Market Overview

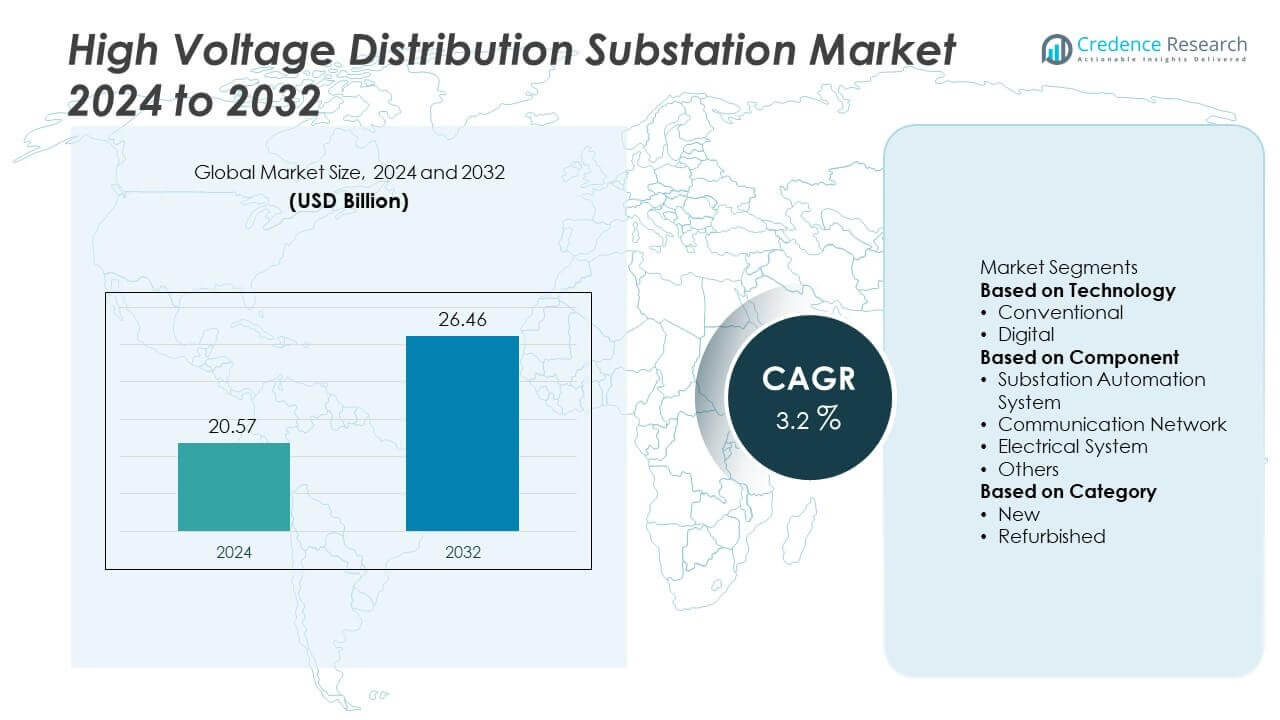

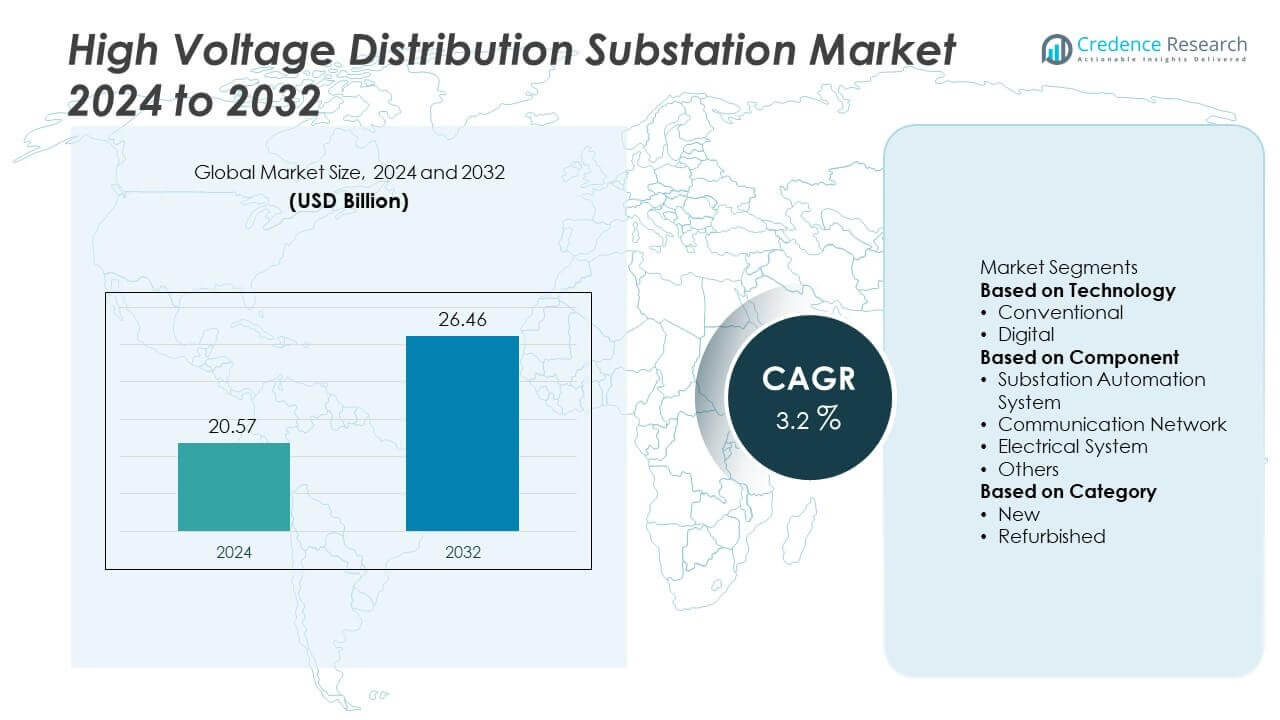

The High Voltage Distribution Substation Market was valued at USD 20.57 billion in 2024 and is projected to reach USD 26.46 billion by 2032, growing at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Voltage Distribution Substation Market Size 2024 |

USD 20.57 Billion |

| High Voltage Distribution Substation Market, CAGR |

3.2% |

| High Voltage Distribution Substation Market Size 2032 |

USD 26.46 Billion |

The High Voltage Distribution Substation Market grows with rising electricity demand, urbanization, and industrial expansion. Governments invest in modern grids to ensure reliable power delivery and integrate renewable energy sources.

The High Voltage Distribution Substation Market demonstrates strong regional growth, shaped by infrastructure maturity, electrification goals, and renewable integration. North America leads with advanced digital grid systems and modernization of aging assets, while Europe emphasizes cross-border energy interconnections and widespread adoption of gas-insulated substations. Asia-Pacific emerges as the fastest-growing region, driven by large-scale electrification in China and India, along with advanced technology use in Japan and South Korea. Latin America expands steadily with industrialization and renewable energy reforms, whereas the Middle East and Africa focus on new installations to support urban development and rural electrification. Key players such as ABB, Hitachi Energy, General Electric, and Eaton drive the market through innovations in smart substations, compact GIS solutions, and digital monitoring platforms. These companies prioritize technological advancements, partnerships, and infrastructure upgrades to strengthen their global presence and meet the rising demand for reliable and efficient high-voltage distribution networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The High Voltage Distribution Substation Market was valued at USD 20.57 billion in 2024 and is projected to reach USD 26.46 billion by 2032, growing at a CAGR of 3.2%.

- Rising electricity demand across industrial, commercial, and residential sectors drives the need for reliable substations that ensure stability and efficient distribution.

- Adoption of digital monitoring, automation, and gas-insulated substations highlights a strong trend toward modernization and efficiency improvements.

- Competitive landscape is shaped by key players such as ABB, Hitachi Energy, Eaton, and General Electric, focusing on smart substations, advanced switchgear, and global expansion strategies.

- High capital costs, long permitting timelines, and supply chain constraints act as restraints that limit adoption in budget-sensitive markets and developing regions.

