| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Luxury Fittings Market Size 2024 |

USD 5,265.46 million |

| India Luxury Fittings Market, CAGR |

9.50% |

| India Luxury Fittings Market Size 2032 |

USD 10,933.88 million |

Market Overview

India Luxury Fittings Market size was valued at USD 5,265.46 million in 2024 and is anticipated to reach USD 10,933.88 million by 2032, at a CAGR of 9.50% between 2025 and 2032.

The India Luxury Fittings Market is experiencing robust growth driven by rising disposable incomes, rapid urbanization, and increasing consumer aspirations for premium home aesthetics. Affluent consumers are investing in high-end kitchens, bathrooms, and living spaces, fueling demand for luxury fittings with innovative designs, smart technology integration, and superior materials. The growth of luxury real estate projects and the hospitality sector further supports market expansion, as developers and hoteliers seek to differentiate offerings with sophisticated fittings. International brands are expanding their presence, while domestic players are innovating to cater to evolving preferences. Key trends include the adoption of smart, connected fittings, a focus on sustainability through eco-friendly materials, and the popularity of customization to match individual tastes. Digitalization of sales channels and growing influence of interior designers and architects are also shaping market dynamics, positioning the India Luxury Fittings Market for sustained long-term growth.

The geographical landscape of the India Luxury Fittings Market is shaped by strong demand in major urban centers across North, West, and South India, where rapid urbanization, real estate development, and a growing base of affluent consumers drive the adoption of high-end fittings in residential, commercial, and hospitality spaces. Metro cities such as Delhi, Mumbai, Bangalore, and Chennai serve as key hubs for luxury projects, with rising investments in smart homes and premium real estate. Regional growth is further supported by expanding infrastructure and changing lifestyle aspirations in emerging cities. Leading players in this dynamic market include Jaquar Group, known for its diverse luxury bathroom solutions; Kohler India, which offers a wide portfolio of innovative and premium products; and Hindware, a trusted brand in both sanitaryware and premium fittings. These companies continue to drive product innovation and brand presence across India’s evolving luxury fittings landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The India Luxury Fittings Market was valued at USD 5,265.46 million in 2024 and is projected to reach USD 10,933.88 million by 2032, registering a CAGR of 9.50% from 2025 to 2032.

- Rising disposable incomes, rapid urbanization, and growing consumer aspirations for premium lifestyles are primary factors driving demand for luxury fittings in India.

- The market is witnessing strong trends in smart home integration, sustainable product design, and customization, with buyers seeking advanced technologies and eco-friendly materials in luxury fittings.

- Leading players such as Jaquar Group, Kohler India, and Hindware dominate the competitive landscape through extensive product portfolios, innovation, and strong brand presence.

- High initial costs of luxury fittings, limited awareness in non-metro regions, and challenges in reaching a broader customer base act as restraints for market expansion.

- North, West, and South India represent the most significant regions for luxury fittings, with metro cities serving as key demand centers, while emerging urban areas offer untapped potential for future growth.

- The market is evolving with the expansion of organized retail, online distribution channels, and increased collaboration between manufacturers, designers, and real estate developers to cater to evolving consumer preferences.

Report Scope

Market Drivers

Rising Disposable Income and Aspirational Consumer Preferences Fuel Market Expansion

Growing disposable incomes among India’s urban and upper-middle-class populations are fueling the demand for luxury fittings across residential and commercial spaces. As consumers seek to elevate their lifestyles, they are prioritizing investments in premium kitchens, bathrooms, and living environments, choosing fittings that reflect sophistication and exclusivity. The desire for personalized, high-quality products encourages spending on branded and bespoke fittings that deliver both function and aesthetic appeal. The aspirational shift toward international standards in living spaces continues to underpin demand for luxury fittings. Developers and homeowners alike prefer products that offer durability, superior design, and status value. The India Luxury Fittings Market benefits from this evolving consumer mindset, which supports a strong premiumization trend.

- For instance, luxury goods spending in India is influenced by rising aspirations and lifestyle changes, with notable growth in fashion, accessories, and home décor.

