Market Overview:

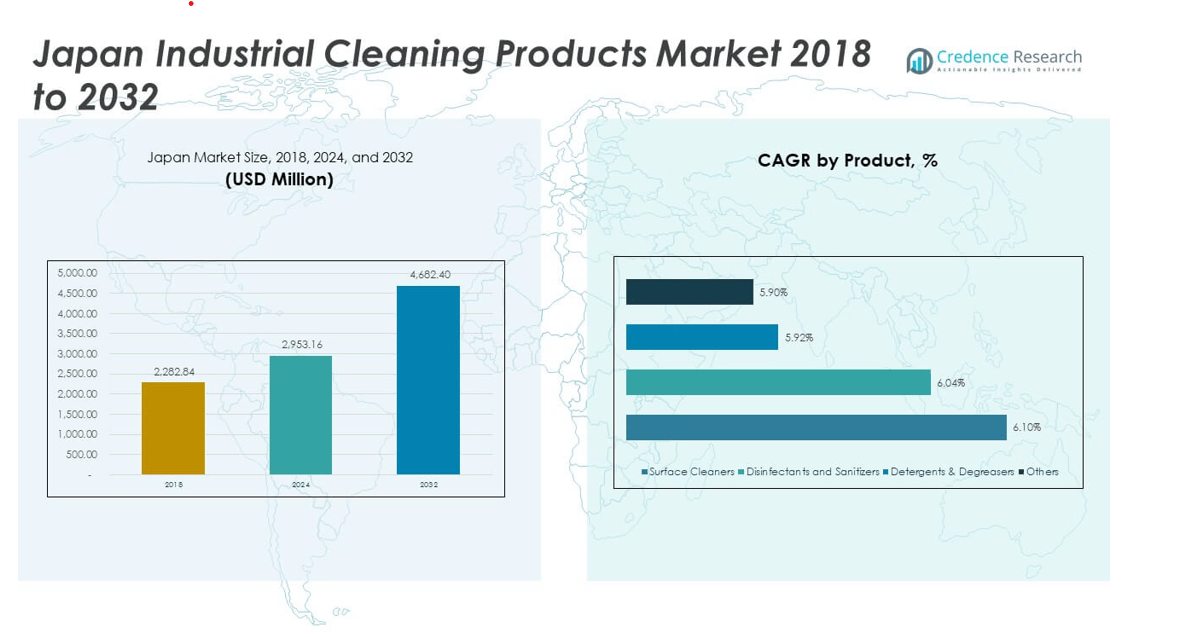

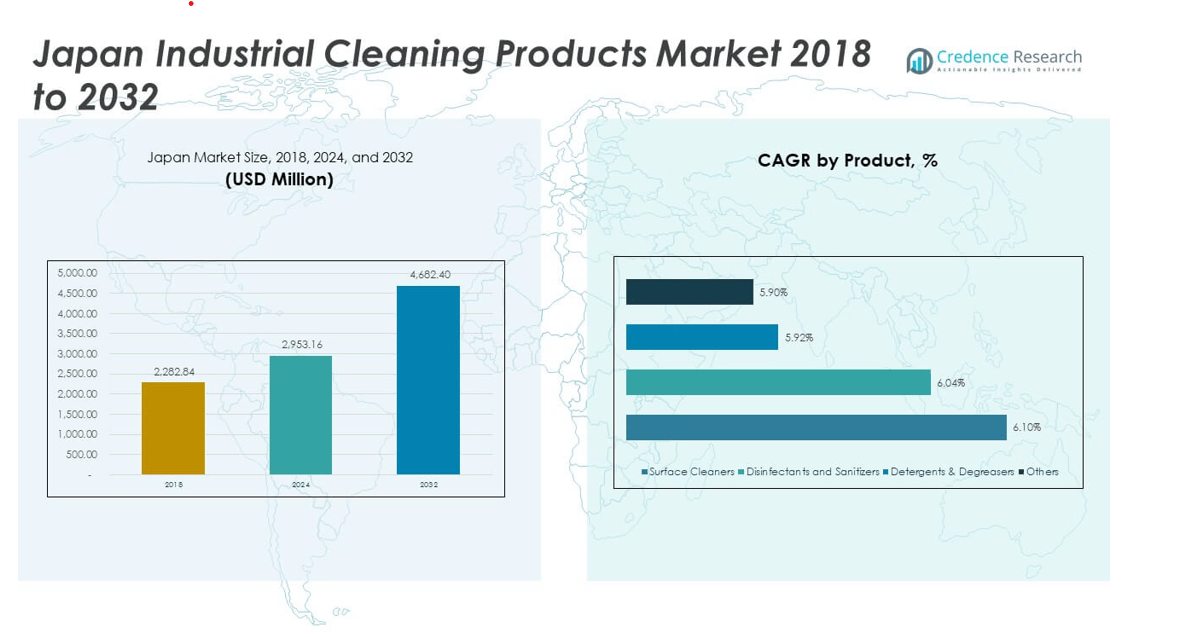

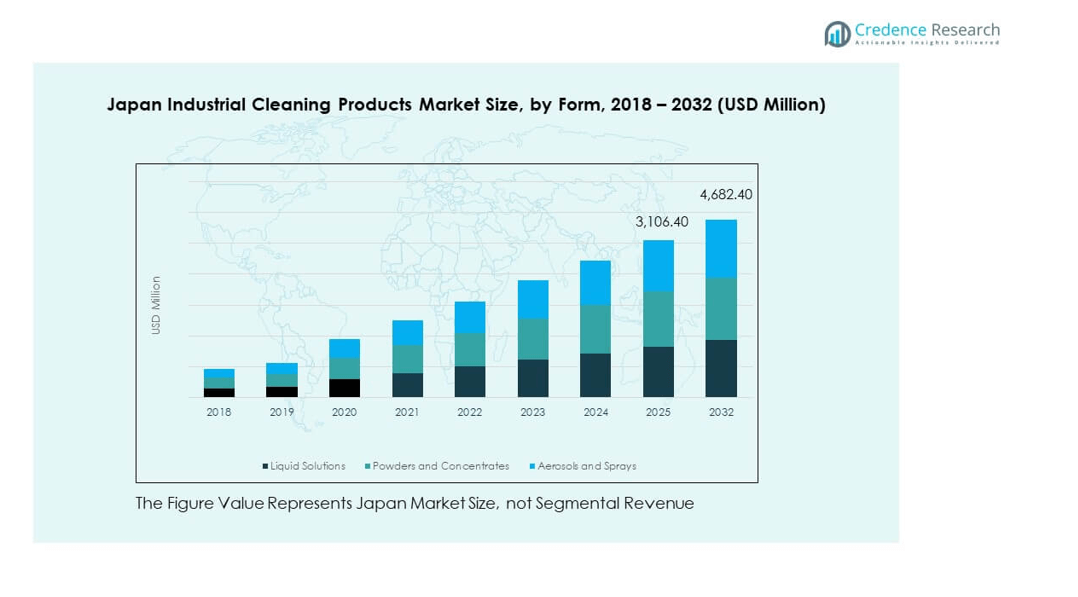

The Japan Industrial Cleaning Products Market size was valued at USD 2,282.84 million in 2018, increasing to USD 2,953.16 million in 2024 and is anticipated to reach USD 4,682.40 million by 2032, at a CAGR of 5.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Industrial Cleaning Products Market Size 2024 |

USD 2,953.16 million |

| Japan Industrial Cleaning Products Market, CAGR |

5.93% |

| Japan Industrial Cleaning Products Market Size 2032 |

USD 4,682.40 million |

The Japan Industrial Cleaning Products Market is driven by growing demand across various industries for improved hygiene and safety standards. Increasing industrialization, especially in manufacturing, food processing, and healthcare, has led to a rising need for specialized cleaning products. Regulatory compliance concerning sanitation practices also contributes to the market’s growth. The shift toward sustainable and eco-friendly cleaning solutions is another significant factor, as industries seek products that reduce environmental impact. Innovation in cleaning technology is further driving product development and adoption across sectors.

Regionally, East Japan leads the market due to the concentration of industrial activity in cities like Tokyo and Yokohama. The region’s robust manufacturing, automotive, and healthcare sectors are key drivers for industrial cleaning products. West Japan, including Osaka and Kobe, follows closely, with significant demand from food processing and chemical industries. South Japan, while smaller in market share, is emerging due to its growing industrial base and expanding awareness of hygiene and cleanliness. Regional growth reflects the importance of compliance with sanitation standards and sustainability in various sectors.

