Market Overview

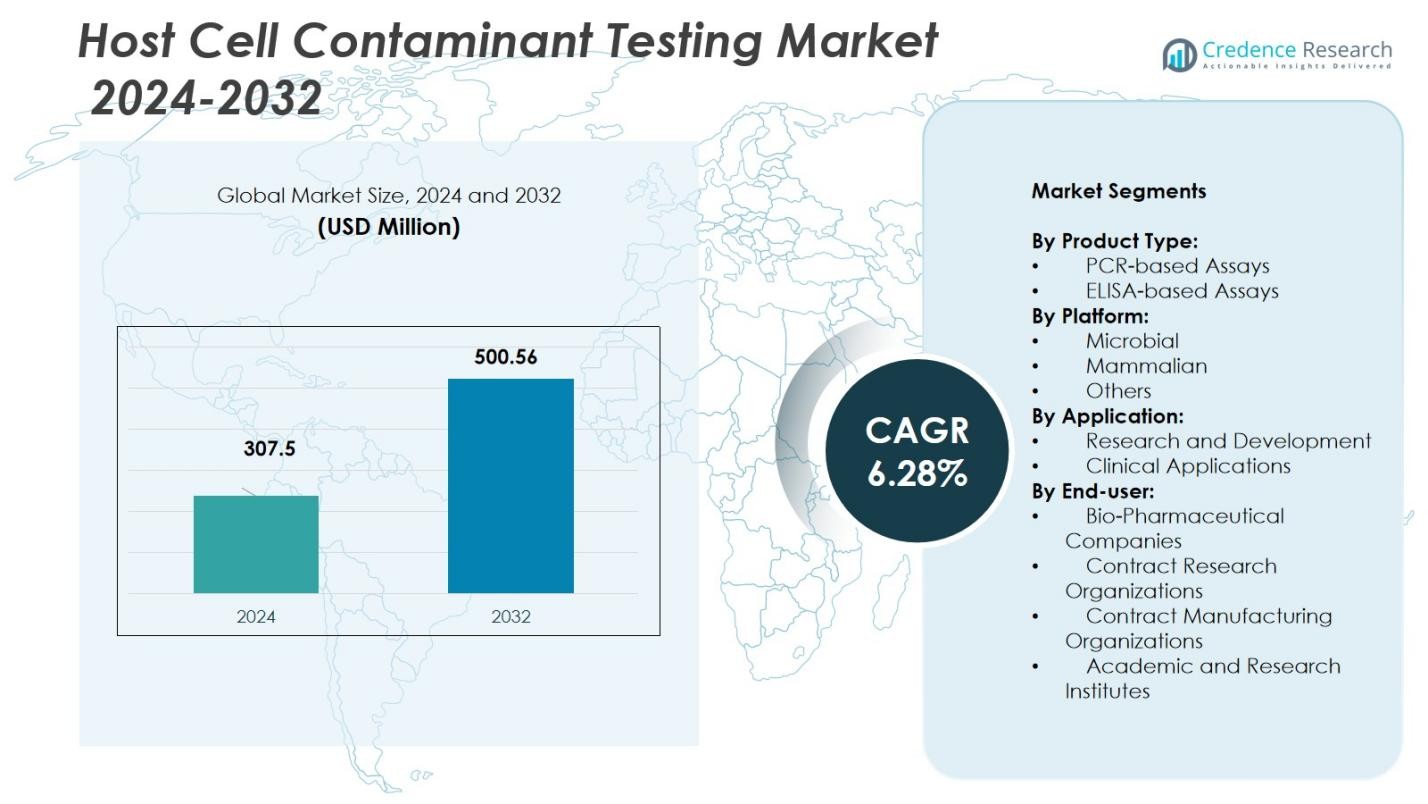

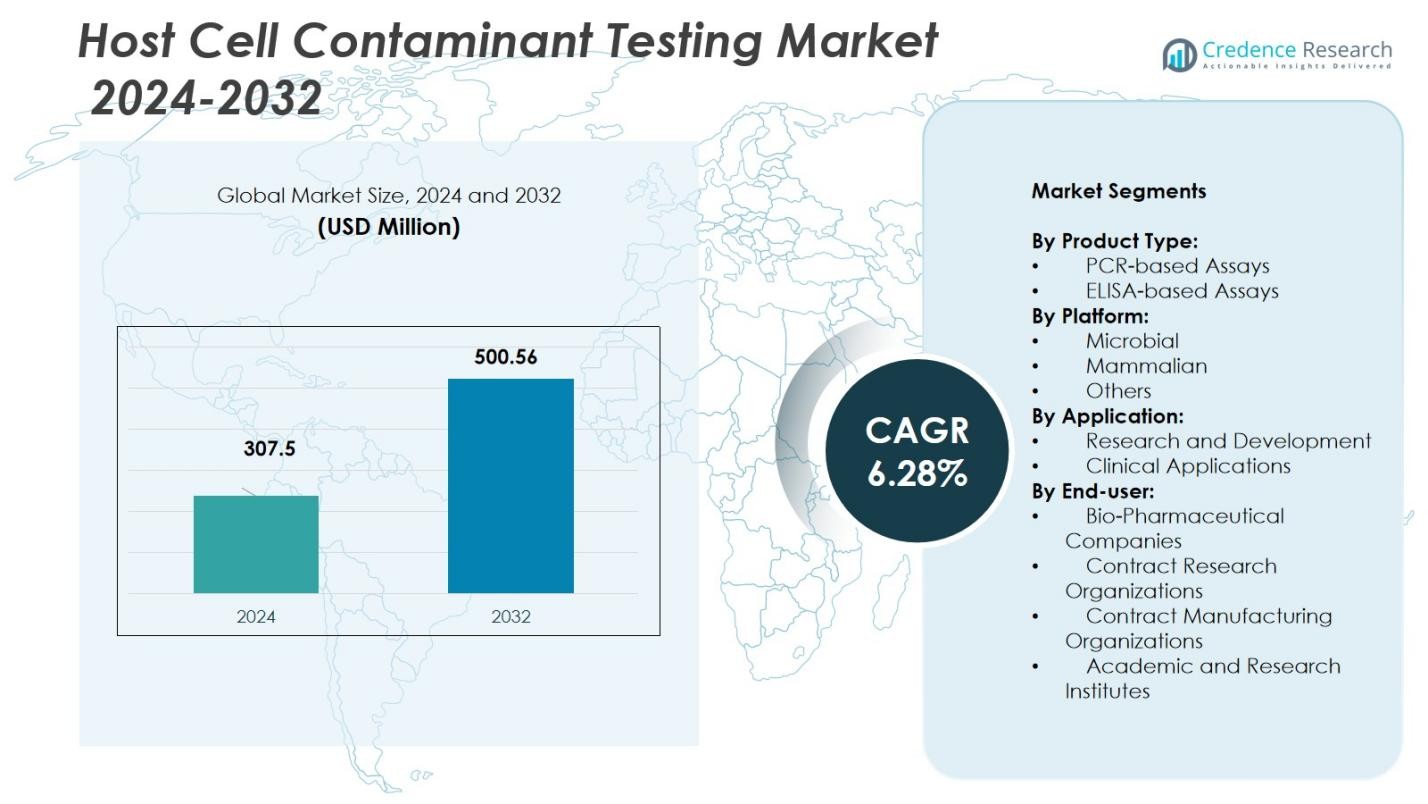

Host Cell Contaminant Testing Market size was valued at USD 307.5 million in 2024 and is anticipated to reach USD 500.56 million by 2032, at a CAGR of 6.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Host Cell Contaminant Testing Market Size 2024 |

USD 307.5 Million |

| Host Cell Contaminant Testing Market, CAGR |

6.28% |

| Host Cell Contaminant Testing Market Size 2032 |

USD 500.56 Million |

Host Cell Contaminant Testing Market is driven by the strong presence of leading players such as Bio-Rad Laboratories, Merck KGaA, Thermo Fisher Scientific, Danaher Corporation, Sartorius AG, Charles River Laboratories, Promega Corporation, Lonza Group, Cygnus Technologies, and Enzo Life Sciences. These companies focus on developing high-sensitivity PCR and ELISA assays, expanding orthogonal detection platforms, and enhancing GMP-compliant analytical services to support biologics manufacturing. North America led the market with a 38% share, supported by advanced bioprocessing infrastructure and stringent regulatory standards, followed by Europe with 30%, reflecting its strong biosimilar production and analytical innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Host Cell Contaminant Testing Market was valued at USD 307.5 million in 2024 and is projected to reach USD 500.56 million by 2032, registering a CAGR of 6.28% during the forecast period.

