Market Overview

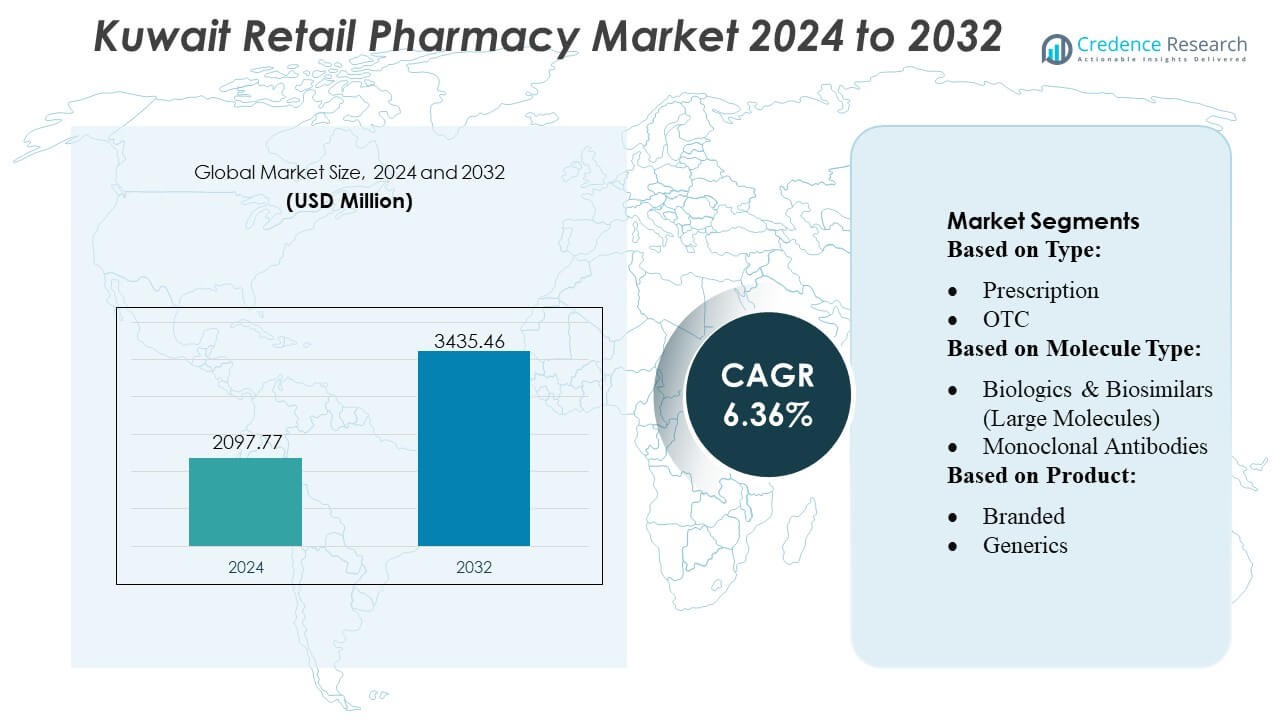

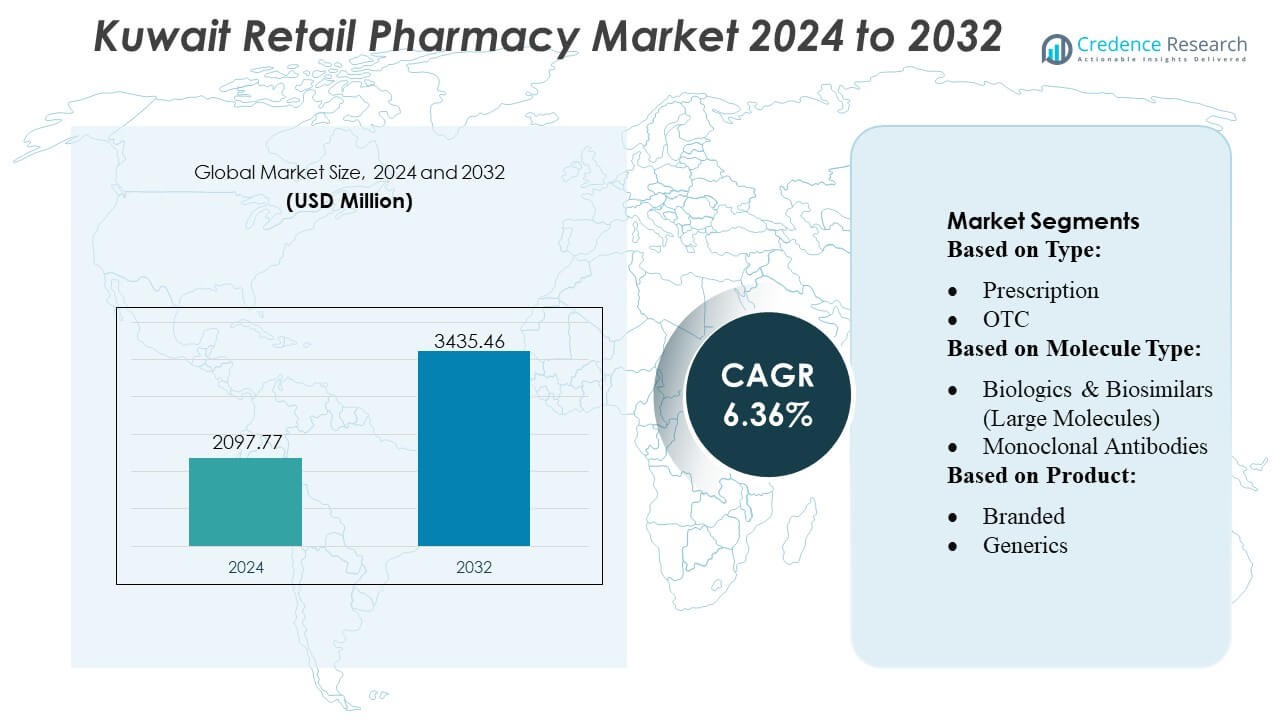

Kuwait Retail Pharmacy Market size was valued USD 2097.77 million in 2024 and is anticipated to reach USD 3435.46 million by 2032, at a CAGR of 6.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Kuwait Retail Pharmacy Market Size 2024 |

USD 2097.77 Million |

| Kuwait Retail Pharmacy Market, CAGR |

6.36% |

| Kuwait Retail Pharmacy Market Size 2032 |

USD 3435.46 Million |

The Kuwait Retail Pharmacy Market is shaped by a mix of multinational pharmaceutical suppliers, regional distributors, and large domestic pharmacy chains that drive product availability, therapeutic depth, and service innovation across the country. Major companies supplying the market—along with strong local retail operators—support wide access to chronic-care medications, specialty drugs, and wellness products. Competitive dynamics intensify as pharmacies expand digital ordering, e-prescription fulfillment, and home-delivery services to strengthen customer engagement. Kuwait City remains the leading region with an exact market share of 34–36%, supported by its high population density, advanced healthcare infrastructure, and strong demand for branded and specialty therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Kuwait Retail Pharmacy Market reached USD 2,097.77 million in 2024 and is projected to hit USD 3,435.46 million by 2032, advancing at a 6.36% CAGR, reflecting consistent demand for chronic-care therapies and expanding retail pharmacy networks.

- Market drivers include rising chronic disease prevalence, growing insurance-backed prescription spending, and rapid digital adoption through e-prescriptions, mobile ordering, and same-day delivery platforms.

- Key trends focus on expanding specialty drug dispensing, higher uptake of generics, and increasing consumer demand for wellness products, preventive care items, and diagnostic self-testing kits.

- Competitive dynamics intensify as retail chains optimize procurement, expand therapeutic assortments, and strengthen digital capabilities, while independent pharmacies differentiate through personalized counseling and neighborhood accessibility.