Market Insights

- The Japan Industrial Cleaning Products Market was valued at USD 2,282.84 million in 2018 and is expected to grow to USD 2,953.16 million in 2024, reaching USD 4,682.40 million by 2032, at a CAGR of 5.93% during the forecast period.

- East Japan dominates with approximately 40% of the market share due to its concentration of manufacturing, automotive, and healthcare industries. West Japan holds around 35%, driven by food processing and chemical industries, while South Japan accounts for 25%, emerging due to expanding commercial and industrial sectors.

- South Japan is the fastest-growing region, with a projected increase in market share driven by expanding awareness of hygiene standards and increased industrial activities in cities like Fukuoka and Okinawa.

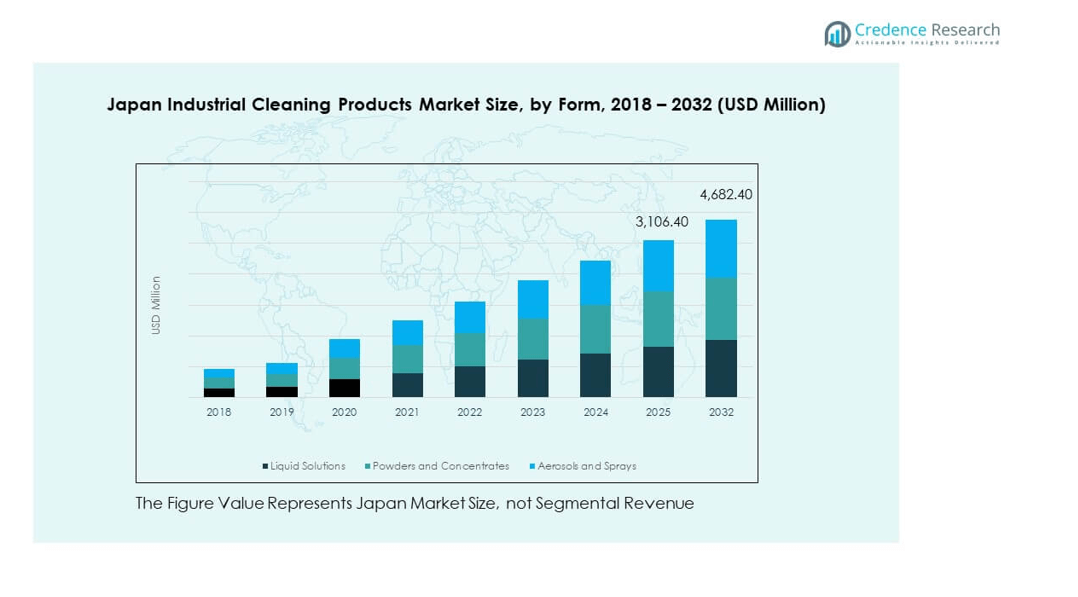

- Liquid Solutions represent the largest market share at approximately 60%, driven by their versatility and wide usage across industries. Aerosols and Sprays follow with a share of around 30%, showing robust demand across various sectors.

- Powders and Concentrates hold a smaller yet important share of about 10%, driven by their cost-effectiveness and high efficacy, especially in large-scale industrial cleaning applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Hygiene and Safety Standards

The Japan Industrial Cleaning Products Market benefits from stringent hygiene and safety standards across various industries. Industries such as manufacturing, automotive, and food processing require consistent and thorough cleaning solutions. This demand ensures the ongoing need for industrial cleaning products. Increased awareness regarding hygiene practices in workplaces and production environments directly contributes to market expansion. Facilities with higher cleanliness standards minimize health risks and prevent contamination. This shift towards maintaining sanitized work environments fuels the demand for specialized cleaning solutions. The growing need for these products aligns with regulatory compliance requirements in key sectors. As industries evolve, they consistently adopt advanced cleaning products to maintain these higher standards.

- For example, Kao Corporation has developed industrial detergents that improve cleaning efficiency in steel production. Their solutions help reduce energy consumption by allowing effective cleaning at lower temperatures, supporting efforts to minimize environmental impact in the industry.

