Market Overview:

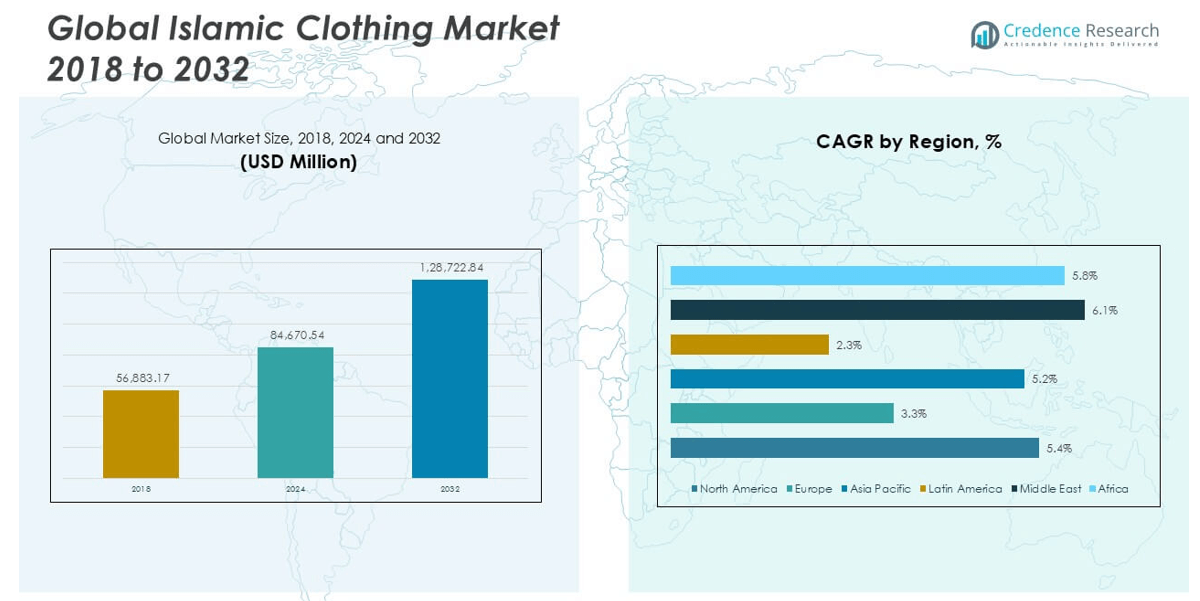

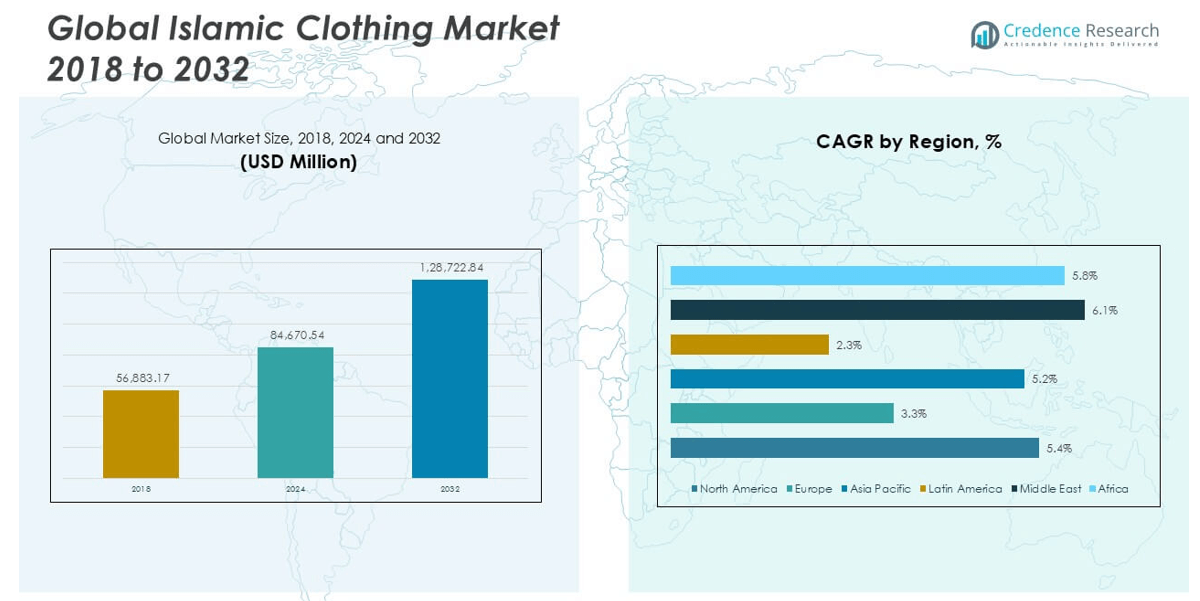

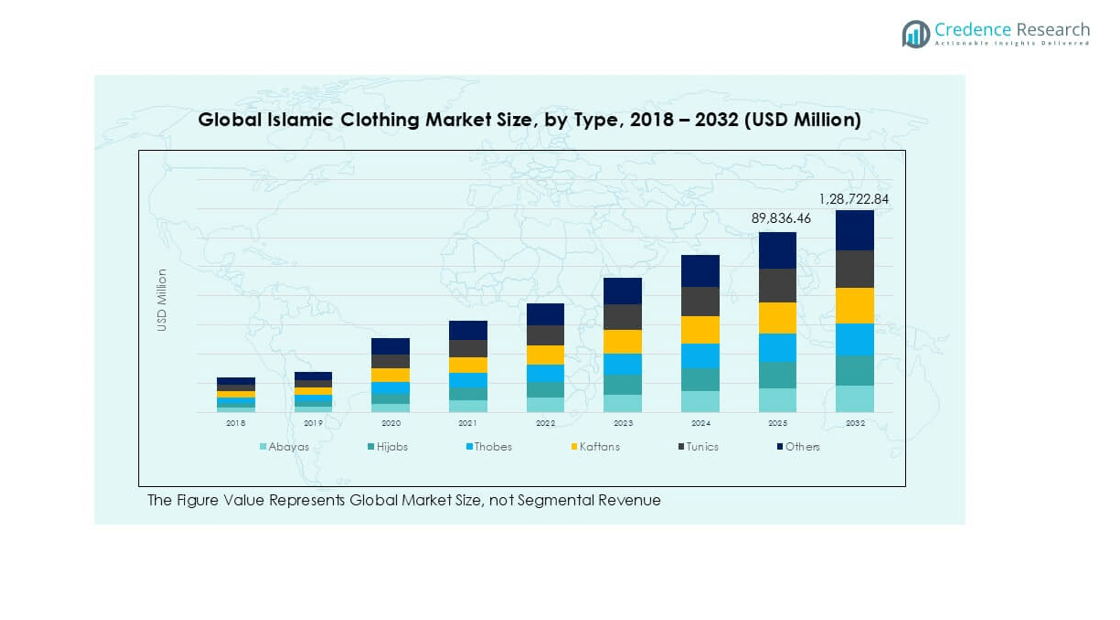

The Islamic Clothing market size was valued at USD 56,883.17 million in 2018, increased to USD 84,670.54 million in 2024, and is anticipated to reach USD 128,722.84 million by 2032, at a CAGR of 5.27% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Islamic Clothing Market Size 2024 |

USD 84,670.54 million |

| Islamic Clothing Market, CAGR |

5.27% |

| Islamic Clothing Market Size 2032 |

USD 128,722.84 million |

The Islamic clothing market features a diverse range of players, including specialized modest wear brands such as Hayaa Clothing, MYBATUA, Sunnah Style, and AlHannah, alongside global fashion houses like Oscar de la Renta, Tommy Hilfiger, and Chanel that have entered the modest fashion segment. These companies compete through product innovation, regional customization, and expanding digital presence. The Middle East dominates the global market, accounting for 32.9% of the total share in 2024, driven by strong cultural adherence, high spending capacity, and demand for both traditional and luxury modest apparel.

Market Insights

- The Islamic clothing market was valued at USD 56,883.17 million in 2018, reached USD 84,670.54 million in 2024, and is projected to grow to USD 128,722.84 million by 2032, at a CAGR of 5.27% during the forecast period.

