Market Overview

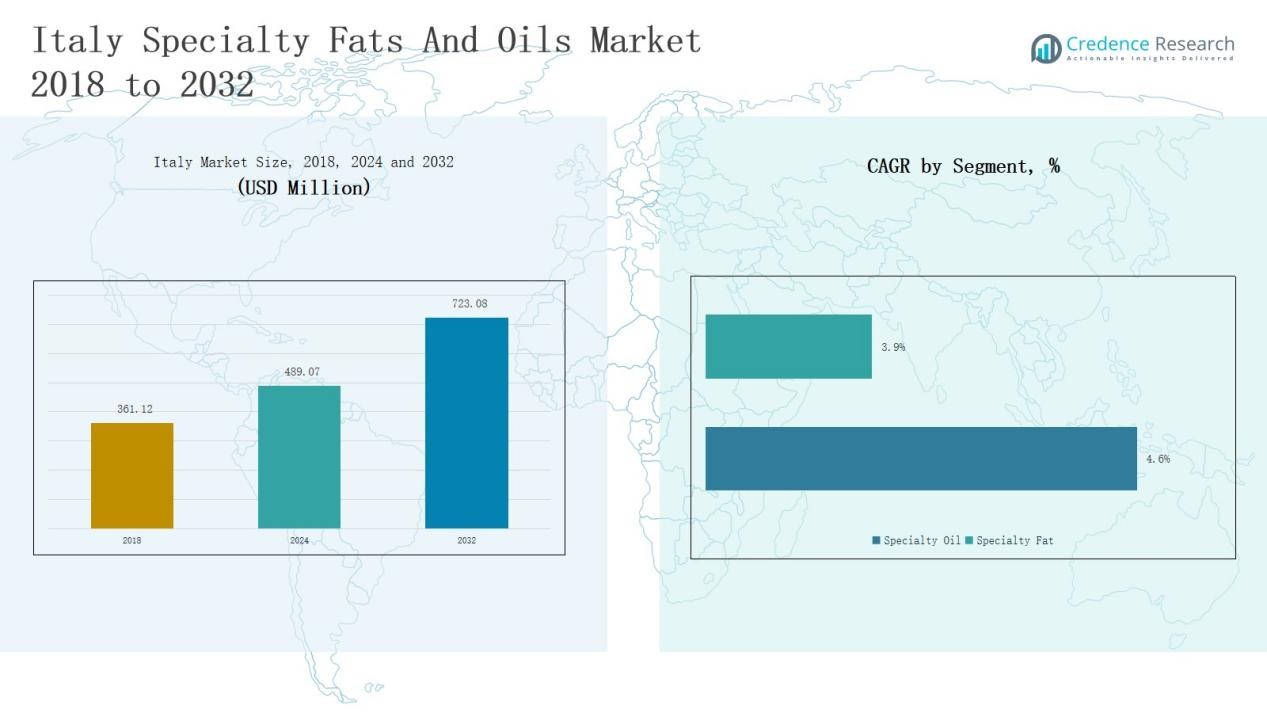

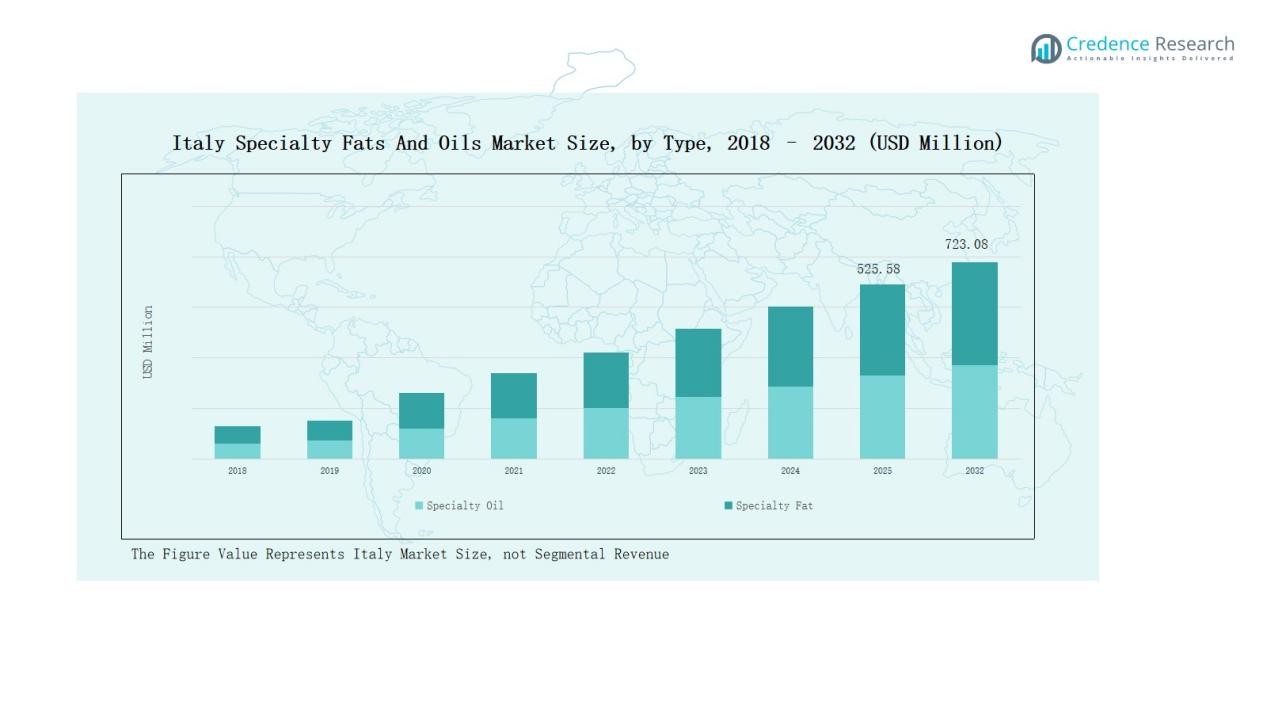

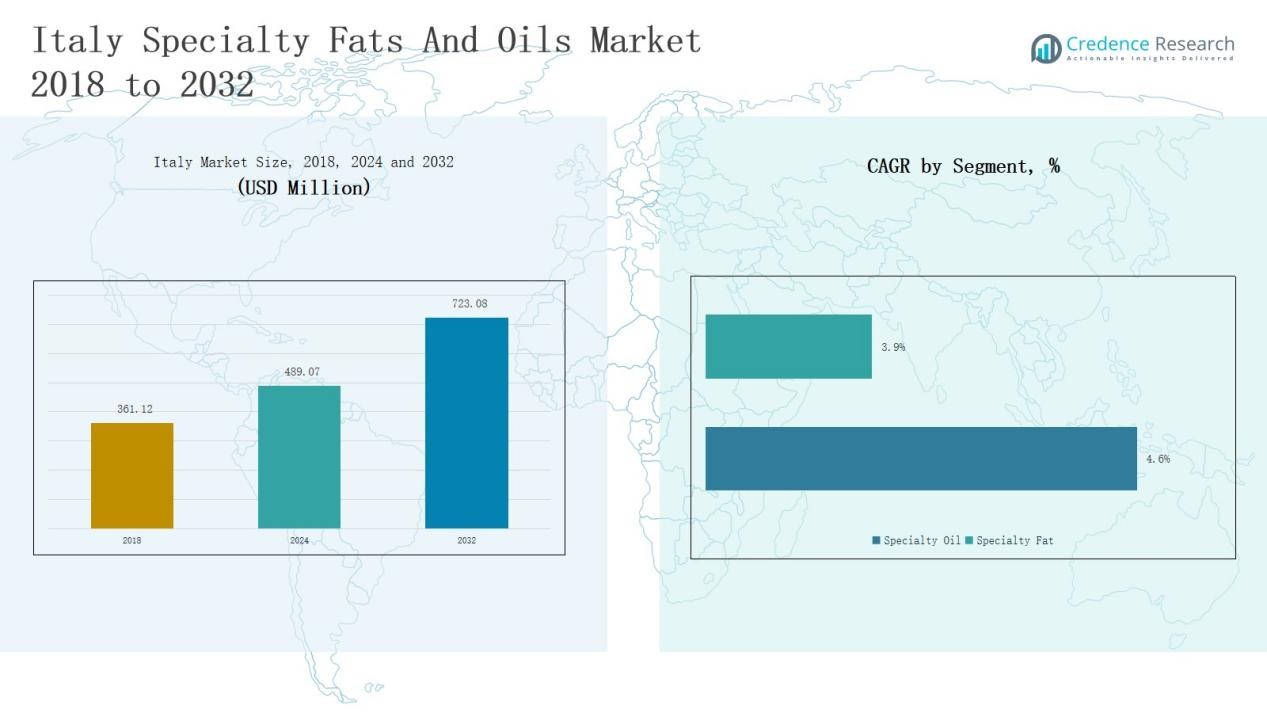

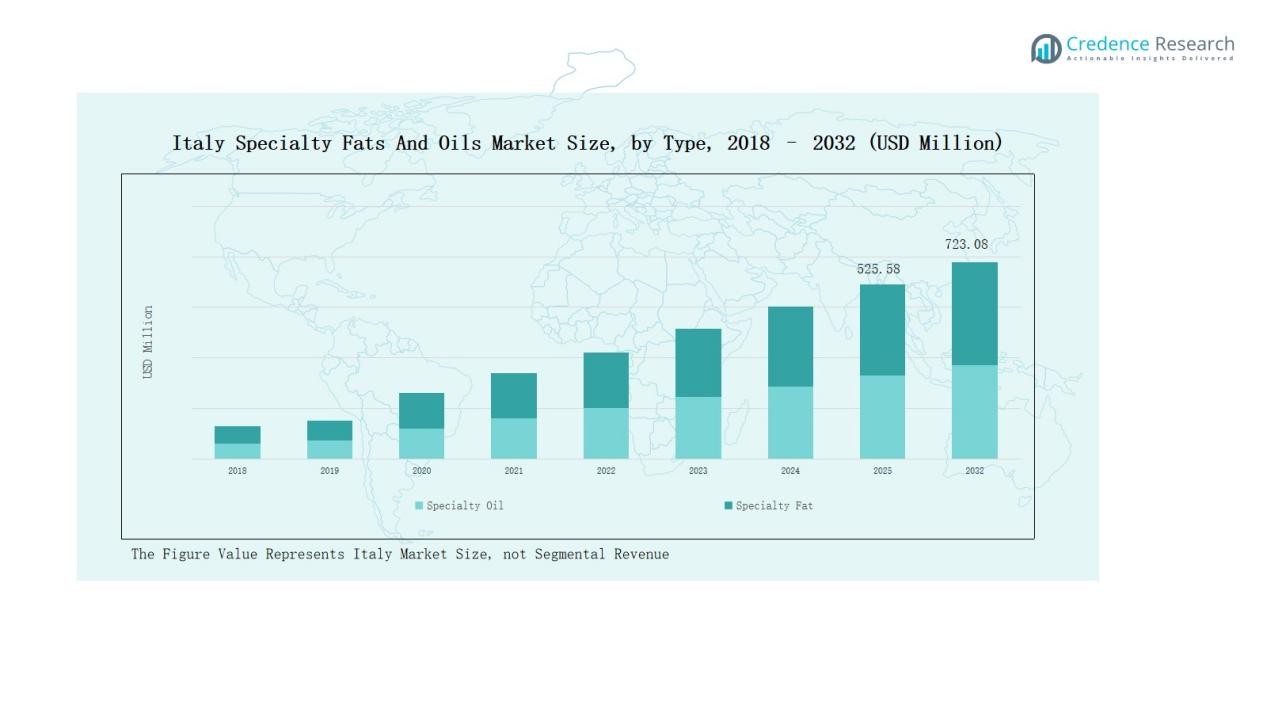

Italy Specialty Fats And Oils Market size was valued at USD 361.12 million in 2018 to USD 489.07 million in 2024 and is anticipated to reach USD 723.08 million by 2032, at a CAGR of 4.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Specialty Fats And Oils Market Size 2024 |

USD 489.07 Million |

| Italy Specialty Fats And Oils Market, CAGR |

4.66% |