Adoption of Environmentally Friendly Products

Environmental concerns and sustainability are key drivers in the Japan Industrial Cleaning Products Market. Companies are increasingly opting for eco-friendly cleaning solutions, driven by both consumer preference and regulatory mandates. With growing awareness of environmental impact, industries seek products that minimize harm to ecosystems. Green products, often free from harmful chemicals, provide a viable alternative to traditional cleaning solutions. Japan’s focus on reducing carbon footprints and promoting sustainable practices plays a significant role in shaping these market trends. The shift towards biodegradable and non-toxic products allows businesses to meet sustainability targets. These products are increasingly being preferred in both industrial and commercial settings. As businesses strive to comply with global sustainability guidelines, the demand for eco-friendly cleaning products continues to grow.

- For example, Saraya Co., Ltd. launched Japan’s first botanical-based, biodegradable detergent under the “Yashinomi” brand in 1971. Since 2010, the company has produced detergents using segregated RSPO-certified palm oil. Their product “Happy Elephant” is made from Soforo, a completely biodegradable natural cleaning agent, highlighted in Saraya’s sustainability literature and third-party initiatives.

Technological Advancements in Cleaning Solutions

Technological innovation is a major driver of the Japan Industrial Cleaning Products Market. New developments in cleaning technology have led to more efficient, faster, and effective products. Automation and advanced formulations contribute to higher cleaning standards. These innovations make cleaning easier and more thorough, leading to greater adoption in industrial settings. Modern cleaning systems, such as self-cleaning mechanisms, further enhance operational efficiency. Technology also enables products that require fewer resources, reducing water and energy consumption. The rise of smart technologies and connected devices has further transformed the way industrial cleaning products are used. This advancement ensures that businesses achieve optimal cleaning results while reducing operational costs.

Government Regulations and Compliance

The Japan Industrial Cleaning Products Market is strongly influenced by government regulations and compliance requirements. Stricter health, safety, and environmental standards ensure consistent demand for industrial cleaning solutions. Government policies in Japan mandate businesses to maintain sanitary environments, especially in industries like food processing and healthcare. Regulatory requirements often specify the type and effectiveness of cleaning products. Compliance with these regulations drives companies to adopt specialized cleaning solutions. The market also benefits from the enforcement of hygiene standards in sectors such as manufacturing and pharmaceuticals. Ensuring cleanliness becomes critical to the functioning of these industries. As regulations tighten, businesses continue to seek products that meet these ever-evolving standards.

Market Trends:

Shift Towards Non-Toxic and Chemical-Free Products

The trend toward non-toxic and chemical-free products is rapidly shaping the Japan Industrial Cleaning Products Market. This change is driven by both environmental concerns and increasing awareness of health risks associated with harsh chemicals. More consumers and businesses prefer cleaning products that are safer for users and the environment. Non-toxic solutions are gaining traction, especially in industries with sensitive environments such as healthcare. This shift is not only beneficial for the environment but also improves the overall health and well-being of employees. The demand for safer alternatives is fueling product innovation and market growth. Consumers increasingly opt for brands that offer green cleaning products with no harmful side effects. This change in consumer preference is expected to drive further market expansion.

Integration of Smart Technology in Cleaning Products

Smart technology integration into industrial cleaning products is emerging as a significant trend in the Japan Industrial Cleaning Products Market. Innovations such as automated cleaning systems, remote-controlled equipment, and sensor-based tools are transforming the way cleaning tasks are performed. These technologies allow for more precise and efficient cleaning, reducing labor costs and time. IoT-enabled cleaning products enable real-time monitoring, making it easier to track the effectiveness of cleaning operations. Additionally, sensors and AI technologies ensure that cleaning is done at the right time and intensity. This shift towards automated and smart cleaning solutions is expected to increase the adoption rate of such products in various industries. Companies are recognizing the value in offering these advanced solutions to improve operational efficiency.

Growth of Online Sales Channels

The rise of e-commerce platforms is significantly impacting the Japan Industrial Cleaning Products Market. Online sales channels have made industrial cleaning products more accessible to a wider audience. Businesses are increasingly turning to online platforms to source cleaning supplies, benefiting from the convenience and competitive pricing. E-commerce platforms also offer detailed product information and customer reviews, helping businesses make informed purchasing decisions. The shift towards online purchasing has led to the development of specialized e-commerce platforms for industrial products. Online platforms also provide easier access to eco-friendly cleaning solutions. The growth of digital channels aligns with consumer preferences for faster and more convenient purchasing processes. The trend towards online shopping is likely to continue shaping the market.

