Market Overview:

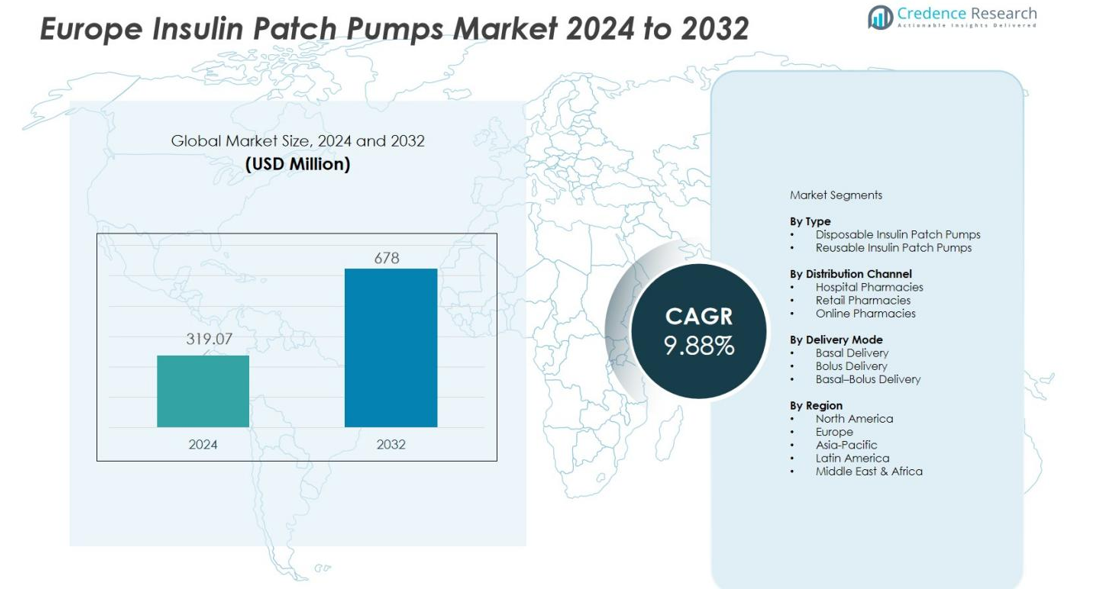

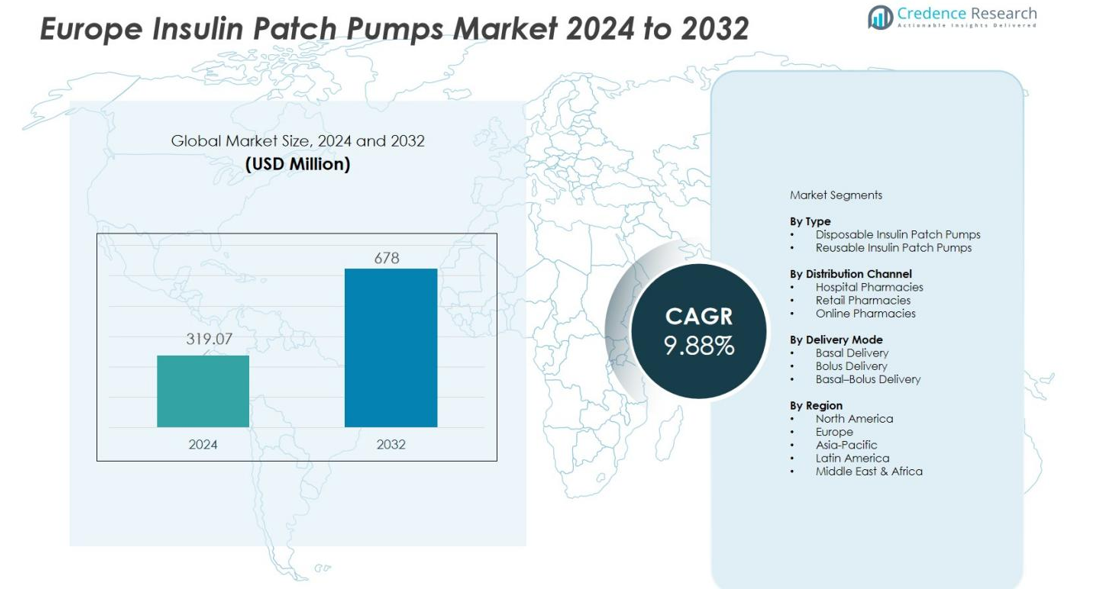

The Europe Insulin Patch Pumps Market size was valued at USD 319.07 million in 2024 and is anticipated to reach USD 678 million by 2032, at a CAGR of 9.88% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Insulin Patch Pumps Market Size 2024 |

USD 319.07 million |

| Europe Insulin Patch Pumps Market, CAGR |

9.88% |

| Europe Insulin Patch Pumps Market Size 2032 |

USD 678 million |

Market growth is primarily fueled by technological advancements, including smart connectivity features, automated insulin dosing, and integration with continuous glucose monitoring (CGM) systems. Increasing awareness of diabetes complications, coupled with demand for minimally invasive and convenient insulin administration solutions, further strengthens market adoption. Supportive reimbursement frameworks in several European countries and ongoing digital health initiatives also contribute to the market’s positive trajectory.

Regionally, Western Europe dominates the market due to its advanced healthcare infrastructure, high diabetes burden, and early adoption of innovative medical technologies. Countries such as Germany, France, and the United Kingdom lead in terms of utilization and technological integration. Meanwhile, Eastern Europe is witnessing gradual growth as healthcare investments rise and patient awareness improves, creating new opportunities for market expansion across the region.

Market Insights:

- The market was valued at USD 319.07 million in 2024 and is projected to reach USD 678 million by 2032, growing at a CAGR of 9.88%.

- Rising diabetes prevalence and demand for discreet, convenient, and user-friendly insulin delivery solutions drive adoption.

- Technological advancements, including smart connectivity, automated dosing, and CGM integration, enhance precision and patient adherence.

- Western Europe leads with 65% market share, driven by advanced healthcare infrastructure and early adoption in Germany, France, and the United Kingdom.

- Market growth is supported by favorable reimbursement policies and digital health initiatives, while high device costs and technical limitations create opportunities for innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Burden of Diabetes and Demand for Convenient Insulin Delivery Solutions

The Europe Insulin Patch Pumps Market expands due to the rising prevalence of diabetes across the region. Patients seek discreet and user-friendly devices that support better glycemic control without complex procedures. Patch pumps offer tubeless designs that enhance mobility and comfort. Healthcare providers promote these devices to improve adherence and overall treatment outcomes.

- For Instance, Insulet’s Omnipod 5, a tubeless automated insulin delivery (AID) system, has been launched across multiple European countries including the UK, Germany, France, the Netherlands, Italy, Denmark, Finland, Norway, and Sweden. Real-world evidence from a large U.S. analysis of nearly 70,000 users showed that adults with a 110 mg/dL target glucose setting achieved a median Time in Range (TIR, 70-180 mg/dL) of 69.9%, with minimal time spent in hypoglycemia.

Advancements in Smart and Automated Insulin Delivery Technologies

Technology upgrades influence the market through improved accuracy, automation, and integration with digital health platforms. Smart patch pumps connect with mobile applications and continuous glucose monitoring systems to support timely insulin adjustments. This capability strengthens patient adoption by reducing manual dosing errors. The market benefits from investments in R&D that enhance device precision and reliability.

- For example, the JewelPUMP™, a system developed by Debiotech SA, utilizes micro-electromechanical systems (MEMS) technology for continuous subcutaneous infusion, with a design intended for a disposable patch portion that could be part of a multi-day system (such as 3 days), aiming to enhance dosage accuracy and patient convenience.

Supportive Healthcare Policies and Expanding Reimbursement Structures

Government efforts to streamline diabetes management reinforce growth opportunities. Several European countries offer reimbursement programs that reduce out-of-pocket expenses, encouraging wider access to insulin patch pumps. Healthcare authorities prioritize cost-effective solutions that lower long-term complications. The market gains momentum through structured programs that promote consistent device usage.

Rising Shift Toward Personalized and Patient-Centered Diabetes Management

Diabetes care programs across Europe highlight personalized treatment strategies. Patch pumps support this shift through adjustable dosing features tailored to individual metabolic needs. It aligns well with clinical goals that aim to reduce complications through timely intervention. Growing awareness among patients and providers strengthens confidence in advanced insulin delivery systems.

Market Trends:

Growing Integration of Digital Health Features and Connected Diabetes Management

The Europe Insulin Patch Pumps Market moves toward fully connected diabetes ecosystems that support real-time data sharing and improved therapy adjustments. Smart patch pumps now link with mobile apps, cloud platforms, and continuous glucose monitoring systems to optimize insulin delivery precision. It enhances patient engagement through personalized alerts, dose history tracking, and remote clinical monitoring. Interoperability standards gain importance to ensure smooth communication between devices and software systems. Manufacturers invest in cybersecurity measures to protect sensitive health information. The trend strengthens long-term adherence among patients who prefer technology-enabled and simplified tools for diabetes care.

- For instance, the Omnipod 5 by Insulet Corporation is a smart patch pump that integrates continuous glucose monitoring (CGM) with insulin delivery via mobile apps and cloud platforms, enabling automated insulin dosing adjustments every 5 minutes based on CGM data.