- North America leads growth with strong investments in digital substations and grid modernization, while Europe advances renewable integration and Asia-Pacific expands fastest with electrification projects in China, India, Japan, and South Korea.

- Latin America progresses with industrial expansion and renewable projects, while the Middle East and Africa focus on electrification and smart city initiatives, creating new opportunities for compact and modular substations.

Market Drivers

Rising Electricity Demand Across Industrial, Commercial, and Residential Sectors

The High Voltage Distribution Substation Market benefits from global growth in power consumption. Expanding industrial activity, urbanization, and digital infrastructure projects create higher electricity requirements. Substations support stable and efficient transmission networks that maintain system reliability. Governments promote grid modernization to reduce outages and improve power quality. Large-scale manufacturing hubs and urban centers require dependable distribution frameworks to sustain productivity. Growing reliance on data centers and electric transport further increases the demand for high-voltage substations.

- For instance, Hitachi Energy announced a US$457 million investment to build a large power transformer factory in South Boston, Virginia, to support high-voltage transmission, power generation, data centers, and industrial demand for North America’s expanding grid. The new plant will produce transformers that can be used for ultra-high voltage (UHV) 765 kV transmission, among other applications.

Government Policies Supporting Renewable Energy Integration and Grid Expansion

The High Voltage Distribution Substation Market is driven by strong government backing for renewable power adoption. Substations enable effective integration of wind, solar, and hydro projects into national grids. It supports transmission stability by balancing intermittent renewable output with base-load power. Policy incentives and investments in smart grid infrastructure enhance market opportunities. Many countries fund grid expansion to address electrification gaps in remote regions. These initiatives create steady demand for substation installations in both developed and emerging economies.

- For instance, Eaton and Siemens Energy have partnered to develop a fast-track method for constructing data centers by integrating standardized, modular 500 MW onsite power plants. This collaboration aims to mitigate grid interconnection delays with grid-independent power supplies using modular gas turbines, battery storage options, and future hydrogen integration, potentially reducing data center time-to-market by up to two years to meet AI and cloud computing demand.

Technological Advancements Enhancing Efficiency and Grid Reliability

The High Voltage Distribution Substation Market experiences growth from innovations in digital monitoring and automation. Smart sensors, IoT platforms, and advanced switchgear improve fault detection and response times. It enables utilities to minimize downtime and optimize load management. Automated control systems support predictive maintenance, reducing operational costs for utilities. Integration of GIS substations further boosts safety and space efficiency in urban areas. Technology-driven modernization ensures grid operators meet growing energy demands with improved resilience.

Urbanization, Infrastructure Development, and Rising Electrification Needs

The High Voltage Distribution Substation Market is supported by rapid urban development and electrification initiatives. Expanding metro rail, airports, and industrial corridors require efficient power distribution networks. It ensures uninterrupted supply for construction, transport, and smart city projects. Rural electrification drives further investments in distribution substations to reach underserved populations. Emerging economies emphasize reliable power delivery to support economic growth. This momentum strengthens long-term demand for substations across diverse applications, ensuring consistent market expansion.

Market Trends

Adoption of Smart Grid Technologies and Digital Substation Solutions

The High Voltage Distribution Substation Market is shaped by the shift toward digital substations. Utilities deploy advanced monitoring systems, intelligent relays, and IoT-based platforms to improve reliability. It enables real-time data collection that enhances fault detection and predictive maintenance. Growing adoption of digital twins allows operators to simulate performance and improve asset management. Smart grid integration supports efficient load balancing and energy optimization. This trend ensures better resilience against power disruptions and strengthens long-term grid stability.

- For instance, ABB has deployed digital substation technologies in Germany’s 380 kV transmission grid, including a 2018 upgrade for TransnetBW that featured eco-efficient and digital capabilities to strengthen the grid.

Growing Deployment of Gas-Insulated Substations in Urban Areas

The High Voltage Distribution Substation Market benefits from rising demand for gas-insulated substations in cities. Limited land availability and higher safety requirements drive preference for compact designs. It allows installation of substations in dense urban environments without compromising efficiency. Gas-insulated technology reduces footprint and ensures lower maintenance compared to conventional systems. Many countries invest in underground or enclosed substations to support infrastructure growth. The urbanization trend reinforces adoption of GIS solutions for reliable and safe power delivery.

