Market Overview

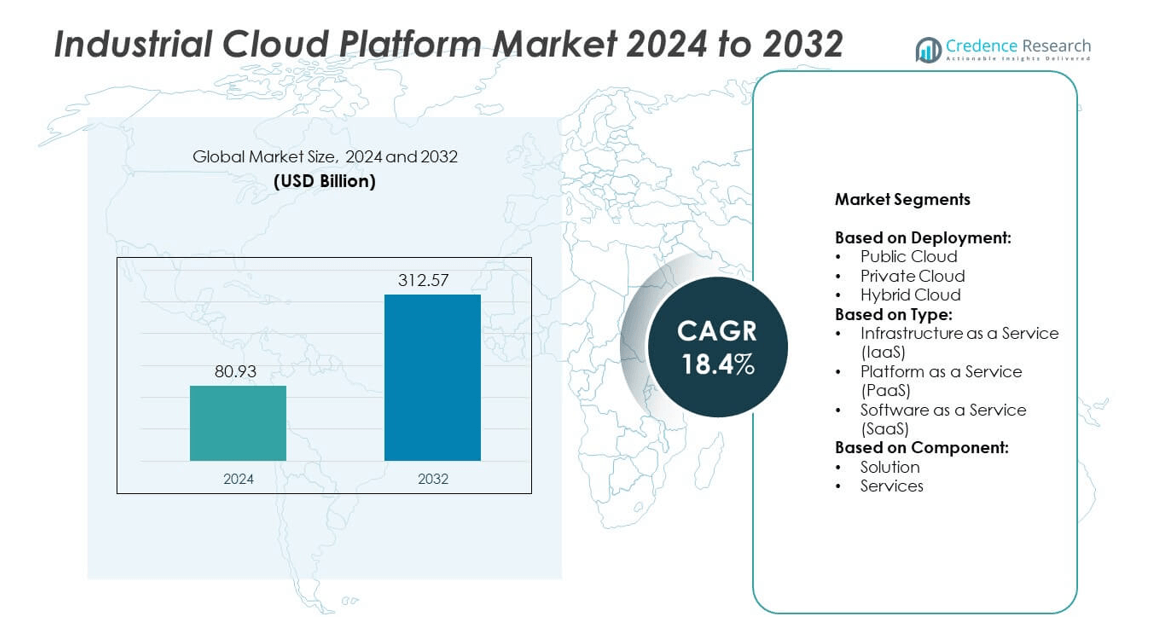

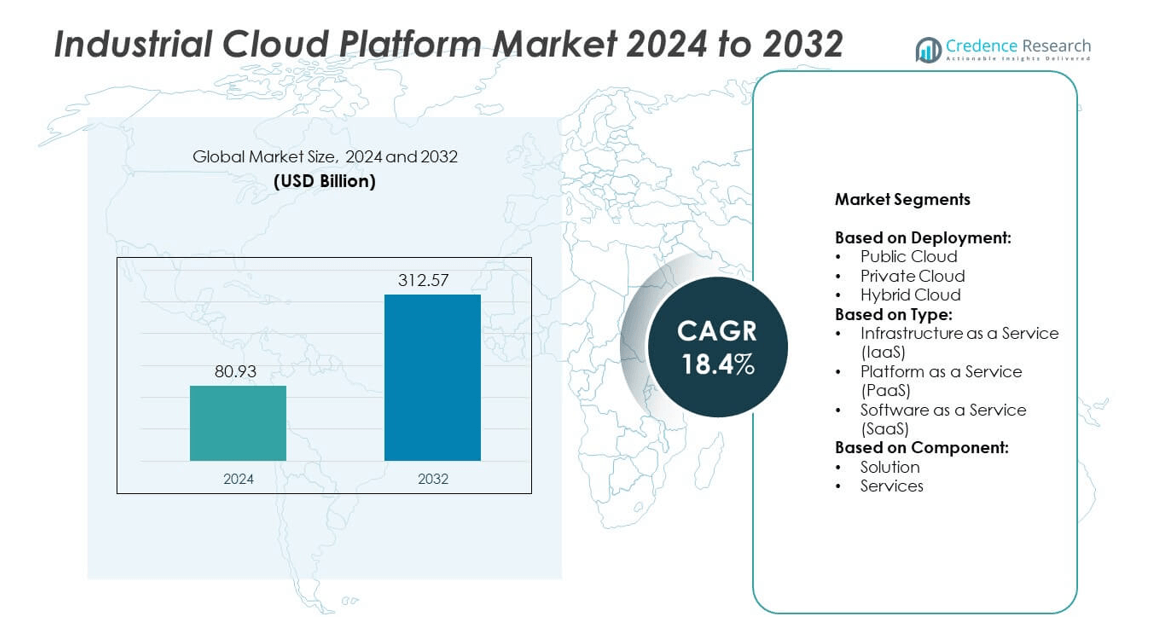

The Industrial Cloud Platform Market size was valued at USD 80.93 billion in 2024 and is anticipated to reach USD 312.57 billion by 2032, registering a CAGR of 18.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Cloud Platform Market Size 2024 |

