Market Overview

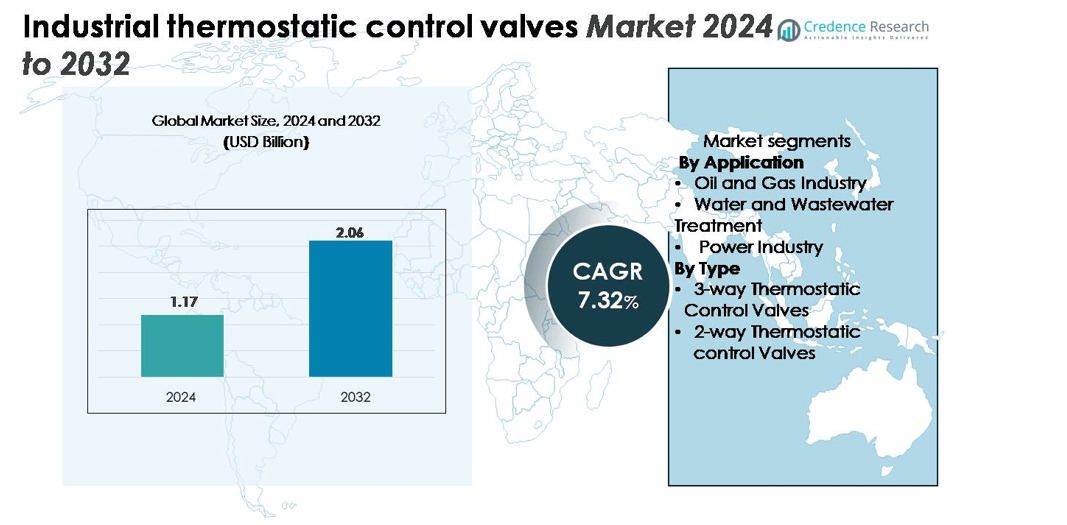

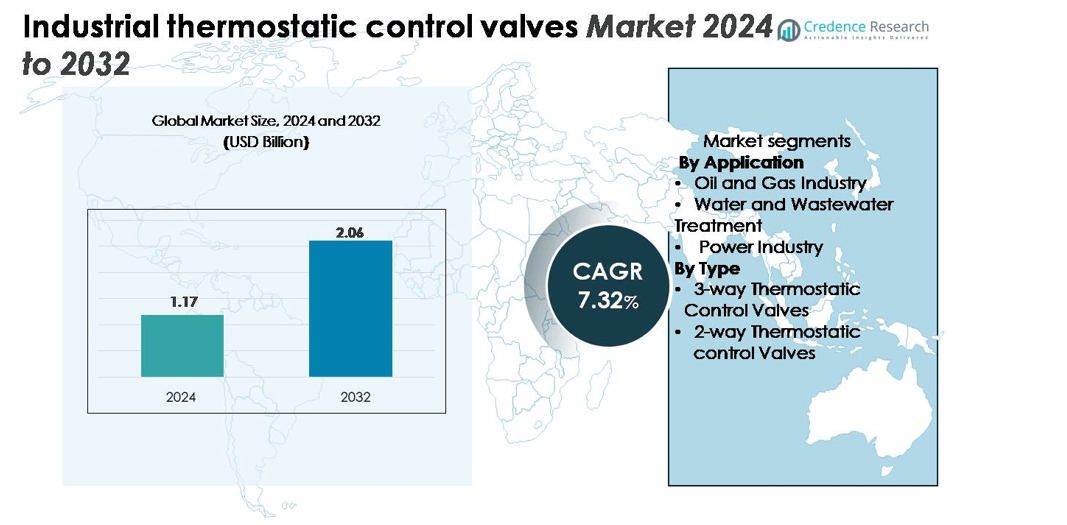

The Industrial Thermostatic Control Valves Market size was valued at USD 1.17 billion in 2024 and is projected to reach USD 2.06 billion by 2032, registering a CAGR of 7.32% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Thermostatic Control Valves Market Size 2024 |

USD 1.17 billion |

| Industrial Thermostatic Control Valves Market, CAGR |

7.32% |

| Industrial Thermostatic Control Valves Market Size 2032 |

USD 2.06 billion |

The Industrial Thermostatic Control Valves Market is led by major players such as Honeywell International Inc., Danfoss A/S, Emerson Electric Co., Spirax Sarco Engineering plc, AMOT Controls, and Schneider Electric SE. These companies hold a combined market share of over 60%, driven by strong R&D capabilities, global supply networks, and advanced product portfolios. They focus on developing energy-efficient and IoT-integrated thermostatic control valves to meet growing automation demands. Regionally, North America leads the market with a 35% share, supported by mature industrial infrastructure and high adoption of smart process control systems. Europe and Asia-Pacific follow, with 28% and 27% shares respectively, driven by sustainability initiatives and rapid industrial expansion.

Market Insights

- The Industrial Thermostatic Control Valves Market was valued at USD 1.17 billion in 2024 and is projected to reach USD 2.06 billion by 2032, growing at a CAGR of 7.32% during the forecast period.

- Increasing demand for energy-efficient temperature regulation in oil and gas, power, and water treatment industries drives market growth, supported by automation and process optimization initiatives.

- Growing adoption of smart and IoT-enabled valves enhances predictive maintenance and operational efficiency, shaping modern industrial control systems.

- The market is moderately consolidated, with Honeywell, Danfoss, Emerson, Spirax Sarco, and AMOT Controls leading through innovation and global expansion, while high initial costs restrain smaller manufacturers.

- North America holds a 35% share, followed by Europe at 28% and Asia-Pacific at 27%; by type, 3-way valves account for 58%, and by application, the oil and gas industry dominates with a 42% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

The oil and gas industry dominates the industrial thermostatic control valves market, accounting for a 42% share in 2024. These valves are essential for maintaining consistent temperatures in refining, petrochemical, and pipeline systems, preventing overheating and equipment failure. Their adoption is increasing due to the need for energy efficiency and enhanced process automation. Expanding upstream and downstream projects, along with modernization of refineries in North America and the Middle East, further strengthen the segment’s growth.

- For instance, Danfoss A/S’s ORV 25-80 three-way valve regulates a screw compressor’s oil flow at 17 m³/h and a nominal outlet temperature of 49 °C in a gas-compression system.

By Type

3-way thermostatic control valves lead the market with a 58% share in 2024, driven by their superior precision and versatility in temperature control. These valves efficiently regulate heat exchange in multi-loop systems and are widely deployed in oil refineries, power plants, and process industries. Their ability to mix or divert flow based on system requirements enhances operational flexibility and reduces energy losses. Manufacturers focus on integrating smart sensing technologies and durable materials to improve performance under demanding industrial condition.

- For instance, Danfoss A/S’s ORV series 3-way oil regulating valves are designed to maintain a constant oil temperature in gas compressor systems by mixing hot and cold oil. These valves can withstand pressures up to 40 bar g (580 psi g) and utilize a thermostatic element which has a standard factory setting of 49 °C (120 °F).

Key Growth Drivers

Rising Demand for Energy-Efficient Flow Control Systems

Industries are increasingly adopting thermostatic control valves to enhance energy efficiency and optimize thermal management. These valves automatically regulate fluid temperature without external power, minimizing energy losses in heating and cooling systems. The oil and gas, power, and water treatment sectors are integrating advanced valve systems to meet sustainability targets and reduce operational costs. Continuous industrial automation and process optimization drive product demand. Manufacturers are focusing on smart valves equipped with sensors and digital controllers to improve monitoring precision and efficiency, ensuring stable operation in energy-intensive environments.

- For instance, AMOT Controls’ 3-way thermostatic valve supports fluid flow rates up to 82 m³/h and operates across temperature settings from 35 °C to 82 °C in industrial oil-cooling systems.

Expansion of Oil, Gas, and Power Infrastructure

Growing investments in refining, petrochemical, and power generation facilities significantly boost the demand for thermostatic control valves. These valves maintain safe temperature levels in lubrication, heat exchange, and process control systems. The expansion of offshore production, LNG terminals, and combined-cycle power plants increases the need for high-performance, corrosion-resistant valves. Governments and private players are upgrading existing infrastructure to meet rising energy demand, further accelerating market growth. The surge in automation across these sectors enhances reliability and reduces downtime, strengthening product adoption.

- For instance, AMOT Controls’ Model G 3-Way Rotary Valve offers precision control within ±1 °F and supports maximum flow rates up to 3,170 GPM in engine cooling and heat exchange systems.

Increasing Industrial Automation and Digitalization

Industrial automation is reshaping temperature control processes by integrating smart thermostatic valves with IoT and predictive analytics. These valves enable real-time temperature regulation, self-adjustment, and remote monitoring across complex systems. Automated temperature control reduces manual intervention, enhancing precision and safety in critical operations. Adoption of Industry 4.0 technologies and data-driven maintenance strategies accelerates valve integration in sectors like oil refining, power generation, and chemical processing. Manufacturers are leveraging digital twin simulations and embedded sensor technologies to deliver predictive maintenance capabilities, extending equipment lifespan and operational reliability.

Key Trends & Opportunities

Integration of Smart and Connected Valves

Smart thermostatic control valves equipped with IoT-enabled sensors and wireless communication systems are gaining rapid traction. These advanced systems provide real-time data on flow, temperature, and valve performance, enabling predictive maintenance and reducing unplanned downtime. Industrial users benefit from enhanced automation, improved safety, and lower operational costs. Cloud-based monitoring platforms allow centralized control and diagnostics, particularly useful in distributed industrial networks. Companies investing in connected valve technologies gain a competitive edge through efficiency improvements and integration with existing process control systems.

- For instance, Danfoss A/S’ NovoCon® digital actuators for PICVs transmit valve position, temperature, and alarm data via BACnet MS/TP or Modbus RTU, supporting flow rates from 3-59 m³/h.

Growing Focus on Sustainability and Process Optimization

ustainability initiatives across industries are driving the adoption of thermostatic control valves that minimize waste heat and energy use. These valves help optimize process temperatures, improving resource utilization and reducing carbon emissions. Water and wastewater treatment plants are adopting temperature-regulated systems for chemical dosing and process heating efficiency. In addition, manufacturers are developing recyclable valve materials and energy-neutral designs. The growing emphasis on ESG compliance and green manufacturing standards offers opportunities for innovation and market expansion.

- For instance, Danfoss A/S achieved a 74% reduction in carbon emissions for its thermostatic expansion valve (TXV) production compared to its 2019 baseline.

Rising Adoption in Emerging Economies

Rapid industrialization in Asia-Pacific, Latin America, and the Middle East is creating new growth opportunities for thermostatic control valve manufacturers. Expanding oil and gas operations, power projects, and water treatment facilities are key demand drivers. Governments are investing heavily in infrastructure modernization, encouraging the use of automation-based temperature control solutions. Local manufacturers are collaborating with global players to introduce cost-efficient, durable valves suited to regional operating conditions. The growing focus on reducing energy intensity and improving production efficiency supports strong market penetration across developing nations.

Key Challenges

High Initial Costs and Complex Integration

The installation of thermostatic control valves, especially smart and automated variants, involves significant capital expenditure. Integration with existing systems requires specialized components, skilled technicians, and calibration processes. Small and medium enterprises often face challenges in justifying these costs, limiting market penetration. Moreover, compatibility issues between legacy control systems and new digital solutions can hinder adoption. Manufacturers are addressing this by offering modular, retrofit-friendly valves, yet widespread implementation remains constrained by cost and technical complexity in developing regions.

Maintenance and Performance Reliability Concerns

Thermostatic control valves operate in harsh environments where fluid impurities, temperature fluctuations, and high pressures can affect long-term reliability. Regular maintenance and calibration are essential to prevent failure and ensure temperature precision. However, inadequate servicing or use of substandard materials can lead to valve sticking, corrosion, or sensor malfunction. These issues increase operational downtime and maintenance costs, impacting productivity. The need for durable designs, corrosion-resistant alloys, and automated self-cleaning systems remains a major focus area for manufacturers seeking to enhance performance reliability.

Regional Analysis

North America

North America leads the industrial thermostatic control valves market with a 35% share in 2024. The region’s dominance is driven by advanced automation in oil refineries, chemical plants, and power generation facilities. High demand for energy-efficient temperature regulation and strict emission control standards support adoption. The United States is the key contributor, with strong investments in process optimization and smart valve technologies. Major players focus on integrating digital monitoring systems for improved operational safety and predictive maintenance, further strengthening the regional market outlook.