| Italy Specialty Fats And Oils Market Size 2032 |

USD 723.08 Million |

The Italy Specialty Fats and Oils Market is shaped by leading players including Oleificio Zucchi S.p.A., Bunge Italia S.r.l., Cargill Italy S.r.l., Wilmar Italia S.p.A., Oleon Italy, Kerry Group Italy, Desmet Ballestra Group, Aromata Group, Naturitalia Srl, and Lubrizol Italy. These companies compete through diverse portfolios of specialty oils and fats, focusing on industrial supply for confectionery, bakery, and foodservice sectors while aligning with EU sustainability and traceability standards. Northern Italy emerged as the dominant region in 2024, holding a 42% market share, driven by its concentration of large-scale confectionery and bakery manufacturers and advanced industrial infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Italy Specialty Fats and Oils Market grew from USD 361.12 million in 2018 to USD 489.07 million in 2024 and will reach USD 723.08 million by 2032.

- Specialty oils dominate with 62.3% share in 2024, led by palm, sunflower, and olive oils, while specialty fats account for 37.7%, supporting bakery and confectionery uses.

- By application, the industry segment leads with 54.6% share in 2024, followed by restaurants at 26.1%, households at 15.4%, and others contributing 3.9%.

- Northern Italy holds the largest regional share at 42% in 2024, driven by strong bakery and confectionery industries, followed by Central Italy with 27% and Southern Italy with 21%.

- Leading players include Oleificio Zucchi, Bunge Italia, Cargill Italy, Wilmar Italia, Oleon Italy, Kerry Group Italy, Desmet Ballestra Group, Aromata Group, Naturitalia, and Lubrizol Italy.

Market Segment Insights

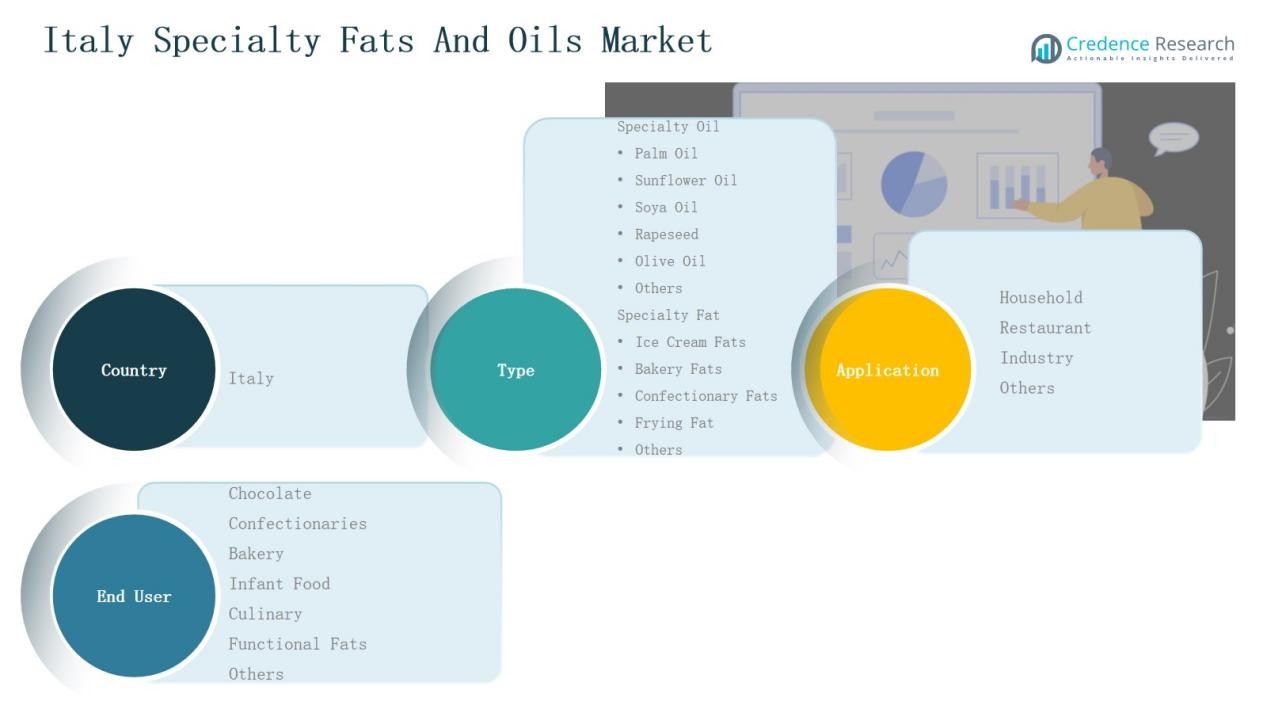

By Type

In the Italy Specialty Fats and Oils Market, specialty oils dominate with 62.3% share in 2024, driven by high consumption of palm and sunflower oil across bakery, confectionery, and processed foods. Palm oil leads within oils due to its versatility, cost efficiency, and established role in large-scale food production. Sunflower and olive oils also hold strong positions, supported by consumer demand for healthier and premium-quality oils. Specialty fats, accounting for 37.7% share, are widely used in bakery and confectionery formulations, where functionality, texture, and shelf-life enhancement remain critical drivers.

- For instance, Cargill launched its latest line of non-hydrogenated specialty fats under the Instruct range in Europe, enhancing texture and stability in confectionery applications.

By Application

The industry segment holds the largest share at 54.6% in 2024, reflecting the strong presence of Italy’s chocolate, confectionery, and bakery manufacturing clusters. These industries rely heavily on specialized fats and oils to achieve desired product consistency and performance. Restaurants contribute 26.1% share, supported by Italy’s robust dining culture and reliance on olive and sunflower oils in culinary preparations. Household use accounts for 15.4% share, sustained by consumer preference for traditional olive oil and packaged cooking oils. The remaining 3.9% share is attributed to other applications, including specialty uses in niche food service and catering.

- For instance, Ferrero Group reported that its Nutella and Ferrero Rocher production in Alba relies on a blend of cocoa butter and vegetable oils to maintain consistent product quality across European markets.

Key Growth Drivers

Rising Demand from Confectionery and Bakery Industry

The strong presence of Italy’s confectionery and bakery sectors drives demand for specialty fats and oils. Manufacturers rely on palm, sunflower, and confectionery fats to ensure texture, stability, and taste consistency in premium chocolate and bakery products. Growing exports of Italian confectionery goods further support consumption of specialty ingredients. Additionally, increasing consumer preference for indulgent and high-quality baked items sustains demand. This industry linkage makes bakery and confectionery the largest consumers, directly boosting the market’s expansion.

- For instance, 3F Group announced a focus on producing natural specialty fats specifically tailored for the bakery and confectionery industries, emphasizing clean-label and texture enhancement solutions.

