Market Overview

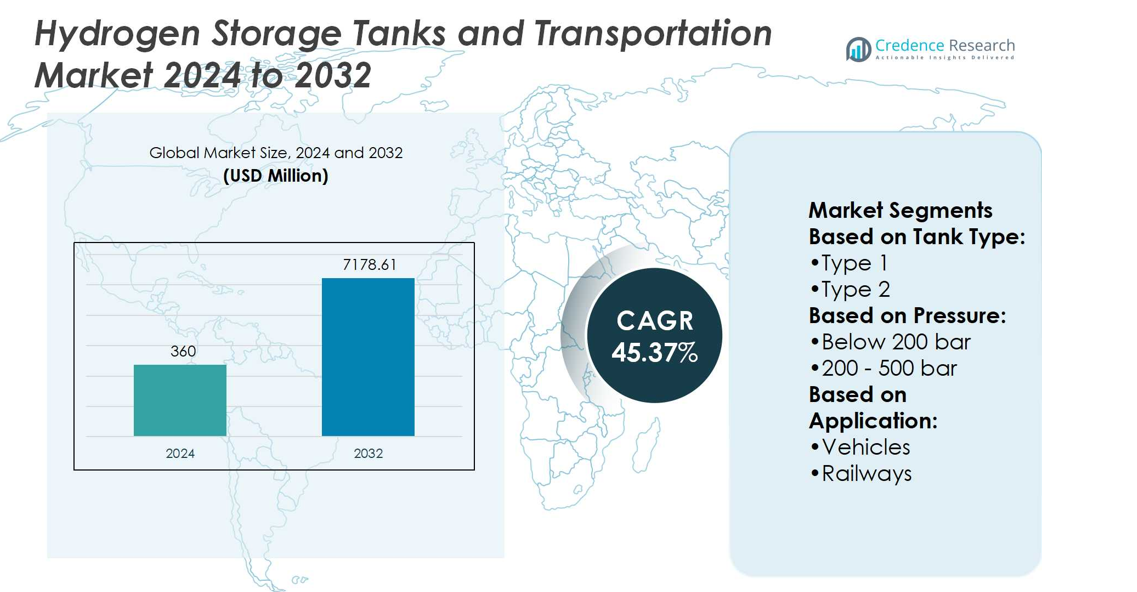

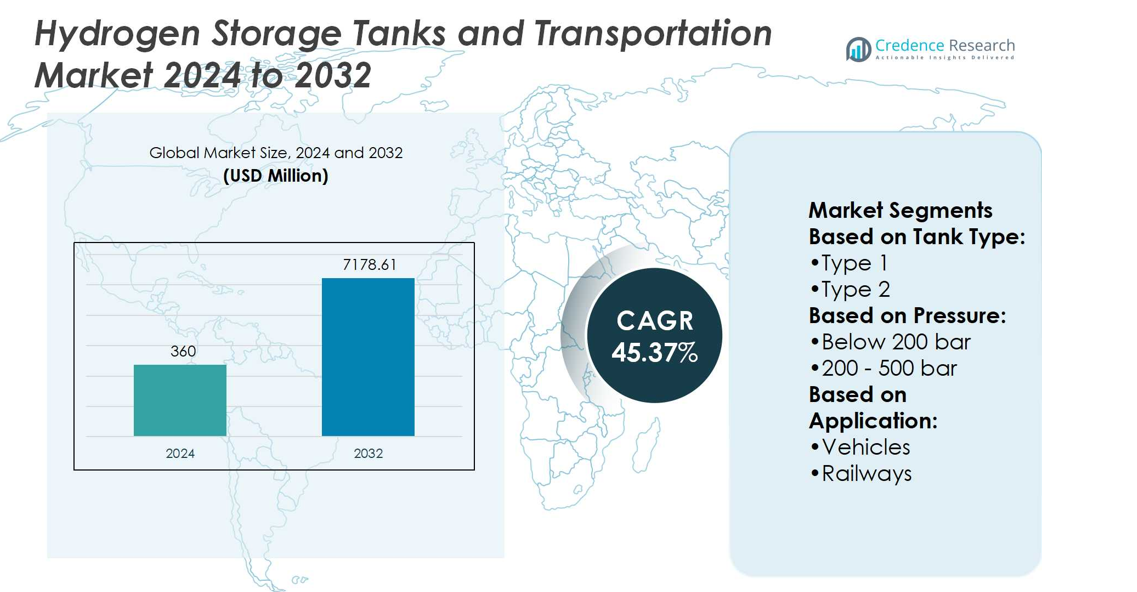

Hydrogen Storage Tanks and Transportation Market size was valued at USD 360 million in 2024 and is anticipated to reach USD 7178.61 million by 2032, at a CAGR of 45.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrogen Storage Tanks and Transportation Market Size 2024 |

USD 360 million |

| Hydrogen Storage Tanks and Transportation Market, CAGR |

45.37% |

| Hydrogen Storage Tanks and Transportation Market Size 2032 |

USD 7178.61 million |

The Hydrogen Storage Tanks and Transportation Market grows through strong demand for clean energy solutions, government-backed hydrogen projects, and increasing adoption in mobility and industrial sectors. Drivers include rising investments in hydrogen corridors, fuel cell vehicles, and large-scale decarbonization initiatives across power and manufacturing industries. It benefits from technological progress in lightweight composite tanks, high-pressure systems, and advanced insulation methods that enhance efficiency and safety. Trends highlight the integration of digital monitoring, smart safety systems, and predictive analytics for improved reliability. Expanding hydrogen infrastructure, cross-border trade networks, and applications in railways and marine transport further strengthen the market’s long-term potential.

The Hydrogen Storage Tanks and Transportation Market shows strong geographical presence, with Asia Pacific leading due to large-scale hydrogen adoption in mobility and industry, followed by Europe driven by strict emission regulations and cross-border infrastructure projects. North America maintains significant share with hydrogen hubs and vehicle deployments, while Latin America and Middle East & Africa record emerging growth through green hydrogen exports. Key players shaping the market include Hexagon Purus, Luxfer Gas Cylinders, NPROXX, Mahytec, and BayoTech.

Market Insights

- Hydrogen Storage Tanks and Transportation Market size was USD 360 million in 2024 and will reach USD 7178.61 million by 2032 at a CAGR of 45.37%.

- Market growth is driven by demand for clean energy, government-backed hydrogen projects, and industrial decarbonization.

- Rising investments in hydrogen corridors, fuel cell vehicles, and manufacturing initiatives strengthen adoption.

- Trends include advanced composite tanks, high-pressure systems, digital monitoring, and predictive safety analytics.

- Competition is shaped by innovation, R&D, and partnerships among global and regional players.

- High production costs, regulatory fragmentation, and limited infrastructure act as restraints.

- Asia Pacific leads adoption, Europe follows with emission-driven policies, North America expands hydrogen hubs, while Latin America and Middle East & Africa grow through green hydrogen exports.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Clean Energy Transition and Hydrogen Economy Growth

The Hydrogen Storage Tanks and Transportation Market benefits from the global energy transition. Governments and industries invest in hydrogen infrastructure to replace fossil fuels. Strong policy support and subsidies accelerate adoption across transportation, power generation, and industrial sectors. It supports decarbonization goals, particularly in countries with ambitious net-zero targets. Market growth aligns with renewable energy integration where hydrogen serves as an effective storage medium. Growing focus on sustainable solutions ensures demand for advanced storage and distribution systems.

- For instance, Marine Service Noord integrates hydrogen fuel systems for mobility applications, including pressurized storage up to 500 bar. While they do not manufacture composite hydrogen tanks, they use commercially available tanks for maritime applications, enabling secure transport for propulsion systems.

Expanding Hydrogen Applications in Automotive and Industrial Sectors

The Hydrogen Storage Tanks and Transportation Market grows with the rapid commercialization of fuel cell vehicles. Automotive OEMs deploy hydrogen-powered buses, trucks, and passenger cars, requiring robust storage solutions. Heavy industries adopt hydrogen for steelmaking, chemicals, and refining to lower emissions. It supports efficiency gains in large-scale industrial operations where electrification remains difficult. Broader adoption of hydrogen across diverse industries strengthens long-term market demand. Strategic collaborations between vehicle manufacturers and tank suppliers further stimulate adoption.

- For instance, Mahytec developed composite storage tanks capable of storing hydrogen at 350 bar, with individual capacities reaching 700 liters, and also engineered solid-state storage systems holding up to 7 kilograms of hydrogen using metal hydrides for industrial and mobility projects.

Technological Advancements Driving Safety, Efficiency, and Performance

The Hydrogen Storage Tanks and Transportation Market advances through continuous innovation in composite materials and tank designs. Lightweight carbon-fiber tanks improve vehicle range and reduce refueling time. Smart monitoring systems enhance safety through real-time pressure and leak detection. It increases reliability and lowers operating risks for both transport and stationary applications. Improved insulation technologies support cryogenic storage and long-distance distribution. These developments make hydrogen infrastructure more scalable and commercially viable. Companies prioritize R&D to ensure compliance with strict safety standards.

Strategic Infrastructure Expansion and Cross-Border Supply Chain Development

The Hydrogen Storage Tanks and Transportation Market expands through large-scale infrastructure projects worldwide. Countries develop hydrogen corridors, fueling stations, and storage hubs to strengthen supply chains. Investments target regional connectivity and cross-border transport of liquid and compressed hydrogen. It ensures stable supply for both domestic consumption and exports. Partnerships between governments, energy firms, and logistics companies enhance adoption. Global demand for secure, efficient transport solutions drives innovation in shipping and pipeline networks. Such developments build resilience and competitiveness across the hydrogen ecosystem.

Market Trends

Growing Focus on Lightweight Composite Materials for Enhanced Storage Efficiency

The Hydrogen Storage Tanks and Transportation Market is witnessing rising demand for advanced composite tanks. Carbon-fiber reinforced systems replace traditional metal due to higher strength-to-weight ratios. Lightweight solutions extend vehicle range and improve payload efficiency in transport applications. It allows faster refueling cycles and reduces overall operating costs. Strong adoption in automotive and aerospace sectors drives investment in next-generation designs. Research partnerships emphasize durability and cost optimization to enable mass-market deployment.

- For instance, Hexagon Purus supplies Type IV hydrogen cylinders designed for 700 bar pressure with storage capacities up to 155 liters per cylinder, each weighing nearly 70% less than steel alternatives, enabling integration into fuel cell trucks and buses with ranges exceeding 500 kilometers.

Increasing Integration of Digital Monitoring and Smart Safety Systems

The Hydrogen Storage Tanks and Transportation Market shows strong emphasis on digitalization. Smart sensors and IoT platforms support real-time monitoring of pressure, temperature, and leaks. It enhances safety, compliance, and operational reliability across large-scale storage facilities. Predictive analytics reduce maintenance costs and extend equipment life. Energy companies integrate automated controls to improve supply chain visibility. The trend strengthens end-user confidence in hydrogen infrastructure.

- For instance, Doosan Mobility Innovation developed the DP30M2 fuel cell drone system powered by hydrogen cartridges containing 1.6 liters of compressed hydrogen at 350 bar, enabling continuous flight times of up to 120 minutes and payload capacities of 5 kilograms.

Expansion of Global Hydrogen Infrastructure and Long-Distance Transport Solutions

The Hydrogen Storage Tanks and Transportation Market benefits from strategic investments in fueling stations, pipelines, and shipping routes. Countries across Asia, Europe, and North America develop hydrogen corridors to support cross-border trade. It ensures secure supply and enables large-scale industrial adoption. Cryogenic storage and liquid hydrogen shipping technologies gain momentum for long-distance distribution. Growing collaboration between governments and private firms accelerates infrastructure rollouts. The trend positions hydrogen as a viable global commodity.

Rising Adoption of Hydrogen in Heavy-Duty and Industrial Applications

The Hydrogen Storage Tanks and Transportation Market experiences strong uptake in heavy-duty mobility and industrial sectors. Trucks, buses, and rail systems increasingly adopt hydrogen storage solutions for clean energy transition. It supports industries such as steel, chemicals, and refining where electrification faces limits. Demand for high-capacity tanks and bulk transport systems grows steadily. Government-backed projects stimulate adoption in logistics and manufacturing. The trend highlights hydrogen’s pivotal role in hard-to-abate sectors.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Requirements for Hydrogen Storage Systems

The Hydrogen Storage Tanks and Transportation Market faces significant cost challenges due to advanced material needs and complex manufacturing processes. Carbon-fiber reinforced tanks, while lightweight and strong, require costly production methods that hinder large-scale affordability. It limits adoption among small and mid-sized operators who seek economical solutions. Strict safety standards further increase expenses by mandating rigorous testing and certification. Manufacturing bottlenecks reduce scalability and delay project timelines. The high upfront investment required creates barriers for emerging players and slows global adoption.

Infrastructure Gaps and Safety Concerns in Large-Scale Hydrogen Deployment

The Hydrogen Storage Tanks and Transportation Market struggles with inadequate infrastructure and safety concerns. Limited fueling stations and cross-border pipelines restrict large-scale transportation and storage networks. It constrains hydrogen’s role as a competitive energy carrier against conventional fuels. Safety risks, including leak detection and high-pressure handling, raise operational challenges and public concerns. Regulatory fragmentation across regions complicates compliance and delays project approvals. The absence of standardized global frameworks affects international collaboration. These barriers restrain the pace of commercialization despite strong policy support.

Market Opportunities

Expansion of Green Hydrogen Projects and Cross-Sector Adoption Creating Growth Potential

The Hydrogen Storage Tanks and Transportation Market holds strong opportunities through the global shift toward green hydrogen. Large-scale renewable energy projects drive demand for safe and efficient storage solutions. It enables integration of solar and wind energy by converting excess power into storable hydrogen. Cross-sector adoption in mobility, power generation, and industrial processes widens the application base. Partnerships between governments, energy firms, and technology providers accelerate commercial rollouts. Growing investment in hydrogen hubs and corridors enhances long-term market visibility and stability.

Advancements in Storage Technologies and Global Trade Development Enhancing Market Reach

The Hydrogen Storage Tanks and Transportation Market benefits from breakthroughs in tank design and cryogenic storage systems. Innovations in lightweight composites and advanced insulation materials reduce costs while boosting efficiency. It supports long-distance transportation through pipelines, shipping, and rail-based logistics. Expanding global trade networks for hydrogen exports create new revenue streams. Strategic collaborations foster standardization and harmonized safety frameworks across regions. These developments position hydrogen as a scalable and commercially viable energy solution worldwide.

Market Segmentation Analysis:

By Tank Type

The Hydrogen Storage Tanks and Transportation Market demonstrates strong segmentation by tank type, with four categories defining adoption trends. Type 1 tanks, made of all-metal structures, remain cost-effective but limited by weight and storage efficiency. Type 2 tanks integrate metal liners with hoop-wrapped composites, offering moderate weight savings and better durability. Type 3 tanks, featuring fully wrapped composites with metal liners, gain traction in high-pressure vehicle applications due to superior strength. It is Type 4 tanks, made from full carbon-fiber composites with polymer liners, that show the fastest growth. Their lightweight design and ability to store hydrogen at very high pressures position them as a preferred solution in mobility and industrial projects.

- For instance, companies like Hexagon Purus, NPROXX, and Voith Composites produce Type IV hydrogen tanks certified for 700 bar pressure. These tanks, with capacities reaching hundreds of liters, significantly reduce tank weight compared to steel alternatives, enabling safe onboard storage in passenger vehicles and buses.

By Pressure

The market divides by pressure capacity, addressing distinct performance requirements across industries. Tanks below 200 bar are used mainly in stationary applications where low pressure suffices. Units rated between 200 and 500 bar dominate mid-range adoption, balancing safety, cost, and energy density. It is the above 500 bar segment that records rising demand from advanced transportation applications. High-pressure systems support longer ranges and reduced refueling times, making them critical for automotive, railway, and marine sectors. These segments benefit from growing research into durable materials and advanced leak-proof designs.

- For instance, NPROXX manufactures Type IV hydrogen storage cylinders certified for 700 bar with capacities exceeding 150 liters per tank, and has engineered rail storage modules capable of holding 1,100 kilograms of hydrogen at 350 bar, enabling continuous operation of fuel cell-powered trains over 600 kilometers without refueling.

By Application

Application-wise, the Hydrogen Storage Tanks and Transportation Market aligns with the energy transition across multiple transport modes. Vehicles represent the largest segment, driven by increasing fuel cell car and bus deployments. Railways adopt hydrogen solutions for routes lacking electrification, with storage tanks ensuring operational efficiency. Marine applications expand as global shipping firms test hydrogen-powered vessels to meet emission targets. It creates significant demand for large-capacity tanks capable of withstanding harsh operating environments. Together, these applications underline the critical role of advanced tank technology in scaling hydrogen adoption across global transport networks.

Segments:

Based on Tank Type:

Based on Pressure:

- Below 200 bar

- 200 – 500 bar

Based on Application:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 32% share of the Hydrogen Storage Tanks and Transportation Market, reflecting its early leadership in hydrogen adoption. The region benefits from extensive investments in hydrogen corridors, government-backed funding programs, and commercial fuel cell vehicle rollouts. The United States leads with strong federal and state-level support, including Department of Energy initiatives for hydrogen hubs. Canada contributes through infrastructure projects targeting mobility and industrial applications. It shows strong collaboration between automakers, energy companies, and tank manufacturers to expand storage capacity and improve safety standards. North America’s advanced research ecosystem fosters innovation in lightweight composites and high-pressure systems. With growing commercial vehicle adoption, the region is set to remain a leading hub for hydrogen storage development.

Europe

Europe secures 28% share of the Hydrogen Storage Tanks and Transportation Market, driven by ambitious climate goals and strict emission regulations. The European Union prioritizes hydrogen under its Green Deal and Fit for 55 framework, ensuring large-scale deployment across industries. Germany, France, and the Netherlands lead infrastructure expansion with cross-border hydrogen corridors and refueling networks. It emphasizes standardization, harmonized safety frameworks, and coordinated investments across member states. Strong activity in rail and marine projects adds momentum to Europe’s adoption of high-capacity storage tanks. Collaboration between public and private stakeholders accelerates cost reduction and supply chain development. Europe’s consistent policy backing secures its role as a global leader in hydrogen storage technologies.

Asia Pacific

Asia Pacific holds the largest share at 34% of the Hydrogen Storage Tanks and Transportation Market, supported by rapid industrial growth and strong government investment. Japan and South Korea spearhead hydrogen initiatives with widespread deployment of fuel cell vehicles and extensive refueling stations. China invests heavily in domestic manufacturing of tanks and infrastructure for hydrogen mobility and industrial applications. It shows high adoption of above 500 bar tanks to support heavy-duty transport and logistics. The region benefits from vertically integrated supply chains that lower costs and strengthen global competitiveness. Strong demand from marine and railway sectors further enhances Asia Pacific’s leadership. With ongoing government subsidies and private investment, Asia Pacific is positioned to maintain its dominance in the market.

Latin America

Latin America captures 3% share of the Hydrogen Storage Tanks and Transportation Market, reflecting its emerging position in hydrogen adoption. Brazil and Chile lead regional projects, focusing on green hydrogen production supported by abundant renewable resources. Early-stage infrastructure projects are being developed to support mobility and industrial adoption. It faces challenges from limited funding and regulatory gaps, but opportunities remain strong in export-driven hydrogen supply chains. Regional focus on decarbonization attracts international partnerships, especially in mining and heavy industry applications. Market participation is set to expand as governments align with global energy transition policies. Latin America remains a developing but promising market for hydrogen storage solutions.

Middle East & Africa

The Middle East & Africa region accounts for 3% share of the Hydrogen Storage Tanks and Transportation Market, with growth concentrated in green hydrogen export initiatives. Countries such as Saudi Arabia and the United Arab Emirates invest in large-scale hydrogen projects integrated with solar and wind resources. South Africa leads within Africa with pilot programs for hydrogen mobility and industrial use. It supports the development of export-oriented infrastructure, including port facilities for liquid hydrogen shipping. Limited domestic demand slows near-term adoption, but export opportunities drive significant investment in storage and transportation technologies. Regional governments collaborate with international partners to position the Middle East & Africa as a global supplier in the hydrogen economy. The region’s long-term growth outlook depends on successful integration of large-scale projects with international demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Marine Service Noord

- Mahytec

- Hexagon Purus

- Hensoldt

- Doosan Mobility Innovation

- ECS GmbH & Co. KG

- Composite Advanced Technologies

- NPROXX

- Luxfer Gas Cylinders

- BayoTech

Competitive Analysis

The Hydrogen Storage Tanks and Transportation companies including BayoTech, Composite Advanced Technologies, Doosan Mobility Innovation, ECS GmbH & Co. KG, Hensoldt, Hexagon Purus, Luxfer Gas Cylinders, Mahytec, Marine Service Noord, and NPROXX. The Hydrogen Storage Tanks and Transportation Market is characterized by strong competition, with companies focusing on innovation, scalability, and compliance with global safety standards. Market participants prioritize the development of lightweight composite tanks capable of withstanding high pressures while ensuring durability and cost efficiency. Strategic emphasis is placed on expanding hydrogen corridors, fueling stations, and long-distance transportation networks to meet rising demand across mobility, rail, and marine sectors. Firms invest heavily in research and development to advance cryogenic storage technologies, smart monitoring systems, and advanced insulation methods that improve performance. Partnerships with governments and energy providers accelerate infrastructure deployment and create opportunities for global trade in hydrogen. Continuous focus on sustainability, efficiency, and large-scale integration defines the competitive strategies shaping this market’s growth trajectory.

Recent Developments

- In November 2024, Hexagon Purus was once again selected by New Flyer to provide hydrogen cylinders for North America’s zero-emission transit buses. Hexagon Purus will deliver its Type 4 hydrogen storage cylinders for use in the transit buses, which can travel up to 600 kilometers on a single refueling.

- In October 2024, Tenaris reaffirmed its role in advancing hydrogen transportation research by participating in the Hydrogenius Symposium and the HyLINE II JIP. Following the symposium, Tenaris joined the HyLINE II JIP, a five-year initiative focusing on the material integrity of welded joints in offshore hydrogen pipelines, collaborating with key industrial partners.

- In October 2024, Celly and UMOE Advanced Composites AS introduced an advanced hydrogen transportation trailer to the U.S. market. Designed to safely and efficiently transport large volumes of hydrogen, this trailer builds on UMOE’s successful six-year track record in Europe.

- In April 2024, NPROXX displayed its hydrogen storage solutions at Hannover Messe, demonstrating advanced technologies like lightweight composite tanks. The company highlighted its role in promoting hydrogen adoption across various sectors, engaging with industry leaders to foster collaboration.

Report Coverage

The research report offers an in-depth analysis based on Tank Type, Pressure, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of hydrogen fuel cell vehicles.

- Demand for lightweight composite tanks will increase to improve storage efficiency.

- Governments will drive growth through supportive hydrogen policies and infrastructure funding.

- High-pressure storage systems will gain traction in mobility and industrial sectors.

- Cryogenic storage solutions will see wider use for long-distance hydrogen transport.

- Digital monitoring and smart safety systems will become standard in storage operations.

- Cross-border hydrogen trade will grow with pipelines and maritime transport projects.

- Industrial sectors such as steel and chemicals will adopt large-scale hydrogen storage.

- Partnerships between technology providers and energy companies will strengthen market competitiveness.

- Global hydrogen hubs and corridors will position hydrogen as a mainstream energy carrier.