Market Overview:

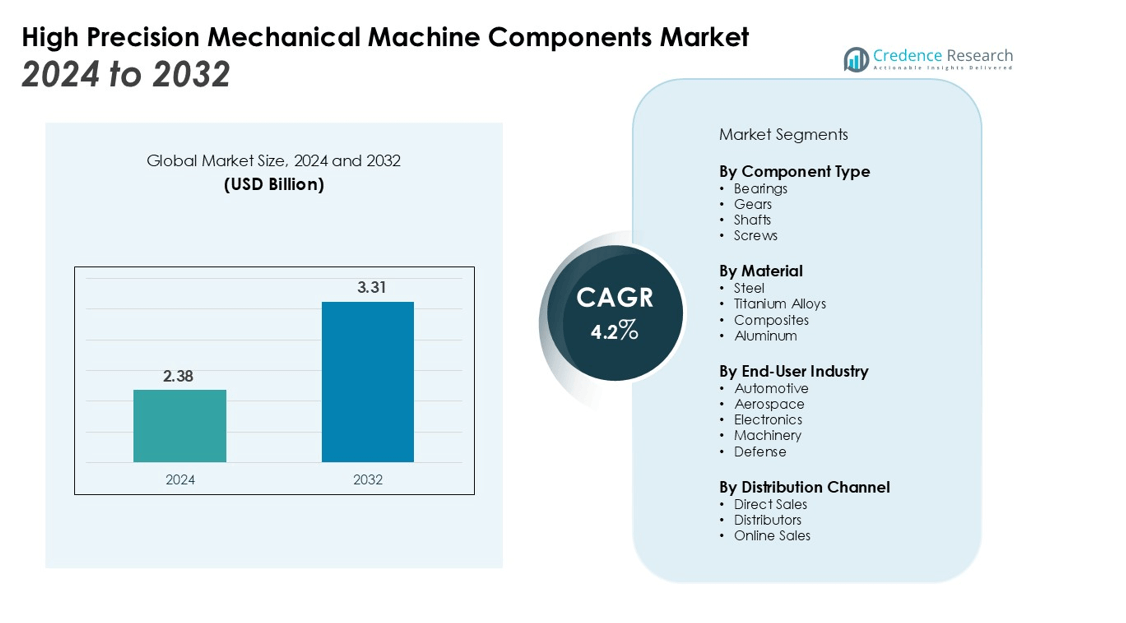

The High Precision Mechanical Machine Components Market size was valued at USD 2.38 billion in 2024 and is anticipated to reach USD 3.31 billion by 2032, at a CAGR of 4.2% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Precision Mechanical Machine Components Market Size 2024 |

USD 2.38 billion |

| High Precision Mechanical Machine Components Market, CAGR |

4.2% |

| High Precision Mechanical Machine Components Market Size 2032 |

USD 3.31 billion |

Key drivers of the High Precision Mechanical Machine Components Market include the rise in automation across manufacturing processes, the demand for high-performance machines, and advancements in materials and design. The push for improved product quality and reduced operational costs has led industries to adopt precision engineering solutions, further fueling market growth. Additionally, the growing adoption of Industry 4.0 and the integration of smart technologies into machinery are contributing significantly to the demand for high-precision components.

Geographically, North America dominates the market, driven by its well-established manufacturing sectors and technological advancements. Europe follows closely, with a strong presence in automotive and aerospace industries, driving the adoption of precision components. The Asia Pacific region is expected to witness the highest growth, supported by rapid industrialization and increasing demand for high-precision machinery in countries like China and India. These regions are focusing on expanding their manufacturing capabilities, further boosting the market for high-precision components.

Market Insights:

- The High Precision Mechanical Machine Components Market is valued at USD 2.38 billion in 2024 and is projected to grow at a CAGR of 4.2%, reaching USD 3.31 billion by 2032.

- The growing demand for automation in manufacturing processes is increasing the need for high-precision components to ensure optimal production efficiency and quality.

