Market Overview

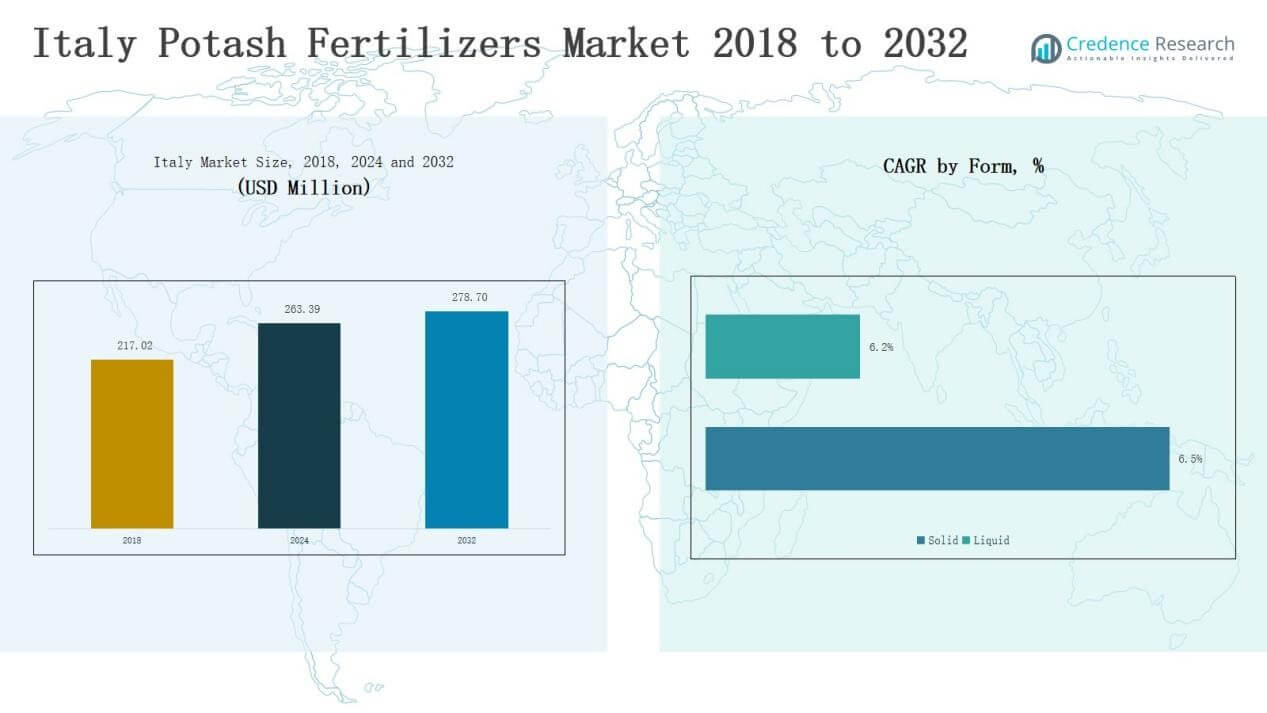

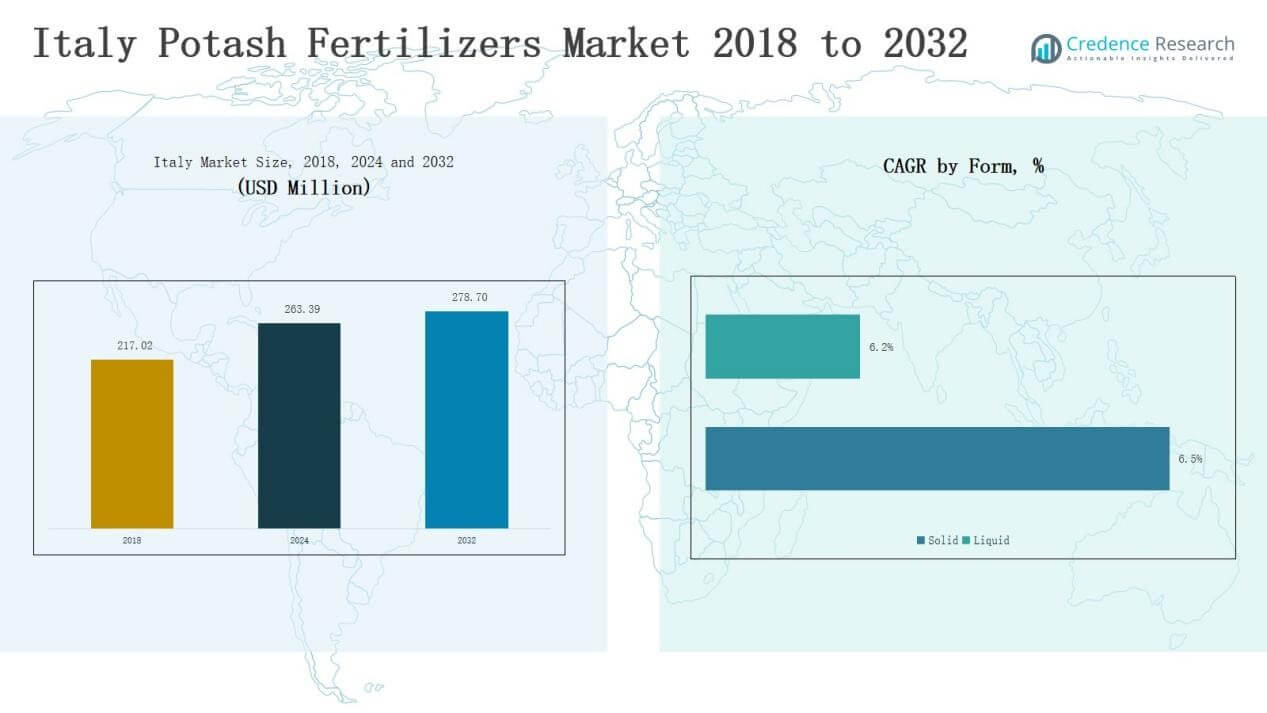

Italy Potash Fertilizers Market size was valued at USD 217.02 million in 2018 to USD 263.39 million in 2024 and is anticipated to reach USD 278.70 million by 2032, at a CAGR of 0.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Potash Fertilizers Market Size 2024 |

USD 263.39 Million |

| Italy Potash Fertilizers Market, CAGR |

0.71% |

| Italy Potash Fertilizers Market Size 2032 |

USD 278.70 Million |

The Italy Potash Fertilizers Market is shaped by a mix of global leaders and domestic suppliers that compete through product innovation, distribution reach, and sustainable practices. Prominent players include Pavoni&C SpA, Arpa S.p.A., HELM AG, The Mosaic Company, Yara International, ICL Group, and K+S Aktiengesellschaft. These companies focus on expanding chloride-free formulations such as sulphate of potash and potassium nitrate to meet the needs of high-value crops, including fruits, vegetables, and vineyards. Northern Italy emerged as the leading region with a 38% share in 2024, driven by extensive cereal and grain cultivation, advanced irrigation systems, and strong adoption of modern farming practices.

Market Insights

- The Italy Potash Fertilizers Market was valued at USD 263.39 million in 2024 and is projected to reach USD 278.70 million by 2032, growing at 0.71% CAGR.

- Potassium Chloride led the type segment with 52% share in 2024, supported by cost efficiency and strong use in cereal and grain cultivation, while sulphate of potash gained demand in fruit and vegetable farming.

- Broadcasting dominated the application method with 48% share in 2024 due to simplicity and lower cost, followed by fertigation driven by greenhouse and irrigation-based crop production.

- Solid formulations accounted for 67% share in 2024, reflecting widespread adoption in field crops, while liquid fertilizers gained momentum in fertigation and foliar applications in vineyards and greenhouses.

