Market Overview

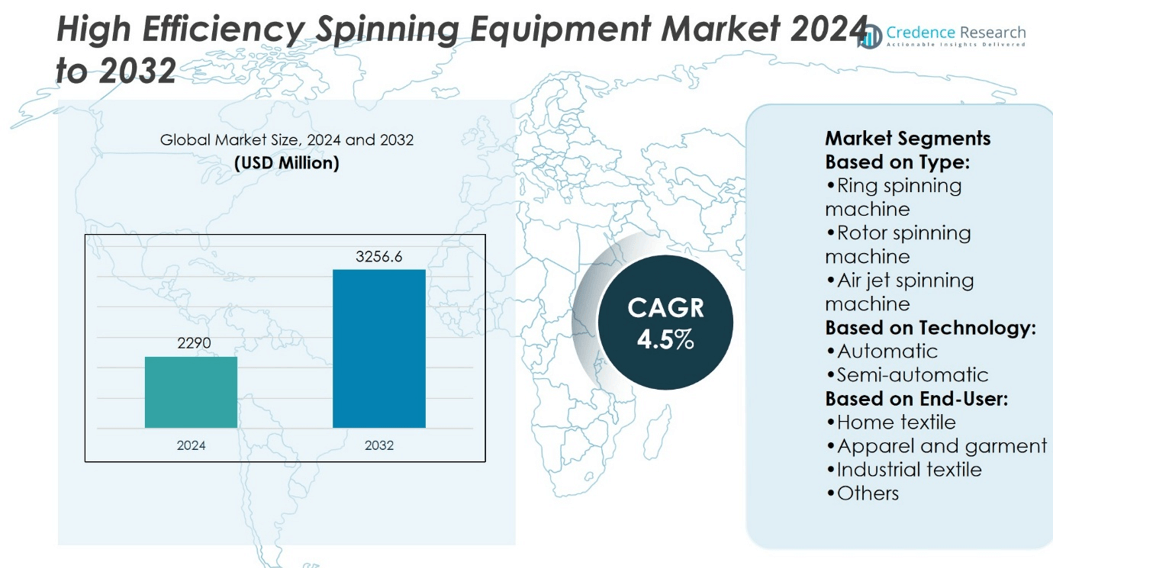

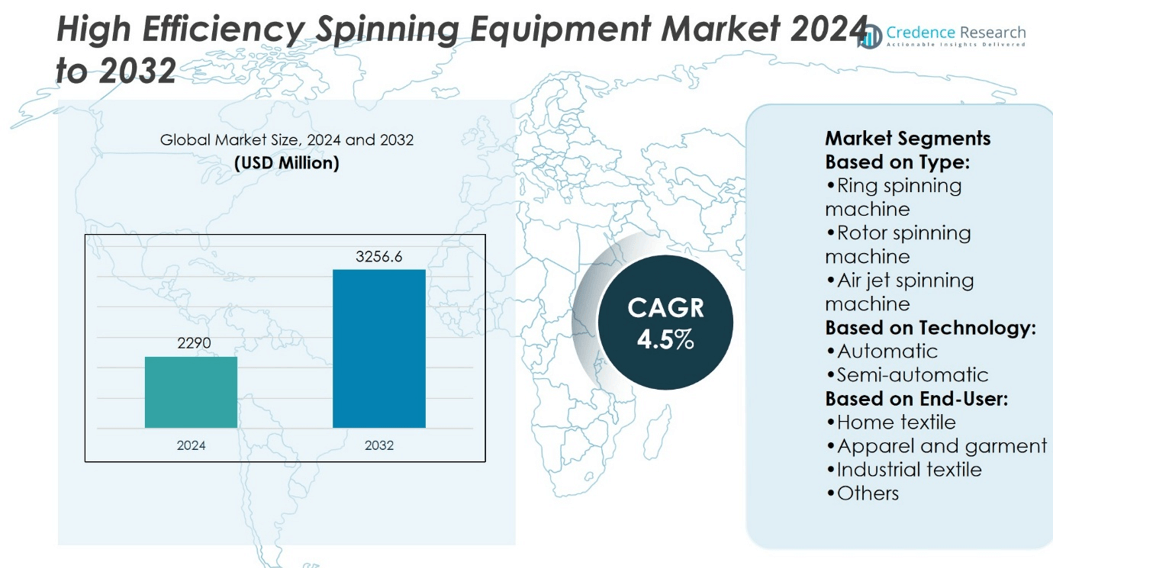

High Efficiency Spinning Equipment Market size was valued at USD 2290 million in 2024 and is anticipated to reach USD 3256.6 million by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Efficiency Spinning Equipment Market Size 2024 |

