Market Overview

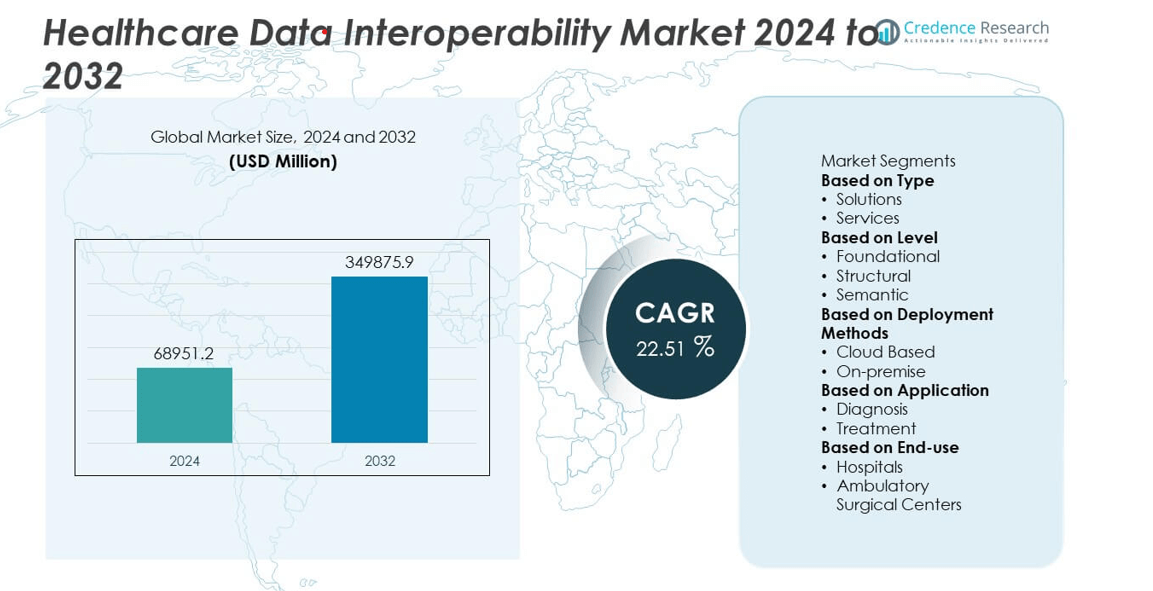

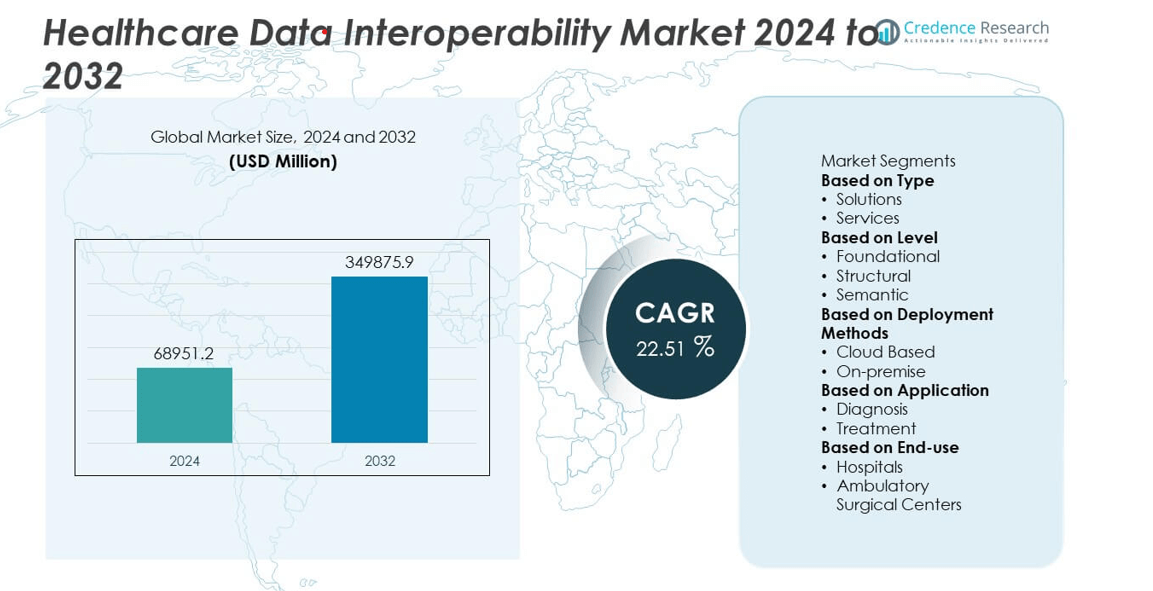

Healthcare Data Interoperability Market size was valued at USD 68.951.2 million in 2024 and is projected to reach USD 349,875.9 million by 2032, growing at a CAGR of 22.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Data Interoperability Market Size 2024 |

USD 68.951.2 million |

| Healthcare Data Interoperability Market , CAGR |

22.51% |

| Healthcare Data Interoperability Market Size 2032 |

USD 349,875.9 million |

The Healthcare Data Interoperability Market grows rapidly due to rising adoption of electronic health records (EHRs), increasing demand for seamless data exchange, and supportive government regulations promoting standardized healthcare IT systems. It benefits from trends such as the integration of cloud-based platforms, API-driven solutions, and advanced analytics.

The Healthcare Data Interoperability Market demonstrates significant growth across North America, Europe, and Asia Pacific due to increasing adoption of electronic health records, digital health initiatives, and government-led standardization programs. North America leads with advanced healthcare infrastructure and strong regulatory support, while Europe benefits from initiatives promoting cross-border health data exchange. The Asia Pacific region exhibits rapid growth driven by expanding digital health infrastructure, rising telemedicine adoption, and growing demand for remote patient monitoring. Key players driving innovation and adoption in this market include Epic Systems Corporation, Cerner (Oracle), InterSystems Corporation, and Koninklijke Philips N.V. These companies focus on developing scalable, secure, and interoperable solutions that integrate legacy systems, enhance clinical decision-making, and enable real-time data sharing. Strategic partnerships, technology advancements, and expansion into emerging regions further strengthen their market presence and contribute to the overall growth of healthcare data interoperability worldwide.

Market Insights

- The Healthcare Data Interoperability Market was valued at USD 68.951.2 million in 2024 and is projected to reach USD 349,875.9 million by 2032, growing at a CAGR of 22.51%.

- Rising adoption of electronic health records and digital health solutions drives the market by enabling seamless data exchange and improving patient outcomes.