- Northern Italy held the leading regional share of 38% in 2024, supported by large-scale mechanized farming, strong vineyard production, and extensive adoption of modern irrigation and fertigation practices.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Potassium Chloride dominated the Italy potash fertilizers market with a 52% share in 2024, supported by its cost efficiency and suitability for large-scale cereal and grain cultivation. Sulphate of Potash held a strong position due to demand from fruit and vegetable growers seeking chloride-free formulations. Potassium Nitrate gained traction in high-value horticultural crops for its dual supply of potassium and nitrogen, while the Others category, including mixed formulations, remained niche. Rising adoption of diversified crop systems and the focus on quality exports further drive differentiated demand across these fertilizer types, reinforcing their long-term role in Italy’s agriculture.

By Application Method

Broadcasting led the segment with a 48% share in 2024, driven by widespread adoption among cereal farmers for its simplicity and lower application cost. Fertigation followed, supported by expanding greenhouse production and irrigation systems in high-value crop regions. Foliar applications gained importance in vineyards and horticulture for targeted nutrient delivery, while Others, such as localized placement, contributed minimally. Increasing emphasis on precision nutrient management and efficiency is expected to boost demand for fertigation and foliar methods, particularly in specialized farming zones across Italy’s central and southern regions.

For instance, Netafim launched its AlphaDisc™ filter line to enhance fertigation efficiency in high-value crops, helping growers reduce clogging and improve irrigation system uniformity.