Shift Toward Healthier Oil Options

Health-conscious consumers in Italy are increasingly favoring sunflower and olive oils as alternatives to hydrogenated fats. Specialty oils with functional properties such as low trans-fat and high nutritional value gain traction in retail and foodservice. Olive oil, in particular, benefits from Italy’s cultural preference and global reputation for premium quality. Food processors are also reformulating products to meet EU nutritional standards. This shift supports steady market growth for oils that align with clean-label and health-driven consumption trends.

- For instance, Carapelli Firenze introduced a new organic olive oil range certified by the Italian Ministry of Agriculture, targeting consumers seeking sustainable and chemical-free options.

Expansion of Foodservice and Quick-Service Restaurants

The rapid growth of Italy’s restaurant and quick-service food outlets creates strong demand for frying fats and cooking oils. Specialty oils and fats are essential for ensuring frying stability, flavor retention, and extended shelf life in fast-moving kitchens. Rising tourism also plays a role, as restaurants and hotels increasingly use specialty oils in diverse cuisines. Growing partnerships between suppliers and foodservice chains further boost the demand base. This expansion positions the foodservice channel as a critical growth driver.

Key Trends & Opportunities

Sustainability and RSPO-Certified Sourcing

Sustainability shapes purchasing decisions in Italy’s fats and oils market. Companies increasingly adopt RSPO-certified palm oil and promote eco-friendly sourcing practices. This trend aligns with EU regulatory pressure on traceability and corporate sustainability commitments. Brands leveraging certified and transparent sourcing appeal to both B2B buyers and consumers. Such initiatives create opportunities for suppliers to differentiate their portfolios, reduce reputational risks, and capture greater market share.

- For instance, Ferrero announced that 100% of the palm oil used globally in its products is RSPO-certified and fully traceable to plantations, reinforcing its commitment to responsible sourcing.

Innovation in Functional and Specialty Fats

Functional fats designed for specific applications present growth opportunities in the Italian market. Innovations such as trans-fat-free bakery fats, cocoa butter equivalents, and ice cream fats meet evolving industrial needs. Manufacturers are investing in R&D to develop products that enhance texture, stability, and nutritional content. These advancements help food companies achieve cost savings without compromising product quality. The growing focus on value-added formulations creates space for suppliers to expand market presence and build stronger relationships with processors.

- For instance, Bunge introduced Betapol® Select, a next-generation structured lipid designed to mimic the fat profile of human milk, targeting infant nutrition applications in European markets.

Key Challenges

Volatility in Raw Material Prices

Price fluctuations in raw materials such as palm and soybean oil create uncertainty for Italian producers. Dependence on imports for many specialty oils exposes the market to global supply disruptions and trade risks. Currency fluctuations also affect procurement costs, pressuring margins for both manufacturers and distributors. Companies are forced to balance cost efficiency with quality to remain competitive. This volatility makes raw material sourcing a persistent challenge in the market.

Strict Regulatory Environment

The Italy Specialty Fats and Oils Market faces stringent EU regulations on food safety, trans-fat content, and labeling requirements. Producers must invest in reformulation and compliance systems to meet standards, which increases operational costs. Regulatory changes, such as restrictions on palm oil use, also disrupt supply chains. Small and medium-sized enterprises often struggle to adapt, limiting their competitiveness. Ensuring compliance while maintaining profitability remains a major hurdle for market participants.

Rising Competition and Substitutes

Intensifying competition from both domestic and global players creates pressure on pricing and differentiation. Substitutes such as butter, margarine, and alternative plant oils gain traction in consumer and foodservice applications. Established brands with strong portfolios often dominate, making market entry difficult for smaller players. To compete effectively, companies must focus on innovation, marketing, and strategic partnerships. The presence of substitutes and fragmented competition remains a key barrier to sustained growth.

Regional Analysis

Northern Italy

Northern Italy leads the Italy Specialty Fats and Oils Market with a 42% share in 2024. The region benefits from a strong presence of confectionery and bakery manufacturers, particularly in Lombardy and Emilia-Romagna. Demand is fueled by industrial use of palm, sunflower, and confectionery fats, which support large-scale production. Consumers in the region also show strong preference for premium olive oil, reinforcing retail demand. The concentration of multinational food processors in Northern Italy further strengthens consumption patterns. It remains the largest contributor to national revenue due to its advanced industrial infrastructure and export-oriented food sector.

