Market Overview

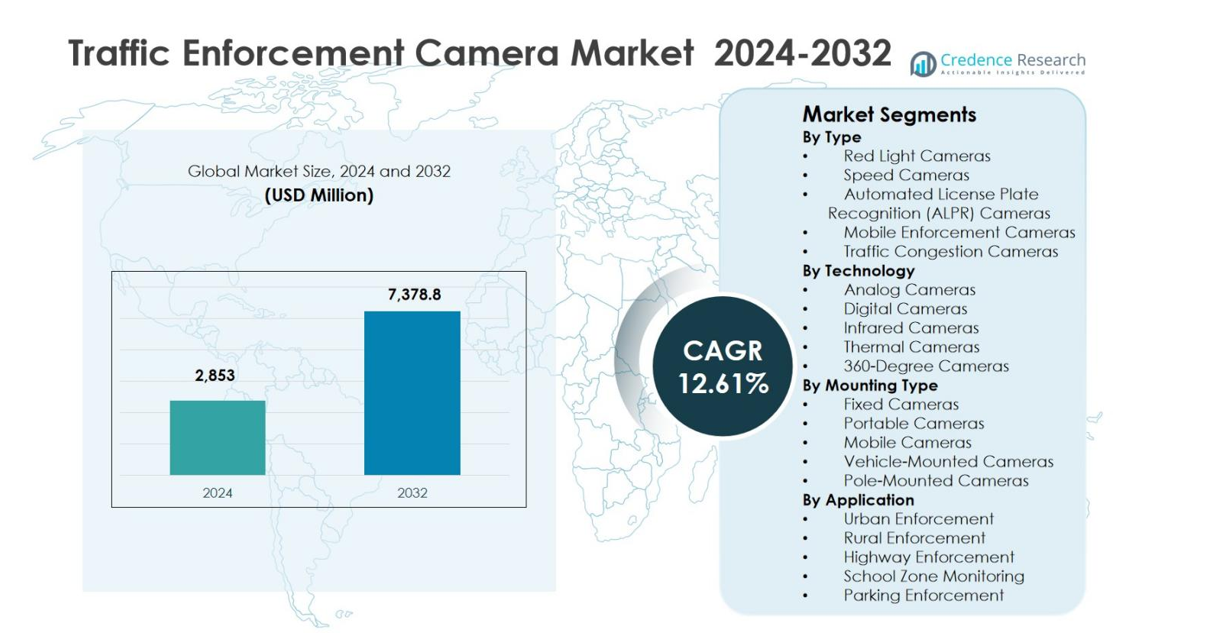

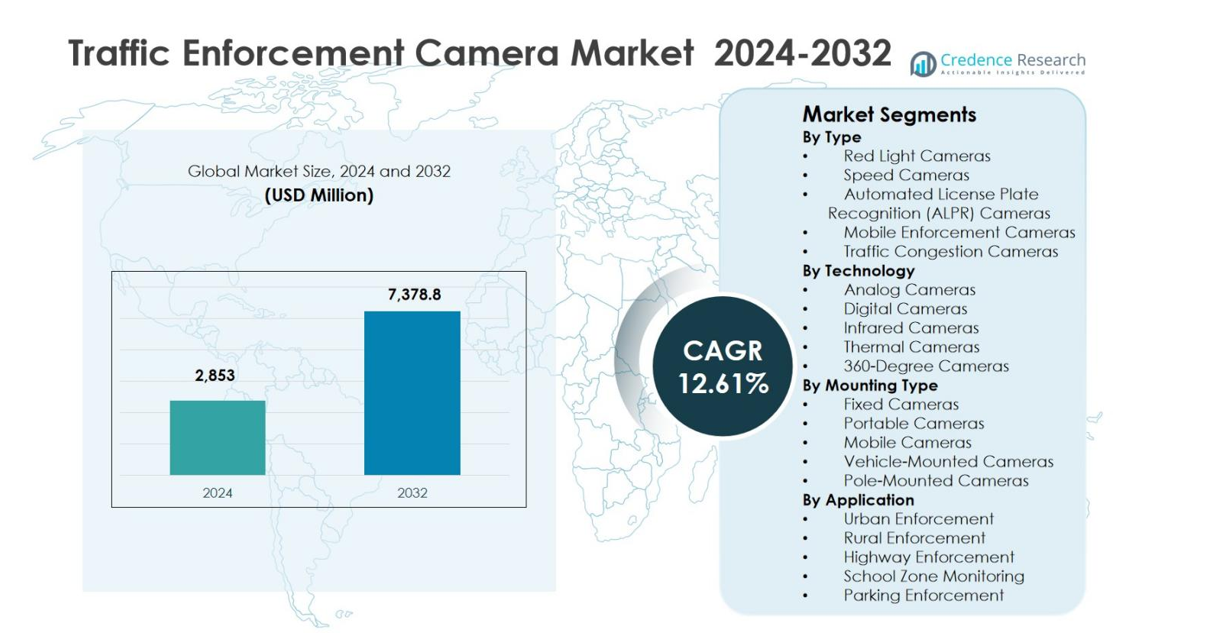

Traffic Enforcement Camera Market size was valued at USD 2,853 Million in 2024 and is anticipated to reach USD 7,378.8 Million by 2032, at a CAGR of 12.61% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Traffic Enforcement Camera Market Size 2024 |

USD 2,853 Million |

| Traffic Enforcement Camera Market, CAGR |

12.61% |

| Traffic Enforcement Camera Market Size 2032 |

USD 7,378.8 Million |

Traffic Enforcement Camera Market is characterized by the presence of established technology providers such as Jenoptik Group, SWARCO Traffic Ltd, Bosch Security Systems, GATSO Deutschland GmbH, TomTom NV, ARH, Elsag, Vysionics Intelligent Traffic Solutions, Jinan Zhiye Electronic Co. Ltd, and Xerox Services, which focus on advanced imaging, AI-enabled enforcement, and integrated traffic management solutions. These companies strengthen their positions through long-term government contracts, system upgrades, and turnkey deployments across urban and highway networks. Regionally, North America led the market with an exact 34.2% share in 2024, supported by strong regulatory enforcement and early adoption of automated traffic monitoring systems. Europe followed with a 28.6% share, driven by strict traffic regulations and smart mobility initiatives, while Asia Pacific accounted for 26.1% share, supported by rapid urbanization and large-scale smart city deployments.

Market Insights

- Traffic Enforcement Camera Market was valued at USD 2,853 Million in 2024 and is projected to reach USD 7,378.8 Million by 2032, registering a CAGR of 12.61% during the forecast period, driven by rising automation in traffic monitoring and enforcement systems.

- Market growth is supported by strict road safety regulations, increasing vehicle density, smart city investments, and the shift from manual policing to automated enforcement solutions across highways, urban roads, and high-risk zones.

- Speed cameras dominated the market by type with a 38.6% share in 2024, while digital cameras led by technology with a 42.9% share, supported by high-resolution imaging, real-time data transmission, and AI-enabled analytics.

- Market participants focus on advanced imaging, AI-based violation detection, system integration, and long-term government contracts to strengthen deployments across urban and highway applications.

- North America led with a 34.2% share in 2024, followed by Europe at 28.6%, Asia Pacific at 26.1%, Latin America at 6.7%, and Middle East & Africa at 4.4%, reflecting varied adoption levels across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Traffic Enforcement Camera Market by type shows strong adoption across red light, speed, ALPR, mobile enforcement, and traffic congestion cameras. Speed cameras dominated the segment in 2024, accounting for 38.6% market share, driven by their widespread deployment for speed monitoring on highways, urban roads, and accident-prone zones. Governments increasingly rely on speed cameras to reduce fatalities, enforce compliance, and generate violation-based revenue. Rising road safety mandates, growing vehicle density, and integration of AI-enabled violation detection systems continue to support sustained demand for speed cameras across both developed and emerging economies.

- For instance, Kapsch TrafficCom supports Spain’s DGT with over 400 hardware pieces including speed measurement equipment, processing more than three million automated fines via video surveillance. Their joint venture maintains these systems nationwide from 2024 through 2027.

By Technology:

Based on technology, the Traffic Enforcement Camera Market includes analog, digital, infrared, thermal, and 360-degree cameras. Digital cameras led the segment with a 42.9% market share in 2024, supported by superior image resolution, real-time data transmission, and seamless integration with intelligent traffic management systems. The shift toward smart city infrastructure and automated traffic enforcement platforms has accelerated adoption of digital cameras over legacy analog systems. Enhanced night-time monitoring, AI-powered analytics, and compatibility with cloud-based platforms further strengthen demand for digital camera technologies globally.

- For instance, Milesight’s DualVision TrafficX Enforcement Camera uses AI deep learning for red light violation detection and achieves a 99% capture rate with 98% plate recognition accuracy across 2-3 lanes up to 50m.

By Mounting Type:

By mounting type, the Traffic Enforcement Camera Market is segmented into fixed, portable, mobile, vehicle-mounted, and pole-mounted cameras. Fixed cameras held the dominant position with a 46.3% market share in 2024, due to their permanent installation at high-violation intersections, highways, and toll points. Fixed systems offer continuous monitoring, higher enforcement accuracy, and long-term cost efficiency for authorities. Increasing investments in permanent traffic surveillance infrastructure, coupled with rising urban congestion and strict enforcement policies, continue to drive strong adoption of fixed-mounted enforcement cameras worldwide.

Key Growth Drivers

Rising Emphasis on Road Safety and Accident Prevention

The Traffic Enforcement Camera Market is driven by increasing global focus on road safety and reduction of traffic-related fatalities. Governments are implementing stricter traffic regulations and adopting automated enforcement systems to minimize speeding, red-light violations, and reckless driving. Traffic enforcement cameras enable continuous, unbiased monitoring and improve compliance with traffic laws. Growing vehicle ownership, rapid urbanization, and higher accident rates in metropolitan areas further strengthen demand. National road safety programs and public awareness campaigns continue to support sustained investment in enforcement camera infrastructure.

- For instance, Jenoptik deployed red light enforcement cameras at traffic junctions, resulting in a 40% drop in accident rates since project start; the initiative doubled camera numbers to boost public safety further.

Expansion of Smart Cities and Intelligent Transportation Systems

Rapid development of smart cities is a major growth driver for the Traffic Enforcement Camera Market. Enforcement cameras are integral components of intelligent transportation systems, enabling real-time traffic monitoring, automated violation detection, and centralized data management. Integration with IoT, cloud platforms, and advanced analytics improves traffic flow and enforcement efficiency. Governments and municipalities increasingly invest in digital traffic infrastructure to reduce congestion and enhance urban mobility. This expansion of smart city initiatives consistently drives large-scale deployment of traffic enforcement cameras.

- For instance, Pittsburgh’s Surtrac system uses AI-driven traffic cameras at intersections to adapt signal timings in real time based on traffic flow data. The deployment reduced vehicle wait times by 40% and emissions by 20% in pilot areas.

Stringent Regulations and Shift Toward Automated Enforcement

The introduction of stringent traffic regulations and automated law enforcement frameworks significantly accelerates the Traffic Enforcement Camera Market. Authorities are transitioning from manual policing to camera-based enforcement to improve accuracy, transparency, and operational efficiency. Automated ticketing systems reduce human intervention and ensure consistent enforcement. Rising penalties for traffic violations and regulatory mandates for speed and red-light monitoring encourage widespread camera adoption. This regulatory environment supports long-term and stable market growth across regions.

Key Trends & Opportunities

Adoption of Artificial Intelligence and Advanced Analytics

Artificial intelligence integration is a prominent trend in the Traffic Enforcement Camera Market, enhancing detection accuracy and system intelligence. AI-powered cameras enable real-time violation identification, vehicle classification, and behavioral analysis. Advanced analytics support predictive traffic management and optimized enforcement strategies. These capabilities reduce false positives and improve evidence reliability. Growing demand for intelligent, data-driven enforcement solutions creates strong opportunities for vendors offering AI-enabled camera systems.

- For instance, in Uttar Pradesh state, India, Hikvision’s checkpoint cameras integrate large-scale AI models to detect seatbelt non-compliance and phone use with high precision. The system reduces false phone use detections by 75% via industry-specific knowledge.

Increasing Demand for Mobile and Flexible Enforcement Solutions

The growing preference for mobile and flexible enforcement solutions presents significant opportunities in the Traffic Enforcement Camera Market. Portable and vehicle-mounted cameras allow rapid deployment in accident-prone zones, construction areas, and temporary traffic hotspots. These solutions offer cost efficiency and operational adaptability compared to permanent installations. Rising use of mobile enforcement during peak traffic periods and special events further supports market expansion and diversification.

- For instance, Jenoptik’s TraffiStar S351 mobile speed camera uses tripod or vehicle mounting for quick setup without road modifications. Operators deploy it flexibly for mobile enforcement in hazardous sections, converting between mobile, semi-stationary, and stationary modes to optimize costs.

Key Challenges

Public Resistance and Data Privacy Concerns

Public resistance and privacy concerns remain a critical challenge for the Traffic Enforcement Camera Market. Continuous surveillance raises issues related to data security, personal privacy, and potential misuse of collected information. Opposition from civil rights groups and public scrutiny can delay project approvals or limit deployment scope. Authorities must ensure transparent data policies, robust cybersecurity measures, and ethical enforcement practices to address these concerns and maintain public acceptance.

High Deployment and Maintenance Costs

High deployment and maintenance costs pose a notable challenge for the Traffic Enforcement Camera Market. Advanced enforcement systems require significant investment in hardware, software, communication networks, and data storage. Ongoing costs for system calibration, maintenance, and upgrades add financial pressure, particularly for smaller municipalities. Budget limitations in developing regions can restrict large-scale adoption, slowing overall market penetration despite strong regulatory drivers.

Regional Analysis

North America

North America held a leading 34.2% market share in 2024 in the Traffic Enforcement Camera Market, driven by strong regulatory enforcement, advanced road infrastructure, and early adoption of automated traffic monitoring systems. The United States dominates regional demand due to widespread deployment of speed and red-light cameras across highways and urban intersections. Federal and state-level road safety initiatives, combined with smart city investments, continue to support adoption. High vehicle ownership, strong integration of AI-based analytics, and well-established law enforcement frameworks further strengthen North America’s position in the global market.

Europe

Europe accounted for 28.6% market share in 2024 in the Traffic Enforcement Camera Market, supported by strict traffic regulations and zero-tolerance road safety policies. Countries such as Germany, the UK, France, and the Netherlands actively deploy speed cameras, ALPR systems, and congestion monitoring solutions. The region benefits from harmonized traffic laws, strong public safety focus, and extensive use of automated enforcement for emission control and congestion charging. Ongoing smart mobility programs and cross-border traffic monitoring initiatives continue to drive steady demand across both Western and Eastern Europe.

Asia Pacific

Asia Pacific captured 26.1% market share in 2024 in the Traffic Enforcement Camera Market, driven by rapid urbanization, rising vehicle density, and expanding smart city projects. China, Japan, South Korea, and India are key contributors, with large-scale deployments in metropolitan areas and national highways. Governments increasingly rely on automated enforcement to manage congestion and improve road safety. Investments in intelligent transportation systems, combined with growing adoption of digital and AI-enabled cameras, support strong growth momentum. Expanding urban infrastructure continues to elevate regional demand.

Latin America

Latin America represented 6.7% market share in 2024 in the Traffic Enforcement Camera Market, supported by increasing road safety initiatives and modernization of urban traffic systems. Brazil, Mexico, and Chile lead regional adoption, particularly in major cities experiencing rising traffic congestion and accident rates. Governments are deploying speed and red-light cameras to improve compliance and reduce fatalities. Although budget constraints persist, public-private partnerships and international funding programs support infrastructure upgrades. Growing awareness of automated enforcement benefits continues to strengthen market penetration across the region.

Middle East & Africa

The Middle East & Africa held 4.4% market share in 2024 in the Traffic Enforcement Camera Market, driven by infrastructure development and stricter traffic regulations in Gulf countries. Nations such as the UAE and Saudi Arabia активно deploy advanced enforcement cameras as part of smart city and road safety initiatives. High investment in digital infrastructure and urban mobility modernization supports adoption. In Africa, gradual implementation in major cities is gaining traction. Government-led safety programs and increasing vehicle ownership continue to create long-term growth opportunities.

Market Segmentations:

By Type

- Red Light Cameras

- Speed Cameras

- Automated License Plate Recognition (ALPR) Cameras

- Mobile Enforcement Cameras

- Traffic Congestion Cameras

By Technology

- Analog Cameras

- Digital Cameras

- Infrared Cameras

- Thermal Cameras

- 360-Degree Cameras

By Mounting Type

- Fixed Cameras

- Portable Cameras

- Mobile Cameras

- Vehicle-Mounted Cameras

- Pole-Mounted Cameras

By Application

- Urban Enforcement

- Rural Enforcement

- Highway Enforcement

- School Zone Monitoring

- Parking Enforcement

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Traffic Enforcement Camera Market highlights the presence of established technology providers such as Jenoptik Group, SWARCO Traffic Ltd, Bosch Security Systems, TomTom NV, GATSO Deutschland GmbH, ARH, Elsag, Vysionics Intelligent Traffic Solutions, Jinan Zhiye Electronic Co. Ltd, and Xerox Services. These companies focus on expanding their portfolios through advanced imaging technologies, AI-enabled violation detection, and integrated traffic management platforms. Market participants emphasize long-term government contracts, system upgrades, and turnkey solutions to strengthen their presence. Strategic partnerships with municipalities and transport authorities support recurring revenue streams and geographic expansion. Continuous investment in digital, infrared, and ALPR-based systems enhances enforcement accuracy and scalability. Competition centers on technological reliability, data analytics capabilities, and compliance with regional regulations, while companies increasingly differentiate through service offerings, system integration expertise, and post-installation support to maintain strong market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ARH

- Bosch Security Systems

- Elsag

- GATSO Deutschland GmbH

- Jenoptik Group

- Jinan Zhiye Electronic Co. Ltd

- SWARCO Traffic Ltd

- TomTom NV

- Vysionics Intelligent Traffic Solutions

- XEROX Services

Recent Developments

- In October 2025, Safe Fleet debuted the FOCUS X3 LTE-connected body camera and FOCUS H3 in-car video system alongside its Violation Detection Suite, including stop arm violation enforcement, at the IACP conference.

- In April 2025, Axon announced new fixed ALPR camera solutions, Axon Outpost and Axon Lightpost, together with a partner program to connect third-party cameras into its Axon Fusus real-time public safety network.

- In July 2025, Gurugram Police in India began enforcement using newly installed ANPR cameras on key corridors such as NH-48 and Dwarka Expressway to automatically detect overspeeding, helmet, seat-belt, and lane violations.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, Mounting Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Traffic Enforcement Camera Market will continue expanding due to stricter road safety regulations and automated law enforcement adoption.

- Governments will increasingly replace manual traffic monitoring with camera-based enforcement systems.

- Integration of artificial intelligence and machine learning will improve violation detection accuracy and operational efficiency.

- Demand for digital, infrared, and multi-sensor cameras will rise across urban and highway applications.

- Smart city development will accelerate large-scale deployment of connected enforcement cameras.

- Mobile and portable enforcement solutions will gain traction for flexible and temporary monitoring needs.

- Centralized data analytics platforms will strengthen evidence management and traffic planning capabilities.

- Public-private partnerships will play a greater role in funding and deploying enforcement infrastructure.

- Emerging economies will witness faster adoption due to urbanization and rising vehicle density.

- Vendors will focus on system upgrades, cybersecurity, and compliance to maintain long-term contracts.