By Form

Solid fertilizers dominated the market with a 67% share in 2024, reflecting their easy storage, longer shelf life, and extensive use in field crops. Liquid formulations grew steadily, mainly in fertigation and foliar applications, where rapid nutrient uptake and uniform application are critical. Their adoption is increasing in modern farming systems, particularly in vineyards and greenhouse cultivation, although they remain secondary to solids. Expanding investments in greenhouse technology and advanced irrigation will accelerate liquid fertilizer demand, yet the established role of solids secures their dominance in bulk crop production across Italy’s key agricultural regions.

For instance, Yara International introduced its new YaraRega water-soluble NPK fertilizers in Italy, designed specifically for fertigation and drip irrigation systems to optimize nutrient efficiency in greenhouse crops.

Key Growth Drivers

Key Growth Drivers

Rising Demand from High-Value Crops

The growing cultivation of fruits, vegetables, and vineyards in Italy is significantly driving demand for potash fertilizers. Farmers increasingly prefer chloride-free variants such as sulphate of potash and potassium nitrate to enhance crop quality and export competitiveness. The shift toward high-value crops ensures consistent uptake of specialized formulations that improve yield, taste, and shelf life. This trend aligns with Italy’s strong agricultural base focused on premium produce for both domestic and international markets.

For instance, ICL has introduced soluble Potassium Nitrate fertilizers that target horticulture crops in Europe and are chloride-free.

Government Support and Sustainable Practices

Government initiatives promoting sustainable agriculture and efficient fertilizer use have boosted the adoption of balanced nutrient application, including potash fertilizers. Subsidy programs, research-backed recommendations, and training for farmers encourage the use of eco-friendly solutions that reduce soil degradation and enhance crop resilience. Policies aimed at optimizing input efficiency and reducing environmental impact support wider adoption across different crop types. This driver strengthens the alignment between agricultural productivity and long-term sustainability goals in Italy.

Expansion of Precision Farming Technologies

The integration of precision farming tools and digital platforms is improving fertilizer application in Italy. Technologies such as GPS-enabled spreaders, soil testing, and fertigation systems enable accurate dosing of potash fertilizers, reducing wastage and maximizing crop response. Adoption of these practices is rising among commercial farms and cooperatives, particularly in Northern and Central Italy. This shift enhances fertilizer efficiency, lowers costs, and ensures consistent returns, thereby positioning precision agriculture as a strong driver of market growth.

For instance, Topcon’s GPS fertilizer spreaders equipped with torque sensing and section control improved precision in fertilizer placement, particularly by automatically activating or deactivating spreader sections on awkward corners, enhancing fertilizer efficiency for Italian farms.

Key Trends & Opportunities

Shift Toward Specialty Potash Fertilizers

The Italian market is witnessing a notable shift toward specialty potash fertilizers, particularly sulphate of potash and potassium nitrate. These formulations cater to the needs of vineyards, fruits, and vegetable crops, where chloride sensitivity is high. Rising consumer demand for organic and premium-quality produce is fueling the adoption of these products. The trend provides opportunities for companies to expand their chloride-free portfolios and capture a growing segment focused on high-value crops.

For instance, potassium nitrate demand surged in controlled-environment and greenhouse farming applications, supporting simultaneous potassium and nitrogen uptake critical for premium produce.

Growth of Liquid Fertilizer Adoption

Liquid formulations are gaining traction, especially in fertigation and foliar applications within greenhouse and vineyard farming. Farmers prefer liquids for their quick absorption, uniform nutrient distribution, and compatibility with advanced irrigation systems. Although solids dominate the market, this trend presents opportunities for manufacturers to develop innovative liquid solutions tailored to Italian crops. Growing investments in modern irrigation and greenhouse cultivation strengthen the role of liquid potash fertilizers in shaping future growth.

For instacne, ICL Group introduced Solinure FertiMatch liquid fertilizers for greenhouse crops in Southern Europe, integrating advanced fertigation compatibility to improve nutrient efficiency.

Key Challenges

Price Volatility of Raw Materials

The market faces challenges from fluctuating raw material prices, particularly potash ore and related imports. Italy relies heavily on external supply, exposing the sector to global price instability and geopolitical risks. Volatility in input costs can limit farmers’ purchasing capacity and reduce adoption rates of premium formulations. This dynamic impacts profitability for both producers and distributors, creating uncertainty across the supply chain.

Environmental Regulations and Compliance

Stringent European Union regulations on fertilizer use and environmental sustainability pose significant challenges to the market. Restrictions on nutrient runoff, emissions, and soil health preservation demand costly compliance from manufacturers and distributors. Farmers must also adapt their practices, which may increase operational expenses. While regulations support sustainability, they create barriers for small-scale producers and delay the widespread adoption of certain fertilizer formulations in Italy.

Competition from Alternative Nutrients

The rising adoption of organic fertilizers, bio-stimulants, and alternative nutrient sources poses competition to conventional potash fertilizers. Growing consumer preference for organic produce encourages farmers to reduce reliance on chemical-based inputs. Although potash remains essential for crop growth, alternatives often position themselves as cost-effective and environmentally friendly. This trend could slow growth in traditional potash fertilizer demand, particularly in regions with higher adoption of organic farming practices.

Regional Analysis

Northern Italy

Northern Italy dominated the Italy Potash Fertilizers Market with a 38% share in 2024, supported by extensive cultivation of cereals, grains, and high-value vineyards. Farmers in this region adopt both solid and liquid formulations, with fertigation gaining momentum due to advanced irrigation networks. The strong presence of commercial farms and cooperatives further enhances large-scale fertilizer use. Demand for chloride-free products such as sulphate of potash is rising, especially in fruit production zones. Northern Italy continues to lead in mechanized farming practices that drive consistent adoption.

Central Italy

Central Italy held a 27% share in 2024, driven by fruit, vegetable, and olive production. Farmers in this region increasingly prefer potassium nitrate and specialty fertilizers to support crop quality and export standards. Fertigation and foliar applications are expanding due to the prevalence of vineyards and horticulture. The region demonstrates a balanced mix of traditional broadcasting and modern application methods. Central Italy plays a vital role in strengthening the market’s focus on premium crops.

Southern Italy

Southern Italy accounted for a 22% share in 2024, reflecting steady demand from pulses, oilseeds, and horticultural crops. Adoption of potash fertilizers is expanding with the modernization of farming practices, though fragmented land holdings present challenges. Farmers rely heavily on cost-efficient potassium chloride, but uptake of specialty products is gradually increasing. Fertilizer usage is influenced by climatic conditions that demand better soil management. Southern Italy contributes significantly to the market through its large agricultural base.

Islands (Sicily and Sardinia)

The Islands region, including Sicily and Sardinia, captured a 13% share in 2024, driven by fruit, vegetable, and vineyard cultivation. Farmers favor foliar and fertigation methods to optimize nutrient efficiency in greenhouse and orchard systems. Specialty fertilizers such as sulphate of potash hold growing importance due to sensitivity of high-value crops. Limited land area compared to mainland regions influences overall volume, but high adoption in targeted crops ensures market relevance. The Islands highlight niche opportunities for premium formulations.

Market Segmentations:

By Type

- Potassium Chloride

- Sulphate of Potash

- Potassium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By Form

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

By Region

- Northern Italy

- Central Italy

- Southern Italy

- Islands

Competitive Landscape

The Italy Potash Fertilizers Market is characterized by the presence of both international leaders and domestic suppliers competing through product innovation, distribution strength, and sustainable solutions. Global companies such as The Mosaic Company, Yara International, ICL Group, HELM AG, and K+S Aktiengesellschaft maintain a strong footprint through large-scale operations and diversified product portfolios. Domestic players like Pavoni&C SpA and Arpa S.p.A. strengthen competitiveness by addressing region-specific crop needs and providing localized services. Companies focus on expanding chloride-free formulations such as sulphate of potash and potassium nitrate to cater to fruit, vegetable, and vineyard growers. Strategic initiatives include partnerships with cooperatives, investments in precision farming solutions, and improved distribution networks to enhance farmer accessibility. Competitive intensity remains high, with differentiation driven by quality, cost efficiency, and alignment with Italy’s shift toward sustainable and high-value agriculture.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In December 2023, Yara International ASA acquired the organic-based fertilizer business of Agribios Italiana to strengthen its presence in Italy and expand its organic fertilizer portfolio.

- In January 2025, K+S AG introduced its C:LIGHT line of potassium and magnesium fertilizers with up to 90% lower CO₂ emissions, aimed at meeting Europe’s growing demand for sustainable crop nutrition.

- In July 2024, ICL (Israel Chemicals Ltd.) received EU organic certification for its potash fertilizers, enabling Italian organic farmers to legally integrate potassium chloride into certified agricultural practices.

Report Coverage

The research report offers an in-depth analysis based on Type, Application Method, Form, Crop Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chloride-free fertilizers will increase with the expansion of fruit and vegetable cultivation.

- Precision farming adoption will strengthen fertilizer efficiency and reduce input costs for farmers.

- Liquid formulations will gain wider use in vineyards and greenhouse systems across the country.

- Government support for sustainable practices will encourage balanced nutrient application among growers.

- Partnerships between global suppliers and local cooperatives will expand product accessibility.

- Specialty fertilizers such as potassium nitrate will see stronger demand from high-value crops.

- Modern irrigation and fertigation systems will drive higher uptake of potash fertilizers.

- Organic and bio-based alternatives will emerge as competitive products alongside conventional potash.

- Regional demand will remain highest in Northern Italy due to mechanized and large-scale farming.

- Investments in supply chain resilience will reduce dependency on imports and improve availability.

Key Growth Drivers

Key Growth Drivers