Market Overview

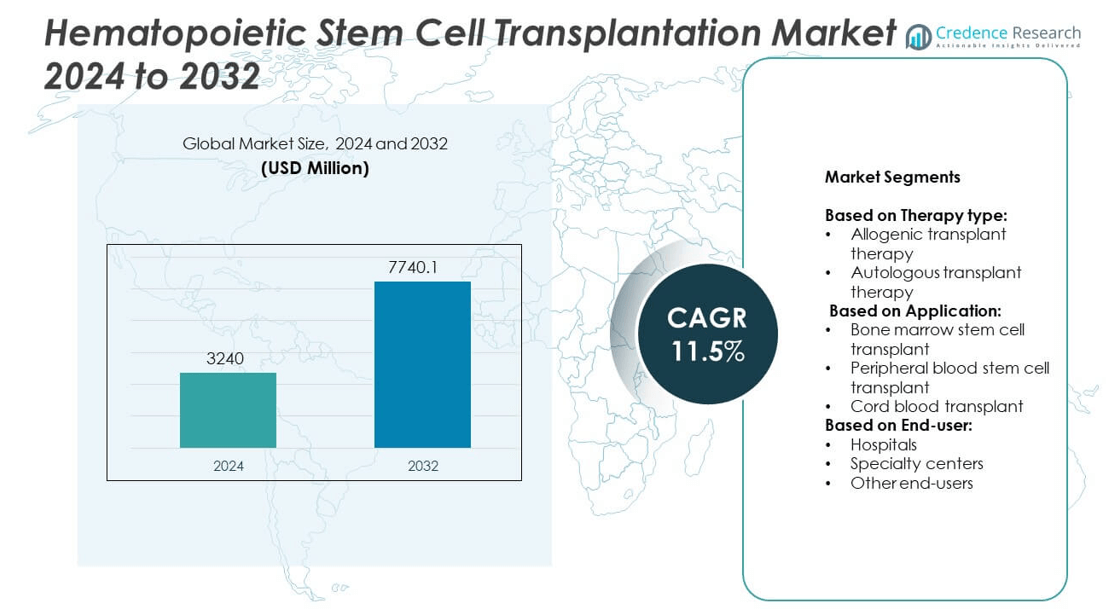

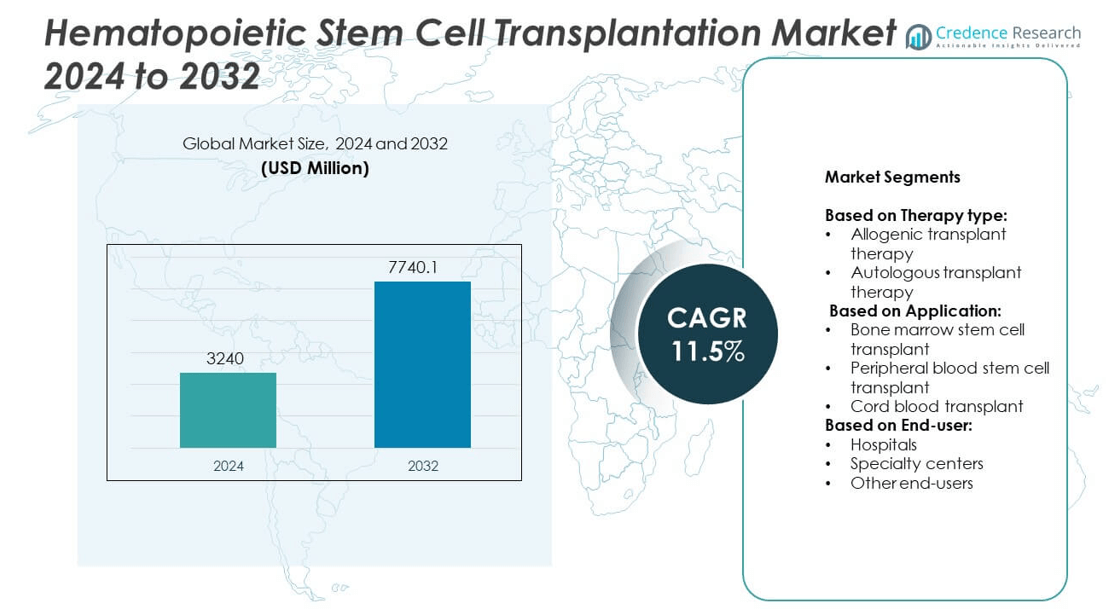

The Hematopoietic Stem Cell Transplantation market size was valued at USD 3240 million in 2024 and is expected to reach USD 7740.1 million by 2032, growing at a CAGR of 11.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hematopoietic Stem Cell Transplantation Market Size 2024 |

