Market Overview:

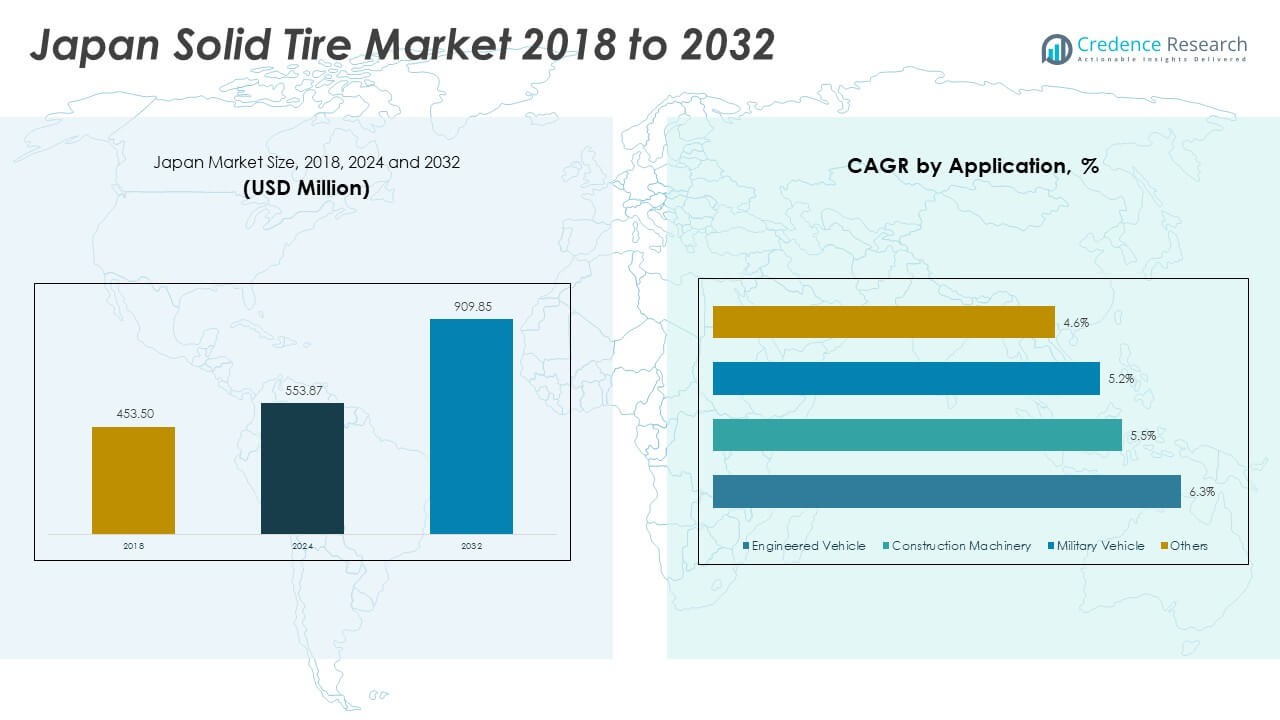

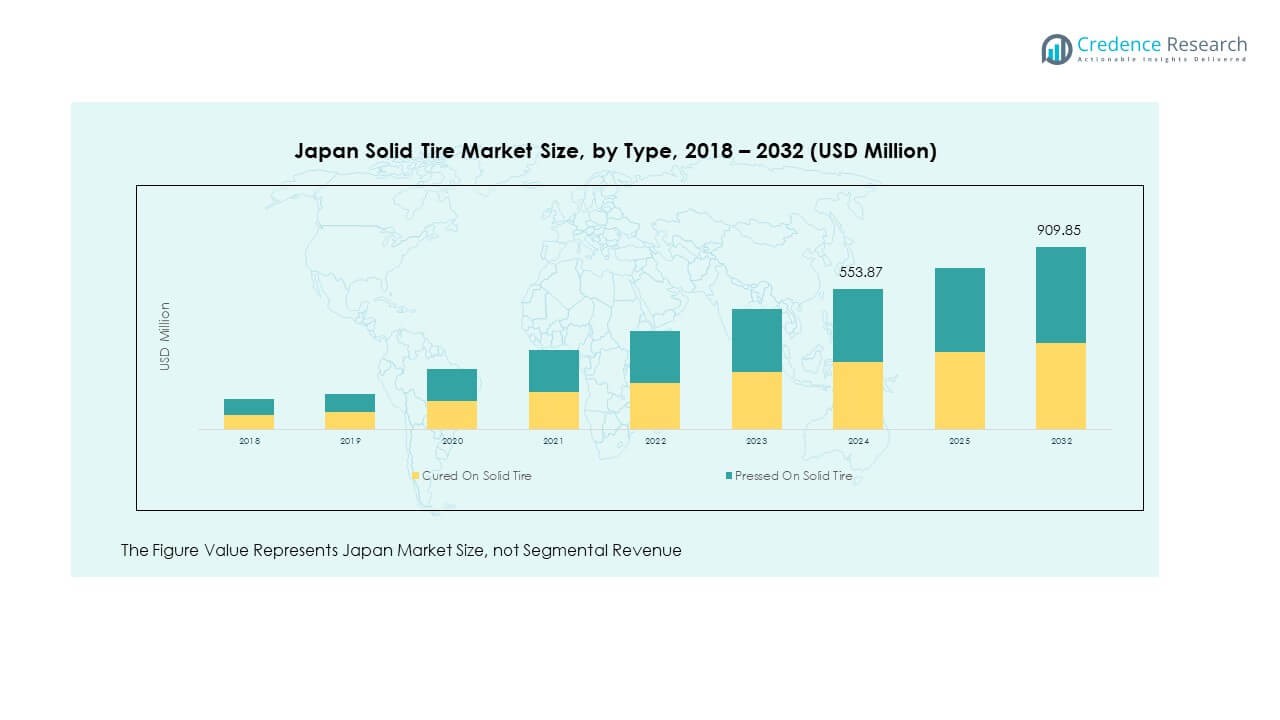

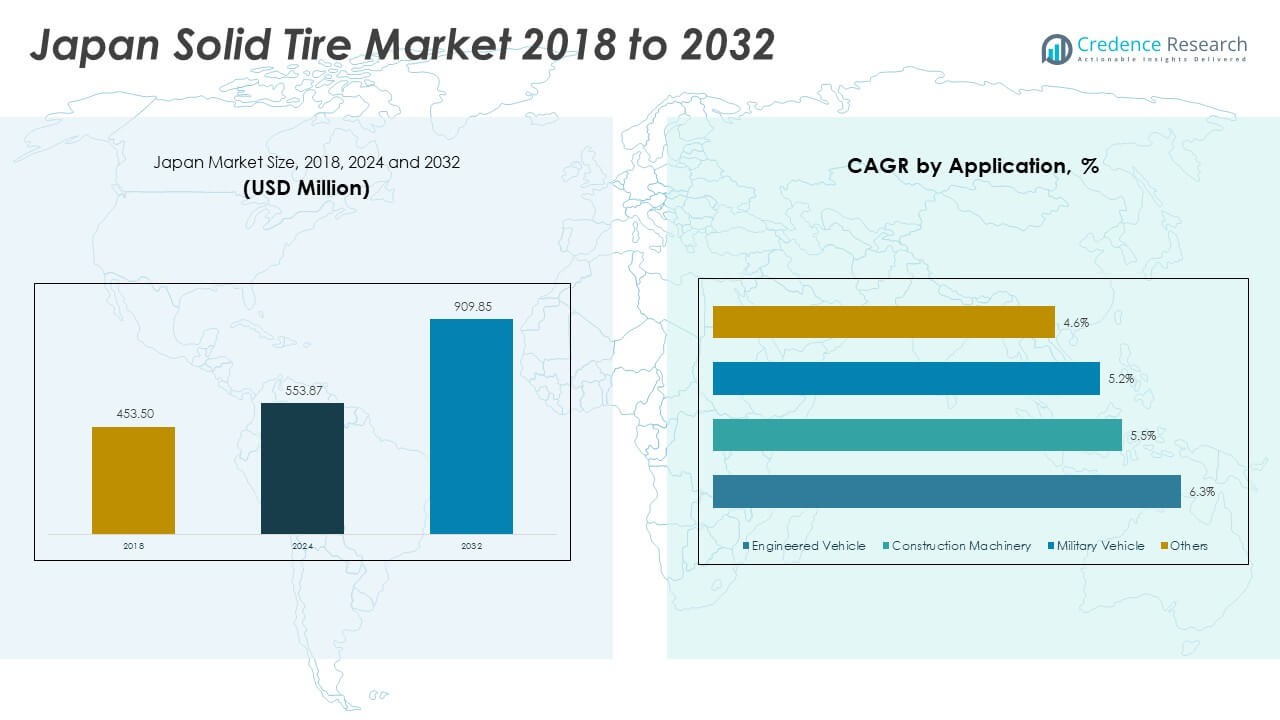

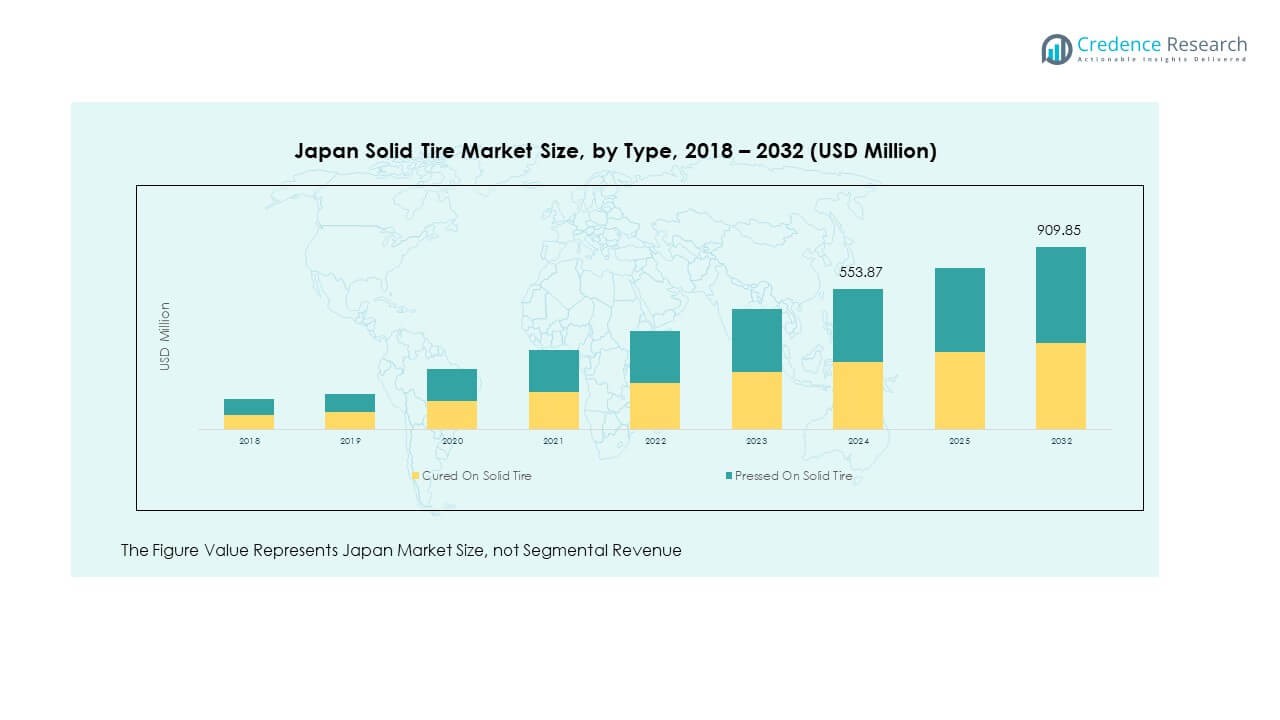

The Japan Solid Tire Market size was valued at USD 453.50 million in 2018 to USD 553.87 million in 2024 and is anticipated to reach USD 909.85 million by 2032, at a CAGR of 6.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Solid Tire Market Size 2024 |

USD 553.87 Million |

| Japan Solid Tire Market, CAGR |

6.40% |

| Japan Solid Tire Market Size 2032 |

USD 909.85 Million |

The market is driven by strong demand from industrial and logistics sectors, where durability and reliability of solid tires play a crucial role in operations. Growth in e-commerce and retail distribution has expanded warehouse and material-handling activities, increasing solid tire adoption. Rising urbanization and infrastructure projects also push demand for forklifts and heavy-duty equipment, further supporting market growth. Companies increasingly focus on cost efficiency and reduced downtime, which strengthens the preference for solid tires over pneumatic alternatives. Sustainability initiatives also encourage adoption of longer-lasting tire options.

Japan dominates the regional solid tire market due to its advanced industrial base, high automation levels, and robust logistics sector. Neighboring Asian countries such as China and South Korea are emerging markets, benefiting from manufacturing expansion and rapid infrastructure development. Southeast Asia is also showing steady growth, driven by rising construction projects and warehouse operations. Japan’s leadership is sustained by technological innovations, strong OEM partnerships, and strict standards that ensure product quality, while emerging markets are fueled by cost-sensitive demand and government-backed industrial growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Solid Tire Market size was USD 453.50 million in 2018, reached USD 553.87 million in 2024, and is projected to hit USD 909.85 million by 2032, at a CAGR of 6.40% during 2024–2032.

- North America (35%), Europe (28%), and Japan (20%) dominate due to strong industrial bases, advanced logistics infrastructure, and high adoption of heavy-duty equipment.

- Asia-Pacific excluding Japan (10%) is the fastest-growing region, fueled by rapid urbanization, manufacturing expansion, and increasing warehouse automation.

- Cured-On Solid Tires account for around 42% share in 2024, reflecting high demand from construction and material-handling applications.

- Pressed-On Solid Tires hold about 58% share in 2024, driven by logistics, warehousing, and industrial equipment use.

Market Drivers:

Rising Demand from Industrial and Logistics Applications Supporting Steady Tire Consumption Growth:

The Japan Solid Tire Market is strongly driven by industrial and logistics expansion. Warehouses and distribution centers rely on forklifts, trolleys, and heavy vehicles that need durable tires. Solid tires withstand high loads and resist punctures, making them a preferred choice. The growth of e-commerce and online retail has created an urgent need for continuous material handling operations. Companies seek reliable equipment to minimize downtime and increase efficiency. Solid tires address these operational goals by offering longer lifespans and reduced maintenance needs. Demand from ports, warehouses, and factories continues to sustain market growth. It positions solid tires as an essential component of industrial equipment in Japan.

- For instance, Japanese forklift manufacturer Toyota utilizes solid polyurethane and solid rubber tires, optimized for specific applications. Polyurethane tires are often used on smaller, electric warehouse models operating on smooth, indoor floors, where they provide excellent durability and resistance to cuts and tears without marking the floor.

Expanding Infrastructure Development Projects Strengthening the Adoption of Heavy-Duty Equipment Tires:

Urban development and large-scale infrastructure projects are major contributors to demand for solid tires. Construction sites require durable tires that can withstand rough terrain and heavy workloads. Solid tires provide consistent performance and reduce replacement frequency, saving operational costs. Government-backed infrastructure projects drive the use of excavators, loaders, and lifting machinery. This directly benefits manufacturers of solid tires that supply to the construction sector. Continuous investments in road, rail, and building development expand the market scope. Companies value the stability and safety benefits these tires provide on challenging work sites. It continues to attract strong demand from construction-focused applications.

- For example, Yantai Wonray Rubber Tyre Co., Ltd produces cured-on solid tires such as size 17.5-25 and 23.5-25 models used extensively on loaders and support trucks at Japanese infrastructure sites, noting their enhanced load capacity and wear resistance. Continuous investments in road, rail, and building development expand the market scope.

Technological Enhancements in Tire Materials and Design Improving Market Penetration:

The development of advanced rubber compounds and reinforced designs is enhancing solid tire performance. Manufacturers focus on improved load-bearing capacity, heat resistance, and wear durability. These innovations reduce rolling resistance and support energy-efficient operations. With sustainability gaining attention, firms also explore eco-friendly production methods. Product innovation has become a competitive differentiator in the Japanese market. Improved comfort and reduced vibration are features increasingly demanded by equipment operators. Technological progress supports broader acceptance of solid tires in high-demand industries. It is creating a pathway for companies to expand their reach in specialized applications.

Rising Focus on Cost Efficiency and Maintenance Reduction Driving User Preferences:

Companies operating in logistics, retail, and industrial sectors prioritize cost-effective solutions. Solid tires reduce maintenance requirements compared to pneumatic alternatives. Their puncture-proof design minimizes downtime, increasing operational continuity. Lower replacement frequency leads to significant cost savings for businesses with large fleets. Extended tire lifespans improve asset utilization and optimize capital expenditure. Operators prefer solutions that support long-term operational stability and safety. The ability to deliver higher performance while reducing total cost of ownership strengthens market preference. It places solid tires at the center of procurement strategies in Japanese industrial operations.

Market Trends

Integration of Automation and Robotics in Warehousing Increasing Dependence on Specialized Tires:

Automation in warehousing and logistics is expanding rapidly across Japan. Automated guided vehicles (AGVs) and robotic forklifts require specialized solid tires. These applications demand high precision, consistent performance, and minimal vibration. Solid tires meet these needs by offering stability and reliability in controlled environments. Growing investments in smart warehouses are accelerating the use of automated systems. Tire producers are adapting designs to support robotics-specific requirements. This trend broadens the application base beyond traditional forklifts and industrial trucks. The Japan Solid Tire Market is aligning with the wider adoption of smart and automated logistics operations.

- For example, one of Japan’s largest tire warehouses automated tire handling of large-sized tires (600-800 mm) weighing between 9 to 70 kg with Mech-Mind’s AI and 3D vision automation, streamlining operations while reducing manual labor and errors. Growing investments in smart warehouses are accelerating the use of automated systems. Tire producers are adapting designs to support robotics-specific requirements.

Sustainability-Oriented Manufacturing Practices Reshaping Competitive Approaches in Tire Production:

Environmental awareness is influencing tire manufacturing in Japan. Producers are adopting recycled materials and energy-efficient production methods. Lifecycle assessments are used to measure environmental performance and reduce carbon footprints. Buyers, particularly large corporations, prefer suppliers aligned with sustainability standards. This shift encourages manufacturers to innovate with eco-friendly compounds and processes. Market competition increasingly reflects differentiation on sustainability credentials. Tire producers that meet corporate and government sustainability benchmarks are gaining an advantage. It is reshaping product development and marketing strategies in the competitive tire industry.

- For instance, Sumitomo Rubber Group has installed a hydrogen energy system at its Shirakawa factory, enabling the production of carbon-neutral tires (Scope 1 and 2) — a first in Japan — while targeting a 55% reduction in CO2 emissions compared to 2017 levels by 2030. Buyers, particularly large corporations, prefer suppliers aligned with sustainability standards.

Expansion of Aftermarket Services and Value-Added Offerings Driving Customer Retention:

Aftermarket services are becoming a key growth area for tire suppliers. Companies seek comprehensive solutions that include installation, monitoring, and maintenance support. Value-added offerings such as predictive maintenance services are gaining popularity. Japanese firms prefer long-term partnerships with suppliers that reduce operational risks. Service-driven models improve customer retention and create recurring revenue opportunities. This trend supports differentiation in a competitive market with multiple suppliers. Solid tire companies focus on integrated service packages to maintain client loyalty. It is creating new competitive dynamics in the Japanese solid tire ecosystem.

Rising Role of Global Players and Partnerships Enhancing Market Competitiveness in Japan:

Global tire manufacturers are strengthening their presence in Japan through partnerships and joint ventures. Collaborative approaches provide access to advanced technology and broader product portfolios. International firms bring expertise in specialized compounds and innovative designs. Local players benefit from shared resources, research support, and expanded distribution. Competition is intensifying with new product launches tailored for Japanese industries. Multinational investments in marketing and service networks expand customer options. This influx of global expertise drives higher standards and product diversity. It positions the Japan Solid Tire Market within a broader global competitive framework.

Market Challenges Analysis:

Price Sensitivity Among End Users Limiting Adoption of Premium Tire Variants:

The Japan Solid Tire Market faces challenges due to price sensitivity among small and medium businesses. While premium variants offer longer lifespans and advanced features, higher upfront costs discourage adoption. Smaller operators often prioritize initial affordability over total lifecycle savings. This creates demand gaps between high-performance products and budget alternatives. Intense competition puts pressure on manufacturers to balance pricing and innovation. Discount-driven procurement practices further strain margins for suppliers. Companies face difficulty in promoting premium solutions to cost-focused buyers. It slows adoption of advanced tires despite their operational advantages.

Rising Raw Material Costs and Supply Chain Disruptions Impacting Production Economics:

Fluctuations in raw material prices create instability in tire production economics. Natural rubber and synthetic compounds are subject to global market volatility. Supply chain disruptions increase procurement challenges for manufacturers in Japan. Rising transportation and energy costs add further pressure to margins. Companies struggle to maintain competitive pricing while covering higher costs. Dependence on imported raw materials exposes the industry to external risks. Manufacturers must adjust strategies to offset these economic pressures. It highlights the vulnerability of the solid tire sector to global supply and cost dynamics.

Market Opportunities:

Growing Demand for Specialized Tires in Robotics and Material Handling Expanding Market Scope:

Automation and robotics adoption in Japan’s logistics and industrial sectors is creating fresh opportunities. Solid tires designed for AGVs, robotic forklifts, and automated systems are in high demand. This demand opens avenues for specialized product development and customized solutions. Companies can expand portfolios by catering to smart warehouse and advanced logistics needs. Tire makers that align with these requirements strengthen their market relevance. The Japan Solid Tire Market benefits from integrating with evolving automation trends. It creates potential for product diversification and stronger supplier-customer partnerships.

Rising Sustainability Mandates Encouraging Eco-Friendly Tire Innovations Across Industries:

Government policies and corporate mandates on sustainability create favorable opportunities for innovation. Solid tire producers can gain a competitive edge by introducing eco-friendly compounds. Recyclable materials, low-emission production processes, and energy-efficient designs are increasingly valued. Firms that align with these mandates improve long-term viability in the market. Adoption of sustainable solutions enhances brand reputation and customer preference. Opportunities exist for suppliers to develop green products while maintaining durability standards. It ensures strong demand among industries seeking compliance and environmental responsibility.

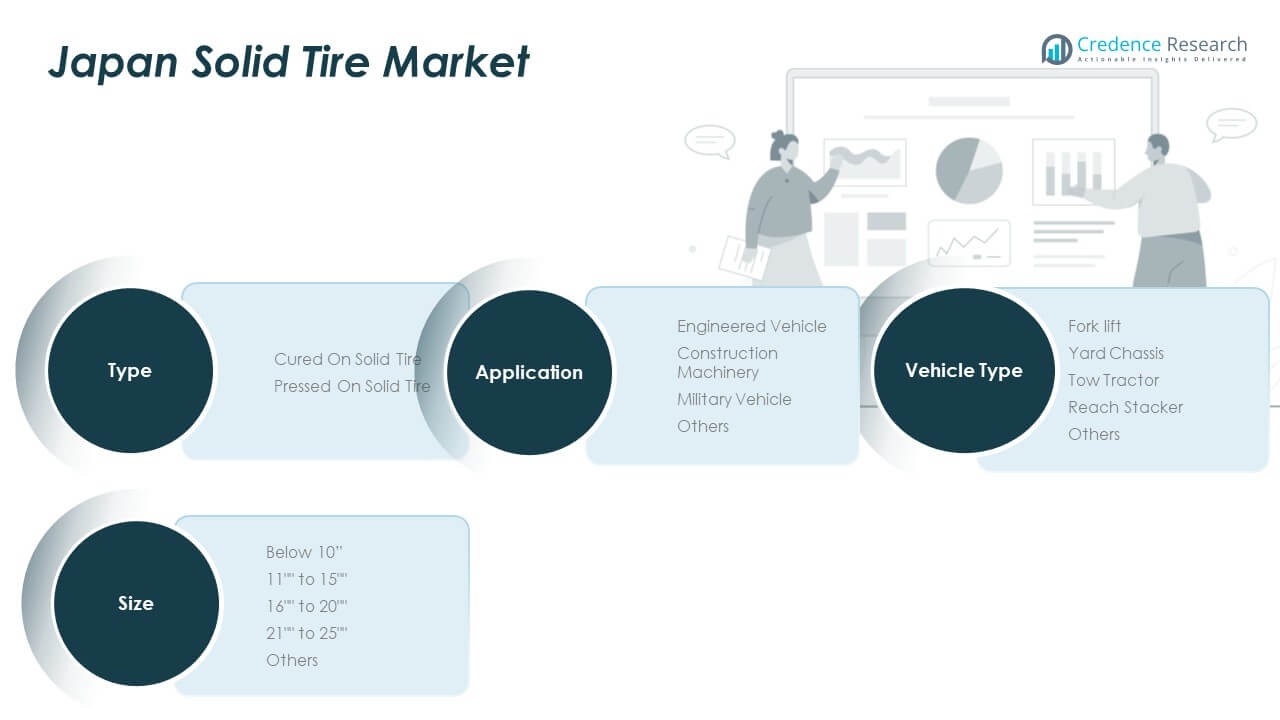

Market Segmentation Analysis:

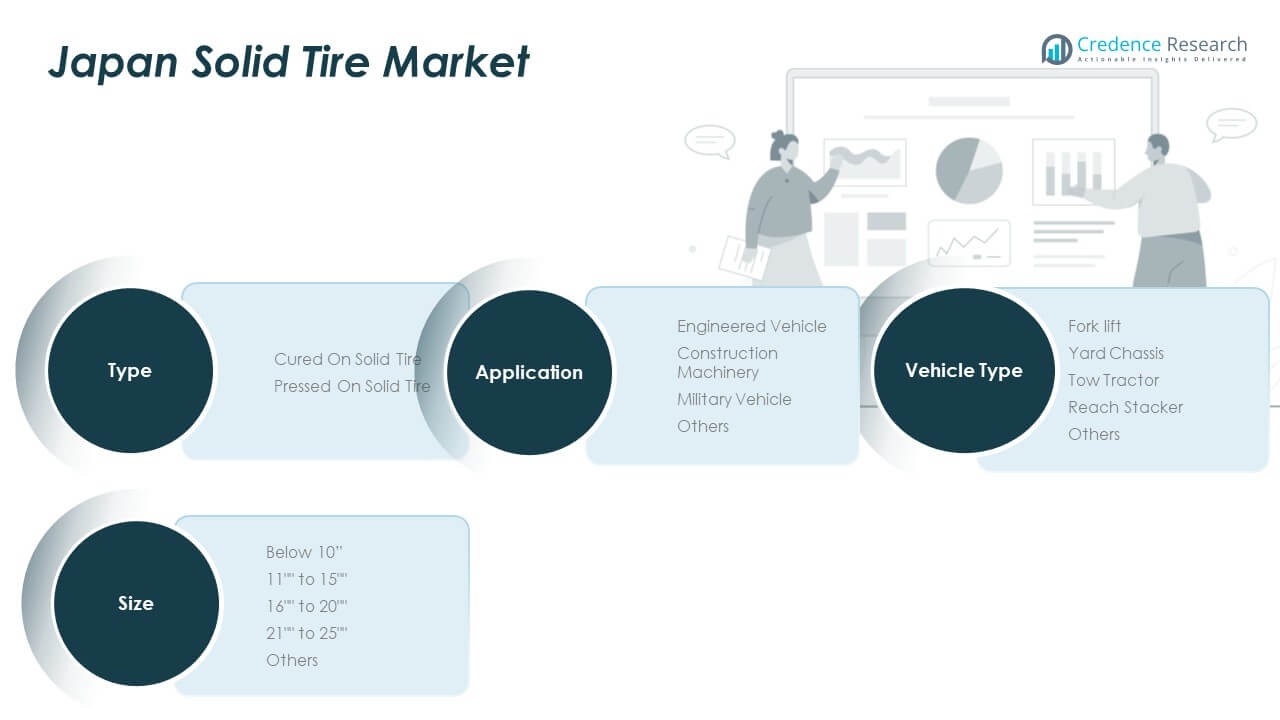

By Type

The Japan Solid Tire Market is divided into cured on solid tires and pressed on solid tires. Pressed on variants dominate due to their widespread use in forklifts and material-handling equipment. Cured on tires hold a steady share, serving applications requiring durability in construction and heavy-duty vehicles.

- For instance, WonRay’s press-on solid tires for forklifts exhibit maximum load-bearing capacities ranging from 970 kg up to 7,205 kg depending on tire size, suitable for medium to heavy-duty industrial vehicles. Cured on tires hold a steady share, serving applications requiring durability in construction and heavy-duty vehicles.

By Application

Key applications include engineered vehicles, construction machinery, military vehicles, and others. Engineered vehicles and construction machinery represent the largest demand base, supported by industrial and infrastructure activities. Military vehicles adopt solid tires for resilience and performance under harsh conditions. Other applications provide incremental growth through specialized usage.

- For instance, engineered vehicles and construction machinery represent a significant demand base, supported by industrial and infrastructure activities, and often use specialized durable tires. Military vehicles, however, rely on a variety of technologies for resilience under harsh conditions, such as advanced pneumatic tires equipped with run-flat systems, rather than solid tires. Furthermore, their tires adhere to military-specific standards for performance and safety, not the civilian guidelines set by the Japan JATMA standards.

By Size

The market spans below 10”, 11” to 15”, 16” to 20”, 21” to 25”, and others. Mid-size ranges between 11” and 20” lead adoption, serving forklifts and industrial vehicles. Larger sizes above 21” cater to heavy machinery, while smaller sizes support compact equipment.

By Vehicle Type

Vehicle segments include forklifts, yard chassis, tow tractors, reach stackers, and others. Forklifts dominate market share, reflecting their central role in warehouses and logistics operations. Yard chassis and tow tractors also contribute significantly in ports and distribution hubs. Reach stackers and other vehicles create niche opportunities through specialized industrial use.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

Kanto Region Driving Market Demand with Industrial and Logistics Concentration

The Kanto region accounts for the largest share of the Japan Solid Tire Market, contributing nearly 38% of total revenue. Tokyo and surrounding prefectures serve as industrial and logistics hubs, with high forklift density in warehouses and ports. Strong growth in e-commerce and large-scale distribution centers strengthens tire adoption in this region. Construction projects and infrastructure upgrades further support demand for heavy-duty machinery using solid tires. Manufacturers prioritize supply networks in Kanto due to concentrated industrial activity. It remains the dominant region due to its balance of logistics, construction, and trade-driven applications.

Kansai and Chubu Regions Showing Steady Growth with Automotive and Manufacturing Strength

The Kansai region represents around 25% share, supported by Osaka and Kobe’s role in manufacturing and shipping. Demand for forklifts, tow tractors, and yard chassis is strong across port facilities and logistics centers. Construction machinery adoption also contributes to tire consumption, particularly in urban expansion projects. Chubu holds about 20% of the market, with Nagoya as a major automotive and industrial hub. Tire demand is reinforced by automotive supply chains, factory operations, and supporting logistics infrastructure. It reflects balanced growth across industrial and manufacturing-driven activities.

Kyushu, Hokkaido, and Other Regions Expanding with Infrastructure Development

Kyushu contributes roughly 10% share, supported by heavy industry, construction activity, and growing port operations in Fukuoka and Kitakyushu. Hokkaido accounts for nearly 7% share, driven by agriculture, mining, and construction equipment requirements in harsh weather conditions. Smaller regions contribute the remaining share through niche industrial activities and regional logistics centers. Growth in renewable energy projects and rural infrastructure also supports localized tire demand. Manufacturers expand distribution networks in these areas to strengthen accessibility and aftersales support. It highlights how regional diversification contributes to overall stability in the Japan Solid Tire Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bridgestone

- MICHELIN

- Goodyear

- Continental

- ZC Rubber

- Sumitomo Rubber

- Pirelli

- Sailun Jinyu Group

- Cooper Tire

- Hankook

- Yokohama

- Kumho Tire

- Linglong Tire

Competitive Analysis:

The Japan Solid Tire Market features strong competition among global and domestic players. Companies such as Bridgestone, Sumitomo Rubber, and Yokohama dominate with their wide product portfolios and strong distribution networks. International brands including Michelin, Goodyear, and Continental compete through advanced technologies and partnerships with Japanese industries. Smaller regional firms maintain presence by offering cost-effective solutions to niche applications. Innovation in tire design and durability continues to differentiate market leaders. Strategic investments in automation and sustainability also strengthen competitive positioning. It remains highly consolidated with leading players maintaining significant influence on pricing and product development.

Recent Developments:

- In August 2025, Sumitomo Rubber Industries acquired Viaduct, a U.S.-based AI solutions company, to integrate advanced AI capabilities with Sumitomo’s proprietary tire sensing technology. This acquisition aims to accelerate predictive maintenance services for fleet vehicles globally, including Japan, thereby advancing connected vehicle health and operational efficiency.

- In June 2025, Bridgestone introduced tires equipped with its ENLITEN technology incorporating recycled steel bead wire sourced from end-of-life tires, developed in partnership with Nippon Steel Corporation and Sanyo Special Steel. These tires, designed for the 2025 Bridgestone World Solar Challenge, feature enhanced durability, puncture resistance, and sustainability, marking a significant innovation in tire recycling and performance optimization. Additionally, in August 2025, Bridgestone launched the W920 commercial trucking tire with ENLITEN technology, engineered for all-weather conditions and focused on extended tire life and traction, reflecting the company’s ongoing commitment to sustainable, high-performance tire solutions.

- In March 2025, Goodyear was awarded the Environmental Achievement of the Year – Tire Design for its ElectricDrive Sustainable-Material (EDS) tire, which incorporates over 70% sustainable materials and is engineered specifically for electric vehicles. This product demonstrates Goodyear’s commitment to sustainable innovation in tire technology. Earlier, in July 2024, Goodyear announced the sale of its Off-The-Road tire business to Yokohama Rubber, with plans to manufacture certain tires for Yokohama under a supply agreement extending up to five years, highlighting strategic portfolio realignment.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will expand steadily across industrial and logistics applications supported by warehouse automation.

- Construction sector activity will strengthen adoption of larger solid tire sizes.

- Forklifts will remain the leading vehicle segment with consistent replacement cycles.

- Cured-on solid tires will gain momentum in heavy machinery applications.

- Pressed-on solid tires will maintain dominance in distribution and port operations.

- Sustainability-driven innovation will push adoption of eco-friendly tire designs.

- Regional demand will be strongest in Kanto and Kansai with growing logistics hubs.

- Partnerships between global and domestic firms will enhance product availability.

- Price competition and raw material volatility will influence profitability strategies.

- Technology advancements in durability and comfort will drive customer preference.