Market Overview:

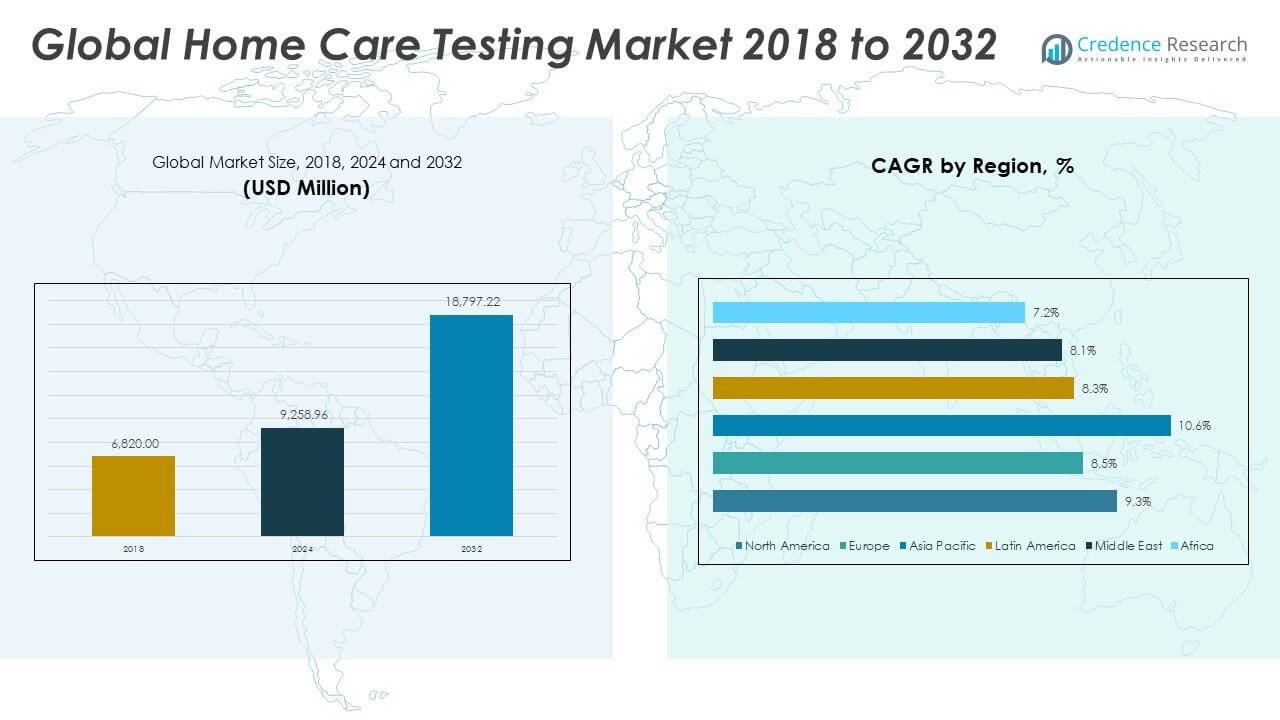

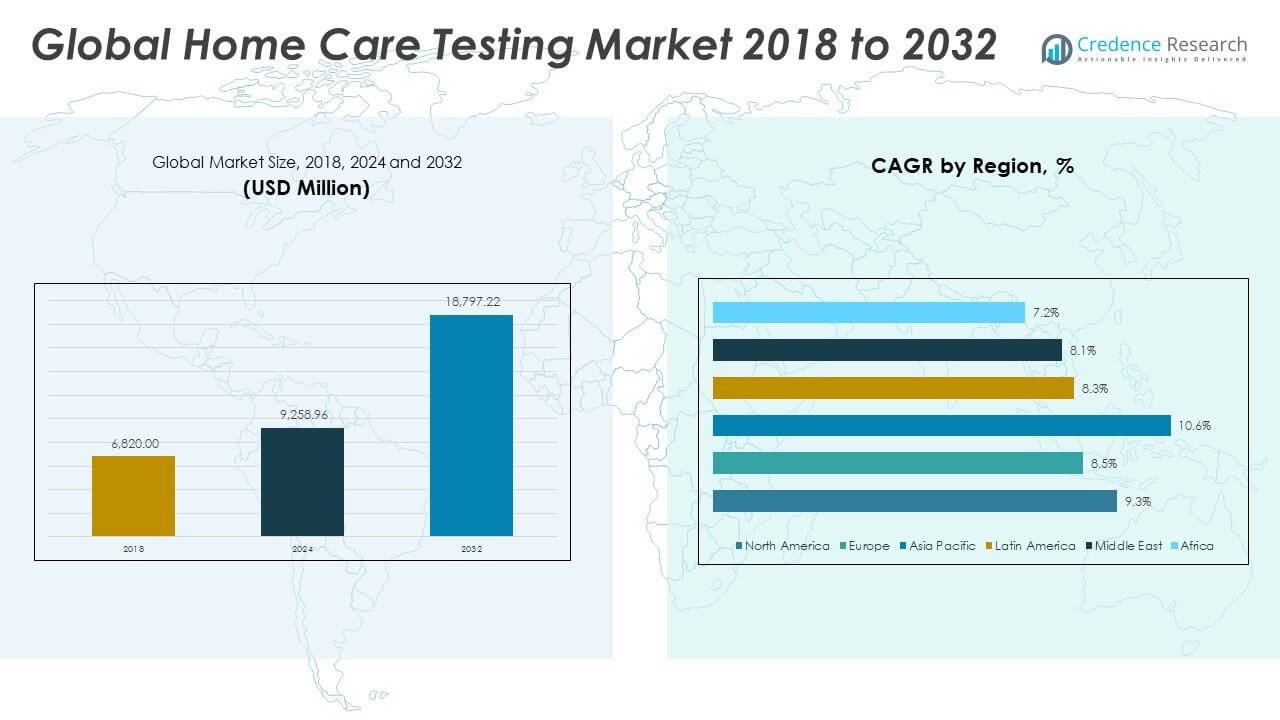

The Global Home Care Testing Market size was valued at USD 6,820.00 million in 2018 to USD 9,258.96 million in 2024 and is anticipated to reach USD 18,797.22 million by 2032, at a CAGR of 9.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Home Care Testing Market Size 2024 |

USD 9,258.96 Million |

| Home Care Testing Market, CAGR |

9.32% |

| Home Care Testing Market Size 2032 |

USD 18,797.22 Million |

Several drivers are accelerating the adoption of home care testing solutions. The increasing global burden of chronic diseases, such as diabetes and hypertension, alongside aging populations, is pushing demand for regular and accessible diagnostic options. Self-monitoring and early detection tools allow patients to manage long-term conditions more efficiently, reducing the need for frequent hospital visits. The COVID-19 pandemic acted as a major catalyst, expanding the use of at-home testing beyond traditional segments into infectious diseases and general wellness. Furthermore, technological innovations—such as miniaturized lab-on-chip diagnostics, connected devices, and AI-powered remote monitoring—have improved test accuracy, reduced turnaround time, and made at-home testing more reliable. The availability of home-based diagnostic solutions through retail pharmacies and online platforms has also improved accessibility. In parallel, increased awareness, favorable reimbursement policies, and regulatory approvals for a broad range of test kits have provided further momentum.