USD 3240 million |

| Hematopoietic Stem Cell Transplantation Market, CAGR |

11.5% |

| Hematopoietic Stem Cell Transplantation Market Size 2032 |

USD 7740.1 million |

The Hematopoietic Stem Cell Transplantation market is driven by the rising prevalence of hematologic cancers, wider availability of alternative donor sources, and strong advancements in regenerative medicine. Increasing use of haploidentical transplants and cord blood banking expands treatment accessibility. Integration of gene-editing and immunotherapy techniques enhances survival outcomes and reduces complications. Hospitals and specialty centers adopt advanced protocols supported by global research collaborations. These drivers, along with digital donor tracking and cryopreservation technologies, shape the market’s growth and highlight evolving treatment trends.

North America leads the Hematopoietic Stem Cell Transplantation market with advanced infrastructure and strong clinical adoption, while Europe emphasizes government support and innovation in transplant protocols. Asia Pacific shows rapid growth with rising healthcare investments and expanding donor registries, supported by increasing medical tourism. Latin America and the Middle East & Africa present emerging opportunities through gradual expansion of specialized facilities. Key players shaping the market include Sanofi, Novartis AG, Bluebird Bio, Inc., and Pluristem Therapeutics Inc.

Market Insights

- The Hematopoietic Stem Cell Transplantation market was valued at USD 3240 million in 2024 and is projected to reach USD 7740.1 million by 2032, growing at a CAGR of 11.5%.

- Rising cases of leukemia, lymphoma, and myeloma increase the demand for advanced transplantation procedures.

- Wider adoption of haploidentical and cord blood transplants expands donor availability and improves patient access.

- Leading players focus on gene-editing, cryopreservation, and immunotherapy integration to enhance transplant safety and long-term outcomes.

- High treatment costs, limited insurance coverage, and complications such as graft-versus-host disease restrain adoption in several regions.

- North America leads with strong infrastructure and research presence, Europe emphasizes innovation and donor registries, Asia Pacific grows with expanding healthcare systems, while Latin America and Middle East & Africa present emerging opportunities.

- The market continues to evolve through clinical trials, global partnerships, and digital solutions that improve donor tracking, patient monitoring, and treatment efficiency, supporting long-term growth across developed and developing regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Prevalence of Hematologic Disorders Driving Advanced Treatment Demand

The Hematopoietic Stem Cell Transplantation market is fueled by the increasing incidence of blood cancers, lymphoma, leukemia, and myeloma. Higher survival rates with early transplantation support greater acceptance among healthcare providers. Growing awareness campaigns by government and non-profit organizations help in early diagnosis, which boosts demand for treatment. Hospitals expand facilities to manage rising patient inflow with specialized transplant units. Research-backed therapies improve long-term outcomes for patients suffering from complex hematologic diseases. It strengthens the role of stem cell transplantation as a frontline therapy.

- For instance, Novartis’s Kymriah had been administered to over 7,000 patients in clinical trials and real-world settings. The 10,000 figure was a milestone for the entire CAR-T field, not a single company’s achievement. In September 2024, the European Bone Marrow Transplantation Group (EBMT) announced that over 10,000 CAR-T treated patients were registered in its registry.

Growing Adoption of Innovative Stem Cell Sources and Techniques

The market benefits from wider adoption of cord blood and haploidentical transplants that expand donor availability. Advances in harvesting and preservation methods improve cell viability and reduce complications. Hospitals and transplant centers invest in modern cryopreservation systems for better efficiency. Emerging approaches, such as reduced-intensity conditioning regimens, make transplantation safer for older patients. Increasing collaborations between biotechnology firms and clinical institutions accelerate innovation pipelines. It creates a sustainable path for addressing unmet clinical needs.

- For instance, Phase 3 clinical trial involved 125 patients, and in its 2023 financial reporting (released in March 2024), Gamida Cell confirmed delivering only six units of omidubicel (Omisirge) commercially during 2023.

Improved Healthcare Infrastructure and Access to Specialized Facilities

The expansion of healthcare infrastructure enhances the adoption of stem cell transplants globally. Emerging economies allocate larger healthcare budgets to strengthen oncology treatment facilities. Governments and private players invest in advanced laboratories and transplant centers to reduce waiting times. Insurance coverage for complex transplant procedures improves patient access in several countries. Growing participation of global organizations supports training programs for specialized healthcare professionals. It enhances the efficiency and availability of transplant services across key regions.

