Market Overview:

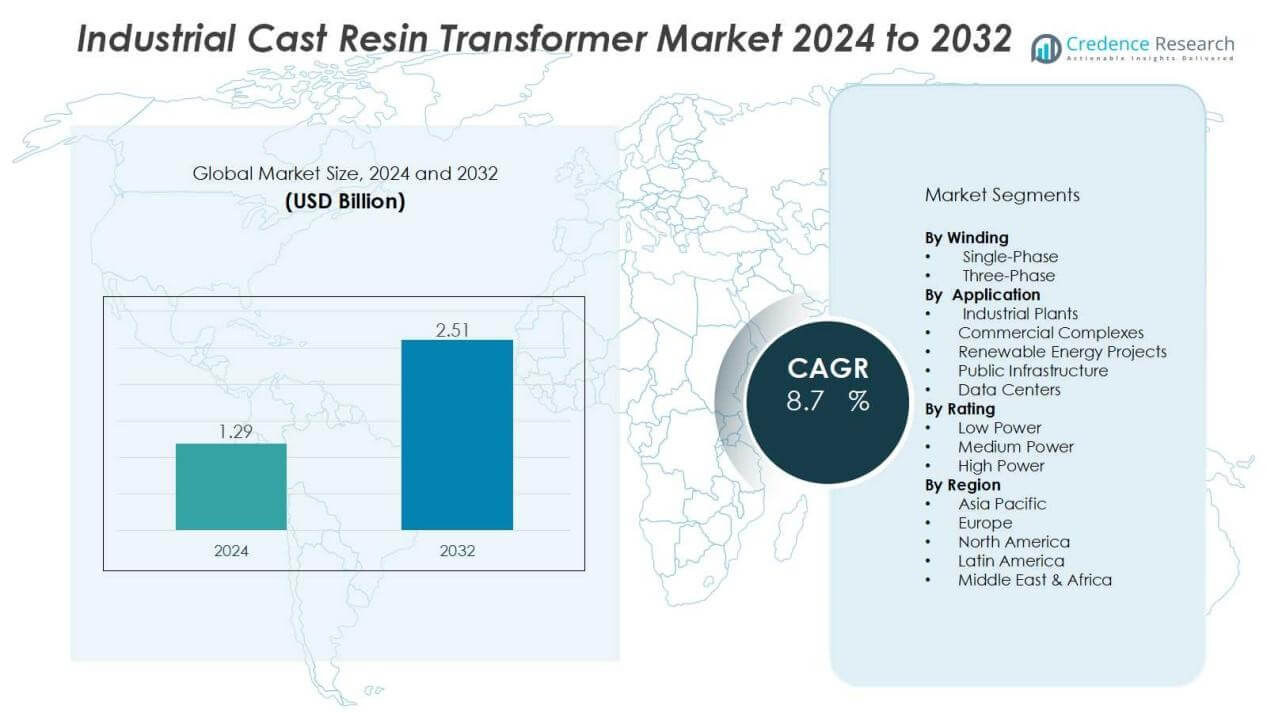

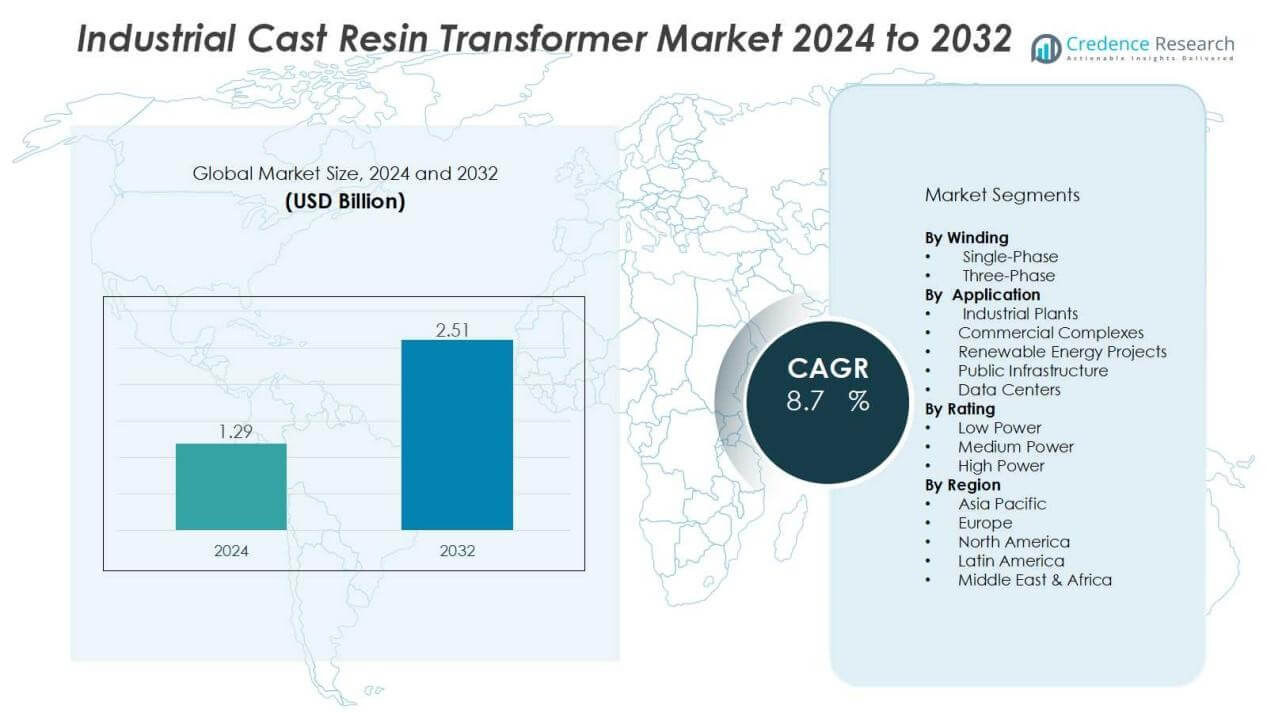

The industrial cast resin transformer market size was valued at USD 1.29 billion in 2024 and is anticipated to reach USD 2.51 billion by 2032, at a CAGR of 8.7 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Cast Resin Transformer Market Size 2024 |

USD 1.29 Billion |

| Industrial Cast Resin Transformer Market, CAGR |

8.7% |

| Industrial Cast Resin Transformer Market Size 2032 |

USD 2.51 Billion |

Key drivers shaping market growth include rapid industrialization, expansion of renewable energy infrastructure, and stringent safety regulations. Cast resin transformers are highly valued for their ability to perform in harsh environments with minimal maintenance. Their integration into smart grids and industrial automation further enhances their market relevance. The rising emphasis on energy efficiency and sustainability also strengthens demand across multiple sectors.

Regionally, Europe leads the market, supported by strong renewable energy targets, advanced grid modernization, and strict safety standards. Asia-Pacific is emerging as the fastest-growing region, fueled by expanding industrial bases in China, India, and Southeast Asia, along with large-scale renewable energy projects. North America maintains a significant share, driven by modernization of aging grid infrastructure and increasing renewable integration, while Latin America and the Middle East & Africa show promising opportunities through expanding industrialization and power distribution investments.

Market Insights:

- The industrial cast resin transformer market was valued at USD 1.29 billion in 2024 and is projected to reach USD 2.51 billion by 2032, growing at a CAGR of 8.7% during 2024–2032.

- Rising demand for energy efficiency and grid modernization continues to drive adoption, as cast resin transformers reduce operational losses compared to oil-filled units.

- Expanding renewable energy infrastructure, including solar and wind projects, increases demand for safe, low-maintenance, and flame-retardant transformer solutions.

- Strict safety and environmental regulations support growth, with dry-type designs eliminating risks of fire hazards and oil leakage.

- Rapid industrialization and infrastructure investments in manufacturing plants, data centers, and commercial facilities further strengthen market momentum.