Regionally, North America dominates the global home care testing market, driven by high healthcare spending, well-established reimbursement systems, and early adoption of remote diagnostics, particularly in the United States. Europe follows closely, with Germany, the UK, and France contributing significantly to regional revenue, supported by patient awareness, aging populations, and government initiatives promoting self-care. Asia Pacific is emerging as the fastest-growing region, led by China and India, where rising disposable incomes, improving healthcare infrastructure, and growing digital penetration are supporting the rapid expansion of at-home diagnostics. Latin America, the Middle East, and Africa are experiencing steady growth, with Brazil, Saudi Arabia, and South Africa showing promising signs due to healthcare reforms and increased public health initiatives. Collectively, global adoption of home care testing continues to rise as a critical enabler of proactive, accessible, and efficient healthcare management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Home Care Testing Market was valued at USD 6,820.00 million in 2018, reached USD 9,258.96 million in 2024, and is anticipated to grow to USD 18,797.22 million by 2032, at a CAGR of 9.32% during the forecast period (2024–2032).

- The increasing global burden of chronic diseases—such as diabetes, hypertension, and cardiovascular conditions—alongside a growing geriatric population, continues to drive demand for regular, accessible, and at-home diagnostic solutions.

- Technological innovations such as lab-on-chip diagnostics, AI-powered remote monitoring, biosensors, and connected devices are significantly improving test accuracy, speed, and ease of use.

- The COVID-19 pandemic greatly accelerated the acceptance of home care testing, broadening its use beyond chronic diseases into infectious disease detection and general wellness screening.

- Regulatory support from agencies like the U.S. FDA and the European Medicines Agency, coupled with expanded access via retail pharmacies, e-commerce platforms, and telehealth services, is boosting market growth and accessibility.

