Market Overview

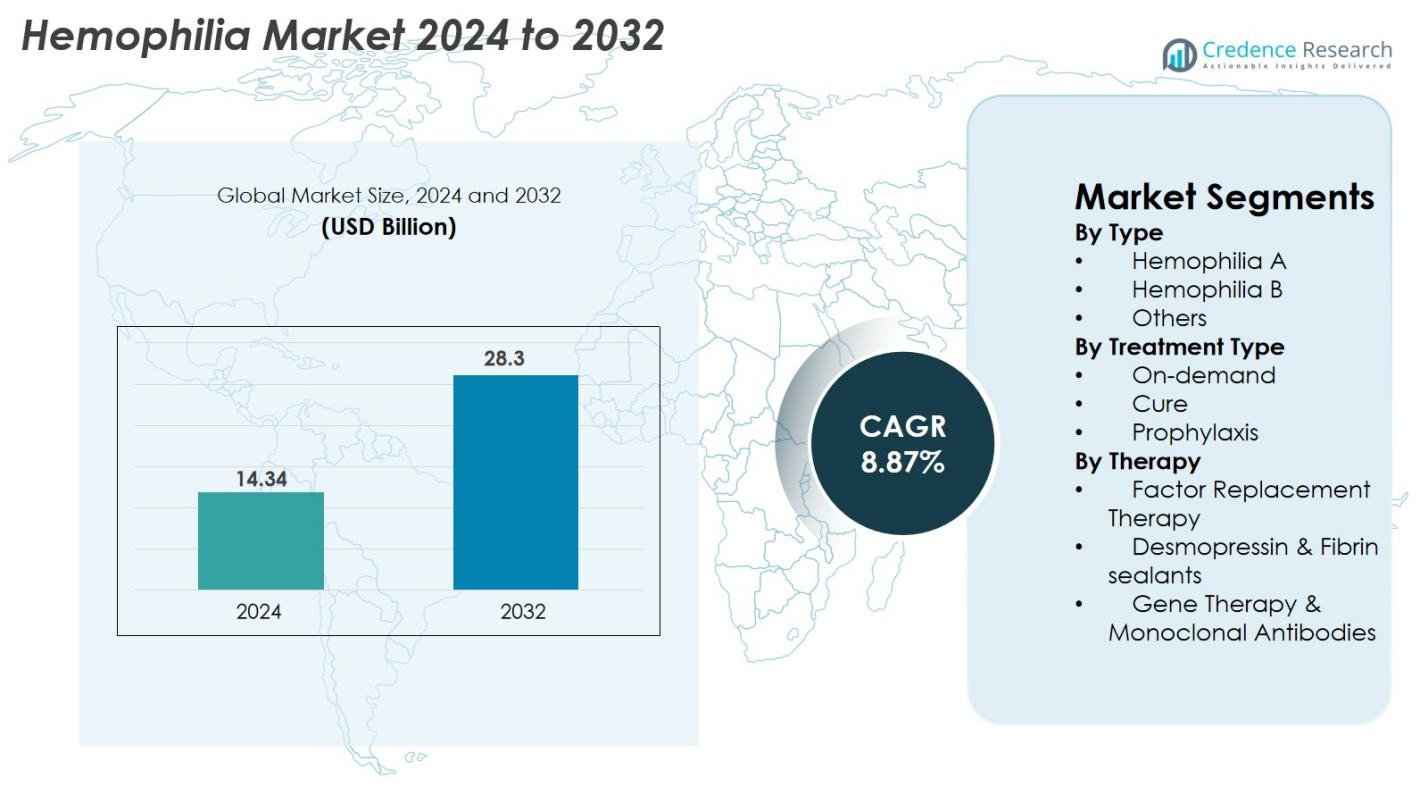

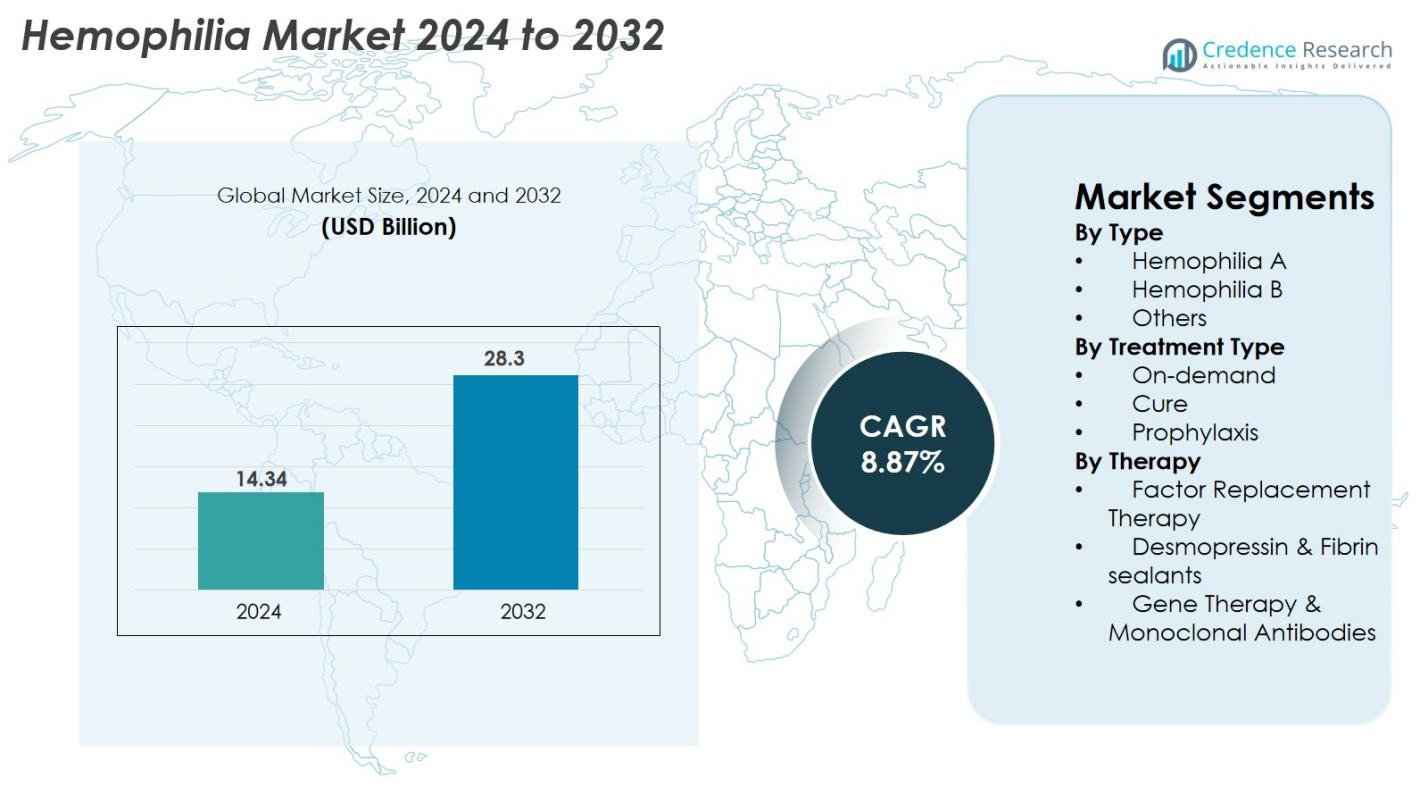

Hemophilia Market size was valued at USD 14.34 Billion in 2024 and is anticipated to reach USD 28.3 Billion by 2032, at a CAGR of 8.87% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hemophilia Market Size 2024 |

USD 14.34 Billion |

| Hemophilia Market, CAGR |

8.87% |

| Hemophilia Market Size 2032 |

USD 28.3 Billion |

Hemophilia Market features strong participation from global biopharmaceutical leaders, including Takeda Pharmaceutical Company Limited, CSL Behring, Pfizer Inc., Bayer AG, BioMarin, Spark Therapeutics Inc., Sanofi, F. Hoffmann-La Roche Ltd., Novo Nordisk A/S, and Octapharma AG, all driving innovation across factor replacement therapies, extended half-life products, monoclonal antibodies, and gene therapies. These companies continuously expand R&D pipelines and strategic partnerships to strengthen product portfolios and global reach. Regionally, North America leads the market with a 38% share in 2024, supported by advanced healthcare infrastructure and high adoption of next-generation therapies, while Europe and Asia-Pacific follow as major contributors to overall market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hemophilia Market was valued at USD 14.34 Billion in 2024 and is projected to reach USD 28.3 Billion by 2032, expanding at a CAGR of 8.87%.

- Rising adoption of prophylaxis therapy, which holds the dominant 62% segment share, and increasing availability of recombinant and long-acting biologics are driving market expansion globally.

- Key trends include rapid advancement in gene therapy and monoclonal antibodies, along with growing use of digital health tools and personalized dosing supported by pharmacokinetic profiling.

- Major players such as Takeda, CSL Behring, Pfizer, Bayer, BioMarin, Sanofi, Roche, Spark Therapeutics, Novo Nordisk, and Octapharma are strengthening competitiveness through innovation, strategic collaborations, and global access programs.

