Market Overview:

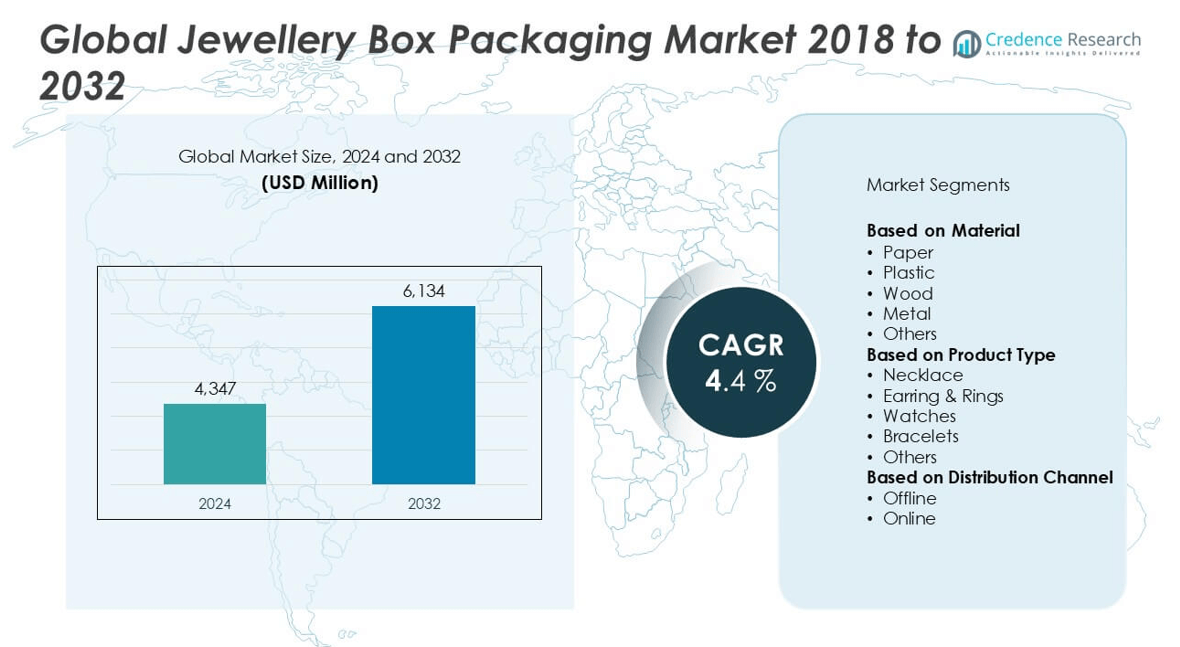

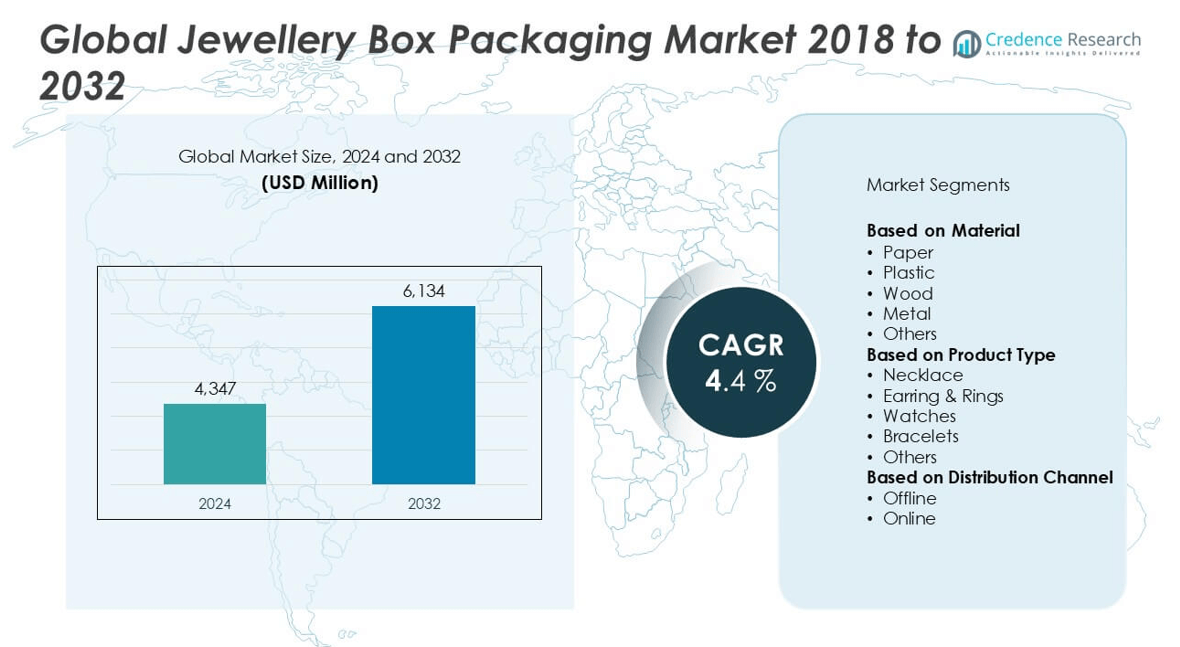

The Jewellery Box Packaging market size was valued at USD 4,347 million in 2024 and is anticipated to reach USD 6,134 million by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Jewellery Box Packaging Market Size 2024 |

USD 4,347 million |

| Jewellery Box Packaging Market, CAGR |

4.4% |

| Jewellery Box Packaging Market Size 2032 |

USD 6,134 million |

Top players in the jewellery box packaging market include Westpack A/S, Stuller, Inc., International Packaging Corporation, Thomas Sabo GmbH & Co. KG, and Finer Packaging Group. These companies lead the industry through a focus on premium design, sustainable materials, and customization to meet diverse brand and consumer demands. Westpack A/S and Stuller, Inc. are especially recognized for their strong international presence and advanced production capabilities. Asia-Pacific emerged as the leading regional market in 2024, accounting for approximately 32% of the global market share, driven by growing jewellery consumption, rising disposable incomes, and a booming e-commerce sector in countries such as China and India.

Market Insights

- The Jewellery Box Packaging market was valued at USD 4,347 million in 2024 and is projected to reach USD 6,134 million by 2032, growing at a CAGR of 4.4% during the forecast period.

- Growing demand for personalized and sustainable packaging, particularly in luxury and gifting segments, is a key driver fueling market growth globally.

- Trends such as smart packaging integration (RFID, QR codes) and the rise of e-commerce platforms are reshaping packaging innovation and consumer engagement strategies.

- The market is moderately fragmented, with major players like Westpack A/S, Stuller, Inc., and International Packaging Corporation focusing on eco-friendly solutions and design innovation; however, high material costs and regulatory constraints present challenges.