- Strong demand for biologics and rising adoption of high-sensitivity assays drive market growth, with PCR-based assays holding a dominant 63% share due to their precision in detecting trace impurities.

- Advancements in orthogonal testing, automation, and digital quality systems shape key trends as manufacturers seek faster, more reliable, and compliant impurity detection workflows.

- Major players, including Bio-Rad, Thermo Fisher, Merck KGaA, Danaher, Sartorius, and Lonza, strengthen their positions through assay innovation, analytical service expansion, and strategic partnerships across the biopharmaceutical sector.

- North America leads the market with 38% share, followed by Europe at 30% and Asia-Pacific at 22%, while mammalian platforms dominate with 56%, reflecting their extensive use in CHO- and HEK293-based biologics production.

Market Segmentation Analysis:

By Product Type

PCR-based assays dominated the Host Cell Contaminant Testing Market in 2024 with a 63% market share, driven by their superior sensitivity, rapid quantification, and ability to detect trace host cell DNA or proteins across biologics manufacturing workflows. Their adoption is particularly strong in monoclonal antibody, gene therapy, and vaccine development, where regulatory scrutiny is high. ELISA-based assays accounted for the remaining 37%, supported by their specificity, affordability, and suitability for high-throughput protein impurity analysis in standardized QC environments.

- For instance, Blay et al. detailed the development of analytical PCR assays compliant with GMP in AAV gene therapy manufacturing, addressing technical and regulatory challenges with innovative PCR techniques.

By Platform

The mammalian platform led the market with a 56% share, supported by the significant use of CHO and HEK293 cell lines in biopharmaceutical production, which necessitates rigorous host cell protein and DNA monitoring. Growing commercialization of complex biologics strengthens its leadership. The microbial platform captured 36%, boosted by the continued use of E. coli expression systems that require targeted impurity profiling. Other platforms accounted for the remaining 8%, serving specialized or emerging bioprocessing applications.

- For instance, CHO cells are the production host for over 70% of approved biologics, favored for their robustness, scalability, and ability to support high yields of monoclonal antibodies and other complex glycoproteins.

By Application

Research and development emerged as the dominant application, capturing a 59% share, driven by the rapid expansion of biologics pipelines, extensive early-stage impurity screening needs, and increasing adoption of high-sensitivity assays for formulation optimization. Regulatory requirements for preclinical impurity characterization further reinforce demand. Clinical applications represented the remaining 41%, supported by rising commercial biologics production, increased validation needs, and growing emphasis on assay robustness during late-stage development and manufacturing.

Key Growth Drivers

Rising Biologics Production and Pipeline Expansion

The rapid expansion of biologics pipelines, including monoclonal antibodies, cell and gene therapies, and recombinant proteins, significantly fuels demand for host cell contaminant testing. Manufacturers prioritize high-sensitivity assays to ensure product purity as regulatory agencies tighten impurity thresholds. Increased outsourcing of bioprocessing, coupled with higher production volumes from CHO and microbial systems, reinforces the need for efficient detection of host cell proteins (HCPs) and DNA. This surge in biologics development drives continuous investment in advanced analytical platforms and validated testing methodologies.

- For instance, NIST employed a molecular weight cutoff filtration combined with shotgun proteomic analysis to detect over 150 host cell proteins in their monoclonal antibody product, improving sensitivity to levels as low as 1 ppm for low molecular weight HCPs.

Stringent Global Regulatory Standards Driving Compliance Needs

Regulatory bodies such as the FDA and EMA mandate comprehensive impurity profiling, making host cell contaminant testing an essential requirement across all stages of biologics development. These guidelines demand validated, highly specific, and quantifiable assays, pushing manufacturers to adopt PCR-based, ELISA-based, and orthogonal testing methods. Increasing inspections, heightened focus on biosafety, and evolving GMP frameworks accelerate adoption. The pressure to minimize residual contaminants to ensure therapeutic safety and efficacy further strengthens demand for advanced testing solutions in both established and emerging markets.