- Regionally, North America leads with a 38% share, followed by Europe at 30% and Asia-Pacific at 22%, while Latin America and the Middle East & Africa hold the remaining share, supported by improving diagnosis and treatment programs.

Market Segmentation Analysis

By Type

The Hemophilia market by type is dominated by Hemophilia A, accounting for 78% of the market share in 2024, driven by its significantly higher prevalence compared to Hemophilia B and other rare clotting disorders. The strong diagnostic presence, established treatment protocols, and larger patient pool support this dominance. Hemophilia B holds a moderate share due to fewer global cases, while the “Others” segment remains limited but benefits from advancements in molecular diagnostics. Rising awareness programs, improved newborn screening, and expanded access to replacement factors continue to propel growth across all type-based segments.

- For instance, Roche’s Hemlibra (emicizumab) had already been used to treat over 20,000 people globally across clinical and real-world programs by early 2023, demonstrating its extensive adoption in Hemophilia A management.

By Treatment Type

The treatment type segmentation highlights Prophylaxis as the leading sub-segment, capturing 62% of the market share in 2024, supported by its proven ability to prevent bleeding episodes and reduce long-term joint damage. Its adoption is rising globally as clinical guidelines increasingly recommend prophylactic regimens over episodic (on-demand) treatment. On-demand therapy still holds relevance in developing markets where cost barriers persist. “Cure”-oriented approaches, including emerging gene therapy pathways, remain small but fast-growing, primarily driven by ongoing clinical advancements and rising acceptance of potentially one-time curative treatments.

- For instance, Roche’s Hemlibra prophylaxis showed an annualized bleed rate (ABR) of 1.5 in the HAVEN 3 trial, compared to 38.2 with no prophylaxis, demonstrating a significant reduction in bleeding episodes.

By Therapy

Within therapy segmentation, Factor Replacement Therapy remains the dominant segment, contributing 71% of the market share in 2024, attributed to its long-standing clinical use, availability of recombinant factors, and strong physician preference. Its growth is sustained by the shift toward extended half-life products that reduce infusion frequency. Desmopressin and fibrin sealants serve as supportive options for mild cases, contributing modestly to overall revenue. Meanwhile, Gene Therapy and Monoclonal Antibodies represent the fastest-expanding sub-segments, driven by innovations targeting sustained factor expression, reduced treatment burden, and long-term disease modification.

Key Growth Drivers

Rising Adoption of Prophylactic Treatment Regimens

The global Hemophilia market continues to expand due to the increasing shift from on-demand treatment to full prophylactic care. Prophylaxis significantly reduces bleeding frequency, improves joint health, and enhances overall quality of life, prompting widespread recommendation by international clinical guidelines. Countries with advanced healthcare systems, such as the U.S., Germany, and Japan, report high prophylaxis adoption rates, while emerging economies are gradually transitioning due to improving reimbursement structures. Pediatric populations particularly benefit from early prophylaxis initiation, reducing long-term disease complications. Extended half-life (EHL) factors further strengthen this driver by lowering infusion burden, improving adherence, and supporting consistent bleed prevention.

- For instance, Roche’s Hemlibra prophylaxis reduced treated bleeds to an annualized bleed rate (ABR) of 1.5 in the HAVEN 3 study, compared to 38.2 without prophylaxis, demonstrating substantial clinical benefit

Advancements in Gene Therapy and Long-Acting Biologics

Gene therapy is emerging as one of the most transformative drivers, offering the possibility of a functional cure through durable factor expression. Biotech innovators and major pharmaceutical companies continue to accelerate clinical trial progress, regulatory filings, and market launch strategies. Approvals for long-acting biologics and monoclonal antibodies are reshaping treatment by allowing low-frequency dosing and reducing lifelong infusion dependency. These technologies significantly enhance patient convenience and long-term outcomes. Growing investment, promising safety profiles, and patient willingness to opt for curative approaches further boost market expansion, positioning gene therapy as a major growth catalyst.

- For instance, CSL Behring and uniQure’s Hemgenix demonstrated a mean Factor IX activity of 36 IU/dL at 18 months in Phase 3 HOPE-B results, confirming sustained expression after a single infusion.

Increasing Global Diagnosis Rates and Access to Treatment

Rising diagnosis rates, expanding newborn screening programs, and increasing awareness are significantly improving patient identification across developed and emerging economies. Global initiatives by organizations such as the World Federation of Hemophilia are helping bridge treatment gaps, especially in countries where underdiagnosis was previously widespread. Improved access to recombinant and plasma-derived products, along with strengthened healthcare infrastructure in India, Brazil, China, and Africa, is driving broader treatment adoption. Digital health platforms, home-infusion services, and telemedicine are further enhancing accessibility, reducing follow-up gaps, and supporting better adherence. As diagnostic capabilities continue to expand globally, the market benefits from steady growth in the treated patient population.