- For example, Rakuten’s rebranded “Rakuten Mart” began operations in September 2024, processing 70,000 daily orders by February 2025. This included significant volumes of cleaning supplies for businesses, demonstrating the scale and adoption of online channels for sourcing industrial cleaning products in Japan.

Preference for Multi-Purpose and All-in-One Products

In the Japan Industrial Cleaning Products Market, there is a growing preference for multi-purpose and all-in-one cleaning products. Industries are increasingly seeking products that offer a broad range of cleaning functions. These versatile solutions help businesses reduce costs and simplify their cleaning processes. Multi-purpose products also save storage space and reduce inventory management complexity. The demand for these products aligns with the need for greater efficiency and convenience in the workplace. Additionally, all-in-one products are often eco-friendlier, as they reduce the number of individual products required. Businesses also benefit from using fewer cleaning agents, which reduces waste and lowers costs. This trend is likely to accelerate as industries focus on maximizing efficiency.

- For example, Ecolab’s ReadyDose™, launched for the Asian market in July 2025, is an innovative tablet-based multi-purpose cleaning solution for food service and industrial establishments. The system is non-phosphate, environmentally friendly, and designed to reduce packaging waste, aligning with the growing demand for all-in-one and greener products in professional settings.

Market Challenges Analysis:

High Cost of Specialized Cleaning Products

One of the major challenges faced by the Japan Industrial Cleaning Products Market is the high cost of specialized cleaning products. Products with advanced formulations or eco-friendly components typically come at a premium price. While these products offer superior performance and environmental benefits, their high costs can be a barrier for small and mid-sized businesses. Cost concerns often lead companies to opt for traditional or less efficient cleaning products. The challenge lies in balancing the demand for high-quality, effective cleaning solutions with the need for affordable options. Companies must also weigh the long-term benefits of investing in high-performance products against the immediate cost of procurement.

Compliance with Evolving Regulatory Standards

Another challenge for the Japan Industrial Cleaning Products Market is staying compliant with constantly evolving regulatory standards. The market faces increasing pressure from local and international regulations concerning product safety and environmental impact. Businesses must adapt their product offerings to meet these regulatory demands, which often results in significant R&D investments. Manufacturers must regularly update their products to comply with new regulations, particularly those that focus on reducing chemical usage and promoting sustainability. As standards become stricter, the cost of product development and compliance rises, placing additional financial burdens on businesses. The need to stay ahead of changing regulations remains a significant challenge for market players.

Market Opportunities:

Growing Demand for Sustainable Products

The Japan Industrial Cleaning Products Market holds substantial opportunities due to the increasing demand for sustainable and eco-friendly products. Consumers and businesses are shifting towards products that support environmental preservation. There is a clear trend towards products that are biodegradable, non-toxic, and free from harmful chemicals. With Japan’s emphasis on sustainability, businesses that prioritize eco-friendly products are likely to see increased demand. Manufacturers who innovate in this space by offering green alternatives will capture a larger share of the market. The growing emphasis on environmental regulations further boosts this trend, providing opportunities for companies to develop products that meet these demands.

Expansion in Emerging Industries

There are significant opportunities for the Japan Industrial Cleaning Products Market in emerging industries such as biotechnology, pharmaceuticals, and electric vehicles. These sectors have unique cleaning requirements due to the sensitive nature of their products and operations. As these industries continue to expand, the need for specialized cleaning solutions will grow. Companies that can provide tailored cleaning products for these sectors will find new revenue streams. Additionally, the rise of automation and digitalization in these industries creates opportunities for more advanced, tech-driven cleaning solutions. The expansion of these sectors offers promising opportunities for market growth.

