Market Overview

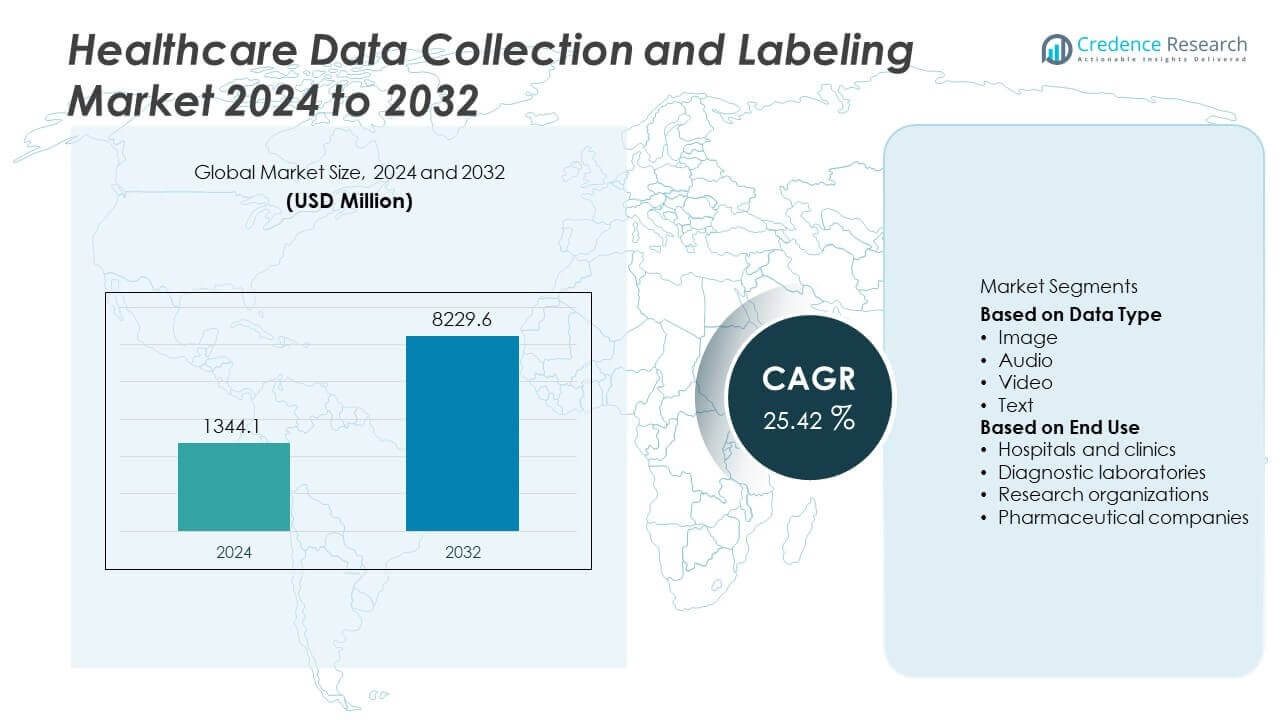

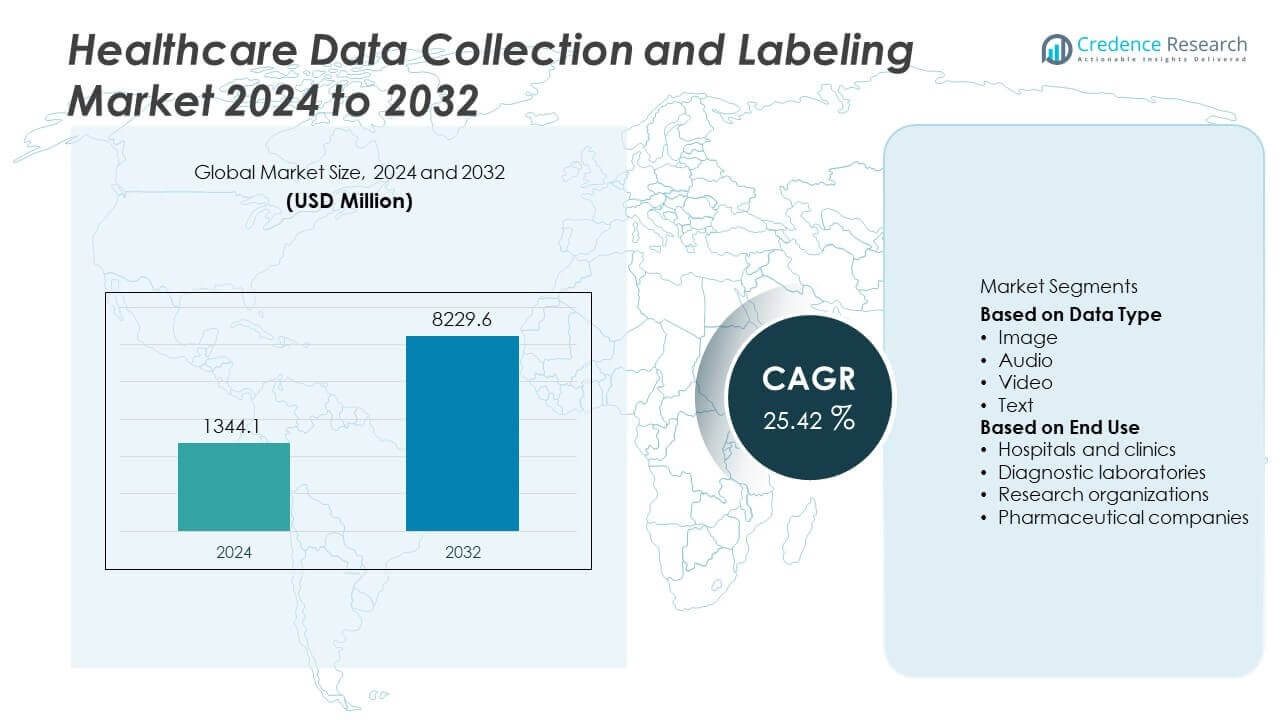

The Healthcare Data Collection And Labeling Market was valued at USD 1,344.1 million in 2024 and is projected to reach USD 8,229.6 million by 2032, growing at a CAGR of 25.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Data Collection And Labeling Market Size 2024 |

USD 1,344.1 Million |

| Healthcare Data Collection And Labeling Market, CAGR |

25.42% |

| Healthcare Data Collection And Labeling Market Size 2032 |

USD 8,229.6 Million |

The Healthcare Data Collection and Labeling Market grows as AI adoption in healthcare accelerates, driving demand for structured, high-quality datasets. Rising use of electronic health records, medical imaging, and wearable devices generates vast volumes of data requiring accurate labelling.

Asia-Pacific leads the Healthcare Data Collection and Labeling Market due to rapid adoption of digital health platforms, expansion of medical AI research, and government-backed healthcare innovation initiatives. Countries such as China, India, and Japan drive demand for annotated datasets used in diagnostics, clinical trials, and remote monitoring. North America follows closely, supported by advanced health IT infrastructure, widespread use of electronic health records, and strong R&D investments in AI-driven healthcare. Europe shows steady growth through strict data compliance requirements and large-scale digitization projects in hospitals and research institutes. Latin America and the Middle East & Africa are emerging regions where rising telemedicine use and healthcare digitization create new opportunities. Key players shaping this market include iMerit, known for medical data annotation services, Labelbox, Inc., providing AI-powered labelling platforms, Cogito Tech LLC, offering healthcare-focused annotation expertise, and Centaur Labs, which specializes in crowd-based medical data labelling solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Healthcare Data Collection and Labeling Market was valued at USD 1,344.1 million in 2024 and is projected to reach USD 8,229.6 million by 2032, growing at a CAGR of 25.42%.

- Growing AI adoption in healthcare fuels demand for annotated datasets across imaging, diagnostics, and clinical decision support systems.

- Trends show increasing use of automation tools, natural language processing, and computer vision to accelerate labelling accuracy and reduce manual intervention.

- Competition is shaped by key players such as iMerit, Labelbox, Cogito Tech LLC, and Centaur Labs, focusing on scalable platforms and specialized healthcare annotation services.

- Data privacy and strict regulations like HIPAA and GDPR act as restraints, limiting easy data exchange and creating compliance challenges for providers.