- Challenges such as high initial costs and limited awareness in emerging markets slow adoption despite long-term efficiency benefits.

- Regionally, Europe held 38% market share in 2024, Asia-Pacific captured 32% as the fastest-growing region, and North America accounted for 21%, reflecting strong modernization and renewable integration efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Energy Efficiency and Grid Modernization:

The industrial cast resin transformer market is strongly supported by the global push toward energy-efficient systems. Governments and industries are focusing on reducing energy losses across transmission and distribution networks. Cast resin transformers offer superior efficiency and lower operational losses compared to traditional oil-filled units. It makes them a preferred choice in modern power infrastructure projects where sustainability and cost optimization are critical.

- For instance, Siemens Energy’s GEAFOL cast resin transformers have been installed over 150,000 times worldwide, featuring a top model rated at 45 MVA that operates reliably with tested voltage endurance up to twice the rated voltage, ensuring high operational efficiency and safety.

Growing Adoption in Renewable Energy Projects:

The expansion of renewable energy infrastructure significantly drives the industrial cast resin transformer market. Solar and wind power plants require reliable and safe transformers that can withstand harsh environmental conditions. Cast resin units meet these demands with their flame-retardant properties and low maintenance requirements. Their use in renewable installations ensures higher safety standards while supporting uninterrupted energy distribution.

- For Instance, Schneider Electric’s Trihal cast resin transformers offer enhanced safety with a fire-resistant design, used in industrial and commercial settings, and feature a short-circuit strength rated up to 30 kA for 1 second, ensuring durability in demanding environments.

Stringent Safety and Environmental Regulations:

Strict safety standards and environmental policies continue to fuel demand in the industrial cast resin transformer market. Traditional oil-filled transformers present higher risks of fire hazards and potential oil leakage. Cast resin transformers, being dry-type, eliminate these risks while ensuring compliance with fire safety and environmental regulations. It helps industries reduce liability and align with evolving global sustainability targets.

Expanding Industrialization and Infrastructure Investments:

Rapid industrial growth and infrastructure development across emerging economies further accelerate the industrial cast resin transformer market. Manufacturing plants, data centers, and commercial complexes require stable and efficient power distribution systems. Cast resin transformers deliver durability and adaptability in environments where continuous power is essential. It positions them as a reliable solution for industries investing in large-scale modernization and expansion.

Market Trends:

Market Trends:

Integration of Smart Technologies and Digital Monitoring:

The industrial cast resin transformer market is experiencing a clear shift toward smart technologies and digital monitoring solutions. Manufacturers are embedding sensors and IoT-based systems that enable real-time performance tracking and predictive maintenance. These upgrades help utilities and industries reduce downtime and extend equipment lifespan. It allows operators to optimize energy usage, prevent faults, and improve overall grid stability. The trend aligns with global investments in smart grids and automation where reliable and connected equipment is essential. Growing demand for digital solutions reflects the need for efficiency, transparency, and advanced asset management across industries.

- For instance, HTT developed a digital twin application for cast resin transformers, demonstrated on a 2000 kVA, 10500/720 V unit, enabling real-time thermal behavior forecasting and hotspot temperature monitoring to optimize load management and maintenance.

Rising Preference for Sustainable and Compact Transformer Designs:

Sustainability and compact design are emerging as defining trends in the industrial cast resin transformer market. Industries are seeking eco-friendly solutions that reduce carbon emissions and minimize land use without compromising efficiency. Cast resin transformers are gaining traction due to their dry-type design, flame-retardant properties, and recyclable materials. It makes them a suitable choice for green building projects, renewable installations, and urban infrastructure. Compact units also enable flexible installation in space-constrained environments such as data centers and commercial complexes. The trend highlights growing emphasis on sustainability, safety, and adaptability in modern power distribution systems.

- For instance, Hitachi Energy’s RESIBLOC cast resin transformers have over 70,000 units installed globally, featuring a cast resin insulation system with high glass fiber content that provides superior mechanical strength and flame retardance, making them highly sustainable and compact for advanced applications.

