East & Africa record steady growth through applications in desalination, agriculture, and mining. Key players such as Clariant, Dow Chemical, Lonza, and AkzoNobel focus on innovation in sustainable formulations, advanced dosing systems, and strategic partnerships to enhance market competitiveness.\

Market Insights

- The Halogen Biocides market was valued at USD 1,775.4 million in 2024 and is projected to reach USD 2,643.1 million by 2032, registering a CAGR of 5.1% during the forecast period.

- The market grows due to increasing demand for effective microbial control in water treatment, industrial processes, healthcare sanitation, and food processing, driven by strict hygiene and safety regulations across multiple sectors.

- Key trends include the shift toward eco-friendly and low-toxicity formulations, integration of smart dosing systems, and adoption of IoT-based monitoring technologies to optimize chemical usage and reduce operational costs.

- The competitive landscape features global players such as Clariant, Dow Chemical, Lonza, and AkzoNobel, focusing on R&D, sustainable product innovation, and partnerships to strengthen their market presence and expand geographically.

- Regulatory challenges and environmental concerns related to chemical discharge limits and toxicity levels act as restraints, requiring continuous reformulation and compliance efforts from manufacturers.

- North America leads in adoption due to mature infrastructure and strong regulatory enforcement, Europe prioritizes environmentally compliant solutions, Asia-Pacific experiences rapid growth with industrialization and water infrastructure investments, while Latin America and the Middle East & Africa record steady expansion in industrial and municipal applications.

- The market outlook remains positive, supported by advancements in formulation technology, growing industrial activities in emerging economies, and rising global emphasis on sustainable and efficient microbial control solutions across critical sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Effective Water Treatment Solutions

The Halogen Biocides market benefits from growing requirements for efficient microbial control in water treatment applications. Industrial, municipal, and residential water systems increasingly face contamination risks from bacteria, algae, and fungi. It provides a broad-spectrum antimicrobial action that supports compliance with stringent water safety regulations. Expanding urban populations and industrial activities drive higher consumption of treated water, amplifying the need for biocides. Regulatory emphasis on preventing waterborne diseases strengthens the demand for halogen-based formulations. The versatility of these products in different water chemistries supports consistent adoption across geographies.

- For instance, Lonza reports that one‑third of the municipal water systems servicing Long Island, New York, employ its calcium hypochlorite sanitizer feeder systems.

Stringent Regulations on Industrial Hygiene and Safety

Government and industry standards promote the use of reliable antimicrobial agents to protect public health and maintain process integrity. The Halogen Biocides market gains from compliance requirements in sectors such as food processing, pulp and paper, and oil and gas. It offers proven efficacy against a wide range of microorganisms, enabling operators to meet hygiene protocols. Companies prioritize biocide technologies that minimize downtime caused by microbial fouling. The effectiveness of halogen biocides under varying operational conditions enhances their relevance in industrial cleaning programs. Rising audits and inspections in regulated sectors further sustain market demand.

- For instance, Dow Chemical’s advanced chlorine dioxide biocide systems have been integrated into over 350 industrial processing plants, reducing biofilm-related production losses by up to 1,500 operational hours annually while meeting strict U.S. EPA disinfection standards.

Growth in Healthcare and Pharmaceutical Applications

Healthcare facilities and pharmaceutical manufacturers require advanced microbial control to ensure sterile environments. The Halogen Biocides market supports these needs through potent disinfection solutions that prevent contamination in production lines and medical facilities. It delivers rapid microbial kill rates, making it suitable for critical applications such as surgical equipment sterilization and laboratory sanitation. The rising prevalence of hospital-acquired infections increases the emphasis on high-performance disinfectants. Growth in pharmaceutical manufacturing capacity, particularly in emerging economies, contributes to higher consumption. The adaptability of halogen biocides in multiple delivery forms enhances operational efficiency in healthcare settings.

Advancements in Product Formulation and Delivery Systems

Innovations in halogen biocide formulations improve stability, reduce corrosiveness, and enhance environmental compatibility. The Halogen Biocides market benefits from controlled-release systems and blends that maintain prolonged antimicrobial activity. It supports industries seeking cost-effective and reliable microbial control without compromising operational safety. Development of products with lower toxicity profiles encourages adoption in sensitive applications. The integration of smart dosing systems allows optimized chemical usage, reducing waste and operational costs. These advancements strengthen the market position of halogen biocides across diverse industrial and commercial sectors.

Market Trends

Shift Toward Environmentally Compliant Biocide Formulations

The Halogen Biocides market witnesses a steady transition toward products that meet stricter environmental regulations. Manufacturers focus on developing formulations with lower residual toxicity and reduced environmental persistence. It addresses growing concerns over ecological impact while maintaining strong antimicrobial performance. The demand for sustainable chemistry drives research into halogen blends that degrade safely after use. Regulatory bodies encourage adoption of eco-friendly alternatives through compliance frameworks. This trend supports broader acceptance across industries with stringent environmental stewardship requirements.