- The market is driven by the rising global Muslim population, growing awareness of modest fashion, and increasing demand for culturally rooted yet contemporary apparel styles.

- Trends such as the expansion of e-commerce platforms, designer collaborations, and the adoption of sustainable and ethical fashion practices are influencing consumer preferences and reshaping product offerings.

- Competitive dynamics include key players like Hayaa Clothing, MYBATUA, Sunnah Style, and AlHannah, along with luxury brands such as Chanel, Oscar de la Renta, and Tommy Hilfiger entering the modest wear space.

- The Middle East leads with 32.9% market share in 2024, followed by Africa at 24.6% and Asia Pacific at 18.3%, while abayas dominate by type and daily wear by application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

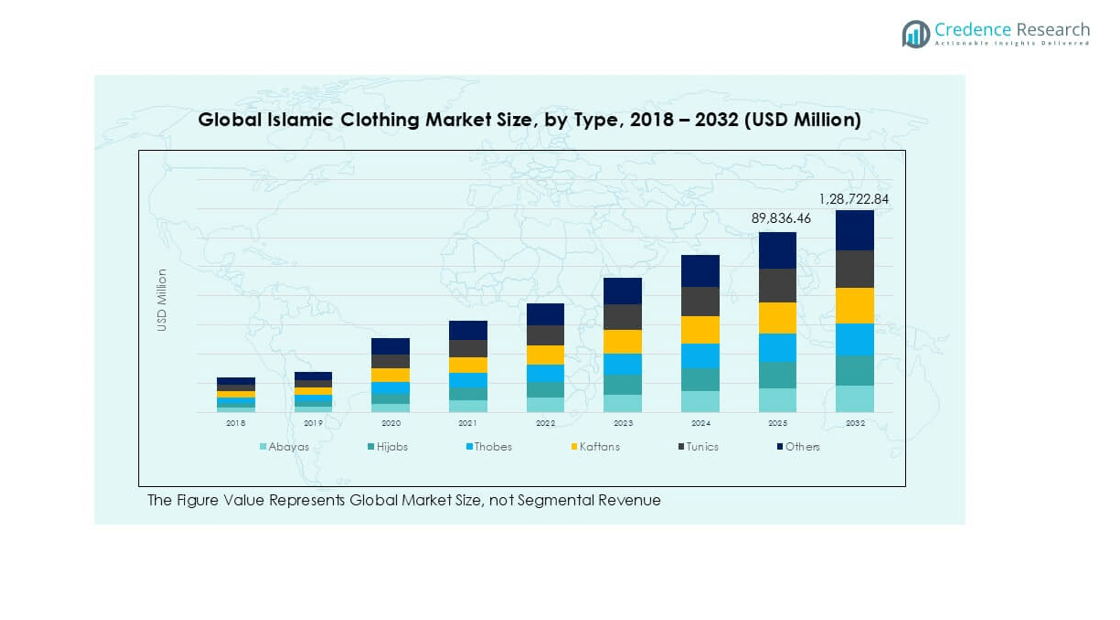

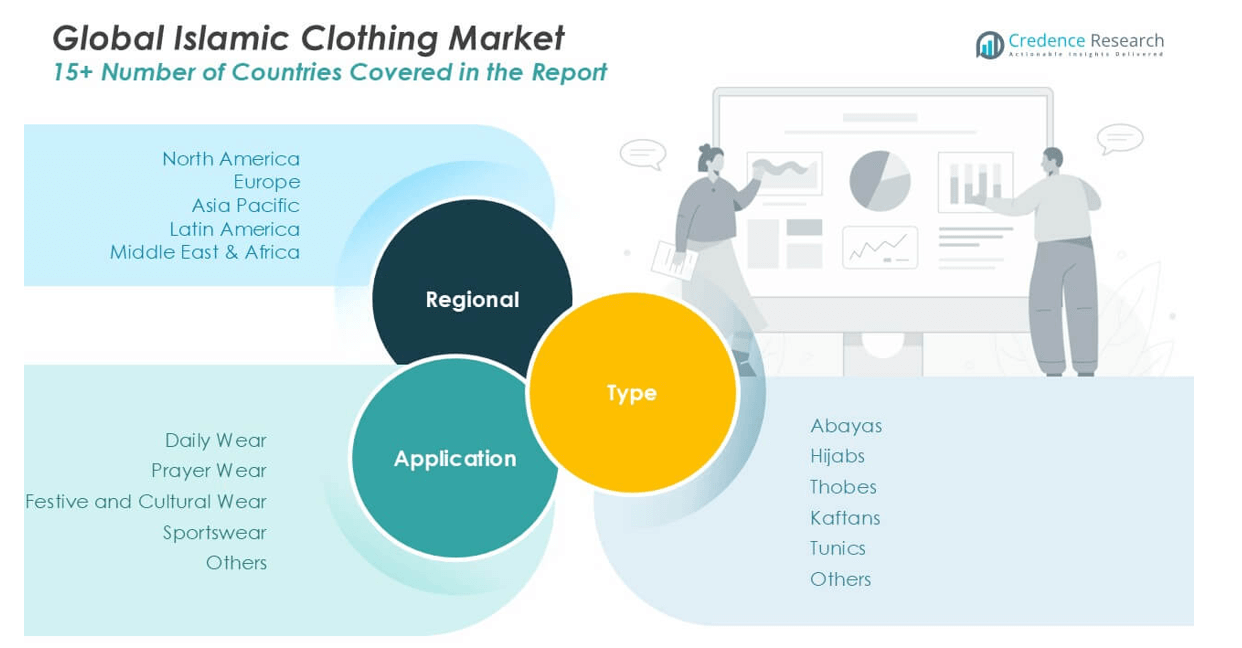

By Type

The Islamic clothing market by type is segmented into abayas, hijabs, thobes, kaftans, tunics, and others. Among these, abayas hold the dominant market share, accounting for a significant portion of total revenue due to their widespread use among Muslim women, particularly in the Middle East and North Africa. The popularity of abayas is driven by their cultural relevance, evolving fashion trends, and increasing availability in modern styles and fabrics. Additionally, the growth of online retail platforms has expanded access to designer abayas, boosting consumer demand across international markets.

- For instance, MYBATUA listed over 1,450 abaya SKUs on its website in 2023 alone, reporting a 63% increase in international orders from the U.S., UK, and UAE markets compared to the previous year.

By Application:

In terms of application, the market is segmented into daily wear, prayer wear, festive and cultural wear, sportswear, and others. Daily wear emerges as the leading sub-segment, holding the largest share due to the consistent and routine demand for modest clothing that aligns with Islamic values. The increasing urban Muslim population and growing awareness about Islamic dress codes contribute to this segment’s dominance. Furthermore, brands are increasingly focusing on comfort, affordability, and style in their daily wear collections, thereby enhancing market penetration and consumer retention.

