Market Overview:

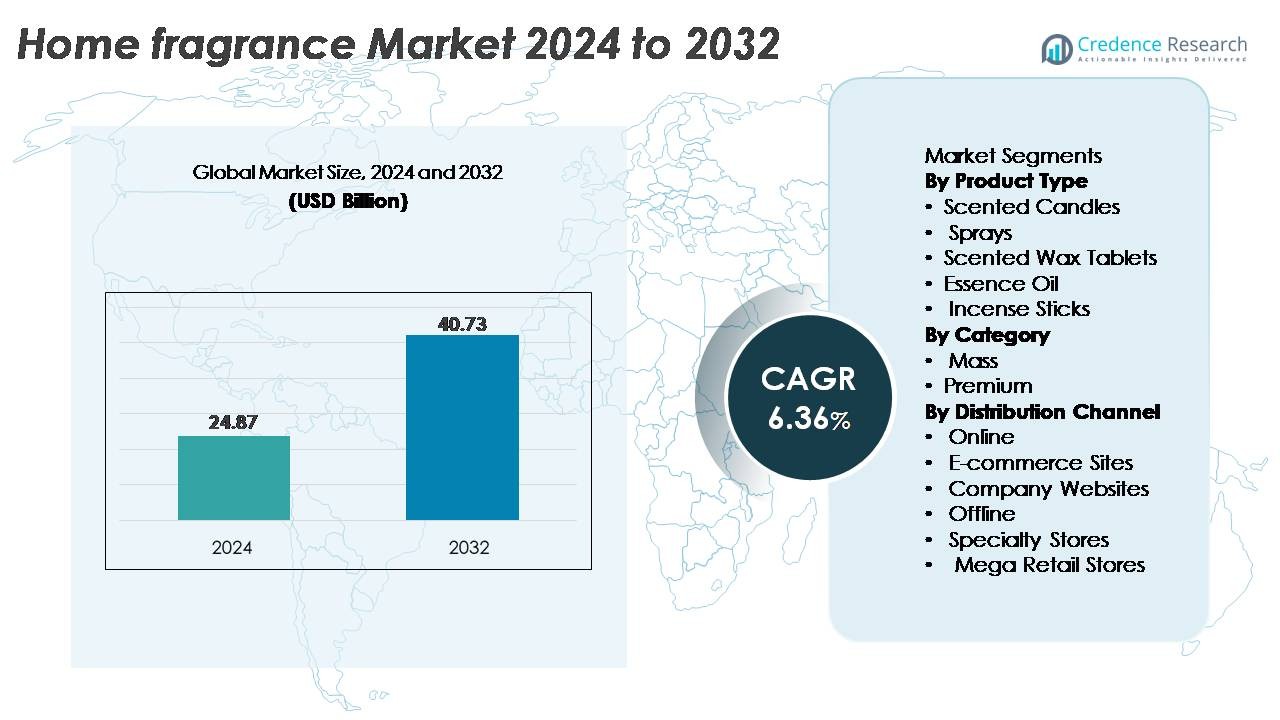

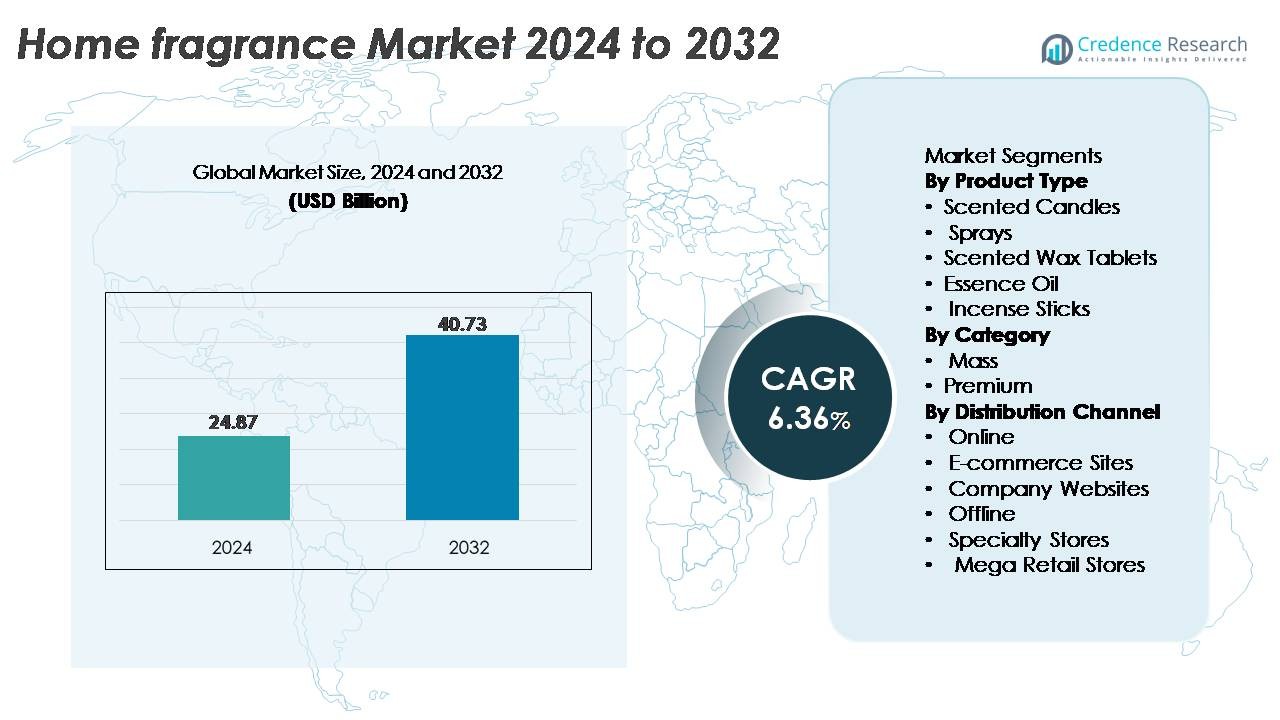

The Global Home Fragrance Market was valued at USD 24.87 billion in 2024 and is projected to reach USD 40.73 billion by 2032, reflecting a CAGR of 6.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Home Fragrance Market Size 2024 |

USD 24.87 Billion |

| Home Fragrance Market, CAGR |

6.36% |

| Home Fragrance Market Size 2032 |

USD 40.73 Billion |

The home fragrance market is shaped by a mix of global leaders and premium fragrance specialists, with companies such as Illume, Nest Fragrances, Lampe Berger, Newell Brands, Candle-lite Company, Johnson & Johnson, Blyth Inc., Colgate-Palmolive Company, L Brands, and Henkel AG & Co. KGaA driving innovation through expanded product portfolios and experiential scent technologies. These players focus on premium candles, diffusers, and natural aroma formulations to strengthen brand positioning across both online and offline channels. North America remains the leading region with approximately 32% market share, supported by strong consumer preference for wellness-oriented ambiance products, high spending on premium home décor, and robust e-commerce adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The home fragrance market reached USD 24.87 billion in 2024 and is projected to hit USD 40.73 billion by 2032 at a CAGR of 6.36%, supported by rising global demand for wellness-centric and premium scent products.

- Strong market drivers include the growing adoption of aromatherapy, increased home personalization, and higher spending on premium scented candles, which hold the largest product share within the category.

- Key trends focus on sustainability, clean-label formulations, refillable diffusers, and the rapid expansion of e-commerce, which continues to outperform offline channels in fragrance subscription and premium product sales.

- Competitive activity intensifies as leading players enhance natural ingredient profiles, expand luxury collections, and strengthen digital engagement, while pricing pressure from private-label brands restrains premium growth momentum.

- Regionally, North America leads with ~32% share, followed by Europe at ~28% and Asia-Pacific at ~25%, while premium products dominate category value contribution across major markets.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The scented candles segment holds the dominant share in the product landscape due to strong consumer preference for premium home décor–oriented fragrances and the expanding availability of artisanal, long-burn, and clean-burn formulations. Growth is supported by innovations such as soy- and coconut-wax blends, lead-free wicks, and naturally derived essential-oil scent profiles. Sprays and essence oils also gain traction as instant-effect fragrance options, while incense sticks remain popular in culturally rooted and meditation-driven markets. Scented wax tablets and diffusers serve niche applications, particularly in wardrobe and small-space aromatization.

- For instance, Yankee Candle’s flagship 22-oz Original Large Jar Candle delivers up to 150 hours of burn time and is produced in highly automated facilities capable of manufacturing more than 200,000 candles per day, demonstrating the scale and performance benchmarks driving this segment forward.

By Category

The premium category leads the market, driven by rising demand for luxury home ambiance products, personalized scent collections, and high-end formulations featuring natural botanicals and long-lasting aroma technologies. Premium brands leverage sophisticated packaging, multi-note scent compositions, and clean-label ingredients to appeal to design-conscious consumers seeking elevated sensory experiences. Meanwhile, the mass category maintains steady adoption through affordability and wide availability across retail chains, appealing particularly to price-sensitive households. However, as consumers trade up to better wellness-oriented home fragrances, premium offerings continue to outpace mass products in revenue expansion.

- For instance, NEST Fragrances’ premium 3-wick candle contains 21.2 oz of proprietary wax and delivers up to 100 hours of burn time, reflecting the performance and craftsmanship standards defining the premium segment.

By Distribution Channel

In distribution, the online segment particularly e-commerce platforms holds the largest share, propelled by convenience, wider assortment, and strong digital merchandising strategies. E-commerce sites dominate due to frequent product launches, influencer-driven brand discovery, and subscription-based fragrance deliveries. Company websites further strengthen direct-to-consumer sales by offering customization, limited editions, and loyalty programs. Offline channels, including specialty stores and mega retail stores, remain essential for experiential purchasing where consumers can test scent profiles. Specialty stores attract premium buyers seeking curated collections, while mega retail chains sustain mass-market momentum through broad accessibility and competitive pricing.

Key Growth Drivers

Rising Consumer Preference for Wellness-Oriented Home Environments

The global shift toward wellness-centric lifestyles serves as a major catalyst for home fragrance adoption. Consumers increasingly associate ambient scents with stress reduction, mood enhancement, and relaxation, driving higher demand across scented candles, essence oils, and aromatherapy diffusers. Indoor scenting has evolved from discretionary spending to a wellness routine integrated into daily living, particularly as more individuals spend extended hours working from home. Aromatherapy-backed formulations using lavender, eucalyptus, chamomile, rosemary, and citrus blends gain traction due to their perceived therapeutic effects. Premium brands capitalize on this shift by producing scientifically tested essential-oil combinations and allergen-free, biodegradable wax systems, further strengthening consumer confidence. Additionally, the surge in home décor awareness, fueled by interior design influencers and lifestyle platforms, reinforces scented products as aesthetic décor elements. As consumers seek personalized home atmospheres, demand for multi-sensory, wellness-driven fragrance solutions expands significantly across regions.

- For instance, Yankee Candle’s ScentPlug fragrance refills are engineered to deliver up to 30 days of continuous aroma per 0.625-oz cartridge, demonstrating how long-duration scent technologies reinforce their appeal in wellness-driven routines.

Expansion of Premium and Natural Ingredient-Based Product Lines

The rapid premiumization of home fragrance products stands as a key growth driver, fueled by rising disposable incomes and increased willingness to invest in high-quality aromatics. Consumers increasingly prefer products crafted with natural, ethically sourced, and toxin-free ingredients, propelling demand for soy-wax candles, botanical essential oil blends, and phthalate-free formulations. Brands differentiate through craftsmanship, long-burn technologies, and sophisticated multi-layered scent structures inspired by fine perfumery. Enhanced packaging design, eco-certified materials, and limited-edition fragrance collections appeal to décor-conscious households seeking exclusivity and luxury. The growing influence of sustainability further pushes companies to innovate with biodegradable waxes, recyclable vessels, and carbon-neutral manufacturing practices. Premium brands benefit from strong brand storytelling, artisanal positioning, and collaborations with fragrance houses to create bespoke scent identities. This shift toward high-value, clean-label products accelerates category revenue and elevates consumer experience across retail and e-commerce channels.

- For instance, LAFCO’s premium 15.5-oz candle uses a soy-based wax blend and delivers up to 90 hours of burn time, reflecting the performance and clean-label standards shaping the premium segment.

Rapid Growth of Digital Distribution and Personalized Fragrance Purchasing

Digitization has transformed the home fragrance market, enabling broader accessibility and deeper consumer engagement. E-commerce platforms, brand-owned websites, and social commerce ecosystems significantly boost product visibility and provide a seamless discovery-to-purchase experience. AI-driven recommendation engines, fragrance quizzes, and virtual scent profiling tools help consumers personalize fragrance selections despite the intangible nature of scent online. Subscription services offering curated monthly scent boxes drive recurring revenue and strengthen brand loyalty. Digital campaigns on Instagram, Pinterest, and TikTok accelerate brand storytelling through mood-driven content, home décor integration, and influencer partnerships. Online reviews, user-generated content, and ratings further influence purchase decisions, particularly among younger demographics. Additionally, direct-to-consumer models allow brands to control pricing, bundle products, launch exclusive online collections, and gather real-time consumer insights. The digital shift significantly reduces entry barriers for emerging brands while strengthening market penetration for established players.

Key Trends & Opportunities:

Increasing Adoption of Eco-Friendly and Sustainable Home Fragrance Formats

Environmental responsibility has become a core market trend, creating significant opportunities for brands developing eco-friendly formulations. Consumers increasingly demand biodegradable waxes, plant-derived essential oils, cotton or wooden wicks, and refillable diffuser systems, accelerating the shift away from paraffin-based and synthetic products. Companies respond by adopting sustainable sourcing practices, carbon-neutral production cycles, and recyclable or compostable packaging. Upcycled fragrance ingredients, such as citrus peel oils and floral waste compounds, gain momentum within premium collections. Refill pods for aroma diffusers and reusable candle jars appeal to environmentally conscious buyers seeking reduced waste. Regulatory pressure on harmful volatile organic compounds (VOCs) also drives innovation in green chemistry, enabling clean-burning products that comply with global safety standards. As sustainability becomes a purchasing criterion for modern consumers, brands offering transparent ingredient disclosures and eco-certifications gain competitive advantage.

- For instance, P.F. Candle Co. reports that its reusable 12.5-oz soy-wax candle vessels are made from glass with 30% post-consumer recycled content, and each candle burns for up to 60 hours, demonstrating how sustainability is directly influencing product engineering.

Growing Demand for Personalized and Multi-Sensory Home Ambiance Experiences

Personalization emerges as a powerful opportunity across the home fragrance sector, with consumers seeking signature scents that reflect moods, seasons, and lifestyle preferences. Brands offer customizable fragrance kits, blend-at-home oil sets, and modular diffusers allowing users to adjust scent intensity. Multi-sensory products combining light, sound, and scent technologies—gain traction, especially in premium aromatherapy and smart-home ecosystems. Connected diffusers with app-based scheduling, smart-room scent zoning, and automated fragrance intensity controls enhance convenience and elevate user experience. Seasonal scent collections inspired by holidays, travel destinations, and luxury perfumery broaden emotional connection with products. This trend aligns with rising interest in personal spaces designed for relaxation, productivity, and well-being. As experiential home living gains value, tailored and tech-enabled fragrance solutions offer strong revenue potential for both established and emerging brands.