- For instance, Hitachi Energy, or its predecessor ABB, commissioned a 400 kV gas-insulated substation (GIS) in New Delhi for Power Grid Corporation of India Limited. This type of compact GIS can occupy significantly less space than a conventional air-insulated substation (AIS), with Hitachi Energy’s own materials citing footprint reductions of up to 70% in urban areas where space is limited.

Integration of Renewable Energy Projects into National Grids

The High Voltage Distribution Substation Market reflects strong momentum from renewable energy integration. Governments prioritize wind, solar, and hydro expansion to achieve sustainability targets. It requires advanced substations that manage fluctuating power flows and grid balancing. Hybrid substations designed for renewable interconnections gain prominence in large-scale projects. The rise of offshore wind and utility-scale solar plants fuels demand for specialized solutions. Strong policy support continues to create growth opportunities in this area.

Increasing Investments in Grid Modernization and Cross-Border Interconnections

The High Voltage Distribution Substation Market sees expansion through modernization projects and cross-border energy trade. Many utilities replace aging infrastructure with modern, high-capacity substations. It supports stable power delivery while reducing transmission losses. Regional interconnection projects in Europe, Asia, and Africa highlight the need for robust substations. International energy exchange enhances grid flexibility and reduces dependency on local generation. Investment momentum in modernization strengthens the market’s role in future-ready energy networks.

Market Challenges Analysis

High Capital Investment and Complex Implementation Requirements

The High Voltage Distribution Substation Market faces challenges from significant upfront costs and complex project execution. Building new substations requires large capital investments in land, equipment, and skilled labor. It often delays projects in regions with limited budgets or economic constraints. Long permitting timelines and regulatory approvals add further barriers to project rollout. Integration of advanced technologies such as GIS and digital monitoring systems increases overall expenses. Smaller utilities and developing economies struggle to adopt these solutions at scale.

Aging Infrastructure, Cybersecurity Risks, and Supply Chain Constraints

The High Voltage Distribution Substation Market is challenged by outdated infrastructure, cyber threats, and material shortages. Many existing substations operate beyond their intended lifespan, creating higher risks of breakdowns. It requires extensive refurbishment that strains utility budgets and disrupts service continuity. Rising digital adoption also exposes substations to cybersecurity vulnerabilities that demand robust protection systems. Shortages of critical components, including switchgear and transformers, extend project timelines. These structural challenges slow modernization efforts and limit the pace of global adoption.

Market Opportunities

Integration of Renewable Energy and Smart Infrastructure Development

The High Voltage Distribution Substation Market presents strong opportunities through renewable energy integration and smart infrastructure growth. Expanding wind and solar projects require advanced substations that manage variable power inputs. It supports grid stability by balancing intermittent generation with demand fluctuations. Governments invest heavily in smart city development, creating demand for compact and digital substations. Rapid electrification in transportation also increases requirements for reliable distribution networks. These factors position substations as critical enablers of sustainable energy transitions.

Expansion Across Emerging Economies and Cross-Border Energy Trade

The High Voltage Distribution Substation Market gains prospects from rapid expansion in emerging economies. Countries in Asia, Africa, and Latin America focus on rural electrification and industrial development. It drives investments in modern substations that improve power accessibility and reliability. Cross-border interconnection projects in regions like Europe, Asia-Pacific, and the Middle East create further growth avenues. Rising collaboration between governments and private utilities accelerates deployment in underserved regions. These opportunities strengthen the global importance of substations in advancing energy security.

Market Segmentation Analysis:

By Technology

The High Voltage Distribution Substation Market, by technology, is divided into air-insulated substations (AIS) and gas-insulated substations (GIS). Air-insulated substations maintain dominance due to their cost-effectiveness and wide use in open spaces. It remains suitable for regions with available land and moderate population density. Gas-insulated substations continue to gain traction, particularly in urban and industrial hubs where space is limited. GIS offers compact design, enhanced safety, and lower maintenance, making it vital for high-capacity power networks. Growing demand for underground and enclosed installations strengthens GIS adoption across developed economies.