- Asia-Pacific led with a 32% market share in 2024, followed by North America at 28% and Europe at 25%; segment-wise, paper-based packaging and earrings & rings product type held the largest shares due to sustainability demand and frequent product purchases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

In 2024, the paper-based jewellery box packaging segment held the largest market share due to its eco-friendly nature, cost-effectiveness, and widespread use in lightweight and decorative packaging. Increasing consumer demand for sustainable and recyclable packaging solutions has significantly driven the adoption of paper materials. Luxury and mid-range brands increasingly prefer paper boxes with custom printing and embossing to enhance aesthetic appeal while maintaining environmental responsibility. Wood and metal segments cater to premium offerings, while plastic remains in demand for durability and affordability but faces challenges from rising sustainability regulations.

- For instance, Westpack A/S reported that over 80% of its jewellery boxes sold in 2023 were made from FSC®-certified paperboard, and it expanded its biodegradable packaging line by introducing more than 50 new SKUs to meet sustainable packaging demand.

By Product Type:

\

The earring & rings packaging segment dominated the market in 2024, accounting for the highest share due to the frequent purchase of these jewellery items and their need for compact, customized packaging. Retailers and brands prioritize elegant and secure packaging for these products to enhance visual presentation and prevent damage during transit. The necklace and bracelet segments also hold significant shares, particularly in premium and gift segments, while the watch packaging market continues to gain traction through luxury watch sales and gift-oriented purchases during festive seasons.

- For instance, Finer Packaging Group announced that over 12 million units of earring and ring boxes were sold in 2023, making up 60% of its total jewellery packaging sales volume.

