Market Overview

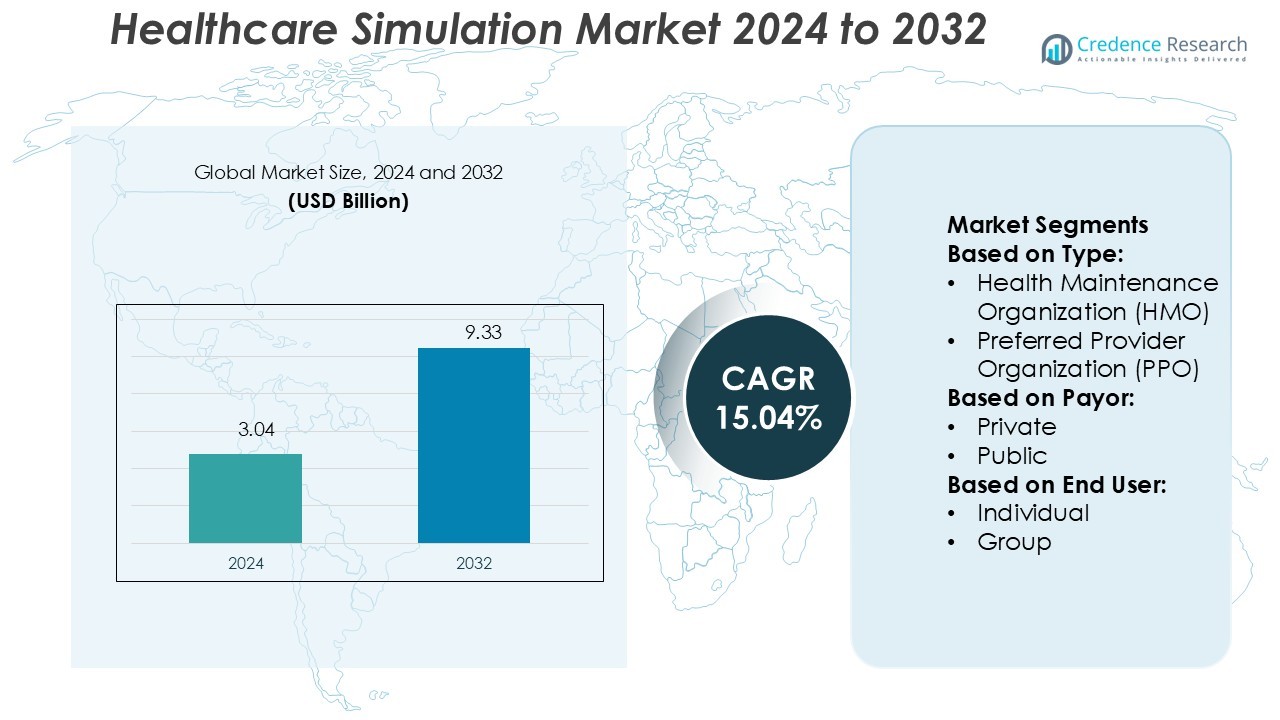

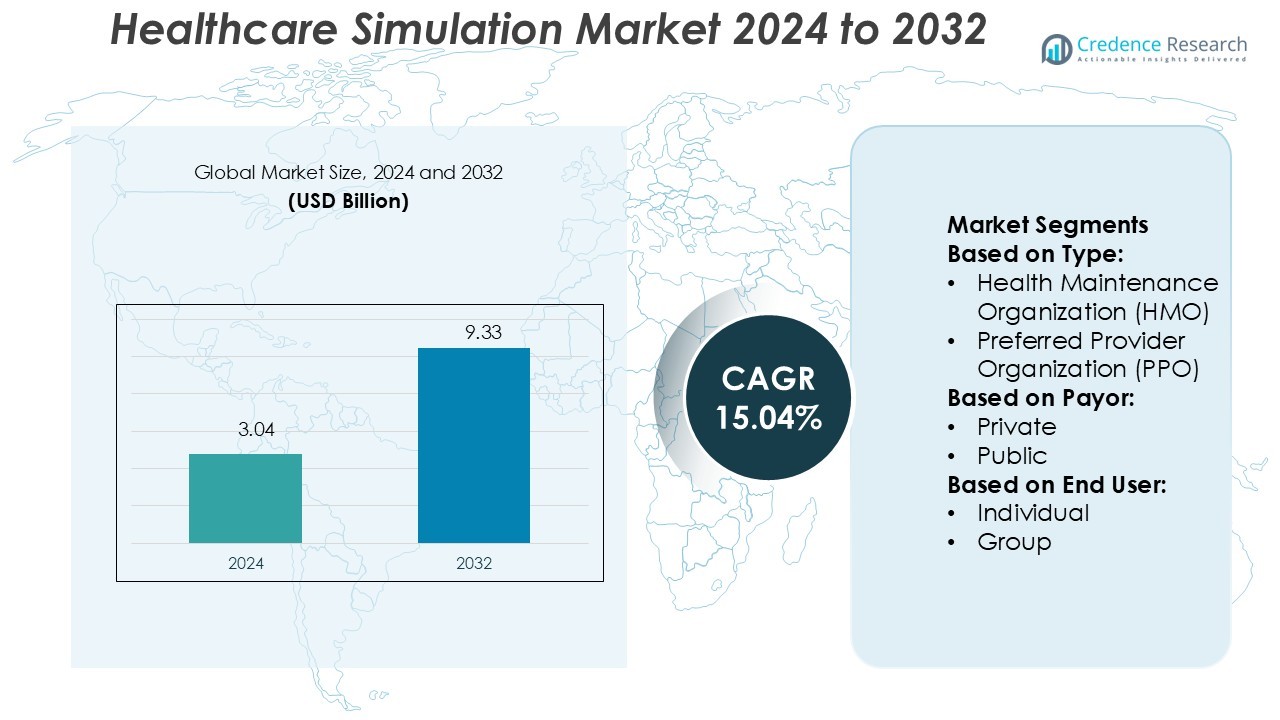

Healthcare Simulation Market size was valued USD 3.04 billion in 2024 and is anticipated to reach USD 9.33 billion by 2032, at a CAGR of 15.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Healthcare Simulation Market Size 2024 |

USD 3.04 Billion |

| Healthcare Simulation Market, CAGR |

15.04% |

| Healthcare Simulation Market Size 2032 |

USD 9.33 Billion |

The healthcare simulation market is driven by key players including Intelligent Ultrasound, Gaumard Scientific, Kyoto Kagaku Co., Ltd, Surgical Science Sweden AB, Simulaids, Operative Experience, Inc., Limbs & Things Ltd, Mentice, 3D Systems, Inc., and Simulab Corporation. These companies focus on advanced simulation technologies such as AI-enabled platforms, VR-based training tools, and high-fidelity manikins to enhance clinical skill development. Strategic partnerships with academic institutions and healthcare providers strengthen their global presence. North America leads the healthcare simulation market with a 39.4% share, supported by strong healthcare infrastructure, early technology adoption, and regulatory initiatives promoting patient safety and training standardization.

Market Insights

- The Healthcare Simulation Market was valued at USD 3.04 billion in 2024 and is projected to reach USD 9.33 billion by 2032, growing at a CAGR of 15.04%.

- Market growth is supported by increasing investments in AI-enabled simulation platforms, VR training tools, and high-fidelity manikins that enhance medical skill development.

- Key players focus on product innovation, strategic partnerships, and academic collaborations to strengthen their competitive position and global reach.

- High initial investment costs and limited skilled personnel act as major restraints, particularly in developing regions.