- For instance, the Aera Smart Diffuser by Prolitec uses micro-droplet technology and its fragrance capsules deliver up to 800 hours of continuous scent diffusion, demonstrating how smart devices are setting new performance benchmarks.

Key Challenges:

Sensitivity, Allergens, and Regulatory Compliance Across Markets

A major challenge for the home fragrance industry is addressing allergen concerns and stringent regulatory requirements surrounding ingredient safety. Consumers increasingly scrutinize formulations for phthalates, parabens, synthetic musks, and volatile organic compounds linked to respiratory irritation. As awareness of indoor air quality continues to rise, brands must meet global safety standards established by IFRA and regional regulatory bodies, requiring costly reformulation and continuous testing. Ingredient transparency adds further pressure, as consumers expect full disclosure of fragrance components. Ensuring hypoallergenic, non-toxic products without compromising scent performance remains technically demanding. Compliance across multiple international markets increases operational complexity and slows product introductions, especially for smaller manufacturers lacking regulatory resources.

High Competition and Pricing Pressure Across Mass and Premium Segments

The home fragrance market faces intense competition due to a large number of local and international brands, private labels, and artisanal producers. Mass-market brands compete primarily on affordability, often challenging premium players to justify higher price points through superior formulations and packaging. Meanwhile, private-label products offered by retail chains exert strong pricing pressure by replicating popular scents at lower costs. Differentiation becomes difficult as scent profiles and packaging styles increasingly overlap across brands. Marketing spend, influencer partnerships, and digital branding are essential but raise acquisition costs. Maintaining profitability while sustaining innovation, premiumization, and quality consistency presents a long-term challenge, especially as customers expect value-driven and eco-friendly options simultaneously.

Regional Analysis:

North America

North America holds around 32% of the home fragrance market, driven by strong demand for premium scented candles, aromatherapy diffusers, and natural essence oils. Consumers prioritize wellness-oriented home environments, reinforcing the popularity of clean-label, allergen-free, and eco-friendly fragrance formats. High disposable incomes, strong gifting culture, and seasonal scent preferences contribute significantly to recurring purchases. The U.S. leads regional adoption due to strong presence of luxury candle brands and e-commerce penetration. Rapid expansion of direct-to-consumer fragrance startups and influencer-driven home décor trends further strengthens market traction across urban households.

Europe

Europe accounts for nearly 28% of the global market, supported by mature consumer preferences for high-quality, artisan-crafted home fragrance products. Countries such as France, Germany, and the U.K. demonstrate strong affinity for premium scented candles, botanical essential oils, and sustainably sourced wax products. Stringent EU regulations on indoor air quality accelerate adoption of natural, non-toxic fragrance formulations. Heritage perfumery houses and design-led brands offer sophisticated scent collections that cater to wellness-driven lifestyles. Additionally, growing interest in minimalist home décor and eco-conscious living supports continuous demand across both specialty retail and online channels.

Asia-Pacific

Asia-Pacific captures around 25% market share, fueled by rising urbanization, expanding middle-class spending, and growing cultural acceptance of modern home ambiance products. China, Japan, and South Korea lead adoption, with consumers gravitating toward sprays, diffusers, and incense-based formats. Japanese and Korean households favor subtle, calming fragrances aligned with wellness and minimalism. The region experiences strong e-commerce-driven demand, supported by rapid digital adoption and influencer-led fragrance trends. Local brands increasingly introduce plant-derived scents and heat-free diffusers tailored to compact living spaces. As lifestyle upgrading accelerates, APAC emerges as the fastest-growing regional market.

Latin America

Latin America holds approximately 8% of the global market, supported by increasing consumer interest in home décor, lifestyle fragrances, and budget-friendly scented candles. Brazil and Mexico dominate regional demand, with households adopting sprays and incense sticks due to affordability and cultural usage. Growing penetration of global fragrance brands introduces premium offerings, though price sensitivity keeps mass-market products dominant. Expansion of modern retail formats and social media–driven home styling trends influence purchasing behavior. Despite economic fluctuations, the region benefits from rising residential real estate activity and evolving wellness trends that encourage indoor scenting routines.

