| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Human Insulin Market Size 2023 |

USD 581.29 Million |

| Italy Human Insulin Market, CAGR |

3.20% |

| Italy Human Insulin Market Size 2032 |

USD 772.40 Million |

Market Overview

Italy Human Insulin Market size was valued at USD 581.29 million in 2023 and is anticipated to reach USD 772.40 million by 2032, at a CAGR of 3.20% during the forecast period (2023-2032).

The Italy Human Insulin market is primarily driven by the rising prevalence of diabetes, an aging population, and growing awareness regarding effective diabetes management. Increasing adoption of advanced insulin delivery devices, such as insulin pens and pumps, is enhancing patient compliance and driving market expansion. Government initiatives promoting early diagnosis and improved access to treatment further support market growth. Additionally, a shift toward biosimilar insulin products is reducing treatment costs and increasing availability, particularly through public healthcare systems. The market also benefits from ongoing research and development efforts aimed at improving insulin formulations for better efficacy and reduced side effects. Technological advancements and digital health integration, including smart insulin devices and mobile health applications, are creating new opportunities for market players. As healthcare infrastructure continues to improve across Italy, the demand for efficient and accessible insulin therapies is expected to grow steadily, reinforcing the market’s positive long-term outlook.

The Italy Human Insulin market is geographically diverse, with significant demand concentrated in the northern regions, such as Milan, Turin, and Venice, where advanced healthcare infrastructure and higher patient awareness drive insulin adoption. Central Italy, including Rome and Florence, also plays a key role, benefiting from strong public health policies and healthcare accessibility. Southern Italy, with cities like Naples and Palermo, faces challenges related to economic constraints and limited access to advanced therapies, though efforts to improve diabetes care are underway. Insular Italy, comprising Sicily and Sardinia, represents a smaller yet growing market, with increasing digital health initiatives enhancing accessibility. Key players in the market include global pharmaceutical giants like Novo Nordisk, Eli Lilly, and Sanofi, which dominate insulin production and distribution. Additionally, companies such as Pfizer, Biocon, and MannKind Corporation are contributing to the competitive landscape with biosimilars and alternative insulin therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Human Insulin market was valued at USD 581.29 million in 2023 and is projected to reach USD 772.40 million by 2032, growing at a CAGR of 3.20% from 2023 to 2032.

- The global human insulin market was valued at USD 21,000 million in 2023 and is projected to reach USD 31,208 million by 2032, growing at a CAGR of 4.50% from 2023 to 2032.

- The rising prevalence of diabetes, particularly Type 2 diabetes, is a significant market driver, increasing demand for effective insulin therapies.

- Technological advancements in insulin delivery systems, such as smart pens and insulin pumps, are driving market growth.

- The shift towards biosimilars and insulin analogs offers more affordable and efficient treatment options, contributing to market expansion.

- Major players like Novo Nordisk, Eli Lilly, and Sanofi dominate the market with a wide range of insulin products and delivery devices.

- Southern Italy faces challenges in access to advanced insulin therapies due to economic constraints and limited healthcare resources.

- Growing awareness, government initiatives, and digital health tools are improving insulin access in underdeveloped regions of Italy.

Report Scope

This report segments the Italy Human Insulin Market as follows:

Market Drivers

Rising Prevalence of Diabetes

One of the primary drivers of the Italy Human Insulin market is the rising prevalence of diabetes, particularly Type 2 diabetes, which accounts for the majority of cases. For instance, as of 2023, almost 3.7 million individuals were suffering from diabetes in Italy, with most of them aged 75 years or older. According to national health statistics and international studies, lifestyle-related factors such as unhealthy diets, physical inactivity, and obesity have contributed significantly to the growing number of diabetes patients in Italy. An aging population further intensifies this trend, as elderly individuals are more susceptible to metabolic disorders. With the increasing burden of diabetes, the demand for effective and accessible insulin therapies is escalating, fueling market growth. Healthcare professionals and public health authorities are emphasizing early diagnosis and consistent treatment, which further reinforces the need for reliable insulin products across the country.

Government Support and Public Healthcare Infrastructure

Italy’s robust public healthcare system plays a significant role in driving the human insulin market. For instance, Italy has a well-developed system of diabetes care, with numerous diabetes centers throughout the country and treatment provided free at the point of delivery. The government has implemented several initiatives aimed at improving diabetes care, including subsidized access to essential medications like insulin, educational programs on disease management, and nationwide screening campaigns. These policies reduce the financial burden on patients and promote consistent usage of insulin therapy. Moreover, regional health authorities work in coordination with public hospitals and pharmacies to ensure that insulin is readily available and affordable. This systematic support encourages adherence to treatment regimens, which contributes directly to stable market demand. Continued policy-level commitment to chronic disease management is expected to further strengthen the insulin supply chain and support long-term market expansion.

Technological Advancements in Insulin Delivery

Technological innovation is another key driver shaping the Italy Human Insulin market. The adoption of user-friendly insulin delivery devices, such as insulin pens and smart pumps, is rising rapidly among patients and healthcare providers. These technologies offer improved accuracy, convenience, and comfort, which significantly enhance patient compliance and therapeutic outcomes. Integration of digital health solutions—such as mobile apps for dose tracking and glucose monitoring—also supports better disease management. Additionally, pharmaceutical companies are investing in the development of ultra-rapid and long-acting insulin analogs, which provide greater flexibility in treatment schedules and reduce the risk of complications. These advancements are not only increasing the effectiveness of treatment but are also expanding the patient base willing to adopt insulin therapy.

Emergence of Biosimilars and Competitive Pricing

The increasing availability of biosimilar insulin products is reshaping the competitive landscape and driving growth within the Italian market. Biosimilars offer comparable efficacy and safety to original branded insulins but at significantly lower costs. This cost-effectiveness is particularly valuable within Italy’s publicly funded healthcare system, where budget constraints and economic considerations influence treatment adoption. As regulatory frameworks evolve to support faster approval and market entry of biosimilars, more patients can benefit from affordable insulin therapies. In turn, this encourages widespread adoption across diverse patient demographics. Pharmaceutical companies are leveraging strategic partnerships and local manufacturing capabilities to enhance supply chain efficiency and ensure broad market penetration, reinforcing this trend as a major driver of long-term market development.

Market Trends

Technological Advancements in Insulin Delivery Systems

The Italian Human Insulin market is experiencing a notable transformation driven by continuous advancements in insulin delivery technologies. For instance, Italy’s insulin devices market is witnessing a surge in technological innovations, including smart insulin pens, continuous glucose monitors (CGMs), and insulin pumps. Smart pens can track dosages and connect to mobile applications, enabling users and healthcare providers to monitor usage patterns and optimize treatment regimens. Meanwhile, insulin pumps particularly patch pumps and hybrid closed-loop systems are gaining popularity due to their ability to automate and fine-tune insulin administration based on real-time glucose readings. These devices improve treatment precision and patient comfort, especially for those requiring multiple daily injections. As digital health adoption grows in Italy, integrated diabetes management solutions combining CGMs, mobile apps, and wearable devices are becoming a critical trend that is reshaping patient behavior and increasing therapy adherence.

Policy Support and Enhanced Public Health Initiatives

Italy’s healthcare policies continue to play a central role in shaping the human insulin market. For instance, Italy’s National Health Service (NHS) ensures that citizens, especially those with diabetes, have unfettered access to essential medicines, devices, and medical services, all without incurring out-of-pocket expenses. National initiatives like the Piano Nazionale Diabete (National Diabetes Plan) focus on early screening, disease prevention, and education to reduce long-term complications. These efforts are particularly targeted at vulnerable populations such as children, the elderly, and low-income groups. Moreover, government-backed regional programs are promoting integrated care models that bring together general practitioners, endocrinologists, and nutritionists to provide comprehensive diabetes care. This supportive regulatory and reimbursement environment significantly boosts insulin adoption and adherence, reinforcing a stable and expanding market.

Transition from Human Insulin to Analogs and Biosimilars

There is a clear shift within the Italian market from traditional human insulin formulations to more advanced insulin analogs and biosimilars. Insulin analogs, such as rapid-acting and long-acting variants, offer better pharmacokinetic profiles, allowing for improved glycemic control, fewer hypoglycemic events, and greater flexibility in dosing schedules. Patients and clinicians increasingly prefer these analogs for their convenience and enhanced efficacy. Alongside this, the growing introduction of biosimilar insulins—cost-effective alternatives to originator biologic drugs—is a major market trend. Biosimilars provide similar therapeutic benefits at a lower price point, making insulin therapy more accessible across diverse socio-economic groups. Regulatory bodies in Italy and the broader EU are supporting this trend by streamlining approval processes and encouraging the use of biosimilars in national healthcare programs, which in turn helps manage healthcare costs without compromising treatment quality.