USD 2290 million |

| High Efficiency Spinning Equipment Market, CAGR |

4.5% |

| High Efficiency Spinning Equipment Market Size 2032 |

USD 3256.6 million |

The High Efficiency Spinning Equipment Market is driven by rising demand for energy-efficient and automated textile machinery that improves productivity and lowers operational costs. Manufacturers adopt advanced systems with smart controls and predictive maintenance to enhance yarn quality and reduce downtime. Strong emphasis on sustainability encourages investment in eco-friendly equipment with reduced power and resource use. Expanding textile production in emerging economies and growing demand for technical textiles further strengthen adoption. Trends highlight rapid digital integration, Industry 4.0 adoption, and increased focus on compact and high-speed machines, positioning the market for continuous growth in diverse textile applications.

The High Efficiency Spinning Equipment Market shows strong presence across Asia-Pacific, Europe, North America, Latin America, and the Middle East & Africa, with Asia-Pacific holding the largest share due to its extensive textile manufacturing base. Europe focuses on sustainability and advanced automation, while North America emphasizes technical textiles. Latin America and the Middle East & Africa present emerging opportunities. Key players include Rieter Group, Saurer Group, Murata Machinery Ltd, Marzoli Machines Textile Srl, Jingwei Textile Machinery Co Ltd, and Picanol Group.

Market Insights

- High Efficiency Spinning Equipment Market size was valued at USD 2290 million in 2024 and is projected to reach USD 3256.6 million by 2032 at a CAGR of 4.5%.

- Rising demand for energy-efficient and automated machines drives adoption across textile industries.

- Digital integration and Industry 4.0 trends strengthen the shift toward smart and connected systems.

- Competition focuses on innovation, sustainability, and expansion of aftersales support networks.

- High capital investment and skilled labor shortages remain restraints for smaller textile producers.

- Asia-Pacific dominates with strong textile exports, while Europe emphasizes eco-friendly processes and automation.

- North America leads in technical textiles, while Latin America and the Middle East & Africa show emerging growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Energy-Efficient Manufacturing Processes

The High Efficiency Spinning Equipment Market benefits from the strong push for energy efficiency in textile production. Manufacturers adopt advanced systems that cut electricity use while boosting operational productivity. Companies implement optimized motors and automated controls to reduce downtime. Energy-efficient machinery also helps firms meet stricter environmental compliance standards. It supports textile mills aiming for sustainable production goals without compromising quality. With rising electricity costs, the focus on lowering power consumption remains a major driver for market adoption.

- For instance, Smit Textile’s more advanced rapier weaving machines, such as the 2FAST model, can achieve high speeds of over 650 picks per minute. These newer machines incorporate various energy-saving features, including a high-efficiency brushless motor, though specifics like a 20% power reduction via an integrated synchronous motor are not a widely reported feature.

Growing Integration of Automation and Digital Control

Automation advances strengthen the High Efficiency Spinning Equipment Market by improving process reliability. Integrated digital control systems enhance precision in yarn formation and minimize defects. Automated equipment reduces manual intervention, helping manufacturers cut labor costs. It also improves consistency in textile output, aligning with global quality standards. The rise of Industry 4.0 encourages adoption of connected and smart machinery. Predictive maintenance features in automated systems extend equipment life and improve utilization.

- For instance, Rieter Group’s Autoconer X6 achieves a winding speed of up to 2,200 meters per minute and, through its Multilink system, enables efficient automation that significantly reduces labor input by optimizing the operator-to-machine ratio.

Expanding Textile Production in Emerging Economies

The High Efficiency Spinning Equipment Market gains momentum from rising textile demand in Asia-Pacific and other regions. Expanding production capacities in India, Bangladesh, and Vietnam drive equipment investments. Manufacturers focus on high-speed machines to meet large-scale orders from global retailers. Growing exports from these economies increase reliance on advanced spinning equipment. It supports countries aiming to strengthen competitiveness in the global textile supply chain. Demand from both apparel and technical textiles adds to market strength.

Increasing Focus on Sustainable and High-Quality Outputs

Sustainability and product quality remain central drivers for the High Efficiency Spinning Equipment Market. Textile firms invest in systems that lower waste and ensure uniform yarn quality. Machines with advanced filtration and recycling functions reduce resource usage. It helps manufacturers align with eco-labels and customer expectations for green textiles. Demand for premium fabrics in fashion and home furnishings boosts need for precise spinning equipment. Strong emphasis on sustainability drives continuous adoption of advanced solutions across textile hubs.

