| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Industrial Fasteners Market Size 2024 |

USD 6087.11 million |

| Japan Industrial Fasteners Market, CAGR |

6.49% |

| Japan Industrial Fasteners Market Size 2032 |

USD 10,068.72 Million |

Market Overview

The Japan Industrial Fasteners Market is projected to grow from USD 6087.11 million in 2024 to an estimated USD 10,231.65 million by 2032, with a compound annual growth rate (CAGR) of 6.49% from 2025 to 2032. The market growth is driven by the expanding manufacturing sector, increased demand for automotive and construction applications, and the rising need for high-quality fasteners in various industrial sectors.

Key drivers of the Japan Industrial Fasteners Market include the increasing adoption of industrial automation, robust demand from the automotive, aerospace, and construction industries, and the rising emphasis on safety and durability in industrial applications. Additionally, advancements in materials and coatings are boosting the demand for innovative fastening solutions. With a surge in demand for lightweight and corrosion-resistant fasteners, these trends are expected to shape the market dynamics in the coming years.

Geographically, Japan holds a significant share of the industrial fasteners market in the Asia Pacific region. The country’s advanced industrial base, combined with strong manufacturing sectors such as automotive, electronics, and construction, contributes to the market’s growth. Key players in the Japan Industrial Fasteners Market include Nitto Seiko Co., Ltd., MISUMI Group, Inc., and TOKYO Fasteners Co., Ltd., which play a vital role in providing innovative fastening solutions across various industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Industrial Fasteners Market is projected to grow from USD 7,818.37 million in 2024 to USD 10,231.65 million by 2032, registering a CAGR of 3.42% from 2025 to 2032.

- Rising demand from the automotive, aerospace, and construction sectors is a primary growth driver, fueled by Japan’s advanced industrial base and focus on quality engineering.

- Increased adoption of industrial automation and smart manufacturing is creating a surge in demand for precision-engineered and technologically advanced fasteners.

- Innovations in lightweight materials and corrosion-resistant coatings are supporting the development of high-performance fastening solutions across key industries.

- Volatile raw material prices, particularly for metals, pose a challenge to manufacturers by increasing production costs and disrupting pricing strategies.

- Complex regulatory requirements and stringent industry standards necessitate continuous investment in compliance, quality control, and certification processes.

- Tokyo, Osaka, and Nagoya dominate the market with over 85% combined share, driven by strong industrial infrastructure, manufacturing hubs, and ongoing infrastructure development.

Market Drivers

Rising Infrastructure Development and Construction Activities

Japan’s ongoing infrastructure development and urban renewal initiatives are key contributors to the growing demand for industrial fasteners. The government has undertaken various public infrastructure projects, including bridge repairs, seismic retrofitting, road expansions, and railway upgrades, to improve national resilience and transportation networks. These projects require a large volume of structural fasteners to ensure safety, strength, and stability.The Japanese construction sector also benefits from the private sector’s investments in commercial buildings, residential complexes, and industrial facilities. High-rise buildings, logistics centers, and smart city developments demand fastening systems capable of withstanding dynamic loads, temperature variations, and environmental stress. As construction companies prioritize faster project execution and long-term durability, the need for reliable and high-performance fasteners becomes more pronounced.Furthermore, the growing adoption of prefabricated construction methods and modular building techniques is increasing the use of specialized fasteners designed for quick assembly and disassembly. These trends collectively amplify the role of industrial fasteners as critical components in Japan’s modern construction landscape.

Increased Focus on Automation and Industrial Innovation

Japan’s commitment to industrial innovation and automation is another major driver of the industrial fasteners market. With a highly advanced manufacturing ecosystem and a labor market impacted by demographic shifts, Japanese industries are increasingly embracing automation, robotics, and smart manufacturing solutions to enhance productivity. Automated assembly lines, robotic arms, and precision machinery all require specialized fasteners to ensure mechanical integrity and safety.The integration of Industry 4.0 technologies, including IoT-enabled systems and data-driven production processes, has led to the development of smart fasteners equipped with sensors and monitoring capabilities. These next-generation fasteners enable real-time tracking of torque, stress, and wear, facilitating predictive maintenance and reducing downtime. As industries aim for greater operational efficiency and reliability, the adoption of these intelligent fastening solutions is expected to rise.Additionally, Japan’s strategic emphasis on green manufacturing and energy efficiency supports the development of lightweight fasteners and sustainable materials. Fastener producers are innovating to align with these goals by offering products that contribute to energy savings, lower emissions, and reduced material waste. This alignment with national industrial policies and sustainability standards ensures continued growth and relevance of fasteners in Japan’s future-oriented manufacturing landscape.