Strategic Collaborations and Market Expansion

The Italian Human Insulin market is also benefiting from increasing collaboration between pharmaceutical companies, biotech firms, and digital health startups. These partnerships are driving innovation and accelerating the development of next-generation insulin formulations and delivery systems. Major players are investing in research and development, forming alliances to co-develop products tailored to specific patient needs, and entering strategic agreements to expand distribution networks. Furthermore, international companies are targeting the Italian market by offering localized solutions, collaborating with domestic healthcare providers, and aligning their products with national health guidelines. Such collaborations not only enhance the competitive landscape but also broaden the range of available insulin therapies, ensuring that the market continues to evolve in line with clinical and patient-driven demand.

Market Challenges Analysis

Rising Cost Pressures and Budget Constraints

One of the key challenges facing the Italy Human Insulin market is the growing pressure to manage healthcare costs within a publicly funded system. Despite the availability of human insulin and its biosimilars at relatively lower prices compared to analog insulins, the rising adoption of advanced insulin therapies and delivery devices has significantly increased overall treatment expenditures. These high costs, particularly for long-acting and ultra-rapid insulin analogs, place a burden on regional health authorities responsible for budgeting and procurement. While the Italian government continues to subsidize essential diabetes care, regional disparities in funding and resource allocation can create inconsistency in access to newer treatments. Furthermore, negotiations for pricing and reimbursement between public health agencies and pharmaceutical companies often slow the introduction of innovative products into the market. As a result, balancing cost containment with the growing demand for advanced therapies remains a persistent challenge.

Regulatory Complexity and Limited Patient Awareness

Another significant hurdle in the Italian insulin market is the complexity of regulatory procedures and limited public awareness regarding newer insulin options. For instance, Italy adheres to the broader European Medicines Agency (EMA) regulatory framework, but navigating the approval, distribution, and reimbursement processes can be time-consuming and bureaucratic. This can delay the availability of biosimilars and innovative insulin therapies, affecting patient access. Additionally, despite educational initiatives, there remains a gap in awareness and understanding among patients especially in rural or aging populations about the benefits of transitioning from human insulin to analog or biosimilar formulations. Cultural resistance to change, fear of new technology, and limited digital literacy can hinder the adoption of modern insulin delivery systems. These factors collectively slow market penetration for advanced treatments and highlight the need for continuous education, streamlined regulatory support, and equitable healthcare outreach across regions.

Market Opportunities

The Italy Human Insulin market presents substantial opportunities for growth, driven by demographic shifts and increasing awareness of diabetes management. With a steadily aging population and rising incidence of Type 2 diabetes, demand for effective and accessible insulin therapies is expected to grow. This demographic trend offers pharmaceutical companies a chance to expand their reach, particularly by developing tailored products for elderly patients who often require simplified treatment regimens. Moreover, growing awareness campaigns and education efforts initiated by healthcare organizations and patient advocacy groups are contributing to early diagnosis and proactive treatment, thus expanding the patient base. The increasing emphasis on personalized medicine and preventive care creates room for innovation in both insulin formulations and delivery technologies.

In addition, the market is poised to benefit from the ongoing digital transformation in healthcare. The integration of smart insulin delivery systems, mobile health applications, and remote monitoring tools provides a promising avenue for companies to enhance treatment outcomes and differentiate their offerings. Furthermore, the expansion of biosimilar insulin products opens opportunities for manufacturers to offer cost-effective alternatives, especially in a healthcare environment focused on sustainability and value-based care. As Italian regulatory bodies continue to promote biosimilar adoption through streamlined approval processes and favorable pricing policies, companies with strong R&D and manufacturing capabilities are well-positioned to capture market share. Collaborative efforts between local healthcare providers, tech firms, and pharmaceutical companies can further accelerate innovation and improve access to advanced diabetes care across urban and underserved regions. These combined factors present a compelling growth landscape for the Italy Human Insulin market over the coming years.

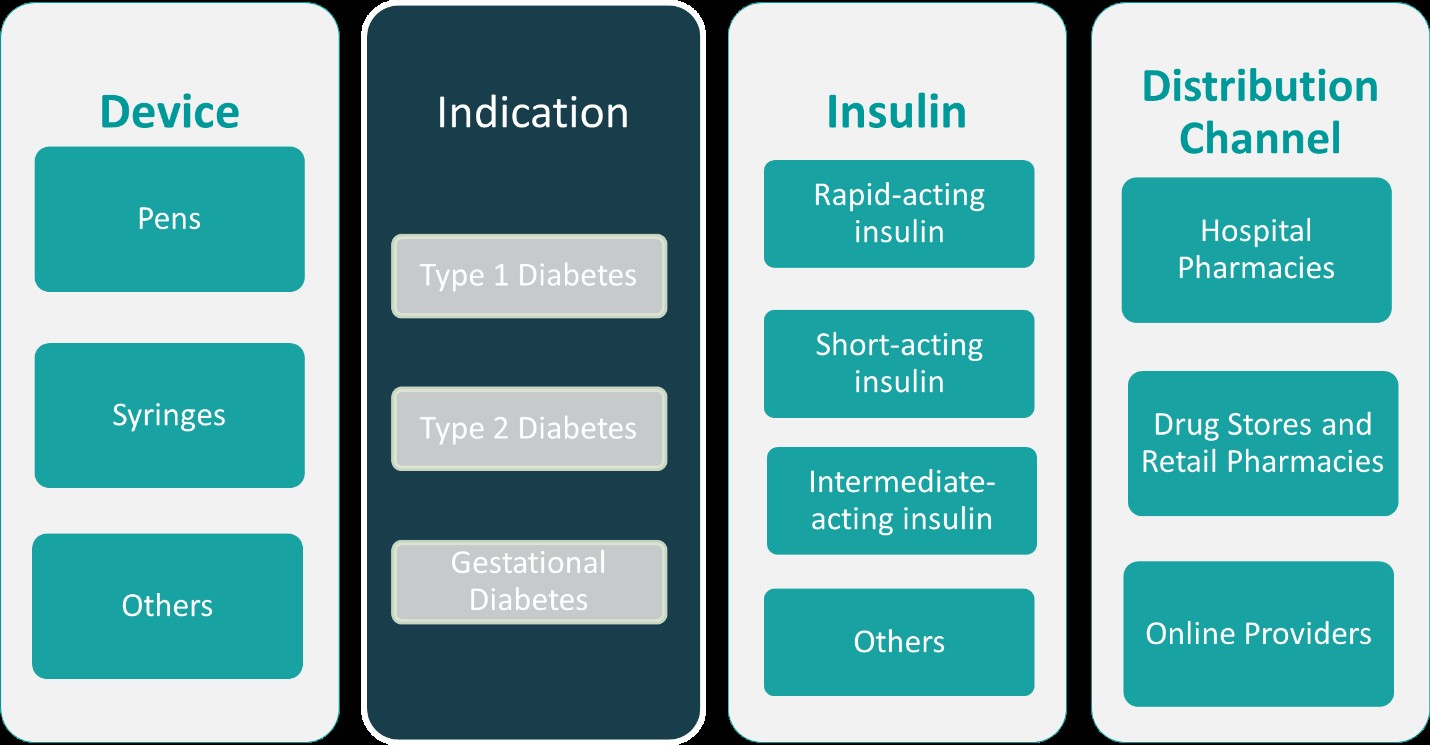

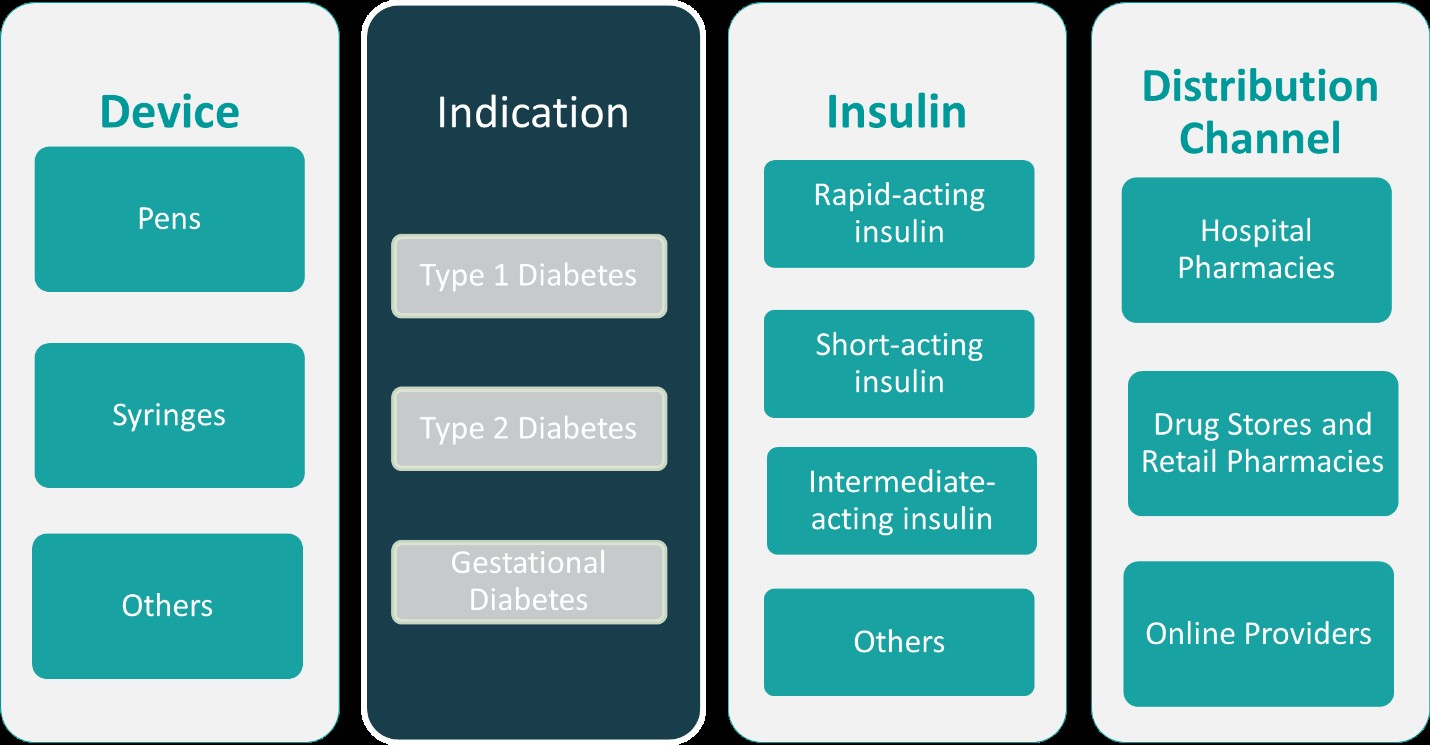

Market Segmentation Analysis:

By Device:

The Italy Human Insulin market is segmented by device into pens, syringes, and others, with insulin pens emerging as the most dominant and rapidly growing segment. Pens are widely preferred by both patients and healthcare providers due to their ease of use, accuracy in dosage, portability, and improved adherence compared to traditional syringes. As self-administration becomes increasingly common, especially among elderly patients and those managing chronic diabetes, pens provide a more patient-friendly alternative. The availability of reusable and pre-filled insulin pens has further increased adoption, particularly in urban settings with better healthcare infrastructure. Syringes continue to hold relevance, especially in hospitals and institutional care settings, due to cost-effectiveness and familiarity among certain patient groups. The “others” segment, including pumps and emerging wearable injectors, is gaining traction with the rise of digital health tools, though its market share remains comparatively smaller. Overall, the growing trend toward convenience and precision is driving the transition from syringes to pen-based insulin delivery.

By Indication:

By indication, the market is categorized into Type 1 Diabetes, Type 2 Diabetes, and Gestational Diabetes, with Type 2 Diabetes accounting for the largest share of insulin usage in Italy. The rising prevalence of Type 2 Diabetes, driven by aging demographics, sedentary lifestyles, and dietary habits, is fueling consistent demand for insulin therapies. Patients often begin with oral antidiabetics but eventually require insulin for long-term glycemic control. In contrast, Type 1 Diabetes patients rely entirely on insulin from the point of diagnosis, contributing to a stable but smaller market segment. Treatment for Type 1 patients is more technology-driven, often involving advanced delivery systems like pumps or smart pens. Gestational Diabetes represents a niche but important segment, requiring temporary insulin therapy during pregnancy. While smaller in volume, this category is growing as awareness and screening rates improve. Overall, increasing focus on early diagnosis and effective insulin regimens across all three indications continues to shape the demand landscape in Italy.

Segments:

Based on Device:

Based on Indication:

- Type 1 Diabetes

- Type 2 Diabetes

- Gestational Diabetes

Based on Insulin:

- Rapid-acting insulin

- Short-acting insulin

- Intermediate-acting insulin

- Others

Based on Distribution Channel:

- Hospital Pharmacies

- Drug Stores and Retail Pharmacies

- Online Providers

Based on the Geography:

- Northern Italy

- Milan

- Turin

- Venice

- Southern Italy

- Naples

- Palermo

- Bari

- Central Italy

- Rome

- Florence

- Bologna

Regional Analysis

Northern Italy

Northern Italy holds the largest share of the human insulin market, accounting for approximately 42% of the national revenue. This dominance is largely driven by advanced healthcare infrastructure, higher population density in urban areas, and greater access to specialized diabetes care. Cities like Milan, Turin, and Venice serve as major medical and pharmaceutical hubs, where early diagnosis and advanced insulin therapies are readily available. The region also benefits from a higher concentration of endocrinologists, diabetes clinics, and research institutions, which contribute to better awareness and management practices. Moreover, Northern Italy’s wealthier demographic supports the adoption of costlier analog insulins and innovative delivery systems such as smart pens and pumps. Government-funded regional programs and consistent public health policies have further reinforced insulin access, making the region a key driver of innovation and growth within the national market.

Central Italy

Central Italy, comprising cities such as Rome, Florence, and Bologna, contributes around 26% of the total human insulin market in Italy. This region benefits from a balanced mix of public healthcare investment and growing private sector participation. Rome, being the capital, serves as an administrative center for national healthcare policy and implementation, offering a structured framework for diabetes care. Public hospitals and academic medical centers in this region often lead government-led awareness campaigns and research programs focused on chronic disease management. Central Italy’s insulin demand is fueled by increasing health consciousness, regular screenings, and efforts to reduce disparities in diabetes care between urban and semi-urban areas. With its growing urban population and focus on innovation, this region is expected to play a larger role in the adoption of biosimilar insulins and digital health tools in the coming years.

Southern Italy

Southern Italy, including cities like Naples, Palermo, and Bari, accounts for an estimated 18% of the Italy human insulin market. While the region has seen improvements in healthcare delivery in recent years, economic constraints and regional disparities continue to limit access to advanced insulin therapies. Public healthcare facilities often face funding limitations, resulting in slower adoption of newer treatment technologies and less consistent patient follow-up. Rural and underserved communities in the south also exhibit lower rates of diagnosis and insulin adherence due to limited health literacy and logistical barriers. Despite these challenges, ongoing government efforts to reduce healthcare inequities and enhance regional capacity are expected to gradually increase the market potential of Southern Italy. Investments in telemedicine and mobile health outreach programs could play a critical role in expanding access to insulin and improving treatment outcomes in the future.

Insular Italy

Insular Italy, encompassing the islands of Sicily and Sardinia, represents the smallest market share at approximately 14%. While population density is lower compared to mainland regions, chronic conditions like diabetes remain a significant public health concern, particularly among aging populations. The region’s geographical isolation presents logistical challenges in the distribution of insulin products and access to specialized care. However, regional healthcare systems have made progress in improving availability through telehealth services, local partnerships, and targeted educational initiatives. Cities such as Palermo and Cagliari are increasingly becoming focal points for public health campaigns aimed at early diabetes detection and treatment. As the infrastructure continues to modernize and digital health becomes more widespread, Insular Italy presents a promising, albeit smaller, opportunity for insulin market growth particularly through biosimilars and compact insulin delivery solutions tailored for remote or resource-limited settings.

Key Player Analysis

- Novo Nordisk A/S

- MannKind Corporation

- Pfizer

- Wockhardt

- Biocon

- Lupin

- Tonghua Dongbao Pharmaceutical Co.

- Eli Lilly and Company

- Sanofi

Competitive Analysis

The Italy Human Insulin market is highly competitive, dominated by several major global players. Novo Nordisk, Eli Lilly, and Sanofi lead the market due to their extensive product portfolios, strong brand recognition, and innovative insulin formulations. Other significant players like Pfizer, MannKind Corporation, Wockhardt, Biocon, Lupin, and Tonghua Dongbao Pharmaceutical Co. are increasing their market presence through biosimilars and affordable insulin alternatives. Many are also incorporating advanced delivery devices, such as smart insulin pens and insulin pumps, to enhance patient convenience and treatment adherence. The adoption of biosimilar insulins is also gaining momentum as companies aim to provide more affordable alternatives to branded insulins, thus addressing cost concerns in the healthcare system. Research and development (R&D) plays a significant role in this competitive landscape, as companies continue to invest in new technologies and insulin formulations to improve efficacy and reduce side effects. In addition, digital health tools, such as mobile apps for insulin tracking and management, are becoming a key differentiator for many players, providing integrated solutions that appeal to tech-savvy patients. Strategic partnerships, collaborations, and acquisitions are common in the industry, as companies look to expand their geographical reach and technological capabilities. Overall, the competition is expected to intensify as both large multinational corporations and smaller biotech firms strive to meet the evolving needs of diabetes patients in Italy.

Recent Developments

- In April 2025, Novo Nordisk announced the discontinuation of Human Mixtard, India’s largest-selling human insulin brand, as part of a global strategy to prioritize newer, patented diabetes and weight loss therapies such as Ozempic and Wegovy. While vial forms of Mixtard, Actrapid, and Insulatard will remain available, pen devices (Penfills and FlexPens) are being phased out, which is expected to disrupt patient access and preference in India.

- In April 2025, Pfizer discontinued the development of danuglipron, its once-daily oral GLP-1 receptor agonist for obesity and type 2 diabetes, following a case of drug-induced liver injury and after reviewing clinical and regulatory feedback. This decision halts further clinical development for both obesity and diabetes indications.

- In March 2025, Biocon Biologics entered a strategic collaboration with Civica, Inc. to expand access to Insulin Aspart in the United States. Biocon will supply the drug substance, which Civica will formulate and commercialize after completing development and clinical trials.

- In December 2024, Lupin acquired the Huminsulin® portfolio in India from Eli Lilly and Company. The range includes Insulin Human (Huminsulin R, NPH, 50/50, and 30/70) and is indicated for type 1 and type 2 diabetes. Lupin had previously marketed these products under a distribution agreement, and the acquisition is aimed at strengthening its diabetes portfolio.

- In November 2024, MannKind’s Afrezza® (insulin human) Inhalation Powder received approval from India’s CDSCO. MannKind expects to ship product to its partner Cipla by the end of 2025.

- In October 2024, Wockhardt filed for approval of its fast-acting insulin analog, Aspart injection (ASPARAPID™), with the Drugs Controller General of India (DCGI). The product, developed indigenously, will be offered in cartridges, vials, and prefilled disposable pens. This expands Wockhardt’s diabetes biosimilars portfolio and addresses a market with limited competition.

Market Concentration & Characteristics

Market concentration in Italy’s human insulin sector is characterized by a few dominant players, with multinational pharmaceutical companies holding significant market share. The industry is largely concentrated in the hands of major global insulin manufacturers, such as Novo Nordisk, Sanofi, and Eli Lilly, which dominate the production and distribution of insulin in the country. These companies benefit from economies of scale, advanced research and development capabilities, and strong brand recognition. The competitive landscape is relatively stable, with limited entry from smaller companies due to the high barriers to entry, including the substantial capital required for research, manufacturing, and regulatory approvals. However, the market also displays a trend towards greater emphasis on biosimilars, which are increasingly gaining traction in Italy. This shift is partly driven by the need to reduce healthcare costs while maintaining effective treatment options for patients with diabetes. Consequently, market dynamics are evolving, though concentration remains high.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Device, Indication, Insulin, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Italy’s human insulin market is expected to see steady growth due to the increasing number of diabetes cases.

- There is a rising demand for innovative insulin products that offer better control and ease of use.

- Research and development investments in Italy are likely to lead to advancements in insulin formulations.

- Italy’s healthcare infrastructure is poised to support increased insulin production and distribution.

- The Italian government’s focus on healthcare improvements will likely boost access to affordable insulin.

- Growing public awareness about diabetes management will contribute to the demand for insulin therapies.

- Italy is expected to experience a shift toward insulin analogs as patients seek more efficient treatments.

- The market for insulin delivery systems, such as pens and pumps, will continue to expand in Italy.

- Italy’s aging population will drive an increase in diabetes-related healthcare needs, including insulin.

- Collaborations between Italian healthcare providers and global pharmaceutical companies will enhance insulin availability.