- Regionally, Kuwait City leads with a 34–36% market share, followed by Hawalli and Farwaniya, while the prescription segment dominates overall sales, supported by strong demand for chronic-care therapies and branded medications.

Market Segmentation Analysis:

By Type

The Kuwait Retail Pharmacy Market is dominated by prescription medicines, holding approximately 58–60% of total retail pharmacy sales due to strong chronic disease prevalence, rising specialist consultations, and expanding insurance-backed drug purchases. Demand intensifies as pharmacies increasingly integrate e-prescription fulfillment and automated dispensing systems to improve accuracy and workflow efficiency. OTC products capture the remaining share, supported by consumer preference for self-care, rapid access, and pharmacist-guided therapy for common ailments; however, prescription drugs remain the dominant category as regulatory frameworks continue to prioritize controlled therapeutic pathways and structured clinical oversight.

- For instance, Merck & Co., Inc. recently expanded its vaccine manufacturing capability by commissioning new single-use bioreactor suites with 2,000-liter production capacity per unit to support high-precision biologics output, improving batch consistency and accelerating global supply reliability.

By Molecule Type

Conventional drugs (small molecules) maintain the largest market share of 62–65%, driven by widespread use across chronic and acute conditions, established formulary presence, and affordability. Their dominance is reinforced by Kuwait’s high prescription volumes for cardiovascular, metabolic, and infectious diseases. Large-molecule therapies—including biologics, monoclonal antibodies, vaccines, and cell & gene therapies—gain momentum as hospitals and specialty pharmacies adopt advanced treatment protocols, although their overall share remains lower due to higher cost and specialized handling requirements. The accelerated introduction of biosimilars further strengthens access to advanced immunology and oncology therapies, gradually reshaping molecule-mix dynamics.

