Market Overview

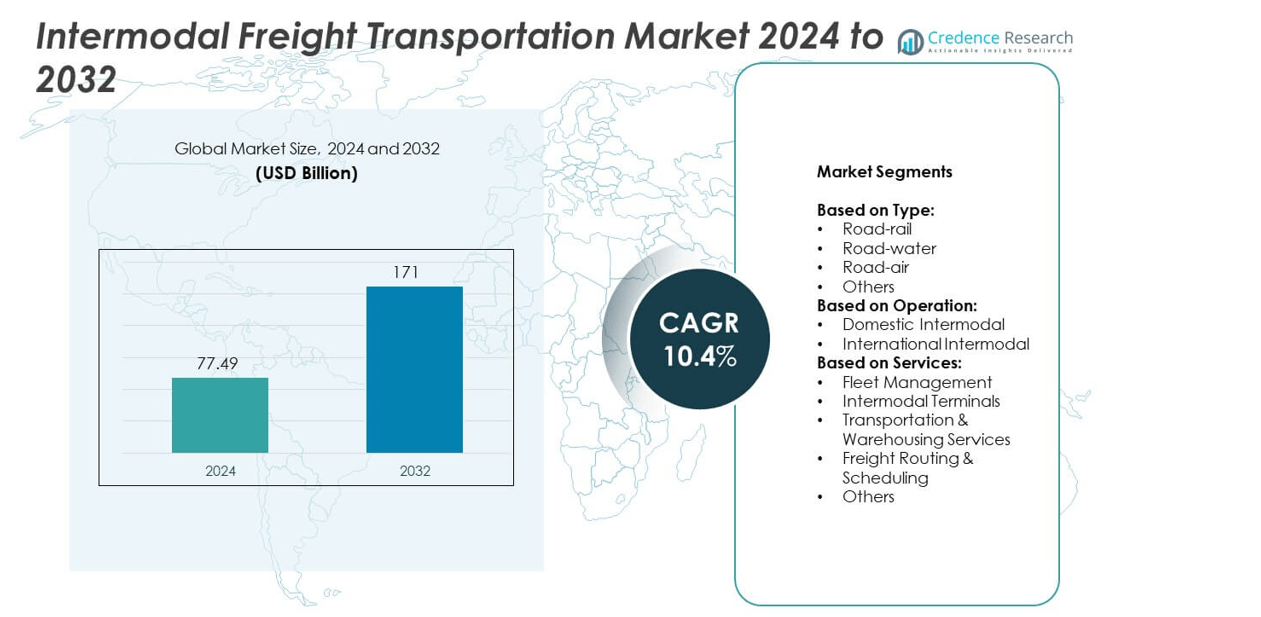

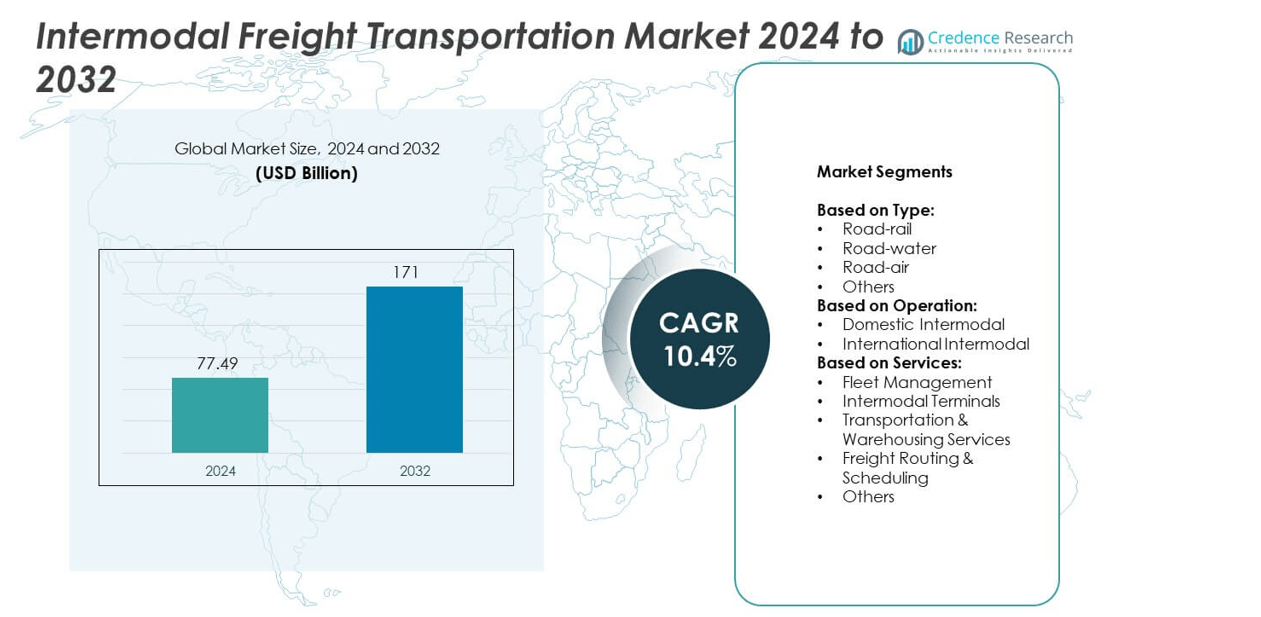

The Intermodal Freight Transportation Market size was valued at USD 77.49 billion in 2024 and is anticipated to reach USD 171 billion by 2032, growing at a CAGR of 10.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intermodal Freight Transportation Market Size 2024 |

USD 77.49 billion |

| Intermodal Freight Transportation Market, CAGR |

10.4% |

| Intermodal Freight Transportation Market Size 2032 |

USD 171 billion |

The Intermodal Freight Transportation market grows through rising global trade, expanding e-commerce, and strong infrastructure investments. Companies adopt intermodal solutions to reduce costs, improve delivery speed, and meet sustainability targets. Digital platforms, IoT-enabled tracking, and AI-driven scheduling enhance operational efficiency and cargo visibility. Governments support growth with funding for rail corridors, ports, and logistics hubs. Increasing demand for eco-friendly freight solutions strengthens adoption of rail and water transport. The market evolves as technology and sustainability reshape global logistics networks.

North America leads with strong rail-road integration and advanced logistics hubs, while Europe emphasizes sustainable transport corridors and cross-border connectivity. Asia Pacific expands rapidly through industrial growth, export activity, and large-scale infrastructure projects. Latin America and the Middle East & Africa show progress with ongoing port and corridor investments. Key players driving the Intermodal Freight Transportation market include Oracle Corporation, Blue Yonder, Inc., The Descartes Systems Group Inc. (Descartes Aljex), and GE Transportation (Wabtec Corporation).

Market Insights

- The Intermodal Freight Transportation market was valued at USD 77.49 billion in 2024 and is projected to reach USD 171 billion by 2032 at a CAGR of 10.4%.

- Rising demand for global trade and expanding e-commerce networks fuel adoption of intermodal solutions for efficient and timely freight movement.

- Digitalization, IoT-enabled tracking, and AI-powered scheduling emerge as key trends improving visibility, reliability, and coordination across multimodal systems.

- Leading companies focus on innovation, partnerships, and mergers to strengthen intermodal capabilities, with technology adoption shaping competitive advantages.

- High infrastructure costs and complex coordination between multiple stakeholders remain critical restraints affecting smooth expansion in developing regions.

- North America leads with robust rail-road networks, Europe advances sustainable transport corridors, Asia Pacific grows through industrial expansion, while Latin America and the Middle East & Africa invest in port and corridor improvements.