- Key challenges include global regulatory variability, risk of user error, data privacy concerns, and the need for secure integration with digital health platforms.

- Regionally, North America dominates the market due to high healthcare expenditure and early technology adoption, while Asia Pacific is the fastest-growing region, led by countries like China and India, supported by rising income levels and improved healthcare infrastructure.

Market Drivers:

Rising Prevalence of Chronic Diseases and Geriatric Population Drives Consistent Demand:

The increasing global burden of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions remains a primary driver of the Global Home Care Testing Market. Patients require frequent and convenient diagnostic testing to monitor and manage these conditions, making home-based solutions both practical and necessary. The aging global population further contributes to market growth, with seniors more likely to experience multiple comorbidities and mobility constraints. Home care testing reduces the need for regular hospital visits, offering elderly patients a safer and more accessible option. Healthcare systems are under pressure to reduce costs while maintaining quality care, and remote diagnostics provide a viable method of achieving that balance. It benefits both patients and providers by lowering strain on facilities and supporting continuous health monitoring from the comfort of home.

- For instance, Abbott’s FreeStyle Libre system has been adopted by over 4.5 million users globally for continuous glucose monitoring, allowing diabetic patients to check their glucose levels up to 1,440 times per day without routine fingersticks.

Technology Advancements Enhance Accuracy, Accessibility, and Adoption Rates:

Rapid technological innovations in diagnostic devices are reshaping how consumers interact with healthcare tools, significantly boosting the adoption of home-based testing kits. Innovations in biosensors, microfluidics, wireless connectivity, and artificial intelligence have made home testing more accurate, faster, and easier to use. Devices are now capable of delivering lab-grade results with minimal user intervention, enhancing patient confidence in self-diagnosis and routine monitoring. Integration with smartphones and cloud-based health platforms allows users and healthcare providers to track data in real time. It enables timely interventions and supports data-driven decision-making in chronic care management. Continuous improvements in usability and portability make these solutions more accessible to a broader demographic, including non-tech-savvy users.

- For instance, Cue Health’s molecular COVID-19 test received FDA Emergency Use Authorization and delivers results in about 20 minutes with accuracy, while connecting results directly to a mobile app for real-time reporting.

Pandemic-Driven Behavioral Shift Toward Self-Care and Remote Diagnostics:

The COVID-19 pandemic created a lasting shift in healthcare behavior, reinforcing the value and viability of self-administered diagnostic tools. With hospitals overwhelmed and individuals seeking safer alternatives, home care testing experienced a sharp increase in usage across various test categories, including infectious diseases and general wellness. This behavioral change has become embedded in consumer health habits, with many individuals now expecting greater convenience and control over their healthcare routines. It accelerated regulatory approvals, supply chain investments, and consumer trust in at-home diagnostics. Retail pharmacies, e-commerce platforms, and digital health providers expanded their offerings to meet surging demand. The pandemic helped validate the role of home diagnostics as a core component of modern healthcare delivery models.

Supportive Regulatory Environment and Expanding Distribution Infrastructure:

Regulatory agencies around the world are recognizing the need for wider availability and approval of home testing kits, accelerating product development and market entry. Agencies such as the U.S. FDA and the European Medicines Agency have streamlined pathways for over-the-counter diagnostics, particularly for chronic disease and infectious conditions. This policy support encourages investment and innovation, leading to a broader range of test types and improved product quality. At the same time, distribution networks have evolved, with major players leveraging pharmacies, telehealth platforms, and online marketplaces to increase market penetration. It enables faster delivery and greater availability in both urban and rural settings. These developments collectively enhance consumer access and help the Global Home Care Testing Market maintain strong forward momentum.

Market Trends:

Expansion of Preventive and Wellness-Oriented Testing Among Younger Demographics:

Preventive health monitoring is gaining traction among younger and health-conscious consumers, shifting the focus of home diagnostics beyond traditional disease management. Individuals in their 20s to 40s are adopting home care testing kits for routine wellness checks, nutritional assessments, hormone tracking, and fitness optimization. This trend reflects growing interest in proactive health management and early detection of imbalances before symptoms emerge. The Global Home Care Testing Market is adapting by offering personalized kits aligned with lifestyle monitoring, fertility planning, stress management, and micronutrient testing. It enables consumers to make data-driven decisions about diet, exercise, and mental well-being. This expansion of use cases is broadening the customer base and driving continuous product innovation.