By Distribution Channel:

The offline distribution channel led the jewellery box packaging market in 2024, holding the largest share owing to strong brand presence in physical retail stores, jewellery showrooms, and specialty packaging outlets. Offline sales benefit from tactile customer experiences, customized consultations, and direct brand interaction. However, the online segment is growing rapidly due to the increasing popularity of e-commerce platforms, direct-to-consumer jewellery brands, and digital marketplaces. Convenience, wide product selection, and promotional discounts continue to boost online purchases, making it the fastest-growing segment in the forecast period.

Market Overview

Rising Demand for Premium and Customizable Packaging

The increasing consumer preference for personalized and aesthetically appealing packaging has significantly driven demand in the jewellery box packaging market. Luxury and boutique jewellery brands are investing in high-end, customizable packaging to reflect brand identity, enhance customer experience, and add perceived value to their products. Custom features such as embossed logos, magnetic closures, and velvet linings not only improve the unboxing experience but also support premium pricing strategies. This trend is especially prevalent in gifting scenarios and high-value product categories, bolstering market expansion.

- For instance, Stuller, Inc. launched over 200 new customizable packaging SKUs in 2023, with velvet-lined boxes and foil-stamped logos accounting for 70% of its premium segment orders.

Growth of E-commerce and Direct-to-Consumer Channels

The rapid expansion of e-commerce and direct-to-consumer jewellery brands is driving the need for durable, visually attractive, and protective packaging solutions. Online jewellery sales demand robust packaging that ensures product safety during shipping while maintaining visual appeal upon delivery. This has increased demand for compact, protective, and brand-enhancing packaging. Additionally, unboxing experiences have become a marketing tool, prompting online sellers to invest in sophisticated packaging that can create a lasting impression and encourage repeat purchases and social media sharing.

- For instance, Packhelp S.A. supplied over 2.4 million customized e-commerce jewellery boxes to direct-to-consumer brands across Europe in 2023, incorporating features such as double-layer corrugation, magnetic closures, and inside-printing design for more than 950 clients in the jewellery segment.

Sustainability and Eco-friendly Packaging Solutions

Rising environmental awareness and stringent packaging regulations are pushing manufacturers to adopt sustainable packaging materials such as recycled paper, biodegradable plastics, and reusable wooden boxes. Consumers are increasingly inclined toward eco-friendly brands, especially in developed markets, prompting companies to replace conventional plastic and foam packaging with greener alternatives. This shift not only meets regulatory compliance but also enhances brand loyalty and market differentiation. As sustainability becomes a key decision-making factor, eco-conscious packaging continues to emerge as a critical driver of growth.

Key Trends & Opportunities

Integration of Smart Packaging Technologies

The jewellery box packaging market is witnessing a trend toward smart packaging integration, including features such as QR codes, RFID tags, and NFC chips. These technologies enhance traceability, product authentication, and customer engagement. Luxury brands are leveraging smart packaging to combat counterfeiting, offer digital certificates, and provide interactive content. This innovation not only secures high-value items but also enriches the consumer experience, creating new opportunities for value-added packaging solutions and digital brand storytelling.

- For instance, Thomas Sabo GmbH & Co. KG integrated NFC-enabled packaging for its limited-edition jewellery line in 2023, enabling over 150,000 customers to verify authenticity and access personalized digital messages.

Expansion into Emerging Economies

Emerging economies in Asia-Pacific, Latin America, and the Middle East offer untapped growth potential for the jewellery box packaging market. Rising disposable incomes, expanding retail infrastructure, and increasing demand for luxury and semi-precious jewellery are driving packaging needs in these regions. Local manufacturers are scaling operations, while global players are entering these markets to capitalize on expanding consumer bases. This regional expansion presents opportunities for diversified material sourcing, cost-efficient production, and greater market penetration.

- For instance, Elite Packaging opened a new 30,000 sq. ft. manufacturing facility in Pune, India, in 2023, increasing its monthly production capacity to 1.2 million units to meet regional demand.

Key Challenges

High Costs of Premium and Sustainable Materials

One of the major challenges in the jewellery box packaging market is the high cost associated with premium and sustainable materials. Recycled paper, FSC-certified wood, and biodegradable polymers often incur greater expenses than conventional options. Additionally, custom design elements and low-volume production for niche brands further elevate costs. These pricing pressures can hinder adoption, particularly among small and medium-sized enterprises, limiting their ability to compete with larger players offering luxury packaging.

Stringent Regulatory Compliance and Material Restrictions

The global focus on environmental conservation has led to increasingly strict regulations on packaging materials, particularly plastics and chemical coatings. Compliance with regional and international packaging standards such as REACH, RoHS, and extended producer responsibility (EPR) adds complexity and cost to manufacturing processes. Adapting to these standards without compromising design, durability, or aesthetics presents a persistent challenge for packaging suppliers and jewellery brands alike, especially when entering multiple global markets.

Supply Chain Disruptions and Raw Material Volatility

Volatile raw material prices and disruptions in the global supply chain significantly impact the jewellery box packaging market. Fluctuations in paper, wood, and polymer prices, coupled with transportation delays and geopolitical tensions, challenge manufacturers in maintaining stable production and pricing. These uncertainties affect timely delivery, increase operational costs, and strain relationships with end-users. Dependence on imported materials further exacerbates this issue, especially in regions with limited local sourcing options.

Regional Analysis

North America

North America held a significant share of the jewellery box packaging market in 2024, accounting for approximately 28% of the global revenue. The region’s strong presence of premium jewellery brands and high consumer spending on luxury goods have fueled the demand for sophisticated and customizable packaging. Additionally, the growing preference for eco-friendly materials in the U.S. and Canada has driven innovation in sustainable packaging solutions. Well-established e-commerce infrastructure and a focus on enhancing unboxing experiences further contribute to market growth. Key players in the region are investing in smart packaging technologies to enhance product security and consumer engagement.

Europe

Europe accounted for around 25% of the jewellery box packaging market in 2024, driven by a mature luxury goods sector and high demand for environmentally sustainable packaging. Countries such as Germany, France, and Italy are major contributors due to the presence of leading jewellery houses and luxury retailers. The region benefits from stringent environmental regulations that encourage the use of recycled and biodegradable materials, shaping consumer preferences. Moreover, increasing investments in design innovation and brand-specific packaging aesthetics continue to fuel demand across both offline and online sales channels, particularly in the premium and gift-oriented product segments.

Asia-Pacific

Asia-Pacific led the global jewellery box packaging market in 2024 with a dominant share of approximately 32%. Rapid urbanization, rising disposable incomes, and growing jewellery consumption in countries like China, India, and Japan have fueled regional growth. The proliferation of e-commerce platforms and emerging middle-class consumer bases have further boosted demand for aesthetically pleasing and cost-effective packaging. Additionally, increasing exports of jewellery from Asia to global markets have created opportunities for durable and visually appealing packaging solutions. The region is witnessing a steady shift toward sustainable materials as consumer awareness about environmental issues rises.

Latin America

Latin America held a modest share of about 8% in the global jewellery box packaging market in 2024. Growth is driven by rising jewellery retail activity, expanding middle-class income, and increasing awareness of brand presentation in countries such as Brazil and Mexico. While economic volatility poses some challenges, local and regional brands are adopting cost-effective yet visually appealing packaging to attract consumers. The rise of artisanal and handmade jewellery has also driven demand for eco-conscious and rustic packaging solutions. Improvements in supply chain infrastructure and digital commerce offer potential for future market expansion.

Middle East & Africa

The Middle East & Africa region captured around 7% of the jewellery box packaging market in 2024. The market is primarily driven by high jewellery consumption in the Gulf Cooperation Council (GCC) countries, particularly the UAE and Saudi Arabia, where luxury gifting and wedding traditions fuel demand for premium packaging. Africa is emerging with gradual growth, supported by increasing retail activity and a growing jewellery manufacturing sector. However, the region faces challenges such as limited manufacturing capabilities and high import dependence for packaging materials. Still, rising tourism and gifting trends are opening new opportunities in the luxury segment.

Market Segmentations:

By Material

- Paper

- Plastic

- Wood

- Metal

- Others

By Product Type

- Necklace

- Earring & Rings

- Watches

- Bracelets

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the jewellery box packaging market is characterized by the presence of both global and regional players striving to enhance their market position through innovation, sustainability, and customization. Leading companies such as Westpack A/S, Stuller, Inc., International Packaging Corporation, and Thomas Sabo GmbH & Co. KG focus on delivering premium, eco-friendly, and visually appealing packaging solutions that align with evolving consumer preferences and brand expectations. These firms invest heavily in R&D and design capabilities to offer personalized packaging that reinforces brand identity and enhances the unboxing experience. Meanwhile, regional players like Gunther Mele Limited, Jewel Box Co., and Finer Packaging Group cater to niche markets with cost-effective and flexible production models. Strategic partnerships with jewellery brands, expansion into emerging markets, and the adoption of sustainable materials are common growth strategies. Competition is also intensifying as e-commerce drives demand for protective and visually distinctive packaging, compelling manufacturers to balance functionality with aesthetics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Jewel Box Co.

