Market Overview:

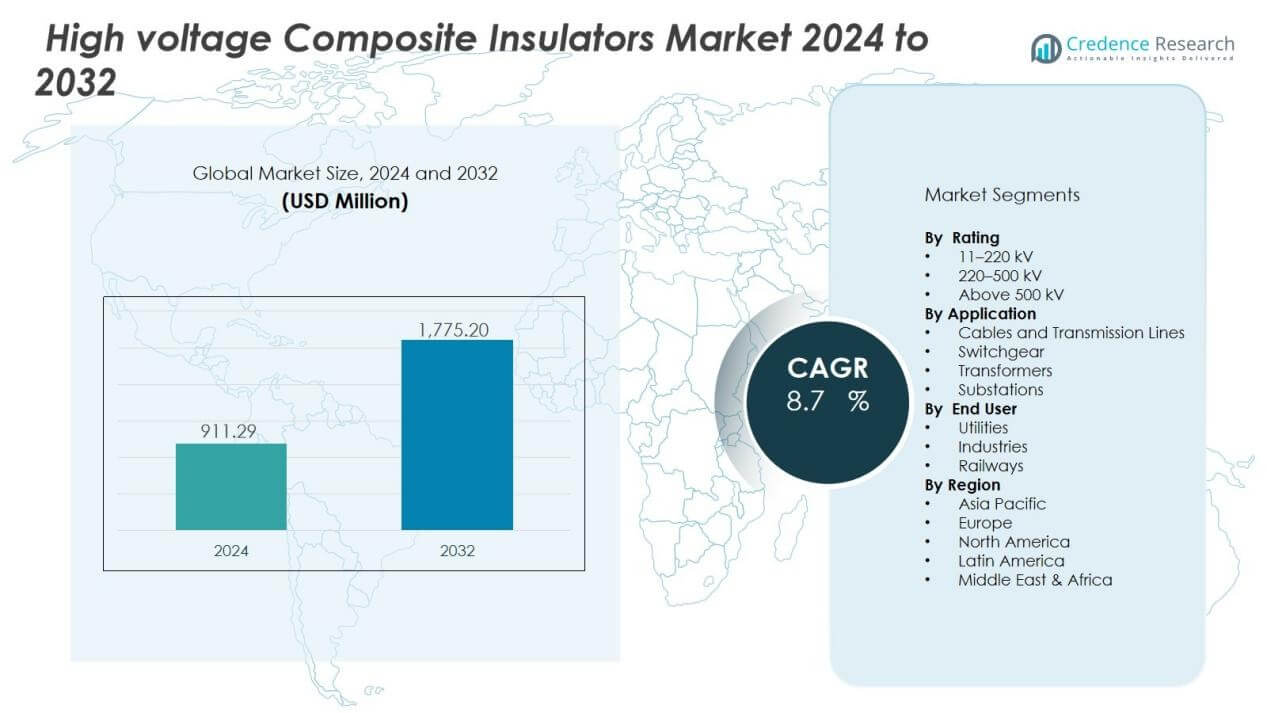

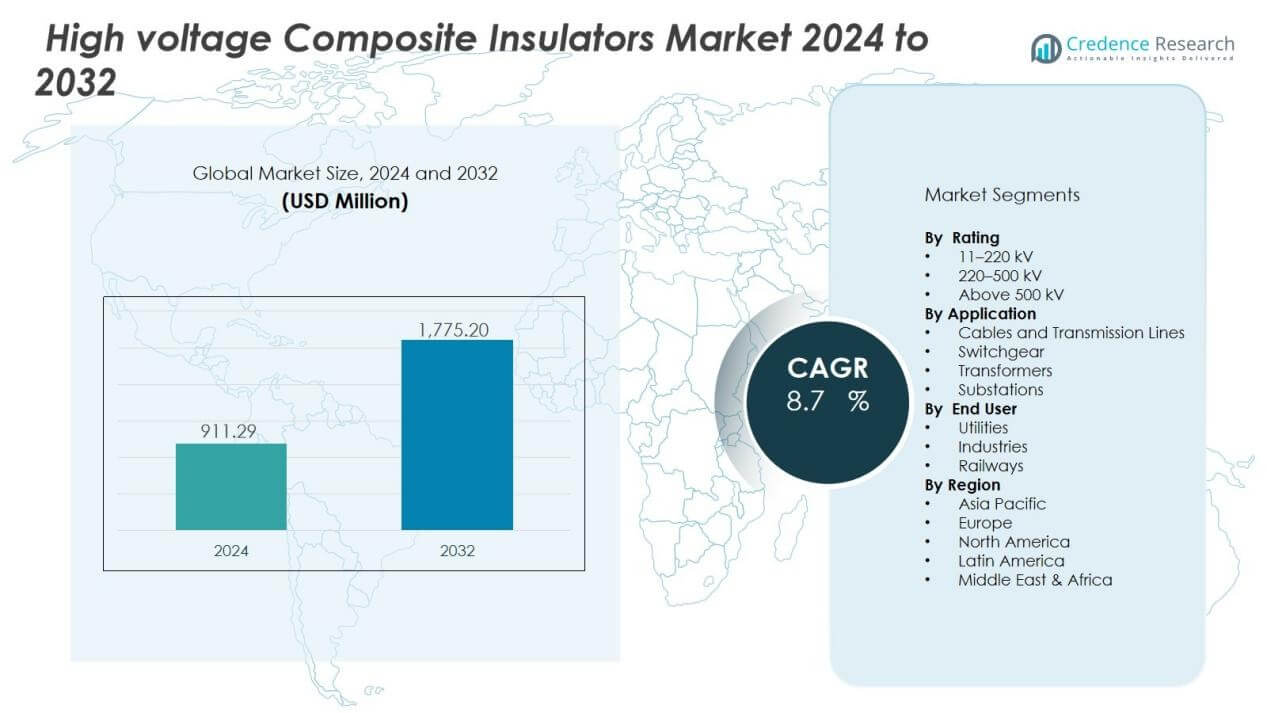

The high voltage composite insulators market size was valued at USD 911.29 million in 2024 and is anticipated to reach USD 1,775.20 million by 2032, at a CAGR of 8.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High voltage Composite Insulators Market Size 2024 |

USD 911.29 Million |

| High voltage Composite Insulators Market, CAGR |

8.7% |

| High voltage Composite Insulators Market Size 2032 |

USD 1,775.20 Million |

Key drivers of this market include the expansion of smart grid projects, rising global electricity demand, and large-scale renewable energy integration into power systems. Composite insulators are favored for their resistance to vandalism, pollution, and harsh weather, which makes them highly suitable for modern transmission infrastructure. Growing investments in upgrading aging grid infrastructure and extending high-voltage networks in developing economies further strengthen market adoption.

Regionally, Asia-Pacific leads the high voltage composite insulators market, supported by rapid industrialization, urbanization, and significant grid expansion projects in China and India. Europe follows, driven by modernization of grid infrastructure and emphasis on renewable integration. North America shows steady growth, underpinned by grid reliability initiatives and replacement of outdated transmission components. Meanwhile, Latin America and the Middle East & Africa are emerging markets, with rising energy infrastructure investments driving gradual adoption.

Market Insights:

- The high voltage composite insulators market was valued at USD 911.29 million in 2024 and is projected to reach USD 1,775.20 million by 2032 at a CAGR of 8.7%.

- Rising electricity demand and expansion of transmission and distribution networks are fueling adoption across utilities and industries.

- Smart grid projects and renewable energy integration create strong demand for durable and flexible composite insulators.

- Utilities are replacing porcelain and glass insulators with composite alternatives due to lighter weight and lower maintenance costs.

- Emerging economies in Asia-Pacific, Africa, and Latin America are driving demand with large-scale infrastructure development.

- High initial costs, counterfeit products, and limited standardization remain major challenges in cost-sensitive regions.