- For instance, LetsGetChecked has processed over 3 million home health tests, including wellness, hormone, and vitamin panels, with results typically available within 2 to 5 days and supported by telehealth consultations.

Rising Consumer Preference for Subscription-Based Testing Models:

A growing number of consumers are subscribing to recurring testing services, which offer convenience, affordability, and consistent health insights. Subscription models allow users to receive test kits at regular intervals, track progress over time, and access digital health reports through integrated platforms. This trend is particularly strong in areas such as at-home STD screening, allergy testing, metabolic health, and female hormone tracking. The Global Home Care Testing Market is leveraging these models to build brand loyalty and enhance customer engagement. It helps diagnostic providers secure recurring revenue streams and enables users to adopt consistent health monitoring practices. These services often include virtual consultations or app-based health coaching, enhancing the overall value proposition.

- For instance, Everlywell offers a subscription model for at-home lab testing, providing access to over 30 validated tests. All tests are processed in CLIA-certified labs, and results are reviewed by board-certified physicians.

Increased Focus on Aesthetics, User Experience, and Discreet Packaging:

Design and usability have become central to product differentiation in the home diagnostics space. Consumers expect kits that are not only accurate but also visually appealing, intuitive to use, and discreetly packaged for privacy and convenience. Many brands now invest in user-friendly instructions, smartphone-compatible interfaces, and minimalistic design elements that resemble lifestyle products rather than medical tools. The Global Home Care Testing Market is seeing more companies emphasize branding and experience to attract non-clinical consumers. It contributes to demystifying health testing and reduces anxiety associated with medical procedures. This approach is especially effective in encouraging first-time users to try home-based testing solutions.

Integration of Genomic and Personalized Data for Tailored Insights:

The convergence of home testing with genomic data and personalized analytics is transforming the value delivered by diagnostic kits. Consumers can now pair their DNA data with regular test results to receive tailored insights on nutrition, exercise response, aging markers, and predispositions to specific conditions. Companies in the Global Home Care Testing Market are building platforms that incorporate genetic reports, biometric trends, and real-time health data into personalized dashboards. It allows users to understand their bodies at a deeper level and take preventive actions aligned with their unique biology. This trend is moving home diagnostics toward precision health, making it an essential tool in individualized wellness management.

Market Challenges Analysis:

Regulatory Complexity and Variability Across Global Markets Restricts Scalability:

The diverse and evolving regulatory landscape poses a significant challenge for manufacturers operating in the Global Home Care Testing Market. Regulatory requirements vary widely by region, complicating product development, approval timelines, and market entry strategies. For instance, what is considered an over-the-counter device in one country may require clinical validation or physician oversight in another. This inconsistency hampers rapid globalization and increases compliance costs for diagnostic companies. It often delays innovation cycles and discourages smaller players from expanding into multiple markets. The Global Home Care Testing Market must navigate these barriers carefully to ensure safe, standardized products reach end users across jurisdictions.

User Accuracy, Misinterpretation, and Data Privacy Concerns Impact Adoption:

Self-administered diagnostics carry the inherent risk of incorrect sample collection, misinterpretation of results, or non-compliance with usage protocols, which can compromise test reliability. Many users may lack the medical knowledge required to act appropriately on test outcomes without professional guidance. The Global Home Care Testing Market faces the added challenge of addressing data privacy concerns, especially as test kits integrate with mobile apps and cloud platforms. Ensuring end-to-end encryption, user consent, and secure storage becomes critical to building consumer trust. It requires companies to invest not only in device functionality but also in digital infrastructure and support services. Balancing ease of use with clinical-grade accuracy and data protection remains a core operational hurdle for sustained market growth.

Market Opportunities:

Expansion into Emerging Economies with Growing Healthcare Access and Digital Infrastructure:

Emerging markets present strong opportunities for the Global Home Care Testing Market, supported by improving healthcare infrastructure, rising middle-class populations, and increasing smartphone penetration. Governments across Asia-Pacific, Latin America, and parts of Africa are investing in telehealth and primary care access, creating a foundation for home-based diagnostics. Consumers in these regions seek cost-effective and convenient solutions for routine health monitoring. Local partnerships, region-specific product design, and multilingual support can enhance market entry and adoption. The Global Home Care Testing Market can benefit from unmet diagnostic needs and the growing preference for self-care in resource-constrained settings. Targeted distribution and education campaigns will help accelerate penetration and trust.