- Advancements in materials and component design, such as high-performance alloys and composites, are driving the demand for durable and efficient mechanical parts.

- The integration of Industry 4.0 technologies, including IoT and robotics, is accelerating the need for high-precision components to enable smart manufacturing.

- North America leads the market with a 35% share, driven by the aerospace, automotive, and defense sectors, while Europe holds a 30% share due to its strong industrial base.

- Challenges such as high production costs and complex manufacturing processes, along with supply chain disruptions, pose barriers to market growth.

- The focus on improving product quality and operational efficiency is driving industries to invest in advanced, high-precision components to enhance performance and reduce defects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Automation and Precision in Manufacturing

The growing demand for automation in various industries, particularly in automotive, aerospace, and electronics, is a key driver of the High Precision Mechanical Machine Components Market. Automation enhances production efficiency and product quality, requiring precise machine components for optimal performance. Companies are adopting advanced automated systems that rely on high-precision components to meet stringent manufacturing standards. This trend is pushing the market for components that ensure accuracy and consistency in production processes.

Advancements in Material Science and Component Design

Advancements in materials and component design have significantly contributed to the expansion of the High Precision Mechanical Machine Components Market. High-strength materials like titanium alloys, composites, and advanced steels are used to enhance the durability and performance of mechanical parts. The development of lightweight and high-performance materials has become essential, particularly in industries like aerospace and automotive, where precision and material strength are crucial for operational efficiency. These innovations are driving the market by improving the overall performance and lifespan of components.

- For instance, the substitution of high-strength steel with an advanced titanium alloy in certain aircraft components resulted in a weight savings of over 580 kg, significantly enhancing operational efficiency.

Growth of Smart Manufacturing and Industry 4.0 Integration

The integration of Industry 4.0 technologies into manufacturing processes is accelerating the demand for high-precision components. The implementation of Internet of Things (IoT) devices, sensors, and robotics in production lines requires components that can withstand constant monitoring and automation. Smart manufacturing systems rely on the precision of mechanical parts to optimize performance and reduce errors. The High Precision Mechanical Machine Components Market benefits from this shift as industries adopt intelligent systems for improved productivity and lower operational costs.

Increasing Focus on Product Quality and Operational Efficiency

Manufacturers across various sectors are prioritizing product quality and operational efficiency, which has led to a surge in demand for high-precision components. Components that can deliver enhanced accuracy and reliability are essential for maintaining high product standards and minimizing defects. The focus on reducing waste and improving operational costs encourages businesses to invest in advanced machinery that relies on precise components. This drive for better product quality and cost-effectiveness plays a critical role in the market’s growth.

- For instance, the manufacturing firm PMi2 utilizes automated quality inspection systems with Contact Coordinate Measuring Machines (CMMs) to provide measurements for complex geometries that are traceable to 1 National Institute of Standards and Technology (NIST) standard.

Market Trends:

Integration of Advanced Manufacturing Technologies

The High Precision Mechanical Machine Components Market is witnessing the integration of advanced manufacturing technologies, such as additive manufacturing and 3D printing, into production processes. These technologies enable the creation of complex, customized components with high accuracy, which traditional methods may not achieve. The use of 3D printing allows manufacturers to optimize designs, reduce material waste, and shorten production cycles. This trend is gaining traction, especially in industries like aerospace and automotive, where the demand for lightweight, high-performance components is increasing. The ability to rapidly prototype and produce intricate designs at reduced costs is a key factor driving the market.

- For instance, Airbus utilizes this technology extensively in its A350 XWB aircraft, which incorporates more than 1,000 flight parts produced via 3D printing.

Shift Towards Sustainable and Eco-Friendly Production

Sustainability has become a significant trend in the High Precision Mechanical Machine Components Market. Manufacturers are increasingly focused on adopting eco-friendly materials and processes to reduce environmental impact. The demand for components made from recyclable or biodegradable materials is growing as industries face pressure to comply with stringent environmental regulations. This shift toward sustainable production not only helps reduce carbon footprints but also enhances the market’s appeal in environmentally conscious regions. Companies are investing in green technologies and energy-efficient manufacturing processes, aligning with global efforts to promote sustainability across industries.

- For instance, the machine manufacturer EMAG has increased energy efficiency by utilizing advanced manufacturing processes like skiving turning instead of grinding, this technological shift reduced the machining time for an axle journal component from 15 seconds to just 3 seconds, substantially decreasing the energy consumption for each part produced.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The High Precision Mechanical Machine Components Market faces challenges due to the high production costs associated with advanced manufacturing processes. Precision components often require specialized materials and advanced machinery, which increases both material and labor costs. These high costs can be a barrier for smaller manufacturers or those in emerging markets, limiting their ability to adopt cutting-edge technologies. The complexity of manufacturing processes, which involve intricate designs and tight tolerances, further increases operational expenses and may lead to longer production cycles, affecting overall profitability.

Supply Chain Disruptions and Availability of Raw Materials

Supply chain disruptions and the availability of raw materials pose significant challenges in the High Precision Mechanical Machine Components Market. Fluctuations in the cost and availability of critical materials, such as high-strength alloys and composites, can hinder production schedules and increase component prices. Geopolitical factors, trade restrictions, and global supply chain uncertainties further exacerbate these issues. Manufacturers face difficulties in maintaining consistent supply chains, which impacts their ability to meet market demands on time and within budget.

Market Opportunities:

Expanding Demand in Emerging Markets

The High Precision Mechanical Machine Components Market presents significant opportunities in emerging markets, where industrialization and manufacturing capabilities are rapidly advancing. Countries in Asia-Pacific, Latin America, and parts of Africa are increasingly investing in automation and high-precision machinery. This growing demand for advanced manufacturing solutions offers a lucrative opportunity for market expansion. As industries in these regions look to improve productivity and efficiency, the adoption of high-precision mechanical components will continue to rise, creating substantial growth prospects for manufacturers.

Technological Advancements in Automation and Robotics

Technological advancements in automation and robotics offer additional growth opportunities for the High Precision Mechanical Machine Components Market. The continued development of smart manufacturing technologies, such as AI, IoT, and robotics, creates a demand for high-precision components that are critical for optimal system performance. These technologies require increasingly sophisticated parts to ensure accuracy, reliability, and efficiency. The shift toward automated production lines across sectors like automotive, aerospace, and electronics will further drive the need for precision components, enabling market players to capitalize on these emerging technological trends.

Market Segmentation Analysis:

By Component Type

The High Precision Mechanical Machine Components Market is segmented into parts such as bearings, gears, shafts, and screws. Bearings dominate the market, as they are essential for reducing friction and ensuring smooth operation in machinery. These components are particularly important in industries requiring high accuracy, including automotive and aerospace, where precision is critical for performance.

- For instance, SKF has leveraged more than 50 years of experience in the automotive industry to develop super-precision bearings that offer high-speed capability and a high degree of running accuracy for critical applications.

By Material

The market is primarily driven by metals, including steel, titanium alloys, and composites. These materials are favored for their strength, durability, and resistance to wear, especially in applications that require high performance. Aerospace and automotive sectors, in particular, benefit from the use of high-strength materials for precision components that need to withstand extreme conditions.

- For instance, the titanium alloy Ti-6Al-4V is commonly used in the Airbus A350 XWB aircraft, where over 70 metric tons of titanium alloy are used in the airframe and engine components.

By End-User Industry

The automotive sector holds a significant share of the High Precision Mechanical Machine Components Market, driven by the growing need for precision parts in vehicle production. The aerospace industry follows closely, with its strict requirements for high-quality components. Other industries, such as electronics, machinery, and defense, also contribute to the market, as they rely on high-precision components to meet operational demands. The automotive and aerospace sectors are expected to remain key drivers of market growth due to their continuous demand for efficient and durable components.

