Market Overview:

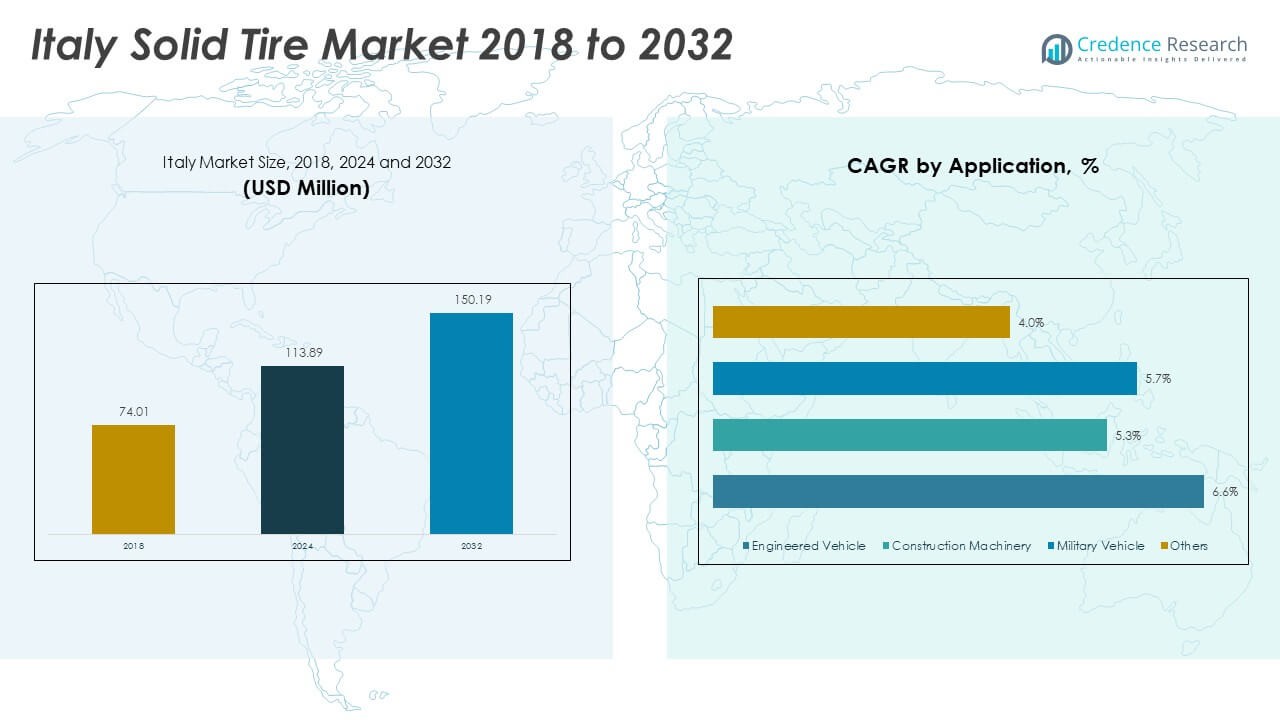

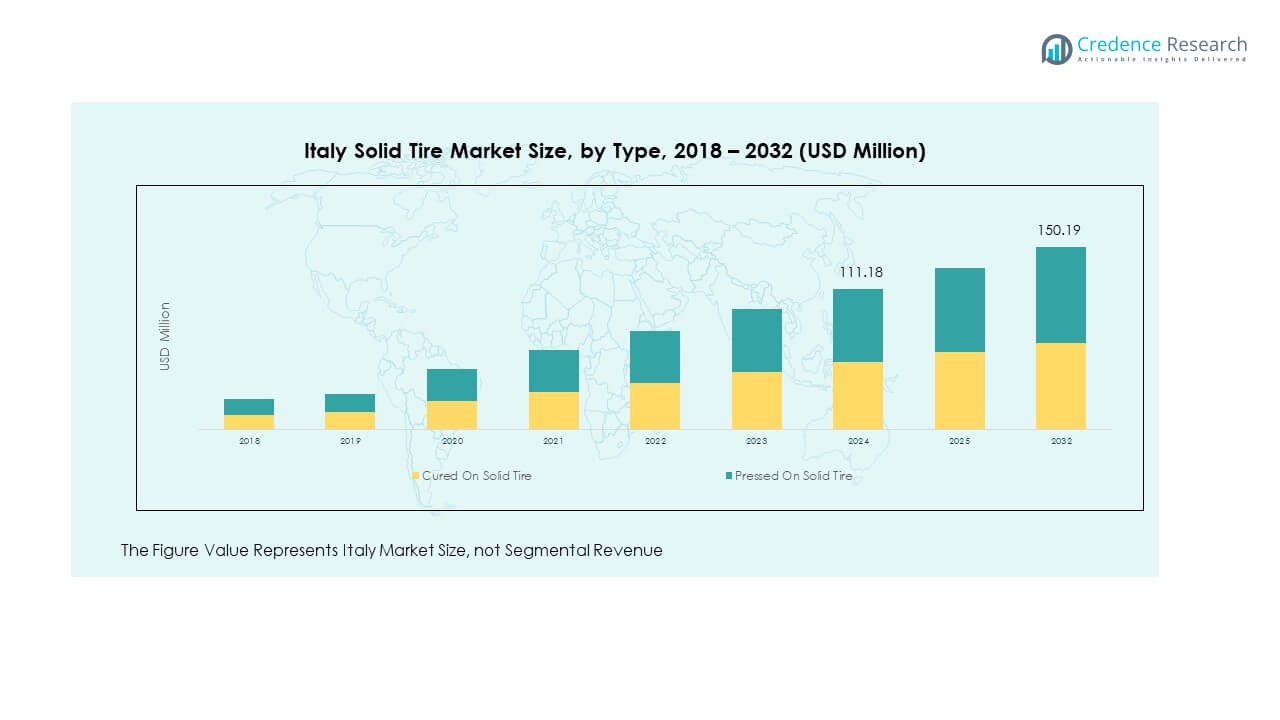

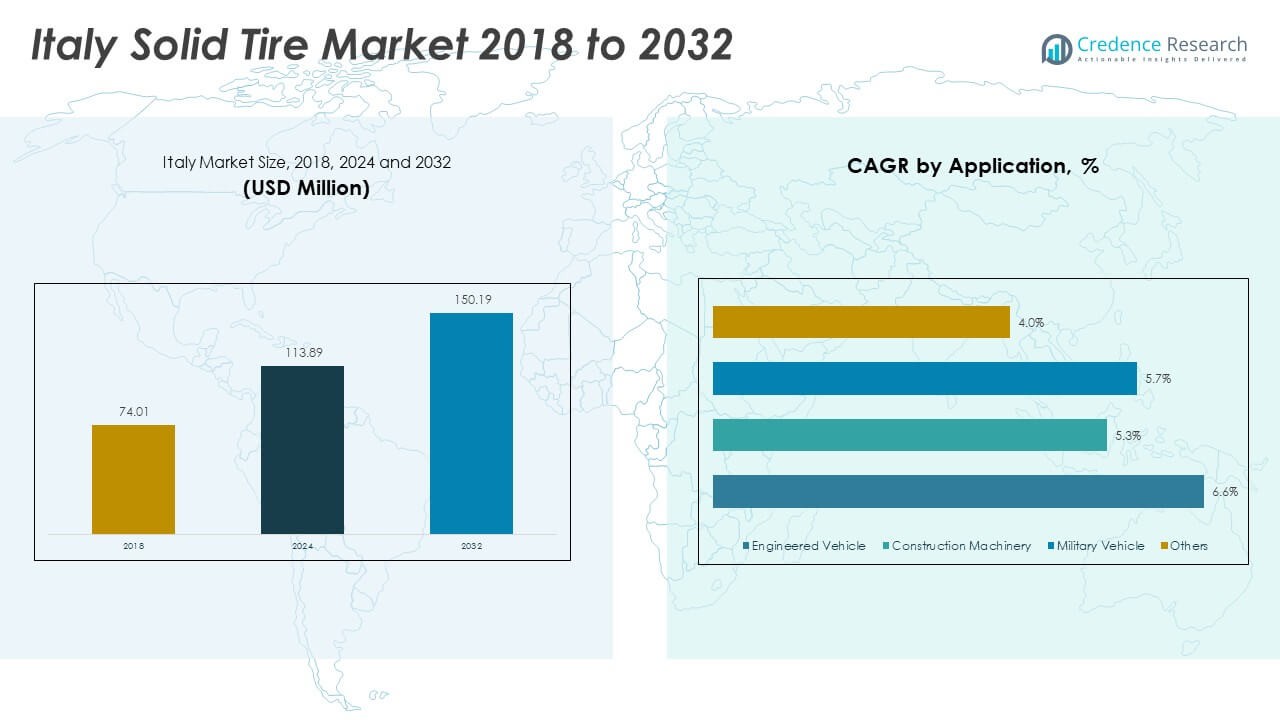

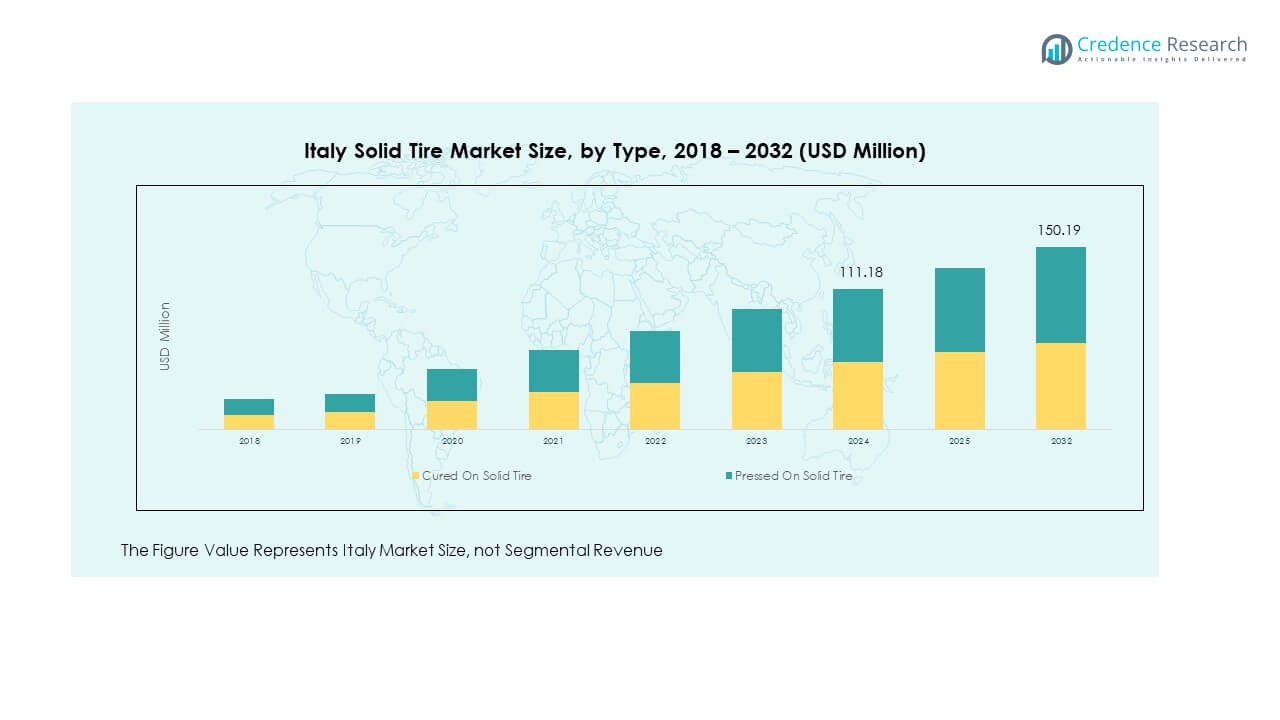

The Italy Solid Tire Market size was valued at USD 74.01 million in 2018 to USD 111.18 million in 2024 and is anticipated to reach USD 150.19 million by 2032, at a CAGR of 3.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Solid Tire Market Size 2024 |

USD 111.18 Million |

| Italy Solid Tire Market, CAGR |

3.83% |

| Italy Solid Tire Market Size 2032 |

USD 150.19 Million |

The market growth is primarily driven by rising demand from industrial, construction, and logistics sectors. Solid tires offer durability, puncture resistance, and minimal maintenance, making them suitable for forklifts, heavy-duty vehicles, and port handling equipment. Italy’s expanding e-commerce logistics and warehousing activities also stimulate adoption. Moreover, stricter safety standards and the shift toward cost-efficient, long-lasting tire solutions encourage industries to replace pneumatic alternatives with solid tires. The growing emphasis on reducing downtime and ensuring operational continuity further strengthens the adoption of these tires across diverse industrial applications.