Strong Automotive and Manufacturing Sector

Japan’s industrial fasteners market thrives on the strength of its automotive and manufacturing sectors, which demand precision and durability. The automotive industry, featuring global leaders such as Toyota, Honda, Nissan, and Subaru, relies heavily on high-performance fasteners for assembling critical components like engines, transmissions, and chassis. These manufacturers prioritize stringent quality standards to ensure safety and reliability in vehicles. Additionally, the shift toward electric and hybrid vehicles has introduced new fastening requirements for battery modules and lightweight structural components.Beyond automotive applications, Japan’s broader manufacturing sector—including electronics, machinery, shipbuilding, and robotics—requires a steady supply of fasteners for assembling products and systems. The adoption of advanced production technologies has further increased the demand for reliable fastening solutions. For instance, robotics and machinery manufacturers seek customized fasteners to optimize product performance and durability. This trend reflects the industry’s focus on innovation and efficiency.Moreover, Japan’s infrastructure development projects contribute to the fastener market’s growth. From bridges to railways, fasteners are indispensable in construction activities. The aerospace sector also plays a role by demanding specialized fasteners that meet strict safety standards. Collectively, these industries underscore Japan’s emphasis on quality manufacturing and its ability to sustain high demand for industrial fasteners across diverse applications.

Advancements in Fastener Materials and Coating Technologies

Technological innovations in materials and coatings are reshaping Japan’s industrial fasteners market. Traditional steel fasteners are increasingly supplemented or replaced by advanced materials like stainless steel, titanium alloys, aluminum, and high-performance polymers. These materials offer superior corrosion resistance, enhanced strength-to-weight ratios, and extended service life—qualities essential for industries such as automotive, aerospace, marine, and construction.Modern coating technologies further enhance fastener performance. Zinc-nickel plating, fluoropolymer coatings, and epoxy-based finishes provide protection against corrosion, wear, and chemical exposure. These coatings reduce maintenance needs while ensuring durability under extreme conditions. Japanese manufacturers are investing in research to develop environmentally friendly coating solutions that comply with strict regulations while maintaining high performance standards.The focus on sustainability is evident as manufacturers explore eco-friendly production methods and recyclable materials. For instance, innovations in nanotechnology have enabled the creation of coatings that are both effective and environmentally compliant. Such advancements align with global trends toward green manufacturing practices.

Market Trends

Sustainability and Eco-Friendly Fastening Solutions

Sustainability is a growing concern within the industrial fasteners market in Japan, reflecting broader global trends in environmental responsibility. Manufacturers are increasingly focused on reducing their carbon footprint and developing eco-friendly fasteners that align with stringent environmental standards. This trend is being driven by both government regulations and the growing consumer demand for sustainable products.In response, fastener manufacturers are innovating by using environmentally friendly materials, such as recycled metals, bio-based polymers, and other sustainable composites, which are being incorporated into fastener designs. Additionally, many companies are adopting new manufacturing processes, such as energy-efficient production methods and reduced material waste strategies, to further minimize their environmental impact. The development of corrosion-resistant coatings that use environmentally safe chemicals is also a key trend, as traditional coatings often involve toxic substances. Moreover, the focus on the circular economy—where products are designed for easy recycling—has led to the creation of fasteners that can be disassembled and reused, contributing to the reduction of landfill waste.The move toward sustainability is not only in response to environmental pressures but also in line with Japan’s national policies to promote green manufacturing and energy-efficient solutions. Industries such as construction, automotive, and electronics, which heavily rely on fasteners, are increasingly requiring products that are not only durable but also sustainable, positioning the fastener market for continued growth in the eco-conscious era.