- For instance, ABB (now Hitachi Energy) delivered a 380 kV gas-insulated substation to support the 1,549 MW combined-cycle power plant for the Fadhili gas complex in Saudi Arabia’s Eastern Province. The substation enables the combined heat and power plant to supply electricity to the complex and feed excess power into the national grid.

By Component

The High Voltage Distribution Substation Market, by component, includes transformers, switchgear, busbars, protection devices, and control systems. Transformers account for the largest share due to their role in voltage regulation and reliable energy distribution. It ensures grid stability by managing high-capacity power flow. Switchgear and protection devices are critical for system safety, offering fault detection and circuit isolation. Busbars contribute to efficient power transmission within substations, while advanced control systems enable automation and monitoring. Increasing digitalization drives investment in smart sensors, communication tools, and IoT-enabled components for better performance and predictive maintenance.

- For instance, Eaton expanded its portfolio with solid-state transformer technology following its acquisition of Resilient Power Systems in August 2025, with plans to accelerate the deployment of the compact, medium-voltage devices to enhance grid reliability and support renewable integration. The acquired technology is also intended for applications in growing global markets like data centers and energy storage.

By Category

The High Voltage Distribution Substation Market, by category, covers new installations and retrofit projects. New installations dominate in emerging economies where urbanization, industrialization, and electrification drive expansion of power infrastructure. It reflects strong demand in regions focusing on renewable integration and grid modernization. Retrofit projects hold significance in developed markets, where utilities replace aging infrastructure with modern, digital substations. Governments in North America and Europe invest in refurbishment to improve efficiency, security, and resilience of existing networks. This balance between new deployment and modernization ensures sustained market growth across diverse regions.

Segments:

Based on Technology

Based on Component

- Substation Automation System

- Communication Network

- Electrical System

- Others

Based on Category

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the High Voltage Distribution Substation Market, accounting for nearly 33% in 2024. The region benefits from advanced grid infrastructure, strong regulatory frameworks, and consistent investment in renewable energy integration. The United States leads the market due to ongoing modernization of aging substations and the expansion of transmission networks to meet rising electricity demand. It supports large-scale renewable projects, including offshore wind and utility-scale solar farms, which require efficient distribution systems. Canada contributes significantly with government programs that prioritize rural electrification and smart grid development, while Mexico focuses on expanding industrial and commercial power access. Increasing adoption of digital substations and gas-insulated designs in urban areas further strengthens the regional growth trajectory.

Europe

Europe represents around 28% of the High Voltage Distribution Substation Market in 2024, reflecting its strong emphasis on renewable energy and cross-border interconnections. Countries such as Germany, France, and the United Kingdom drive market growth through extensive investments in wind and solar power integration. The European Union supports grid harmonization projects that enhance interconnectivity among member states, ensuring stable energy trade across borders. It highlights a shift toward digital and gas-insulated substations, particularly in densely populated regions where land availability is limited. Southern and Eastern Europe also show steady demand, with infrastructure modernization programs aimed at replacing outdated substations. Europe’s strong regulatory environment and focus on sustainability ensure continuous investments in grid reliability and energy transition goals.

Asia-Pacific

Asia-Pacific accounts for approximately 26% of the High Voltage Distribution Substation Market in 2024, making it one of the fastest-growing regions. China dominates with large-scale investments in transmission and distribution networks to support its rapid urbanization and industrial expansion. It also leads renewable energy integration, deploying substations to connect wind and solar plants to the national grid. Japan and South Korea focus heavily on advanced gas-insulated substations to optimize space and enhance safety in densely populated areas. India demonstrates robust growth through government-backed electrification projects and rising industrial activity, creating strong demand for both new installations and retrofit solutions. Southeast Asian nations, including Vietnam, Indonesia, and Thailand, invest in substations to strengthen their developing power infrastructure. This diverse regional landscape underscores the importance of high-voltage substations in meeting Asia-Pacific’s growing energy needs.