- Increasing need for efficient information sharing across hospitals, clinics, and laboratories supports collaborative care and reduces redundant testing.

- Cloud-based platforms, API-driven solutions, and integration of advanced analytics and AI are key trends shaping the market, enhancing real-time access and predictive care.

- Competitive landscape includes major players such as Epic Systems Corporation, Cerner (Oracle), InterSystems Corporation, and Koninklijke Philips N.V., focusing on innovation, partnerships, and regional expansion.

- Market restraints include regulatory compliance challenges, data privacy concerns, technical barriers, and limited standardization across legacy and modern systems.

- Regionally, North America leads with advanced infrastructure and strong regulatory support, Europe grows through cross-border data initiatives, Asia Pacific expands rapidly via telemedicine and digital health investments, while Latin America and Middle East & Africa show emerging opportunities driven by infrastructure development and digital health adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Adoption of Electronic Health Records and Digital Healthcare Solutions Driving Market Expansion

The increasing adoption of electronic health records (EHRs) across hospitals, clinics, and other healthcare facilities significantly drives the Healthcare Data Interoperability Market. It enables seamless sharing of patient information across multiple platforms, enhancing clinical decision-making and operational efficiency. Hospitals aim to reduce medical errors and improve patient outcomes by integrating diverse data systems. Interoperable solutions support real-time access to critical health information, promoting timely interventions. Regulatory frameworks encouraging digital record-keeping further push institutions toward adoption. It helps healthcare providers streamline workflows while maintaining compliance with data security standards. The integration of advanced health IT systems ensures better coordination among multidisciplinary teams.

- For instance, in 2025, Epic Systems Corporation enabled over 1,000 hospitals and 22,000 clinics to transition to TEFCA connectivity using its QHIN, Epic Nexus. This nationwide data-sharing infrastructure facilitates real-time clinical information access and supports standardized interoperability across care networks.

Growing Need for Data Exchange Across Healthcare Providers and Institutions

Healthcare organizations increasingly demand robust solutions for data exchange to support collaborative care. The Healthcare Data Interoperability Market benefits from this need, as it provides secure channels for sharing patient records. It enables physicians, specialists, and laboratories to access consistent and accurate information, improving treatment planning. Efficient data exchange reduces redundant testing and lowers healthcare costs. Institutions prioritize platforms that maintain data integrity while supporting scalability for growing patient populations. It allows providers to respond to emergent healthcare challenges efficiently. Interoperable systems strengthen connections between primary, secondary, and tertiary care providers.

- For instance, In 2025, InterSystems Corporation launched IntelliCare, an AI-powered EHR platform. Designed to deliver real-time data exchange across the healthcare ecosystem, the platform supports interoperability using modern standards like HL7 FHIR. It ensures fast, secure information access for care teams by eliminating traditional IT silos and leveraging AI to streamline workflows.

Regulatory Mandates and Government Initiatives Supporting Interoperability Investments

Government regulations and mandates promoting healthcare data standardization fuel market growth. The Healthcare Data Interoperability Market experiences increased investment due to policies that require secure data sharing and compliance with national standards. It ensures patient privacy while supporting interoperability across public and private healthcare sectors. Funding initiatives encourage adoption of certified health IT solutions and continuous infrastructure upgrades. Regulatory frameworks reduce fragmentation in data management and facilitate nationwide healthcare connectivity. It enables institutions to achieve accreditation and maintain operational transparency. Standardization drives uniformity in clinical documentation, enhancing the overall quality of care.

Integration of Advanced Technologies to Enhance Clinical Decision-Making and Patient Care

Integration of artificial intelligence, analytics, and cloud-based platforms strengthens the Healthcare Data Interoperability Market. It supports predictive insights, population health management, and personalized care delivery. Advanced tools enable healthcare providers to detect trends, monitor patient progress, and optimize resource allocation. Interoperable solutions allow secure storage and rapid retrieval of large datasets. It enhances collaboration between researchers, clinicians, and administrative staff. Adoption of innovative technologies improves patient engagement, reduces errors, and supports evidence-based treatment. The market gains momentum as institutions prioritize systems that deliver both operational efficiency and superior clinical outcomes.

Market Trends

Expansion of Cloud-Based and API-Driven Interoperability Solutions Transforming Healthcare Data Exchange

The Healthcare Data Interoperability Market experiences a significant shift toward cloud-based platforms and API-driven solutions. It enables secure and scalable access to patient records across multiple care settings. Providers leverage cloud infrastructure to store, retrieve, and share data efficiently without heavy reliance on on-premise systems. API-driven models ensure seamless integration between legacy applications and modern health IT systems. It reduces operational complexities and accelerates collaboration among hospitals, laboratories, and insurance providers. Adoption of cloud technologies enhances disaster recovery and data backup capabilities. It allows organizations to maintain continuity of care while supporting digital transformation strategies.

- For instance, In August 2025, Oracle Health (the company name for Cerner, which Oracle acquired in 2022) launched a new AI-powered ambulatory EHR on its cloud-native platform, Oracle Cloud Infrastructure (OCI). This system is distinct from the legacy Cerner Millennium technology and was built from the ground up to feature embedded conversational and voice-activated AI for clinicians.

Increasing Focus on Patient-Centric Data Management and Personalized Care Delivery

Healthcare organizations emphasize patient-centered care, driving trends in interoperable data systems. The Healthcare Data Interoperability Market benefits from this shift, providing tools that centralize patient information. It allows clinicians to access complete medical histories, lab results, and imaging reports in real-time. Centralized data enhances diagnostic accuracy and treatment customization for individual patients. Providers prioritize systems that support patient engagement and consent management. It strengthens communication between patients and care teams, improving adherence to treatment plans. Trend adoption supports better population health monitoring and long-term care strategies.

- For instance, In 2025, Koninklijke Philips N.V. integrated its cardiac diagnostics services with Epic’s Aura platform. This collaboration allows patient ECG results to flow automatically from Philips devices into Epic’s electronic health records (EHRs). The partnership is intended to improve care coordination and patient engagement by streamlining diagnostic workflows and eliminating manual data entry.

Adoption of Standardized Protocols and Open Data Formats Enhancing System Compatibility

The market shows a clear trend toward standardized communication protocols and open data formats. The Healthcare Data Interoperability Market gains momentum as institutions implement HL7, FHIR, and other interoperability standards. It ensures compatibility between diverse healthcare systems and devices. Standardization reduces errors associated with manual data entry and accelerates clinical workflows. Providers achieve more consistent reporting and facilitate regulatory compliance. It improves cross-institution collaboration and supports large-scale health data analytics. Trend adoption strengthens the foundation for future innovations in digital healthcare infrastructure.

Integration of Advanced Analytics, AI, and Machine Learning Driving Intelligent Healthcare Operations

Healthcare providers increasingly deploy advanced analytics, artificial intelligence, and machine learning to extract actionable insights from interoperable data. The Healthcare Data Interoperability Market aligns with this trend, offering platforms that support predictive care and operational optimization. It enables identification of patterns in patient outcomes, resource utilization, and disease progression. Providers rely on intelligent systems to streamline administrative tasks and reduce inefficiencies. It enhances early detection of health risks and supports precision medicine initiatives. Trend adoption empowers organizations to make evidence-based decisions while improving overall patient experience.

Market Challenges Analysis

Complex Regulatory Compliance and Data Privacy Concerns Impeding Seamless Interoperability

The Healthcare Data Interoperability Market faces challenges due to strict regulatory requirements and growing concerns over data privacy. It must navigate multiple standards and guidelines across different regions, which increases implementation complexity. Healthcare providers often struggle to maintain compliance while ensuring efficient data exchange. Integrating diverse systems without compromising patient confidentiality requires substantial investment in security infrastructure. It increases operational costs and demands continuous staff training. Misalignment between local and international data regulations can delay deployment of interoperable solutions. Providers need robust frameworks to mitigate risks while maintaining high-quality patient care.

Technical Barriers and Limited Standardization Hindering Wide-Scale Adoption

Healthcare organizations encounter technical difficulties and limited standardization when adopting interoperable systems. The Healthcare Data Interoperability Market experiences slow integration due to legacy systems and proprietary data formats. It challenges providers to achieve seamless communication across multiple platforms. Insufficient interoperability standards hinder collaboration between healthcare institutions and third-party vendors. It requires additional resources to develop custom interfaces and ensure system compatibility. Variability in technology adoption rates across regions further complicates implementation. Providers must overcome these technical barriers to fully realize the benefits of efficient and secure data exchange.

Market Opportunities

Expansion of Telehealth Services and Remote Patient Monitoring Driving New Growth Opportunities

The Healthcare Data Interoperability Market presents significant opportunities through the growth of telehealth services and remote patient monitoring. It enables seamless sharing of patient data between remote care providers and primary healthcare facilities. Healthcare organizations can improve patient outcomes by accessing real-time information for chronic disease management and post-discharge monitoring. It supports integration of wearable devices, mobile applications, and home-based diagnostic tools into centralized systems. Providers can reduce hospital readmissions and enhance preventive care programs. It creates avenues for innovative service delivery models and partnerships with technology vendors. Increasing patient demand for convenient, connected care further strengthens market potential.

Leveraging Artificial Intelligence and Advanced Analytics to Enhance Decision-Making and Operational Efficiency

Opportunities also arise from the adoption of artificial intelligence and advanced analytics within interoperable healthcare systems. The Healthcare Data Interoperability Market benefits from platforms that enable predictive insights and population health management. It allows providers to identify trends, optimize resource allocation, and anticipate patient needs. Integration of AI-driven tools improves clinical decision-making and supports personalized treatment strategies. It enhances operational efficiency by automating administrative tasks and reducing workflow bottlenecks. Providers can leverage large datasets to advance research and innovation. Expanding technology adoption offers significant potential for revenue growth and improved healthcare delivery.

Market Segmentation Analysis:

By Type

The Healthcare Data Interoperability Market includes integration platforms, interface engines, and clinical data repositories. Integration platforms dominate due to their ability to unify diverse healthcare systems and enable seamless data exchange. Interface engines remain relevant by connecting legacy applications with modern electronic health record (EHR) systems. Clinical data repositories centralize patient information, supporting research, analytics, and clinical decision-making. It allows providers to access accurate and comprehensive data efficiently, improving patient care and operational planning.

- For instance, Mirth Connect facilitates the exchange of over 340 million clinical documents annually and supports over 800 integration points. In March 2025, NextGen announced that starting with version 4.6, Mirth Connect would transition from a dual open-source/commercial model to a single commercial-only license.

By Level

The market divides into enterprise-level and departmental-level interoperability. Enterprise-level solutions drive adoption by enabling system-wide coordination across hospitals, clinics, laboratories, and insurance providers. It ensures consistent workflows and standardized patient information across multiple facilities. Departmental-level interoperability targets specific units, including radiology, cardiology, and laboratory departments. It allows specialized teams to access relevant data promptly, enhancing efficiency and quality of care. Providers increasingly implement a combination of both levels to optimize resource utilization and reduce redundant procedures.

- For instance, At Cleveland Clinic, enterprise-wide interoperability is enabled by Epic, their unified electronic health record (EHR) system. While InterSystems Health Connect helps manage data integration across many systems, it is Epic that provides the comprehensive patient record used for diagnostics and care coordination.

By Deployment Methods

4The market includes on-premise, cloud-based, and hybrid solutions. Cloud-based deployment leads adoption due to its scalability, cost efficiency, and ease of integration across platforms. It allows healthcare organizations to access and share patient data securely from multiple locations, supporting telehealth and remote patient monitoring. On-premise solutions remain important for institutions with strict data privacy regulations and legacy infrastructure. Hybrid models combine cloud flexibility with on-premise control, ensuring operational continuity while meeting regulatory and security requirements. It provides organizations with a balanced approach to modernize their IT infrastructure while safeguarding sensitive patient information.

Segments:

Based on Type

Based on Level

- Foundational

- Structural

- Semantic

Based on Deployment Methods

Based on Application

Based on End-use

- Hospitals

- Ambulatory Surgical Centers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the global Healthcare Data Interoperability Market, accounting for 41.6% of the market in 2023. The United States is a significant contributor, driven by advanced healthcare infrastructure, widespread adoption of electronic health records (EHRs), and strong government initiatives like the Health Information Technology for Economic and Clinical Health (HITECH) Act. These factors have significantly propelled the demand for interoperable healthcare solutions. The presence of major industry players such as Cerner Corporation, Epic Systems, and Allscripts Healthcare Solutions further strengthens the region’s position. The U.S. healthcare interoperability solutions market size surpassed USD 1.16 billion in 2024 and is projected to attain around USD 4.35 billion by 2034, growing at a CAGR of 14.13% from 2025 to 2034 .

Europe

Europe is experiencing rapid growth in the healthcare data interoperability sector, with a projected CAGR of 30.3% between 2025 and 2034. The European Union’s focus on creating a Digital Single Market and initiatives like the European Health Data Space aim to enhance data sharing across member states. Countries such as Germany, France, and the UK are at the forefront, investing in interoperable solutions to improve healthcare delivery and patient outcomes. The region’s emphasis on data privacy and security, coupled with the adoption of standards like HL7 and FHIR, fosters a conducive environment for interoperability solutions. This growth is further supported by events and conferences organized by industry stakeholders to improve awareness and knowledge about healthcare interoperability systems.

Asia Pacific

The Asia Pacific region is witnessing the fastest growth in the healthcare data interoperability market, with a projected CAGR of 12.89% between 2024 and 2030. Countries like China, India, Japan, and South Korea are investing heavily in digital health infrastructure to address the challenges of aging populations and increasing healthcare demands. Initiatives such as India’s National Digital Health Mission aim to create an integrated digital health infrastructure, facilitating the adoption of interoperability standards. The region’s growing middle class and increasing smartphone penetration further drive the demand for interoperable healthcare solutions, enabling remote patient monitoring and telemedicine services.