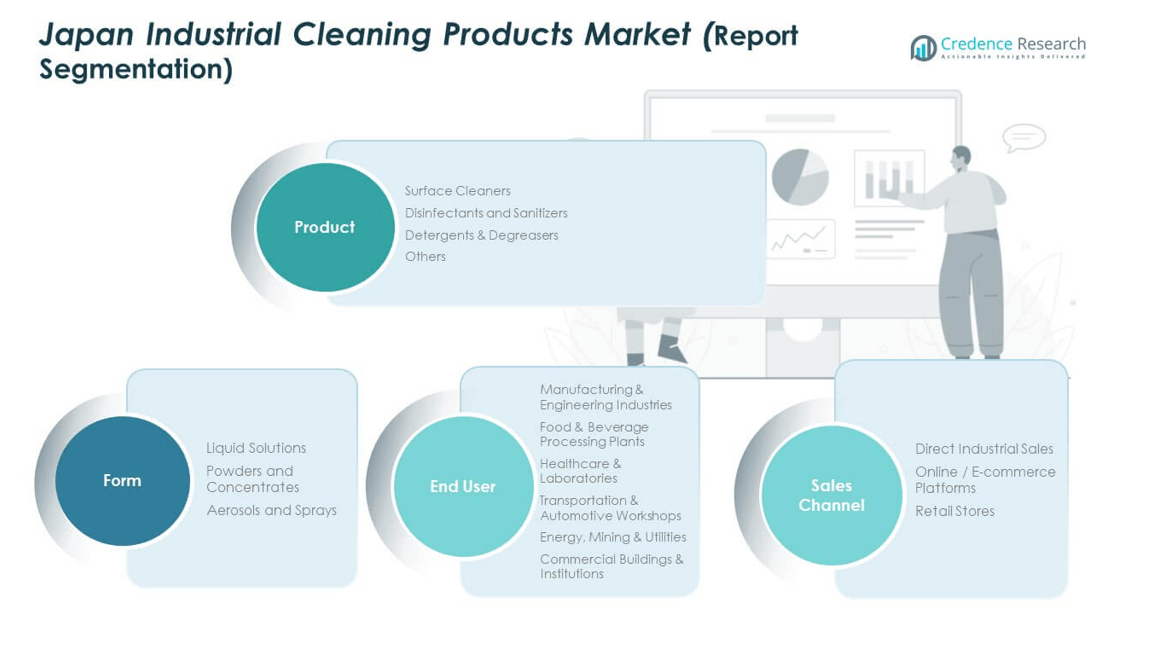

Market Segmentation Analysis

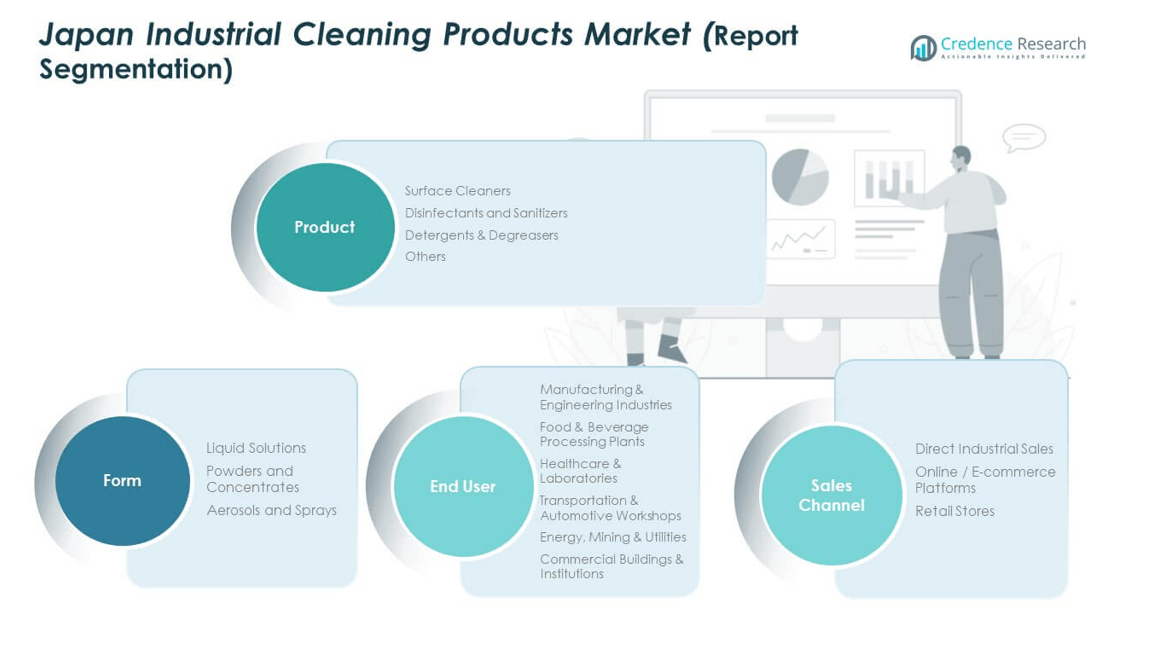

By Product Type

The Japan Industrial Cleaning Products Market includes various product types, with surface cleaners, disinfectants, and sanitizers being prominent. These products are widely used across industries to maintain hygiene and prevent contamination. Detergents and degreasers are also essential, particularly in the automotive and manufacturing sectors. Other products like floor cleaners, air fresheners, and specialty items cater to niche market segments. Each product type plays a crucial role in maintaining cleanliness and ensuring operational efficiency across industries. The demand for disinfectants and sanitizers is increasing, driven by the growing emphasis on hygiene and safety standards.

By Form

The market is segmented by form, including liquid solutions, powders and concentrates, and aerosols and sprays. Liquid solutions are the most commonly used form, offering ease of application and versatility across various surfaces. Powders and concentrates are preferred for their high efficacy and cost-effectiveness, especially in large-scale industrial cleaning. Aerosols and sprays are gaining traction due to their convenience and ability to provide targeted cleaning solutions. This variety in forms allows businesses to choose products based on their specific cleaning needs and operational preferences.

By End User

The Japan Industrial Cleaning Products Market serves several end-user industries, including manufacturing and engineering industries, food and beverage processing plants, and healthcare and laboratories. Each sector has its own set of cleaning requirements, with healthcare demanding high levels of hygiene, especially in clinical environments. The transportation and automotive workshops segment also plays a crucial role, requiring regular cleaning for vehicle maintenance. The energy, mining, and utilities sector presents unique challenges, with large-scale operations needing specialized cleaning solutions. Commercial buildings and institutions require maintenance cleaning to ensure safe and hygienic environments for employees and customers.

- For example, in 2025, Ecolab, as a leading supplier of industrial cleaning technologies, presented its latest food-safety programs and antimicrobial treatment solutions at the International Production & Processing Expo, emphasizing broad adoption in the Japanese food processing and healthcare industries. Ecolab displayed Exelerate™ CSD 15, DrySan Trio, and Keno™san products targeting contamination control at industrial scale across Japan’s facilities.