- For instance, PCR-ELISA methods have been enhanced for drug development quality control by companies such as Danaher Life Sciences, which use this highly sensitive and specific technique to detect genetic markers relevant for biosafety and efficacy validation.

Advancements in Assay Technologies Enhancing Sensitivity and Speed

Technological progress in molecular diagnostics, automation, and microfluidics is transforming host cell contaminant testing. Next-generation PCR platforms, enhanced ELISA kits, and rapid-release assays enable highly sensitive, low-limit-of-detection results with reduced turnaround times. Integration of AI-driven analytics and high-throughput systems supports real-time monitoring and process optimization. These innovations allow manufacturers to detect impurities earlier, reduce batch failures, and ensure consistent quality. As bioprocessing workflows evolve toward continuous manufacturing, demand grows for more robust, automated, and scalable contaminant detection solutions.

Key Trends & Opportunities

Growing Adoption of Multiplex and Orthogonal Testing Approaches

The industry is witnessing increased adoption of multiplex and orthogonal testing strategies to improve accuracy and meet regulatory expectations for comprehensive impurity characterization. Combining PCR, ELISA, LC-MS, and advanced analytical techniques allows manufacturers to cross-verify results and achieve deeper contaminant profiling. This trend opens opportunities for assay developers to introduce integrated platforms that consolidate testing steps, reduce operational complexity, and improve data reliability. As biologics become more complex, demand for multi-modal testing solutions is expected to rise across both R&D and commercial manufacturing.

- For instance, Samsung Biologics has developed integrated biologics development platforms that align technical depth with cross-functional processes, enhancing tech transfer accuracy and readiness for GMP batch testing.

Rising Demand for Automation and Digital Quality Control Systems

Automation is emerging as a major opportunity as manufacturers aim to reduce manual errors, shorten testing cycles, and enhance data traceability. Automated sample preparation, robotic ELISA systems, and digital PCR platforms are transforming workflow efficiency. Adoption of digital quality control tools, including cloud-based LIMS and AI-enabled analytics, supports real-time decision-making and regulatory documentation. This creates strong potential for technology providers that offer end-to-end automated impurity testing solutions tailored for high-volume bioprocessing environments. The shift toward smart manufacturing amplifies this opportunity.

- For instance, Beckman Coulter Life Sciences offers the CellMek SPS, a fully automated sample preparation system that processes diverse sample types on demand for clinical flow cytometry, significantly expanding laboratory capabilities.

Key Challenges

High Cost of Advanced Assays and Analytical Infrastructure

Despite strong demand, the high cost of sophisticated PCR systems, advanced ELISA platforms, and mass spectrometry-based techniques remains a barrier, especially for smaller biopharma companies and academic institutes. Investment in skilled personnel, GMP-compliant facilities, and validated workflows further increases operational spending. These financial constraints limit adoption in resource-constrained environments and drive reliance on outsourcing. The challenge lies in balancing accuracy and affordability while maintaining regulatory compliance across global biologics development pipelines.

Complexity in Standardizing Assays for Diverse Expression Systems

Standardization remains a key operational challenge due to variability across mammalian, microbial, and emerging expression platforms. Differences in host cell protein profiles, purification efficiency, and manufacturing scale complicate assay validation and cross-platform comparability. Ensuring consistent detection thresholds and reproducible results becomes difficult as biologics pipelines diversify. Manufacturers must invest in platform-specific reagents, reference standards, and orthogonal testing methods, increasing workflow complexity. This lack of universal standardization can delay product development timelines and hinder regulatory submissions.

Regional Analysis

North America

North America led the Host Cell Contaminant Testing Market with a 38% market share, driven by the strong presence of biopharmaceutical manufacturers, advanced biologics pipelines, and robust regulatory oversight from agencies such as the FDA. The region benefits from high adoption of PCR- and ELISA-based assays across commercial manufacturing and clinical programs. Major investments in cell and gene therapy facilities and increased outsourcing to specialized CROs and CMOs further accelerate demand. Continuous advancements in analytical technologies and strong funding for biotechnology research reinforce North America’s dominant position.

Europe

Europe accounted for 30% of the market, supported by a well-established biopharmaceutical sector, high regulatory compliance standards set by the EMA, and strong adoption of host cell impurity testing across monoclonal antibody and recombinant protein production. Countries such as Germany, Switzerland, and the U.K. lead assay development and analytical innovation. Expansion of biosimilar manufacturing and increased investments in biologics R&D contribute to rising demand. Collaborative research networks and strong academic-industry partnerships strengthen Europe’s role in advancing high-sensitivity impurity detection technologies.