- Increasing focus on sustainability drives preference for rail and water transport over road-only freight, positioning intermodal solutions as a vital part of low-carbon logistics strategies worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Trade and Expanding Cross-Border Supply Chains

Global trade growth drives steady demand for reliable transport solutions across multiple regions. Companies look for efficient movement of goods between ports, rail networks, and road systems. The Intermodal Freight Transportation market benefits from strong trade links that improve cargo flow across countries. It supports faster delivery of raw materials and finished products to global buyers. Businesses reduce dependence on single transport modes by diversifying logistics channels. Expanding supply chains create continuous opportunities for intermodal integration.

- For instance, Maersk operates approximately 735 container vessels with a capacity of about 4.54 million TEUs. This fleet ensures global connectivity and is undergoing a major renewal to replace older ships with new, fuel-efficient vessels

E-commerce Expansion and Consumer Expectations for Timely Deliveries

The rapid rise of e-commerce continues to transform logistics needs across developed and emerging economies. Online retailers require delivery models that support quick and flexible distribution. The Intermodal Freight Transportation market helps reduce delays by linking multiple transport networks. It ensures that goods reach warehouses and customers within strict timelines. Growing customer expectations for same-day and next-day deliveries increase reliance on intermodal solutions. Companies strengthen their competitiveness through reliable fulfillment strategies.

- For instance, According to a June 2025 report from Capital One Shopping, Amazon Logistics processed 6.3 billion packages in the U.S. during 2024, which translates to approximately 17.2 million packages per day. While this is a very high volume, it is slightly less than the 18 million mentioned in the claim.

Infrastructure Development and Government Investment in Transport Networks

Investment in modern rail, road, and port infrastructure creates a strong foundation for freight efficiency. Governments allocate large budgets to expand multimodal corridors and logistics hubs. The Intermodal Freight Transportation market gains direct benefits from policy support that enhances connectivity. It reduces bottlenecks and lowers operational costs for logistics operators. Integrated terminals improve coordination between railways, trucking companies, and shipping lines. Large-scale infrastructure upgrades ensure long-term improvements in freight movement.

Sustainability Goals and Pressure to Reduce Carbon Emissions

Corporate strategies focus on reducing environmental impact while maintaining supply efficiency. Regulators push for adoption of low-emission transport solutions across industries. The Intermodal Freight Transportation market supports sustainable freight by reducing fuel use through optimized routes. It allows companies to meet compliance targets and respond to consumer concerns. Combining rail with road transport decreases greenhouse gas emissions per shipment. Rising awareness of climate targets accelerates intermodal adoption globally.

Market Trends

Integration of Digital Platforms and Advanced Tracking Technologies

Digitalization drives major change in logistics operations across global supply chains. Companies adopt IoT-enabled sensors, AI-based route optimization, and blockchain systems for transparency. The Intermodal Freight Transportation market benefits from real-time tracking that improves scheduling accuracy. It enables faster communication between carriers, shippers, and customs authorities. Advanced platforms reduce risks of delays and improve asset utilization. Growing reliance on digital solutions strengthens operational efficiency across networks.

- For instance, India’s Dedicated Freight Corridor (DFC) consists of two main sections: the Eastern Dedicated Freight Corridor (EDFC), spanning 1,337 kilometers from Ludhiana to Sonnagar, and the Western Dedicated Freight Corridor (WDFC), covering 1,506 kilometers from Jawaharlal Nehru Port Terminal (JNPT) to Dadri, for a total length of 2,843 kilometers. As of March 2025, 96.4% of the network was operational.

Growing Preference for Rail-Road and Road-Water Combinations

Operators emphasize cost-effective and reliable transport modes that balance speed with sustainability. Road-rail and road-water combinations gain wider acceptance for regional and cross-border trade. The Intermodal Freight Transportation market expands with increased use of rail corridors for bulk freight. It enhances long-haul connectivity while reducing congestion on highways. Short-sea shipping integrated with trucking supports flexible movement across coastal regions. These multimodal choices optimize time and cost performance for shippers.