Market Challenges Analysis:

High Initial Costs and Limited Awareness in Emerging Markets:

The industrial cast resin transformer market faces challenges from high upfront costs compared to oil-filled alternatives. Many small and medium-scale industries, particularly in developing regions, prefer cheaper conventional solutions despite long-term benefits. Limited awareness about energy efficiency and safety advantages further restricts adoption. It creates barriers for manufacturers who must invest in education and promotional initiatives to build market confidence. Higher installation costs also discourage rapid adoption in price-sensitive markets where capital expenditure remains constrained.

Technical Limitations and Harsh Operating Conditions :

The industrial cast resin transformer market also encounters difficulties related to technical constraints. While dry-type units offer strong safety features, they can have limited overload capacity compared to oil-filled models. In regions with extreme heat or heavy industrial demand, performance issues may arise without advanced cooling solutions. It places pressure on manufacturers to improve designs and develop transformers capable of withstanding diverse environments. Maintenance-free claims are also tested in demanding applications, creating concerns about long-term reliability. These limitations slow down adoption in sectors requiring heavy-duty, high-capacity performance.

Market Opportunities:

Expansion of Renewable Energy and Green Infrastructure Projects:

The industrial cast resin transformer market holds strong opportunities through the global expansion of renewable energy. Solar and wind projects increasingly demand reliable, safe, and low-maintenance transformers suited for outdoor and harsh conditions. Cast resin units meet these needs while aligning with sustainability goals and carbon reduction targets. It enables developers to deploy efficient solutions that comply with international safety and environmental standards. The growing push for smart cities and green buildings also creates demand for compact and eco-friendly transformers. This synergy strengthens opportunities for adoption across multiple sectors focused on clean energy and sustainable infrastructure.

Rising Demand from Industrial and Urban Infrastructure Growth:

Urbanization and industrial expansion present significant opportunities for the industrial cast resin transformer market. Data centers, commercial complexes, and manufacturing facilities require stable and efficient power distribution systems. Cast resin transformers offer durability, safety, and adaptability in these high-demand environments. It makes them well-suited for installations where continuous, reliable power is critical. Emerging economies are investing heavily in industrial hubs and modern power networks, boosting adoption potential. These factors provide manufacturers with strong growth avenues to expand market penetration and develop advanced product offerings.

Market Segmentation Analysis:

By Winding

The industrial cast resin transformer market includes segments by winding such as single-phase and three-phase units. Three-phase transformers dominate usage in industrial and utility sectors due to their higher efficiency and ability to handle large power loads. Single-phase units serve niche applications in smaller facilities and localized power distribution. It reflects the broader industry trend of aligning equipment with specific power demands and operational environments.

- For instance, SGB-SMIT Group produces three-phase cast resin transformers with capacities up to 25 MVA and applied voltages up to 40.5 kV, featuring a mean time between failures (MTBF) of over 2,400 years, demonstrating remarkable reliability in heavy industrial use.

By Rating

The market is segmented by rating into low, medium, and high power categories. Medium-rated transformers hold significant demand, particularly in manufacturing facilities, commercial complexes, and renewable projects. Low-rated units are widely used in residential or small-scale commercial applications where power requirements remain modest. High-rated transformers serve heavy-duty industries and large infrastructure projects where continuous high-load operation is essential. It shows a clear segmentation pattern based on operational scale and performance needs.

- For instance, ABB offers low-voltage dry-type transformers rated at 112.5 KVA specifically designed for general residential and small commercial applications, known for their long service life exceeding 20 years and compliance with DOE 2016 efficiency standards.

By Application

The industrial cast resin transformer market spans diverse applications including industrial plants, commercial spaces, renewable energy projects, and public infrastructure. Industrial facilities drive strong demand due to the need for reliable, safe, and low-maintenance distribution systems. Commercial complexes and data centers increasingly adopt cast resin transformers for their compact size and fire safety benefits. Renewable energy applications are expanding rapidly, requiring transformers that can withstand outdoor conditions and fluctuating loads. It highlights how sector-specific priorities shape adoption trends across global markets.