- North America leads with a 39.4% market share, followed by Europe with 27.8% and Asia Pacific with 23.6%. The hospital and academic segment accounts for the largest share, driven by regulatory support and training standardization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Health Maintenance Organization (HMO) segment holds the largest market share in the healthcare simulation market. HMO models offer lower premiums and coordinated care through primary care providers, increasing patient enrollment. Strong cost-control mechanisms and preventive care programs enhance their appeal. Growth is supported by rising awareness of managed healthcare plans and improved reimbursement structures. Many healthcare institutions adopt HMO models to streamline service delivery and reduce administrative costs, driving their dominance over PPO and EPO models.

- For instance, Intelligent Ultrasound had deployed over 1,700 high-fidelity ultrasound simulator systems to more than 800 medical institutions in an expanded number of countries.

By Payor

The private payor segment dominates the healthcare simulation market, supported by growing employer-sponsored health plans and personalized insurance options. Private insurers provide flexible coverage, faster claim processing, and value-added services, attracting more consumers. Increasing competition among private insurers leads to innovative plan offerings and improved customer engagement. This growth is further driven by digital health adoption and the expansion of virtual care services, which align well with private sector efficiency models and cost-sharing programs.

- For instance, Gaumard Scientific’s HAL® S5301 patient simulator includes a wireless, tetherless design that enables fully operational use during transport and supports Bluetooth, RF, and wired connectivity modes.

By End User and Mode

The individual segment leads the healthcare simulation market due to rising consumer demand for flexible and affordable coverage. Growing awareness of personalized health plans and digital enrollment platforms supports this trend. In terms of mode, the online segment holds the dominant share, driven by telehealth expansion and digital access to insurance services. Online platforms offer convenience, real-time plan comparison, and faster onboarding. Increased smartphone penetration and growing preference for virtual healthcare solutions further strengthen this segment’s growth.