- For instance, In 2023, DB Cargo, the rail freight transport subsidiary of Deutsche Bahn, saw its total tonnage transported across its entire European network fall by 11.1% to 197.6 million tons, down from 222.3 million tons in 2022. Factors such as strikes, infrastructure disruptions, and a decline in sectors like steel and chemicals contributed to this drop

Rising Demand for Temperature-Controlled and Specialized Cargo Solutions

Perishable goods, pharmaceuticals, and high-value products require advanced intermodal solutions. Companies invest in refrigerated containers and specialized handling facilities at terminals. The Intermodal Freight Transportation market adapts to meet rising demand for cold-chain logistics. It enables safe transit of sensitive cargo across longer distances without loss of quality. Expansion of global food trade fuels adoption of reefer-equipped railcars and vessels. Specialized solutions create new revenue opportunities for logistics providers.

Adoption of Sustainability-Centered Practices and Green Corridors

Sustainability goals encourage development of eco-friendly intermodal corridors across major trade routes. Governments and private operators collaborate to create rail and port systems with reduced emissions. The Intermodal Freight Transportation market aligns with these targets by shifting freight from road to rail. It cuts fuel consumption and supports low-carbon distribution models. Operators introduce hybrid and electric trucks for last-mile delivery segments. Sustainable practices become a defining trend for long-term competitiveness.

Market Challenges Analysis

Complex Coordination Between Multiple Transport Modes and Stakeholders

Intermodal operations require seamless coordination among carriers, port authorities, rail operators, and trucking firms. Differences in scheduling, regulations, and handling standards often slow down cargo movement. The Intermodal Freight Transportation market faces delays when integration across systems is weak. It creates challenges in achieving real-time visibility and effective communication between stakeholders. Bottlenecks at terminals further reduce efficiency and increase costs for shippers. Lack of standardization across global networks makes coordination more difficult.

High Infrastructure Costs and Operational Inefficiencies in Developing Regions

Large-scale investment is essential to build and maintain intermodal hubs, terminals, and rail corridors. Developing economies struggle to allocate sufficient resources for modern infrastructure upgrades. The Intermodal Freight Transportation market encounters obstacles in regions with poor connectivity and outdated facilities. It limits the ability of logistics operators to provide consistent and cost-effective services. Operational inefficiencies lead to longer transit times and reduced reliability for customers. High initial costs discourage smaller operators from adopting intermodal models.

Market Opportunities

Expansion of Trade Routes and Cross-Border Economic Corridors

Global initiatives to strengthen trade partnerships create new opportunities for intermodal growth. Investments in cross-border corridors and free trade agreements expand the scope of logistics networks. The Intermodal Freight Transportation market benefits from increased connectivity between ports, inland rail, and road systems. It enables companies to tap into emerging markets with efficient transport solutions. Growth in cross-regional supply chains supports higher demand for multimodal services. Enhanced trade routes open pathways for long-term industry development.

Rising Adoption of Smart Logistics and Green Transport Solutions

Technological progress and sustainability targets reshape opportunities for logistics providers. Smart logistics platforms improve visibility, predictive planning, and cargo tracking across networks. The Intermodal Freight Transportation market gains from adoption of greener practices supported by policy incentives. It allows operators to reduce emissions while optimizing fuel use and delivery speed. Demand for eco-friendly and digital solutions drives stronger competitiveness in the market. Integration of sustainable practices and smart tools ensures new revenue potential.

Market Segmentation Analysis:

By Type:

Road-rail dominates the global market due to its cost efficiency and ability to carry bulk cargo across long distances. It supports both domestic and cross-border freight by linking trucking with extensive rail corridors. Road-water transport shows strong growth in coastal economies where short-sea shipping reduces highway congestion. Road-air serves high-value and time-sensitive cargo, providing speed for critical deliveries. The Intermodal Freight Transportation market includes other combinations such as pipeline and inland waterways, which cater to niche regional needs. It creates diversified options for shippers seeking flexible logistics models.

- For instance, UPS integrates telematics with its On-Road Integrated Optimization and Navigation (ORION) software to optimize delivery routes, reduce fuel consumption, animprove efficiency. As of 2016, approximately 55,000 U.S. routes utilized ORION, which is powered by telematics data

By Operation:

Domestic intermodal holds a major share in developed nations with strong inland rail and trucking networks. It supports regional e-commerce fulfillment and retail distribution with reliable efficiency. International intermodal continues to expand across Asia, Europe, and North America through enhanced port connectivity. It enables long-distance trade flows and supports global supply chain integration. Growing international trade agreements strengthen demand for cross-border multimodal corridors. It creates wider opportunities for logistics providers operating across multiple countries.

- For instance, As of early 2025, CMA CGM company uses a variety of reefer container sizes, including 20′, 40′ High Cube, and 45′ PalletWide, to transport perishable and pharmaceutical goods globally. Its fleet includes SMART reefer technology for real-time cargo monitoring

By Services:

Fleet management plays a crucial role in ensuring efficient vehicle use and reduced downtime. It enables operators to optimize capacity and maintain reliability in daily operations. Intermodal terminals act as the backbone of multimodal systems by managing cargo transfers between transport modes. Transportation and warehousing services offer value-added benefits, including storage and distribution, that improve supply chain flexibility. Freight routing and scheduling enhance reliability by optimizing delivery times across long routes. The Intermodal Freight Transportation market also includes other specialized services such as customs handling, which supports cross-border efficiency. It ensures that service diversity strengthens the competitive landscape for global logistics providers.

Segments:

Based on Type:

- Road-rail

- Road-water

- Road-air

- Others

Based on Operation:

- Domestic Intermodal

- International Intermodal

Based on Services:

- Fleet Management

- Intermodal Terminals

- Transportation & Warehousing Services

- Freight Routing & Scheduling

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Intermodal Freight Transportation market with 35%. Strong integration of rail and trucking networks across the United States, Canada, and Mexico supports regional dominance. It benefits from established infrastructure such as Class I railroads and advanced highway systems. The United States leads the region through its extensive freight rail corridors that connect ports with inland hubs. It allows shippers to move bulk goods, manufactured products, and consumer goods efficiently. Trade agreements like USMCA further enhance cross-border intermodal activity. Growth in e-commerce and distribution hubs across key states strengthens market presence in this region.

Europe

Europe accounts for 28% of the global Intermodal Freight Transportation market. It benefits from highly developed rail infrastructure and government policies favoring sustainable transport. Countries such as Germany, France, and the Netherlands invest heavily in intermodal terminals and green logistics corridors. It supports the EU’s climate goals by reducing reliance on road-only freight. Cross-border coordination between European nations improves connectivity for both domestic and international supply chains. Adoption of rail-water combinations in ports like Rotterdam and Hamburg boosts cargo efficiency. Expansion of trans-European networks ensures long-term growth for regional intermodal operations.

Asia Pacific

Asia Pacific represents 25% of the Intermodal Freight Transportation market, supported by rapid industrialization and export-driven economies. China leads the region with vast railway investments, including the Belt and Road Initiative. It enables stronger connections between inland production centers and major coastal ports. Japan and South Korea focus on advanced logistics technologies that integrate road, rail, and sea transport. India increases adoption through policy support for multimodal logistics parks and freight corridors. Rising e-commerce activity drives demand for faster domestic and international freight services. It ensures continuous expansion of intermodal solutions across both developed and emerging markets in the region.

Latin America

Latin America holds 7% of the global Intermodal Freight Transportation market. Brazil and Mexico dominate with investments in road-rail connectivity and port upgrades. It benefits from improved logistics corridors that connect agricultural exports to international markets. Regional governments emphasize modernization of ports and inland terminals to reduce logistics bottlenecks. Limited infrastructure in smaller economies remains a challenge, but investments continue to improve efficiency. Growth of regional trade partnerships supports cross-border integration between neighboring countries. It strengthens opportunities for expanding intermodal operations in key industrial zones.

Middle East and Africa

The Middle East and Africa together account for 5% of the Intermodal Freight Transportation market. Gulf countries invest in modern ports and logistics hubs that connect to international shipping routes. It benefits from large-scale infrastructure projects such as Saudi Arabia’s Vision 2030 and the UAE’s logistics corridor expansion. Africa focuses on developing rail-road links to support mineral exports and regional trade. Limited infrastructure capacity continues to slow progress in parts of the region. However, rising trade with Asia and Europe increases the need for multimodal solutions. It creates new opportunities for long-term growth in logistics and intermodal freight transport.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Blue Yonder, Inc.

- Elemica (Eyefreight BV)

- Oracle Corporation

- The Descartes Systems Group Inc. (Descartes Aljex)

- Transplace, Inc.

- Cognizant Technology Solutions Corp

- WiseTech Global

- GE Transportation (Wabtec Corporation)

- HighJump (Körber AG)

- Motorola Solutions, Inc.

Competitive Analysis

The leading players in the Intermodal Freight Transportation market include Blue Yonder, Inc., Elemica (Eyefreight BV), Oracle Corporation, The Descartes Systems Group Inc. (Descartes Aljex), Transplace, Inc., Cognizant Technology Solutions Corp, WiseTech Global, GE Transportation (Wabtec Corporation), HighJump (Körber AG), and Motorola Solutions, Inc. These companies shape the competitive landscape by offering advanced technology platforms, logistics management tools, and integrated supply chain solutions. Their strategies focus on optimizing intermodal operations through software innovation, automation, and real-time visibility. Competition centers on providing cost-efficient, reliable, and sustainable freight management solutions. Established players strengthen their presence by expanding partnerships with logistics providers and enhancing digital platforms for improved cargo tracking. Integration of AI, IoT, and predictive analytics plays a key role in driving operational efficiency across networks. Companies invest in innovation to address challenges like coordination between modes and increasing regulatory compliance. Strategic mergers, acquisitions, and collaborations support market consolidation and global reach. The competitive environment remains dynamic, with technology adoption and sustainability emerging as core differentiators. Players that deliver seamless intermodal connectivity and scalable digital solutions will secure stronger positions in the evolving market.

Recent Developments

- In 2025, Freight Technologies, Inc. integrated its Fr8App platform with Blue Yonder’s Transportation Management System (TMS) for Bayer Crop Science via Electronic Data Interchange. This integration aims to streamline logistics, improve shipment visibility, and reduce manual processes

- In 2025, Blue Yonder acquired Pledge Earth Technologies Ltd. (“Pledge”) to enhance its supply chain platform with accredited carbon emissions reporting capabilities. This move expands sustainability tracking across all transport modes

- In 2024, Oracle announced new AI and machine learning enhancements to its Oracle Transportation Management Cloud. These enhancements aim to improve real-time decision-making and efficiency in intermodal transportation

Report Coverage

The research report offers an in-depth analysis based on Type, Operation, Services and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand through stronger integration of digital tracking and AI-driven platforms.

- Governments will continue investing in rail and port infrastructure to improve intermodal efficiency.

- Sustainability targets will increase reliance on rail and water transport over road-only freight.

- Cross-border trade agreements will boost international intermodal corridors and regional connectivity.

- Cold-chain logistics will see higher demand for reefer containers in food and pharma supply.

- E-commerce growth will drive faster adoption of flexible intermodal delivery models.

- Private operators will focus on expanding terminal capacity and fleet modernization.

- Emerging markets will invest in multimodal hubs to support industrial and export growth.

- Automation in scheduling and customs clearance will reduce delays in freight movement.

- Hybrid and electric trucks will enhance last-mile integration within intermodal supply chains.