Latin America

Latin America holds nearly 8% of the High Voltage Distribution Substation Market in 2024, supported by expanding industrialization and energy reforms. Brazil leads the regional market with significant investments in grid modernization and integration of renewable projects, particularly hydropower and solar. It plays a key role in regional energy trade, requiring efficient substation networks for cross-border connections. Mexico shows growing adoption driven by industrial growth and urban expansion, while countries such as Chile, Argentina, and Colombia prioritize substation installations to enhance electricity reliability. It faces challenges related to funding and infrastructure gaps, but rising public-private partnerships create new opportunities. Increasing adoption of gas-insulated substations in metropolitan areas supports sustainable urban development.

Middle East and Africa

The Middle East and Africa together account for around 5% of the High Voltage Distribution Substation Market in 2024, reflecting gradual but steady growth. The Middle East, led by Saudi Arabia, the United Arab Emirates, and Qatar, invests heavily in substation projects to support industrialization, smart cities, and renewable energy initiatives. It focuses on deploying advanced substations that can handle growing demand for reliable electricity in high-temperature environments. Africa shows emerging opportunities, with South Africa, Nigeria, and Egypt investing in electrification and grid expansion programs. Many countries face challenges from limited financial resources and infrastructure readiness, but international funding supports progress in these regions. Growing demand for mobile and modular substations also addresses the needs of remote and rural communities, expanding market reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Grid to Great

- Eaton

- Hitachi Energy

- Alstom

- Belden

- L&T Electrical and Automation

- General Electric

- Cisco Systems

- ABB

- Efacec

Competitive Analysis

The competitive landscape of the High Voltage Distribution Substation Market is defined by leading players including ABB, Hitachi Energy, General Electric, Eaton, Alstom, Cisco Systems, Belden, L&T Electrical and Automation, Efacec, and Grid to Great. These companies compete by focusing on advanced technologies, digital monitoring platforms, and compact gas-insulated substations that meet the rising demand for reliable and efficient power distribution. They emphasize innovation in automation, smart sensors, and IoT integration to strengthen grid resilience and reduce downtime. Partnerships with governments, utilities, and private developers enhance their presence in large-scale grid modernization projects, renewable energy integration, and smart city development. Global expansion remains a core strategy, with investment in emerging markets where electrification and industrialization drive fresh demand for substations. Strong portfolios of transformers, switchgear, and protection devices allow these companies to serve diverse infrastructure needs while maintaining competitiveness in both developed and developing regions. This intense competition ensures continuous innovation and steady market growth.

Recent Developments

- In June 2025, Hitachi Energy Launched the Compact Line Voltage Regulator (C-LVR), a transformer-integrated device presented at CIRED 2025. It enables voltage regulation at feeder level within the same footprint as a standard distribution transformer.

- In June 2025, Eaton Completed the acquisition of Resilient Power Systems Inc., enhancing its capability in solid-state transformer technology—key for future grid and substation innovation.

- In May 2025, Hitachi Energy Successfully tested a 765 kV / 400 kV single-phase, 250 MVA natural ester-filled transformer—the largest of its kind. This unit sets new benchmarks for ultra-high-voltage AC transmission safety and environmental performance.

- In April 2025, Hitachi Energy (with BHEL) Was selected to design and deliver ±800 kV HVDC terminals forming part of a 950 km, 6 GW bi-pole HVDC transmission system connecting Bhadla (Rajasthan) to Fatehpur (Uttar Pradesh) in India.

Report Coverage

The research report offers an in-depth analysis based on Technology, Component, Category and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for digital substations will rise with increasing grid automation.

- Renewable energy integration will create strong need for advanced distribution systems.

- Gas-insulated substations will gain preference in urban and space-limited areas.

- Smart grid adoption will expand opportunities for digital monitoring solutions.

- Cross-border interconnection projects will strengthen demand for high-capacity substations.

- Emerging economies will invest in new installations to support electrification.

- Retrofit projects will accelerate in developed markets with aging infrastructure.

- IoT-enabled devices will enhance predictive maintenance and operational efficiency.

- Modular and mobile substations will support remote and rural power access.

- Global collaboration between utilities and technology providers will drive innovation.