Market Overview

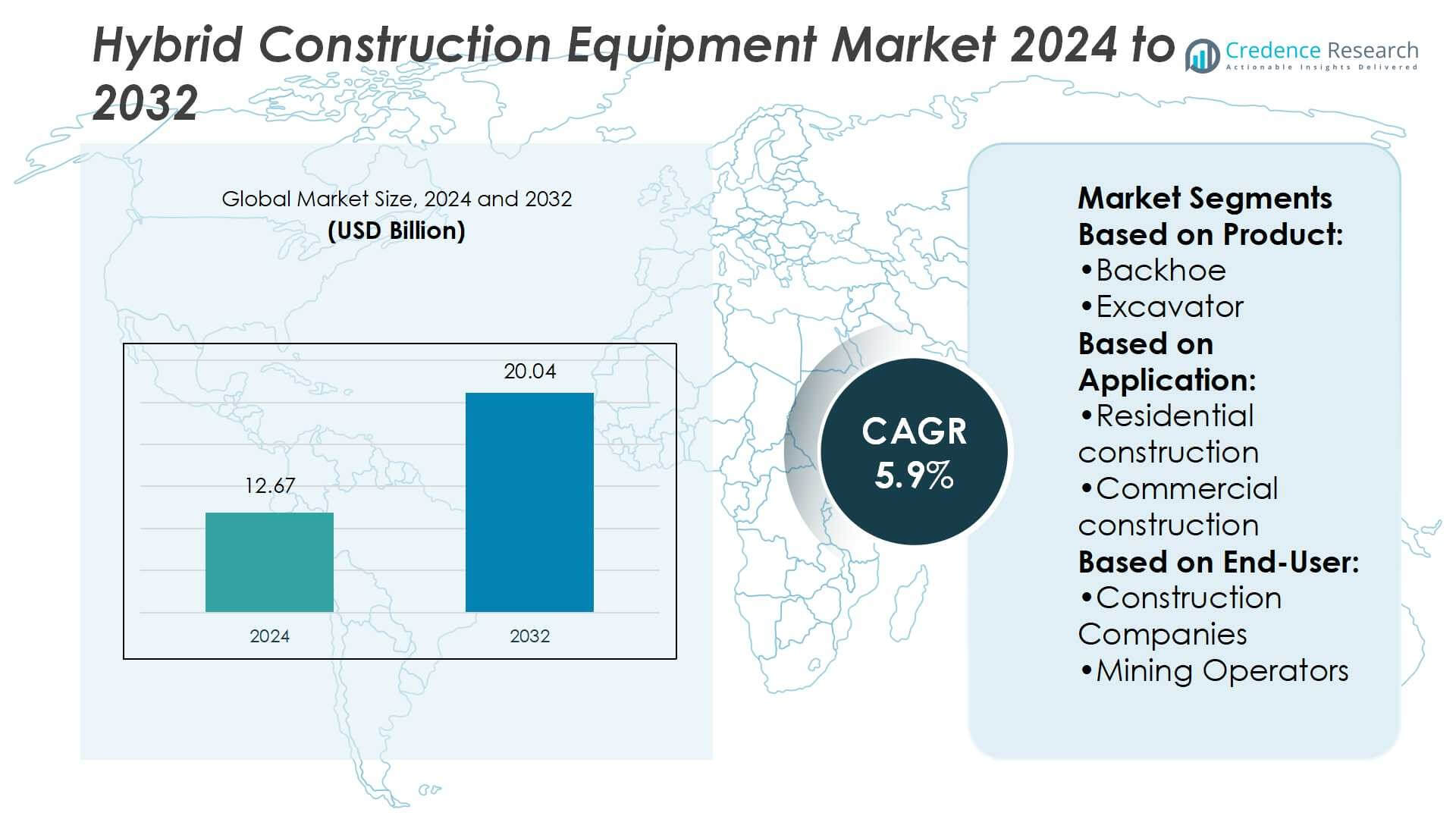

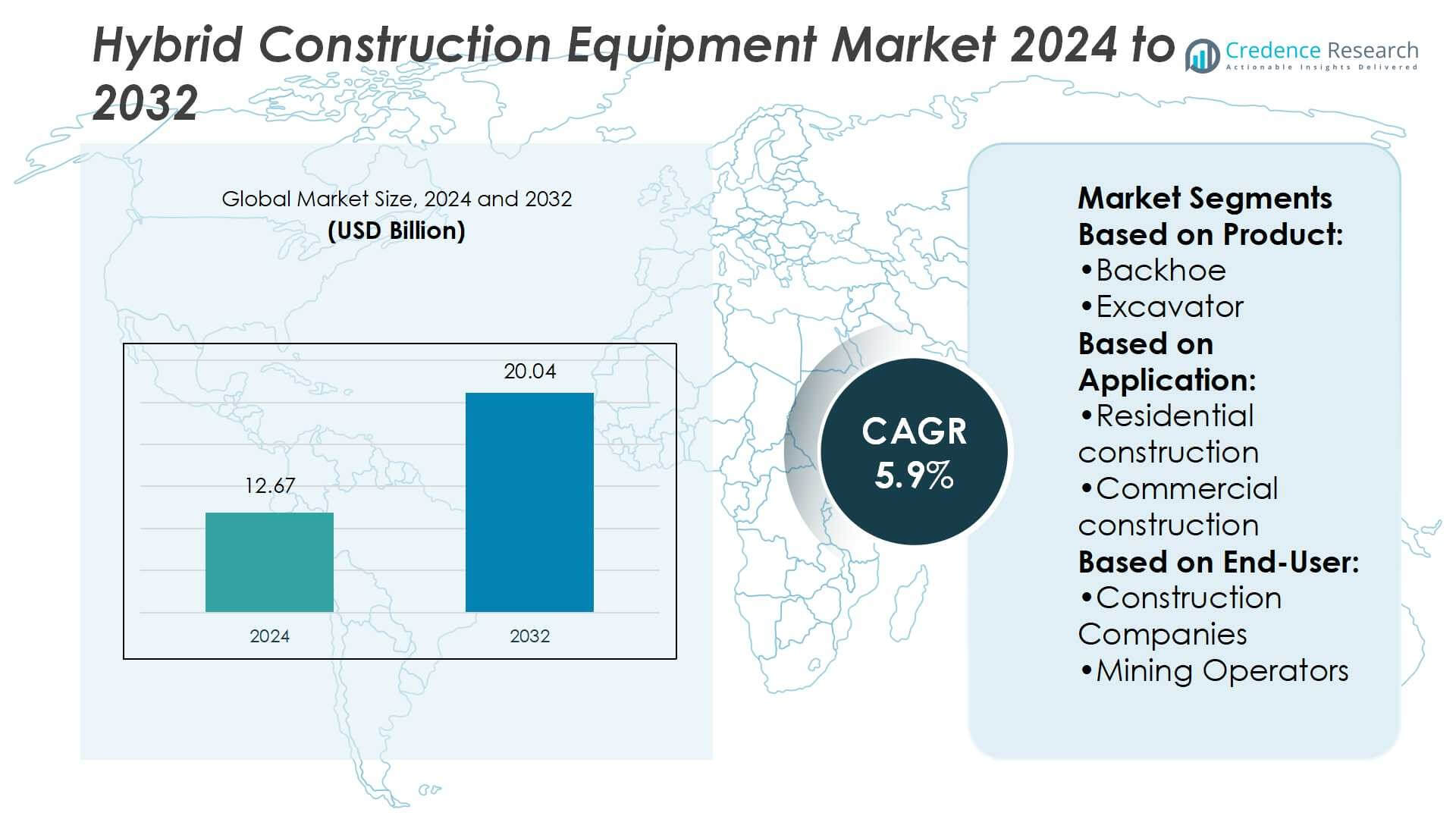

Hybrid Construction Equipment Market size was valued at USD 12.67 billion in 2024 and is anticipated to reach USD 20.04 billion by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hybrid Construction Equipment Market Size 2024 |

USD 12.67 Billion |

| Hybrid Construction Equipment Market, CAGR |

5.9% |

| Hybrid Construction Equipment Market Size 2032 |

USD 20.04 Billion |

The Hybrid Construction Equipment Market grows steadily, driven by rising demand for fuel efficiency, lower emissions, and cost reduction across construction and mining sectors. Governments enforce stricter environmental regulations, creating strong incentives for hybrid adoption. It benefits from technological advancements in hybrid powertrains, regenerative energy systems, and battery improvements that enhance reliability and performance. Market trends highlight increasing integration of digital monitoring, telematics, and smart fleet management tools. Compact and versatile hybrid equipment gains traction in urban projects, while sustainable procurement practices and green financing programs accelerate adoption across global construction and infrastructure development initiatives.

The Hybrid Construction Equipment Market shows strong geographical presence, with Asia-Pacific leading due to large-scale infrastructure projects and rapid urbanization, followed by North America and Europe driven by strict emission norms and advanced construction technologies. Latin America and the Middle East & Africa record steady but smaller growth, supported by mining and resource-driven projects. Key players shaping the market include Caterpillar, Komatsu, Volvo, Hitachi Construction Machinery, Deere & Co., CNH Industrial, Doosan, Liebherr, Terex, and Sany.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Hybrid Construction Equipment Market size was valued at USD 12.67 billion in 2024 and is anticipated to reach USD 20.04 billion by 2032, at a CAGR of 5.9%.

- Demand rises with focus on fuel efficiency, reduced emissions, and cost savings in construction and mining sectors.

- Advancements in hybrid powertrains, regenerative systems, and batteries enhance performance, reliability, and operational life.

- Competitive landscape features leading global manufacturers focusing on innovation, sustainability, and service expansion.

- High initial investment and limited infrastructure act as restraints for widespread adoption.

- Asia-Pacific leads market share, followed by North America and Europe, while Latin America and Middle East & Africa show steady but smaller growth.

- Compact hybrid equipment and sustainable procurement practices drive adoption, supported by government incentives and green financing programs.

Market Drivers

Growing Emphasis on Fuel Efficiency and Environmental Sustainability

Hybrid Construction Equipment Market experiences strong momentum due to rising demand for fuel-efficient solutions. Construction firms prioritize lower operating costs and reduced carbon emissions. Governments enforce stricter emission regulations that encourage hybrid adoption. Energy-efficient machinery supports sustainability commitments by large contractors. It provides measurable reductions in fuel consumption while enhancing productivity. This shift reflects the construction industry’s transition toward greener operations.

- For instance, The Bobcat T7X all-electric compact track loader features a 72.6-kilowatt-hour lithium-ion battery and can run for up to four hours of continuous operation on a single charge.

Increasing Infrastructure Development and Urbanization Projects

Global urbanization and large-scale infrastructure projects support hybrid equipment adoption. Governments invest in transport, housing, and renewable energy infrastructure. Hybrid systems provide cost savings and operational flexibility across diverse construction environments. It ensures higher uptime and better reliability compared to conventional equipment. The growing scale of construction activities amplifies demand for hybrid machinery. Market expansion aligns with long-term infrastructure investment cycles.

- For instance, The weight range of 60,032 to 62,413 pounds is confirmed by Volvo’s technical specifications for the EC250E Hybrid. The bucket capacity of 1–2 cubic yards is also confirmed in the product specifications.

Rising Demand for Technological Innovation and Performance Optimization

Hybrid Construction Equipment Market benefits from rapid advancements in hybrid powertrains and control systems. Innovations improve torque management, power output, and energy recovery. Contractors prefer equipment with integrated digital monitoring and smart energy management. It enhances performance while lowering maintenance requirements. Continuous R&D investments from key manufacturers drive competitive differentiation. Demand for advanced, durable, and high-performing hybrid solutions continues to grow.

Strong Focus on Cost Reduction and Operational Efficiency

Construction companies prioritize equipment that reduces lifetime costs. Hybrid systems cut fuel expenses and extend engine life. Operators achieve longer duty cycles with fewer refueling needs. It increases productivity without compromising efficiency. OEMs offer flexible financing and service models that strengthen adoption. The market gains traction among both large contractors and smaller operators seeking financial efficiency.

Market Trends

Market Trends

Integration of Advanced Hybrid Powertrain Technologies for Higher Efficiency

Hybrid Construction Equipment Market shows a clear trend toward advanced hybrid powertrain systems. Manufacturers focus on improving fuel economy while maintaining performance. Integration of electric motors with diesel engines ensures optimal power distribution. It supports reduced emissions without compromising heavy-duty capabilities. Hybrid models also feature regenerative braking and energy storage for extended operation. This technological direction strengthens equipment appeal among contractors seeking efficient solutions.

- For instance, Caterpillar’s product specifications for the 988K XE confirm a bucket capacity range of 6.2 to 17 cubic yards (4.7–13 m³). C18 ACERT. The wheel loader uses a Cat C18 ACERT engine that produces 588 hp (439 kW).

Growing Role of Digital Monitoring and Smart Fleet Management

Hybrid construction machines increasingly feature digital monitoring tools for better operational control. Real-time data analytics enable predictive maintenance and energy optimization. Fleet managers gain detailed insights into fuel usage and performance metrics. It enhances decision-making for large-scale construction operations. Remote monitoring also improves equipment utilization across multiple project sites. Adoption of smart fleet management systems continues to expand across the market.

- For instance, The Hitachi ZH210-5 hybrid excavator uses the TRIAS HX hybrid system, which recovers energy via a swing motor. The excavator has a rated power of 122 kW. Its operating weight varies by model and configuration.

Rising Demand for Compact and Versatile Hybrid Equipment

Construction projects in urban areas demand compact and flexible machinery. Hybrid Construction Equipment Market reflects growing interest in smaller, multi-functional models. Compact excavators, loaders, and forklifts offer mobility in tight spaces. It ensures efficiency without sacrificing environmental benefits. Contractors in residential and commercial projects prefer versatile machines with hybrid capability. This trend aligns with infrastructure growth in dense urban regions.

Expansion of Green Financing and Sustainable Procurement Practices

Contractors and governments increasingly adopt sustainable procurement strategies. Hybrid machinery qualifies for green financing programs and tax incentives. It provides measurable support for organizations with environmental commitments. Large firms integrate hybrid fleets into sustainability reporting and ESG goals. Public infrastructure tenders often specify energy-efficient equipment preferences. This financing and policy trend accelerates hybrid equipment adoption globally.

Market Challenges Analysis

High Initial Investment Costs and Limited Return Awareness

Hybrid Construction Equipment Market faces challenges due to high upfront costs of hybrid machinery. Many contractors remain hesitant to invest without clear short-term returns. It demands higher capital than conventional diesel equipment, limiting adoption by small and mid-sized firms. Lack of awareness about long-term fuel savings and maintenance benefits adds complexity. Price-sensitive markets often prefer traditional equipment despite rising fuel costs. Limited demonstration projects and cost-benefit studies reduce buyer confidence in hybrid solutions.

Infrastructure Gaps and Technical Complexity in Hybrid Integration

The market also struggles with insufficient charging and service infrastructure in many regions. Hybrid machinery requires specialized maintenance and skilled technicians, which are not widely available. It increases downtime risks for construction companies in developing markets. Integration of hybrid systems with existing fleets often creates operational hurdles. Uncertainty about battery life, replacement costs, and recycling adds further resistance. These technical and infrastructural gaps continue to slow widespread acceptance of hybrid equipment.

Market Opportunities

Rising Government Incentives and Strong Push for Sustainable Construction

Hybrid Construction Equipment Market holds strong opportunities from global sustainability policies and government initiatives. Many regions offer tax benefits, subsidies, and low-interest financing for eco-friendly machinery. It creates favorable conditions for contractors to modernize fleets. Public sector projects increasingly demand energy-efficient equipment, creating steady opportunities for hybrid adoption. Global infrastructure investment programs further expand the scope for sustainable machinery deployment. Manufacturers that align product portfolios with these incentives gain a significant competitive advantage.

Advancements in Battery Technology and Expanding Aftermarket Services

The market benefits from rapid progress in battery chemistry, storage capacity, and durability. Longer battery life reduces replacement concerns and improves overall cost-effectiveness. It enables hybrid systems to perform more efficiently across demanding construction tasks. Expansion of aftermarket services and flexible leasing models also supports adoption. Contractors gain access to hybrid equipment without heavy capital expenditure. Continuous improvements in technology and service models open new opportunities for global market penetration.

Market Segmentation Analysis:

By Product

Hybrid Construction Equipment Market demonstrates diverse growth across earthmoving and roadbuilding machinery. Excavators lead the segment due to high utilization in large-scale infrastructure and urban development projects. It offers fuel efficiency, strong digging capacity, and reduced emissions, making it a preferred choice among contractors. Backhoes also show consistent adoption in both small and mid-sized projects, where versatility and cost-effectiveness remain key. Roadbuilding equipment gains traction with government investments in highways and smart city initiatives. The demand for multi-functional machinery supports steady expansion of this product category.

- For instance, New Holland’s midi excavator range (6-12 tonne class) includes the E70D, E75D, E85D, E90D, E100D. Maximum reach spans from 6,650 mm to 8,040 mm, digging depths from 4,020 mm to 4,670 mm, and dump heights from 4,590 mm to 6,270 mm.

By Application

The market records significant demand from residential and commercial construction projects. Residential developments rely on compact hybrid excavators and backhoes for efficiency in limited space. Commercial construction emphasizes equipment with longer duty cycles and advanced fuel-saving features. It strengthens adoption where operational cost reduction is critical. Industrial construction creates opportunities for large-scale hybrid machinery capable of handling heavy loads. Mining and quarrying also represent a strong segment, where hybrid systems reduce fuel consumption and support environmental compliance in resource-intensive operations.

- For instance, Komatsu’s HB365LC-3 hybrid excavator has a rated engine power of 202 kW (271 hp), a bucket capacity of 2.66 m³, and operating weight between 36.4 to 37.4 tonnes.

By End User

Construction companies dominate market demand, driven by large-scale infrastructure projects and urban expansion. These firms adopt hybrid machinery to meet sustainability commitments and improve fleet efficiency. It enhances productivity while lowering lifetime costs across multiple project types. Mining operators also contribute significantly, focusing on reducing operational expenses in high-consumption environments. Hybrid equipment provides reliability in demanding mining sites where energy efficiency translates into substantial savings. Both end-user groups strengthen the long-term growth potential of hybrid machinery through steady procurement and investment.

Segments:

Based on Product:

Based on Application:

- Residential construction

- Commercial construction

Based on End-User:

- Construction Companies

- Mining Operators

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis

North America

North America accounts for 28% of the Hybrid Construction Equipment Market. The United States leads adoption, supported by government incentives for sustainable construction and emission reduction mandates. Contractors prefer hybrid machinery due to high fuel savings across large infrastructure projects. It benefits from advanced R&D by major OEMs based in the region. Canada contributes with growing adoption in mining and roadbuilding sectors. Strong aftersales networks and financing programs sustain growth across both countries.

Europe

Europe represents 24% of the market share, reflecting strong regulatory pressure on emissions. Countries such as Germany, France, and the UK emphasize hybrid solutions in urban construction. The European Union provides funding support for green technologies, which accelerates hybrid fleet replacement. It demonstrates significant adoption in roadbuilding, commercial construction, and public infrastructure. Scandinavia and Western Europe lead in sustainability-focused procurement. Eastern Europe shows slower growth due to higher costs and limited financing programs.

Asia-Pacific

Asia-Pacific dominates with 34% of the global share, making it the largest region. China drives demand through major infrastructure investment and large-scale urban expansion. India follows with strong adoption in residential and industrial projects. Japan focuses on advanced hybrid models with high efficiency and precision. It benefits from abundant raw material supply, cost-competitive manufacturing, and government-backed electrification policies. Rising population density and urbanization further strengthen regional adoption.

Latin America

Latin America holds 8% of the Hybrid Construction Equipment Market. Brazil and Mexico lead adoption due to highway expansion, mining operations, and commercial construction. Limited access to financing slows growth among smaller contractors. It shows potential in resource-driven projects where fuel savings reduce operational expenses. Regulatory frameworks remain less strict than in Europe or North America. Gradual policy improvements are expected to support hybrid adoption in the long term.

Middle East & Africa

Middle East & Africa together contribute 6% of the global market. GCC countries lead with infrastructure megaprojects and urban development initiatives. It demonstrates adoption in mining and oil-related construction projects where efficiency is critical. Africa shows slower adoption due to limited infrastructure and higher upfront equipment costs. Government-backed investments in sustainable projects may accelerate demand. Long-term opportunities exist in mining and energy-related construction sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Doosan

- Volvo

- Caterpillar

- Terex

- Hitachi Construction Machinery

- CNH Industrial

- Komatsu

- Deere & Co.

- Liebherr

- Sany

Competitive Analysis

The Hybrid Construction Equipment Market features including Caterpillar, CNH Industrial, Deere & Co., Doosan, Hitachi Construction Machinery, Komatsu, Liebherr, Sany, Terex, and Volvo. The Hybrid Construction Equipment Market is marked by intense competition driven by technological innovation, sustainability goals, and evolving customer demand. Manufacturers prioritize hybrid powertrain efficiency, advanced telematics, and energy recovery systems to enhance performance and meet regulatory requirements. It encourages continuous investment in research, strategic partnerships, and product diversification across multiple equipment categories. Companies also focus on expanding aftermarket services, flexible leasing, and financing solutions to increase adoption among contractors. Regional presence, brand reputation, and alignment with government incentives strongly influence market positioning. Competition intensifies as firms work to balance cost efficiency, durability, and compliance with global sustainability standards.

Recent Developments

- In August 2025, JCB is about to transform the construction equipment scenario in India, when it will introduce a new generation of machines. It will be equipped with prototypes that are hydrogen-powered, fully electric, low-fuel consumption hybrid equipment, and enhanced diesel-powered machines that are approved to the CEV Stage-V norms.

- In July 2025, New Holland Construction introduces W100D Compact Wheel Loader with an all-new operator-centric cab and cab features. Constructed with landscapers, agricultural operators, snow removers and others in mind, the W100D is a dependable powerhouse with a deliberate design to provide productivity and performance in a small class size where there has been scarce choice.

- In January 2025, Volvo CE introduces New Generation Excavators in Southeast Asia to enhance efficiency, productivity and safety of the customers. The New Generation 5 models include: EC210, EC220, EC230, EC300 and EC360 and they will be sold throughout the region starting January 2025.

- In July 2024, Hitachi Construction Machinery Americas releases a super long front excavator, no compromises, dedicated to the North American market. The ZX210LC-7H Super Long Front (SLF) offers 50 ft, 4 in (15.35 m) of reach at ground level and a 39-ft, 2-in (11.94-m) dig depth with fewer trade-offs in that it was specifically designed for this purpose.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for sustainable and fuel-efficient machinery.

- Hybrid systems will gain traction in both developed and emerging construction markets.

- Battery technology improvements will enhance equipment performance and reduce lifecycle costs.

- Governments will strengthen hybrid adoption through stricter emission policies and incentives.

- Contractors will increasingly replace diesel fleets with hybrid models for cost savings.

- Digital monitoring and telematics will become standard features in hybrid machinery.

- Compact hybrid equipment will see high demand in urban and residential projects.

- Mining and quarrying sectors will adopt hybrids to reduce fuel consumption and emissions.

- Aftermarket services and leasing models will support wider adoption across small operators.

- Global competition will intensify as manufacturers invest in innovation and regional expansion.

Market Trends

Market Trends