By Sales Channel

The Japan Industrial Cleaning Products Market is characterized by multiple sales channels, including direct industrial sales, online platforms, and retail stores. Direct industrial sales allow businesses to purchase products in bulk for large-scale operations, ensuring cost efficiency. Online and e-commerce platforms offer convenience and easy access to a wide range of cleaning products. These platforms are increasingly popular among small and medium-sized businesses seeking a broad product selection. Retail stores provide an offline option for immediate product needs, particularly for small-scale businesses or individual buyers. Each channel plays a significant role in expanding the availability of cleaning products across different sectors.

- For example, Lion Corporation’s laundry detergents, including TOP NANOX, continue to lead the Japanese and regional SEA markets as the No. 1 total laundry detergent brand, validated by NielsenIQ for June 2023 and confirmed in Lion’s product documentation.

Segmentation

By Product Type

- Surface Cleaners

- Disinfectants and Sanitizers

- Detergents & Degreasers

- Others

By Form

- Liquid Solutions

- Powders and Concentrates

- Aerosols and Sprays

By End User

- Manufacturing & Engineering Industries

- Food & Beverage Processing Plants

- Healthcare & Laboratories

- Transportation & Automotive Workshops

- Energy, Mining & Utilities

- Commercial Buildings & Institutions

By Sales Channel

- Direct Industrial Sales

- Online / E-commerce Platforms

- Retail Stores

Regional Analysis

East Japan

East Japan, including key industrial cities like Tokyo and Yokohama, holds the largest market share within the Japan Industrial Cleaning Products Market, accounting for approximately 40% of the total market. This region is home to major manufacturing facilities, automotive industries, and healthcare centers, all of which drive the demand for industrial cleaning products. The dense industrial base in this region, coupled with Japan’s commitment to high cleanliness standards, ensures steady market growth. Companies in this area frequently adopt advanced cleaning solutions to meet stringent regulatory standards. The presence of numerous industrial parks further enhances demand for specialized cleaning products, especially in automotive and electronics sectors.