Latin America

Latin America is gradually adopting healthcare data interoperability solutions, with countries like Brazil and Mexico leading the way. The region faces challenges such as limited healthcare infrastructure and budget constraints, but there is a growing recognition of the need for efficient data exchange to improve healthcare delivery. Government initiatives and partnerships with international organizations are promoting the adoption of interoperable solutions. The expansion of mobile networks and internet access is also contributing to the growth of digital health services, creating opportunities for interoperability solutions to enhance patient care and streamline healthcare processes.

Middle East and Africa

The Middle East and Africa region is in the early stages of adopting healthcare data interoperability solutions. Countries like the United Arab Emirates and Saudi Arabia are investing in healthcare infrastructure and digital health initiatives to improve healthcare delivery. The region’s focus on developing smart cities and implementing e-health strategies provides a foundation for the growth of interoperable healthcare systems. Challenges such as data privacy concerns and regulatory complexities exist, but strategic investments and collaborations with international technology providers are paving the way for the adoption of interoperability solutions to enhance healthcare services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Epic Systems Corporation

- OSP

- InterSystems Corporation

- iNTERFACEWARE Inc.

- Cerner (Oracle)

- NXGN Management, LLC.

- Infor (Koch Industries, Inc)

- com

- Orion Health group of companies

- Koninklijke Philips N.V.

Competitive Analysis

Competitive landscape in the Healthcare Data Interoperability Market includes leading players such as Epic Systems Corporation, Cerner (Oracle), InterSystems Corporation, Koninklijke Philips N.V., Infor (Koch Industries, Inc), Orion Health group of companies, NXGN Management, LLC, OSP, ViSolve.com, and iNTERFACEWARE Inc. These companies focus on developing scalable, secure, and interoperable solutions that integrate legacy systems, enhance real-time data access, and improve clinical decision-making. Market leaders differentiate through continuous innovation, strategic partnerships, mergers and acquisitions, and expansion into emerging regions. They invest in cloud-based platforms, API-driven architectures, and AI-powered analytics to provide comprehensive solutions for hospitals, laboratories, and telehealth providers. Companies emphasize compliance with global healthcare standards, including HL7 and FHIR, to ensure interoperability and data security. Focus on patient-centric care, predictive analytics, and population health management strengthens their competitive advantage. Aggressive marketing, collaboration with government initiatives, and targeted regional strategies enable these players to maintain market leadership while addressing evolving healthcare challenges. Continuous investment in research and development ensures they stay ahead in technology adoption, operational efficiency, and service quality, positioning the Healthcare Data Interoperability Market for sustained growth globally.

Recent Developments

- In July 2025, Koninklijke Philips N.V. Partnered with Dräger, Hamilton Medical, Getinge, and B. Braun on Service‑Oriented Device Connectivity (SDC) standards. This move advances vendor‑neutral device interoperability in hospitals.

- In July 2025, Koninklijke Philips N.V. Collaborated with Epic to integrate Philips’ ambulatory cardiac monitoring services with Epic’s Aura diagnostics suite. This enables ECG orders and results to flow directly within Epic, reducing manual entry.

- In March 2025, InterSystems Corporation Launched InterSystems IntelliCare, an AI-powered EHR platform focused on streamlined workflows and connected, modern healthcare systems.

- In Feb 2025, Oracle (Cerner) Filed application as a QHIN (Qualified Health Information Network) under TEFCA, furthering its interoperability reac

Report Coverage

The research report offers an in-depth analysis based on Type, Level, Deployment Methods, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of electronic health records will continue to expand across hospitals and clinics.

- Cloud-based and hybrid deployment solutions will drive scalable and flexible data management.

- Integration of artificial intelligence and advanced analytics will enhance clinical decision-making.

- Telehealth and remote patient monitoring will increase demand for interoperable systems.

- Standardization of healthcare data formats and protocols will simplify cross-platform integration.

- Growing focus on patient-centered care will promote seamless access to personal health information.

- Emerging markets in Asia Pacific, Latin America, and the Middle East will offer significant growth opportunities.

- Strategic partnerships and collaborations among technology providers will accelerate innovation.

- Regulatory support for digital health initiatives will encourage widespread interoperability adoption.

- Investment in cybersecurity and data privacy solutions will strengthen trust and system reliability.