- Swiftpak Ltd.

- Asch Grossbardt Inc.

- GBE Packaging Supplies

- Elite Packaging

- Boxpac

- Potters Ltd.

- International Packaging Corporation

- Finer Packaging Group

- Thomas Sabo GmbH & Co. KG

- Westpack A/S

- Stuller, Inc.

- Gunther Mele Limited

Recent Developments

- In March 2025, WOLF released the Ballet Musical Jewelry Box to celebrate its 190th anniversary. The jewelry box features a walnut wood veneer exterior, an embroidered Swan Lake theatre design interior, and two interchangeable ballet dancers that perform when activated.

- In December 2024, Japanese jewellery brand Tasaki and the Ritz Paris unveiled their fourth collaboration, the Nouvelle Ère collection. This series comprises four parts-Lumineux, Scintillement, Unisson, and Harmonie-each drawing inspiration from the rich history and elegance of the Ritz Paris, featuring designs with diamonds, canary tourmalines, Akoya pearls, tanzanite stones, amethysts, peridots, and tourmalines.

- In September 2024, Actress and entrepreneur Issa Rae partnered with San Francisco-based fine jewellery brand Cast to launch the Braeve Collection. This collaboration aimed to make artfully designed jewellery more accessible and to inspire and empower women through unique designs.

- In September 2024, Orra Fine Jewellery announced its role as the official jewellery partner for the Elle Style Awards 2024, marking the event’s debut in India. This partnership underscores Orra’s commitment to timeless sophistication and exceptional design, aligning with Elle’s celebration of innovators who blend traditional influences with contemporary trends in fashion.

- In May 2024, KIMITAKE introduced rebranded jewelry packaging inspired by Japanese cultural heritage. The design features traditional elements such as the Kyoto Nishijin-Ori Drawstring Bag with the ‘Sakuragawa’ pattern, a Paulownia Box, and Kyo-Yuzen Dyeing techniques, reflecting the brand’s commitment to preserving traditional artistry.

Market Concentration & Characteristics

The Jewellery Box Packaging Market displays a moderately fragmented structure with a mix of global leaders and regional players competing on design innovation, material quality, and customization capabilities. It exhibits moderate to high brand loyalty in premium segments, where customers prioritize aesthetics and sustainability. The market features consistent demand across both offline and online channels, driven by jewellery sales volume, gifting occasions, and rising luxury consumption. Key players focus on enhancing value through eco-friendly materials, digital integration, and compact formats that ensure protection during transit. It shows moderate entry barriers due to the need for specialized production, material sourcing, and compliance with environmental standards. The market benefits from stable consumer trends but requires constant innovation to meet evolving packaging expectations. Customization remains a defining characteristic, especially in high-value jewellery categories. It responds actively to seasonal spikes and cultural events, reflecting the cyclical nature of the jewellery sector. Players must balance design, cost, and sustainability to remain competitive.

Report Coverage

The research report offers an in-depth analysis based on Material, Product Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for sustainable and eco-friendly packaging materials will continue to rise, influencing design and production practices.

- Customization and personalization will remain central to brand differentiation and customer engagement.

- E-commerce growth will drive the need for durable, protective, and aesthetically pleasing packaging solutions.

- Luxury and premium jewellery brands will invest more in high-end, reusable packaging to enhance the unboxing experience.

- Integration of smart technologies such as RFID tags and QR codes will gain momentum for authentication and customer interaction.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will present new growth opportunities due to rising jewellery consumption.

- Regulatory pressure on plastic use and carbon emissions will encourage adoption of biodegradable and recyclable alternatives.

- Innovation in lightweight and compact packaging formats will help reduce logistics costs and environmental impact.

- Strategic collaborations between jewellery brands and packaging firms will strengthen value-added service offerings.

- The offline channel will remain dominant, but online distribution will see faster growth due to changing consumer buying behavior.