Product Innovation in Specialized Testing Segments and Integrated Health Platforms:

Specialized segments such as fertility tracking, genetic testing, and chronic condition management offer high-value opportunities for innovation and differentiation. The Global Home Care Testing Market is shifting toward integrated solutions that combine diagnostics with mobile apps, data analytics, and virtual health consultations. This model enables long-term engagement and personalized care pathways. Demand is rising for comprehensive kits that monitor multiple biomarkers in one process. Developers that offer seamless user experiences and clinically backed insights will capture greater loyalty and market share. Expanding into these advanced categories can unlock new revenue streams and position companies as leaders in personalized healthcare delivery.

Market Segmentation Analysis:

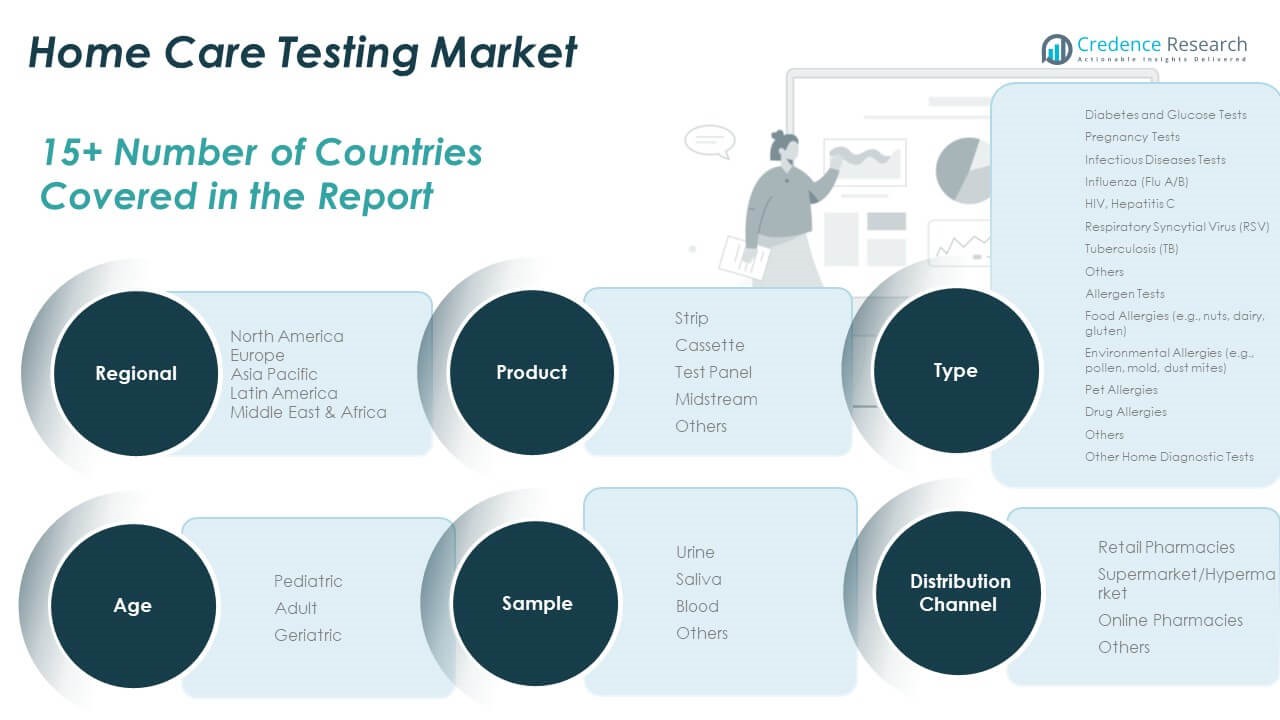

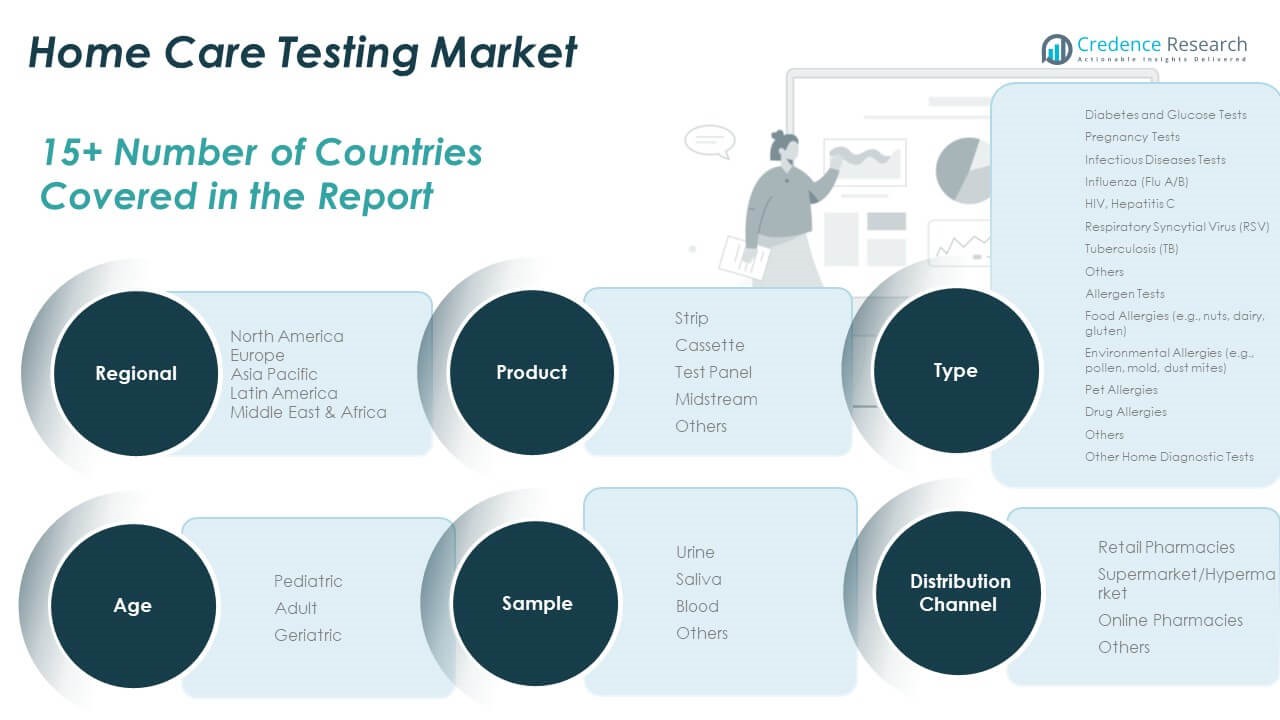

By Product

The market includes strips, cassettes, test panels, midstream, and others. Strips dominate due to their cost-effectiveness and ease of use, especially in glucose monitoring. Cassettes and test panels are widely used in infectious disease detection, offering multi-analyte capabilities. Midstream formats are preferred in pregnancy testing for their hygienic design and user convenience.

- For instance, Roche’s Accu-Chek blood glucose monitoring products are used in over 100 countries. Roche reports that more than 200 tests are performed every second with Accu-Chek systems worldwide, underscoring their global reach and reliability.

By Type