Market Trends

Adoption of Smart and Connected Spinning Systems

The High Efficiency Spinning Equipment Market is witnessing strong adoption of smart systems. Manufacturers integrate IoT-enabled controls to monitor real-time machine performance. Data analytics helps predict maintenance needs and avoid costly breakdowns. It improves efficiency by optimizing spinning speeds and reducing material waste. Smart connectivity also allows remote monitoring, providing better oversight for large-scale textile plants. Growing digitalization across manufacturing drives further investment in connected spinning machinery.

- For instance, Oerlikon Neumag introduced its EvoSteam staple fiber system, which replaces conventional water-bath cooling with steam-based conditioning. This innovation cuts water consumption by up to 10 million liters annually for a single production line, while lowering energy demand by up to 8% and reducing the CO₂ footprint.

Increasing Use of Sustainable and Eco-Friendly Machinery

The High Efficiency Spinning Equipment Market reflects rising demand for eco-friendly solutions. Equipment designed for lower energy use and reduced emissions gains strong acceptance. Water-saving and waste-reduction features support sustainability goals for textile producers. It enables compliance with strict environmental policies in Europe and North America. Eco-friendly machinery also enhances the appeal of manufacturers to global fashion brands. Demand for green production continues to expand adoption across diverse textile applications.

- For instance, Murata Machinery Ltd.’s Vortex 870 EX spinning machine achieves a maximum yarn take-up speed of 550 meters per minute, spins directly from sliver without roving or winding, and integrates its Muratec Smart Support (MSS) system to monitor up to 90 machines in real time on a single network.

Expansion of High-Speed and Automated Machinery

High-speed and automation-focused systems are reshaping the High Efficiency Spinning Equipment Market. Equipment now operates with higher spindle speeds, reducing production cycles. Automation features minimize errors, ensuring consistent yarn quality for export-driven markets. It also reduces reliance on skilled labor, which remains scarce in many regions. Integration of robotic handling supports faster transitions between production runs. Manufacturers prioritize advanced automation to remain competitive in large-scale textile operations.

Growing Focus on Technical Textiles and Specialty Applications

The High Efficiency Spinning Equipment Market benefits from rising interest in technical textiles. Specialized machinery supports production of performance fabrics for automotive, defense, and healthcare. It enables precise control over yarn properties, improving durability and functionality. Demand for specialty fibers, including blends with carbon and aramid, boosts equipment upgrades. Growing investments in research accelerate development of spinning systems for niche applications. Expanding technical textile use strengthens opportunities for advanced spinning equipment worldwide.

Market Challenges Analysis

High Capital Investment and Maintenance Costs

The High Efficiency Spinning Equipment Market faces challenges linked to high capital investment requirements. Manufacturers must allocate significant budgets to acquire advanced systems with automation and energy-saving features. It limits adoption among small and medium textile enterprises operating with restricted finances. Regular maintenance and specialized spare parts add to overall ownership costs. Many firms struggle to justify these expenses in highly competitive, low-margin textile markets. The high cost barrier often delays technology adoption in developing economies where price sensitivity dominates decision-making.

Shortage of Skilled Workforce and Technical Barriers

The High Efficiency Spinning Equipment Market also struggles with a shortage of skilled workforce. Advanced machinery requires trained operators to manage digital interfaces and automated controls. It creates pressure on manufacturers to invest in training programs, slowing production upgrades. Lack of expertise in predictive maintenance further raises risks of unplanned downtime. Technical barriers such as compatibility with existing infrastructure complicate integration of new systems. Resistance to shifting from traditional equipment remains high in regions with limited access to advanced training facilities.

Market Opportunities

Expansion into Sustainable and Energy-Efficient Textile Production

The High Efficiency Spinning Equipment Market holds strong opportunities through the global push for sustainable textiles. Manufacturers seek machinery that reduces energy use, lowers emissions, and improves resource efficiency. It positions advanced spinning systems as a key enabler of green manufacturing practices. Equipment with recycling features and water-saving technologies attracts demand from eco-conscious producers. Global fashion brands increasingly favor suppliers aligned with sustainability goals, strengthening adoption. The opportunity to provide environmentally responsible solutions drives innovation and market expansion.

Rising Demand from Technical Textiles and Emerging Economies

The High Efficiency Spinning Equipment Market gains growth potential from rising demand for technical textiles. Specialized machinery supports production of performance fabrics for automotive, medical, and defense industries. It enables manufacturers to produce high-value fibers with greater precision and durability. Expanding economies in Asia-Pacific and Africa invest in modern equipment to build competitive textile industries. Government incentives for industrial modernization create favorable conditions for equipment suppliers. Opportunities increase as developing regions aim to capture greater shares of global textile exports.

Market Segmentation Analysis:

By Type

The High Efficiency Spinning Equipment Market is categorized into ring, rotor, air jet, friction, compact, and other machines. Ring spinning machines dominate due to their ability to produce high-quality yarn for diverse applications. Rotor spinning machines attract demand for coarse and medium yarns used in denim and industrial fabrics. Air jet spinning machines gain traction for high-speed operations, reducing production cycles and improving efficiency. Friction spinning machines support specialty yarn production, meeting needs in technical textiles. Compact spinning machines remain vital for producing fine yarn with reduced hairiness, meeting premium textile standards. Other machines serve niche requirements, strengthening market diversity.

- For instance, AT Truetzschler draw frame feature a maximum silver delivery speed of 1000 meters per minute, enabled by digital servo drives and disc-level monitoring systems that deliver precise, metre-by-metre quality control in high-speed production lines.

By Technology

The market divides into automatic and semi-automatic technologies. Automatic machines drive strong adoption due to precision, reduced labor reliance, and higher productivity. It enhances consistency in yarn quality while integrating smart controls for predictive maintenance. Semi-automatic machines remain relevant in cost-sensitive regions were partial automation balances efficiency and affordability. Manufacturers in emerging markets often prefer semi-automatic solutions to manage capital expenditure while upgrading production. The shift toward automation reflects the growing influence of Industry 4.0 in textile manufacturing.

- For instance, Jutex manufactures jute spinning machines with options such as a 4¾-inch pitch and a 112-spindle configuration. These machines can be equipped with automatic doffing to improve efficiency and are designed to produce yarn for continuous jute spinning lines.

By End User

The High Efficiency Spinning Equipment Market caters to home textile, apparel and garment, industrial textile, and other sectors. Home textile producers adopt advanced systems to deliver consistent quality in bedding, upholstery, and furnishing fabrics. Apparel and garment industries demand high-speed equipment to meet global fashion cycles and large-scale orders. Industrial textile producers invest in durable machinery for technical fabrics used in automotive, defense, and healthcare. It allows greater precision in processing specialty fibers that require strict performance standards. Other end users include niche markets such as sportswear and protective clothing, creating further scope for adoption. Together, these segments highlight diverse opportunities for equipment suppliers across traditional and advanced textile sectors.

Segments:

Based on Type:

- Ring spinning machine

- Rotor spinning machine

- Air jet spinning machine

Based on Technology:

Based on End-User:

- Home textile

- Apparel and garment

- Industrial textile

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for nearly 18% of the High Efficiency Spinning Equipment Market share, supported by advanced manufacturing infrastructure and early adoption of automation technologies. The region’s textile producers focus on premium-quality yarns, technical fabrics, and sustainable processes. It benefits from strong integration of digital systems, IoT-enabled machinery, and energy-efficient solutions across mills. Demand is driven by industrial textiles for defense, automotive, and healthcare sectors, which require precision and durability. The U.S. leads this regional market, supported by investment in smart manufacturing initiatives and reshoring strategies. Canada contributes steadily with demand for home textiles and apparel, particularly eco-friendly fabrics. Partnerships between equipment manufacturers and textile mills continue to expand market presence.

Europe

Europe holds around 22% of the High Efficiency Spinning Equipment Market share, driven by strict environmental regulations and sustainability goals. The region emphasizes eco-friendly production processes, leading to higher adoption of energy-efficient spinning systems. Germany, Italy, and France remain key hubs for advanced textile manufacturing, with a strong focus on quality and innovation. It benefits from demand for technical textiles used in automotive, aerospace, and protective applications. European producers integrate compact spinning and automation technologies to ensure consistent quality standards. The fashion sector in Italy and France further boosts the need for precision equipment. Strong R&D investments and government-backed sustainability initiatives make Europe a leader in green textile production.

Asia-Pacific

Asia-Pacific dominates with nearly 42% of the High Efficiency Spinning Equipment Market share, driven by large-scale textile production and export activities. China, India, Bangladesh, and Vietnam serve as global textile hubs, accounting for a significant portion of global yarn output. It is characterized by rising investments in high-speed, automated spinning systems to meet global demand. Government incentives supporting modernization and industrial growth further strengthen the market in this region. The apparel and garment segment drives major demand, with global brands sourcing fabrics from Asia-Pacific producers. Adoption of rotor and air jet spinning machines continues to accelerate, reducing production cycles. With rapid industrialization, Asia-Pacific maintains its position as the strongest market for advanced spinning equipment.