Urbanization and Growth in Luxury Real Estate Bolster Product Adoption

Rapid urbanization and expansion of luxury real estate projects in metro cities and tier-I urban centers contribute significantly to market growth. It capitalizes on the surge in new residential developments and the renovation of high-end homes and commercial establishments. Real estate developers are integrating luxury fittings to attract discerning buyers and command premium pricing for their properties. The hospitality sector, including luxury hotels and resorts, consistently demands upscale fittings to create distinctive guest experiences. Expansion of office and retail spaces in prime locations further accelerates adoption of high-end fittings. The India Luxury Fittings Market captures these opportunities by aligning product portfolios with evolving infrastructure trends.

- For instance, the luxury housing segment in India saw a 75% year-on-year increase in sales, reflecting strong demand for upscale living spaces.

Technological Advancements and Smart Home Integration Drive Innovation

Advancements in smart home technologies and automation influence the adoption of luxury fittings that integrate seamlessly with digital ecosystems. Consumers now expect intelligent solutions such as sensor-operated faucets, remote-controlled lighting, and touchless sanitaryware. Manufacturers focus on research and development to bring innovation and convenience to the premium segment. Products featuring connectivity, energy efficiency, and customizable settings resonate with tech-savvy buyers. The India Luxury Fittings Market remains at the forefront of adopting such technologies, ensuring its relevance among forward-thinking consumers.

Emphasis on Sustainability and Customization Shapes Future Demand

Environmental awareness and the demand for sustainable living are reshaping consumer preferences within the premium fittings segment. It encourages manufacturers to use eco-friendly materials, water-saving features, and processes with minimal environmental impact. The desire for unique, customized fittings that match individual style and design sensibilities is gaining traction. Designers and architects increasingly specify products that combine sustainability with luxury, creating bespoke living environments. The India Luxury Fittings Market leverages these trends by offering tailored solutions and promoting products that align with environmental and lifestyle priorities.

Market Trends

Integration of Smart Technologies and Digital Connectivity Enhances Consumer Experience

The India Luxury Fittings Market is witnessing strong momentum toward the integration of smart technologies and digital connectivity within premium home environments. Consumers seek fittings that offer seamless control, convenience, and enhanced user experience through features like sensor-based faucets, touchless controls, and app-enabled shower systems. It incorporates advanced automation and IoT capabilities, enabling homeowners to customize lighting, water flow, and climate settings according to their preferences. Manufacturers are collaborating with technology companies to create intelligent, user-friendly solutions that cater to tech-savvy buyers. The trend towards voice-activated and remotely controlled fittings continues to gain ground, reflecting a growing preference for digital lifestyles. Demand for products with energy and water-saving features is rising, reinforcing the role of technology in shaping market preferences.

- For instance, government initiatives such as the Smart Cities Mission are driving the adoption of intelligent home solutions, including sensor-based faucets and touchless controls.

Growth of Organized Retail and Online Distribution Channels Expands Market Reach

The expansion of organized retail and the rise of online distribution platforms are transforming the accessibility and visibility of premium fittings in India. The India Luxury Fittings Market leverages omni-channel strategies to engage consumers through exclusive showrooms, design studios, and robust e-commerce platforms. It enables buyers to compare, customize, and purchase fittings from anywhere, enhancing convenience and transparency. Retailers invest in immersive experiences, virtual consultations, and interactive displays to showcase product capabilities and foster brand loyalty. Digital marketing and influencer collaborations are further shaping consumer awareness and purchase decisions. These trends collectively support wider adoption and continued growth across diverse customer segments.

- For instance, the rise of e-commerce platforms and omni-channel retail strategies is making luxury fittings more accessible to a broader consumer base.

Customization and Personalization Define the Next Phase of Product Design

The growing desire for unique and personalized living spaces is shaping the evolution of product offerings in the India Luxury Fittings Market. It reflects a shift away from standardization, with consumers seeking fittings tailored to their specific tastes and interior themes. Custom finishes, exclusive materials, and bespoke designs allow homeowners and designers to express individual style and enhance property value. Manufacturers respond by expanding customization options, offering modular systems and a wide variety of colors, textures, and patterns. The rise of limited-edition collections and collaborations with renowned designers underscores this trend. Emphasis on craftsmanship and attention to detail remains a significant driver of consumer choice.