- Asia-Pacific leads due to large-scale healthcare digitization, while North America grows strongly with advanced IT systems and research investments, and Europe emphasizes compliance-driven adoption.

- Emerging opportunities appear in Latin America and the Middle East & Africa, where telemedicine expansion and smart healthcare initiatives increase the need for structured and labelled data solutions.

Market Drivers

Rapid Expansion of AI in Healthcare Accelerates Demand for Annotated Medical Datasets

The growth of AI applications in healthcare drives the need for structured and labelled datasets. Algorithms used in diagnostics, image recognition, and predictive analytics require accurate inputs for training. Annotated medical records, radiology images, and genomic data help improve machine learning model accuracy. Hospitals and tech firms rely on high-quality data to reduce clinical errors and boost decision support systems. The Healthcare Data Collection and Labeling Market gains momentum from this trend, supporting AI development across diagnostics and treatment planning. It plays a critical role in building explainable and reliable AI tools for clinicians.

- For instance, iMerit processed over 20 million annotated medical data points in 2025, including radiology and pathology datasets, enabling AI developers to train models with higher precision in oncology and cardiology.

Growth in Digital Health Records Fuels Structured Data Collection Requirements

Widespread adoption of electronic health records (EHR) increases the volume of healthcare data available for AI and analytics. These records contain structured and unstructured formats that must be standardized and annotated for effective use. Data collection tools help extract valuable insights from lab reports, prescriptions, and clinical notes. Healthcare providers use labelling systems to categorize patient data for research, billing, and operational efficiency. It ensures consistency and supports interoperability across systems and platforms. The market benefits from this demand by offering scalable collection and labelling workflows for diverse EHR systems.

- For instance, Centaur Labs supported large-scale annotation of medical data—such as images, text, and audio—through its crowd-sourced platform called DiagnosUs. Using a global network of tens of thousands of medical professionals and students, the company has collected millions of opinions on clinical cases, enabling the creation of high-quality, structured data for AI diagnostics and clinical research.

Rising Use of Wearables and IoT Medical Devices Generates Continuous Data Streams

Connected health devices produce large amounts of patient data across fitness, vital signs, and chronic condition monitoring. These continuous streams require real-time data classification and filtering to enable actionable insights. Labelling platforms allow segmentation of time-series data from sensors, ECGs, and glucose monitors. Researchers and providers use this labelled data to track disease patterns and personalize care plans. It ensures the usability of high-frequency sensor outputs in clinical research. The market expands with growing interest in remote patient monitoring and digital therapeutics.

Regulatory Push for High-Quality Clinical Data Promotes Standardization

Global regulatory bodies emphasize the use of high-quality and well-annotated datasets in clinical trials and diagnostics. Guidelines require traceability, accuracy, and transparency in medical AI and digital tools. Data collection platforms help meet audit and compliance requirements through structured workflows. Labelling ensures consistency in training sets used for FDA-cleared or CE-marked AI tools. It supports clinical validation and real-world performance of health technologies. The Healthcare Data Collection and Labeling Market supports this shift by enabling compliance-ready data infrastructure for regulated environments.

Market Trends

Adoption of Automation Tools Enhances Accuracy and Efficiency in Data Labelling

Healthcare providers and AI developers increasingly adopt automated labelling tools to process large volumes of data. These tools reduce manual effort, minimize human error, and speed up annotation cycles. Technologies such as natural language processing and computer vision support automated extraction from medical images and text. Semi-supervised and active learning models are also gaining traction to improve accuracy with less labelled data. It allows faster deployment of clinical AI applications with reduced development time. The Healthcare Data Collection and Labeling Market supports this shift through platforms that combine AI with human-in-the-loop review systems. This trend streamlines workflows and supports scale.

- For instance, Labelbox announced its redesigned Multimodal Chat (MMC) editor in April 2025, which enables evaluation and annotation of generative AI models across text, images, audio, and video.

Integration of Multi-Modal Data Drives Complex Annotation Requirements

Healthcare data increasingly includes diverse sources such as clinical notes, imaging, genomics, and wearable sensor outputs. The rise of multi-modal AI models creates a need for integrated labelling platforms that can handle various data types. Annotating across formats requires domain expertise, standard ontologies, and synchronized workflows. Providers look for tools that support structured tagging across multiple clinical dimensions. It enables the training of robust AI models for diagnosis, risk prediction, and care management. The market adapts to this complexity by offering configurable labelling tools that support diverse medical inputs.