- Asia-Pacific led with 42% share in 2024, followed by Europe at 27% and North America at 19%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Global Demand for Reliable Power Transmission Infrastructure:

The high voltage composite insulators market benefits from increasing electricity demand worldwide. Governments and utilities are expanding transmission and distribution networks to meet industrial, commercial, and residential needs. Composite insulators offer high mechanical strength, long service life, and superior performance in harsh environments. Their role in improving transmission reliability and reducing outages drives adoption across regions.

- For instance, Changyuan Technology Group Ltd. (CYG) has successfully deployed over 10 million high voltage composite insulators worldwide, enhancing global energy infrastructure reliability.

Growing Investments in Grid Modernization and Renewable Integration:

The transition toward smart grids and renewable energy sources supports strong market growth. Investments in wind and solar power projects require durable high-voltage equipment capable of handling fluctuating loads. The high voltage composite insulators market gains traction through their ability to resist pollution and UV radiation while supporting flexible grid designs. It provides a cost-effective solution for utilities seeking long-term operational stability.

- For instance, Siemens Energy AG offers composite long rod insulators rated up to 800 kV with high mechanical tensile strength, used extensively in smart grid modernization projects.

Replacement of Traditional Porcelain and Glass Insulators:

Utilities are increasingly replacing porcelain and glass insulators with composite alternatives due to superior properties. Composite designs are lighter, easier to install, and less prone to breakage, lowering operational costs. The high voltage composite insulators market grows as utilities prioritize efficient and low-maintenance solutions. It also aligns with industry goals to enhance system reliability while reducing downtime.

Expanding Infrastructure Development in Emerging Economies:

Emerging markets are investing heavily in new power infrastructure to support industrialization and urban growth. Countries across Asia-Pacific, Africa, and Latin America are expanding transmission capacity, creating demand for advanced insulators. The high voltage composite insulators market benefits from their suitability in diverse climates and resistance to environmental stress. It plays a vital role in ensuring stable energy supply for growing economies.

Market Trends:

Increasing Focus on Advanced Materials and Product Innovation:

The high voltage composite insulators market is witnessing a strong trend toward advanced material use and product innovation. Manufacturers are incorporating silicone rubber and hybrid composites to improve hydrophobicity, mechanical durability, and resistance to environmental degradation. Product development focuses on designs that enhance performance under heavy pollution, coastal conditions, and extreme temperatures. It supports the need for insulators that extend service life and minimize maintenance requirements. Companies are also working on lightweight and compact designs to reduce installation costs and improve handling efficiency. The emphasis on material science advancements strengthens the reliability and competitiveness of composite insulators in global energy infrastructure projects.

- For instance, composite insulators, like those manufactured by Hitachi Energy, are known for their high tensile strength, which enhances their durability under extreme environmental conditions

Rising Adoption in Smart Grid Projects and Digital Monitoring Solutions:

The shift toward smart grids and digitalized energy systems is shaping the high voltage composite insulators market. Utilities are adopting insulators with embedded sensors that provide real-time condition monitoring and predictive maintenance capabilities. It allows operators to detect faults early, reduce downtime, and optimize asset management. The adoption of such technologies is expanding in developed regions where smart grid investments are high. Emerging economies are also beginning to integrate intelligent solutions as they modernize power networks. This trend highlights the growing role of smart insulators in building resilient, efficient, and sustainable energy systems worldwide.

- For instance, the Croatian company Callidus Group, in collaboration with the University of Osijek, has developed a LoRa-based IoT monitoring device for high-voltage insulators that records sensor data to identify faults in real-time, targeting transmission lines operating in the 10kV to 100kV range.

Market Challenges Analysis:

High Costs of Installation and Quality Concerns in Developing Regions:

The high voltage composite insulators market faces challenges related to higher initial costs compared to traditional porcelain alternatives. Many utilities in developing regions remain hesitant to adopt advanced insulators due to budget constraints. It also requires skilled labor for proper installation and maintenance, adding to overall project expenses. Concerns about counterfeit or low-quality products further hinder confidence in adoption. Limited standardization across markets creates inconsistencies in performance and safety. These factors slow down replacement rates and restrict faster penetration in cost-sensitive regions.