Diabetes and glucose tests hold the largest market share, driven by the global rise in diabetic patients. Pregnancy tests maintain high demand across geographies. Infectious disease tests—including influenza (Flu A/B), HIV, hepatitis C, RSV, and tuberculosis—are gaining traction with increased awareness and accessibility. Allergen testing is expanding, covering food, environmental, pet, and drug allergies. Other home diagnostic tests support preventive care and chronic disease management.

- For instance, Clearblue digital pregnancy tests are over 99% accurate from the day of the expected period, as confirmed by laboratory and consumer studies involving hundreds of women. The tests are widely used and trusted by healthcare professionals for their reliability and ease of use.

By Age Group

Adults represent the largest user segment, supported by growing health-conscious behavior and self-monitoring practices. Geriatric adoption is increasing due to chronic illness prevalence and limited mobility. Pediatric testing is rising steadily, particularly in allergy and infection screening.

By Sample Type

Urine remains the most commonly used sample due to its non-invasive nature. Blood is preferred for more complex diagnostics, while saliva offers a painless alternative in wellness and infectious disease testing. Other sample types serve niche or specialized needs.

By Distribution Channel

Retail pharmacies lead due to product availability and consumer trust. Online pharmacies are rapidly growing, driven by digital convenience and discrete access. Supermarkets and other channels provide added reach, especially in emerging markets.

Segmentation:

By Product

- Strip

- Cassette

- Test Panel

- Midstream

- Others

By Type

- Diabetes and Glucose Tests

- Pregnancy Tests

- Infectious Diseases Tests

- Influenza (Flu A/B)

- HIV, Hepatitis C

- Respiratory Syncytial Virus (RSV)

- Tuberculosis (TB)

- Others

- Allergen Tests

- Food Allergies (e.g., nuts, dairy, gluten)

- Environmental Allergies (e.g., pollen, mold, dust mites)

- Pet Allergies

- Drug Allergies

- Others

- Other Home Diagnostic Tests

By Age Group

- Pediatric

- Adult

- Geriatric

By Sample Type

- Urine

- Saliva

- Blood

- Others

By Distribution Channel

- Retail Pharmacies

- Supermarket/Hypermarket

- Online Pharmacies

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Home Care Testing Market size was valued at USD 2,356.99 million in 2018, reached USD 3,159.10 million in 2024, and is anticipated to reach USD 6,404.25 million by 2032, at a CAGR of 9.3% during the forecast period. North America holds the largest share of the Global Home Care Testing Market, driven by advanced healthcare infrastructure, high healthcare expenditure, and strong consumer awareness. The United States dominates regional demand, supported by a mature regulatory environment and early adoption of digital health technologies. Consumers in this region increasingly prefer home-based diagnostics for chronic conditions such as diabetes and cardiovascular diseases. Retail pharmacies and e-commerce platforms play a central role in distribution, offering wide access to test kits. The region continues to lead innovation, with companies investing in connected devices and AI-powered monitoring solutions.

Europe

The Europe Home Care Testing Market size was valued at USD 1,758.20 million in 2018, grew to USD 2,292.26 million in 2024, and is projected to reach USD 4,390.14 million by 2032, registering a CAGR of 8.5%. Europe represents a significant share of the Global Home Care Testing Market, led by countries such as Germany, the UK, and France. Strong public healthcare systems and increased focus on self-care support regional demand. Aging populations and rising chronic disease incidence are driving wider adoption of home diagnostics. Governments promote preventive care and remote health monitoring through supportive health policies. The market benefits from high digital literacy and a growing base of tech-enabled health consumers.

Asia Pacific

The Asia Pacific Home Care Testing Market size was valued at USD 1,810.03 million in 2018, reached USD 2,557.75 million in 2024, and is forecast to reach USD 5,689.93 million by 2032, at a CAGR of 10.6%. Asia Pacific is the fastest-growing region in the Global Home Care Testing Market, with strong momentum from China, India, and Japan. Increasing disposable incomes, expanding healthcare access, and rising chronic disease rates fuel market growth. The population shift toward urban centers and high smartphone penetration support digital and home-based diagnostics. Consumers seek convenient, affordable testing solutions, driving demand for products across all types. Public and private investments in healthcare infrastructure strengthen the region’s long-term potential.

Latin America

The Latin America Home Care Testing Market size was valued at USD 436.48 million in 2018, reached USD 586.93 million in 2024, and is expected to grow to USD 1,106.59 million by 2032, at a CAGR of 8.3%. Latin America contributes steadily to the Global Home Care Testing Market, led by Brazil, Mexico, and Argentina. Urbanization and improving healthcare access are creating a favorable environment for home diagnostics. The region shows growing interest in self-monitoring, especially for diabetes and pregnancy testing. Distribution through retail pharmacies and online platforms is expanding in major cities. Manufacturers are increasingly localizing products to match consumer preferences and regulatory standards.

Middle East

The Middle East Home Care Testing Market size was valued at USD 280.98 million in 2018, rose to USD 359.19 million in 2024, and is projected to reach USD 663.65 million by 2032, with a CAGR of 8.1%. The Middle East market is emerging within the Global Home Care Testing Market, supported by expanding health insurance coverage and growing awareness of preventive care. GCC countries, including the UAE and Saudi Arabia, are leading adoption, driven by smart healthcare initiatives and tech-savvy populations. Consumers are embracing home testing for both chronic disease management and wellness tracking. Retail pharmacy chains and government health programs are increasing accessibility. The market outlook is positive with continued investment in healthcare modernization.

Africa

The Africa Home Care Testing Market size was valued at USD 177.32 million in 2018, increased to USD 303.73 million in 2024, and is anticipated to reach USD 542.66 million by 2032, at a CAGR of 7.2%. Africa holds the smallest share in the Global Home Care Testing Market but shows steady growth. Rising awareness of chronic disease management and improving healthcare infrastructure are key drivers. Urban centers in South Africa, Egypt, and Kenya are adopting home diagnostics at a faster pace. The region faces challenges in affordability and distribution reach, yet opportunities are expanding through mobile health solutions and community-based programs. Companies are exploring partnerships to localize production and widen access.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abbott

- BD (Becton, Dickinson and Company)

- Quidel Corporation

- BioSure

- Hoffmann-La Roche Ltd.