Geographically, Italy represents one of the most mature markets within Europe due to its advanced industrial base and strong automotive ecosystem. Regions with concentrated manufacturing and logistics hubs, such as Northern Italy, lead in adoption owing to high demand for forklifts and heavy machinery. Emerging opportunities are observed in Southern regions, where infrastructure development and port modernization projects are boosting solid tire usage. Neighboring European countries, particularly Germany and France, also influence market dynamics through cross-border trade and shared industrial standards, positioning Italy as a key contributor to the broader regional market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Solid Tire Market size was USD 74.01 million in 2018, reaching USD 111.18 million in 2024, and is projected to hit USD 150.19 million by 2032, registering a CAGR of 3.83%.

- Northern Italy leads with 38% share, supported by its industrial hubs and logistics infrastructure. Central Italy follows with 27%, driven by construction and warehousing, while Southern Italy holds 22%, supported by port activity and emerging logistics corridors.

- The Southern Italy region is the fastest growing, expanding due to rising infrastructure investments, modernization of ports, and increased government-backed logistics projects.

- Pressed-On Solid Tires dominate with 62% share in 2024, reflecting their widespread use in forklifts and industrial vehicles.

- Cured-On Solid Tires account for 38% share, driven by demand in heavy-duty applications requiring enhanced durability and lower downtime.

Market Drivers:

Rising demand from logistics, construction, and industrial equipment drives adoption of durable solid tires:

The Italy Solid Tire Market gains strength from industrial and logistics sectors requiring durable tire solutions. Companies handling heavy equipment prioritize products that minimize downtime and reduce maintenance costs. Solid tires outperform pneumatic tires by offering puncture resistance and higher load-bearing capacity. Construction projects across Italy increase reliance on forklifts and loaders equipped with these tires. The logistics industry, supported by expanding warehousing networks, reinforces this growth. It responds to efficiency needs by ensuring stable operations under high stress. Port authorities also contribute by adopting solid tires for container-handling equipment. Strong industrial demand positions solid tires as a core segment in the country.

- For instance, Italmatic manufactures solid tires vulcanized in cylindrical molds with six radial sectors using three high-performance compounds, ensuring maximum durability and extended service life without frequent replacements. Construction projects across Italy increase reliance on forklifts and loaders equipped with these tires to handle loads exceeding 3,000 kg in port and warehouse operations.

Increasing safety standards and operational continuity requirements boost solid tire penetration:

The Italy Solid Tire Market benefits from strict safety standards shaping industrial operations. Companies aim to minimize accidents caused by tire failures in high-pressure environments. Solid tires provide stability that reduces risks and ensures safer load movement. Regulations favor tires that perform reliably under heavy loads without pressure fluctuations. Industries adopt them to maintain compliance while securing operational continuity. It supports businesses by reducing liability concerns and improving workforce safety. Warehousing and logistics firms emphasize reliable tire performance to sustain high-volume operations. Growing regulatory oversight ensures ongoing investment in solid tire solutions.

- For example, Carloni Srl, an Italian pioneer in tire retreading since 1943, holds UNI EN ISO 9001 certification and produces retreaded solid tires that match the reliability and safety of new products, giving fleet operators confidence in compliance while securing operational continuity. Their retreading efforts avoid raw material consumption and reduce CO2 emissions, supporting corporate sustainability goals while enhancing workforce safety.

Cost efficiency and long-term performance attract industrial users toward solid tires:

The Italy Solid Tire Market attracts users with its cost-saving advantages over pneumatic options. Solid tires last longer, require less frequent replacement, and cut maintenance spending. Firms adopt them to achieve predictable operating costs and limit production interruptions. It provides a durable solution that aligns with cost-conscious strategies in heavy industries. Businesses benefit from improved return on investment by choosing tires that sustain demanding use. Operators in ports and factories emphasize reduced downtime through durable tire performance. Efficiency gains highlight the product’s importance for industrial decision-makers. Solid tires continue to build preference across multiple heavy-duty applications.

Growing e-commerce and warehousing expansion amplify demand for robust tire solutions:

The Italy Solid Tire Market receives momentum from the expansion of e-commerce and warehousing. Increased consumer demand has accelerated the growth of logistics and distribution hubs. These facilities operate equipment continuously, requiring reliable tire performance. Solid tires support uninterrupted operations by providing durability and resistance to wear. Warehousing operators rely on them to ensure efficient handling of heavy loads. It strengthens overall logistics efficiency by minimizing replacement cycles. Growing focus on timely delivery drives investment in dependable tire infrastructure. The rise of retail distribution ensures continuous growth for solid tire adoption.

Market Trends:

Adoption of advanced tire designs enhances durability and performance in industrial sectors:

The Italy Solid Tire Market shows a clear shift toward advanced tire designs. Manufacturers focus on innovative compounds and structural improvements that boost longevity. Products with enhanced tread patterns provide stability under uneven surfaces. It supports smoother operations in warehouses and construction zones. High-performance solid tires attract industries aiming to balance safety with efficiency. Tire makers also invest in eco-friendly materials that improve sustainability standards. Growing demand for specialized tires across equipment categories highlights design-driven innovation. Enhanced engineering strengthens product competitiveness across the industrial sector.

- For instance, Trelleborg’s Construction Solid Series tires incorporate solidflex technology featuring elliptical apertures that absorb shocks and reduce vibration—delivering improved operator comfort and machine protection even under extreme loads. These tires undergo rigorous field-testing to handle torque and high loads on construction sites, prolonging tire life by over 30% compared to conventional designs.

Integration of digital monitoring tools supports predictive maintenance for industrial fleets:

The Italy Solid Tire Market experiences growth from digital integration in fleet operations. Tire manufacturers develop smart solutions with embedded sensors that track wear and performance. Fleet managers use this data to plan maintenance before failures occur. It reduces unexpected downtime and enhances efficiency in logistics operations. Real-time insights allow firms to optimize resource allocation across equipment fleets. The trend reflects increasing interest in predictive maintenance strategies. Industries invest in digital tools to improve decision-making and reduce costs. Adoption of monitoring systems expands alongside solid tire deployment.

- For instance, Continental’s ContiConnect Live system enables real-time tire monitoring on trailers, providing pressure and temperature data every five seconds. This real-time insight allows fleet managers to identify potential tire failures before they occur, reducing unexpected downtime by enabling predictive maintenance.

Rising focus on sustainable manufacturing processes influences production and procurement choices:

The Italy Solid Tire Market aligns with broader sustainability objectives. Producers adopt green manufacturing methods that reduce emissions and resource consumption. Recycling initiatives extend the lifecycle of raw materials used in production. It appeals to companies with corporate sustainability goals across industries. Demand grows for environmentally responsible tire options in both industrial and logistics applications. Government policies reinforce these shifts by encouraging eco-friendly procurement. Businesses prioritize suppliers offering certified sustainable solutions. Sustainable production practices become a core differentiator in competitive landscapes.

Expansion of aftermarket services increases accessibility and strengthens product life cycle:

The Italy Solid Tire Market benefits from the development of strong aftermarket services. Companies provide retreading and refurbishment solutions to extend product life. Accessible services improve affordability for small and medium enterprises. It ensures that solid tires remain viable across diverse industrial users. Service providers expand offerings to cover installation, inspection, and repair. Growing partnerships between tire makers and logistics operators enhance coverage. Businesses value comprehensive support that improves operational continuity. Aftermarket expansion complements the primary sales channel, ensuring higher market stability.

Market Challenges Analysis:

High initial costs and competitive pressure from pneumatic alternatives limit wider adoption:

The Italy Solid Tire Market faces challenges related to higher upfront investment compared to pneumatic options. Buyers with budget constraints hesitate to shift despite long-term benefits. It creates resistance among smaller operators seeking cost-effective solutions. Pneumatic tires also remain attractive in lighter-duty applications where cost matters more. Strong competition pressures manufacturers to lower prices, reducing profit margins. Market penetration slows when potential buyers balance short-term affordability against durability. Adoption relies heavily on convincing industries about long-term savings. Competitive pricing challenges remain a barrier to expansion.

Limited awareness and supply chain issues restrict growth in emerging industrial regions:

The Italy Solid Tire Market also struggles with limited awareness among emerging operators. Many businesses remain unfamiliar with advantages over conventional alternatives. It affects adoption in small-scale logistics and regional construction sectors. Supply chain inefficiencies also hinder availability in less-developed areas. Import dependency increases costs and delays delivery schedules. Small operators face difficulty accessing reliable aftermarket support. Uneven distribution networks reduce the appeal of solid tires in underserved markets. Awareness and supply chain limitations continue to shape growth challenges.

Market Opportunities:

Growing infrastructure investments and port modernization projects stimulate higher tire demand:

The Italy Solid Tire Market benefits from government-backed infrastructure programs. Construction of highways, bridges, and logistics hubs drives equipment demand. Solid tires support these developments by offering durability under heavy use. Port modernization projects also create opportunities for suppliers. It fuels adoption in container handling and cargo-moving equipment. Investments strengthen industrial requirements, encouraging manufacturers to scale supply. Expanding infrastructure projects maintain long-term potential for tire suppliers.

Rising demand from specialized applications creates scope for niche product innovation:

The Italy Solid Tire Market gains opportunities from specialized equipment categories. Niche applications in mining, aviation ground support, and material handling require tailored solutions. Tire producers innovate to meet unique demands of these sectors. It fosters product differentiation and secures new revenue streams. Growth in specialized industries increases the scope for custom engineering. Manufacturers capable of addressing specific needs strengthen their competitive edge. Niche-driven demand creates an opportunity for expansion beyond mainstream logistics and construction.

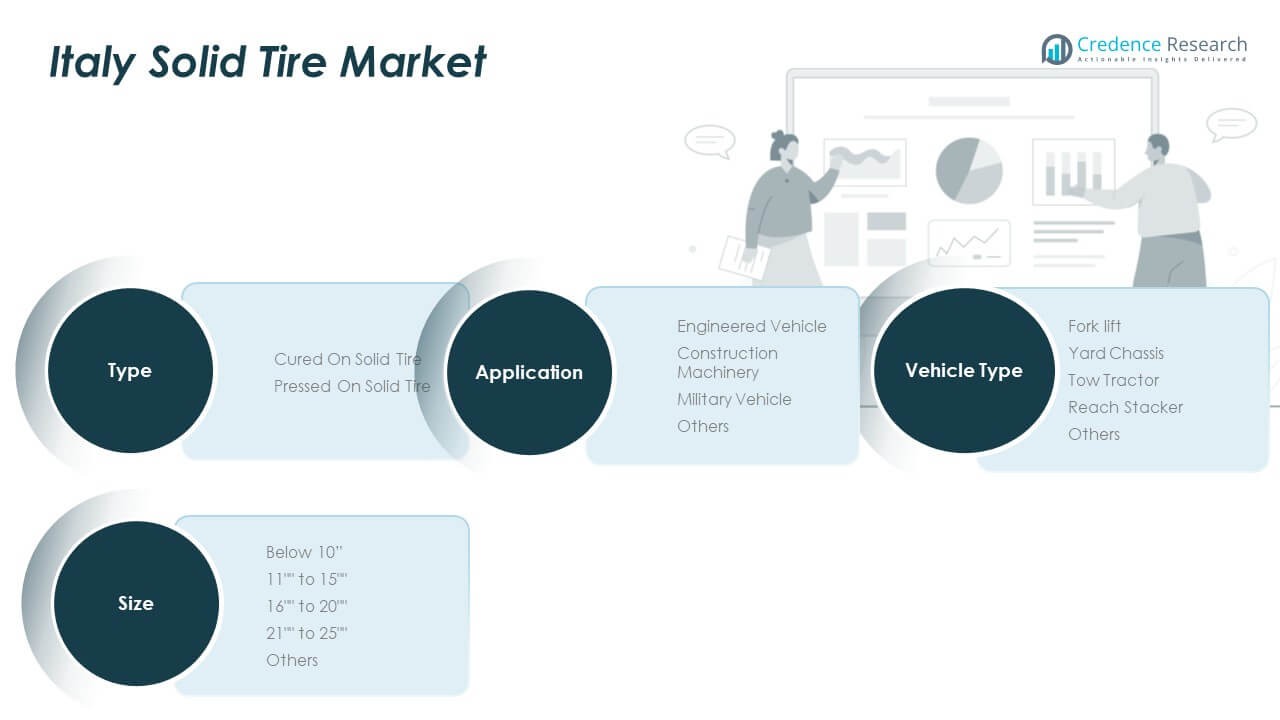

Market Segmentation Analysis:

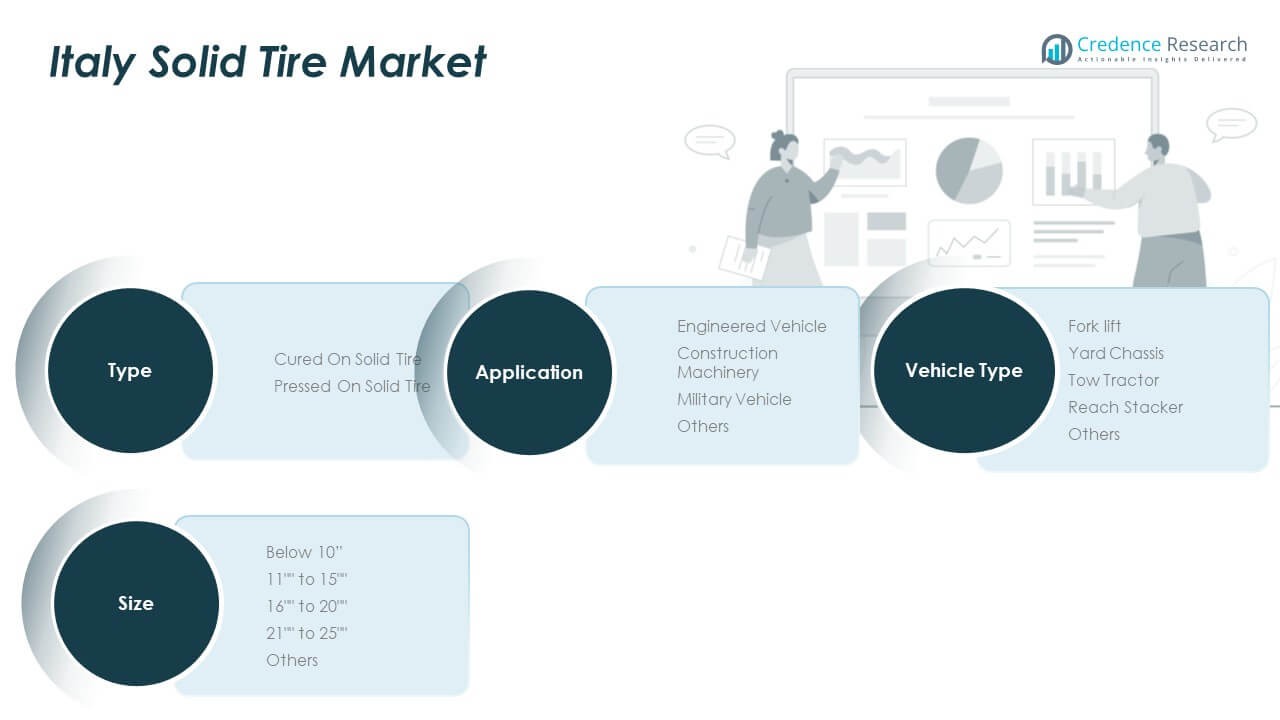

By Type

The Italy Solid Tire Market is segmented into cured on solid tires and pressed on solid tires. Pressed on solid tires dominate due to their extensive use in forklifts and industrial equipment, offering quick installation and dependable performance. Cured on solid tires retain relevance in heavy-duty applications requiring high durability and extended service life. It reflects a balanced demand structure driven by operational efficiency and long-term performance.

- For instance, pressed on tires excel in warehouse environments where equipment frequently operates on metal ramps and abrasive surfaces, minimizing downtime and maintenance needs. Cured on solid tires retain relevance in heavy-duty applications requiring high durability and extended service life, such as in construction machinery operating in rough terrains and demanding load conditions.

By Application

Applications include engineered vehicles, construction machinery, military vehicles, and others. Engineered vehicles lead demand, supported by logistics, warehousing, and port operations. Construction machinery contributes strongly, with infrastructure projects fueling tire requirements. Military vehicles rely on solid tires for durability under rugged conditions. Other applications, such as agricultural and specialized handling equipment, expand the market footprint.

- For example, Construction machinery contributes strongly, with infrastructure projects fueling requirements for tires such as Trelleborg’s Brawler HPS models, engineered to absorb shocks and withstand heavy loads in tough terrains.

By Size

Market distribution spans below 10”, 11”–15”, 16”–20”, 21”–25”, and others. The 11”–15” category holds the largest share, as it suits a wide range of industrial vehicles and forklifts. Larger sizes, such as 16”–20” and 21”–25”, serve heavy machinery in construction and ports. Smaller sizes target compact equipment, while the “others” segment captures niche and specialized demand.

By Vehicle Type

Segments include forklifts, yard chassis, tow tractors, reach stackers, and others. Forklifts dominate due to intensive use in logistics and warehousing facilities. Yard chassis and tow tractors support transport and port-related activities. Reach stackers play a key role in container handling across trade hubs. Other vehicle categories contribute niche demand, reinforcing the market’s diversified structure.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

Northern Italy – Industrial and Logistics Powerhouse

Northern Italy holds the largest share of the Italy Solid Tire Market, representing 38% of total revenue. The region benefits from a strong industrial base, advanced logistics networks, and concentrated manufacturing hubs. Forklifts and yard chassis dominate demand in warehouses and production facilities. It also gains momentum from port activity in Genoa and Trieste, which increases adoption in container handling. Construction projects across Lombardy and Emilia-Romagna further support growth. Industrial users emphasize pressed-on solid tires for efficiency, securing the region’s leadership position.

Central Italy – Balanced Growth with Diverse Applications

Central Italy accounts for around 27% of the market, supported by warehousing, logistics, and construction activity. Logistics hubs in Tuscany and Lazio create consistent demand for engineered vehicles and tow tractors. Infrastructure investments in Rome and Florence drive adoption in construction machinery applications. It benefits from supply networks that strengthen availability of cured-on and pressed-on tires. Military demand also supports growth, with defense vehicles requiring resilient tire performance. A balanced distribution across size categories highlights the region’s diverse application base.

Southern Italy – Fastest Growing Region with Expanding Opportunities

Southern Italy contributes 22% of the Italy Solid Tire Market and emerges as the fastest-growing regional segment. Port cities including Naples, Bari, and Palermo generate strong demand for reach stackers and tow tractors. Infrastructure upgrades and port modernization projects fuel adoption of heavy-duty solid tires. It attracts investment from manufacturers building stronger distribution channels in emerging hubs. Agricultural machinery also contributes to regional sales in rural markets. Expansion of logistics corridors in Campania and Sicily ensures long-term opportunities, positioning Southern Italy as a future growth center.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Camso (Michelin Group)

- Continental AG

- Trelleborg AB

- Global Rubber Industries (GRI)

- NEXEN Tire

- Setco Solid Tire & Rim Assembly

- Superior Tire & Rubber Corp.

- Maxam Tire

- TY Cushion Tire

- Yantai Balsanse Rubber Co., LTD.

Competitive Analysis:

The Italy Solid Tire Market is moderately consolidated, with global and regional players competing across industrial, logistics, and construction applications. Leading companies such as Camso (Michelin Group), Continental AG, and Trelleborg AB hold strong positions through broad product portfolios and extensive distribution networks. It benefits from innovation in tire durability, sustainability, and aftermarket services, which serve as key differentiators. Smaller firms strengthen competitiveness by targeting niche applications like port handling and military vehicles. Strategic alliances, regional expansions, and technology-driven solutions intensify competition. The market’s growth potential continues to attract investment from established and emerging participants.

Recent Developments:

- In August 2025, Superior Tire & Rubber Corp. announced a multi-million-dollar capital investment plan to scale production capacity and amplify automation across its four business units, including remanufacturing operations and construction track pads. This expansion includes a new manufacturing facility launched earlier in 2025 in Warren, Pennsylvania, to support increasing demand in agricultural and construction sectors.

- In February 2025, NEXEN Tire was named the original equipment tire supplier for Hyundai’s latest flagship SUV, the Palisade. The supplied ‘N’FERA Supreme S’ tires feature AI-enhanced tread patterns engineered to reduce noise and vibration, in addition to advanced load distribution technology designed for durability and comfort at high speeds.

- In January 2025, MAXAM Tire reinforced its marketing and brand presence by expanding its partnership as the title sponsor for the 2025 Bassmaster Elite Series, showcasing its industrial forklift tires MS600 and MS700 powered by EcoPoint3 technology, designed for superior tread life and traction performance.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for solid tires in Italy will strengthen across logistics and warehousing operations.

- Construction projects and infrastructure upgrades will boost heavy machinery applications.

- Military and defense sectors will adopt resilient solid tires for specialized vehicles.

- Digital monitoring tools will gain traction, supporting predictive maintenance strategies.

- Sustainability-driven production will shape supplier competitiveness across regions.

- Forklifts will remain the largest vehicle type segment, sustaining consistent demand.

- Growth in Southern Italy will outpace other regions due to port modernization projects.

- Product innovation in cured-on tires will address heavy-duty equipment requirements.

- Aftermarket services will expand, increasing accessibility for small and medium operators.

- Collaboration between global and regional players will accelerate market penetration.