Europe

Europe accounts for a 28% market share, supported by extensive industrial modernization and environmental regulations. Countries such as Germany, France, and the UK lead in adopting energy-efficient control systems across manufacturing and water treatment sectors. The region emphasizes sustainable production, driving demand for eco-friendly and precision-based thermostatic valves. The presence of established valve manufacturers and automation technology providers enhances product innovation. European industries increasingly invest in smart, IoT-enabled systems that optimize temperature management while complying with strict energy efficiency standards.

Asia-Pacific

Asia-Pacific holds a 27% share and represents the fastest-growing regional market for industrial thermostatic control valves. Rapid industrialization, expanding energy infrastructure, and rising manufacturing output in China, India, and Japan are key growth drivers. Increasing government initiatives to modernize water management and power generation systems further boost demand. The region’s cost-effective production capabilities attract leading manufacturers to establish local facilities. Growing focus on process automation, along with large-scale investments in oil, gas, and renewable energy projects, continues to propel regional market expansion.

Latin America

Latin America captures a 6% share of the global market, with growth led by Brazil and Mexico. Expanding oil and gas exploration projects, along with growing industrial automation adoption, drive market development. Governments are promoting energy-efficient technologies in manufacturing and power plants, encouraging the use of thermostatic control valves. The modernization of water treatment infrastructure also supports demand. However, economic fluctuations and limited domestic manufacturing capacity constrain rapid growth, making partnerships with global suppliers essential for technology advancement and market expansion.

Middle East & Africa

The Middle East & Africa region holds a 4% market share, primarily driven by strong demand from the oil and gas industry. Countries such as Saudi Arabia, the UAE, and South Africa are investing in large-scale industrial and energy projects. Thermostatic control valves play a critical role in maintaining temperature precision across refining, petrochemical, and desalination facilities. The push toward industrial automation and sustainable energy systems enhances product adoption. While infrastructure gaps pose challenges, continuous investment in process efficiency and smart control systems supports long-term market potential.

Market Segmentations:

By Application

- Oil and Gas Industry

- Water and Wastewater Treatment

- Power Industry

By Type

- 3-way Thermostatic Control Valves

- 2-way Thermostatic Control Valves

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The industrial thermostatic control valves market is moderately consolidated, with key players focusing on innovation, material enhancement, and digital integration to strengthen their market presence. Leading companies such as Honeywell International Inc., Spirax Sarco Engineering plc, Danfoss A/S, AMOT Controls, and Emerson Electric Co. dominate the competitive landscape through extensive product portfolios and global distribution networks. These players emphasize developing smart thermostatic valves equipped with IoT-based sensors, self-actuating mechanisms, and predictive maintenance capabilities. Strategic collaborations, mergers, and new product launches remain central to their growth strategies. For instance, Danfoss expanded its range of energy-efficient control valves tailored for high-temperature applications in process industries. Regional players are also focusing on cost-effective designs and durable materials to capture emerging market demand. The increasing shift toward automation, sustainability, and real-time monitoring continues to shape competition, driving companies to prioritize technological advancement and energy optimization across diverse industrial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Armstrong

- Huegli Tech

- Danfoss

- Fushiman

- Watson McDaniel

- AMOT

- Metrex Valve

- MVA

- Fluid Power Energy

- Dwyer Instruments

Recent Developments

- In 2023, IMI Hydronic Engineering, under IMI plc, might have introduced innovations in their thermostatic control valve product lines. This could include improvements in valve design, materials, or integration with digital control systems for enhanced performance.

- In 2023, Cameron has continued its efforts in the industrial thermostatic control valve market by enhancing valve technologies for demanding environments like oil and gas, focusing on durability, and precise temperature regulation

Report Coverage

The research report offers an in-depth analysis based on Application, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart thermostatic control valves with IoT and sensor integration will continue to rise.

- Demand from oil, gas, and power sectors will grow as industries modernize their process infrastructure.

- Manufacturers will focus on developing energy-efficient and self-actuating valve systems.

- Predictive maintenance solutions will become standard for improving operational reliability.

- Asia-Pacific will emerge as the fastest-growing market due to rapid industrialization.

- Digitalization in process control systems will enhance temperature accuracy and energy management.

- Sustainable materials and eco-friendly valve designs will gain greater adoption.

- Integration with cloud-based monitoring platforms will support real-time diagnostics.

- Partnerships between valve manufacturers and automation firms will increase innovation.

- Ongoing infrastructure upgrades in water and wastewater facilities will create new growth opportunities.