Rising Research Investments and Supportive Regulatory Environment

The market experiences significant growth through large-scale research and development funding. Pharmaceutical and biotech companies focus on developing safer, more effective transplant protocols. Clinical trials expand in number, focusing on reducing relapse and improving survival rates. Regulatory bodies streamline approval processes for advanced stem cell-based therapies. Government-backed initiatives encourage innovation in regenerative medicine and cellular therapies. It creates favorable conditions for long-term growth and adoption of advanced treatment solutions.

Market Trends

Growing Shift Toward Haploidentical and Alternative Donor Transplants

The Hematopoietic Stem Cell Transplantation market shows a strong shift toward haploidentical and alternative donor procedures. Broader availability of family-based partial matches helps overcome limitations of unrelated donor registries. Advanced graft manipulation techniques reduce risks of rejection and improve outcomes. Hospitals adopt innovative conditioning regimens to expand patient eligibility. This shift widens treatment access for patients in regions with smaller donor pools. It establishes alternative donor transplants as a key growth trend in the field.

- For instance, Johns Hopkins has performed a large number of haploidentical transplants over the years, with news releases and program descriptions on the Johns Hopkins website mentioning having performed more than 500 and even over 1,000 haploidentical transplants.

Rising Integration of Cell and Gene Therapy Innovations

The market witnesses increasing convergence of stem cell transplantation with advanced cell and gene therapy solutions. Gene-edited stem cells enhance disease resistance and treatment success rates. Biotechnology firms focus on reducing graft-versus-host disease through targeted genetic modifications. Clinical centers explore hybrid strategies that combine traditional transplantation with engineered cell infusions. Strong industry partnerships accelerate commercialization of these technologies. It strengthens the role of regenerative medicine in shaping future treatment models.

- For instance, bluebird bio announced in 2023 the commercial launch of its Zynteglo and Skysona gene therapies, the number of patients treated was considerably lower than 350. By the end of 2023, the company had completed 26 patient starts for these two therapies.

Increased Use of Cryopreservation and Digital Tracking Systems

The adoption of cryopreservation and digital monitoring technologies is expanding rapidly. Modern preservation systems extend stem cell shelf life without compromising viability. Healthcare providers deploy digital platforms for real-time tracking of donor registries and logistics. Automated processes improve accuracy and reduce human errors in transplantation workflows. Demand for transparent and efficient supply chains drives investment in smart systems. It aligns the market with global trends in digitization and precision medicine.

Expanding Global Clinical Trials and Cross-Border Collaborations

The market benefits from a rising number of international clinical trials. Research institutions collaborate across borders to evaluate innovative transplantation protocols. Multi-country studies help generate diverse patient data and improve reliability of results. Governments encourage global knowledge exchange to speed up medical advancements. Pharmaceutical firms leverage partnerships to access wider patient pools for testing. It builds a collaborative ecosystem that fosters rapid progress in treatment innovation.

Market Challenges Analysis

High Treatment Costs and Limited Accessibility in Developing Regions

The Hematopoietic Stem Cell Transplantation market faces a major challenge from the high cost of procedures. Transplants require advanced infrastructure, skilled professionals, and costly drugs for conditioning and post-care. Many developing nations struggle with affordability, restricting patient access to treatment. Insurance coverage remains uneven, leaving patients with significant out-of-pocket expenses. Hospitals in lower-income regions often lack specialized facilities, forcing patients to travel abroad. It creates disparities in access and limits the market’s global penetration.

Post-Transplant Complications and Donor Availability Constraints

Complications such as graft-versus-host disease and relapse remain serious barriers for patients. Despite innovations in conditioning regimens, long-term side effects hinder adoption. Limited donor availability, especially in ethnically diverse populations, reduces the success rate of timely transplants. Even with advancements in haploidentical and cord blood procedures, donor matching continues to be complex. Clinical trials aim to improve safety, but slow regulatory approvals delay availability of new therapies. It highlights the ongoing struggle to balance innovation with patient safety and accessibility.

Market Opportunities

Expanding Role of Regenerative Medicine and Advanced Therapies

The Hematopoietic Stem Cell Transplantation market holds strong opportunities through integration with regenerative medicine. Gene-editing tools such as CRISPR open pathways to engineer safer, more effective stem cells. Pharmaceutical companies explore combinations of transplantation with immunotherapies to enhance survival rates. Investment in precision medicine enables development of personalized transplant protocols tailored to genetic profiles. Hospitals adopt digital health platforms to monitor patient outcomes and reduce complications. It creates a foundation for future therapies that combine cellular innovation with advanced medical technologies.