Sustainable Materials and Green Design Gain Strategic Importance

The increasing focus on environmental responsibility is driving the adoption of sustainable materials and green design practices within the luxury fittings segment. The India Luxury Fittings Market is adapting to heightened consumer awareness of eco-friendly products and manufacturing processes. It encourages the use of recycled metals, certified woods, and low-impact production techniques to minimize environmental footprints. Water-efficient and energy-saving fittings are becoming standard requirements, especially in premium real estate and hospitality projects. Manufacturers highlight sustainability credentials and certifications as differentiators in marketing. This trend positions the market to meet regulatory requirements and align with the values of environmentally conscious buyers.

Market Challenges Analysis

Supply Chain Complexities and Skilled Labor Shortages Impact Market Efficiency

Supply chain inefficiencies and the shortage of skilled labor also present ongoing challenges for the India Luxury Fittings Market. It relies on the timely availability of high-quality materials, imported components, and specialized installation services, which can be disrupted by logistical bottlenecks or regulatory delays. The lack of trained professionals for installing and maintaining advanced fittings affects customer satisfaction and brand reputation. Inconsistent quality control and regional disparities in service standards create hurdles for market leaders aiming to deliver a premium experience nationwide. Overcoming these issues requires investment in local manufacturing, improved distribution networks, and targeted training programs for installers and service technicians.

- For instance, India’s talent shortage paradox highlights the mismatch between available skilled labor and industry demand, affecting operational efficiency.

High Cost of Luxury Fittings and Limited Consumer Awareness Restrain Widespread Adoption

The India Luxury Fittings Market faces significant challenges due to the high cost of premium products and limited consumer awareness in non-metro regions. It often restricts its reach to affluent urban consumers, leaving a large segment of the population untapped. Many homeowners and commercial buyers perceive luxury fittings as discretionary rather than essential, making price sensitivity a persistent barrier. Limited exposure to international brands and a lack of knowledge about the long-term benefits of advanced fittings further impede market penetration. The absence of effective marketing and demonstration in smaller cities reduces demand and slows adoption rates. Companies must address these gaps to expand the market beyond metropolitan areas.

Market Opportunities

Expansion into Tier II and Tier III Cities Unlocks New Growth Potential

The India Luxury Fittings Market holds significant opportunities by targeting emerging urban centers and affluent populations in tier II and tier III cities. It can leverage increasing disposable incomes and a growing appetite for premium home solutions in these regions. Real estate development in smaller cities is rising, driving demand for high-quality fittings in both residential and commercial projects. Companies that invest in localized marketing strategies and build strong distribution networks can capture market share beyond metropolitan areas. Educational initiatives and showroom experiences help raise consumer awareness and position luxury fittings as accessible aspirational products. The shift in consumer behavior toward branded, value-added solutions supports broader adoption across diverse geographies.

Product Innovation and Sustainability Enhance Competitive Advantage

Manufacturers can capitalize on opportunities by focusing on product innovation and sustainable design in the India Luxury Fittings Market. It responds to evolving consumer preferences for technologically advanced, eco-friendly, and customizable fittings. Smart home integration, energy efficiency, and water-saving features differentiate products in a crowded marketplace. Brands that offer bespoke solutions and collaborate with architects or designers strengthen customer loyalty and project value. The adoption of green materials and transparent sourcing appeals to environmentally conscious buyers and helps meet emerging regulatory standards. By prioritizing innovation and sustainability, companies can establish leadership positions and drive long-term growth.

