| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Caffeinated Beverage Market Size 2024 |

USD 5,128.81 million |

| India Caffeinated Beverage Market, CAGR |

7.34% |

| India Caffeinated Beverage Market Size 2032 |

USD 9,039.82 million |

Market Overview

India Caffeinated Beverage market size was valued at USD 5,128.81 million in 2024 and is anticipated to reach USD 9,039.82 million by 2032, at a CAGR of 7.34% during the forecast period (2024-2032).

The India caffeinated beverage market is experiencing robust growth driven by rising urbanization, increasing disposable income, and shifting consumer lifestyles that favor convenient and energy-boosting drink options. A growing young population with a preference for functional beverages, coupled with the expanding café culture, is significantly boosting demand. Additionally, the increasing awareness of mental alertness and physical performance enhancement is pushing consumers toward caffeinated products such as energy drinks, RTD coffees, and caffeinated teas. Market players are responding with innovative flavors, clean-label ingredients, and sugar-free formulations to meet the evolving health preferences of consumers. The proliferation of modern retail formats and e-commerce platforms is further supporting product accessibility across urban and semi-urban areas. Trends such as premiumization, plant-based ingredients, and sustainable packaging are also shaping purchasing behavior. These dynamics collectively contribute to a favorable growth environment for caffeinated beverage brands in India over the forecast period.

The geographical landscape of the India caffeinated beverage market is diverse, with strong demand emerging from both metropolitan cities and rapidly developing tier-II and tier-III towns. Northern and western regions lead in consumption due to higher urbanization, evolving lifestyles, and greater exposure to global beverage trends, while southern India maintains a robust preference for coffee-based products. Eastern India, though comparatively nascent, is witnessing swift growth driven by improving retail infrastructure and rising consumer awareness. Key players shaping the competitive landscape include The Coca-Cola Company, PepsiCo, Red Bull, Ocean Drinks Private Limited, and Tata Consumer Products Ltd. These companies are actively expanding their product portfolios and investing in marketing, regional customization, and omni-channel distribution strategies to capture a broader consumer base. Innovation in flavor profiles, functional benefits, and sustainable packaging are central to their strategies, helping them maintain brand loyalty while attracting health-conscious and younger demographics across India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India caffeinated beverage market was valued at USD 5,128.81 million in 2024 and is expected to reach USD 9,039.82 million by 2032, growing at a CAGR of 7.34% during the forecast period.

- The global caffeinated beverage market was valued at USD 252,050.67 million in 2024 and is expected to reach USD 369,284.04 million by 2032, growing at a CAGR of 4.89%.

- Increased urbanization, rising disposable incomes, and a growing preference for functional beverages are key market drivers.

- The trend toward ready-to-drink (RTD) and on-the-go caffeinated beverages is gaining momentum among urban consumers.

- Flavor innovation, particularly natural ingredients like herbal extracts and coffee blends, is becoming central to product differentiation.

- The market faces challenges from rising health concerns related to caffeine consumption, along with regulatory restrictions on energy drinks.

- Regional growth varies, with northern and western India leading in consumption, while southern and eastern regions show emerging potential.

- Key players such as The Coca-Cola Company, PepsiCo, Red Bull, and Tata Consumer Products Ltd dominate the competitive landscape.

Report Scope

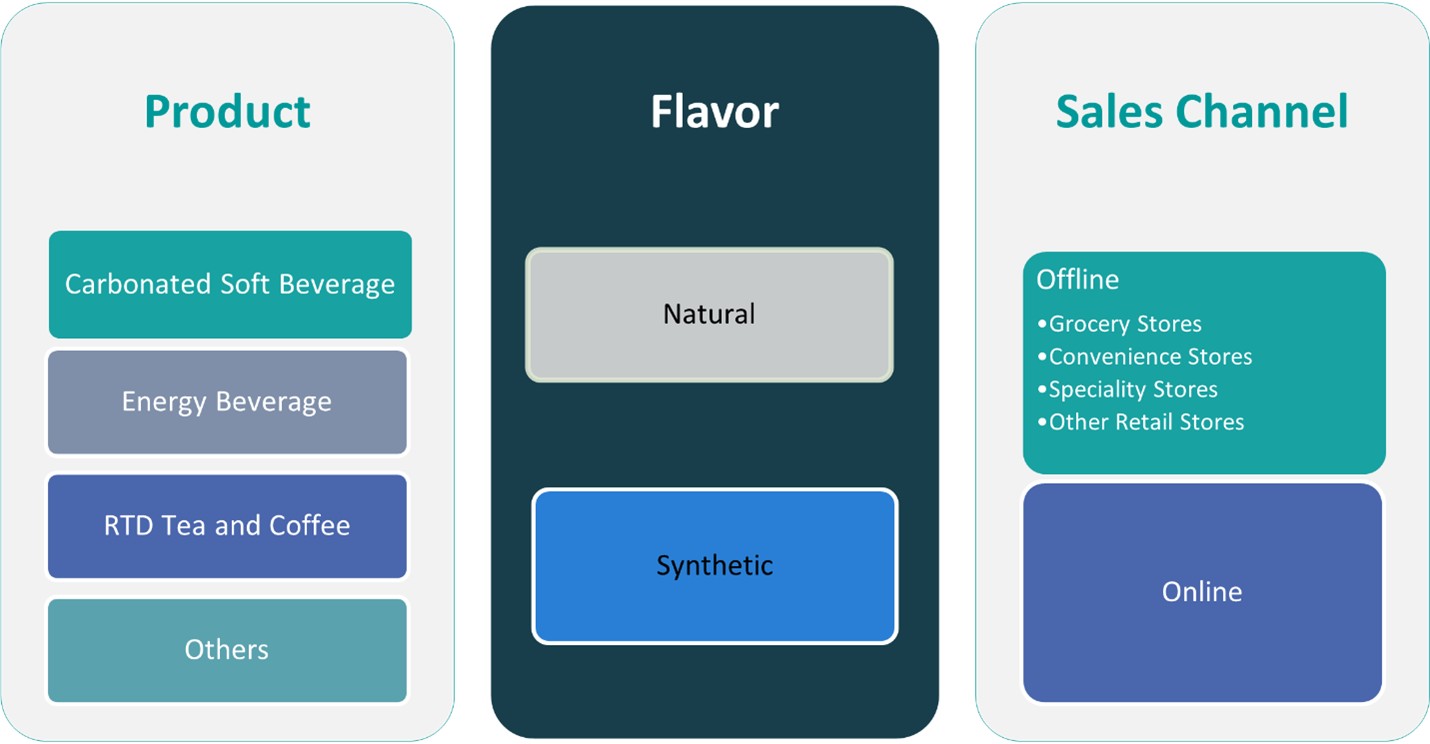

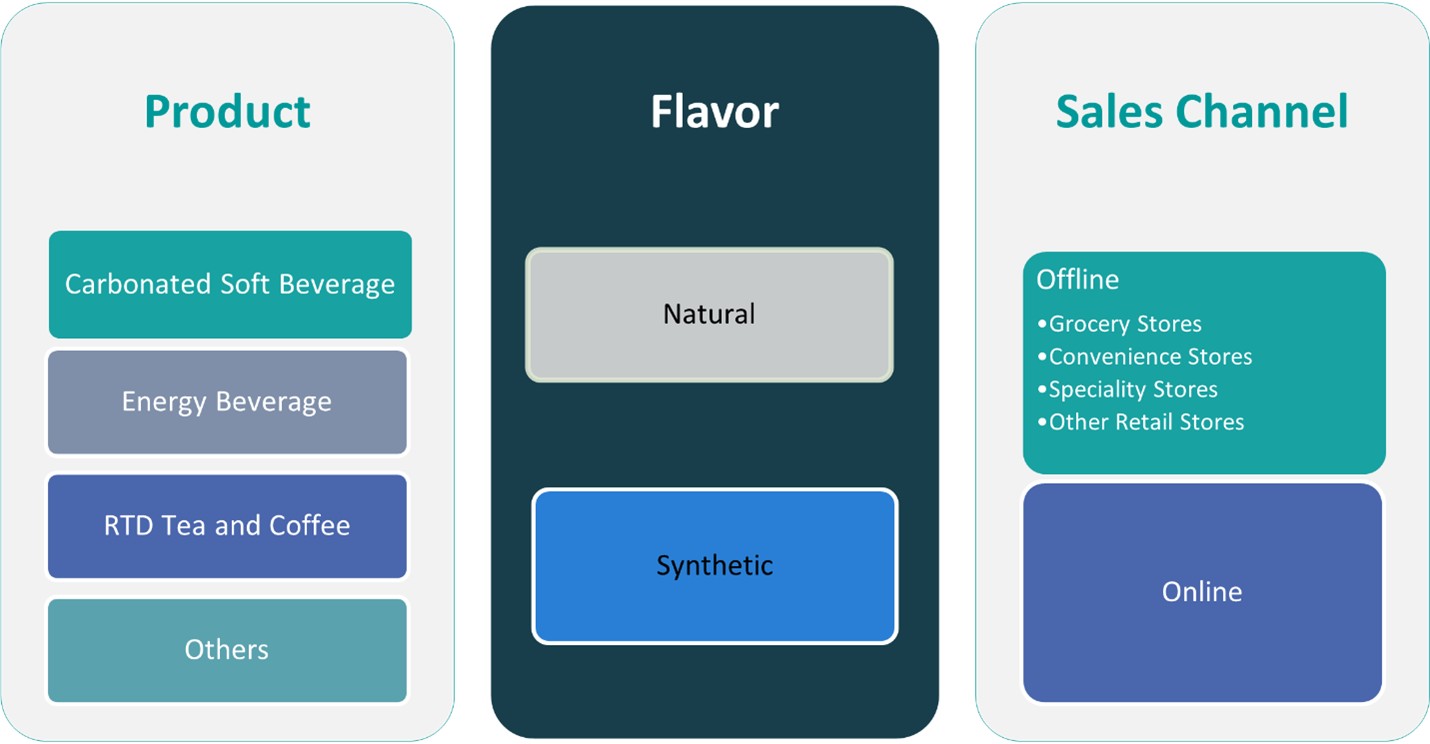

This report segments the India Caffeinated Beverage Market as follows:

Market Drivers

Rising Urbanization and Changing Lifestyles

India’s rapid urbanization and evolving lifestyle patterns are significantly influencing the growth of the caffeinated beverage market. With a growing urban population seeking convenient and on-the-go refreshment options, there has been a notable shift toward ready-to-drink (RTD) formats and energy-boosting beverages. Urban consumers, especially millennials and Gen Z, are increasingly opting for caffeine-infused drinks as an alternative to traditional beverages due to their functional benefits such as enhanced alertness and quick energy replenishment. For instance, India’s coffee market is projected to grow significantly, driven by younger consumers embracing café culture and global coffee varieties. Moreover, busy work schedules and a fast-paced lifestyle have heightened the demand for products that offer both stimulation and convenience. This demographic shift is fostering the emergence of café chains, vending solutions, and portable beverage packaging, all of which contribute to increased market penetration and visibility of caffeinated drinks across Indian cities.

Health Consciousness and Functional Beverage Demand

The growing awareness of health and wellness is another major driver shaping India’s caffeinated beverage market. Consumers are increasingly seeking functional beverages that offer health benefits beyond basic hydration. For instance, India’s functional beverage market is experiencing rapid growth, driven by rising demand for nutrient-rich drinks such as probiotics and herbal infusions. Caffeinated drinks, particularly those infused with vitamins, adaptogens, and natural ingredients, are gaining popularity as they cater to consumers’ desire for mental clarity, improved focus, and enhanced physical performance. Furthermore, the demand for low-sugar or sugar-free variants reflects a broader movement toward healthier consumption habits. Brands are actively innovating to align with these trends, launching products that meet both wellness expectations and regulatory standards. This shift is especially strong among fitness-conscious individuals and working professionals, further expanding the target customer base for such products across various distribution channels.

Expanding Middle-Class Population and Disposable Incomes

The expanding middle-class population with rising disposable incomes plays a pivotal role in accelerating the demand for premium and branded caffeinated beverages in India. As income levels improve, consumers are more willing to spend on lifestyle-oriented products that enhance performance, energy, and social identity. This change in spending behavior is encouraging global and domestic brands to introduce a wider range of products tailored to the Indian palate, including flavored coffees, carbonated energy drinks, and herbal-infused caffeinated teas. Premiumization trends are becoming evident as consumers show greater interest in high-quality ingredients, sustainable sourcing, and ethically produced beverages. This demand for value-added products is not only boosting market volumes but also enhancing brand differentiation and customer loyalty in an increasingly competitive landscape.

Retail Expansion and E-Commerce Growth

The increasing availability of caffeinated beverages through modern retail formats and online platforms is significantly enhancing market reach and accessibility. Organized retail chains, supermarkets, hypermarkets, and café outlets are offering a wider variety of caffeinated drinks, often supported by promotional campaigns and product sampling. Additionally, the surge in e-commerce and quick-commerce platforms has enabled direct-to-consumer sales, allowing brands to reach remote and semi-urban locations with minimal overhead. Online marketplaces also provide a platform for smaller and niche brands to establish a presence, promoting competition and innovation. Digital marketing and influencer-driven promotions further amplify product visibility among tech-savvy Indian consumers. As retail infrastructure continues to evolve, both offline and online, it will remain a crucial enabler for the sustained growth of the caffeinated beverage market in India.

Market Trends

Growth of Ready-to-Drink (RTD) and On-the-Go Formats

One of the most prominent trends in the India caffeinated beverage market is the rising popularity of ready-to-drink (RTD) and on-the-go formats. Urban consumers, especially working professionals and college students, increasingly prefer beverages that provide instant energy and convenience. RTD coffees, cold brews, and energy drinks are gaining traction as they cater to fast-paced lifestyles and eliminate the need for preparation. This trend is further supported by the growing café culture and the proliferation of vending machines in workplaces and public spaces. Manufacturers are investing in portable, resealable, and innovative packaging solutions to appeal to this segment, driving higher consumption rates and encouraging brand switching among consumers looking for variety and ease.

Digital-First Strategies and Direct-to-Consumer (D2C) Models

The digital transformation in India’s retail ecosystem is shaping the way caffeinated beverages are marketed and sold. Companies are increasingly adopting direct-to-consumer (D2C) models, leveraging social media platforms, influencer partnerships, and targeted digital advertising to engage with consumers. For instance, the global direct-to-consumer (D2C) coffee market is forecast to grow significantly, reflecting the shift toward online retail and personalized shopping experiences. Online marketplaces and brand websites allow for greater personalization, subscription models, and bundled offers, enhancing customer experience and retention. Start-ups and established brands alike are using analytics and consumer insights to tailor product launches and campaigns, making digital-first strategies a key trend that is expected to gain momentum in the coming years.

Innovation in Flavors and Ingredients

Flavor and ingredient innovation remains a key trend as manufacturers aim to differentiate their offerings in a competitive market. Indian consumers are showing an increasing preference for unique, fusion flavors that combine traditional tastes with modern appeal such as masala chai-flavored energy drinks or cardamom-infused cold brews. In addition, there is growing interest in beverages that contain natural caffeine sources like green tea, guarana, yerba mate, and coffee beans, especially among health-conscious buyers. For instance, the Food Safety and Standards Authority of India (FSSAI) has proposed regulations for energy drinks, including guidelines on caffeine levels and functional ingredients. Many brands are also incorporating herbal extracts, adaptogens, and functional ingredients to enhance the health value of their products. These innovations cater to a more aware and experimental consumer base, encouraging trial and repeat purchases while building brand loyalty.

Shift Toward Health-Conscious and Clean Label Products

Health-conscious consumption is becoming a central theme in India’s beverage industry, and caffeinated beverages are no exception. Increasing awareness about sugar-related health issues and lifestyle diseases has fueled demand for low-sugar, zero-calorie, and clean-label products. Consumers are scrutinizing product labels more closely and gravitating toward drinks that feature organic, natural, or plant-based ingredients. Brands are responding with transparency in labeling, clearer nutritional information, and the use of alternative sweeteners such as stevia. This trend is especially pronounced in tier-1 and metro cities, where consumers are highly influenced by global health movements and are actively seeking beverages that align with their fitness and wellness goals.

Market Challenges Analysis

Health Concerns and Regulatory Pressures

Despite the growing demand for caffeinated beverages in India, rising health concerns pose a significant challenge to market expansion. Increased consumer awareness regarding the adverse effects of excessive caffeine intake such as anxiety, insomnia, and cardiovascular issues has led to skepticism among health-conscious individuals. For instance, the Food Safety and Standards Authority of India (FSSAI) is re-evaluating existing regulations for caffeinated energy drinks to make them stricter, including mandatory disclosures of caffeine content and consumption limits on packaging. Regulatory bodies, including the Food Safety and Standards Authority of India (FSSAI), continue to monitor and impose stricter guidelines on caffeine content and ingredient transparency, particularly for energy drinks marketed to younger audiences. This increased scrutiny may limit the use of synthetic additives, high sugar content, and artificial flavorings, compelling brands to reformulate products to comply with evolving standards. These changes may increase production costs and affect product consistency, especially for multinational brands looking to localize their offerings. Additionally, concerns over long-term health impacts could deter some consumers from regular consumption, posing a barrier to sustained growth in this category.

Market Fragmentation and Intense Competition

India’s caffeinated beverage market is highly fragmented, with a mix of multinational corporations, regional brands, and emerging start-ups competing for market share. While this dynamic environment encourages innovation, it also creates challenges related to brand differentiation, pricing pressure, and customer retention. Established players dominate shelf space and consumer mindshare through aggressive marketing, widespread distribution, and strong brand equity, making it difficult for smaller or newer entrants to scale operations. Moreover, with many brands offering similar product profiles particularly in energy drinks and RTD coffee segments maintaining consistent consumer loyalty becomes increasingly difficult. Price sensitivity among a large portion of the Indian population further complicates matters, as consumers often shift toward lower-cost alternatives during economic uncertainty. In such a competitive and price-conscious environment, achieving profitability while maintaining product quality and innovation remains a persistent challenge for many industry participants.

Market Opportunities

The India caffeinated beverage market presents substantial growth opportunities driven by rising demand in semi-urban and rural areas, where consumer awareness and purchasing power are steadily increasing. While urban centers remain the primary revenue generators, tier-II and tier-III cities are emerging as untapped markets due to improving retail infrastructure and digital penetration. As internet access and smartphone usage rise, e-commerce and quick-commerce platforms are enabling brands to reach previously underserved regions with greater efficiency. Furthermore, the younger population in these areas is becoming more open to experimenting with new beverage formats, particularly those that offer functional benefits like increased energy and focus. This shift provides an excellent opportunity for brands to localize their offerings, expand their distribution networks, and introduce affordable yet value-driven products that cater to regional tastes and preferences.

Another key opportunity lies in the increasing consumer shift toward healthier and premium offerings. With growing concerns around sugar intake, fatigue, and stress management, there is a strong market for functional caffeinated beverages formulated with natural ingredients, low or no sugar, and added health benefits such as adaptogens or antioxidants. Brands that focus on clean-label formulations, sustainable sourcing, and ethical packaging can gain traction among environmentally and health-conscious consumers. Moreover, the rise of veganism and plant-based lifestyles in urban markets opens further avenues for product innovation, especially in dairy-free RTD coffees and tea-based energy beverages. The combination of innovation, personalization, and health orientation allows manufacturers to cater to a more sophisticated consumer base while building brand loyalty. By capitalizing on these evolving preferences and expanding into underserved regions, companies can secure long-term growth and establish a stronger presence in India’s rapidly evolving caffeinated beverage market.

Market Segmentation Analysis:

By Product:

The India caffeinated beverage market, segmented by product type, reflects diverse consumer preferences and usage occasions. Among these, carbonated soft beverages continue to hold a substantial share due to their mass appeal, widespread availability, and aggressive marketing by multinational brands. However, the energy beverage segment is witnessing the fastest growth, fueled by increasing demand from fitness-conscious individuals, gamers, and young professionals seeking performance-enhancing and stimulating drinks. These beverages are gaining traction in both urban and semi-urban areas due to their perceived functional benefits. Meanwhile, the ready-to-drink (RTD) tea and coffee segment is growing steadily, driven by urban lifestyles and increased coffee culture across metros and tier-I cities. Consumers value the convenience and premium image associated with RTD formats, especially cold brews and green tea variants. The ‘others’ category, which includes herbal caffeine infusions and niche botanical drinks, is gradually expanding as consumers explore healthier and more natural alternatives. Together, these segments highlight a shift toward function, convenience, and lifestyle-driven beverage consumption in India.

By Flavor:

Flavor segmentation in the India caffeinated beverage market reveals growing consumer inclination toward natural flavors, driven by increasing health consciousness and awareness of ingredient quality. Products formulated with natural extracts, such as green tea, coffee beans, yerba mate, and fruit essences, are gaining favor among urban and health-oriented consumers. This trend is particularly strong in RTD tea and coffee categories, where transparency, clean labels, and organic positioning play a crucial role in influencing purchase decisions. On the other hand, synthetic flavors continue to dominate the mass market, particularly in carbonated soft drinks and traditional energy beverages, where bold and intense flavors are associated with excitement and energy. These are more affordable and widely available, appealing to price-sensitive and younger demographics across urban and rural India. However, as consumer preferences evolve and regulatory scrutiny around artificial additives increases, many brands are investing in hybrid formulations that combine appealing synthetic tastes with natural flavor bases. This dual demand presents opportunities for innovation and targeted product development.

Segments:

Based on Product:

- Carbonated Soft Beverage

- Energy Beverage

- RTD Tea and Coffee

- Others

Based on Flavor:

Based on Sales Channel:

- Offline

- Grocery Stores

- Convenience Stores

- Speciality Stores

- Other Retail Stores

- Online

Based on the Geography:

- Northern

- Western

- Southern

- Eastern

Regional Analysis

Northern Region

The northern region of India holds the largest share of the caffeinated beverage market, accounting for approximately 31% of the total revenue. This dominance is primarily attributed to the high population density, urbanization, and the well-established retail infrastructure in states like Delhi, Punjab, Haryana, and Uttar Pradesh. Northern India exhibits a strong preference for both traditional tea and emerging caffeine formats such as RTD coffee and energy drinks. The presence of a young, aspirational consumer base with growing disposable incomes has contributed to increased consumption, particularly in tier-I and tier-II cities. Additionally, the expansion of café chains and vending machine installations in educational institutions, metro stations, and IT hubs further fuels product visibility and trial. As health awareness grows, demand for low-sugar and natural energy beverages is also on the rise, encouraging brands to diversify their offerings to match shifting regional preferences.

Western Region

The western region accounts for around 27% of the India caffeinated beverage market, driven by economic hubs like Mumbai, Pune, Ahmedabad, and Surat. The region benefits from a cosmopolitan demographic, early adoption of global food trends, and a strong café culture, making it a hotspot for RTD teas, cold brews, and premium coffee blends. Maharashtra, in particular, serves as a major consumption and distribution center due to its high-income consumer segments and advanced retail channels. Additionally, the widespread availability of energy beverages in gyms, convenience stores, and e-commerce platforms boosts sales among urban millennials and fitness enthusiasts. Western India’s thriving hospitality sector also plays a key role in sustaining demand across hotels, restaurants, and cafes. With a growing number of consumers seeking personalized, functional, and health-oriented drinks, this region remains a strategic focus for premium and emerging caffeinated beverage brands.

Southern Region

Southern India contributes approximately 23% to the overall caffeinated beverage market, with major cities like Bengaluru, Chennai, Hyderabad, and Kochi serving as key demand centers. Known for its deep-rooted coffee culture and high literacy rates, the southern region shows strong affinity for RTD coffee, filter coffee variants, and herbal caffeinated drinks. Consumers here are more health-conscious and often opt for beverages that offer natural ingredients, clean labels, and functional benefits. The IT boom and urban lifestyle trends have further propelled demand for convenience-based caffeine formats among working professionals. Moreover, southern states show high brand loyalty, especially toward indigenous or regionally tailored beverage products. With rising e-commerce penetration and increasing disposable income in tier-II cities, the southern region presents significant growth potential for both mainstream and niche caffeine-based beverages in the coming years.

Eastern Region

The eastern region holds a market share of approximately 20%, making it the smallest yet rapidly evolving segment of India’s caffeinated beverage market. States like West Bengal, Odisha, Bihar, and Assam are witnessing increased urbanization, which, coupled with rising income levels and improved retail infrastructure, is driving greater acceptance of non-traditional beverage formats. While tea remains culturally dominant in the region, younger demographics are showing a growing interest in RTD tea, energy drinks, and cold coffee. The expansion of convenience stores, quick-commerce platforms, and digital payment systems is making caffeinated beverages more accessible across urban and semi-urban pockets. Although price sensitivity remains a challenge, local and national brands are introducing smaller, more affordable SKUs to attract a broader consumer base. As awareness of health and wellness continues to spread, demand for natural and functional beverage options is expected to accelerate in the eastern region over the forecast period.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- The Coca-Cola Company

- PepsiCo

- Red Bull

- Ocean Drinks Private Limited

- Tata Consumer Products Ltd

Competitive Analysis

The India caffeinated beverage market is highly competitive, with several established global and regional players dominating the landscape. Leading players such as The Coca-Cola Company, PepsiCo, Red Bull, Ocean Drinks Private Limited, and Tata Consumer Products Ltd are actively driving market growth through diverse product offerings, robust distribution networks, and significant marketing investments. These companies are focusing on diversifying their portfolios to cater to the growing demand for energy drinks, RTD teas and coffees, and other functional beverages. They are also exploring new flavors, healthier options, and more convenient packaging formats to attract a broad spectrum of consumers, from young, active individuals to health-conscious drinkers. In addition to traditional marketing strategies, brands are increasingly investing in digital marketing, influencer partnerships, and e-commerce platforms to expand their reach. Regional players, on the other hand, are focusing on localized flavors and more affordable options to compete with global giants. Price sensitivity remains a key factor in the competition, as brands seek to balance affordability with quality. As health-consciousness rises, many companies are shifting towards natural ingredients and low-sugar formulations to appeal to the evolving preferences of Indian consumers. This competitive environment is driving constant innovation and expansion in the market.

Recent Developments

- In March 2025, PepsiCo expanded its Pepsi MAX Caffeine Free line with a new 500ml bottle in the UK, responding to rising demand for caffeine-free and sugar-free colas among younger consumers.

- In February 2025, Coca-Cola introduced Simply Pop, a prebiotic, fruit juice-enriched soda targeting the “better-for-you” market segment, competing with brands like Poppi and Olipop.

- In January 2025, Nestlé implemented a new global organizational structure for its Waters & Premium Beverages division, operating as a standalone business.

- In June 2024, the Starbucks Corporation, one of the renowned brands in caffeinated beverages industry launched new range of Caramel Vanilla Swirl Iced Coffee, handcrafted energy drinks and few other products. Starbucks Tripleshot Energy drink, recently launched offering is characterized by 65mg of caffeine content, protein, B vitamins. The products is provided in three flavor choices including dark caramel, bold mocha, and rich vanilla.

- In February 2024, Dunkin’, one of the applauded brands in food & beverages industry introduced SPARKD’ Energy by Dunkin’, iced beverages equipped with minerals, vitamins and some amount of caffeine. The flavors include berry burst entailing strawberry and raspberry, and peach sunshine featuring lychee and juicy peach flavors.

Market Concentration & Characteristics

The India caffeinated beverage market exhibits a moderate level of concentration, with several global and regional players dominating the landscape. The presence of multinational corporations, alongside a growing number of local brands, creates a dynamic competitive environment. While a few large companies hold significant market shares, regional players are capitalizing on niche segments and local preferences, particularly in tier-II and tier-III cities. The market is characterized by diverse consumer demands, with products ranging from carbonated soft drinks to RTD coffees, energy drinks, and functional beverages. Increasing health consciousness among Indian consumers is driving a shift toward low-sugar, natural, and functional beverages, leading to innovation in flavor profiles and ingredients. Price sensitivity is another key characteristic, as many consumers seek affordable yet high-quality options. With the rising influence of e-commerce and social media, brands are adapting quickly to consumer trends, further intensifying market competition and driving growth.

Report Coverage

The research report offers an in-depth analysis based on Product, Flavor, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to continue its robust growth trajectory, driven by evolving consumer preferences and increasing disposable incomes.

- Health-conscious formulations, including low-sugar, plant-based, and functional beverages, are anticipated to gain significant traction among Indian consumers.

- The ready-to-drink (RTD) coffee segment is projected to expand, fueled by urbanization, busy lifestyles, and the influence of café culture.

- Sustainability will become a central focus, with brands adopting eco-friendly packaging and ethical sourcing practices to meet consumer demand for responsible products.

- Technological advancements, such as AI-driven personalization and smart brewing equipment, are expected to enhance the consumer experience and operational efficiency.

- Regional flavors and local sourcing will play a pivotal role in product differentiation, catering to India’s diverse palate and cultural preferences.

- The expansion of e-commerce platforms will facilitate wider distribution, enabling consumers to access a broader range of caffeinated beverages conveniently.

- Premiumization trends will lead to a rise in specialty coffee offerings, with consumers willing to pay more for quality and unique experiences.

- The emergence of new entrants focusing on niche segments and innovative products will intensify competition and drive market innovation.

- Collaborations between beverage brands and lifestyle influencers are expected to enhance brand visibility and appeal to younger demographics.