- For instance, Solvay achieved a 95% reduction in scope 1 and 2 greenhouse gas emissions at its Paulínia and Santo André sites in Brazil between 2005 and 2024 through process optimization and carbon-neutral initiatives.

Integration of Advanced Dosing and Monitoring Technologies

Automation in biocide application gains traction across industrial and municipal water treatment facilities. The Halogen Biocides market benefits from smart dosing systems that adjust chemical input based on real-time microbial load data. It optimizes usage, lowers operational costs, and ensures consistent protection. Remote monitoring tools enable predictive maintenance and improved process control. Integration with IoT platforms allows plant operators to manage biocide performance more effectively. The move toward data-driven chemical management reflects a growing emphasis on operational efficiency and sustainability.

- For instance, Solvay inaugurated a regenerative thermal oxidation (RTO) system at its Green River, Wyoming site in October 2024, reducing that facility’s GHG emissions by up to 20% annually through advanced emissions control.

Expansion in High-Growth Industrial Sectors

Industries such as oil and gas, pulp and paper, and food processing continue to expand biocide consumption due to process-critical microbial control requirements. The Halogen Biocides market responds with specialized products tailored to unique operational conditions in these sectors. It maintains consistent performance in high-temperature, high-pressure, and variable pH environments. Global industrialization, particularly in emerging economies, strengthens demand. The capability to integrate halogen biocides into diverse treatment regimes supports their competitive advantage. This expansion is further fueled by infrastructure development and investment in manufacturing capacity.

Rising Focus on Healthcare and Sanitation Applications

Public health concerns and infection control priorities elevate demand for effective disinfection solutions in healthcare and sanitation. The Halogen Biocides market addresses this need through high-efficacy products that act rapidly against a wide spectrum of pathogens. It finds application in hospital surface disinfection, pharmaceutical cleanrooms, and community sanitation programs. The emphasis on preventing disease transmission reinforces its relevance in both developed and developing regions. Growth in healthcare infrastructure investment enhances product penetration. This trend aligns with global initiatives promoting safer and cleaner public environments.

Market Challenges Analysis

Stringent Regulatory Compliance and Environmental Concerns

The Halogen Biocides market faces significant challenges from evolving environmental regulations and chemical safety standards. Many regions enforce strict discharge limits and restrictions on active ingredients due to toxicity and ecological persistence concerns. It requires continuous product reformulation to meet compliance while maintaining antimicrobial efficacy. Manufacturers face increased R&D costs and extended approval timelines for new products. Public and governmental scrutiny over chemical use in sensitive environments adds further pressure. These regulatory hurdles can slow market entry and reduce competitiveness for smaller producers.

Health and Safety Risks in Handling and Application

The effective use of halogen biocides demands strict adherence to safety protocols to prevent risks to workers and end-users. The Halogen Biocides market contends with concerns over potential skin, eye, and respiratory irritation during handling. It necessitates specialized training, protective equipment, and controlled dosing systems to minimize hazards. Inadequate handling practices can lead to operational inefficiencies and liability issues. Growing awareness of occupational health standards drives demand for safer alternatives, challenging market share retention. The need for balanced performance and safety remains a critical operational challenge for industry participants.

Market Opportunities

Growing Demand from Emerging Economies and Expanding Industrial Base

The Halogen Biocides market can leverage increasing industrial activity and urbanization in emerging economies to expand its footprint. Rapid growth in sectors such as power generation, food processing, and manufacturing drives demand for effective microbial control solutions. It offers reliable performance in varied environmental conditions, making it suitable for diverse applications. Expanding water treatment infrastructure in regions facing scarcity and contamination challenges creates new procurement opportunities. Industrial investments in Asia-Pacific, Latin America, and the Middle East strengthen the potential for long-term growth. The scalability of halogen biocide solutions supports adoption across both large-scale and decentralized systems.

Innovation in Sustainable and Application-Specific Formulations

Rising interest in environmentally compliant chemical solutions opens opportunities for product innovation and market differentiation. The Halogen Biocides market can benefit from the development of low-toxicity, controlled-release, and biodegradable formulations. It enables industries to meet regulatory and sustainability targets without compromising efficacy. Opportunities exist in tailoring products for niche applications such as medical sanitation, aquaculture, and advanced cooling systems. Partnerships with technology providers for smart dosing integration enhance value propositions. Continuous innovation in formulation and delivery systems positions manufacturers to capture demand from high-growth, regulation-sensitive sectors.