Asia-Pacific

Asia-Pacific held a 22% market share, emerging as one of the fastest-growing regions due to expanding biologics manufacturing capabilities in China, India, South Korea, and Japan. Increasing government support for biopharmaceutical production, rising investment from multinational companies, and the growth of regional CMOs drive assay adoption. The shift toward high-quality biologics manufacturing encourages wider use of PCR-based and orthogonal impurity testing methods. Growing biosimilar development and continuous capacity expansion position Asia-Pacific as a key contributor to future market growth.

Latin America

Latin America captured 6% of the market, driven by increasing biopharmaceutical research activity in Brazil and Mexico and gradual adoption of advanced analytical testing standards. Growing interest in biosimilars and government initiatives aimed at strengthening local biologics production support market expansion. However, budget constraints and limited access to high-end analytical instruments slow adoption compared to developed regions. As regional facilities invest in GMP compliance and expand collaboration with global CROs and CMOs, the demand for host cell contaminant testing is expected to steadily increase.

Middle East & Africa

The Middle East & Africa region held a 4% market share, supported by emerging biotechnology hubs in the UAE, Saudi Arabia, and South Africa. Investments in healthcare modernization, local vaccine production, and early-stage biologics research gradually increase the need for impurity testing. Limited infrastructure and high dependency on imported analytical solutions continue to restrain growth. However, rising collaborations with global biopharma companies and capacity-building programs across academic institutes are strengthening regional capabilities. Government-led initiatives targeting biomanufacturing advancement are expected to enhance adoption in the coming years.

Market Segmentations:

By Product Type:

- PCR-based Assays

- ELISA-based Assays

By Platform:

- Microbial

- Mammalian

- Others

By Application:

- Research and Development

- Clinical Applications

By End-user:

- Bio-Pharmaceutical Companies

- Contract Research Organizations

- Contract Manufacturing Organizations

- Academic and Research Institutes

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Host Cell Contaminant Testing Market is shaped by leading players such as Bio-Rad Laboratories, Thermo Fisher Scientific, Merck KGaA, Danaher Corporation, Sartorius AG, Charles River Laboratories, Lonza Group, Promega Corporation, Cygnus Technologies, and Enzo Life Sciences. These companies focus on expanding high-sensitivity PCR and ELISA assay portfolios, strengthening orthogonal detection platforms, and enhancing regulatory-compliant analytical services. Strategic investments in automation, rapid-release assays, and digital quality systems support their differentiation in biologics manufacturing workflows. Partnerships with biopharmaceutical companies, CMOs, and CROs enable broader adoption of host cell protein and DNA testing solutions. Many players are advancing microfluidic-based and next-generation immunoassay technologies to reduce turnaround time and improve detection limits. Continuous innovation, geographic expansion, and heightened focus on GMP-validated testing capabilities intensify market competitiveness as biologics pipelines expand globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, Cygnus Technologies partnered with TriLink BioTechnologies to launch the AccuRes™ Host Cell DNA Quantification Kits for more accurate contaminant DNA testing.

- In May 2024, Krishgen Biosystems launched KRIBIOLISA™ High Five (H5) host cell protein ELISA kit designed for more sensitive and specific detection of host cell proteins.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Platform, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as biologics, cell therapies, and gene therapies expand globally.

- Adoption of high-sensitivity PCR and ELISA assays will increase to meet evolving regulatory expectations.

- Automation and digital quality systems will become standard in impurity detection workflows.

- Orthogonal testing approaches will gain wider use for comprehensive impurity profiling.

- Demand for rapid-release and real-time contaminant testing solutions will rise across manufacturing.

- Asia-Pacific will emerge as a major growth hub driven by expanding biomanufacturing capacity.

- Collaborations between biopharma companies and specialized CROs and CMOs will accelerate advanced testing adoption.

- Development of microfluidic and next-generation immunoassay platforms will reduce turnaround time.

- Standardization efforts will strengthen assay reproducibility across diverse expression systems.

- Increasing focus on continuous bioprocessing will drive innovation in integrated impurity monitoring technologies.