Customization and Demand for Specialized Fasteners

Customization is becoming increasingly important in the Japan Industrial Fasteners Market. As industries evolve, the demand for specialized fasteners tailored to specific applications is on the rise. This trend reflects the growing need for fasteners that meet stringent industry standards in terms of performance, size, material composition, and durability.In sectors such as automotive, aerospace, and construction, fasteners are required to meet unique and highly specific demands. For instance, in the automotive industry, manufacturers are looking for fasteners that can meet specific torque and strength requirements while also being lightweight and corrosion-resistant. Similarly, in the aerospace sector, fasteners must endure extreme conditions, including high stress, high temperatures, and exposure to corrosive elements. The trend of customized fasteners is being driven by the growing complexity of products and systems in these industries, where precision and reliability are paramount.Additionally, technological advancements in manufacturing processes such as 3D printing and additive manufacturing are enabling the production of highly specialized, bespoke fasteners. This level of customization allows for fasteners to be designed to fit exact specifications, reducing waste and increasing efficiency in assembly processes. The ability to offer customized solutions not only meets the unique needs of customers but also provides a competitive edge in the market, as more manufacturers demand tailored fastening solutions to meet specific operational challenges.

Adoption of Lightweight and High-Strength Fasteners

A notable trend in the Japan Industrial Fasteners Market is the increasing demand for lightweight, high-strength fasteners. As industries such as automotive, aerospace, and construction focus on enhancing fuel efficiency, reducing emissions, and improving structural performance, the need for lightweight materials has become paramount. For instance, companies like Toyota and Honda are leveraging advanced materials such as titanium and aluminum alloys to reduce vehicle weight while maintaining structural integrity. This shift is also driven by government initiatives promoting sustainable manufacturing practices. In aerospace, companies are using specialized alloys and composites to meet stringent performance requirements. The trend aligns with broader sustainability goals by contributing to energy efficiency and reducing environmental footprints across various sectors.

Technological Integration: Smart and Digital Fasteners

The integration of technology into industrial fasteners is another defining trend in the Japanese market. As industries push for smarter, more connected manufacturing processes, there has been a surge in the development of smart fasteners that incorporate sensors and wireless communication technologies. For instance, Japanese SMEs are adopting IoT platforms to enhance real-time monitoring and maintenance of production equipment, reducing downtime risks. These smart fasteners provide critical data on stress, strain, torque, and wear levels, enabling predictive maintenance and reducing the risk of failure. In sectors such as aerospace and automotive, where component reliability is crucial, the ability to monitor and track fastener performance is becoming increasingly important. This technological evolution is contributing significantly to Japan’s Industry 4.0 transformation, aligning with government strategies like Society 5.0, which emphasizes technological innovation for societal betterment.

Market Challenges

Complex Regulatory Compliance and Industry Standards

Navigating Japan’s intricate regulatory landscape and stringent industry standards presents significant challenges for fastener manufacturers. Industries such as automotive, aerospace, and electronics rely heavily on fasteners, necessitating adherence to rigorous safety and performance certifications. Japan’s regulatory framework emphasizes quality control, environmental sustainability, and product safety, requiring manufacturers to invest heavily in research, testing, and certification processes.For instance, fasteners used in aerospace and automotive applications must endure rigorous testing for stress resistance, corrosion resistance, and material integrity. Non-compliance with these standards can result in recalls, legal complications, and reputational damage. Additionally, Japanese manufacturers must align with global standards like ISO certifications to remain competitive in international markets. This dual compliance with domestic and international regulations adds complexity to production processes.Japanese Industrial Standards (JIS) play a vital role in ensuring fastener quality through systematic management practices such as material composition verification and process capability assessments. Moreover, advancements like Statistical Process Control (SPC) have been widely adopted to enhance manufacturing precision. These measures ensure traceability and continuous improvement during production rather than relying solely on final inspections. Despite these efforts, adapting to evolving regulations while maintaining sustainability and performance remains a persistent challenge for manufacturers in this competitive market.

Complex Regulatory Compliance and Industry Standards

The second key challenge is navigating the complex regulatory environment and stringent industry standards that govern fastener production in Japan. With industries such as automotive, aerospace, and electronics, which rely heavily on fasteners, adhering to various safety and performance certifications is critical. Japan’s regulatory requirements for fasteners are rigorous, especially concerning quality control, environmental sustainability, and product safety. Fastener manufacturers must continuously meet these standards, requiring significant investments in research and development, testing, and certification processes.For instance, fasteners used in the aerospace and automotive industries must undergo thorough testing for stress resistance, corrosion resistance, and material integrity. Non-compliance with these regulations can lead to costly recalls, legal issues, and damage to a company’s reputation. Furthermore, the need to comply with global standards, such as ISO certifications, adds another layer of complexity for manufacturers, particularly those exporting fasteners internationally. Adapting to rapidly changing regulatory requirements, while ensuring the fastener’s performance and sustainability, presents a significant ongoing challenge in the market.