Segmentations:

By Winding:

By Rating:

- Low Power

- Medium Power

- High Power

By Application:

- Industrial Plants

- Commercial Complexes

- Renewable Energy Projects

- Public Infrastructure

- Data Centers

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Europe:

Europe accounted for 38% market share in the industrial cast resin transformer market in 2024. It maintains this lead due to stringent safety regulations, renewable energy integration, and advanced grid modernization initiatives. European Union climate targets encourage widespread use of eco-friendly and flame-retardant transformers. The presence of established manufacturers also supports innovation and availability across utilities and industrial sectors. Governments emphasize energy efficiency and carbon neutrality, further accelerating adoption. Industrial facilities, transport hubs, and renewable projects across Germany, France, and the U.K. continue to anchor regional dominance.

Asia-Pacific:

Asia-Pacific captured 32% market share in the industrial cast resin transformer market in 2024. It is the fastest-growing regional market, supported by large-scale industrialization in China, India, and Southeast Asia. Expanding renewable energy projects, urbanization, and rising electricity demand drive significant adoption. Infrastructure investments in smart cities and manufacturing hubs also increase reliance on safe, efficient transformers. Governments in the region encourage clean energy deployment, supporting market expansion. Cast resin units provide durability in high-temperature and humid environments, making them suitable for varied industrial applications.

North America:

North America held 21% market share in the industrial cast resin transformer market in 2024. It benefits from modernization of aging grid infrastructure and growth in renewable energy integration. Strong focus on safety and operational efficiency supports adoption across utilities and industrial users. Data centers, healthcare facilities, and commercial complexes are also driving demand. Federal and state-level initiatives encouraging energy efficiency strengthen the regional market outlook. Cast resin transformers meet performance needs in diverse applications, from renewable projects to critical infrastructure. It ensures steady growth across the U.S. and Canada.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The industrial cast resin transformer market features strong competition with established global and regional manufacturers. Key players include ABB, CG Power, Bharat Heavy Electricals, Eaton, GE, Hitachi Energy, Fuji Electric, Raychem RPG, and SGB SMIT. These companies compete on technology, efficiency, and reliability, while expanding portfolios to meet diverse industrial and commercial requirements. It focuses on innovations such as IoT-enabled monitoring, compact designs, and enhanced safety features to strengthen adoption across sectors. Strategic partnerships, regional expansions, and product launches support their market presence. Local manufacturers in emerging economies also add competition by offering cost-effective solutions. Continuous investment in sustainable and energy-efficient designs ensures leading companies maintain an edge in long-term growth.

Recent Developments:

- In May 2025, ABB announced the acquisition of BrightLoop, a power electronics firm based in France, expanding its off-highway vehicle and marine electrification business.

- In March 2025, CG Power received approval for a $36 million deal to acquire Renesas Electronics’ RF components business.

Report Coverage:

The research report offers an in-depth analysis based on Winding, Rating, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The industrial cast resin transformer market will witness steady adoption across renewable energy projects, driven by the need for efficient and safe power systems.

- It will benefit from stricter global safety and environmental regulations that favor dry-type and eco-friendly solutions.

- Growing investments in smart grid infrastructure will create strong opportunities for digital and IoT-enabled transformer integration.

- Urbanization and rising electricity demand in emerging economies will continue to expand deployment in industrial hubs and smart cities.

- The market will see increasing traction in data centers and commercial facilities requiring stable and maintenance-free power distribution.

- Technological advancements in cooling systems and materials will address performance limitations in harsh operating environments.

- Sustainability goals and green building certifications will enhance demand for recyclable and compact cast resin transformers.

- Global manufacturers will expand product portfolios with higher capacity models tailored for heavy-duty industrial applications.

- Collaborations between governments and private players will accelerate adoption through renewable-focused infrastructure investments.

- It will continue to grow as industries prioritize safe, efficient, and adaptable power systems across diverse applications.

Market Trends:

Market Trends: