Market Overview:

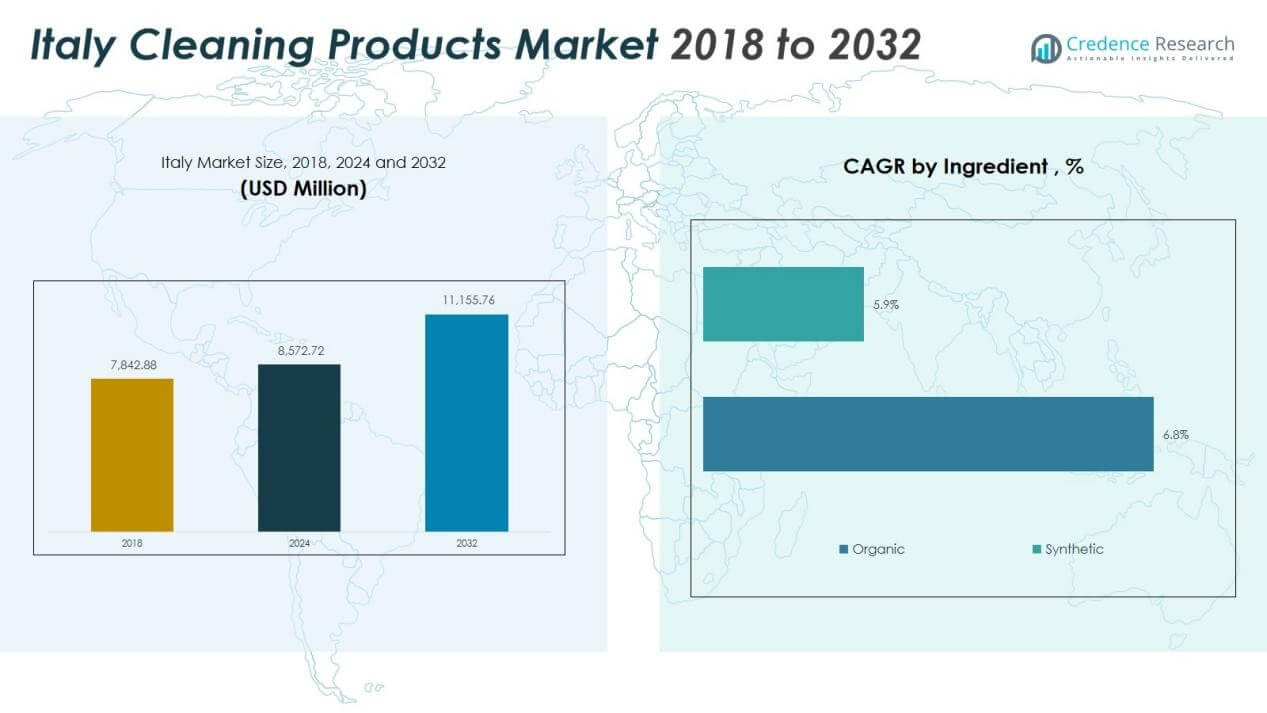

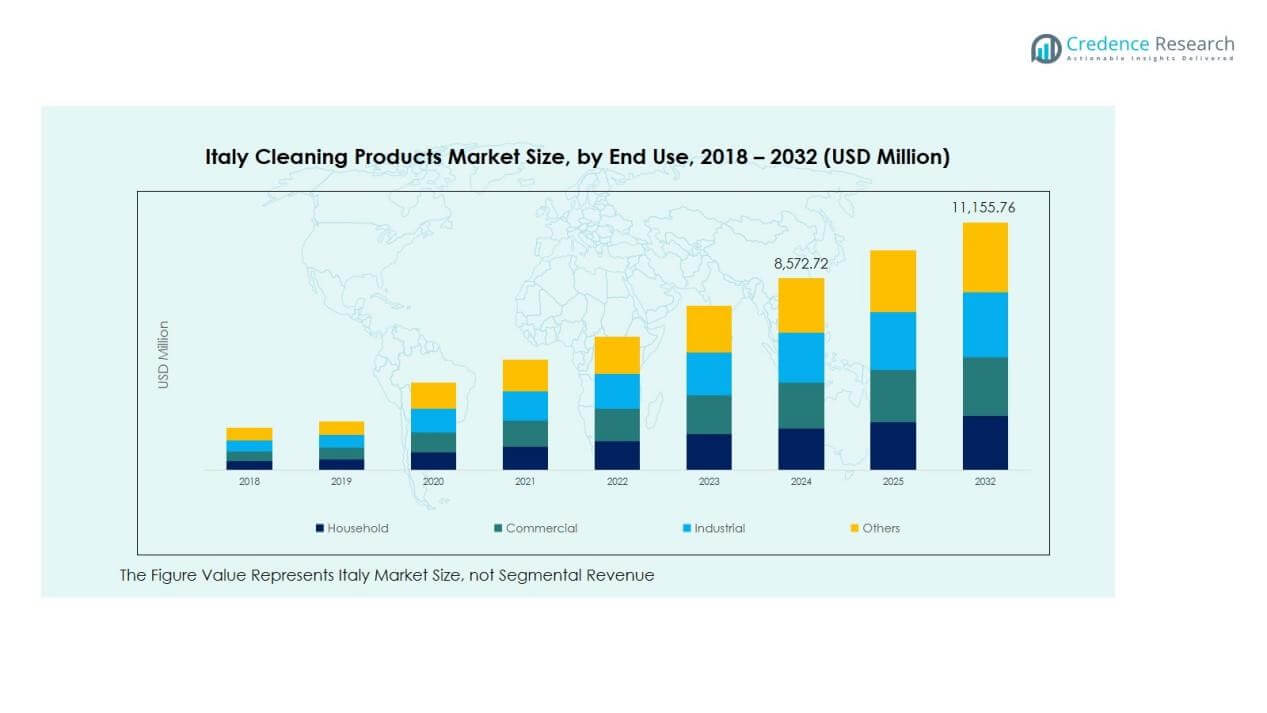

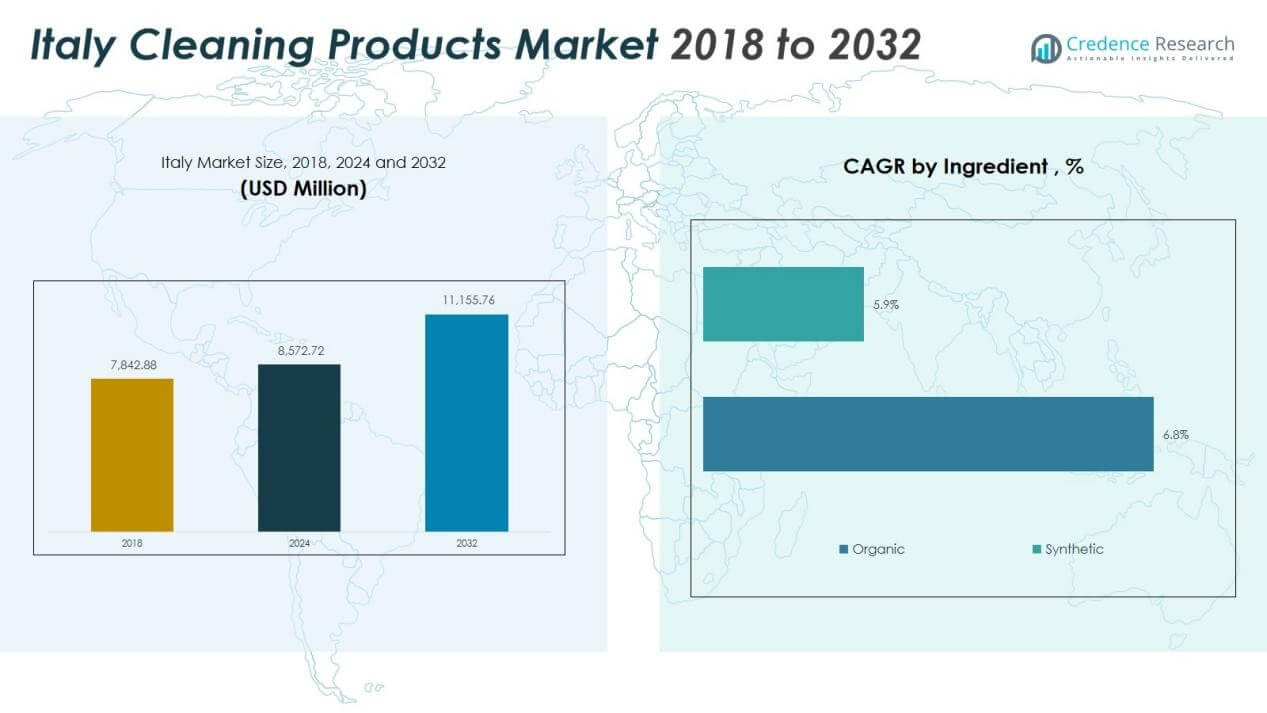

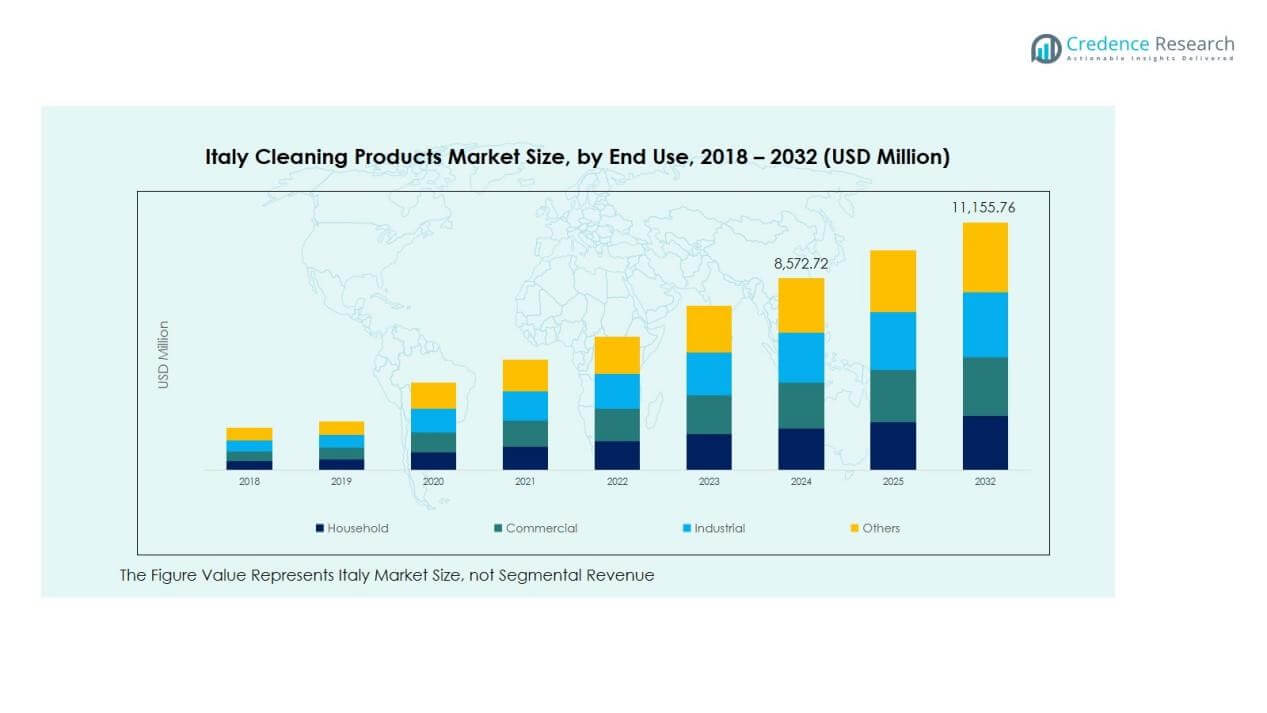

The Italy Cleaning Products Market size was valued at USD 7,842.88 million in 2018 to USD 8,572.72 million in 2024 and is anticipated to reach USD 11,155.76 million by 2032, at a CAGR of 3.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Cleaning Products Market Size 2024 |

USD 8,572.72 Billion |

| Italy Cleaning Products Market, CAGR |

3.35% |

| Italy Cleaning Products Market Size 2032 |

USD 11,155.76 Billion |

Key factors driving the market include heightened awareness of hygiene, particularly post-pandemic, which has increased demand for disinfectants and surface cleaners. Additionally, there is a growing consumer preference for eco-friendly, natural cleaning products, which is propelling innovation and premium product offerings. The expansion of e-commerce and the proliferation of discount retail formats and convenience stores have also broadened the reach of cleaning products, further boosting market demand.

In Italy, the market exhibits regional variation. Northern and central Italy, where higher income levels and urbanization rates prevail, dominate the market, with consumers in these areas more inclined to purchase premium and eco-friendly products. Conversely, southern Italy and smaller towns are witnessing slower growth, though opportunities for expansion are emerging as retail modernization and consumer education progress. The market also has a significant import component, with local production being relatively fragmented.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Cleaning Products Market was valued at USD 7,842.88 million in 2018, is projected to reach USD 8,572.72 million by 2024, and is expected to grow to USD 11,155.76 million by 2032, with a CAGR of 3.35%.

- Northern and Central Italy dominate the market with significant shares, driven by higher income levels, urbanization, and preference for premium products, contributing to robust demand for cleaning solutions.

- Southern Italy is the fastest-growing region, with increased urbanization and evolving retail formats driving market expansion, especially in cleaning product adoption in rural areas.

- Surface cleaners hold the largest segment share, followed by toilet cleaners and dishwashing products, reflecting consumer demand for everyday household and commercial cleaning solutions.

- The market is fragmented, with organic and synthetic products capturing substantial shares, as consumers increasingly opt for eco-friendly solutions alongside effective synthetic formulations.

Market Drivers:

Rising Hygiene Awareness

The growing focus on hygiene and sanitation plays a critical role in driving the Italy Cleaning Products Market. The COVID-19 pandemic significantly raised awareness about cleanliness, leading to an increase in demand for disinfectants, surface cleaners, and sanitizers. This heightened hygiene consciousness among consumers continues to sustain market growth, with individuals and businesses prioritizing cleanliness in both residential and commercial spaces. The market is further supported by the ongoing public health campaigns emphasizing the importance of cleanliness for overall well-being.

- For instance, Menikini-General Vapeur, a leading Italian steam technology manufacturer established in 1977, has achieved 99.999% bactericidal efficacy against Staphylococcus aureus through its SDD (Steam Disinfection Device) certified technology, with dry steam generators producing 110 g/min of saturated steam at 185°C, enabling deep sanitization across food processing facilities, healthcare institutions, and commercial environments without reliance on harsh chemicals.

Consumer Preference for Eco-Friendly Products

Sustainability has become a major driver in the Italy Cleaning Products Market. Consumers are increasingly seeking eco-friendly cleaning solutions that are biodegradable and made from natural ingredients. This shift toward environmentally conscious products is pushing manufacturers to innovate and offer more sustainable alternatives. The rising preference for sustainable products aligns with broader global trends of reducing carbon footprints and minimizing environmental impact, benefiting the market for green cleaning solutions.

- For Instance, Henkel aims to reduce virgin plastics from fossil sources in its consumer products by 50% by 2025 and has increased post-consumer recyclate to at least 50% in European liquid detergent and hair care packaging for brands like Persil. In 2020, Henkel released over 400 million bottles made entirely of recycled plastic for its cleaning products.

Expansion of E-commerce Channels

The rise of e-commerce has expanded the accessibility of cleaning products, further driving growth in the Italy Cleaning Products Market. Consumers now have the convenience of purchasing cleaning supplies online, often at competitive prices, with the added benefit of home delivery. This trend has been accelerated by the increasing reliance on online shopping, especially in urban areas. E-commerce platforms provide a wider range of products, including specialty and premium cleaning solutions, helping cater to diverse consumer needs and preferences.

Urbanization and Growing Disposable Income

Urbanization and increased disposable income in Italy contribute significantly to the growth of the cleaning products market. As more people move to cities, demand for cleaning products in both residential and commercial sectors rises. Higher disposable income also allows consumers to spend more on premium cleaning solutions, further boosting market demand. The trend toward urban living and the need for efficient, high-quality cleaning solutions in homes and businesses present substantial growth opportunities for market players.

Market Trends:

Emergence of Biodegradable and Natural Formulations

In the Italy Cleaning Products Market, consumers increasingly select biodegradable and natural‑ingredient options. Manufacturers respond by expanding product lines that feature plant‑based surfactants, low‑chemical formulas and recyclable packaging. Firms also promote certifications such as Ecolabel or eco‑friendly marks to reassure environmentally‑conscious shoppers. Packaging innovation supports minimal‑waste formats and refillable systems that meet evolving demand. The trend pushes companies to integrate sustainability into research, production and branding strategies.

- For Instance, Copma, a leading Italian cleaning company with Ecolabel certification, developed the PCHS® (Probiotic Cleaning Hygiene System), positioning the company as an innovator in sustainable sanitation.

Growth of Digital Commerce and Personalized Cleaning Solutions

The market experiences strong momentum from digital commerce channels and tailored offerings. Online retail platforms widen access to premium, niche and international cleaning brands, making it easier for consumers in Italy to compare and purchase varied products. Subscription services and bundled kits deliver convenience and customisation based on household size, lifestyle or hygiene requirements. Brands use data analytics to propose targeted cleaning solutions for surfaces, fabrics or bacteria control. This focus on channel expansion and personalised productisation strengthens manufacturer‑retailer partnerships and creates differentiated market positioning.

- For instance, Amazon.it contributed to Amazon’s total revenues from all activities in Italy, which were over €11 billion in 2024. In the broader Italian beauty and personal care e-commerce market (which was valued at approximately €1.3 billion in 2023), Amazon is a leading platform, and its sales in this category contribute significantly to its revenue.

Market Challenges Analysis:

Rising Cost Pressures and Raw Material Volatility

The Italy Cleaning Products Market faces significant pressure from increasing raw material and energy costs. Manufacturers report difficulty sourcing key ingredients, which drives up production expenses and limits margin flexibility. Delivery delays and shipping bottlenecks further raise operational risks and reduce reliability of supply chains. Many firms struggle to balance cost inflation while retaining competitive pricing. This dynamic weakens profitability and forces firms to make trade‑offs between quality, cost and availability. Sustained high input costs may slow expansion or innovation across the sector.

Intense Price Sensitivity and Competitive Fragmentation

Price sensitivity among Italian consumers presents another challenge for the Italy Cleaning Products Market. Many buyers opt for private‑label or low‑cost alternatives, which compresses pricing power for established brands. The market also remains highly fragmented with many local manufacturers, which raises competition and complicates consolidation efforts. Ongoing regulatory requirements—such as chemical regulations and eco‑certification—raise compliance costs and disproportionately affect smaller producers. Barriers to scaling up operations and standardising across regions limit industry efficiency. Without strong differentiation or premium positioning, many firms struggle to maintain profitability.

Market Opportunities:

Expansion of Sustainable and Premium Product Segments

The Italy Cleaning Products Market offers promising growth through the development of eco‑friendly and premium offerings. Demand for biodegradable formulas and natural‑ingredient variants continues to rise, allowing brands to command higher price points. It gives manufacturers a chance to differentiate themselves in a crowded marketplace and build brand loyalty. Investment in design, fragrance innovation and premium packaging creates added value and attracts upscale buyers. Supply chain agility supports faster time‑to‑market for high‑end launches. Firms that emphasise sustainability and premium quality can establish stronger positioning across Italian retail channels.

Growth in Digital‑First Channels and Untapped Regional Markets

Online sales and under‑penetrated regional markets represent significant opportunities for the cleaning products sector. The Italy Cleaning Products Market can benefit from e‑commerce expansion, direct‑to‑consumer models and subscription services that reach younger, tech‑savvy shoppers. Rural and southern regions still show lower product uptake, offering space for channel extension and retail modernisation. Targeted partnerships with convenience stores and discount chains help access value‑seeking consumers. Leveraging data analytics enables brands to customise offers by household size, hygiene concern or lifestyle. Strong digital and regional execution will drive incremental volume and market share.

Market Segmentation Analysis:

By Product Type

The Italy Cleaning Products Market is diverse, with various product types catering to specific consumer needs. Surface cleaners hold a significant share, driven by the increasing demand for household and commercial cleaning. Toilet cleaners and dishwashing products also show robust growth due to consistent usage across residential and institutional spaces. Glass and metal cleaners continue to be in demand for both domestic and commercial applications, reflecting a growing focus on specialized surface care. Fabric cleaners and floor cleaners also remain essential in households, contributing steadily to market expansion.

- For instance, Fater S.p.A., through its ACE brand marketed across 38 countries, maintains leadership with its advanced formulation technology that enables consistent effectiveness across varying surface types and water hardness levels, reaching approximately 3 out of 4 Italian households with product presence.

By Ingredient

The market is segmented into organic and synthetic ingredients, with a noticeable shift toward organic cleaning solutions. Consumers are increasingly seeking environmentally friendly and non-toxic alternatives. Organic products, which include plant-based ingredients and biodegradable materials, are gaining popularity due to heightened health awareness and sustainability concerns. Synthetic products, on the other hand, continue to dominate due to their effectiveness and lower cost, appealing to budget-conscious consumers. The balance between these two segments reflects ongoing trends in consumer preferences for both performance and environmental impact.

- For instance, Dr. Bronner’s Pure Castile Liquid Soap utilizes a fully plant-based oil blend composed of saponified coconut, olive, palm kernel, hemp, and jojoba oils with zero synthetic foaming agents, achieving readily biodegradable status under OECD Guideline 310 testing standards and packaged in 100% post-consumer recycled bottles.

By End-Use

The Italy Cleaning Products Market caters to various end-users, with household cleaning products leading the way. Household usage is driven by increasing hygiene awareness and the growing trend of DIY cleaning. Commercial and industrial sectors also contribute significantly, with cleaning products used in offices, hospitality, and manufacturing environments. The demand in these sectors is driven by the need for effective, large-scale cleaning solutions. Other specialized end-use categories, such as healthcare and foodservice, continue to show growth due to regulatory hygiene standards and specific cleaning requirements.

Segmentations:

By Product Type:

- Surface cleaners

- Toilet cleaners

- Glass & metal cleaners

- Floor cleaners

- Fabric cleaners

- Dishwashing products

- Others (personal care cleaners, building cleaners, etc.)

By Ingredient:

By End-use:

- Household

- Commercial

- Industrial

- Others

By Price Range:

Regional Analysis:

Regional Distribution in the Italy Cleaning Products Market

The Italy Cleaning Products Market shows varied performance across its regions. Northern and central Italy dominate the market, benefiting from higher income levels, urbanization, and strong retail infrastructures. In these regions, consumers have a preference for premium and eco-friendly products, which drives demand for higher-priced cleaning solutions. The market in these areas is also more competitive, with established brands having a stronger presence and more diverse product offerings. Urban areas in the north and center reflect the highest per capita consumption due to more significant disposable income and demand for specialized cleaning products.

Growth in Southern Italy and Rural Regions

Southern Italy and rural regions experience slower but steady growth in the cleaning products market. While these areas have lower levels of disposable income and consumer awareness, there is a growing trend toward modernizing cleaning practices. The market potential is increasing as urbanization spreads, and retail formats evolve, enabling greater product availability. In these regions, consumers tend to opt for more cost-effective cleaning solutions. However, with ongoing consumer education and the introduction of environmentally friendly products, there is an opportunity for market expansion.

Influence of Regional Retail Infrastructure and Distribution Channels

Regional variations in retail infrastructure play a critical role in the market dynamics of the Italy Cleaning Products Market. In more developed regions, such as the north and center, modern retail formats, including e-commerce platforms, supermarkets, and specialized stores, provide extensive distribution networks. These channels enhance product accessibility and consumer convenience. Conversely, in southern and rural regions, the availability of cleaning products remains limited, with traditional outlets dominating. However, the expansion of online retail and the increasing penetration of modern retail formats are likely to improve access and boost market growth across all regions.

Key Player Analysis:

Competitive Analysis:

The Italy Cleaning Products Market is highly competitive, with both local and international players striving for market share. Leading companies such as Angelini Industries, MA‑FRA S.p.A., Henkel AG & Co. KGaA, and Procter & Gamble Co. dominate the sector, each offering a diverse range of cleaning solutions. These companies maintain a strong presence by continuously innovating their product offerings, improving performance, and expanding their distribution networks. They focus on premium segments, eco-friendly formulations, and specialized cleaning solutions to meet the growing demand for sustainable and effective products. The market also witnesses significant competition from smaller, local brands offering budget-friendly options. Large players use strategic developments like mergers, acquisitions, and regional expansions to strengthen their position. As consumer preferences evolve, companies in the Italy Cleaning Products Market must adapt quickly to maintain market relevance and meet shifting demands for sustainability and product performance.

Recent Developments:

- In March 2025, Procter & Gamble launched the Always Pocket Flexfoam and became the first-ever period care partner at Coachella.

- In October 2025, Henkel announced an expansion of its strategic partnership with Dow to decarbonize its adhesives portfolio by integrating low-carbon feedstocks and renewable electricity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient, End-use and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Italy Cleaning Products Market is expected to experience continued growth driven by evolving consumer preferences and environmental awareness.

- Urbanization and increasing disposable income will further boost demand for cleaning products, particularly in premium segments.

- Eco-friendly and sustainable product offerings will become more prevalent as consumers demand cleaner, greener alternatives.

- Technological advancements in cleaning formulations and packaging will continue to shape the market, with an emphasis on performance and environmental impact.

- The rise of e-commerce and digital retail platforms will expand product reach, providing consumers with more convenient purchasing options.

- There will be a growing focus on personalized cleaning solutions, with brands offering tailored products for specific consumer needs.

- The shift towards organic and plant-based cleaning ingredients will strengthen as part of broader environmental and health-conscious trends.

- Regulatory standards regarding product safety and environmental impact will continue to influence market dynamics and drive innovation.

- The southern and rural regions of Italy will present increasing growth opportunities as urbanization and modern retail formats expand.

- Competition will intensify, with both global and local players adopting strategies such as mergers, acquisitions, and product diversification to maintain their market positions.