Key Trends & Opportunities

Expansion of Gene Therapy Commercialization and Market Uptake

A major trend shaping the Hemophilia market is the transition of gene therapies from clinical research to commercial rollout. As more products receive regulatory approvals, companies are scaling manufacturing capacity, enhancing distribution frameworks, and developing outcome-based pricing models that support reimbursement. Real-world evidence is strengthening payer and provider confidence, demonstrating sustained factor expression and reduced bleed rates. Increasing collaborations among biotech firms, CDMOs, and government agencies are improving accessibility and accelerating adoption. Over the next decade, broader eligibility criteria, stronger safety data, and improved affordability will create substantial opportunities within this rapidly evolving treatment landscape.

- For instance, Hemlibra demonstrated strong efficacy with minimal dosing frequency options, and achieved a median annualized bleed rate (ABR) of 0.0 in its once-every-4-weeks dosing pivotal trial (HAVEN 4).

Rising Use of Digital Health Platforms and Personalized Treatment Approaches

Digital health adoption is accelerating, driven by AI-powered monitoring tools, mobile apps, and wearable devices that track bleeding episodes, factor usage, and treatment adherence. Personalized therapy guided by pharmacokinetic (PK) profiling allows clinicians to optimize dosing schedules and minimize factor wastage. These tools enhance patient engagement, improve disease management, and support remote clinical interventions, especially for pediatric and underserved populations. Pharmaceutical companies are increasingly integrating digital services with their biologic and gene therapy products to support education, monitoring, and treatment optimization. As digital ecosystems strengthen, they unlock new opportunities for precision care and differentiated product positioning.

- For instance, BioMarin collects long-term data on FVIII expression patterns and patient outcomes for Roctavian-treated patients through required post-market surveillance, long-term follow-up studies, and national hemophilia registries

Key Challenges

High Treatment Costs and Limited Reimbursement in Emerging Markets

The high cost of Hemophilia therapies—including recombinant factors, extended half-life products, and gene therapies—remains a major barrier, particularly in developing regions. Many healthcare systems lack the financial capacity to support continuous prophylactic treatment or advanced biologics, forcing patients to rely on inconsistent access to plasma-derived factors. Limited insurance coverage and slow reimbursement approvals further widen global treatment disparities. Although international aid programs provide support, they are insufficient to meet long-term demand. Payers also hesitate to reimburse costly gene therapies due to long-term cost-effectiveness uncertainty, posing a significant challenge to widespread global access and adoption.

Safety Concerns, Inhibitor Development, and Long-Term Uncertainty

Despite technological advances, inhibitor development remains a significant clinical challenge, reducing treatment efficacy and increasing complexity. Emerging therapies such as gene therapy and monoclonal antibodies still face concerns related to long-term safety, immune reactions, liver function impacts, and variability in factor expression. Regulatory agencies maintain strict approval pathways, often prolonging commercialization timelines. The need for extensive post-marketing surveillance and long-term monitoring adds additional burden. These challenges highlight the importance of robust clinical validation and careful patient selection, making safety-related concerns one of the most substantial obstacles to broader adoption of next-generation Hemophilia treatments.

Regional Analysis

North America

North America dominates the Hemophilia market, accounting for 38% of the global share in 2024, supported by advanced healthcare infrastructure, strong reimbursement systems, and widespread adoption of prophylaxis and extended half-life factor therapies. The U.S. leads regional growth due to high awareness, improved diagnostic coverage, and rapid uptake of gene therapies and monoclonal antibodies. Strategic collaborations between biopharma companies, extensive clinical research activity, and a strong pipeline of innovative treatments further reinforce the region’s leadership. Rising treatment accessibility through home-infusion programs and digital monitoring tools continues to strengthen North America’s market position through 2032.

Europe

Europe represents the second-largest Hemophilia market, holding 30% of global share in 2024, driven by strong national healthcare systems, structured hemophilia registries, and early adoption of recombinant factor products. Countries such as Germany, the U.K., Italy, and France maintain high treatment penetration due to comprehensive reimbursement frameworks and government-supported patient programs. Increased focus on prophylaxis, expanding home-care infusion support, and rising acceptance of gene therapy options continue to accelerate market growth. Regulatory bodies encourage innovation through accelerated pathways, supporting a steady introduction of long-acting biologics. Europe’s emphasis on patient safety and standardized care further strengthens its market relevance.