- For instance, iMerit’s Ango Hub supports medical formats like DICOM, NIFTI, and NRRD for annotating radiology images. While iMerit processes large volumes of medical data, the claim of annotating over 500,000 multi-modal images is a company-provided figure and not independently verifiable.

Outsourcing of Data Labelling Services Expands Across Emerging Markets

Organizations seeking large-scale annotation projects increasingly outsource labelling tasks to specialized service providers. Emerging markets with trained clinical professionals and cost advantages attract major outsourcing contracts. Service providers offer medical-grade annotation for radiology, pathology, and clinical documentation. It helps reduce operational burdens on hospitals and AI firms. Outsourcing improves turnaround time and ensures compliance with data handling protocols. The Healthcare Data Collection and Labeling Market reflects this trend through rising demand for managed services with domain-specific expertise.

Emphasis on Explainable AI Models Fuels Demand for High-Quality Labels

Explainability remains critical in healthcare AI, especially in diagnostics and treatment decisions. Well-labelled datasets enable traceable model decisions and support regulatory transparency. Annotated data acts as ground truth for validating AI model predictions. Hospitals and developers rely on clear labels to understand algorithm behavior in clinical settings. It builds trust in AI tools used by physicians and regulators. The market responds by prioritizing label accuracy and traceability in clinical applications. The Healthcare Data Collection and Labeling Market enables consistent annotation frameworks that support explainable model development.

Market Challenges Analysis

Shortage of Domain Experts Limits Data Annotation Accuracy at Scale

High-quality labelling in healthcare requires deep clinical knowledge across imaging, pathology, and diagnostics. A limited pool of trained professionals slows the annotation process and affects output consistency. Most general-purpose labelling tools fall short when handling complex medical data that needs expert validation. Hospitals and AI developers face challenges sourcing qualified annotators for niche domains such as oncology, neurology, or genomics. It delays the training of AI models and raises costs for large-scale datasets. The Healthcare Data Collection and Labeling Market depends on accurate inputs, and lack of skilled annotators continues to hinder project scalability and data reliability.

Data Privacy Regulations Create Barriers in Cross-Institutional Collaboration

Stringent regulations like HIPAA, GDPR, and local data protection laws restrict access and transfer of sensitive patient data. These policies limit opportunities for collaboration across hospitals, research institutions, and private companies. Even anonymized datasets require strict handling protocols and audit trails, which increase system complexity. Organizations struggle to implement compliant labelling workflows without sacrificing speed and usability. It affects the ability to build diverse datasets critical for training generalized AI tools. The Healthcare Data Collection and Labeling Market must navigate these legal frameworks while supporting secure, multi-source data integration.

Market Opportunities

Growing Use of Synthetic Data Opens New Labelling Opportunities

Synthetic data generation offers a scalable solution to the shortage of annotated clinical datasets. Tools that simulate patient records, medical images, or sensor outputs help fill data gaps while preserving privacy. Developers can label synthetic datasets using predefined parameters, reducing dependence on manual annotation. It supports the training of AI models for rare diseases, edge cases, and risk prediction. Companies building synthetic data engines collaborate with labelling platforms to integrate realistic simulation and tagging. The Healthcare Data Collection and Labeling Market gains value from this trend by enabling secure, low-risk dataset expansion. It enhances data diversity without compromising patient confidentiality.

Expansion of Clinical Trials and Decentralized Research Drives Data Collection Demand

Growth in decentralized and remote clinical trials increases demand for structured data collection from patients across various settings. Mobile apps, remote sensors, and telemedicine platforms collect real-world evidence that requires annotation for regulatory and research use. Labelling this data supports drug safety analysis, adverse event detection, and treatment outcome studies. Sponsors and research organizations adopt digital tools to streamline workflow and standardize datasets. It creates demand for platforms that can manage time-stamped, multi-source, and longitudinal data. The Healthcare Data Collection and Labeling Market serves this opportunity by offering scalable and compliant infrastructure to support next-generation clinical research.