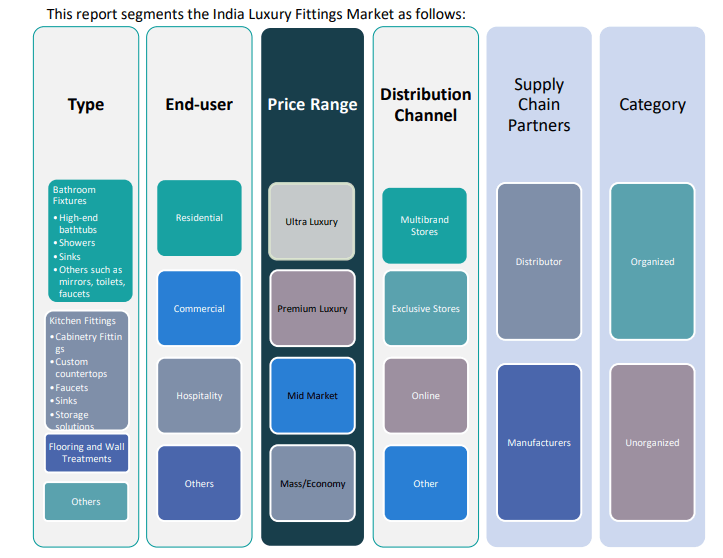

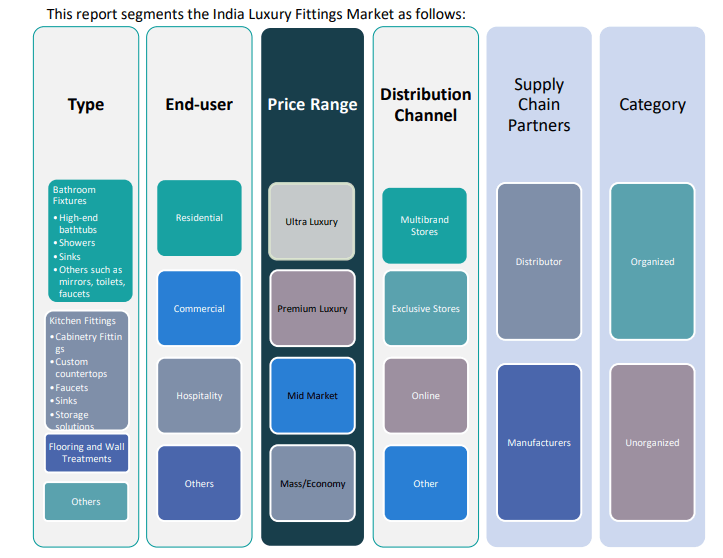

Market Segmentation Analysis:

By Product Type:

Bathroom fixtures constitute a significant share, driven by growing demand for high-end bathtubs, advanced faucets, premium basins, and toilets. Consumers prioritize aesthetics, comfort, and innovative technology in these areas, seeking fittings that elevate both form and function. The segment for kitchen fittings captures a strong market position, supported by rising investments in cabinetry fittings, custom countertops, luxury faucets, premium sinks, modular kitchens, and tailored storage solutions. Demand for well-designed, functional kitchens is expanding, especially among urban and affluent buyers who view the kitchen as a key area for luxury upgrades. Flooring and wall treatments represent another key segment, with wooden flooring leading preferences due to its visual appeal and association with premium interiors. The market includes various other flooring and wall options, allowing flexibility for consumers to personalize living and working spaces. The “others” category under product type encompasses niche and emerging fittings that cater to evolving trends and specialized requirements, supporting a diversified portfolio.

By End-User:

Residential buyers dominate the India Luxury Fittings Market, with homeowners seeking to enhance the comfort and value of their living spaces. The commercial segment, including offices, high-end retail, and luxury malls, demonstrates strong growth as organizations aim to create sophisticated environments for employees and clients. Hospitality remains an important end-user segment, with hotels and resorts investing in luxury fittings to deliver exclusive guest experiences. Other end-users, such as institutional buyers and specialty projects, present niche opportunities for market expansion.

By Price Range:

The ultra-luxury and premium luxury segments command a major share, appealing to customers who value exclusivity, advanced technology, and superior craftsmanship. Mid-market luxury attracts aspirational buyers seeking quality upgrades without the highest price tag. Mass market luxury, while a smaller share, introduces branded fittings at accessible price points, widening the customer base. The diverse segmentation of the India Luxury Fittings Market enables stakeholders to align offerings with consumer expectations, maximize growth potential, and address varied lifestyle needs across the country.

Segments:

Based on Product Type:

- Bathroom Fixtures

- High-End Bathtubs

- Faucets

- Basins and Toilets

- Others

- Kitchen Fittings

- Cabinetry Fittings

- Custom Countertops

- Faucets

- Sinks

- Modular Kitchen

- Storage Solutions and Others

- Flooring and Wall Treatments

- Others

Based on End-User:

- Residential

- Commercial

- Hospitality

- Others

Based on Price Range:

- Ultra Luxury

- Premium Luxury

- Mid-Market

- Mass Market

Based on Category:

Based on Distribution Channel:

- Multibrand Stores

- Exclusive Stores

- Online

- Others

Based on Supply Chain Partner:

- Distributor

- Manufacturers

Based on the Geography:

- North India

- West India

- South India

- East and Northeast India

Regional Analysis

North India

North India accounts for the largest share of the India Luxury Fittings Market, commanding approximately 32% of total revenue in 2024. It benefits from the concentration of affluent urban centers such as Delhi NCR, Chandigarh, Jaipur, and Lucknow, where demand for high-end residential, commercial, and hospitality projects remains robust. Rapid urbanization, a high density of luxury real estate developments, and a growing base of premium homeowners drive demand for sophisticated fittings across bathrooms, kitchens, and flooring segments. Prominent hotel chains, upscale retail outlets, and luxury apartments in North India emphasize quality, design, and branded fittings, supporting the region’s leadership position. The presence of leading developers and international brands strengthens market accessibility and consumer confidence. North India’s role as a hub for government, business, and tourism activity continues to spur investments in luxury infrastructure, reinforcing its dominant market share.

West India

West India holds the second-largest share in the India Luxury Fittings Market, contributing around 29% of total revenue in 2024. The region’s economic prosperity, led by Mumbai, Pune, Ahmedabad, and Goa, underpins a vibrant luxury fittings market. Mumbai’s high-rise apartments, luxury villas, and world-class hospitality industry create sustained demand for premium fittings. The expansion of real estate in Pune and the hospitality boom in Goa further bolster regional growth. It stands out for its embrace of global design trends and willingness to invest in technology-driven, eco-friendly fittings. The increasing presence of multinational companies and HNIs (High Net-worth Individuals) elevates expectations for quality and exclusivity in both residential and commercial projects. West India’s diverse demographic, with a mix of traditional and cosmopolitan consumers, supports innovation and broadens market penetration.

South India

South India captures approximately 24% share of the India Luxury Fittings Market, reflecting the growing affluence in cities such as Bangalore, Chennai, Hyderabad, and Kochi. The IT and startup ecosystem, especially in Bangalore and Hyderabad, has given rise to a large segment of upwardly mobile professionals who invest in premium home and office spaces. Developers in South India focus on integrated townships and luxury apartment complexes, which incorporate advanced fittings to differentiate offerings. The region’s emphasis on sustainable and smart living aligns with consumer preferences for eco-friendly materials and digital integration in fittings. Growth in the hospitality sector, particularly in Bangalore and Chennai, also supports rising demand for luxury fittings in hotels and serviced apartments. South India’s cultural appreciation for aesthetics and design innovation fuels adoption and supports ongoing market expansion.

East and Northeast India

East and Northeast India represent a smaller but rapidly growing segment, contributing around 10% of the India Luxury Fittings Market revenue in 2024. Kolkata, Bhubaneswar, Guwahati, and emerging urban centers lead regional demand, supported by rising investments in infrastructure and real estate development. Improvements in connectivity, business environment, and disposable incomes are enabling greater adoption of premium fittings across residential and commercial segments. Hospitality and retail projects in metropolitan and tourist locations further increase uptake. The region remains in the early stages of market penetration, but growing exposure to luxury lifestyles, expanding distribution networks, and targeted marketing initiatives are expected to accelerate adoption rates. East and Northeast India offer untapped potential, especially as awareness and accessibility of luxury fittings improve.

Key Player Analysis

- FCML

- Kohler India

- Jaquar Group

- Hafele India

- Roca India

- Hindware

- Cera Sanitaryware Ltd.

- TOTO India

- Antica Ceramica

- Tisva (Premium luxury)

- Klove Studio

- Duravit

- Hansgrohe SE

Competitive Analysis

The India Luxury Fittings Market is highly competitive, featuring a mix of established domestic brands and global leaders. Key players such as Jaquar Group, Kohler India, Hindware, Cera Sanitaryware Ltd., FCML, Roca India, and Hafele India set the benchmark for product quality, design innovation, and brand recognition. These companies invest heavily in research and development to introduce advanced technologies, smart fittings, and sustainable solutions that cater to evolving consumer preferences. Their diverse product portfolios span bathroom fixtures, kitchen fittings, and flooring, allowing them to serve multiple segments within the luxury market. Strong distribution networks, strategic collaborations with architects and developers, and a robust retail presence, both offline and online, reinforce the dominance of these leading brands. It remains crucial for these companies to maintain consistent quality, exceptional after-sales service, and brand loyalty through continuous engagement with customers. Competitive pricing strategies, the launch of limited-edition collections, and the ability to offer customized solutions further differentiate these players. The intense focus on innovation and customer experience enables market leaders to sustain growth and defend market share in an increasingly discerning and aspirational market environment.