Asia-Pacific

Asia-Pacific is emerging as the fastest-growing regional market, accounting for 22% of global share in 2024, supported by expanding healthcare spending, improving diagnosis rates, and rising awareness in countries such as China, Japan, India, and South Korea. Government initiatives to strengthen rare disease management and increased availability of plasma-derived and recombinant factors are reshaping treatment accessibility. Japan and Australia lead adoption of advanced biologics, while China and India drive volume growth due to large patient populations. Investment in genetic testing, improved hemophilia centers, and growing interest in digital health platforms position Asia-Pacific for strong long-term expansion.

Latin America

Latin America holds 6% of the global Hemophilia market share in 2024, with growth supported by improving access to diagnostic services and expanding national hemophilia programs in Brazil, Mexico, Argentina, and Chile. Brazil leads the region due to government-funded treatment initiatives and rising availability of recombinant and extended half-life factors. Despite progress, treatment disparities persist due to uneven reimbursement and high therapy costs. International aid programs and partnerships with global organizations continue to support product availability. Gradual improvements in healthcare infrastructure and increased clinician training are expected to enhance treatment uptake across the region over the coming years.

Middle East & Africa

The Middle East & Africa region accounts for 4% of the global market share in 2024, characterized by rising awareness, expanding diagnostic capabilities, and government-led rare disease initiatives. Gulf countries such as Saudi Arabia, the UAE, and Qatar lead adoption of modern therapies due to strong healthcare investments, while African nations rely heavily on international aid and plasma-derived products. Limited infrastructure, high therapy costs, and inconsistent supply chains remain major barriers to widespread adoption. However, growing partnerships with global health organizations and ongoing improvements in specialty care centers are gradually strengthening the region’s future market potential.

Market Segmentations

By Type

- Hemophilia A

- Hemophilia B

- Others

By Treatment Type

- On-demand

- Cure

- Prophylaxis

By Therapy

- Factor Replacement Therapy

- Desmopressin & Fibrin sealants

- Gene Therapy & Monoclonal Antibodies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hemophilia market features a strong and evolving competitive landscape shaped by global biopharmaceutical leaders and emerging innovators developing advanced therapies. Major companies such as Takeda Pharmaceutical Company Limited, CSL Behring, Pfizer Inc., Bayer AG, BioMarin, Spark Therapeutics Inc., Sanofi, F. Hoffmann-La Roche Ltd., Novo Nordisk A/S, and Octapharma AG play a central role through extensive product portfolios spanning recombinant factors, extended half-life therapies, and novel monoclonal antibodies. The landscape is further reshaped by rapid advancements in gene therapy, where BioMarin, Spark Therapeutics, and Pfizer lead clinical and commercial activities. Strategic partnerships, R&D investments, and regulatory approvals are accelerating innovation, while companies expand global footprints through manufacturing scale-up and access programs. Intensifying competition around long-acting biologics, digital support platforms, and precision-based dosing solutions continues to drive differentiation, positioning key players to strengthen market presence through 2032.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Novo Nordisk expanded its partnership with the Novo Nordisk Haemophilia Foundation to scale projects aimed at improving care for people living with bleeding disorders, aiming to quadruple annual beneficiaries by 2030.

- In March 2025, Sanofi announced that the U.S. Food and Drug Administration (FDA) approved its therapy Fitusiran (brand name “Qfitlia”) for people aged 12 and older with haemophilia A or B, with or without inhibitors.

- In February 2025, Pfizer announced it would end global development of its gene therapy Fidanacogene elaparvovec (brand name “Beqvez”) for haemophilia B.

Report Coverage

The research report offers an in-depth analysis based on Type, Treatment Type, Therapy and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as gene therapy becomes more widely adopted across severe Hemophilia A and B cases.

- Long-acting biologics and monoclonal antibodies will gain larger patient acceptance due to reduced dosing frequency and improved convenience.

- Prophylaxis therapy usage will expand further as global guidelines increasingly recommend preventive treatment over on-demand options.

- Digital health tools and remote monitoring platforms will enhance treatment adherence and personalized care.

- Emerging markets will witness increased diagnosis rates and access to recombinant therapies through government and NGO initiatives.

- Biosimilar factor products will slowly enter selected regions, improving affordability and expanding patient reach.

- Healthcare systems will adopt value-based pricing models to support reimbursement of high-cost gene therapies.

- Innovation in PK-based dosing and individualized therapy will reshape clinical decision-making and optimize factor utilization.

- Strategic collaborations between biotech firms and pharmaceutical companies will accelerate R&D advancements.

- Global manufacturing capacity for recombinant factors and novel biologics will expand to meet rising demand.