Market Overview

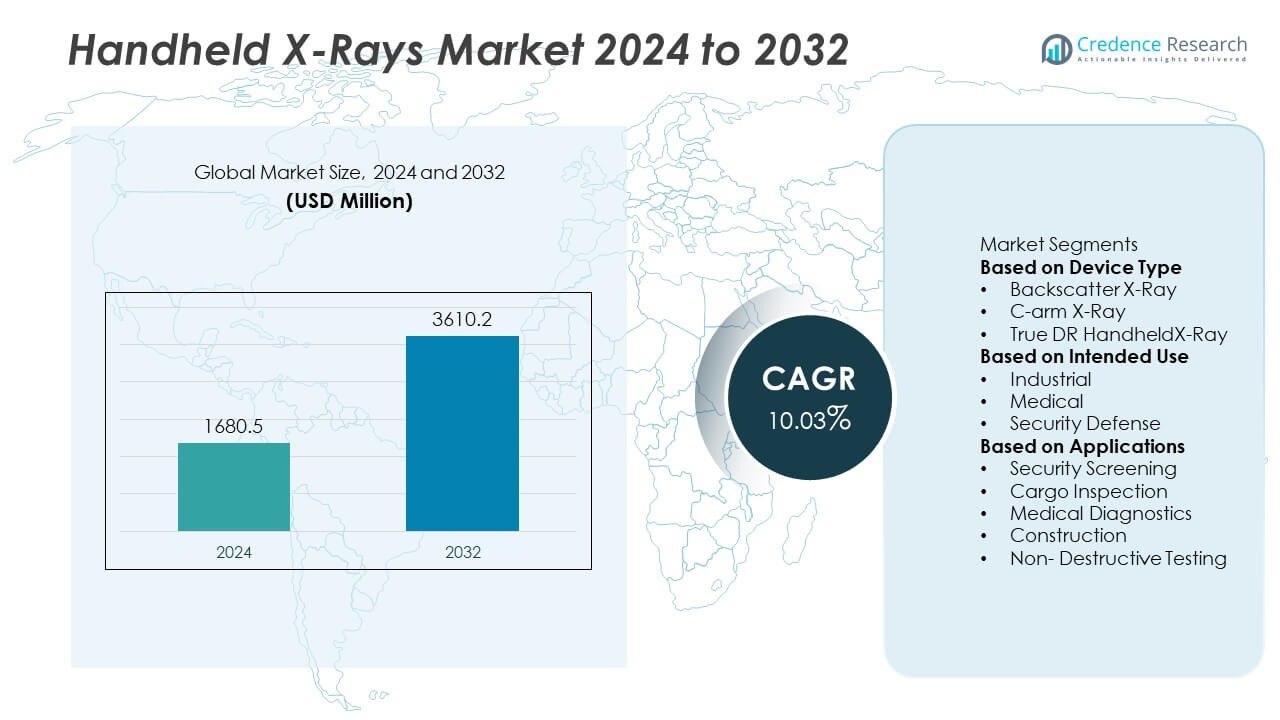

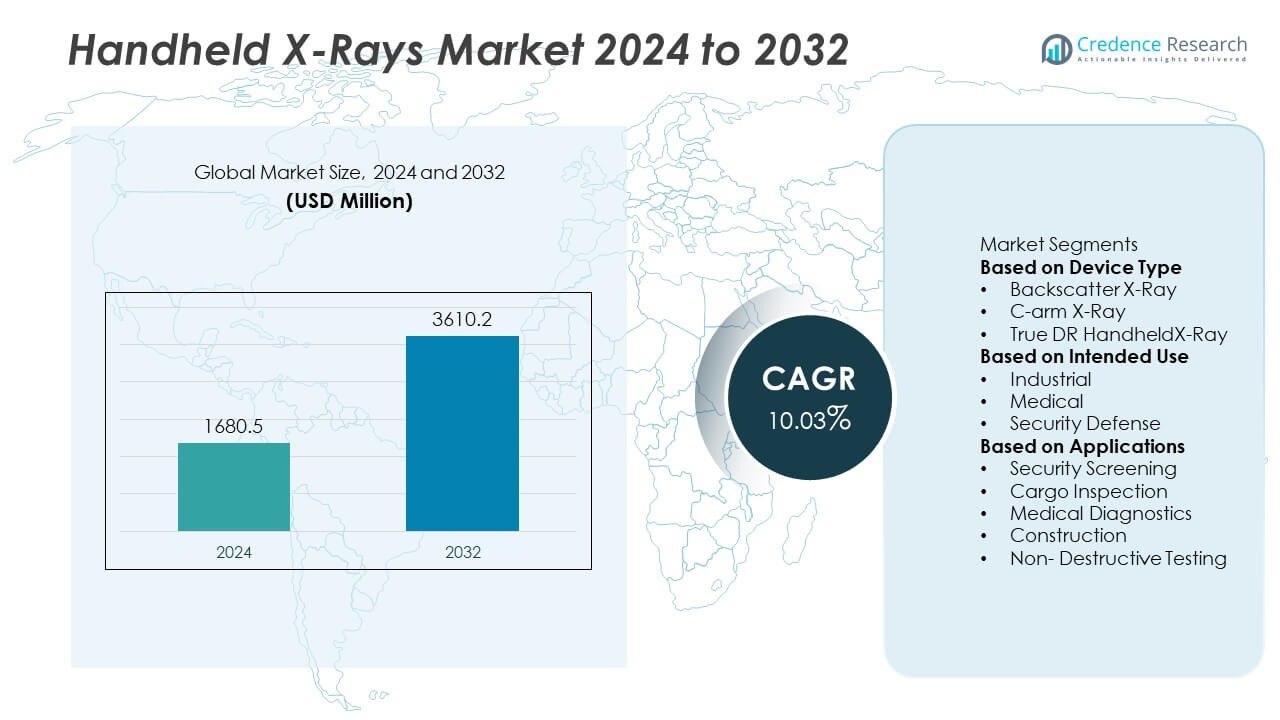

The Handheld X-Rays Market was valued at USD 1,680.5 million in 2024 and is projected to reach USD 3,610.2 million by 2032, expanding at a CAGR of 10.03% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Handheld X-Rays Market Size 2024 |

USD 1,680.5 Million |

| Handheld X-Rays Market, CAGR |

10.03% |

| Handheld X-Rays Market Size 2032 |

USD 3,610.2 Million |

The Handheld X-Rays Market grows due to rising demand for portable diagnostic solutions in healthcare, dentistry, and field applications. It supports rapid imaging in emergency care, rural healthcare, and mobile clinics, reducing patient wait times and enhancing diagnostic efficiency. Technological advancements, including digital sensors and wireless connectivity, improve image quality and operational ease.

The Handheld X-Rays Market sees strong adoption across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, driven by healthcare infrastructure advancements and portable imaging demand. North America leads in technological innovation and regulatory approvals, while Europe emphasizes safety compliance and integration in dental and medical practices. Asia-Pacific experiences rapid growth due to expanding rural healthcare access and rising diagnostic awareness. Latin America and the Middle East & Africa adopt these devices for mobile clinics and emergency care in remote areas. Key players such as Fujifilm Holdings Corporation, Philips Healthcare, Carestream Health, and Hologic, Inc. focus on developing lightweight, high-resolution devices with enhanced connectivity features. These companies invest in R&D to integrate AI-driven image processing and improve portability, catering to a diverse range of applications from dental diagnostics to on-field medical assessments in both developed and emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Handheld X-Rays Market was valued at USD 1,680.5 million in 2024 and is projected to reach USD 3,610.2 million by 2032, growing at a CAGR of 10.03% during the forecast period.

- Rising demand for portable diagnostic solutions in dental, orthopedic, and emergency care settings drives adoption, with devices enabling faster imaging at the point of care and reducing dependency on stationary radiography units.

- Technological advancements such as AI-assisted image processing, wireless data transfer, and improved battery efficiency enhance operational efficiency and accuracy in various medical applications.

- The competitive landscape features a mix of established medical imaging companies and specialized device manufacturers, focusing on lightweight designs, radiation safety, and integration with digital health systems to strengthen market position.

- High initial acquisition costs and regulatory compliance requirements for radiation safety remain key restraints, limiting adoption in smaller clinics and low-resource healthcare environments.

- North America leads in innovation and product adoption, Europe maintains strong demand with strict safety regulations, and Asia-Pacific experiences rapid growth supported by rural healthcare expansion and government investments.

- Strategic partnerships, mobile healthcare initiatives, and expanded R&D efforts in emerging markets present opportunities for companies to penetrate new regions while catering to growing needs for compact, high-performance diagnostic tools.

Market Drivers

Rising Demand for Portable Diagnostic Solutions in Medical Imaging

The Handheld X-Rays Market grows with the increasing preference for portable diagnostic tools in clinical and field settings. It enables healthcare professionals to perform immediate imaging at the point of care, reducing patient transfer requirements. Emergency medical teams, dental practitioners, and rural health clinics adopt handheld units to enhance accessibility. Advances in miniaturization and battery technology improve device portability without compromising image quality. Rapid imaging capabilities support faster diagnosis and treatment decisions. The ability to conduct diagnostics in non-traditional environments strengthens adoption across diverse healthcare segments.

- For instance, Fujifilm Holdings Corporation launched the FDR Xair portable X-ray unit weighing only 3.5 kg, enabling up to 100 exposures per charge and delivering high-resolution images within 2 seconds.

Technological Advancements Enhancing Image Quality and Workflow Efficiency

Innovations in detector technology and digital imaging software drive adoption in the Handheld X-Rays Market. It benefits from enhanced image resolution, lower radiation exposure, and improved user interfaces. Integration with wireless data transfer systems enables instant sharing of images with radiologists and specialists. AI-powered image enhancement tools assist in accurate interpretation and diagnostic precision. Upgrades in ergonomic design improve ease of handling, reducing operator fatigue during extended use. Compatibility with electronic medical record systems streamlines workflow and supports efficient patient management.

- For instance, Thales Group introduced the Pixium Portable EZ-C detector series with a 35 × 43 cm model weighing 2.8 kg and offering 150-micron pixel pitch for enhanced clarity, integrated with wireless PACS connectivity for real-time imaging access.

Growing Application in Dental, Orthopedic, and Veterinary Practices

The Handheld X-Rays Market expands with rising demand in dental clinics, orthopedic care, and veterinary medicine. It offers precise imaging for fracture detection, dental cavity assessment, and pre-surgical planning. Veterinary applications gain traction in both small animal and equine care due to ease of use in field conditions. Dental practitioners adopt handheld units for chairside diagnostics, improving patient consultation efficiency. Orthopedic specialists benefit from portable devices for sports medicine and emergency injury evaluation. Broader application diversity strengthens market penetration across multiple healthcare domains.

Increasing Adoption in Industrial and Security Screening

Beyond healthcare, the Handheld X-Rays Market sees growth in industrial inspection and security screening applications. It supports non-destructive testing of materials, welds, and structural components in manufacturing and construction. Security agencies use handheld systems for baggage, cargo, and package inspection in high-security areas. Portable X-ray devices enable field verification in remote or hazardous environments where stationary systems are impractical. Advancements in ruggedized designs extend operational reliability in challenging conditions. The versatility of these devices across sectors reinforces their market potential.