Middle East & Africa

The Middle East & Africa region represents roughly 7% market share, driven by cultural affinity for rich, long-lasting fragrances and traditional scent formats such as incense and bakhoor. Gulf countries, particularly the UAE and Saudi Arabia, exhibit strong demand for luxury home fragrance collections, decorative diffusers, and oud-based aroma blends. High disposable incomes and preference for opulent home interiors support premium segment growth. Africa shows rising but gradual adoption, primarily centered around mass-market sprays and incense sticks. Growing modern retail expansion and increasing popularity of home ambiance products contribute to steady regional momentum.

Market Segmentations:

By Product Type

- Scented Candles

- Sprays

- Scented Wax Tablets

- Essence Oil

- Incense Sticks

By Category

By Distribution Channel

Online

- E-commerce Sites

- Company Websites

Offline

- Specialty Stores

- Mega Retail Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The home fragrance market features a highly competitive landscape characterized by a blend of global luxury brands, mass-market manufacturers, artisanal candle producers, and emerging digital-native companies. Leading players focus on product innovation, natural ingredient adoption, and premium scent development to differentiate amid rising consumer expectations for wellness-driven and eco-friendly formulations. Luxury brands emphasize artisanal craftsmanship, multi-layered fragrance compositions, and aesthetically designed packaging to appeal to décor-conscious households, while mass-market players leverage scale, affordability, and wide retail distribution to secure volume leadership. E-commerce acceleration enables newer brands to gain visibility through influencer partnerships and direct-to-consumer strategies, particularly in scented candles, diffusers, and essence oils. Companies increasingly invest in sustainable materials, recyclable containers, and clean-label formulations to comply with global safety standards and strengthen brand trust. Strategic collaborations with perfumers, designers, and wellness experts further enhance product appeal, intensifying competition across both premium and mass segments.

Key Player Analysis:

- Illume

- Nest Fragrances

- Lampe Berger

- Newell Brands

- Candle-lite Company

- Johnson & Johnson

- Blyth Inc.

- Colgate-Palmolive Company

- L Brands

- Henkel AG & Co. KGaA

Recent Developments:

- In October 2025, Newell Brands (through its subsidiary Yankee Candle) unveiled a new premium fragrance line named “YC Collection” featuring updated design, a refined wax blend, and several modern scent profiles.

- In September 2025, ILLUME announced it will close its Maple Grove manufacturing plant, with production outsourced to third-party partners; marketing and sales of its fragrance line will continue under its parent firm.

- In October 2023, The Yankee Candle Company, Inc. of Newell Brands Inc. introduced two scents White Spruce & Grapefruit and Silver Sage & Pine, available in different sizes. The packaging options include melts, big jars, medium jars, and huge tumblers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product type, Category, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for wellness-focused and mood-enhancing fragrance products will continue to rise as consumers prioritize home ambiance and stress-relief routines.

- Premium candles, natural oils, and eco-friendly formulations will gain stronger traction as sustainability becomes a core purchasing criterion.

- Smart diffusers and app-controlled scent systems will expand as connected home technologies integrate more deeply with lifestyle products.

- Direct-to-consumer fragrance brands will strengthen market influence through personalization tools and subscription-based scent offerings.

- Clean-label and non-toxic formulations will increasingly shape product development as indoor air quality awareness grows.

- Seasonal and limited-edition fragrance collections will drive faster product rotation and elevate brand engagement.

- E-commerce channels will maintain rapid growth, supported by influencer partnerships and digital scent-discovery tools.

- Refillable formats and recyclable packaging will become mainstream as brands commit to circular design principles.

- Regional scent preferences will diversify, prompting brands to develop culturally tailored fragrance profiles.

- Competition will intensify as global brands, niche artisans, and private labels expand offerings across premium and mass categories.

Market Segmentation Analysis:

Market Segmentation Analysis: