CHAPTER NO. 1 : INTRODUCTION 18

1.1.1. Report Description 18

Purpose of the Report 18

USP & Key Offerings 18

1.1.2. Key Benefits for Stakeholders 18

1.1.3. Target Audience 19

1.1.4. Report Scope 19

CHAPTER NO. 2 : EXECUTIVE SUMMARY 20

2.1. India Consumer Appliance Market Snapshot 20

2.1.1. India Consumer Appliance Market, 2018 – 2032 (Units) (USD Million) 22

2.2. Insights from Primary Respondents 23

CHAPTER NO. 3 : INDIA CONSUMER APPLIANCE MARKET – INDUSTRY ANALYSIS 24

3.1. Introduction 24

3.2. Market Drivers 25

3.2.1. Increasing Consumer Spending Power and Rising Disposable Income 25

3.2.2. Rising Smart Appliances 26

3.3. Market Restraints 27

3.3.1. Rising Inflation and Rise in Production Cost 27

3.4. Market Opportunities 28

3.4.1. Market Opportunity Analysis 28

CHAPTER NO. 4 : ANALYSIS COMPETITIVE LANDSCAPE 29

4.1. Company Market Share Analysis – 2024 29

4.1.1. India Consumer Appliance Market: Company Market Share, by Volume, 2024 29

4.1.2. India Consumer Appliance Market: Company Market Share, by Revenue, 2024 30

4.1.3. India Consumer Appliance Market: Top 6 Company Market Share, by Revenue, 2024 30

4.1.4. India Consumer Appliance Market: Top 3 Company Market Share, by Revenue, 2024 31

4.2. India Consumer Appliance Market Company Volume Market Share, 2024 32

4.3. India Consumer Appliance Market Company Revenue Market Share, 2024 33

4.4. Strategic Developments 34

4.4.1. Acquisitions & Mergers 34

New Product Launch 34

Regional Expansion 34

4.5. Key Players Product Matrix 35

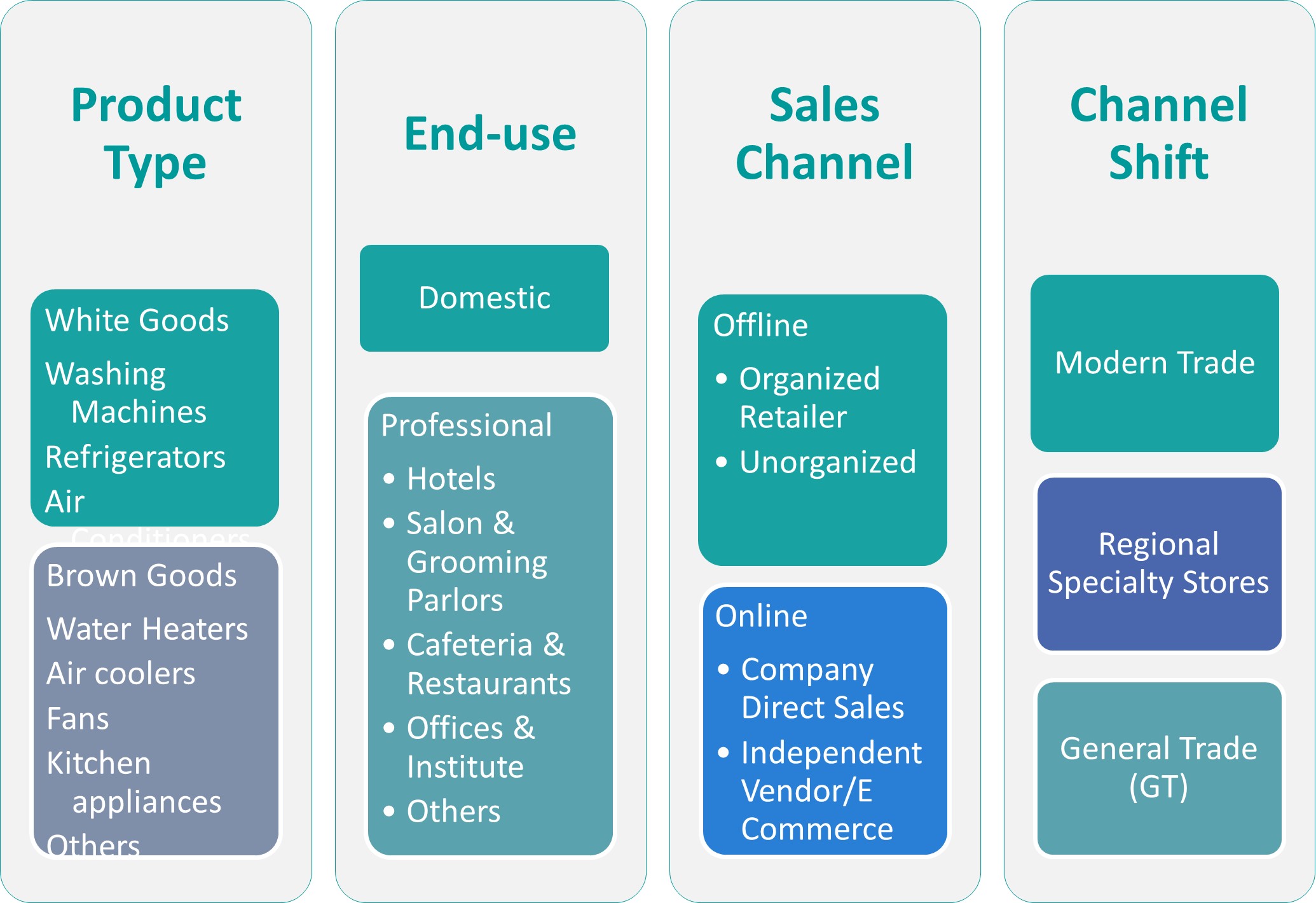

CHAPTER NO. 5 : INDIA CONSUMER APPLIANCE MARKET – BY PRODUCT TYPE SEGMENT ANALYSIS 36

5.1. India Consumer Appliance Market Overview, by Product Type Segment 36

5.1.1. India Consumer Appliance Market Volume Share, By Product Type, 2023 & 2032 37

5.1.2. India Consumer Appliance Market Revenue Share, By Product Type, 2023 & 2032 37

5.1.3. India Consumer Appliance Market Attractiveness Analysis, By Product Type 38

5.1.4. Incremental Revenue Growth Opportunity, by Product Type, 2024 – 2032 38

5.1.5. India Consumer Appliance Market Revenue, By Product Type, 2018, 2023, 2027 & 2032 39

5.2. White Goods 40

5.3. Brown Goods 41

CHAPTER NO. 6 : INDIA CONSUMER APPLIANCE MARKET – BY END-USE SEGMENT ANALYSIS 42

6.1. India Consumer Appliance Market Overview, by End-use Segment 42

6.1.1. India Consumer Appliance Market Volume Share, By End-use, 2023 & 2032 43

6.1.2. India Consumer Appliance Market Revenue Share, By End-use, 2023 & 2032 43

6.1.3. India Consumer Appliance Market Attractiveness Analysis, By End-use 44

6.1.4. Incremental Revenue Growth Opportunity, by End-use, 2024 – 2032 44

6.1.5. India Consumer Appliance Market Revenue, By End-use, 2018, 2023, 2027 & 2032 45

6.2. Domestic 46

6.3. Professional 47

6.3.1. Hotels 48

6.3.2. Salon & Grooming Parlors 49

6.3.3. Cafeteria & Restaurants 50

6.3.4. Offices & Institute 51

6.3.5. Others 52

CHAPTER NO. 7 : INDIA CONSUMER APPLIANCE MARKET – BY SALES CHANNEL SEGMENT ANALYSIS 53

7.1. India Consumer Appliance Market Overview, by Sales Channel Segment 53

7.1.1. India Consumer Appliance Market Volume Share, By Sales Channel, 2023 & 2032 54

7.1.2. India Consumer Appliance Market Revenue Share, By Sales Channel, 2023 & 2032 54

7.1.3. India Consumer Appliance Market Attractiveness Analysis, By Sales Channel 55

7.1.4. Incremental Revenue Growth Opportunity, by Sales Channel, 2024 – 2032 55

7.1.5. India Consumer Appliance Market Revenue, By Sales Channel, 2018, 2023, 2027 & 2032 56

7.2. Offline 57

7.2.1. Organized Retailer 58

7.2.2. Unorganized 59

7.3. Online 60

7.3.1. Company Direct Sales 61

7.3.2. Independent Vendor/E Commerce 62

CHAPTER NO. 8 : INDIA CONSUMER APPLIANCE MARKET – BY CHANNEL SPLIT SEGMENT ANALYSIS 63

8.1. India Consumer Appliance Market Overview, by Channel Split Segment 63

8.1.1. India Consumer Appliance Market Volume Share, By Channel Split, 2023 & 2032 64

8.1.2. India Consumer Appliance Market Revenue Share, By Channel Split, 2023 & 2032 64

8.1.3. India Consumer Appliance Market Attractiveness Analysis, By Channel Split 65

8.1.4. Incremental Revenue Growth Opportunity, by Channel Split, 2024 – 2032 65

8.1.5. India Consumer Appliance Market Revenue, By Channel Split, 2018, 2023, 2027 & 2032 66

8.2. Modern Trade 67

8.3. Regional Specialty Stores 68

8.4. General Trade (GT) 69

CHAPTER NO. 9 : CONSUMER APPLIANCE MARKET – ANALYSIS 70

9.1.1. India Consumer Appliance Market Volume, By Regional, 2018 – 2023 (Units) 70

9.1.2. India Consumer Appliance Market Revenue, By Regional, 2018 – 2023 (USD Million) 71

9.1.3. India Consumer Appliance Market Volume, By State-level, 2018 – 2023 (Units) 72

9.1.4. India Consumer Appliance Market Revenue, By State-level, 2018 – 2023 (USD Million) 73

9.1.5. India Consumer Appliance Market Volume, By City-tier, 2018 – 2023 (Units) 74

9.1.6. India Consumer Appliance Market Revenue, By City-tier, 2018 – 2023 (USD Million) 75

9.1.7. India Consumer Appliance Market Volume, By Product Type, 2018 – 2023 (Units) 76

9.1.8. India Consumer Appliance Market Revenue, By Product Type, 2018 – 2023 (USD Million) 77

9.1.8.1. India Consumer Appliance Market Volume, By White Goods, 2018 – 2023 (Units) 78

9.1.8.2. India Consumer Appliance Market Revenue, By White Goods, 2018 – 2023 (USD Million) 79

9.1.8.3. India Consumer Appliance Market Volume, By Brown Goods, 2018 – 2023 (Units) 80

9.1.8.4. India Consumer Appliance Market Revenue, By Brown Goods, 2018 – 2023 (USD Million) 81

9.1.9. India Consumer Appliance Market Volume, By End-use, 2018 – 2023 (Units) 82

9.1.10. India Consumer Appliance Market Revenue, By End-use, 2018 – 2023 (USD Million) 83

9.1.11. India Consumer Appliance Market Volume, By Sales Channel, 2018 – 2023 (Units) 84

9.1.12. India Consumer Appliance Market Revenue, By Sales Channel, 2018 – 2023 (USD Million) 85

9.1.13. India Consumer Appliance Market Volume, By Channel Split, 2018 – 2023 (Units) 86

9.1.14. India Consumer Appliance Market Revenue, By Channel Split, 2018 – 2023 (USD Million) 87

CHAPTER NO. 10 : COMPANY PROFILES 88

10.1. Samsung Electronics Co Ltd 88

10.1.1. Company Overview 88

10.1.2. Product Portfolio 88

10.1.3. Swot Analysis 88

10.1.4. Business Strategy 88

10.1.5. Financial Overview 89

10.2. LG Electronics Inc. 90

10.3. Godrej Appliances 90

10.4. Sony Corporation 90

10.5. Dell 90

10.6. Company 6 90

10.7. Company 7 90

10.8. Company 8 90

10.9. Company 9 90

10.10. Company 10 90

List of Figures

FIG NO. 1. India Consumer Appliance Market Volume & Revenue, 2018 – 2032 (Units) (USD Million) 22

FIG NO. 2. Company Share Analysis, 2024 29

FIG NO. 3. Company Share Analysis, 2024 30

FIG NO. 4. Company Share Analysis, 2024 30

FIG NO. 5. Company Share Analysis, 2024 31

FIG NO. 6. India Consumer Appliance Market – Company Volume Market Share, 2024 32

FIG NO. 7. India Consumer Appliance Market – Company Revenue Market Share, 2024 33

FIG NO. 8. India Consumer Appliance Market Volume Share, By Product Type, 2023 & 2032 37

FIG NO. 9. India Consumer Appliance Market Revenue Share, By Product Type, 2023 & 2032 37

FIG NO. 10. Market Attractiveness Analysis, By Product Type 38

FIG NO. 11. Incremental Revenue Growth Opportunity by Product Type, 2024 – 2032 38

FIG NO. 12. India Consumer Appliance Market Revenue, By Product Type, 2018, 2023, 2027 & 2032 39

FIG NO. 13. India Consumer Appliance Market for White Goods, Volume & Revenue (Units) (USD Million) 2018 – 2032 40

FIG NO. 14. India Consumer Appliance Market for Brown Goods, Volume & Revenue (Units) (USD Million) 2018 – 2032 41

FIG NO. 15. India Consumer Appliance Market Volume Share, By End-use, 2023 & 2032 43

FIG NO. 16. India Consumer Appliance Market Revenue Share, By End-use, 2023 & 2032 43

FIG NO. 17. Market Attractiveness Analysis, By End-use 44

FIG NO. 18. Incremental Revenue Growth Opportunity by End-use, 2024 – 2032 44

FIG NO. 19. India Consumer Appliance Market Revenue, By End-use, 2018, 2023, 2027 & 2032 45

FIG NO. 20. India Consumer Appliance Market for Domestic, Volume & Revenue (Units) (USD Million) 2018 – 2032 46

FIG NO. 21. India Consumer Appliance Market for Professional, Volume & Revenue (Units) (USD Million) 2018 – 2032 47

FIG NO. 22. India Consumer Appliance Market for Hotels, Volume & Revenue (Units) (USD Million) 2018 – 2032 48

FIG NO. 23. India Consumer Appliance Market for Salon & Grooming Parlors, Volume & Revenue (Units) (USD Million) 2018 – 2032 49

FIG NO. 24. India Consumer Appliance Market for Cafeteria & Restaurants, Volume & Revenue (Units) (USD Million) 2018 – 2032 50

FIG NO. 25. India Consumer Appliance Market for Offices & Institute, Volume & Revenue (Units) (USD Million) 2018 – 2032 51

FIG NO. 26. India Consumer Appliance Market for Others, Volume & Revenue (Units) (USD Million) 2018 – 2032 52

FIG NO. 27. India Consumer Appliance Market Volume Share, By Sales Channel, 2023 & 2032 54

FIG NO. 28. India Consumer Appliance Market Revenue Share, By Sales Channel, 2023 & 2032 54

FIG NO. 29. Market Attractiveness Analysis, By Sales Channel 55

FIG NO. 30. Incremental Revenue Growth Opportunity by Sales Channel, 2024 – 2032 55

FIG NO. 31. India Consumer Appliance Market Revenue, By Sales Channel, 2018, 2023, 2027 & 2032 56

FIG NO. 32. India Consumer Appliance Market for Offline, Volume & Revenue (Units) (USD Million) 2018 – 2032 57

FIG NO. 33. India Consumer Appliance Market for Organized Retailer, Volume & Revenue (Units) (USD Million) 2018 – 2032 58

FIG NO. 34. India Consumer Appliance Market for Unorganized, Volume & Revenue (Units) (USD Million) 2018 – 2032 59

FIG NO. 35. India Consumer Appliance Market for Online, Volume & Revenue (Units) (USD Million) 2018 – 2032 60

FIG NO. 36. India Consumer Appliance Market for Company Direct Sales, Volume & Revenue (Units) (USD Million) 2018 – 2032 61

FIG NO. 37. India Consumer Appliance Market for Independent Vendor/E Commerce, Volume & Revenue (Units) (USD Million) 2018 – 2032 62

FIG NO. 38. India Consumer Appliance Market Volume Share, By Channel Split, 2023 & 2032 64

FIG NO. 39. India Consumer Appliance Market Revenue Share, By Channel Split, 2023 & 2032 64

FIG NO. 40. Market Attractiveness Analysis, By Channel Split 65

FIG NO. 41. Incremental Revenue Growth Opportunity by Channel Split, 2024 – 2032 65

FIG NO. 42. India Consumer Appliance Market Revenue, By Channel Split, 2018, 2023, 2027 & 2032 66

FIG NO. 43. India Consumer Appliance Market for Modern Trade, Volume & Revenue (Units) (USD Million) 2018 – 2032 67

FIG NO. 44. India Consumer Appliance Market for Regional Specialty Stores, Volume & Revenue (Units) (USD Million) 2018 – 2032 68

FIG NO. 45. India Consumer Appliance Market for General Trade (GT), Volume & Revenue (Units) (USD Million) 2018 – 2032 69

List of Tables

TABLE NO. 1. : India Consumer Appliance Market: Snapshot 20

TABLE NO. 2. : Drivers for the India Consumer Appliance Market: Impact Analysis 25

TABLE NO. 3. : Restraints for the India Consumer Appliance Market: Impact Analysis 27

TABLE NO. 4. : India Consumer Appliance Market Volume, By Regional, 2018 – 2023 (Units) 70

TABLE NO. 5. : India Consumer Appliance Market Volume, By Regional, 2024 – 2032 (Units) 70

TABLE NO. 6. : India Consumer Appliance Market Revenue, By Regional, 2018 – 2023 (USD Million) 71

TABLE NO. 7. : India Consumer Appliance Market Revenue, By Regional, 2024 – 2032 (USD Million) 71

TABLE NO. 8. : India Consumer Appliance Market Volume, By State-level, 2018 – 2023 (Units) 72

TABLE NO. 9. : India Consumer Appliance Market Volume, By State-level, 2024 – 2032 (Units) 72

TABLE NO. 10. : India Consumer Appliance Market Revenue, By State-level, 2018 – 2023 (USD Million) 73

TABLE NO. 11. : India Consumer Appliance Market Revenue, By State-level, 2024 – 2032 (USD Million) 73

TABLE NO. 12. : India Consumer Appliance Market Volume, By City-tier, 2018 – 2023 (Units) 74

TABLE NO. 13. : India Consumer Appliance Market Volume, By City-tier, 2024 – 2032 (Units) 74

TABLE NO. 14. : India Consumer Appliance Market Revenue, By City-tier, 2018 – 2023 (USD Million) 75

TABLE NO. 15. : India Consumer Appliance Market Revenue, By City-tier, 2024 – 2032 (USD Million) 75

TABLE NO. 16. : India Consumer Appliance Market Volume, By Product Type, 2018 – 2023 (Units) 76

TABLE NO. 17. : India Consumer Appliance Market Volume, By Product Type, 2024 – 2032 (Units) 76

TABLE NO. 18. : India Consumer Appliance Market Revenue, By Product Type, 2018 – 2023 (USD Million) 77

TABLE NO. 19. : India Consumer Appliance Market Revenue, By Product Type, 2024 – 2032 (USD Million) 77

TABLE NO. 20. : India Consumer Appliance Market Volume, By White Goods, 2018 – 2023 (Units) 78

TABLE NO. 21. : India Consumer Appliance Market Volume, By White Goods, 2024 – 2032 (Units) 78

TABLE NO. 22. : India Consumer Appliance Market Revenue, By White Goods, 2018 – 2023 (USD Million) 79

TABLE NO. 23. : India Consumer Appliance Market Revenue, By White Goods, 2024 – 2032 (USD Million) 79

TABLE NO. 24. : India Consumer Appliance Market Volume, By Brown Goods, 2018 – 2023 (Units) 80

TABLE NO. 25. : India Consumer Appliance Market Volume, By Brown Goods, 2024 – 2032 (Units) 80

TABLE NO. 26. : India Consumer Appliance Market Revenue, By Brown Goods, 2018 – 2023 (USD Million) 81

TABLE NO. 27. : India Consumer Appliance Market Revenue, By Brown Goods, 2024 – 2032 (USD Million) 81

TABLE NO. 28. : India Consumer Appliance Market Volume, By End-use, 2018 – 2023 (Units) 82

TABLE NO. 29. : India Consumer Appliance Market Volume, By End-use, 2024 – 2032 (Units) 82

TABLE NO. 30. : India Consumer Appliance Market Revenue, By End-use, 2018 – 2023 (USD Million) 83

TABLE NO. 31. : India Consumer Appliance Market Revenue, By End-use, 2024 – 2032 (USD Million) 83

TABLE NO. 32. : India Consumer Appliance Market Volume, By Sales Channel, 2018 – 2023 (Units) 84

TABLE NO. 33. : India Consumer Appliance Market Volume, By Sales Channel, 2024 – 2032 (Units) 84

TABLE NO. 34. : India Consumer Appliance Market Revenue, By Sales Channel, 2018 – 2023 (USD Million) 85

TABLE NO. 35. : India Consumer Appliance Market Revenue, By Sales Channel, 2024 – 2032 (USD Million) 85

TABLE NO. 36. : India Consumer Appliance Market Volume, By Channel Split, 2018 – 2023 (Units) 86

TABLE NO. 37. : India Consumer Appliance Market Volume, By Channel Split, 2024 – 2032 (Units) 86

TABLE NO. 38. : India Consumer Appliance Market Revenue, By Channel Split, 2018 – 2023 (USD Million) 87

TABLE NO. 39. : India Consumer Appliance Market Revenue, By Channel Split, 2024 – 2032 (USD Million) 87