Central Italy

Central Italy holds a 27% share in 2024, supported by its vibrant restaurant and household segments. Olive oil consumption dominates in Tuscany and Lazio, reflecting cultural traditions and premium quality branding. Restaurants and quick-service outlets in urban centers rely heavily on specialty frying fats and sunflower oil. The region benefits from rising tourism, which drives demand across both restaurants and foodservice channels. Industrial use is present but limited compared to the North. It maintains steady growth, driven by strong culinary demand and regional heritage in oil production.

Southern Italy

Southern Italy accounts for 21% share in 2024, where household consumption of olive oil represents the largest driver. Local production in regions such as Puglia and Calabria ensures strong supply of premium oils. Industrial use of specialty fats is smaller but growing with expansion of bakery and confectionery facilities. Rising interest in healthier and natural oils strengthens demand, especially within domestic markets. Restaurants and small-scale producers increasingly use sunflower and rapeseed oils for cost efficiency. It plays an important role in maintaining Italy’s leadership in olive oil exports.

Islands (Sicily and Sardinia)

The Islands region contributes 10% share in 2024, with olive oil production as the key strength. Sicily remains an important hub for high-quality olive oils that are exported globally. Household consumption dominates, supported by traditional cooking practices and local preferences. Industrial use is relatively limited, but niche applications in confectionery and bakery are growing. Tourism continues to expand restaurant and foodservice demand across Sicily and Sardinia. It provides stable growth opportunities, anchored by heritage-driven olive oil production and regional culinary traditions.

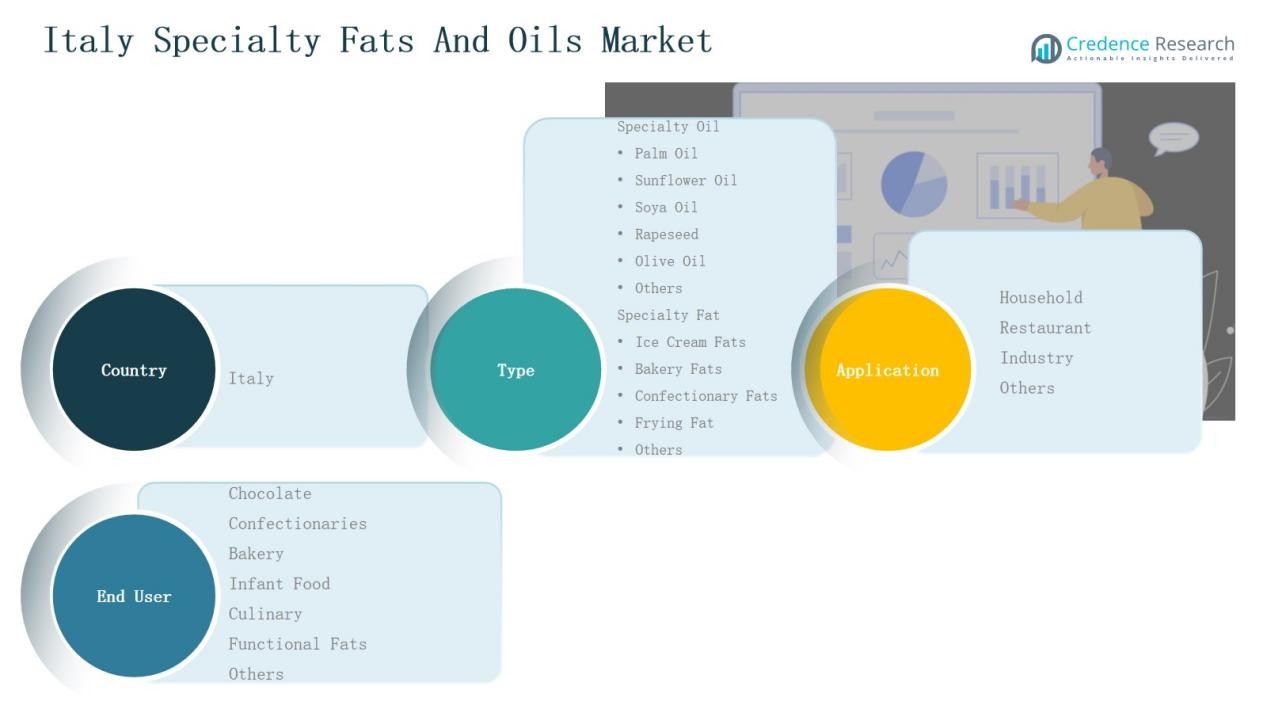

Market Segmentations:

By Type

Specialty Oils

- Palm Oil

- Sunflower Oil

- Soya Oil

- Rapeseed

- Olive Oil

- Others

Specialty Fats

- Ice Cream Fats

- Bakery Fats

- Confectionery Fats

- Frying Fats

- Others

By Application

- Household

- Restaurant

- Industry

- Others

By End User

- Chocolate

- Confectioneries

- Bakery

- Infant Food

- Culinary

- Functional Fats

- Others

By Region

- Northern Italy

- Central Italy

- Southern Italy

- Island

Competitive Landscape

The Italy Specialty Fats and Oils Market is characterized by a mix of global multinationals and strong domestic producers competing across oils and fats segments. Leading companies such as Oleificio Zucchi S.p.A., Bunge Italia, Cargill Italy, Wilmar Italia, and Oleon Italy dominate through extensive product portfolios, large-scale distribution, and established industrial partnerships. They focus on supplying palm, sunflower, and olive oils to bakeries, confectioneries, and foodservice sectors while maintaining compliance with strict EU sustainability and traceability standards. Domestic players, including Aromata Group and Naturitalia Srl, strengthen their presence with specialized offerings in olive oil and niche fats aligned to Italian culinary traditions. Kerry Group Italy and Desmet Ballestra Group emphasize innovation in functional fats and value-added formulations for bakery and infant food. Intense competition drives continuous investment in R&D, RSPO-certified sourcing, and strategic collaborations with food processors. The market remains highly fragmented, with both global scale and local specialization shaping competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In July 2025, NewPrinces S.p.A. (formerly Newlat Food) acquired the Plasmon biscuit brand from Kraft Heinz, including its specialty food operations and the Latina production facility. This move strengthens NewPrinces’ position in Italy’s specialty food sector, which closely connects to specialty fats and oils through product formulations and industrial use.

- In November 15, 2024 Atlante S.r.l. launched “Vitto” extra virgin olive oil on the Swiss market. The launch targets consumers focused on high ingredient quality and aims to highlight the taste and nutritional qualities of classic Italian olive oil.

- In July 2025, NewPrinces S.p.A. signaled interest in further acquisitions after taking over Kraft Heinz’s Italian specialty food brands and Diageo’s local operations. This expansion strengthens its role in specialty food production, closely linked to fats and oils demand.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for specialty oils will rise with growing use in bakery and confectionery.

- Olive oil will continue to strengthen its position in household and premium segments.

- Sunflower oil will gain traction due to its healthier profile in foodservice applications.

- Functional fats will see increasing adoption in infant food and specialized nutrition.

- RSPO-certified palm oil will expand its role under strict EU sustainability requirements.

- Restaurants and quick-service outlets will drive higher consumption of frying fats.

- Food processors will invest in reformulated trans-fat-free products to meet regulations.

- Domestic producers will leverage heritage-based branding to compete with global players.

- Partnerships between suppliers and confectionery manufacturers will deepen across regions.

- Export opportunities for Italian olive oil will enhance global market influence.