Recent Developments

- In February 2025, TOTO has introduced a new range of matte-finish washbasins, tailored to meet the demand for personalized and versatile bathroom designs. Featuring a sleek above-counter style, the collection adds a modern, elegant touch to any space. Crafted with TOTO’s advanced LINEARCERAM technology, these ultra-thin washbasins offer exceptional strength and durability, seamlessly combining aesthetics with lasting performance.

- In November 2024, Hafele has introduced its luxury appliances from ASKO and Falmec, combining advanced technology, elegance, and meticulous craftsmanship. These Premium luxury appliances are designed to enhance the kitchen experience, offering innovative solutions for contemporary living. ASKO’s luxury range is renowned for its attention to detail, enhancing the overall user experience. The Style series by ASKO includes a variety of laundry care products, such as washing machines, tumble dryers, and drying cabinets, all featuring cutting-edge technologies, sophisticated design, and exceptional performance.

- In October 2024, Kohler, a global leader in bath and kitchen solutions, has introduced its first-ever Studio Kohler in India, marking a significant milestone in luxury and innovation. Located in the vibrant Banjara Hills area of Hyderabad, this highly anticipated space aims to revolutionize bathroom design and fittings, blending art with cutting-edge technology. The Studio Kohler offers an immersive experience for architects, designers, and discerning customers, providing a platform to explore exceptional products, foster creative dialogue, and bring their design ideas to life.

- In February 2024, Spain-based sanitaryware Roca invested ₹400 crore to expand its manufacturing capacity in Tamil Nadu, aiming to boost its export operations from India. Of its nine production facilities across the country, four are situated in Tamil Nadu—at Ranipet, Perundurai, Sriperumbudur, and Irungattukottai. In India, Roca Bathroom Products operates under multiple brand names, including Laufen, Roca, Parryware, and Johnson Pedder.

- In February 2024, Kohler’s latest innovation, the Numi 2.0 smart toilet, is being showcased at the prestigious India Design 2024 exhibition. Salil Sadanandan, a key spokesperson for the brand, highlights the advanced technology behind this aesthetically designed, high-tech smart toilet. Combining cuttingedge features with luxurious design, the Numi 2.0 offers a seamless blend of innovation, comfort, and sustainability, representing Kohler’s commitment to transforming the bathroom experience. The smart toilet, designed with modern sensibilities in mind, promises to set new standards in luxury and functionality in the bathroom space.

Market Concentration & Characteristics

The India Luxury Fittings Market demonstrates moderate to high market concentration, with a handful of established domestic and international brands dominating overall value and volume. It features strong brand-driven competition, where recognized names set standards in design, innovation, and product quality. The market is characterized by a preference for premium materials, advanced technologies, and personalized solutions, appealing to affluent and aspirational consumers. Organized retail, exclusive showrooms, and online channels play vital roles in reaching target segments and enhancing brand visibility. Product differentiation through smart features, sustainable materials, and customization is a defining trait, while consumer demand centers around metro cities and emerging urban hubs. The India Luxury Fittings Market thrives on evolving lifestyle trends, real estate development, and collaborations between manufacturers, architects, and developers to deliver bespoke and high-value solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User, Price Range, Category, Distribution Channel, Supply Chain Partner and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The India Luxury Fittings Market is projected to grow steadily, driven by increasing disposable incomes and a growing preference for premium home aesthetics.

- Rising urbanization and real estate development in metro and tier-II cities are expanding the customer base for luxury fittings.

- Consumers are increasingly seeking smart, connected fittings that offer convenience, energy efficiency, and modern design.

- Sustainability is becoming a key focus, with demand growing for eco-friendly materials and water-saving technologies.

- Leading companies are investing in innovation and expanding their product portfolios to cater to diverse consumer preferences.

- The expansion of organized retail and online distribution channels is enhancing market accessibility and consumer engagement.

- Collaborations between manufacturers, architects, and interior designers are fostering the development of customized luxury solutions.

- Challenges such as high product costs and limited awareness in non-metro regions may impact market penetration.

- North, West, and South India are expected to remain dominant regions, with emerging opportunities in East and Northeast India.

- The market’s future outlook is positive, with sustained growth anticipated across residential, commercial, and hospitality sectors.