West Japan

West Japan follows with a market share of around 35%, encompassing cities like Osaka and Kobe, which are significant hubs for the chemical and food processing industries. The industrial cleaning products market in this region is driven by manufacturing, especially in heavy industries such as steel and machinery. The food and beverage sector also plays a major role in driving the demand for disinfectants, surface cleaners, and sanitizers. West Japan’s market growth is bolstered by growing awareness of hygiene and safety regulations. This region is seeing a rising demand for eco-friendly and innovative cleaning solutions as businesses strive for sustainability and compliance with environmental standards.

South Japan

South Japan, including areas like Fukuoka and Okinawa, represents a smaller portion of the Japan Industrial Cleaning Products Market, with a market share of approximately 25%. While the region is less industrialized compared to East and West Japan, its demand for industrial cleaning products is growing steadily, driven by the expansion of commercial buildings, healthcare facilities, and food processing plants. The market here is also witnessing an increasing adoption of cleaning products tailored to meet local regulatory standards. The government’s push towards maintaining hygiene in food safety and public spaces further accelerates product adoption, especially in the tourism-driven areas of Okinawa.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kao Corporation

- Dow Inc.

- Gard Chemicals

- Evonik Industries AG

- Chemform

- Stepan Company

- Ecolab Inc.

- 3M

- BASF SE

- Sumitomo Chemical

- Other Key Players

Competitive Analysis

The competitive landscape of the Japan Industrial Cleaning Products Market is highly fragmented, with several key players leading the market. Kao Corporation, Dow Inc., and Ecolab Inc. dominate the market due to their strong product portfolios, extensive distribution networks, and innovative solutions. Kao Corporation’s focus on eco-friendly cleaning solutions and sustainable product development aligns well with the growing trend for green products in the Japanese market. Dow Inc. leverages its global reach and advanced technological expertise in manufacturing high-performance cleaning products, which has helped it secure a significant share of the market. Ecolab Inc. is another strong competitor, known for its comprehensive cleaning and sanitization systems, which cater to industries ranging from food and beverage to healthcare. The market also sees competition from local players such as Gard Chemicals and Sumitomo Chemical, who offer cost-effective and region-specific products tailored to meet the unique demands of Japanese industries. Global players like 3M and BASF SE are further intensifying competition with their diverse range of cleaning products and innovative technologies. These companies are actively expanding their presence through strategic mergers, acquisitions, and product launches. The increasing shift towards automation and the development of smart cleaning systems is also driving competition, with companies investing in technological advancements to meet the evolving needs of the market.

Recent Developments

- In October 2025, Evonik officially opened its new “Alu5” fumed alumina production facility in Yokkaichi, Japan. The plant produces advanced aluminum oxide grades used in electromobility, lithium-ion batteries, and coating applications, significantly strengthening Evonik’s presence in the Asian cleaning and maintenance chemicals market.

- In July 2025, BASF strengthened its industrial enzyme portfolio with new liquid enzyme offerings for stain removal, fabric care, and whiteness, supporting next-generation cleaning and laundry formulations in Japan and worldwide.

- In July 2025, Dow Inc. announced the shutdown of three upstream European assets as part of a global strategy to right-size capacity and reduce energy exposure. In April 2025, Dow expanded its partnership with Univar Solutions to deepen the distribution and development of silicone products and sustainable chemicals throughout Asia, benefiting Japan’s industrial cleaning sector.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, End User and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan Industrial Cleaning Products Market will see increased adoption of eco-friendly products as industries strive to meet sustainability targets.

- Technological advancements will drive the development of automated cleaning solutions, improving efficiency and reducing labor costs.

- The demand for disinfectants and sanitizers will remain high, especially in healthcare and food processing sectors, where hygiene is paramount.

- The market will see steady growth in the manufacturing and automotive industries, both of which require specialized cleaning products.

- Online and e-commerce platforms will expand as key sales channels, offering greater accessibility and convenience for businesses.

- Demand for multi-purpose cleaning products will rise, as companies seek to streamline operations and reduce costs.

- Regional players will play an increasingly important role as local industries adopt cleaning solutions tailored to their specific needs.

- The trend towards compliance with stricter regulatory standards will fuel the demand for specialized, high-performance cleaning products.

- South Japan’s growing industrial base and rising awareness of hygiene will contribute to the market’s expansion in the region.

- Collaboration and partnerships among key market players will lead to new product innovations and enhance competitive positioning in the market.