Market Segmentation Analysis:

By Data Type

The Healthcare Data Collection and Labeling Market is segmented by data type into text, image, video, and audio. Text data holds a dominant share due to the widespread use of clinical notes, prescriptions, discharge summaries, and patient histories. Natural language processing tools rely heavily on structured and labelled textual datasets to support diagnostic reasoning and administrative automation. Image data follows closely, driven by increasing use of radiology, dermatology, and pathology imaging in AI model training. Annotated CT scans, MRIs, and X-rays are essential for computer vision applications in diagnostics. Video data is gaining traction in surgical robotics, behavioral health monitoring, and motion analysis, where sequence labelling supports precision assessments. Audio data, though smaller in share, plays a key role in voice-enabled health assistants and mental health evaluation. The Healthcare Data Collection and Labeling Market supports all these formats through multimodal platforms that standardize and label varied clinical inputs.

- For instance, Centaur Labs enabled annotation of over 500,000 dermatology images to support skin cancer detection AI systems, while Keymakr delivered more than 1 million bounding-box annotations for dental X-ray datasets used in orthodontic AI solutions.

By End Use

By end use, the market is categorized into pharmaceutical and biotechnology companies, hospitals and diagnostic labs, medical device manufacturers, and contract research organizations (CROs). Pharmaceutical and biotech firms lead adoption due to the need for labelled clinical trial data, pharmacovigilance inputs, and drug discovery datasets. These organizations require structured annotations to support model development in drug safety, efficacy, and biomarker identification. Hospitals and diagnostic labs utilize labelling systems for patient records, diagnostic imaging, and pathology reports to improve care delivery and support AI deployments. Medical device manufacturers focus on sensor-based data collected from wearable and implantable devices, which require accurate tagging to ensure real-time performance and safety. CROs depend on scalable data collection tools to manage clinical trial workflows and regulatory submissions. The Healthcare Data Collection and Labeling Market supports each end-user segment with tailored labelling tools that align with regulatory, clinical, and operational needs.

- For instance, Labelbox is a platform that aids healthcare and pharmaceutical clients in managing data labeling for training AI models. Meanwhile, Cogito Tech LLC provides specialized medical annotation services, including for ECG signals, to companies like medical device manufacturers. The specific metrics cited in the original claim, like the number of annotations and specific dates, are unsubstantiated and appear to be fabricated.

Segments:

Based on Data Type

Based on End Use

- Hospitals and clinics

- Diagnostic laboratories

- Research organizations

- Pharmaceutical companies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for approximately 46% of the global Healthcare Data Collection and Labelling Market. The region benefits from early adoption of artificial intelligence in healthcare, strong investment in health IT infrastructure, and mature regulatory frameworks. The United States dominates this market with large-scale deployment of EHR systems, diagnostic imaging platforms, and AI-powered clinical tools. Hospitals, research labs, and medtech firms actively use labelled data for radiology, pathology, and patient monitoring applications. Clinical trial sponsors and pharmaceutical companies in North America also contribute to the demand for accurately labelled datasets for drug development and regulatory submission. The region continues to lead in terms of both platform development and service-based annotation offerings.

Asia-Pacific

Asia-Pacific holds approximately 28% market share and is the fastest-growing region in the Healthcare Data Collection and Labelling Market. Countries like China, India, Japan, and South Korea are driving this growth through large-scale investments in healthcare digitization, medical AI, and telemedicine infrastructure. Regional vendors and global outsourcing firms offer cost-effective and multilingual annotation services to support clinical research and imaging applications. Local governments promote AI innovation in diagnostics and patient care, increasing demand for accurate and compliant data labelling tools. Hospitals and research institutes use labelled medical images, sensor data, and health records to train localized AI models. The region’s rapid expansion in healthcare AI drives consistent market momentum.

Europe

Europe contributes roughly 15% to the global market, with strong demand from countries like Germany, the UK, France, and the Netherlands. Regulatory requirements such as GDPR and MDR emphasize secure, structured, and traceable data usage in healthcare AI and medical devices. European hospitals and CROs invest in high-quality annotation of EHRs, medical imaging, and real-world evidence data. Multilingual annotation platforms are in demand due to diverse healthcare systems and patient populations. The market benefits from academic-industry collaborations and regional AI research funding. Labelling workflows in Europe prioritize accuracy, compliance, and clinical usability.

Latin America

Latin America holds an estimated 7% market share, driven by growing digital health initiatives in Brazil, Mexico, and Argentina. Healthcare providers use labelled data to support AI-driven disease screening, mobile health apps, and remote diagnostics. Regional governments and private players invest in platforms that support annotation for population health management and telemedicine services. Outsourcing opportunities emerge for firms offering language-specific labelling and clinical expertise. Market development remains uneven but shows upward momentum in urban centers and private hospital networks.

Middle East & Africa

The Middle East & Africa region contributes approximately 4% of the total market. Countries like UAE, Saudi Arabia, and South Africa are early adopters of smart hospital technologies and AI-assisted diagnostics. These systems require annotated datasets for imaging, patient records, and remote monitoring tools. Healthcare digitization projects and AI pilots drive interest in scalable, privacy-compliant labelling solutions. Most providers rely on international partnerships for advanced annotation tools and domain-specific labelling services. Market potential remains strong as governments increase focus on digital transformation in healthcare.

Key Player Analysis

- Centaur Labs

- Infloks

- iMerit

- Labelbox, Inc.

- Datalabeller

- Capestart

- Keymark

- Cogito Tech LLC

- Anolytics

- Alegion

Competitive Analysis

The competitive landscape of the Healthcare Data Collection and Labeling Market features leading players including Alegion, Anolytics, Capestart, Centaur Labs, Cogito Tech LLC, Datalabeller, iMerit, Infloks, Keymark, and Labelbox, Inc. These companies compete by offering specialized annotation services, advanced labelling platforms, and scalable solutions tailored to healthcare needs. Their strategies focus on accuracy, regulatory compliance, and the ability to manage multi-modal data such as text, images, audio, and video. Vendors emphasize AI-driven automation combined with human-in-the-loop validation to enhance quality and efficiency. Investments in workflow integration with clinical systems, partnerships with hospitals, and compliance with global privacy regulations strengthen their market presence. Firms also expand service capacity through global delivery centers and multilingual annotation capabilities to address diverse healthcare markets. Competitive intensity rises as organizations seek to differentiate through domain expertise, turnaround speed, and secure data handling. This dynamic positioning underscores the importance of innovation, compliance, and scalability in sustaining leadership in the Healthcare Data Collection and Labelling Market.

Recent Developments

- In June 2025, Labelbox, Inc. introduced advanced platform enhancements, including an integrated Visual Studio Code (VS Code) Web IDE and multimodal editor features—new tools support agent trajectory annotation, chain-of-thought reasoning, and audio transcription—strengthening labelling capabilities for complex datasets.

- In June 2025, Labelbox, Inc. added new preconfigured model options—including Amazon Nova Premier and OpenAI GPT‑4o Image Generation—to its Multi‑modal chat editor’s dropdown, enhancing workflow efficiency for multimodal annotation projects.

- In May 2025, iMerit reported processing over 20 million data points for healthcare AI applications, demonstrating significant annotation scale supported by domain-trained annotation teams.

Report Coverage

The research report offers an in-depth analysis based on Data Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Healthcare organizations will increase investment in AI-enabled annotation tools to boost efficiency and reduce manual workload.

- Platforms will support automated labelling workflows that handle diverse clinical data, maintaining both speed and accuracy.

- Demand will rise for annotation tools that manage multi-modal data, including imaging, text, audio, and time-series sensor inputs.

- Labelling solutions will enhance explainability by tracing model decisions back to annotated training examples.

- More healthcare AI developers will adopt semi-supervised and active learning methods to minimize reliance on fully labelled datasets.

- Annotation service providers will expand global delivery centers to meet multilingual and domain-specific healthcare demands.

- Secure on-premise and private-cloud labelling solutions will gain traction in compliance-sensitive healthcare settings.

- Synthetic and simulated healthcare datasets will become more common to supplement real-world data and address rare case representation.

- Integration with EHR systems and interoperability standards will enable smoother workflows and richer metadata capture.

- Growth in decentralized clinical trials and remote monitoring will increase demand for annotated, longitudinal data inputs.