USD 80.93 billion |

| Industrial Cloud Platform Market, CAGR |

18.4% |

| Industrial Cloud Platform Market Size 2032 |

USD 312.57 billion |

The Industrial Cloud Platform market grows through strong demand for digital transformation, cost efficiency, and real-time analytics. Companies adopt cloud platforms to modernize operations, integrate AI and machine learning, and improve productivity. Hybrid and multi-cloud strategies gain traction, offering flexibility and compliance support. Edge computing integration enhances real-time decision-making across industries. Rising sustainability goals further drive adoption, as enterprises use cloud solutions to monitor energy use and reduce emissions. These trends position industrial cloud platforms as essential for future-ready operations.

North America leads the Industrial Cloud Platform market with strong adoption across manufacturing, energy, and automotive industries, while Europe follows with demand driven by regulatory compliance and sustainability initiatives. Asia Pacific shows rapid growth supported by industrial modernization in China, Japan, and India. Latin America and the Middle East & Africa record steady adoption through digital transformation agendas. Key players shaping the market include Schneider Electric SE, Amazon Web Services, Siemens AG, and Microsoft Corporation, each focusing on innovation and sector-specific solutions.

Market Insights

- The Industrial Cloud Platform market was valued at USD 80.93 billion in 2024 and is expected to reach USD 312.57 billion by 2032, growing at a CAGR of 18.4%.

- Strong demand for digital transformation drives adoption as industries seek cost efficiency and operational agility.

- Integration of AI, machine learning, and edge computing emerges as a major trend enhancing real-time analytics and automation.

- Competition intensifies among global players focusing on hybrid cloud, cybersecurity, and industry-specific platforms to strengthen market presence.

- Data security concerns, legacy infrastructure integration challenges, and high migration costs act as restraints limiting adoption in some sectors.

- North America leads adoption through early technology integration and strong infrastructure, while Europe follows with compliance-driven demand and sustainability goals.

- Asia Pacific shows fast growth with manufacturing modernization in China, India, and Japan, while Latin America and the Middle East & Africa record steady progress through energy, automotive, and digital transformation projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Digital Transformation Across Industries

The Industrial Cloud Platform market benefits from the accelerating digitalization of manufacturing, energy, and automotive sectors. Companies adopt cloud platforms to modernize operations, streamline production, and enhance competitiveness. It enables integration of advanced analytics, automation, and AI for decision-making. Manufacturers deploy cloud-based tools to reduce downtime and improve efficiency. Energy firms use platforms to optimize asset management and monitor performance. The broad demand for digital transformation ensures consistent growth across industries.

- For instance, a 2017 report stated that “approximately 1 million devices and systems worldwide are now connected via MindSphere”. The platform’s capabilities allow for advanced analytics on large data volumes to optimize key performance indicators (KPIs) like overall equipment effectiveness, quality, and output. Siemens Industrial IoT offerings, including the MindSphere application Predictive Service Assistance, use artificial intelligence (AI) to optimize the maintenance efficiency of drive systems and minimize unplanned downtime.

Rising Need for Cost Efficiency and Operational Flexibility

Organizations seek to reduce infrastructure expenses and improve scalability, driving adoption of industrial cloud platforms. It eliminates heavy upfront investments in hardware and maintenance. Businesses can scale resources based on project needs, improving financial efficiency. Cloud platforms also support flexible deployment models like public, private, and hybrid. This adaptability appeals to enterprises with varying security and compliance needs. The shift toward leaner operations supports long-term reliance on cloud services.

- For instance, GE Power migrated its version of Predix to Amazon Web Services (AWS) to improve scalability. An earlier cloud migration project by the former GE Oil & Gas business, between 2014 and 2016, achieved a 52% reduction in TCO by migrating 500 applications to the cloud.

Enhanced Data Management and Real-Time Analytics Capabilities

The Industrial Cloud Platform market grows with the increasing importance of data-driven insights. It offers enterprises advanced tools for collecting, processing, and analyzing industrial data in real time. Cloud-based analytics improves predictive maintenance, reducing equipment failures and costs. Manufacturers gain operational visibility across production lines and supply chains. Real-time monitoring ensures better quality control and faster response to issues. Data integration across units enhances collaboration and performance optimization.

Strong Support from Regulatory and Sustainability Initiatives

Governments and regulators promote industrial cloud adoption through policies supporting digital infrastructure. It aligns with sustainability goals by enabling energy-efficient operations and reduced carbon emissions. Companies leverage cloud-based solutions to track emissions, waste, and compliance requirements. Environmental regulations in developed economies encourage investment in smarter platforms. Cloud adoption also supports transparency and reporting demanded by international standards. The regulatory push and sustainability focus create steady momentum for industrial cloud platforms.

Market Trends

Integration of Artificial Intelligence and Machine Learning in Industrial Operations

The Industrial Cloud Platform market witnesses strong adoption of AI and ML technologies to improve efficiency. It helps enterprises detect patterns, predict failures, and automate decision-making. AI-enabled platforms optimize workflows and reduce operational bottlenecks. Machine learning models enhance forecasting accuracy for demand planning and inventory control. Industrial players invest in AI-driven analytics to strengthen competitiveness. The growing maturity of AI technologies makes integration with cloud platforms more widespread.

- For instance, Bosch’s Industry 4.0 solutions have helped internal manufacturing operations reduce stocks by 30% and increase process efficiency by 10%

Expansion of Hybrid and Multi-Cloud Strategies Among Enterprises

Companies increasingly prefer hybrid and multi-cloud approaches to balance flexibility and control. It enables enterprises to distribute workloads across different platforms while meeting security needs. Hybrid cloud offers a balance between scalability of public cloud and privacy of private cloud. Multi-cloud reduces vendor dependency and increases resilience. Businesses in regulated industries adopt these models to comply with strict data rules. The rising preference for diversified cloud models drives strategic investment in industrial platforms.

- For instance, The MXIE platform is often deployed as part of the Nokia Digital Automation Cloud (DAC) or with the Nokia Modular Private Wireless solutions, which include private LTE and 5G networks. These private wireless networks, combined with on-site edge processing, are designed to provide the low latency (<20 ms) required for mission-critical applications like real-time machine control and worker safety

Growing Focus on Edge Computing for Real-Time Applications

The Industrial Cloud Platform market expands with the rise of edge computing integration. It allows data processing closer to machines, enabling real-time decision-making. Manufacturers deploy edge solutions to reduce latency and improve responsiveness. Energy and utilities benefit from faster monitoring of distributed assets. Edge-enabled platforms reduce bandwidth costs while ensuring operational continuity. The synergy of cloud and edge solutions strengthens industrial adoption across critical sectors.

Adoption of Industry-Specific Cloud Platforms for Custom Applications

Vendors design specialized cloud platforms tailored for manufacturing, logistics, and energy. It allows industries to access solutions that meet their specific operational needs. Industry-focused platforms support compliance, workflow customization, and integration with legacy systems. Manufacturing firms adopt sector-based solutions to manage supply chain and production data. Energy companies use tailored platforms for asset performance and grid management. The rise of domain-specific solutions positions industrial cloud as a strategic enabler.

Market Challenges Analysis

Data Security Concerns and Compliance Complexities in Cloud Adoption

The Industrial Cloud Platform market faces hurdles from rising cybersecurity threats and strict regulatory demands. It exposes enterprises to risks such as data breaches, intellectual property theft, and operational disruptions. Industrial players must meet compliance standards that vary across regions, creating deployment barriers. Sensitive industrial data often requires secure storage and transfer, challenging cloud providers to maintain trust. Organizations hesitate to shift critical workloads without proven data protection frameworks. The need for consistent global compliance adds pressure on both providers and users.

High Integration Costs and Legacy System Constraints in Industrial Environments

Enterprises encounter difficulties in integrating cloud platforms with outdated legacy infrastructure. It requires extensive investment in modernization, creating financial strain for small and mid-sized firms. Complex migration processes slow adoption across traditional industries. Resistance to change from operational teams also limits large-scale transitions. Companies with heavy reliance on legacy systems often delay digital transformation plans. The challenge of balancing modernization with cost control continues to affect adoption rates across industries.

Market Opportunities

Rising Demand for Smart Manufacturing and Industry 4.0 Initiatives

The Industrial Cloud Platform market holds strong opportunities from the global shift toward Industry 4.0. It supports smart factories by enabling automation, predictive analytics, and machine-to-machine communication. Manufacturers invest in digital twins and connected devices to boost productivity and reduce downtime. Cloud platforms provide scalable infrastructure to manage complex industrial data. The demand for real-time insights strengthens the value of cloud-based solutions in manufacturing. Industry 4.0 adoption across developed and emerging markets enhances the long-term growth outlook.

Expanding Role in Sustainability and Energy-Efficient Operations

Organizations focus on sustainable practices, creating opportunities for industrial cloud platforms to drive efficiency. It allows companies to monitor energy consumption, reduce emissions, and meet environmental targets. Cloud-based solutions help firms optimize resource utilization across supply chains and production units. Energy-intensive sectors adopt platforms to align with global sustainability regulations. Providers develop advanced tools to support compliance reporting and eco-friendly operations. The growing emphasis on environmental responsibility accelerates adoption across multiple industries.

Market Segmentation Analysis:

By Deployment:

The Industrial Cloud Platform market is segmented into public, private, and hybrid cloud models. Public cloud adoption grows quickly due to its cost efficiency and scalability. It supports enterprises that need on-demand resources without heavy infrastructure investment. Private cloud gains traction among industries requiring high security and strict compliance. Large firms in energy, defense, and healthcare adopt private models for greater control. Hybrid cloud emerges as a preferred option, combining scalability with security. It enables businesses to balance sensitive workloads and general applications effectively.

- For instance, In 2023, Microsoft synthesized over 65 trillion security signals per day across its global ecosystem of devices, apps, platforms, and endpoints, including those from its Azure cloud service.

By Type:

The market is categorized into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). IaaS dominates due to its ability to provide flexible computing and storage resources. It is widely used for running complex industrial workloads and applications. PaaS grows with demand for customized application development and integration tools. Enterprises use PaaS to streamline operations and deploy solutions faster. SaaS adoption rises in manufacturing and logistics, offering prebuilt solutions for collaboration, analytics, and monitoring. The increasing shift toward cloud-native tools accelerates growth in all three segments.

- For instance,According to a LinkedIn article from June 2025, modernizing Programmable Logic Controller (PLC) systems involves hardware upgrade costs ranging from $1,500 to $5,000 per CPU for CompactLogix controllers and $4,000 to over $10,000 per CPU for ControlLogix controllers.

By Component:

The Industrial Cloud Platform market includes solutions and services. Solutions cover platform offerings that manage data, analytics, and industrial workflows. It enables enterprises to gain operational visibility and enhance decision-making. Services grow as companies require consulting, integration, and ongoing management. Managed services help industries reduce IT complexity and focus on core operations. Professional services also play a critical role in ensuring smooth migration and compliance. The growing demand for both solution deployment and service support drives balanced growth across this segment.

Segments:

Based on Deployment:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Based on Type:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

Based on Component:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for the largest share of the Industrial Cloud Platform market with 38% of the global revenue. The region benefits from early adoption of advanced digital technologies and strong investment in industrial automation. It hosts leading cloud providers and industrial firms that drive innovation across sectors like manufacturing, oil and gas, and automotive. The United States leads regional growth, supported by initiatives that encourage smart factory deployment and real-time data integration. Canada contributes with adoption in energy and resource-based industries, aligning with sustainability goals. It maintains its dominance due to robust infrastructure, strong vendor presence, and active partnerships between technology companies and enterprises. The consistent emphasis on Industry 4.0 accelerates regional expansion and cements North America’s leadership position.

Europe

Europe holds 27% of the Industrial Cloud Platform market, supported by strict regulatory frameworks and sustainability mandates. The European Union drives cloud adoption through initiatives that promote digital transformation and greener operations. Germany, the United Kingdom, and France remain key contributors, with industries adopting hybrid cloud models to balance compliance and operational efficiency. The region places significant focus on data security and sovereignty, encouraging investments in private and hybrid platforms. Manufacturing industries in Germany and automotive firms across Western Europe integrate cloud platforms to optimize production. It benefits further from strong policy support like the European Green Deal, which fosters energy-efficient technologies. The market in Europe continues to expand with a balance of compliance-driven adoption and innovation.