Market Trends

Integration of AI and Digital Imaging Capabilities

The Handheld X-Rays Market adopts artificial intelligence and advanced digital imaging tools to improve diagnostic accuracy and workflow efficiency. It leverages AI algorithms for automated image enhancement, noise reduction, and anomaly detection. Digital connectivity allows instant image transfer to cloud platforms or hospital PACS for remote consultations. Real-time analysis supports faster clinical decision-making and reduces the likelihood of diagnostic errors. AI-driven features expand usage in resource-limited settings by assisting less experienced operators. These capabilities align with the industry’s shift toward precision diagnostics and connected healthcare ecosystems.

- For instance, in December 2024, Konica Minolta Healthcare Americas integrated BoneView AI into its mKDR Xpress mobile X-ray system, enabling automated fracture detection with analysis completed in under 30 seconds for over 50 anatomical regions.

Advancements in Lightweight and Ergonomic Designs

Continuous improvements in device design influence adoption trends in the Handheld X-Rays Market. It benefits from the development of lighter, more compact units that reduce operator fatigue and enhance maneuverability. Innovations in materials and component integration enable powerful imaging performance without added bulk. Enhanced ergonomics support single-handed operation, making devices more suitable for mobile clinics, emergency services, and field inspections. Long-lasting battery life and rapid recharge capabilities improve device uptime. These design enhancements contribute to broader usability across medical, veterinary, and industrial environments.

- For instance, the Fujifilm FDR Xair portable X‑ray unit weighs only about 3.5 kg and supports approximately 100 exposures on a full battery charge, with the power pack recharging in roughly 4 hours

Growing Preference for Low-Dose Radiation Technology

Radiation safety remains a significant trend shaping the Handheld X-Rays Market. It advances with the integration of low-dose imaging technologies that minimize patient and operator exposure. Digital detectors with higher sensitivity enable clear images at reduced exposure levels. This trend supports regulatory compliance and aligns with global safety guidelines. Low-dose systems are particularly beneficial in pediatric care, dental practices, and repeated imaging scenarios. Manufacturers emphasize safety features such as built-in shielding and dose tracking software to meet evolving industry standards.

Expansion into Non-Medical Applications

The Handheld X-Rays Market witnesses expanding applications in industrial inspection, aerospace, and security sectors. It plays a critical role in non-destructive testing for structural integrity assessments in manufacturing and construction. Portable X-ray systems are increasingly deployed in customs, border control, and event security for rapid screening of goods and equipment. Their mobility enables inspection in remote or high-risk locations where fixed systems are impractical. Enhanced imaging clarity and ruggedized designs increase operational reliability in challenging environments. This diversification of end-use applications broadens the market’s growth potential.

Market Challenges Analysis

Regulatory Compliance and Certification Barriers

The Handheld X-Rays Market faces significant challenges in meeting stringent regulatory requirements across different regions. It must comply with standards from agencies such as the FDA, CE, and IEC, which demand extensive testing, documentation, and certification before market entry. Navigating these processes can delay product launches and increase development costs. Differences in safety and performance regulations between countries create further complexity for global manufacturers. Compliance also requires ongoing updates to product design and documentation as regulations evolve. Smaller companies may struggle to allocate resources for these regulatory demands, impacting competitiveness and market penetration.

High Acquisition Costs and Maintenance Demands

Affordability and upkeep present ongoing obstacles for wider adoption in the Handheld X-Rays Market. It often involves high initial purchase costs, which can limit accessibility for smaller clinics, veterinary practices, and industrial users in cost-sensitive regions. Maintenance requirements, including calibration, battery replacement, and software updates, add to total ownership expenses. The need for specialized training to ensure safe and effective operation can slow implementation, particularly in emerging markets. Limited availability of spare parts and authorized service centers can extend downtime during repairs. These factors collectively challenge broader adoption despite the technology’s diagnostic and operational benefits.

Market Opportunities

Rising Demand in Point-of-Care and Remote Healthcare Settings

The Handheld X-Rays Market presents significant growth potential with the expanding use of portable diagnostic solutions in point-of-care and remote healthcare environments. It enables faster diagnosis in emergency departments, rural clinics, and disaster response scenarios where access to traditional imaging facilities is limited. The portability and ease of use make these systems valuable for mobile medical units and home healthcare providers. Growing investments in telehealth integration create opportunities for transmitting X-ray results instantly to specialists for rapid evaluation. The demand for compact, battery-operated devices that maintain image quality aligns with healthcare systems’ goals to improve patient outcomes. Manufacturers focusing on lightweight designs and wireless connectivity can capture emerging opportunities in underserved regions.

Expansion into Veterinary, Dental, and Industrial Applications

Diversification into non-traditional sectors offers substantial opportunity for the Handheld X-Rays Market. It finds growing adoption in veterinary medicine for on-site diagnostics in equine care, small animal clinics, and wildlife rehabilitation. Dental practices increasingly adopt handheld units to streamline imaging in small spaces and reduce patient repositioning. In industrial applications, these devices support non-destructive testing for manufacturing, construction, and security inspections. The versatility of handheld units to operate in diverse field conditions broadens their addressable market. Manufacturers introducing specialized software, ruggedized casings, and industry-specific imaging modes can strengthen their presence across multiple verticals. This multi-sector expansion increases resilience against fluctuations in healthcare demand.

Market Segmentation Analysis:

By Device Type

The Handheld X-Rays Market segments by device type into digital handheld X-ray systems and analog handheld X-ray systems. Digital models lead due to their ability to produce high-resolution images with immediate viewing capability, enabling faster diagnostic decisions. They integrate seamlessly with picture archiving and communication systems (PACS) and electronic medical records (EMR) platforms, enhancing workflow efficiency. Analog devices maintain relevance in cost-sensitive markets where basic imaging functions meet operational requirements. The adoption of battery-powered and lightweight designs improves portability and expands usage in mobile health and field operations. Technological advancements in detector sensitivity and wireless data transfer further strengthen the appeal of digital devices.

- For instance, the Fujifilm FDR Xair XD2000 handheld digital unit weighs approximately 3.5 kg (including battery), delivers around 100 radiographic shots per full charge, and features a 450 W generator operating at 90 kV and 5 mA

By Intended Use

Segmentation by intended use includes medical, dental, veterinary, and industrial purposes. The medical segment dominates due to the growing need for portable imaging in emergency medicine, orthopedics, and rural healthcare. Dental practices adopt handheld devices for intraoral imaging, particularly in clinics with limited space or mobile dental units. Veterinary applications benefit from field-ready systems that allow rapid diagnosis in equine, small animal, and exotic pet care. Industrial use covers non-destructive testing in sectors such as aerospace, manufacturing, and construction, where on-site inspections are essential. It meets specific performance requirements in each intended use, supporting diverse industry adoption. Manufacturers tailoring features like imaging modes and ergonomic design to each segment can capture broader demand.

- For instance, Shenzhen Mindray’s MobiEye 700 handheld X-ray system weighs 3.6 kg, operates at up to 110 kV with 40 mA output, and supports over 220 exposures per full battery charge, making it suitable for mobile medical and industrial inspections in remote locations

By Applications

The Handheld X-Rays Market serves applications in diagnostic imaging, surgical guidance, emergency response, and security screening. Diagnostic imaging remains the largest application, driven by the demand for quick and accurate results at the point of care. Surgical guidance applications use handheld systems for intraoperative imaging to ensure precision in orthopedic and dental procedures. Emergency response teams deploy portable units during disaster relief, mass casualty incidents, and battlefield medical support. Security and customs agencies use handheld X-ray devices for rapid inspection of cargo, baggage, and packages in high-risk environments. It supports critical decision-making in both clinical and non-clinical contexts, with design versatility enabling operation in challenging environments. The combination of portability, image quality, and connectivity features sustains its value across multiple high-impact use cases.

Segments:

Based on Device Type

- Backscatter X-Ray

- C-arm X-Ray

- True DR HandheldX-Ray

Based on Intended Use

- Industrial

- Medical

- Security Defense

Based on Applications

- Security Screening

- Cargo Inspection

- Medical Diagnostics

- Construction

- Non- Destructive Testing

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32.6% of the Handheld X-Rays Market share, driven by advanced healthcare infrastructure, high adoption of portable diagnostic devices, and strong regulatory compliance frameworks. The United States leads regional demand due to the widespread integration of digital handheld X-ray units in hospitals, urgent care centers, dental clinics, and veterinary practices. Federal initiatives promoting early diagnosis and portable imaging technologies contribute to consistent procurement. Canada follows with steady adoption across rural and remote healthcare settings, where mobility and compact form factors address accessibility challenges. The presence of established manufacturers, robust reimbursement policies, and integration with digital health platforms strengthens the region’s growth trajectory. High investment in R&D also supports the launch of advanced battery-powered and wireless-enabled handheld X-ray devices.

Europe

Europe holds 28.4% of the global market, supported by stringent diagnostic imaging regulations, emphasis on radiation safety, and growing use in point-of-care environments. Germany, the United Kingdom, and France are key markets adopting portable X-ray units in hospital wards, emergency departments, and field medicine. The increasing prevalence of dental care demand across clinics and mobile dental units further drives adoption. In Eastern Europe, the expansion of mobile health services enhances accessibility to underserved communities. The region benefits from EU funding programs for healthcare modernization and investments in radiation dose reduction technologies. Integration with picture archiving and communication systems (PACS) ensures compliance with health data protection requirements while improving workflow efficiency.

Asia-Pacific

Asia-Pacific captures 24.9% of the Handheld X-Rays Market share, fueled by rising healthcare investments, expanding rural healthcare networks, and increased focus on portable imaging solutions. China, Japan, and India are leading adopters, driven by high patient volumes and growing infrastructure for community-based diagnostics. Dental and veterinary sectors contribute significantly, particularly in urbanizing regions where clinics seek space-saving, mobile imaging solutions. Governments in Southeast Asia implement programs to equip rural health facilities with cost-effective handheld X-ray devices, improving early disease detection rates. The region also experiences growing adoption in security applications, including customs inspections and border control. The availability of competitively priced domestic manufacturing boosts accessibility and accelerates adoption in emerging economies.

Latin America

Latin America represents 8.7% of the market share, with Brazil, Mexico, and Argentina driving growth through increased adoption in public health systems and mobile medical units. Handheld X-ray systems play a vital role in rural outreach programs, dental care initiatives, and veterinary services. The growing prevalence of mobile clinics and field hospitals enhances demand for compact imaging solutions. Governments and non-governmental organizations (NGOs) support procurement for disaster response and infectious disease control. Despite budget constraints, partnerships with international suppliers and funding agencies support gradual market expansion. Integration with telemedicine platforms further improves diagnostic reach across remote areas.

Middle East & Africa

The Middle East & Africa accounts for 5.4% of the global market, with adoption concentrated in Gulf Cooperation Council (GCC) countries and select African nations. Portable X-ray devices address diagnostic gaps in regions with limited fixed imaging infrastructure. Saudi Arabia and the UAE lead in procurement for hospitals, dental facilities, and mobile screening units. In Africa, NGOs and health agencies deploy handheld systems in rural clinics, refugee camps, and emergency medical missions. Demand is supported by initiatives to combat infectious diseases through early imaging-based diagnosis. The market faces challenges related to training and maintenance, but ongoing investments in healthcare modernization and mobile diagnostic capabilities sustain growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thales Group

- Fujifilm Holdings Corporation

- Ziehm Imaging GmbH

- Medtronic plc

- Philips Healthcare

- Varian Medical Systems, Inc

- Konica Minolta, Inc

- Carestream Health

- Shenzhen Mindray BioMedical Electronics Co., Ltd.

- Hologic, Inc

Competitive Analysis

Leading players in the Handheld X-Rays Market include Fujifilm Holdings Corporation, Philips Healthcare, Hologic, Inc., Varian Medical Systems, Inc., Carestream Health, Medtronic plc, Konica Minolta, Inc., Ziehm Imaging GmbH, Shenzhen Mindray BioMedical Electronics Co., Ltd., and Thales Group, each focusing on advancing portable imaging technologies with enhanced resolution, reduced radiation exposure, and seamless integration with digital health platforms. Fujifilm invests in lightweight, battery-operated devices for rapid diagnostics in dental and orthopedic care, while Philips emphasizes ergonomic, wireless-enabled systems to improve workflow efficiency in hospitals and mobile clinics. Hologic strengthens its portfolio with AI-driven imaging for breast and bone health, and Shenzhen Mindray leverages cost-efficient manufacturing to expand in emerging markets. Carestream Health enhances accessibility through portable X-ray systems with cloud-based reporting, Konica Minolta and Ziehm Imaging target high-precision imaging in trauma and emergency care, and Thales Group advances compact X-ray detector technologies for improved image quality.

Recent Developments

- In December 2024, Dynamic Digital Radiography (DDR) technology, which allows visualization of anatomy in motion, saw expanded clinical use. Scientific papers presented at RSNA 2024 highlighted DDR, emphasizing its ability to improve diagnosis by showing dynamic movement. The technology is compatible with mobile systems like AeroDR TX m01 and mKDR Xpress

- In December 2024, Konica Minolta Healthcare Americas announced a strategic partnership with Gleamer to integrate its BoneView AI solution into its lineup of advanced digital radiography systems—including the KDR Advanced U‑Arm, KDR Flex Overhead X‑ray System, and mKDR Xpress Mobile X‑ray system.

- In March 2023, Thales Group introduced the Pixium Portable EZ-C series featuring ultra-lightweight wireless detectors. The 24 × 30 cm model weighs 1.6 kg and the 35 × 43 cm unit weighs 2.8 kg.

Market Concentration & Characteristics

The Handheld X-Rays Market shows moderate concentration, with competition driven by a mix of multinational corporations and specialized imaging device manufacturers. It features a balance between established medical technology companies with extensive distribution networks and smaller innovators focusing on portable imaging advancements. Product differentiation relies on image resolution, battery efficiency, radiation safety, and integration with digital health platforms. The market benefits from technological convergence, combining lightweight ergonomics with advanced sensor and imaging software. Regulatory compliance and certification remain essential for market entry, influencing product development timelines. It attracts strategic collaborations between device manufacturers and healthcare providers to accelerate adoption in clinical, dental, and veterinary applications. Growing demand for point-of-care diagnostics and mobile health services reinforces the competitive landscape, while continuous investment in AI-assisted image analysis and wireless connectivity enhances operational value for end users.

Report Coverage

The research report offers an in-depth analysis based on Device Type, Intended Use, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for portable imaging devices will increase with the expansion of point-of-care diagnostics.

- AI integration in handheld X-ray systems will enhance image interpretation accuracy.

- Battery technology improvements will extend device operating hours and reduce downtime.

- Wireless connectivity will enable faster image sharing and integration with hospital systems.

- Adoption in dental and veterinary practices will rise due to compact design and mobility.

- Regulatory approvals for advanced low-radiation devices will accelerate global market penetration.

- Growth in home healthcare services will expand usage beyond traditional hospital settings.

- Emerging markets will adopt handheld X-rays to address infrastructure and mobility challenges.

- Technological advances will improve image quality and reduce radiation exposure.

- Strategic partnerships between device makers and healthcare providers will drive innovation and distribution.