Rising Demand in Emerging Economies and Global Collaborations

The market finds new growth avenues in emerging economies where healthcare infrastructure is improving rapidly. Governments invest in oncology centers and transplantation facilities to meet rising patient needs. Growing partnerships between local hospitals and global biotechnology firms expand knowledge sharing and clinical expertise. International donor registries expand coverage, improving patient access to suitable matches. Medical tourism in countries with cost-effective transplant services attracts patients from high-cost regions. It positions emerging markets as critical contributors to future adoption and innovation.

Market Segmentation Analysis:

By Therapy Type:

Allogenic and autologous transplant therapy. Allogenic therapy dominates due to wider adoption in treating complex hematologic conditions such as leukemia and lymphoma. It benefits from the use of matched donors, providing long-term disease control and improved survival rates. Autologous therapy continues to hold steady demand, particularly for multiple myeloma and certain lymphomas. Its lower risk of graft rejection supports higher patient acceptance, though relapse risk remains a concern. Both therapies continue to evolve with improved protocols and conditioning regimens.

- For instance, According to data from the Center for International Blood and Marrow Transplant Research (CIBMTR), a total of 23,535 hematopoietic cell transplants were reported in the U.S. in 2019, of which 9,299 were allogeneic transplants, confirming the significant scale of these procedures

By Application:

Bone marrow stem cell transplant maintains strong relevance in treatment, though peripheral blood stem cell transplant has emerged as the leading segment. Peripheral blood procedures are less invasive, deliver faster engraftment, and allow shorter recovery times, driving wider preference among physicians. Bone marrow transplant remains essential for specific patient groups, especially pediatric cases. Cord blood transplant represents a growing segment, providing access for patients without matched donors. It offers advantages in immunological tolerance, though limited cell doses restrict use in adults. Expanding cord blood banking networks continue to support this segment’s growth.

- For instance, Cincinnati Children’s Hospital Medical Center is a leader in hematopoietic stem cell transplantation (HSCT), with a program that has performed thousands of transplants since its inception. The center typically performs around 100 transplants annually, utilizing various stem cell sources, including peripheral blood.

By End-User:

Hospitals dominate the market with advanced infrastructure, specialized transplant units, and integrated post-transplant care facilities. Large hospitals also lead clinical trials and research, reinforcing their central role. Specialty centers provide focused expertise and personalized treatment pathways, offering competitive growth potential in high-income regions. Other end-users, including smaller healthcare facilities, play a supporting role in pre- and post-transplant management. It reflects a balanced ecosystem where hospitals remain the backbone, while specialty centers contribute to innovation and patient-focused care.

Segments:

Based on Therapy type:

- Allogenic transplant therapy

- Autologous transplant therapy

Based on Application:

- Bone marrow stem cell transplant

- Peripheral blood stem cell transplant

- Cord blood transplant

Based on End-user:

- Hospitals

- Specialty centers

- Other end-users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for the largest share of the Hematopoietic Stem Cell Transplantation market with 38% in 2024. The region benefits from advanced healthcare infrastructure, leading transplant centers, and strong research capabilities. The United States drives most of the demand with high adoption of allogenic and autologous therapies for leukemia, lymphoma, and myeloma patients. Favorable reimbursement policies, combined with extensive donor registries, improve patient access to life-saving treatments. Canada supports market growth through government-backed healthcare initiatives and rising investment in oncology treatment facilities. It reflects the maturity of the region where innovation, clinical trials, and early adoption of new techniques support long-term growth.

Europe

Europe holds a significant market share of 29% in 2024, supported by well-established healthcare systems and government funding. Countries such as Germany, the United Kingdom, and France lead in the number of annual transplants performed. Expanding donor registries across the European Union ensure broader patient access to suitable matches. Rising focus on reducing graft-versus-host disease and expanding cord blood banks improve the clinical landscape. Specialty centers in the region adopt hybrid therapies combining transplantation with immunotherapy for better outcomes. It demonstrates Europe’s commitment to strengthening advanced medical care and maintaining leadership in transplantation innovation.

Asia Pacific

Asia Pacific captures 22% of the global share in 2024, showing the fastest growth potential during the forecast period. Rising cancer incidence and expanding healthcare infrastructure in China, India, and Japan support the demand for transplantation. Increasing government investments and private healthcare spending improve the availability of advanced treatment facilities. Cord blood banking sees rapid development in countries like Japan and South Korea, expanding options for patients without matched donors. Medical tourism in India and Singapore further boosts the region’s role in cost-effective transplantation. It positions Asia Pacific as a key driver of market expansion, with high patient volumes and growing clinical expertise.

Latin America

Latin America represents a market share of 6% in 2024, with Brazil and Mexico leading adoption. Healthcare investments in oncology treatment and donor registry expansion support growth in the region. Patients increasingly travel to specialized centers in larger cities to access advanced transplantation services. Limited infrastructure and affordability challenges continue to restrict broader adoption across rural areas. Government-led initiatives aim to improve donor matching programs and expand access to modern therapies. It highlights the region’s gradual progress as healthcare systems strengthen and awareness improves.

Middle East and Africa

The Middle East and Africa collectively hold 5% of the market share in 2024, with growing opportunities for expansion. Countries like Saudi Arabia, South Africa, and the United Arab Emirates invest in advanced oncology centers and transplant facilities. Access to international expertise and collaborations with global research institutions improve clinical capabilities. Affordability and limited donor availability remain barriers, but increasing government initiatives aim to bridge gaps. Medical tourism in Gulf countries supports demand, especially from patients seeking cost-effective yet advanced care. It underscores the region’s emerging role, where investment and partnerships drive gradual market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bluebird Bio, Inc.

- Sanofi

- Escape Therapeutics, Inc.

- Marker Therapeutics, Inc.

- Novartis AG

- Taiga Biotechnologies, Inc.

- Talaris Therapeutics

- Merck KGaA

- Pluristem Therapeutics Inc.

- Regen Biopharma Inc.

- GlaxoSmithKline plc

- Kiadis Pharma

- CellGenix GmbH

Competitive Analysis

The competitive landscape of the Hematopoietic Stem Cell Transplantation market features leading players such as Pluristem Therapeutics Inc., Sanofi, Taiga Biotechnologies, Inc., CellGenix GmbH, Novartis AG, Regen Biopharma Inc., Kiadis Pharma, Marker Therapeutics, Inc., Escape Therapeutics, Inc., GlaxoSmithKline plc, Merck KGaA, Bluebird Bio, Inc., and Talaris Therapeutics. These companies focus on advancing stem cell therapies, expanding donor sources, and enhancing transplant safety. Strong emphasis is placed on developing next-generation technologies, including gene-edited stem cells and innovative conditioning regimens. Strategic investments in clinical trials drive the evaluation of novel therapies that reduce relapse rates and improve patient survival. Partnerships between biotechnology firms and healthcare institutions accelerate access to new solutions across global markets. Expansion of cord blood banking and cryopreservation capabilities strengthens the infrastructure needed to support patient demand. Many companies pursue collaborations to enhance immunotherapy integration, boosting the effectiveness of transplantation procedures. With continued investment in regenerative medicine, these players compete on innovation, safety, and global reach, positioning themselves as key contributors to the long-term growth of this market. The competitive environment remains highly dynamic, with a balance of established pharmaceutical leaders and specialized biotechnology firms shaping future advancements.

Recent Developments

- In 2025, Sanofi Ongoing evaluation of Sarclisa subcutaneous (SC) delivery via an on-body injector in the front-line setting through the ISASOCUT Phase 2 and GMMG‑HD8 Phase 3 studies.

- In 2024, Bluebird Bio, Inc. Presented positive long-term data for LYFGENIA™ (lovotibegligene autotemcel), a gene therapy for sickle cell disease

- In 2022, Priothera was granted permission by the US Food and Drug Administration to begin a Phase 2b/3 research with mocravimod (a synthetic, sphingosine 1-phosphate receptor (S1PR) modulator) in acute myeloid leukemia (AML) patients undergoing allogeneic hematopoietic stem cell transplant (HSCT).

Report Coverage

The research report offers an in-depth analysis based on Therapy Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising cases of leukemia, lymphoma, and multiple myeloma.

- Allogenic transplants will continue to dominate due to strong clinical effectiveness.

- Autologous transplants will maintain steady demand for relapsed and refractory cancers.

- Cord blood transplants will gain traction with improved banking and storage facilities.

- Haploidentical transplants will grow with better graft manipulation and lower rejection risks.

- Digital platforms will streamline donor registries and improve matching efficiency.

- Research in gene editing will enhance safety and long-term transplant success.

- Emerging economies will invest more in advanced oncology and transplant facilities.

- Hospitals will remain the leading providers, while specialty centers will expand regional reach.

- Global collaborations will accelerate innovation and broaden access to advanced therapies.