Rising Demand for Wearable, Discreet, and Tubeless Insulin Delivery Solutions

Wearable patch pumps gain strong traction due to their compact designs, comfort, and ability to reduce lifestyle disruptions. The market shifts toward tubeless systems that eliminate the limitations of traditional pump tubing. It encourages patients to maintain consistent insulin administration without device-related inconvenience. Hybrid closed-loop capabilities enter the spotlight, enabling automated basal adjustments based on real-time glucose fluctuations. Manufacturers explore lightweight materials and extended-wear adhesive technologies to improve pump stability and user confidence. The trend aligns with growing patient expectations for convenience, mobility, and personalized self-management solutions across Europe.

- For instance, Insulet’s Omnipod DASH tubeless insulin pump has shown robust real-world use among over 14,000 users, maintaining consistent glucose control without the inconvenience of tubing. This device supports patients in maintaining routine insulin administration effectively.

Market Challenges Analysis:

High Device Costs and Limited Reimbursement Coverage Across Regions

The Europe Insulin Patch Pumps Market faces challenges linked to high device prices and uneven reimbursement policies across countries. Many patients hesitate to adopt patch pumps due to recurring expenses for consumables and accessories. It creates financial pressure, particularly in regions with limited insurance support. Healthcare systems evaluate cost-effectiveness carefully before expanding reimbursement eligibility. Manufacturers encounter slow adoption in markets where price sensitivity remains high. The gap between patient demand and financial accessibility restricts broader penetration.

Technical Limitations, Adhesive Concerns, and Variable User Experience

Patch pump performance depends on strong adhesion, accurate dosing, and durable wear, yet users report issues that affect daily comfort. Some patients experience skin irritation or pump detachment, which reduces confidence in long-term usage. It raises concerns among clinicians who require consistent device reliability for effective therapy. Technical errors, software glitches, and battery limitations also influence user satisfaction. Training gaps create uneven user experience, especially among first-time pump users. These factors slow the transition from traditional insulin delivery methods to advanced wearable options.

Market Opportunities:

Expansion of Smart, Automated, and Interoperable Insulin Delivery Ecosystems

The Europe Insulin Patch Pumps Market creates strong opportunities through rising demand for intelligent and integrated diabetes management solutions. Manufacturers can leverage digital health platforms, app connectivity, and CGM interoperability to deliver highly automated insulin dosing systems. It enhances clinical decision support and strengthens patient engagement. Hybrid closed-loop technologies open new avenues for precision therapy and long-term adoption. Healthcare providers welcome solutions that lower complication risks through timely insulin adjustments. These advancements position patch pumps as core components within Europe’s rapidly evolving digital diabetes care landscape.

Growing Adoption Potential in Emerging European Markets and Untapped Patient Segments

Several Eastern European countries invest in diabetes care infrastructure, creating new openings for wearable insulin technologies. Expanding reimbursement coverage and stronger patient education efforts can accelerate uptake in these regions. It supports wider access to modern insulin delivery methods beyond large metropolitan centers. Younger patient populations show high willingness to adopt compact, discreet, and tech-enabled devices. Manufacturers that tailor pricing, awareness campaigns, and distribution channels can strengthen their presence. This growth potential broadens the market’s reach and builds long-term competitive advantage across Europe.

Market Segmentation Analysis:

By Type

The Europe Insulin Patch Pumps Market divides into disposable and reusable pump systems, with disposable types holding a strong position due to their simplicity and minimal maintenance requirements. Patients prefer these devices for single-use convenience and reduced device-handling steps. Reusable pumps gain momentum among users seeking cost efficiency supported by replaceable insulin cartridges. It broadens device choice and enables tailored adoption across varied patient lifestyles. Both formats continue to meet specific clinical needs within structured diabetes care pathways.

- For instance, the CE-certified PAQ device features a reusable electronic portion combined with a disposable insulin-filled component that can hold up to 330 units of U100 insulin and runs continuously for three days, offering patients single-use convenience without complex handling steps.

By Distribution Channel

Distribution spans hospital pharmacies, retail pharmacies, and online pharmacies, with hospital pharmacies maintaining a leading role due to clinician-led recommendations and controlled dispensation. Retail pharmacies support wider reach and provide ongoing access to consumables required for routine use. Online pharmacies expand steadily as digital purchasing accelerates and logistical networks strengthen across Europe. It improves access for patients who prefer home delivery and remote ordering. The diverse channel mix reinforces consistent supply and long-term adherence.

- For instance, in Europe, 93.3% of medicinal products are distributed through pharmaceutical full-line wholesalers servicing hospital pharmacies, which operate 1,490 warehouses and supply over 520 million people, highlighting their critical role in controlled dispensation and reliable supply continuity.

By Delivery Mode

Delivery mode includes basal, bolus, and basal–bolus systems, with basal–bolus holding the dominant share due to its precision in supporting flexible daily insulin requirements. These systems align with modern diabetes management standards and offer strong clinical outcomes. Basal-only modes remain relevant for patients needing steady background delivery. Bolus pumps focus on mealtime dosing where rapid action is essential. It reflects rising demand for personalized insulin delivery configurations that improve glycemic stability.

Segmentations:

By Type

- Disposable Insulin Patch Pumps

- Reusable Insulin Patch Pumps

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Delivery Mode

- Basal Delivery

- Bolus Delivery

- Basal–Bolus Delivery

By Region

- Western Europe

- Central Europe

- Eastern Europe

- Northern Europe

- Southern Europe

- Rest of Europe

Regional Analysis:

Strong Market Presence Across Western Europe Supported by Advanced Healthcare Systems

Western Europe holds 65% of the Europe Insulin Patch Pumps Market, establishing a clear leadership position across the region. Its dominance reflects advanced healthcare systems and strong acceptance of modern insulin-delivery technologies. Germany, France, and the United Kingdom drive usage through structured diabetes programs and high adoption of wearable devices. It benefits from reimbursement systems that lower patient cost burdens. Healthcare facilities integrate connected monitoring tools that strengthen treatment adherence and outcomes.

Growth Acceleration in Central and Eastern European Countries

Central and Eastern Europe account for 20% of the Europe Insulin Patch Pumps Market and demonstrate steady expansion supported by rising healthcare investments. Adoption improves as patient education programs highlight the benefits of modern insulin-delivery methods. Countries such as Poland, Czech Republic, and Hungary register sustained increases in device uptake. It reflects a shift toward accessible diabetes management across urban and non-urban regions. Government digital-health initiatives support broader access and reduce adoption barriers.

Increasing Adoption of Connected Diabetes Solutions Across Northern Europe and Other Regions

Northern Europe and remaining regional markets together hold 15% of the Europe Insulin Patch Pumps Market, driven by strong interest in connected, patient-centric technologies. Demand strengthens for digital insulin-delivery systems that support precise, personalized dosing. It aligns with preventive-care goals and rising telehealth utilization. Countries invest in platforms that enable remote monitoring and continuous glucose insights. This trend enhances device confidence and supports consistent market expansion across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Medtronic plc

- Insulet Corporation

- Tandem Diabetes Care, Inc.

- Roche Diabetes Care

- Ypsomed AG

- Cellnovo Group

- SOOIL Development Co., Ltd.

- Hoffmann-La Roche Ltd.

- Valeritas Holdings, Inc.

- Bigfoot Biomedical, Inc.

- Lifecare Innovations Pvt. Ltd.

- Animas Corporation

Competitive Analysis:

The Europe Insulin Patch Pumps Market displays strong competitive activity driven by leading medical device companies and emerging innovators. Established players leverage advanced engineering, broad distribution networks, and strong clinical validation to maintain dominant positions. It pushes firms to enhance device accuracy, connectivity features, and user comfort to retain patient and clinician preference. New entrants focus on automated dosing technologies and mobile platform integration to differentiate their offerings. Competitive pressure intensifies as companies pursue value-based pricing models to secure reimbursement and strengthen hospital procurement agreements. Partnerships with digital-health firms support development of integrated ecosystems that improve chronic disease management. Manufacturers invest in regulatory compliance, real-world performance data, and customer support programs to build trust and expand adoption. The competitive landscape continues to evolve through product upgrades, strategic collaborations, and regional expansion, creating a dynamic environment for sustained innovation across Europe.

Recent Developments:

- In April 2025, Medtronic advanced its partnership with Abbott by submitting FDA approval for an interoperable insulin pump integrating Abbott’s continuous glucose monitoring platform.

- In May 2025, Medtronic announced its intent to spin off its diabetes business within 18 months into a standalone, publicly traded company to focus on high-margin growth markets and create a scaled leader in diabetes technology.

Report Coverage:

The research report offers an in-depth analysis based on Type, Distribution Channel, Delivery Mode and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will experience sustained demand driven by rising diabetes prevalence and a shift toward user-friendly insulin delivery technologies.

- Adoption of connected and automated patch pump systems will increase as healthcare providers emphasize precision dosing and real-time monitoring.

- Integration between patch pumps and continuous glucose monitoring platforms will strengthen digital diabetes ecosystems.

- Manufacturers will focus on compact, discreet, and extended-wear designs to improve comfort and long-term adherence.

- Reimbursement expansion across more European countries will support broader patient access and accelerate regional penetration.

- Hybrid closed-loop features will gain traction, enabling more personalized and proactive insulin management.

- Investment in cybersecurity and data integrity solutions will rise to support secure digital-health integration.

- Eastern Europe will record faster adoption rates due to improving healthcare infrastructure and rising patient awareness.

- Collaborations between device manufacturers and digital-health companies will drive innovation and enhance clinical outcomes.

- Sustainability-focused design improvements, including reusable components, will influence future product development and procurement preferences.