Key Growth Drivers

Rising Demand for Advanced Medical Training

Healthcare professionals increasingly rely on realistic training tools to enhance patient safety. High-fidelity simulation systems allow learners to practice critical procedures in controlled environments. Academic institutions and hospitals are integrating simulation labs into their training programs to reduce medical errors. Government and private funding for medical education further support this adoption. The growing focus on competency-based learning continues to push healthcare organizations to invest in simulation platforms, driving strong market expansion.

- For instance, Hamamatsu Photonics offers a variety of light sources for biomedical and industrial applications, which includes both lamps and lasers LC8 is a UV spot light source that uses a mercury-xenon lamp and is suitable for tasks like UV curing or microscope illumination.

Growing Focus on Patient Safety and Risk Reduction

Healthcare systems are adopting simulation technology to minimize adverse events and improve clinical outcomes. Simulation enables repeated practice of complex procedures without putting real patients at risk. Hospitals use scenario-based training to strengthen teamwork and response time in emergencies. Regulatory bodies also promote structured simulation-based assessments as part of quality standards. This focus on safer care delivery boosts investment in simulation tools, accelerating market growth.

- For instance, ROHM Semiconductor develops red laser diodes, such as the RLD63NPCx series, which operate at a typical wavelength of 635 nm. These high-precision laser diodes are suitable for applications such as optical disk pickups and sensors.

Technological Advancements in Simulation Platforms

Continuous innovation enhances the realism and performance of simulation technologies. Artificial intelligence, virtual reality, and augmented reality are improving the accuracy and adaptability of training systems. Integration with electronic health records allows more personalized learning experiences. Portable and cloud-based solutions also enable remote training and scalability for institutions. These innovations are making simulation more accessible and effective, driving strong adoption across medical education and healthcare organizations.

Key Trends & Opportunities

Expansion of Virtual and Remote Simulation

The market is witnessing a rapid shift toward web-based and VR-driven training solutions. These tools allow learners to access simulation modules without physical lab constraints. Hospitals and universities use remote platforms for continuous education and emergency response training. The flexibility of these solutions is opening opportunities in developing regions and rural areas with limited infrastructure.

- For instance, Nichia’s NDB7K75 laser diode is a high-power blue laser diode with a dominant wavelength of 450 nm, delivering 3.5 W output power for applications such as high-intensity lighting and industrial processing.

Integration of AI and Analytics in Training Programs

AI-powered simulation platforms offer real-time performance tracking and personalized feedback. These capabilities help trainers identify skill gaps and improve learning outcomes. Analytics also support evidence-based training design and accreditation compliance. This trend is creating opportunities for software providers and driving the adoption of advanced simulation technologies in healthcare institutions.

- For instance, IPG Photonics offers high-power single-mode fiber lasers in its YLR-SM series. These lasers can provide up to 3 kW of continuous-wave output, typically with a wavelength of ~1,070 nm.

Rising Investments in Specialized Simulation Centers

Healthcare systems are increasing investments in dedicated simulation centers to support advanced learning. These centers enable multi-disciplinary training, emergency response preparation, and complex surgical procedure practice. Industry partnerships and academic collaborations are also expanding, creating new revenue streams and growth opportunities for simulation solution providers.

Key Challenges

High Initial Investment and Maintenance Costs

Advanced simulation systems require significant capital for installation, equipment, and ongoing updates. Many healthcare institutions face budget constraints, particularly in developing regions. Maintenance, software upgrades, and faculty training add to the operational costs. This financial barrier limits access to advanced simulation tools and slows adoption among smaller facilities.

Limited Trained Personnel and Technical Expertise

Effective simulation training depends on skilled instructors and technicians. Many institutions lack trained personnel to manage complex systems and run simulation scenarios effectively. This shortage impacts the quality and consistency of training programs. Without sufficient investment in workforce development, the expansion of healthcare simulation remains constrained.

Regional Analysis

North America

North America leads the healthcare simulation market with a 39.4% share in 2024. The region benefits from advanced healthcare infrastructure, strong regulatory support, and widespread use of simulation-based medical training. The U.S. dominates due to early technology adoption in academic and clinical settings. Federal funding and accreditation requirements further encourage simulation integration in medical education. High investments in AI-powered simulators and virtual reality platforms enhance training efficiency. Leading universities and hospitals continue to expand their simulation centers, solidifying North America’s position as the largest regional market.