- For instance, Hayaa Clothing launched its “Essentials” line in 2022 with over 500 SKUs optimized for daily wear, resulting in a 2.3x increase in monthly customer retention and over 80,000 units sold within the first 10 months.

Market Overview

Rising Global Muslim Population

The growing global Muslim population is a primary driver of the Islamic clothing market. As the number of Muslim consumers increases, so does the demand for modest apparel aligned with religious and cultural expectations. According to global demographic trends, significant population growth is anticipated in Muslim-majority regions such as the Middle East, Southeast Asia, and parts of Africa. This expansion creates a robust and sustainable customer base for Islamic clothing, encouraging both established brands and new entrants to diversify product offerings and invest in region-specific fashion innovations.

- For instance, AlHannah Islamic Clothing increased its product localization by introducing 120 new region-specific designs in 2023 tailored for markets in Indonesia and Nigeria, resulting in a 47% year-over-year increase in regional sales.

Expansion of E-commerce and Online Retail

The rapid growth of e-commerce platforms has significantly contributed to the accessibility and availability of Islamic clothing. Online channels enable consumers to access a wide range of modest fashion options regardless of geographic limitations, thereby enhancing market reach. Digital retail platforms also allow brands to offer customized services, style suggestions, and size flexibility. The growing digital literacy and increasing smartphone penetration, particularly in developing economies, further support this trend. As a result, e-commerce continues to be a vital enabler of global Islamic clothing sales and brand visibility.