Latin America

Latin America represents about 8% of the High Efficiency Spinning Equipment Market share, supported by expanding textile industries in Brazil, Mexico, and Argentina. Growth is linked to increasing regional demand for home textiles and apparel. It is also influenced by government initiatives to boost domestic textile competitiveness. Brazil leads the market, focusing on industrial modernization and sustainable manufacturing methods. Mexico benefits from proximity to North America, serving as a key supplier to U.S. apparel brands. While the market remains smaller compared to Asia-Pacific and Europe, investment in modern equipment is rising. Local producers aim to reduce production costs through energy-efficient machinery adoption.

Middle East & Africa

The Middle East & Africa accounts for close to 10% of the High Efficiency Spinning Equipment Market share, with growing opportunities in Turkey, South Africa, and Egypt. Turkey remains a dominant textile hub, integrating high-speed machines to serve global exports. It emphasizes premium fabrics, technical textiles, and sustainability standards, strengthening demand for advanced equipment. South Africa and Egypt show rising adoption, supported by regional initiatives to strengthen textile supply chains. It benefits from investments aimed at reducing import dependency and creating competitive domestic industries. Infrastructure upgrades and foreign investments in textile manufacturing further contribute to growth. Though smaller in scale, the region demonstrates strong long-term potential for equipment suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Smit Textile

- Rieter Group

- Marzoli Machines Textile Srl

- Sumitomo Heavy Industries Ltd

- Picanol Group

- Neumag GmbH

- Jingwei Textile Machinery Co Ltd

- Saurer Group

- Murata Machinery Ltd

- ATE Pvt Ltd

Competitive Analysis

The competitive landscape of the High Efficiency Spinning Equipment Market players including ATE Pvt Ltd, Jingwei Textile Machinery Co Ltd, Marzoli Machines Textile Srl, Murata Machinery Ltd, Neumag GmbH, Picanol Group, Rieter Group, Saurer Group, Smit Textile, and Sumitomo Heavy Industries Ltd. The High Efficiency Spinning Equipment Market is highly competitive, driven by continuous innovation and demand for advanced manufacturing solutions. Companies focus on developing high-speed, energy-efficient, and automated systems to improve productivity and reduce operational costs. Strong emphasis on digital integration, predictive maintenance, and smart monitoring supports efficiency gains across textile operations. Growing attention to sustainability pushes manufacturers to introduce eco-friendly designs with lower resource consumption. Competition intensifies as firms expand global service networks, invest in R&D, and pursue strategic collaborations. The market reflects a balance between established global players and emerging regional manufacturers offering cost-effective solutions.

Recent Developments

- In June 2025, Akio Toyoda offers bid which convert Toyota industries into private sector, aiming to restructure Toyota’s business aiming corporate reshaping movement.

- In May 2025, Truetzschler India inaugurated its cutting-edge manufacturing facility in Sanand, near Ahmedabad. Representing an investment of Rs. 400 crore, the new plant state-of-the-art manufacturing facility in Ahmedabad, Gujarat (India), with an investment.

- In May 2025, Rieter announced the acquisition of Barmag from OC Oerlikon, aiming to strengthen and expand its technology position in the textile industry. Barmag is a provider of filament spinning systems used for manufacturing manmade fibers and texturing machines.

- In March 2024, Murata Machinery launched its intelligent spinning machines featuring automation and real-time performance monitoring. These machines are customized to suit the needs of smart factories; thus, they contribute immensely to the improvement of efficiency, with greatly reduced manual intervention.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see stronger adoption of automation to improve efficiency and reduce labor reliance.

- Demand for energy-efficient spinning systems will grow with stricter environmental standards worldwide.

- Integration of IoT and smart monitoring will support predictive maintenance in textile operations.

- Technical textiles will create new opportunities for advanced spinning equipment suppliers.

- Compact and air jet spinning machines will gain wider acceptance for premium yarn production.

- Emerging economies will drive investments in modern equipment to expand textile exports.

- Sustainability initiatives will push manufacturers to adopt eco-friendly and resource-saving machinery.

- Digital control systems will enhance quality consistency and reduce production downtime.

- Service-based models and aftersales support will become more critical for market competitiveness.

- Global fashion demand cycles will continue to influence equipment upgrades and capacity expansions.