Market Segmentation Analysis:

By Biocide Type

The Halogen Biocides market segments by biocide type into chlorine-based, bromine-based, iodine-based, and other halogen derivatives. Chlorine-based biocides dominate due to their broad-spectrum antimicrobial action, cost-effectiveness, and ease of application in large-scale water treatment and sanitation. Bromine-based products gain traction in applications requiring stability under high temperatures and variable pH conditions, such as cooling towers and oilfield operations. Iodine-based biocides find niche demand in healthcare, food processing, and aquaculture due to their rapid pathogen neutralization and lower corrosiveness. It demonstrates adaptability across diverse operational environments, driving sustained adoption in both industrial and municipal sectors. The availability of specialized formulations within each type supports tailored solutions for specific contamination challenges.

- For instance, Dow’s DBNPA‑based formulations achieve microbial kill rates within ten minutes and decompose to benign end products with a measured half-life of less than thirty minutes in aquatic systems.

By Application

The Halogen Biocides market serves multiple application areas, including water treatment, oil and gas, pulp and paper, healthcare, food and beverage processing, and industrial cleaning. Water treatment remains the largest segment, driven by the need to control microbial growth in municipal supplies, wastewater facilities, and industrial systems. Oil and gas operations utilize halogen biocides to prevent biofouling and microbiologically influenced corrosion in pipelines and storage systems. Pulp and paper mills employ them to manage slime-forming organisms, ensuring uninterrupted production. Healthcare and food sectors demand high-purity formulations for surface disinfection and process hygiene. It maintains a strong presence across sectors where microbial control directly impacts operational efficiency and safety compliance.

- For instance, activated sodium bromide systems employed in chemical plant cooling towers achieved effective microbial control at a maintained residual of approximately 0.11 (Cl₂ equivalent), while also reducing mild steel corrosion in five out of eight treated towers.

By Formulation

Formulation types in the Halogen Biocides market include liquid, powder, and tablet forms. Liquid formulations lead due to their ease of dosing, quick dispersion, and compatibility with automated delivery systems. Powder forms offer extended shelf life and simplified transport, appealing to remote industrial sites and small-scale operations. Tablet formulations provide controlled release, making them ideal for swimming pools, cooling systems, and decentralized water treatment units. It benefits from advancements in formulation technology that improve stability, reduce corrosiveness, and enhance environmental safety. The availability of multiple delivery forms ensures adaptability to different operational requirements, supporting wider market penetration.

Segments:

Based on Biocide Type

- Chlorine-based Biocides

- Bromine-based Biocides

- Iodine-based Biocides

- Fluorine-based Biocides

Based on Application

- Water Treatment

- Industrial Cleaning

- Personal Care Products

- Agricultural Disinfection

Based on Formulation

Based on Industry

- Municipal

- Healthcare

- Food Beverage

- Oil Gas

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32.6% of the Halogen Biocides market share, supported by mature industrial infrastructure, strict environmental regulations, and advanced water treatment systems. The United States leads regional consumption, with high demand from municipal water treatment plants, oil and gas operations, and food processing facilities. It benefits from strong regulatory enforcement by agencies such as the U.S. Environmental Protection Agency (EPA), which mandates effective microbial control in critical sectors. Canada follows with investments in eco-friendly biocide solutions, particularly in industrial cooling systems and pulp and paper mills. Ongoing infrastructure upgrades, coupled with the presence of major chemical manufacturers, sustain steady product adoption. The region also shows a rising trend toward controlled-release and low-toxicity formulations to meet sustainability targets.

Europe

Europe holds 28.4% of the Halogen Biocides market share, driven by stringent health, safety, and environmental regulations under frameworks such as REACH and the Biocidal Products Regulation (BPR). Germany, France, and the United Kingdom lead consumption, with significant demand from municipal water treatment, industrial sanitation, and healthcare applications. It experiences growth in advanced dosing technologies that optimize chemical use while reducing environmental impact. The pulp and paper sector, particularly in Scandinavia, remains a key consumer, requiring continuous microbial control to maintain production quality. The shift toward eco-compliant and biodegradable formulations is prominent, driven by public and governmental pressure for greener chemical solutions. Cross-industry partnerships between chemical suppliers and technology providers accelerate innovation in sustainable halogen biocide applications.

Asia-Pacific

Asia-Pacific captures 25.7% of the Halogen Biocides market share, fueled by rapid industrialization, expanding urban populations, and growing investments in water treatment infrastructure. China leads the region with large-scale adoption in municipal water treatment, textile manufacturing, and industrial cooling systems. India shows fast growth, supported by government programs aimed at improving water quality and public health standards. It benefits from increasing demand in food and beverage processing, driven by stringent hygiene requirements. Southeast Asian nations, including Indonesia and Vietnam, expand usage in aquaculture and sanitation. The diversity of industrial applications and rising environmental compliance awareness create significant opportunities for market expansion in this region.