Asia Pacific

Asia Pacific represents 22% of the Industrial Cloud Platform market, showing rapid growth due to industrial expansion and government support for digital initiatives. China, Japan, India, and South Korea lead adoption with investments in manufacturing modernization and smart infrastructure. The region’s large manufacturing base drives high demand for scalable cloud solutions that can manage complex operations. It shows significant traction in sectors like electronics, automotive, and logistics. Government policies in China and India promote cloud-based platforms to accelerate industrial competitiveness. Japan focuses on advanced applications such as digital twins and predictive analytics in manufacturing. It maintains strong growth potential with expanding cloud infrastructure and rising demand for industrial digitalization.

Latin America

Latin America accounts for 7% of the Industrial Cloud Platform market, driven by digital adoption in emerging economies such as Brazil and Mexico. Companies in the region seek cost-effective solutions to modernize operations and enhance efficiency. It faces challenges like uneven infrastructure development and limited access to high-speed connectivity. However, manufacturing, mining, and oil and gas sectors show increasing interest in cloud solutions. Brazil leads the region with industrial investments focused on hybrid and public cloud platforms. Mexico also shows progress with adoption in automotive and logistics industries. It remains a growing market with strong potential supported by digital transformation agendas and private sector initiatives.

Middle East and Africa

The Middle East and Africa hold 6% of the Industrial Cloud Platform market, supported by rising investments in oil and gas, energy, and infrastructure. Countries such as the United Arab Emirates and Saudi Arabia lead regional growth with large-scale industrial projects. It benefits from government-led digital transformation programs such as Vision 2030 initiatives. Industries adopt cloud platforms to improve asset monitoring, energy efficiency, and operational visibility. Africa shows gradual adoption, with South Africa emerging as a key market. The region faces challenges such as infrastructure gaps, but ongoing investment in connectivity and smart industry accelerates adoption. It continues to expand steadily with opportunities in both energy-rich economies and emerging industrial hubs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider Electric SE

- Amazon Web Services, Inc.

- Nokia

- Honeywell International Inc.

- Oracle Corporation

- Siemens AG

- Google Cloud

- IBM Corporation

- General Electric Company

- Microsoft Corporation

- Google LLC

Competitive Analysis

The leading players in the Industrial Cloud Platform market include Schneider Electric SE, Amazon Web Services, Inc., Nokia, Honeywell International Inc., Oracle Corporation, Siemens AG, Google Cloud, IBM Corporation, General Electric Company, Microsoft Corporation, and Google LLC. These companies play a critical role in shaping the competitive landscape through innovation, partnerships, and strategic investments. Each focuses on expanding its portfolio to meet the growing demand for scalable, secure, and industry-specific solutions. Competition is driven by the integration of artificial intelligence, edge computing, and data analytics into cloud platforms. Vendors strengthen their market position by offering hybrid and multi-cloud models to address both flexibility and compliance needs. Global partnerships with industrial firms help create tailored solutions for manufacturing, energy, and logistics. Market leaders focus on enhancing cybersecurity features to address rising concerns over data protection. Service expansion into emerging economies also remains a priority to capture new growth opportunities. The market sees a strong push toward sustainability, with providers aligning platforms to meet environmental regulations and energy efficiency targets. Strategic acquisitions, product launches, and investments in digital infrastructure highlight the competitive momentum. Innovation and sector-focused offerings remain the key differentiators among top industrial cloud providers.

Recent Developments

- In 2025, Schneider Electric showcased a comprehensive AI-ready data center solutions portfolio under its EcoStruxure platform. It introduced Prefabricated Modular EcoStruxure Pod Data Center to address high-density AI and accelerated compute workloads, collaborating with NVIDIA for AI cluster infrastructure reference designs.

- In 2024, Microsoft Cloud for Sustainability expanded ESG capabilities to help organizations manage environmental impact and regulatory compliance.

- In 2024, AWS committed another $10 billion toward expanding data center infrastructure in Ohio, reinforcing its cloud foundation for AI capacit

Report Coverage

The research report offers an in-depth analysis based on Deployment, Type, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Industrial Cloud Platform market will expand with rising adoption of Industry 4.0 solutions.

- Hybrid and multi-cloud models will dominate due to flexibility and compliance needs.

- AI and machine learning integration will strengthen predictive analytics and automation.

- Edge computing will grow to support real-time industrial applications.

- Demand for cybersecurity features will increase with higher cloud adoption.

- Industry-specific cloud platforms will see strong uptake in manufacturing and energy.

- Sustainability goals will drive adoption of cloud for energy-efficient operations.

- Partnerships between cloud providers and industrial firms will accelerate innovation.

- Emerging economies will contribute significantly through manufacturing modernization.

- Regulatory support will continue to boost secure and scalable cloud adoption.