Market Overview:

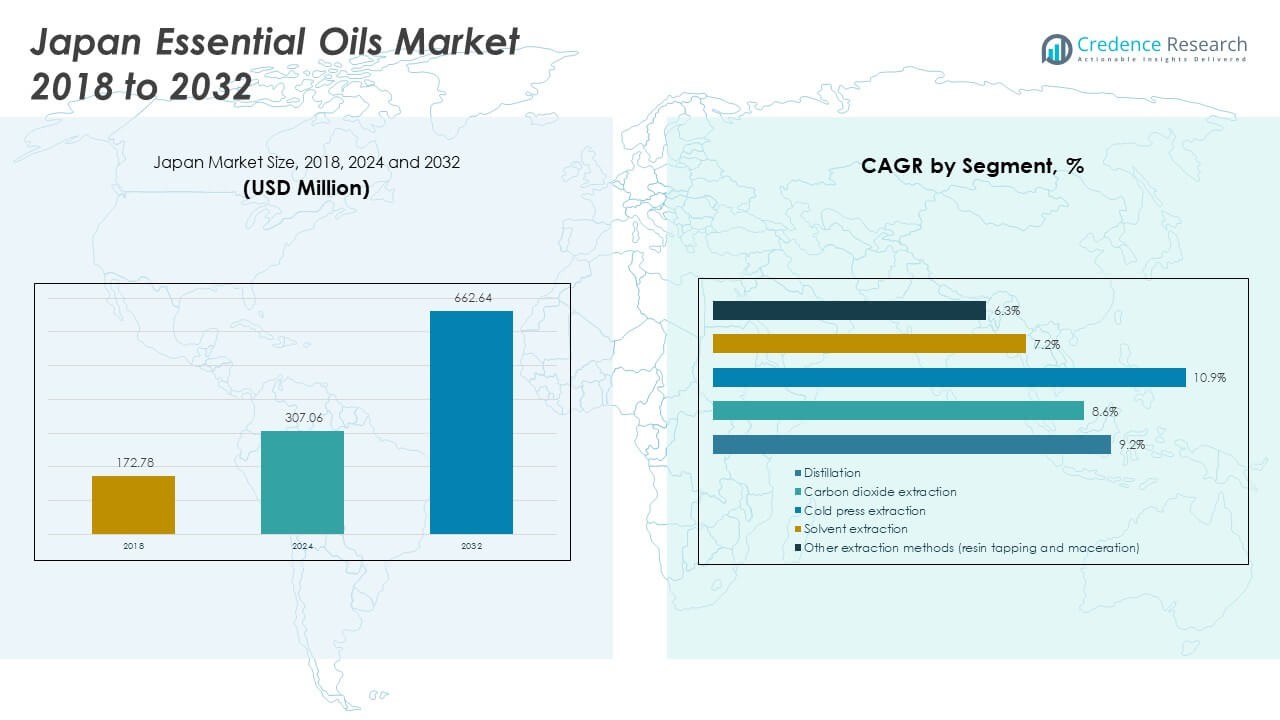

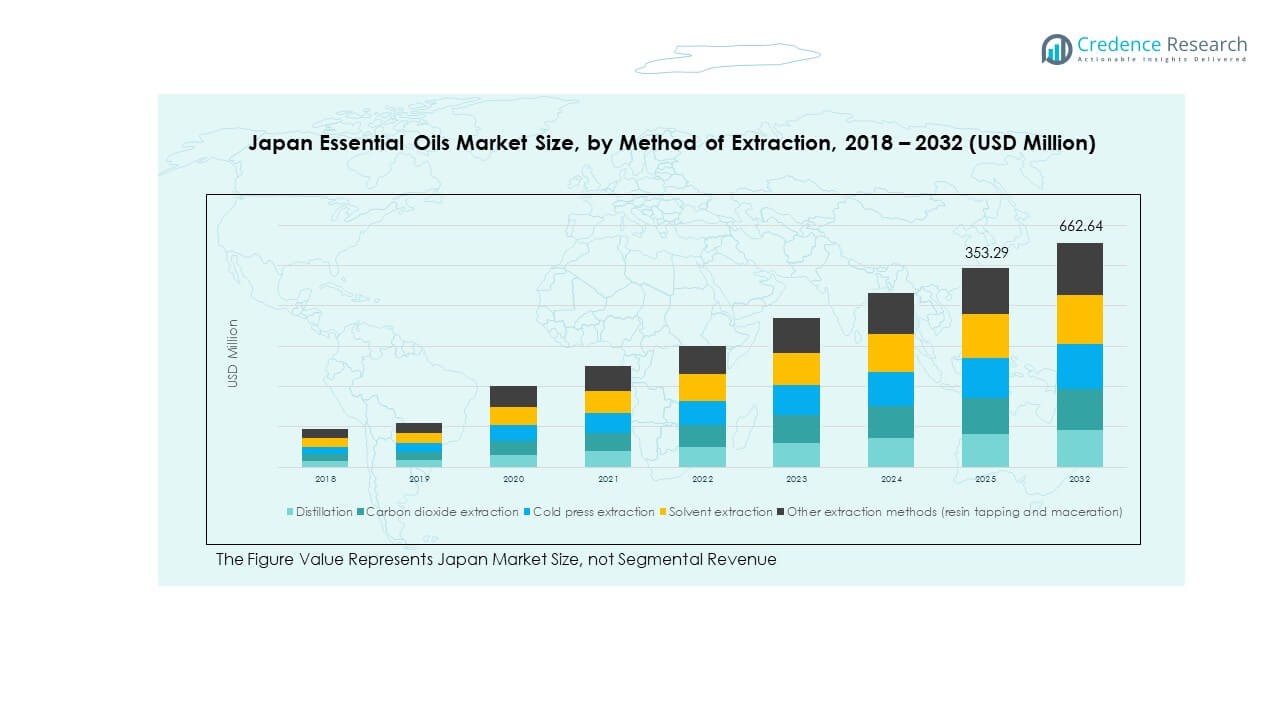

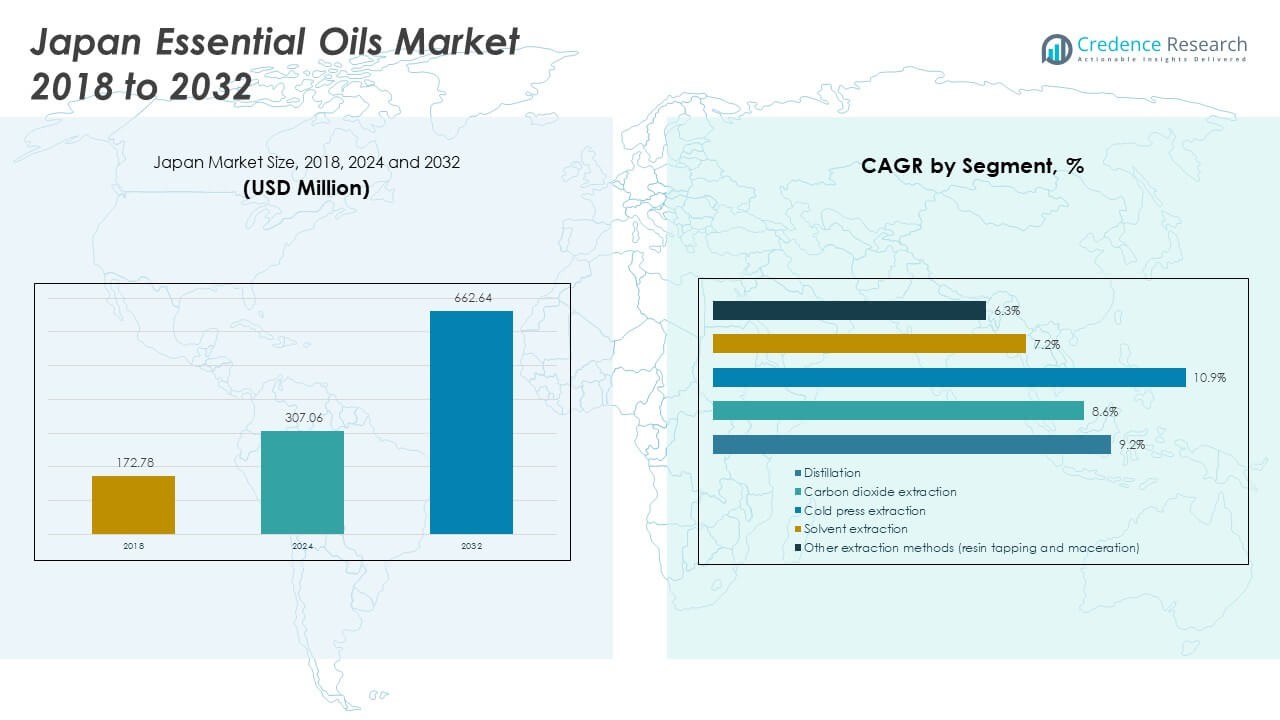

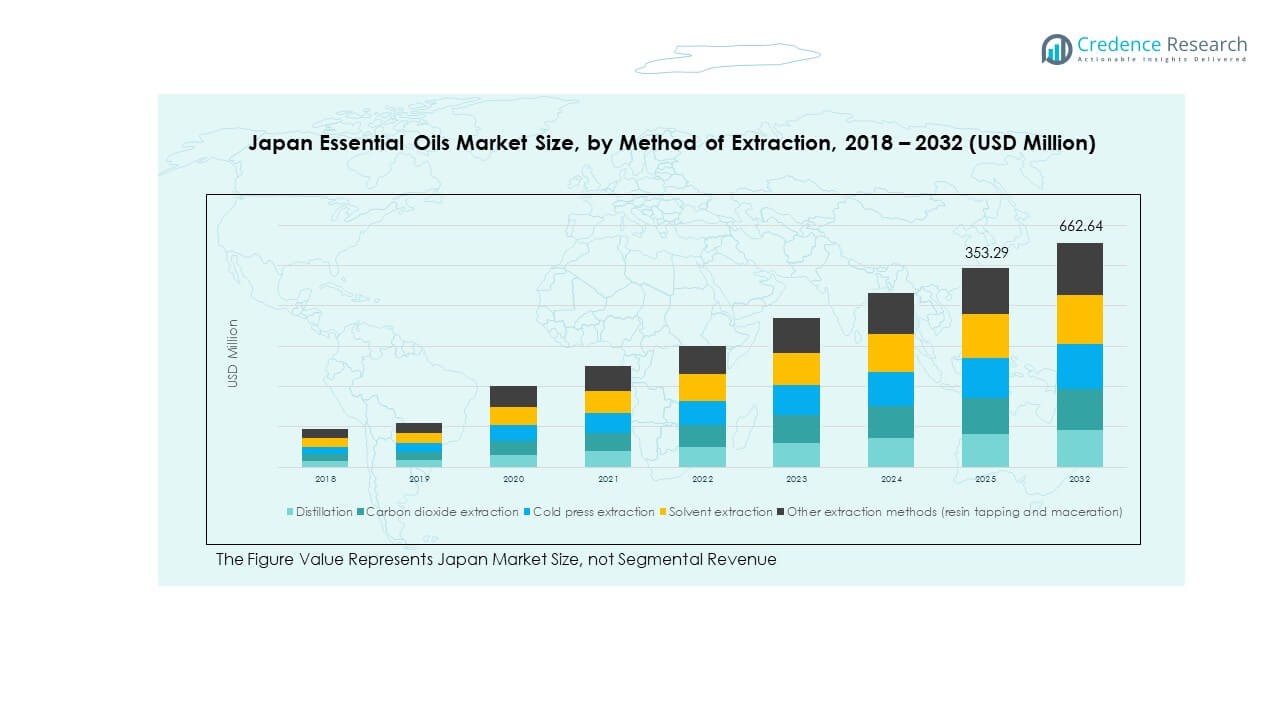

The Japan Wood Essential Oils Market size was valued at USD 172.78 million in 2018 to USD 307.06 million in 2024 and is anticipated to reach USD 662.64 million by 2032, at a CAGR of 9.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Wood Essential Oils Market Size 2024 |

USD 307.06 Million |

| Japan Wood Essential Oils Market, CAGR |

9.40% |

| Japan Wood Essential Oils Market Size 2032 |

USD 662.64 Million |

Growth in the Japan Wood Essential Oils Market is driven by rising consumer demand for natural and sustainable wellness products. Expanding applications in cosmetics, aromatherapy, pharmaceuticals, and personal care are pushing adoption. Increasing awareness of health benefits, combined with Japan’s strong cultural preference for natural remedies, enhances market penetration. Manufacturers are investing in advanced extraction methods to improve oil quality and yield. Rising disposable income and premium product demand also support growth.

Regional growth in the Japan Wood Essential Oils Market reflects Asia-Pacific dominance due to cultural heritage and manufacturing strength. Japan leads with a strong domestic base in personal care and wellness, while China and India are emerging with expanding essential oil exports and rising domestic demand. North America and Europe remain secondary markets, driven by aromatherapy and organic product adoption. Emerging economies in Southeast Asia are beginning to show strong interest due to rising wellness trends and expanding middle-class populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Wood Essential Oils Market was USD 172.78 million in 2018, USD 307.06 million in 2024, and is projected to reach USD 662.64 million by 2032, growing at a CAGR of 9.40%.

- North America held a 32% share in 2024, driven by wellness culture and aromatherapy demand; Europe captured 28% with strong cosmetic and pharmaceutical applications; Asia-Pacific followed with 25% due to cultural heritage and rising local production.

- Asia-Pacific is the fastest-growing region, supported by domestic demand in Japan, expanding exports from China and India, and wellness tourism growth in Southeast Asia.

- Distillation accounted for 52% of extraction share in 2024, reflecting its dominance as a cost-effective and widely accepted method.

- Carbon dioxide extraction represented 18% share, gaining traction as a clean, solvent-free process appealing to premium and eco-conscious markets.

Market Drivers:

Rising Demand for Natural Health and Wellness Solutions:

The Japan Wood Essential Oils Market benefits from the increasing preference for natural and plant-based health alternatives. Consumers in Japan value traditional remedies and holistic therapies, creating steady demand. Aromatherapy, stress relief, and mental wellness practices continue to push consumption. Companies focus on clean-label and organic oils to meet stricter consumer expectations. Expansion in wellness tourism also supports usage in spas and therapeutic centers. It is witnessing high adoption in both personal and commercial spaces.

- For instance, Japan Aroma Laboratory Co., Ltd. developed a vacuum-controlled microwave-assisted extraction system for Abies sachalinensis essential oil in Hokkaido that shortens extraction duration and enhances energy efficiency while maintaining oil purity.

Expanding Applications in Cosmetics and Personal Care Industry:

Cosmetics and skincare brands are integrating wood essential oils into their product lines for fragrance, therapeutic, and preservative properties. Demand for eco-friendly and sustainable ingredients aligns with Japanese consumer expectations for safety and purity. Premium beauty segments use essential oils to differentiate offerings. Rising interest in natural perfumes and organic skincare pushes wider adoption. Leading brands in Japan highlight wood essential oils in marketing campaigns to capture health-conscious buyers.

- For instance, Shiseido utilizes an Internet of Things (IoT) skincare service brand called Optune, which was introduced to deliver personalized skincare. The at-home skin analyzer and product dispenser system customizes skincare by analyzing skin conditions and environmental factors in real-time, dispensing one of over 80,000 possible combinations of serums and lotions.

Growing Adoption in Food and Beverage and Pharmaceutical Sectors:

The Japan Wood Essential Oils Market is also supported by use in flavoring agents, nutraceuticals, and herbal supplements. Pharmaceutical industries employ oils for antimicrobial and therapeutic properties. Functional foods and beverages incorporate essential oils to enhance both health benefits and taste. Strong government support for wellness-focused innovations adds momentum. Rising investment in research further drives adoption across new formulations.

Technological Advancements in Extraction Methods:

Innovation in distillation and cold-press extraction boosts oil yield and quality. Advanced technologies help reduce energy consumption and preserve active compounds. Japanese companies invest in modernized facilities to compete globally. Efficiency improvements lower costs and enhance competitiveness. Carbon dioxide extraction and solvent-free processes gain prominence as eco-friendly solutions. It supports scalability and caters to international quality standards, improving Japan’s export potential.

Market Trends:

Rising Popularity of Aromatherapy and Wellness Tourism:

The Japan Wood Essential Oils Market is strongly influenced by the global surge in aromatherapy practices. Spas, wellness retreats, and healthcare centers in Japan integrate essential oils for holistic therapies. Demand grows among younger populations seeking natural stress relief. Tourism-driven consumption adds further momentum as wellness experiences feature essential oils. Expanding wellness culture strengthens long-term adoption.

- For instance, the spa industry in Tokyo has seen increased interest in wellness services incorporating sustainable practices. Some high-end spas have noted growing client demand for natural and ethically-sourced essential oils, including popular scents like cedarwood and sandalwood, reflecting broader consumer preferences in 2024 for eco-friendly wellness products.

Increasing Shift Toward Sustainable and Ethical Sourcing:

Japanese consumers are highly conscious of ethical sourcing and environmental sustainability. Market players emphasize eco-friendly harvesting and transparent supply chains. Certification standards ensure authenticity and quality. Brands highlight sustainable sourcing practices to gain consumer trust. Rising imports of certified organic oils reflect these preferences. It strengthens the brand value of ethical suppliers in the Japanese market.

- For instance, Ryohin Keikaku Co., Ltd. (MUJI) promotes a commitment to sustainable wood procurement, which is part of its broader ESG strategy. The company’s initiatives include a focus on using certified wood (such as FSC, PEFC, and SGEC) and ensuring traceability. In practice, this aligns with Japan’s efforts toward legal timber sourcing, like the Clean Wood Act, which promotes sustainable forestry and supports local timber industries.

Expansion of Online Distribution Channels:

E-commerce platforms and direct-to-consumer strategies reshape access to wood essential oils. Online retail offers broader product visibility and competitive pricing. Japanese consumers rely on digital platforms for premium and niche essential oils. Rising mobile commerce further accelerates this trend. Companies optimize digital marketing to capture health-conscious millennials. Subscriptions and bundled wellness kits expand online sales.

Product Innovation with Functional and Premium Blends:

Manufacturers create innovative blends targeting specific health outcomes such as relaxation, immunity, or skincare. Premiumization trends emphasize luxury packaging and customized formulations. Functional blends appeal to younger, urban populations seeking convenience. Japanese brands introduce hybrid offerings combining essential oils with cosmetics or supplements. This innovation diversifies revenue streams and sustains market momentum.

Market Challenges Analysis:

Regulatory Compliance and Quality Standardization Issues:

The Japan Wood Essential Oils Market faces challenges from strict government regulations and varying global standards. Companies must meet rigorous quality, purity, and labeling requirements. Non-compliance risks rejection of imports and damages credibility. Counterfeit and adulterated products add further complexity, affecting consumer trust. Standardization efforts are vital but costly, pushing smaller players at risk.

Price Volatility and Supply Chain Constraints:

Fluctuating raw material costs pose challenges for stable pricing. Climate change, seasonal harvests, and limited sourcing regions disrupt supply reliability. Import dependency raises exposure to currency fluctuations and trade barriers. Smaller producers struggle with scalability and stable raw material access. Global competition for sustainable wood oils increases pressure on Japan’s local suppliers.

Market Opportunities:

Rising Demand for Premium and Organic Oils:

The Japan Wood Essential Oils Market is gaining from premium consumer segments seeking organic and therapeutic oils. High-income groups and wellness-focused customers drive demand for certified natural oils. Brands offering premium, eco-friendly, and ethically sourced oils capture strong loyalty.

Growing Export Potential and Regional Expansion:

Japanese companies have opportunities to expand exports across Asia-Pacific and Western markets. Rising demand in emerging countries creates new distribution channels. Strategic alliances with global cosmetic and pharmaceutical brands enhance international footprint. Investments in export-focused facilities support long-term growth.

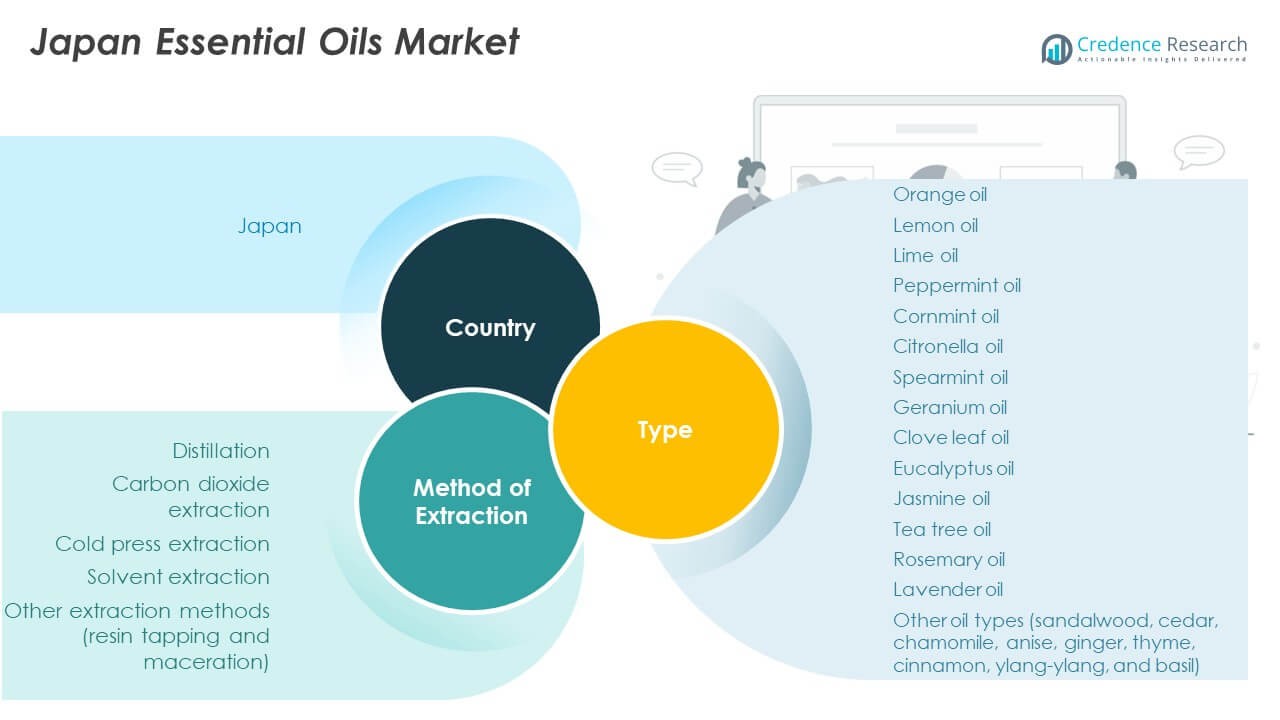

Market Segmentation Analysis:

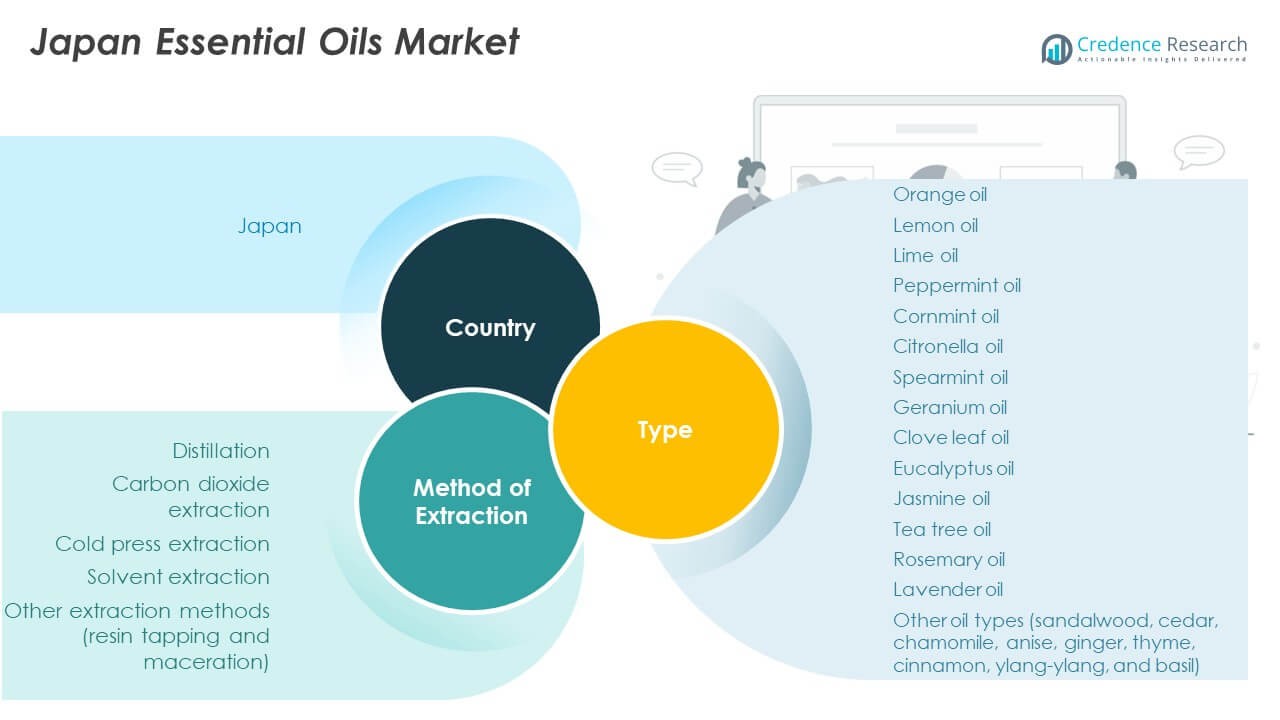

By Type

The Japan Wood Essential Oils Market is segmented into citrus oils such as orange and lemon, along with peppermint, lavender, eucalyptus, sandalwood, cedar, and other specialty oils. Citrus oils dominate due to their widespread use in cosmetics, food flavoring, and aromatherapy. Premium oils such as sandalwood and cedar attract strong demand in luxury skincare and wellness products, reinforcing Japan’s preference for high-quality natural ingredients. Lavender and rosemary are popular in therapeutic applications, while peppermint and tea tree oils maintain steady use in personal care and pharmaceutical products.

By Method of Extraction

Distillation holds the leading share due to its efficiency and traditional acceptance in Japan. It remains cost-effective for mass-market citrus oils while maintaining quality. Carbon dioxide extraction and cold press methods are growing, supported by demand for solvent-free and eco-friendly oils. Solvent extraction caters to specialized segments requiring higher yield or unique compounds. Other methods, including resin tapping and maceration, remain niche but serve premium and artisanal markets.

- For instance, he hinoki wood distillation plants use steam distillation to extract wood essential oils prized for their calming properties, optimizing extraction efficiency while ensuring environmental sustainability.

Competitive Landscape within Segments

Companies differentiate by focusing on premium oil categories and advanced extraction processes. Japanese players invest in technology-driven methods to maintain purity and sustainability. Global suppliers’ partner with local distributors to enhance availability and tap into the premium consumer base. The segmentation structure reflects a balance between high-volume citrus oils and niche, high-value wood oils, ensuring long-term market diversity and growth.

Segmentation:

By Type

- Orange Oil

- Lemon Oil

- Lime Oil

- Peppermint Oil

- Cornmint Oil

- Citronella Oil

- Spearmint Oil

- Geranium Oil

- Clove Leaf Oil

- Eucalyptus Oil

- Jasmine Oil

- Tea Tree Oil

- Rosemary Oil

- Lavender Oil

- Other Oils (sandalwood, cedar, chamomile, anise, ginger, thyme, cinnamon, ylang-ylang, basil)

By Method of Extraction

- Distillation

- Carbon Dioxide Extraction

- Cold Press Extraction

- Solvent Extraction

- Other Methods (resin tapping, maceration)

Regional Analysis:

Japan: Core Market Strength (40% share)

The Japan Wood Essential Oils Market dominates the regional landscape with around 40% share in 2024. Strong cultural heritage in natural wellness, advanced cosmetic industries, and premium product positioning drive this lead. Companies leverage strict quality standards and innovative extraction methods to secure consumer trust. Rising demand in aromatherapy, skincare, and pharmaceuticals strengthens domestic consumption. It continues to grow steadily as essential oils become embedded in daily wellness practices.

China and India: Emerging Growth Hubs (35% share combined)

China and India together account for nearly 35% of the regional share, supported by their roles as both producers and consumers. China benefits from expanding cosmetics and food industries, alongside robust export capacity. India leverages its ayurvedic tradition and cost-efficient production to supply domestic and global markets. Urban consumers in both countries are showing increasing preference for organic and premium oils. It highlights their dual role in fueling regional consumption and strengthening supply chains.

Southeast Asia: Expanding Wellness Tourism Demand (15% share)

Southeast Asia, led by Thailand, Indonesia, and Malaysia, holds about 15% share of the market. Growth is driven by wellness tourism, with spas and resorts integrating wood essential oils into therapies. Rising disposable incomes and cultural affinity for natural remedies support demand expansion. Japanese imports are valued for their purity and premium quality, reinforcing brand trust. It positions Southeast Asia as a fast-emerging cluster within the broader Asia-Pacific market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ogawa & Co., Ltd.

- Wellnesskit Co Ltd

- Yugen Kaisha YS Kikaku

- Aethon International LLP

- Arora Aromatics

- Hetaksh Essential Oils

- EMS International Trading Co Ltd

- MIKI

- Essential Oil Company Japan

- Others

Competitive Analysis:

The Japan Wood Essential Oils Market features intense competition among domestic and global companies. Ogawa & Co., Ltd., Wellnesskit Co Ltd, and Yugen Kaisha YS Kikaku lead with strong local networks and premium portfolios. International players like Arora Aromatics and EMS International Trading Co Ltd compete with wide distribution. Companies emphasize sustainability, organic certifications, and advanced extraction methods to gain share. Differentiation relies on branding, quality assurance, and supply chain transparency. Price competition and innovation define strategic positioning. It demonstrates a fragmented but dynamic competitive structure where niche players thrive alongside established corporations.

Recent Developments:

- In January 2025, Ogawa & Co., Ltd., a comprehensive manufacturer of essential oils, extracts, flavors, and fragrances in Japan, continues to promote the charms of Japan through its products, emphasizing its position as a key player in the essential oils market.

- Hetaksh Essential Oils is a leading B2B supplier of natural essential and carrier oils serving more than 40 countries as of mid-2025 and continues to offer premium products, although no new launches or partnerships specific to Japan were reported at this time.

Report Coverage:

The research report offers an in-depth analysis based on type and method of extraction. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for natural and organic essential oils

- Expansion of aromatherapy in wellness tourism

- Growth of premium and luxury oil segments

- Wider adoption in cosmetics and personal care

- Increasing role in pharmaceuticals and nutraceuticals

- Strong export opportunities in Asia-Pacific and Western markets

- Technological improvements in extraction methods

- Rising consumer focus on sustainability and traceability

- Growth of online and direct-to-consumer channels

- Increasing innovation in functional oil blends