Market Opportunities

Growing Demand from Emerging Technologies and Electric Vehicles (EVs):

One of the most promising opportunities in the Japan Industrial Fasteners Market lies in the rapid advancement of emerging technologies and the accelerating shift toward electric vehicles (EVs). As Japan strengthens its commitment to sustainable mobility and smart manufacturing, the demand for lightweight, high-strength, and corrosion-resistant fasteners is expected to surge. EV production, in particular, requires specialized fasteners for battery packs, lightweight structural components, and thermal management systems. This shift presents fastener manufacturers with opportunities to innovate in design, materials, and integration with smart systems. Moreover, industries adopting advanced robotics and automated assembly lines are seeking fastening solutions with precise torque control and high reliability, further driving growth in specialized product segments.

Infrastructure Modernization and Smart City Projects:

Japan’s continued investment in infrastructure development and smart city initiatives creates a significant opportunity for the fasteners market. Projects involving the renovation of aging infrastructure, earthquake-resistant construction, and high-speed transportation systems demand advanced fastening solutions with enhanced durability and structural integrity. With the government’s focus on modernizing urban centers and improving public utilities, there is a rising need for construction-grade and structural fasteners that meet high safety standards. Additionally, the adoption of modular construction techniques and prefabricated structures is expected to boost the demand for specialized fasteners that enable efficient and secure assembly. This growing need positions fastener manufacturers to expand their offerings and capitalize on long-term infrastructure-driven growth across the country.

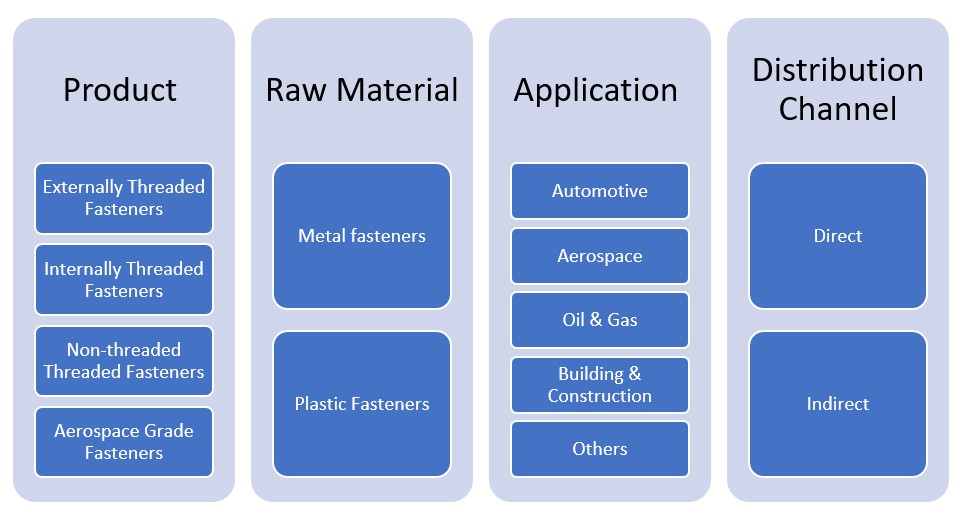

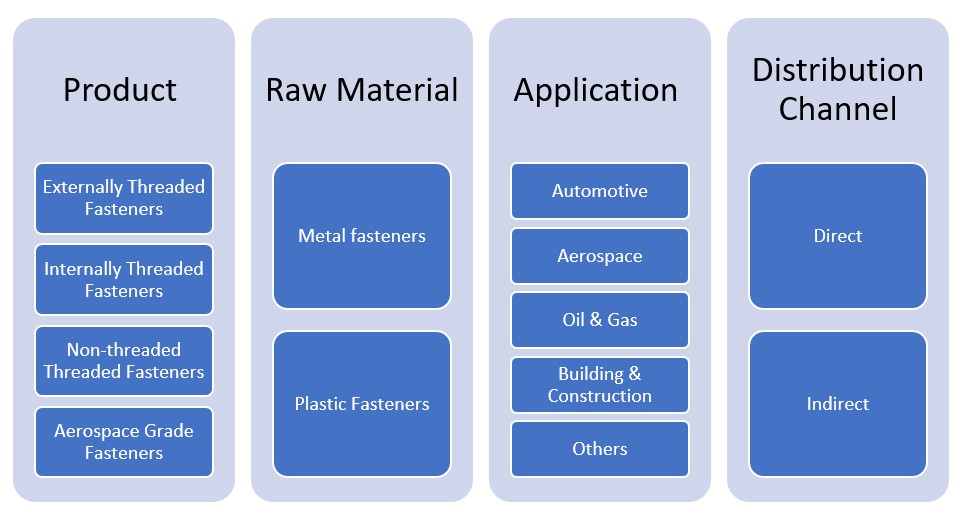

Market Segmentation Analysis

By Product

The Japan Industrial Fasteners Market is divided into several categories based on product types. Externally threaded fasteners hold the largest share in this segment. These include bolts, screws, and studs, widely used in industries such as automotive, construction, and machinery. Externally threaded fasteners are in high demand due to their versatility and strong mechanical properties, enabling them to perform well in a wide range of applications.Internally threaded fasteners, such as nuts, are another critical product segment. These fasteners are essential in applications that require a secure connection between components, especially in the automotive and machinery sectors. The demand for internally threaded fasteners is driven by the need for durability and safety in high-stress environments.Non-threaded fasteners, such as rivets and pins, are also prevalent in industries like aerospace and construction, where strong, permanent connections are necessary. These fasteners are particularly used for joining materials without the need for threading, offering advantages like ease of use and reduced material stress.Aerospace-grade fasteners are a specialized segment, with growing demand driven by Japan’s strong aerospace industry. These fasteners are designed to meet stringent performance and safety standards, making them crucial for aerospace applications that demand precision, strength, and reliability.

By Raw Material

The raw material segment in the Japan Industrial Fasteners Market is dominated by metal fasteners, particularly those made from steel, titanium, and aluminum. Metal fasteners are widely used due to their strength, durability, and resistance to corrosion, making them ideal for high-performance applications in industries such as automotive, aerospace, and construction. Titanium and aluminum fasteners are gaining popularity for their lightweight properties, particularly in the aerospace and automotive sectors where weight reduction is a key consideration.Plastic fasteners, though a smaller segment, are experiencing increased demand in applications that require corrosion resistance or in situations where metal fasteners may not be suitable. These include industries such as electronics, consumer goods, and medical devices. The lightweight and cost-effective nature of plastic fasteners make them a preferred choice in non-heavy-duty applications.

Segments

Based on Product

- Externally Threaded Fasteners

- Internally Threaded Fasteners

- Non-threaded Threaded Fasteners

- Aerospace Grade Fasteners

Based on Raw Material

- Metal fasteners

- Plastic Fasteners

Based on Application

- Automotive

- Aerospace

- Oil & Gas

- Building & Construction

- Others

Based on Distribution Channel

Based on Region

Regional Analysis

Tokyo and Kanto Region (40%)

Tokyo, the capital of Japan, along with the surrounding Kanto region, dominates the Japan Industrial Fasteners Market, accounting for approximately 40% of the total market share. This region is home to the country’s most significant manufacturing and industrial activity, including sectors like automotive, electronics, and heavy machinery. As Japan’s economic and industrial center, Tokyo’s proximity to major automotive manufacturers such as Toyota, Honda, and Nissan drives the demand for industrial fasteners in automotive production. Additionally, the Kanto region hosts a variety of infrastructure projects, including building construction, transportation networks, and public works, further boosting the demand for fasteners in the region.

Osaka and Kansai Region (25%)

The Kansai region, which includes Osaka, is another critical market for industrial fasteners, contributing around 25% to the overall market. Osaka is known for its diversified industrial base, including machinery, steel, and chemical industries, all of which require industrial fasteners in their manufacturing processes. The region is also a key player in the aerospace sector, which increasingly demands high-performance, aerospace-grade fasteners. The infrastructure development, particularly in the Osaka metropolitan area and nearby cities such as Kobe and Kyoto, also contributes to the steady demand for fasteners in construction and urban development projects.

Key players

- Nitto Seiko Co., Ltd.

- IHI Corporation

- Kamax Japan Co., Ltd.

- Standard Fasteners Co., Ltd.