Europe

Europe holds a 27.8% share of the healthcare simulation market in 2024. The region’s growth is supported by robust government initiatives to standardize medical training and improve patient safety. Countries such as Germany, the U.K., and France lead adoption through strong academic and clinical collaborations. The European healthcare system emphasizes quality assurance and continuous professional education. Advanced simulation labs and increased funding for healthcare digitalization further strengthen market expansion. Growing partnerships between technology providers and medical institutions position Europe as a key innovation hub in simulation technologies.

Asia Pacific

Asia Pacific accounts for a 23.6% share of the healthcare simulation market in 2024. Rapid healthcare infrastructure development, growing medical education demand, and rising investments in digital training tools drive regional growth. China, Japan, and India are leading adopters, supported by government health programs and expanding medical universities. Affordable VR-based and cloud-enabled simulators increase accessibility in training environments. The region is also witnessing a surge in private investments and international collaborations. Strong economic growth and digital transformation initiatives position Asia Pacific as the fastest-growing regional market.

Latin America

Latin America represents a 5.2% share of the healthcare simulation market in 2024. Brazil and Mexico lead adoption, supported by healthcare modernization programs and rising demand for skilled medical professionals. The region focuses on improving patient safety and emergency response capabilities. Simulation centers in teaching hospitals and universities are expanding with support from government and private funding. Partnerships with international training organizations help build capacity and technical expertise. Although investment levels are lower than in developed markets, growing awareness of simulation benefits supports steady regional growth.

Middle East & Africa

The Middle East & Africa account for a 4% share of the healthcare simulation market in 2024. Market growth is driven by government-led healthcare transformation programs and increasing adoption of digital training technologies. The UAE and Saudi Arabia are leading the region with investments in advanced simulation centers for medical education. Partnerships with global simulation companies support rapid skill development in critical care and emergency medicine. Limited infrastructure in parts of Africa presents challenges, but rising healthcare spending and workforce training needs offer promising growth potential.

Market Segmentations:

By Type:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

By Payor:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The healthcare simulation market is shaped by key players such as Intelligent Ultrasound, Gaumard Scientific, Kyoto Kagaku Co., Ltd, Surgical Science Sweden AB, Simulaids, Operative Experience, Inc., Limbs & Things Ltd, Mentice, 3D Systems, Inc., and Simulab Corporation. The healthcare simulation market is becoming increasingly competitive, driven by strong investments in advanced training technologies. Companies are focusing on AI-enabled platforms, virtual reality, and high-fidelity manikins to enhance the realism of medical training. Partnerships with universities, hospitals, and training centers are expanding global reach and improving product adoption. Many firms are prioritizing scalable and cloud-based solutions to support remote and hybrid learning environments. Continuous innovation, regulatory compliance, and training standardization are key factors shaping the market. Strategic mergers, acquisitions, and new product launches are strengthening market positions and supporting long-term growth opportunities.

Key Player Analysis

- Intelligent Ultrasound

- Gaumard Scientific

- Kyoto Kagaku Co., Ltd

- Surgical Science Sweden AB

- Simulaids

- Operative Experience, Inc.

- Limbs & Things Ltd

- Mentice

- 3D Systems, Inc.

- Simulab Corporation

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In May 2025, Goodwin University revealed plans for a nursing simulation center. This facility will include high-fidelity mannequins and specialized medical environments, offering students extensive, hands-on training experiences to prepare them for real-world clinical situations.

- In January 2024, Laerdal Medical announced a global distribution partnership with SIMCharacters, an Austrian company specializing in neonatal simulation technology. The partnership aims to revolutionize medical training and enhance healthcare simulation.

- In January 2024, CAE Inc.collaborated with SimHawk. This collaboration aims to combine SimHawk’s didactic and motion-based learning with CAE Healthcare’s manikin-based simulation, ultimately offering a more comprehensive and effective training experience.

- In June 2023, Wolters Kluwer Health announced collaborating with Laerdal Medical and the National League for Nursing (NLN) to launch vrClinicals for Nursing. This VR-based learning solution is designed to address the gaps in nursing education and prepare students for the real-world pressures of nursing practice.

Report Coverage

The research report offers an in-depth analysis based on Type, Payor, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of AI-powered simulation platforms in training programs.

- Virtual reality and augmented reality tools will enhance immersive medical education.

- Cloud-based simulation solutions will support remote and hybrid learning models.

- Government funding and regulatory support will strengthen training infrastructure.

- Integration with electronic health records will improve personalized learning experiences.

- Demand for specialized simulation centers will grow across academic institutions.

- Strategic collaborations will expand simulation access in emerging economies.

- Advancements in sensor technologies will increase training accuracy and realism.

- Mobile and portable simulation devices will enable flexible learning environments.

- Continuous innovation will drive broader acceptance in both clinical and academic settings.