Segmentations:

By Component Type

- Bearings

- Gears

- Shafts

- Screws

By Material

- Steel

- Titanium Alloys

- Composites

- Aluminum

By End-User Industry

- Automotive

- Aerospace

- Electronics

- Machinery

- Defense

By Distribution Channel

- Direct Sales

- Distributors

- Online Sales

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

North America holds the largest share of the High Precision Mechanical Machine Components Market, accounting for 35% of the global market. This dominance is driven by the region’s advanced manufacturing infrastructure and strong industrial sectors, particularly aerospace, automotive, and defense. The United States is a key driver in this region, supported by substantial investments in technological innovation, automation, and smart manufacturing. The region’s emphasis on high-quality, precision components and ongoing demand for automation across industries solidifies its market position.

Europe

Europe commands a 30% share of the High Precision Mechanical Machine Components Market, with countries like Germany, France, and the UK being the primary contributors. The automotive and aerospace industries are major consumers of high-precision components in this region. Strong industrial capabilities and a focus on sustainability in manufacturing drive demand. Europe’s commitment to innovation and regulatory compliance continues to foster the growth of high-precision components, positioning it as a significant market player in global manufacturing.

Asia-Pacific

Asia-Pacific accounts for 25% of the High Precision Mechanical Machine Components Market share and is expected to experience the highest growth during the forecast period. Countries such as China, Japan, and India are rapidly industrializing, with increasing demand for high-precision parts in automotive, electronics, and machinery sectors. The region’s adoption of Industry 4.0 technologies and automation is contributing to the rising demand for advanced components. With expanding manufacturing capabilities and growing technological adoption, Asia-Pacific will continue to be a key region for market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Danaher

- Bosch Rexroth

- SKF

- GKN

- Hexagon

- Schaeffler

- JTEKT

- Mitsubishi Heavy Industries

- Renishaw

- NSK

- NTN

- Parker Hannifin

- THK

- Rexnord

Competitive Analysis:

The High Precision Mechanical Machine Components Market is highly competitive, with key players focusing on technological innovation, product quality, and customer relationships to maintain market share. Leading companies include SKF Group, Schaeffler Group, Timken Company, and NTN Corporation. These firms leverage advanced manufacturing techniques, such as precision machining and automation, to deliver high-quality components that meet the evolving demands of industries like automotive and aerospace. Competitive strategies include expanding product portfolios, forming strategic alliances, and investing in R&D to develop cutting-edge materials and designs. Regional players are also enhancing their capabilities to cater to local demand while adhering to international standards. Market participants focus on optimizing production processes and reducing lead times to enhance cost-efficiency, which helps in gaining a competitive edge. With increasing demand for precision components, companies are positioning themselves to capitalize on growth opportunities across various end-use industries.

Recent Developments:

- In May 2025, Danaher entered into a partnership with AstraZeneca to develop and commercialize diagnostics for precision medicine, including next-generation AI-powered diagnostic tools.

- In September 2025, GKN Aerospace announced it is expanding its facility in Newington, Connecticut, with a new production line to support additive manufacturing for Fan Case Mount Rings for the Pratt & Whitney GTF engine.

Report Coverage:

The research report offers an in-depth analysis based on Component Type, Material, End-User Industry, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for high-precision components will continue to rise across automotive, aerospace, and electronics sectors.

- Technological advancements in automation and Industry 4.0 will drive the need for increasingly precise components.

- The focus on improving operational efficiency and reducing waste will further accelerate the adoption of high-precision components.

- Growth in emerging markets, particularly in Asia-Pacific, will present significant opportunities for market expansion.

- Increasing investments in sustainable and eco-friendly manufacturing processes will push the market toward greener components.

- The development of new materials, including advanced composites and alloys, will enhance component durability and performance.

- Growing consumer demand for high-quality, reliable products will necessitate precision components to ensure performance and safety.

- Automation in manufacturing will require greater integration of high-precision components in production systems.

- The need for lightweight, high-performance materials will drive the aerospace and automotive industries to adopt more precise components.

- Companies will continue to invest in research and development to innovate and stay competitive in the evolving market landscape.