Environmental Stress and Limited Awareness Among End Users:

Composite insulators face challenges in regions with extreme weather conditions, where continuous exposure to UV rays, salt, and pollution can degrade performance over time. The high voltage composite insulators market struggles when users lack awareness about the long-term benefits of these advanced products. It often leads to reliance on traditional solutions despite their higher maintenance needs. Limited technical knowledge among smaller utilities and operators makes adoption slower in certain regions. Strict testing requirements and compliance with evolving safety standards also increase the complexity for manufacturers. These issues collectively pose hurdles to widespread market expansion.

Market Opportunities:

Expansion of Renewable Energy Projects and Smart Grid Investments:

The high voltage composite insulators market holds significant opportunities through the global shift toward renewable energy and smart grid expansion. Wind and solar power projects require durable and lightweight insulators that can perform under varying load conditions. It offers utilities solutions that improve efficiency while reducing long-term operational costs. Governments and private investors are funding large-scale renewable integration, creating demand for modern insulator technologies. The push for smart grids further accelerates adoption, with composite insulators supporting digital monitoring and automation. This creates strong growth potential across both developed and emerging markets.

Rising Demand in Emerging Economies and Infrastructure Development:

Emerging regions present untapped opportunities for the high voltage composite insulators market, supported by urbanization and industrialization. Countries in Asia-Pacific, Africa, and Latin America are expanding transmission and distribution infrastructure at a rapid pace. It provides manufacturers with the chance to supply advanced insulators that suit diverse climate conditions. Growing awareness of the benefits of composite insulators, such as reduced maintenance and longer service life, supports market penetration. Partnerships between international suppliers and local governments are expected to drive future projects. These developments open new avenues for long-term market growth and competitiveness.

Market Segmentation Analysis:

By Rating:

The high voltage composite insulators market is segmented by rating into 11–220 kV, 220–500 kV, and above 500 kV categories. The 11–220 kV segment dominates due to widespread adoption in medium-scale transmission and distribution networks. It is preferred for urban and rural distribution lines requiring durability and reliability. The 220–500 kV segment is expanding with grid modernization projects and renewable energy integration. The above 500 kV category is gaining attention for ultra-high-voltage projects in regions investing in long-distance power transmission.

- For Instance, G.K. Xianghe Electricals, based in India, manufactures a wide range of silicon rubber composite insulators. Their product offerings include insulators rated up to 220 kV for various applications within the power transmission and distribution network.

By Application:

Key applications include cables and transmission lines, switchgear, transformers, and substations. Transmission lines account for the largest share, driven by continuous upgrades in grid infrastructure worldwide. It supports long-distance power transfer while reducing operational risks in polluted and harsh environments. Substations represent another strong segment as they rely on advanced insulators to ensure stable operations. Switchgear and transformers also contribute steadily, with utilities focusing on reliability and performance improvement.

- For Instance, CHINT Electric’s natural ester-insulated transformers, including 500kV and 750kV models, were recognized in 2023 for international-leading technical performance enhancing environmental safety and operational efficiency.

By End-Use:

End-use industries include utilities, industries, and railways. Utilities dominate the high voltage composite insulators market, supported by large-scale infrastructure upgrades and renewable integration. It addresses the demand for reduced maintenance costs and long-term reliability in power delivery. Industrial end-users are adopting composite insulators to ensure safety and efficiency in high-voltage operations. Railways also show growing adoption, with expanding electrification projects across developing and developed economies fueling demand.

Segmentations:

By Rating:

- 11–220 kV

- 220–500 kV

- Above 500 kV

By Application:

- Cables and Transmission Lines

- Switchgear

- Transformers

- Substations

By End-Use:

- Utilities

- Industries

- Railways

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific accounted for 42% market share in 2024, making it the leading region. China and India drive demand with large-scale transmission and distribution expansion to support industrialization and urban growth. The high voltage composite insulators market benefits from government-backed investments in renewable energy integration and grid modernization. It gains further momentum through rapid urbanization and increasing electricity consumption across emerging economies. Japan and South Korea contribute with advanced technology adoption and replacement of aging infrastructure. Manufacturers view the region as a primary growth hub supported by long-term energy strategies.

Europe:

Europe held 27% market share in 2024, supported by strong commitments to renewable energy and sustainability. Countries such as Germany, France, and the UK lead investments in smart grids and advanced transmission infrastructure. The high voltage composite insulators market in the region benefits from strict regulatory standards emphasizing durability and environmental resilience. It also gains traction through replacement of traditional porcelain insulators with modern composite designs. Growing offshore wind projects in Northern Europe further boost demand for advanced insulator technology. Manufacturers prioritize this region for innovation-driven adoption and consistent infrastructure upgrades.

North America:

North America accounted for 19% market share in 2024, with the United States holding the largest portion. The region emphasizes replacement of aging infrastructure and investment in reliable grid systems. The high voltage composite insulators market benefits from government initiatives supporting energy efficiency and renewable integration. It is also driven by rising adoption of smart monitoring systems within utilities. Canada contributes with infrastructure upgrades to support expanding clean energy capacity. Market players focus on steady long-term demand in this region through modernization and advanced technology integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bonomi Eugenio SpA

- DECCAN ENTERPRISES PRIVATE LIMITED

- Hitachi Energy Ltd.

- CYG Insulator Co.,Ltd.

- Maschinenfabrik Reinhausen GmbH

- KUVAG GmbH & Co KG

- Nanjing Electric Technology Group Co., Ltd.

- Navitas Insulators Pvt Ltd

- Rayphen

- PFISTERER Holding SE

- SAA GRID TECHNOLOGY CO., LTD.

Competitive Analysis:

The high voltage composite insulators market is characterized by strong competition among global and regional manufacturers. Key players include Bonomi Eugenio SpA, DECCAN ENTERPRISES PRIVATE LIMITED, Hitachi Energy Ltd., CYG Insulator Co., Ltd., Maschinenfabrik Reinhausen GmbH, KUVAG GmbH & Co KG, Nanjing Electric Technology Group Co., Ltd., and Navitas Insulators Pvt Ltd. It is driven by continuous innovation in material technology, design improvements, and the integration of smart monitoring capabilities. Leading companies focus on expanding production capacity and forming strategic partnerships to strengthen their global footprint. Regional manufacturers emphasize cost-effective solutions tailored to local conditions, while global firms prioritize advanced performance and long-term reliability. The competitive landscape highlights a balance between price competitiveness and technological advancement, with utilities and industries favoring suppliers offering durability, safety, and lifecycle cost efficiency. It is expected to evolve further with rising investments in smart grid projects and renewable energy integration.

Recent Developments:

- In June 2025, Bonomi North America, part of Bonomi Group, launched the Ghibson high-performance and rubber-lined butterfly valve packages motorized with Valbia electric actuators, as well as the LOCPOWER energy-harvesting control device patented by Valpres at ACE 2025 in Denver.

- In August 2025, Hitachi Energy completed its acquisition of the remaining stake in eks Energy, enhancing its leadership in power conversion systems for energy storage.

Report Coverage:

The research report offers an in-depth analysis based on Rating, Application, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The high voltage composite insulators market will continue to expand with growing demand for grid modernization projects.

- Increasing integration of renewable energy will drive the adoption of durable and lightweight composite insulators.

- Utilities will focus on replacing traditional porcelain and glass insulators with advanced composite alternatives.

- Smart grid development will create opportunities for insulators with digital monitoring and predictive maintenance features.

- Emerging economies will contribute strongly through large-scale investments in power transmission and distribution infrastructure.

- Manufacturers will prioritize innovation in materials to enhance resistance against pollution, UV radiation, and extreme weather.

- Partnerships between global suppliers and regional players will strengthen supply chains and support localized production.

- Government policies promoting sustainable and resilient energy infrastructure will reinforce long-term market growth.

- The market will see increasing adoption in coastal and industrial zones requiring high-performance insulation solutions.

- Rising awareness of lifecycle cost savings will drive utilities to accelerate adoption of composite insulators.