- For instance, Sunnah Style reported that 82% of its total sales in 2023 came from mobile e-commerce, driven by a fully responsive platform and integration with Instagram Shop and WhatsApp Business API.

Increasing Modest Fashion Awareness Among Non-Muslim Consumers

Modest fashion has gained popularity beyond Muslim communities, driven by broader cultural trends favoring conservative, elegant, and inclusive fashion. Many non-Muslim consumers are increasingly embracing Islamic clothing styles such as kaftans, tunics, and maxi dresses for their aesthetics and comfort. This shift is amplified by social media influencers, fashion bloggers, and global fashion shows that spotlight modest wear. The rising interest from mainstream fashion segments offers brands new market opportunities and reinforces the global appeal of Islamic fashion, thereby accelerating overall market growth.

Key Trends & Opportunities

Designer Collaborations and Fashion Innovation

The Islamic clothing market is experiencing a surge in designer collaborations and high-fashion collections. Leading designers and brands are launching modest wear lines that blend traditional elements with contemporary aesthetics. This trend not only elevates the fashion value of Islamic clothing but also attracts a younger, style-conscious demographic. Innovation in fabric, cuts, and embellishments enhances product appeal and helps brands differentiate themselves in a competitive market. These collaborations present a major opportunity to position Islamic clothing in premium and luxury fashion segments globally.

- For instance, Tommy Hilfiger introduced a Ramadan capsule collection in 2022, featuring 23 modest wear items across five GCC markets, which sold out 65% of its inventory within four weeks of launch.

Sustainable and Ethical Fashion Movement

The growing global focus on sustainability and ethical fashion is influencing consumer preferences in the Islamic clothing market. Consumers are increasingly seeking garments made from organic, eco-friendly, and ethically sourced materials. This aligns well with Islamic principles emphasizing cleanliness, modesty, and ethical practices. Brands that incorporate sustainable practices, such as transparent supply chains and fair labor policies, are likely to gain consumer trust and long-term loyalty. This presents a key opportunity for brands to strengthen their identity while supporting global environmental and social responsibility goals.

Key Challenges

Cultural Sensitivity and Regional Diversity

One of the major challenges in the Islamic clothing market is catering to the vast cultural and regional diversity within the global Muslim community. Preferences for style, color, fabric, and design vary significantly across geographies, making it difficult to standardize offerings. For instance, clothing popular in the Middle East may not align with consumer preferences in Southeast Asia or Sub-Saharan Africa. Brands must invest in localized product development and cultural research to address these variations effectively and avoid potential missteps.

- For instance, Chanel tailored its modest wear collection for the Indonesian market by launching 18 unique pieces through local fashion week collaborations in Jakarta in 2023, resulting in a 3.8x increase in engagement from Southeast Asian consumers.

Counterfeit Products and Unregulated Markets

The widespread availability of counterfeit Islamic clothing products poses a significant challenge for established brands. These unauthorized products, often sold at lower prices in unregulated markets and online platforms, compromise brand reputation and reduce profit margins. Additionally, low-quality counterfeit items can lead to customer dissatisfaction, negatively impacting the credibility of the entire market. Combating this issue requires stronger intellectual property enforcement, consumer education, and improved supply chain traceability.

Price Sensitivity and Limited Brand Loyalty

Price sensitivity remains a concern in the Islamic clothing market, especially in developing countries where disposable income is limited. Many consumers prioritize affordability over brand value, leading to limited brand loyalty and high competition among low-cost providers. As a result, premium and mid-tier brands face challenges in maintaining market share without compromising on quality. Companies must adopt strategic pricing, offer value-added services, and invest in brand differentiation to overcome this hurdle and build long-term consumer relationships.

Regional Analysis

North America:

The Islamic clothing market in North America was valued at USD 6,049.24 million in 2018 and reached USD 8,620.31 million in 2024. It is projected to grow to USD 13,259.74 million by 2032, registering a CAGR of 5.4% during the forecast period. North America accounted for approximately 10.2% of the global market share in 2024. Growth in the region is driven by a rising Muslim population, increasing demand for modest fashion among younger consumers, and expanding multicultural representation. The market benefits from strong e-commerce infrastructure and the presence of both domestic and international modest wear brands.

- For instance, Hayaa Clothing opened its first fulfillment center in New Jersey in 2023, which decreased its average delivery time from 9.2 days to 3.7 days across the U.S. and Canada, leading to a 26% increase in repeat purchases within six months.

Europe:

Europe’s Islamic clothing market was valued at USD 7,066.82 million in 2018 and reached USD 9,653.01 million in 2024. It is expected to grow to USD 12,615.70 million by 2032, reflecting a modest CAGR of 3.3%. In 2024, Europe represented around 11.4% of the global market share. The region’s growth is supported by a well-established Muslim population and increased cultural integration. Demand for stylish, modest apparel is growing, particularly in countries like the UK, France, and Germany. However, market expansion is tempered by regulatory scrutiny and varying cultural attitudes toward religious attire across different EU nations.

- For instance, MYBATUA’s UK-based distribution hub handled over 93,000 European orders in 2023, with 38% of sales attributed to first-time buyers introduced via influencer collaborations targeting British Muslim women aged 20–35.

Asia Pacific:

Asia Pacific held the second-largest share in 2024, accounting for approximately 18.3% of the global Islamic clothing market. The region’s market value rose from USD 9,461.95 million in 2018 to USD 15,450.26 million in 2024 and is projected to reach USD 27,046.60 million by 2032, at a CAGR of 5.2%. The market is driven by large Muslim populations in countries such as Indonesia, Malaysia, and India, coupled with the rapid expansion of modest fashion retail and rising disposable incomes. Increasing digital penetration and social media influence are also enhancing market accessibility and consumer awareness.

Latin America:

The Islamic clothing market in Latin America remains relatively small, with a market size of USD 1,555.19 million in 2018, growing to USD 2,265.17 million in 2024, and projected to reach USD 2,753.74 million by 2032 at a CAGR of 2.3%. In 2024, Latin America contributed 2.7% to the global market share. Growth is modest due to a smaller Muslim demographic, but increasing globalization and niche fashion demands are slowly influencing market development. Brazil and Argentina are key markets with emerging demand for modest wear, particularly among immigrants and younger consumers seeking inclusive and diverse fashion styles.

Middle East:

The Middle East is the largest regional market for Islamic clothing, with a value of USD 18,841.41 million in 2018, increasing to USD 27,841.66 million in 2024. It is projected to reach USD 41,812.20 million by 2032, registering the highest CAGR of 6.1%. The region commanded 32.9% of the global market share in 2024. Demand is primarily fueled by religious adherence, cultural norms, and high per capita spending on apparel. Countries like Saudi Arabia, the UAE, and Qatar lead in both traditional and modern Islamic clothing, with luxury brands and designer collaborations further enhancing market value.

Africa:

Africa’s Islamic clothing market was valued at USD 13,908.56 million in 2018 and reached USD 20,840.13 million in 2024. It is expected to rise to USD 31,234.86 million by 2032, growing at a robust CAGR of 5.8%. In 2024, Africa accounted for 24.6% of the global market share, making it the second-largest regional market. The region’s growth is propelled by a large and youthful Muslim population, increasing urbanization, and a rising interest in culturally rooted fashion. Countries such as Nigeria, Egypt, and Morocco are witnessing rapid market development supported by strong local demand and entrepreneurial activity in modest fashion.

Market Segmentations:

By Type:

- Abayas

- Hijabs

- Thobes

- Kaftans

- Tunics

- Others

By Application:

- Daily Wear

- Prayer Wear

- Festive and Cultural Wear

- Sportswear

- Others

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Islamic clothing market is characterized by a mix of established global fashion houses and specialized modest wear brands competing for market share. Key players such as Hayaa Clothing, MYBATUA, Sunnah Style, and AlHannah focus primarily on traditional and contemporary Islamic apparel, catering directly to the core modest fashion consumer base. These brands emphasize product diversity, affordability, and cultural authenticity. In contrast, international luxury brands like Chanel, Oscar de la Renta, and Tommy Hilfiger have introduced modest wear collections, tapping into the growing global demand for inclusive fashion. Their market entry enhances brand prestige and reaches affluent Muslim consumers, especially in the Middle East and Southeast Asia. Strategic initiatives such as online expansion, influencer collaborations, and sustainable fashion practices are shaping competition. The market also witnesses frequent product innovation and regional customization to meet diverse cultural preferences, positioning customer-centric and digitally agile players at a distinct competitive advantage.

- For instance, Oscar de la Renta’s modest wear collaboration with UAE-based influencer Marwa Al Qassimi in 2023 garnered over 4.2 million impressions within the first week of launch and contributed to a 19% sales spike across their Dubai and Riyadh stores.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hayaa Clothing

- Oscar de la Renta

- Tommy Hilfiger

- MYBATUA

- Sunnah Style

- Chanel

- AlHannah

Recent Developments

- In June 2025, Hayaa Clothing continues to offer a wide selection of modest Islamic clothing, including abayas, jilbabs, hijabs, and prayer dresses. New customer reviews indicate ongoing product releases and updates, with notable releases in April 2025 including the “HC ANISA Printed With Solid Front Cap Premium One-Piece Hijab” and the “Rose Pink Jersey Maxi Dress”.

- In June 2025, Tommy Hilfiger is still recognized for its pioneering 2020 launch of the first hijab, a move that signaled a significant step towards inclusivity in mainstream fashion. This initiative continues to be cited as an important milestone for global brands embracing Islamic clothing. While the launch was a notable moment, some observers note that it’s just a small part of a larger shift towards more inclusive and modest fashion offerings.

- In August 2024, Alhaya Fashion, a leading online retailer of traditional Emirati clothing, launched its new Women’s Abaya Collection featuring elegant and modest designs suitable for all occasions. This launch is expected to further solidify Alhaya Fashion’s influence in the growing modest fashion market.

- In February 2023, Noon, a U.A.E.-based e-commerce company, acquired Namshi for an undisclosed amount, aiming to enhance its digital ecosystem by expanding its fashion and lifestyle offerings. This strategic move strengthens Noon’s position as a dominant player in the Middle East’s online fashion sector.

Market Concentration & Characteristics

The Islamic Clothing Market displays a moderately concentrated structure, with a mix of established modest wear brands and global fashion houses operating across key regions. It features strong regional dominance from the Middle East, which holds the largest share due to deep-rooted cultural adherence and high spending power. The market caters to a broad consumer base ranging from traditional to fashion-forward individuals, making product diversification essential. Companies such as Hayaa Clothing, MYBATUA, and AlHannah focus on culturally authentic designs, while luxury brands including Chanel and Oscar de la Renta target premium segments. It reflects distinct regional preferences, influenced by religious norms, climate, and social expectations. Online retail channels and social media platforms strengthen brand visibility and reach, supporting growth across both developed and emerging economies. Consumers show increasing interest in sustainable, ethically produced clothing, prompting companies to adopt transparent practices. Innovation in design and fabric remains a key competitive factor across market segments and regions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Islamic clothing market will continue to grow steadily due to rising demand for modest fashion among Muslim and non-Muslim consumers.

- Online retail platforms will play a crucial role in expanding the reach of Islamic apparel across global markets.

- Brands will increasingly adopt sustainable and ethical manufacturing practices to meet consumer expectations.

- Demand for modern and stylish Islamic wear will rise, especially among younger and urban Muslim populations.

- Regional customization of designs will become more prominent to cater to diverse cultural preferences.

- Luxury fashion houses are expected to expand their modest wear collections to tap into high-income Muslim markets.

- Social media and influencer marketing will shape consumer choices and drive brand engagement.

- Collaborations between traditional designers and contemporary labels will result in more innovative offerings.

- Technological integration in production and marketing will enhance efficiency and customer experience.

- Africa and Asia Pacific will emerge as key growth regions due to demographic strength and increasing fashion awareness.