- Nova Biomedical

- Siemens Healthcare GmbH

- ACON Laboratories, Inc.

- OraSure Technologies, Inc.

- Chembio Diagnostics, Inc.

Competitive Analysis:

The Global Home Care Testing Market features a competitive landscape marked by strong presence of established diagnostic companies and innovative startups. Key players include Abbott, BD, Quidel Corporation, F. Hoffmann-La Roche Ltd., and Siemens Healthcare GmbH, all of which offer extensive portfolios across diabetes, infectious diseases, and pregnancy testing. These companies leverage global distribution networks, regulatory expertise, and continuous R&D investment to maintain market leadership. Emerging players such as BioSure, OraSure Technologies, and Chembio Diagnostics focus on rapid diagnostics and user-friendly formats, targeting niche applications and underserved regions. Strategic collaborations, acquisitions, and digital integration remain central to competitive strategies. Companies are also prioritizing AI-driven platforms and connected devices to enhance consumer engagement and data tracking. The Global Home Care Testing Market is evolving with a strong emphasis on innovation, regulatory compliance, and product accessibility, making competition both dynamic and growth-oriented across diverse healthcare ecosystems.

Recent Developments:

- In June 2025, QuidelOrtho announced a new strategy to accelerate growth in molecular diagnostics, leveraging its expertise in immunoassay and molecular testing. The company is focusing on expanding its portfolio and capabilities in rapid, accurate home and point-of-care testing solutions.

- In June 2025, Roche highlighted its ongoing global partnerships and the expansion of affordable HPV testing technologies. These initiatives are aimed at advancing cervical cancer elimination, particularly in low-income countries, and reflect Roche’s commitment to innovation in diagnostic technologies for home and point-of-care use.

- In May 2025, Siemens Healthineers introduced new sustainability solutions for clinical labs, including the Atellica analyzers, which became the first clinical laboratory diagnostic instruments to achieve the My Green Lab ACT Ecolabel Certification. These analyzers are designed to reduce environmental impact and improve efficiency in clinical chemistry and immunoassay testing.

- In April 2025, Abbott announced a first-of-its-kind partnership to integrate data from its Libre continuous glucose monitoring (CGM) systems directly into Epic’s electronic health record systems in the U.S. This collaboration aims to streamline glucose data access for over 575,000 healthcare providers, enhancing workflow efficiency and supporting more informed patient care.

- In February 2025, BD revealed its intent to separate its Biosciences and Diagnostic Solutions business from the rest of the company. This strategic move is designed to enhance focus and investment in high-growth medical technology, positioning both entities for accelerated innovation and value creation in diagnostics and life sciences.

Market Concentration & Characteristics:

The Global Home Care Testing Market exhibits moderate to high market concentration, with a mix of dominant multinational corporations and agile regional players shaping its structure. It is characterized by rapid innovation cycles, strong regulatory influence, and growing consumer demand for convenience and privacy in healthcare. Leading companies such as Abbott, Roche, and BD hold significant market share due to their wide product portfolios, strong brand recognition, and global distribution networks. The market favors companies that invest in user-friendly designs, digital integration, and reliable clinical performance. It remains highly responsive to public health trends and technological advances, with a growing shift toward personalized, preventive diagnostics. Pricing sensitivity, ease of use, and access across multiple channels—particularly online—continue to define competitive dynamics and customer loyalty. The Global Home Care Testing Market reflects both the complexity of healthcare delivery and the increasing role of patient-driven diagnostic solutions.

Report Coverage:

The research report offers an in-depth analysis based on product, type, age group, sample type, and distribution channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Home Care Testing Market is expected to double in size by 2032, driven by rising demand for decentralized diagnostic solutions.

- Adoption of AI-enabled diagnostic tools and connected health platforms will enhance accuracy and user engagement.

- Preventive health monitoring and wellness-focused testing will expand significantly among younger, tech-savvy consumers.

- Growing healthcare investment in emerging markets will open new opportunities for localized product development and distribution.

- Regulatory bodies are likely to further streamline approval processes for over-the-counter and digital diagnostic kits.

- Home testing for infectious diseases and chronic conditions will continue to gain relevance in global health strategies.

- Integration with telehealth platforms will create seamless diagnostic-to-treatment workflows, increasing value to consumers.

- Subscription-based testing services will gain traction as users seek consistency and convenience in health tracking.

- Customizable multi-test panels will emerge to meet rising demand for bundled diagnostics across conditions.

- Competitive pressure will drive continuous innovation in test design, sample collection methods, and real-time data sharing.