- Nippon Fasteners Co., Ltd.

Competitive Analysis

The Japan Industrial Fasteners Market is characterized by intense competition among both domestic and international players, with a strong emphasis on innovation, quality, and application-specific solutions. Leading companies such as Nitto Seiko Co., Ltd. and IHI Corporation maintain a competitive edge through advanced product portfolios, strong R&D capabilities, and a focus on customized fastening solutions. Nitto Seiko, in particular, benefits from its integrated product offerings, including fastening machinery and automated systems. Kamax Japan Co., Ltd. and Nippon Fasteners Co., Ltd. are known for their high-performance automotive and industrial fasteners, meeting stringent quality standards. Meanwhile, Standard Fasteners Co., Ltd. leverages cost-efficient manufacturing and a broad distribution network to serve mid-size and large enterprises. Market players compete on parameters such as technological innovation, durability, precision engineering, and client-centric services. As demand continues to evolve with trends like lightweight materials and smart manufacturing, key players are investing in next-generation fasteners to maintain market leadership.

Recent Developments

- In December 2024, Nitto Seiko reported progress under its medium-term business plan “Mission G-second,” focusing on automation and electrification demands. Despite economic slowdowns in regions like the U.S. and Thailand, the company improved operating income through price adjustments for screw fastening machines.

- In December 2024, ARP launched an upgraded high-strength fastener kit for DART LS Next engine blocks. This kit uses 8740 chromoly steel, offering improved fatigue strength and reliability, catering to high-performance automotive applications.

- In February 2024, ITW reported its financial results for 2023, highlighting a 2% organic growth and a 130 basis point increase in operating margin to 25.1%. While the report emphasizes customer-focused innovation, it does not specifically detail advancements in fastener product lines.

- In January 2025, Arconic undertook a project to relocate a 10,000-ton forging press from overseas to a new facility in Rancho Cucamonga, California. This expansion aimed to enhance their aeronautics operations by integrating advanced manufacturing capabilities.

- In February 2025, Nifco has focused on sustainability by developing plastic products that enhance workability and reduce weight in automotive applications, contributing to better fuel efficiency and reduced environmental impact.

Market Concentration and Characteristics

The Japan Industrial Fasteners Market exhibits a moderate to high level of market concentration, with a mix of well-established domestic manufacturers and a few global players dominating the competitive landscape. Key characteristics of the market include a strong emphasis on precision engineering, product durability, and compliance with stringent industry standards, particularly for automotive and aerospace applications. The market is highly specialized, with a significant portion of production tailored to meet the specific requirements of end-use industries. Companies focus heavily on R&D, automation, and material innovation to stay competitive, while maintaining long-term partnerships with OEMs and tier-1 suppliers. Moreover, the market is characterized by a high degree of product customization, technological integration, and a preference for quality over price, reflecting Japan’s advanced industrial standards and its focus on reliability, safety, and performance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Raw Material, Application, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Japan’s shift towards electric vehicle (EV) production will significantly boost demand for lightweight, high-performance fasteners designed for battery systems and energy-efficient assemblies.

- With Japan’s expanding aerospace sector, the need for advanced, corrosion-resistant, and high-strength fasteners is expected to rise, particularly for aircraft structural components.

- The market will witness greater integration of smart fasteners equipped with sensors for real-time monitoring, enhancing maintenance efficiency and operational reliability.

- Environmental regulations and corporate sustainability goals will drive the adoption of eco-friendly fastener materials and manufacturing processes with reduced carbon footprints.

- As industries embrace automation, demand for precision-engineered fasteners compatible with robotic assembly systems will increase, particularly in automotive and electronics.

- Fastener manufacturers will invest in developing new materials such as carbon composites and bio-based polymers to meet the evolving needs of lightweight and sustainable production.

- The market will see a rise in demand for customized fasteners tailored to specific industry applications, enabling manufacturers to offer differentiated solutions and gain competitive advantage.

- Digital tools and IoT integration will streamline fastener manufacturing and supply chain operations, reducing lead times and improving inventory management for suppliers and distributors.

- Government investments in infrastructure repair and urban development will create long-term demand for construction-grade fasteners, particularly in seismic-resistant building designs.

- Japanese manufacturers will capitalize on export opportunities in emerging Asian markets by offering high-quality, certified fasteners to meet growing regional industrial demand.