Latin America

Latin America represents 8.1% of the Halogen Biocides market share, with Brazil and Mexico as primary consumers. The region’s demand is driven by the food processing, oil and gas, and municipal water treatment sectors. It sees increased adoption in agricultural irrigation systems to control microbial contamination. Economic development initiatives, coupled with foreign investment in industrial facilities, support gradual market growth. The pulp and paper industry in Brazil also contributes to steady product demand. Efforts to improve urban sanitation and safe drinking water supply enhance the need for reliable biocide solutions.

Middle East & Africa

The Middle East & Africa account for 5.2% of the Halogen Biocides market share, with demand concentrated in the oil and gas, desalination, and power generation sectors. Gulf Cooperation Council (GCC) countries invest heavily in desalination plants where halogen biocides play a critical role in preventing biofouling. South Africa demonstrates notable growth in municipal water treatment and mining applications. It benefits from rising infrastructure projects that require microbial control in water systems. Increasing environmental regulations and industrial diversification efforts in the Middle East further support the uptake of advanced biocide technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clariant

- Niteo Products

- Albemarle Corporation

- Solvay

- Dow Chemical

- Olin Corporation

- Huntsman Corporation

- Troy Corporation

- Lonza

- AkzoNobel

Competitive Analysis

The competitive landscape of the Halogen Biocides market is characterized by the presence of established global chemical manufacturers focusing on product innovation, regulatory compliance, and market expansion strategies. Key players include Clariant, Dow Chemical, Lonza, AkzoNobel, Solvay, Albemarle Corporation, Huntsman Corporation, Olin Corporation, Troy Corporation, and Niteo Products. These companies invest heavily in R&D to develop eco-friendly, low-toxicity, and high-efficiency biocide formulations that meet evolving environmental and safety regulations. They actively expand product portfolios to cater to diverse applications, including water treatment, oil and gas, pulp and paper, healthcare, and food processing. Strategic collaborations with technology providers enhance dosing and monitoring capabilities, supporting operational efficiency for end-users. Geographic expansion into high-growth markets such as Asia-Pacific and Latin America remains a priority, supported by targeted partnerships and acquisitions. Competitive differentiation also comes from offering tailored solutions for niche industries, ensuring adaptability to varied environmental conditions and compliance requirements, thereby strengthening market positioning.

Recent Developments

- In December 2024, Olin announced the shutdown of its diaphragm-grade chlor alkali capacity at its Freeport, Texas facility. This decision was prompted by Dow’s plan to close its propylene oxide (PO) unit at the same site at the end of 2025, as Olin’s capacity supplied feedstock to Dow’s unit. The closure is part of Olin’s strategy to reduce its diaphragm-grade chlor alkali capacity and redirect its focus towards higher-return operations

- In April 2024, Solvay formed a new partnership with an agricultural firm to develop environmentally friendly biocides for crop protection.

- In June 2023, Clariant announced a commitment to researching and developing next-generation biocides. This initiative focuses on creating products that are both more sustainable and more effective. Clariant’s approach emphasizes biocompatibility and addresses current and future regulatory needs, particularly regarding PFAS (per- and polyfluoroalkyl substances).

Market Concentration & Characteristics

The Halogen Biocides market reflects a moderately consolidated structure, with a mix of global chemical manufacturers and specialized regional suppliers competing on product performance, regulatory compliance, and innovation. It features a high degree of technological focus, driven by the need for eco-friendly formulations, advanced dosing systems, and application-specific solutions. Leading players leverage scale, R&D investment, and strategic partnerships to maintain market presence, while smaller firms target niche applications and localized demand. Competition is shaped by regulatory frameworks that require continuous product adaptation to meet safety and environmental standards. The market serves diverse end-use industries, including water treatment, oil and gas, pulp and paper, healthcare, and food processing, each with distinct performance requirements. Product differentiation often relies on stability under varying operational conditions, broad-spectrum efficacy, and ease of integration into existing treatment systems. Demand stability is reinforced by the essential role of microbial control in maintaining operational efficiency and public health.

Report Coverage

The research report offers an in-depth analysis based on Biocide Type, Application, Formulation, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for effective microbial control in water treatment and industrial processes.

- Adoption of eco-friendly and low-toxicity halogen biocides will increase to meet environmental regulations.

- Advanced dosing and monitoring technologies will gain traction for optimized chemical usage.

- Industrial growth in emerging economies will create new application opportunities.

- Healthcare and sanitation sectors will drive steady demand for high-purity formulations.

- Strategic collaborations between chemical manufacturers and technology providers will strengthen market competitiveness.

- Research into controlled-release and biodegradable formulations will accelerate product innovation.

- Regulatory compliance requirements will continue to influence product development strategies.

- The oil and gas sector will maintain stable consumption for biofouling prevention.

- Rising focus on operational efficiency will encourage adoption of smart biocide management systems.