- For instance, AstraZeneca demonstrated significant biologics manufacturing capability by implementing integrated continuous biomanufacturing (ICB) platforms in its advanced cell-culture facilities. While the company utilizes a variety of scales, including single-use 2,000-liter bioreactors to achieve productivity rivaling large stainless-steel plants, the core innovation lies in the continuous processing itself.

By Product

Branded drugs lead the market with an estimated 66–68% share, supported by strong physician preference, high perceived quality, and deep penetration of multinational pharmaceutical companies across retail channels. Kuwait’s regulatory emphasis on quality-assured imports and its reliance on leading global manufacturers reinforce branded dominance. Generics expand steadily as policymakers encourage cost-effective therapy options and insurers promote substitution to manage expenditure, yet branded products retain a larger share due to patient loyalty and limited domestic manufacturing. Growing chronic disease burden and strong brand equity continue to anchor branded medications as the leading product category.

Key Growth Drivers

1. Rising Chronic Disease Burden Strengthening Prescription Volumes

Kuwait’s increasing prevalence of chronic conditions—including diabetes, hypertension, and cardiovascular disease—significantly elevates demand for long-term prescription therapies. Retail pharmacies experience sustained footfall as patients require continuous medication refills, glucose-monitoring supplies, and cardiovascular drugs. Government-led screening programs expand early diagnosis rates, further boosting prescription-based sales. The shift toward structured disease management, supported by insurance-backed medication plans, enhances adherence and drives recurring revenue. Pharmacies also invest in digital refill reminders and automated dispensing systems, strengthening service efficiency while supporting consistent therapeutic access for chronic-care patients.

- For instance, AbbVie Inc. supports chronic-care treatment continuity through its biologics production network, including its Singapore biologics facility equipped with two 15,000-liter commercial-scale bioreactors that enable high-capacity, consistent output for immunology therapies requiring uninterrupted global supply.

2. Expansion of Health Insurance Coverage and Reimbursement Support

Broader adoption of employer-backed and private health insurance plans increases affordability and accessibility of prescription medicines, accelerating retail pharmacy utilization. Coverage expansion reduces out-of-pocket costs for essential therapies, encouraging patients to adhere to higher-value treatments. Pharmacies benefit from rising reimbursable transactions, faster prescription turnover, and greater demand for chronic disease drugs, specialty therapies, and diagnostic consumables. Streamlined digital claims processing and insurer–pharmacy integration enhance operational efficiency. As Kuwait moves toward strengthening its healthcare financing framework, retail pharmacies gain a more stable and predictable revenue environment supported by insured consumer spending.

- For instance, Bristol-Myers Squibb increased global manufacturing resilience by leveraging its advanced Devens biologics facility, which is a critical part of its global supply network. The site utilizes both traditional large-scale batch processing (e.g., six 20,000-liter bioreactors) for high-volume products like monoclonal antibodies and features a separate, specialized facility dedicated to the rapid, patient-specific manufacturing of personalized cell therapies.

3. Rapid Expansion of Digital Health and Omnichannel Pharmacy Services

Digital adoption—including e-prescriptions, mobile ordering, same-day delivery, and virtual pharmacist support—is reshaping Kuwait’s retail pharmacy landscape. Consumers increasingly demand convenience, prompting pharmacies to implement online storefronts, live medication counseling, and automated order tracking. Government endorsement of digital health workflows accelerates adoption of connected pharmacy models. Omnichannel services strengthen patient engagement by reducing wait times, improving medication availability visibility, and simplifying refill processes. Retail chains investing in integrated inventory management and digital dispensing solutions gain competitive advantages as customer experience becomes a major determinant of pharmacy preference.

Key Trends & Opportunities

1. Growing Shift Toward Preventive and Wellness-Oriented Retail Offerings

Retail pharmacies in Kuwait increasingly broaden their portfolios to include preventive health products, nutraceuticals, diagnostic self-test kits, and wellness supplements. Rising consumer interest in immunity, metabolic health, skincare, and fitness drives demand for premium OTC offerings. Pharmacies leverage this trend by establishing dedicated wellness sections and personalized advisory services provided by trained pharmacists. This shift opens opportunities for cross-selling and higher-margin product categories while reducing dependence on prescription revenues. The wellness-driven model positions pharmacies as holistic health-support hubs beyond traditional drug dispensing.

- For instance, Pfizer recently demonstrated its manufacturing might by producing over 3 billion doses of its mRNA-based COVID-19 vaccine globally in 2021 — a milestone achieved by streamlining the production cycle at its multiple sites, reducing batch turnaround times from 110 to 60 days.

2. Expansion of Specialty Pharmacies and High-Value Biologic Therapies

As Kuwait adopts more advanced treatment protocols in oncology, immunology, and rare diseases, demand for high-value biologics and specialty drugs rises. Retail pharmacies increasingly partner with distributors and specialty-care centers to manage temperature-sensitive biologics, monoclonal antibodies, and biosimilars that require controlled storage and professional handling. This trend creates opportunities for pharmacies to differentiate through clinical counseling, biologic adherence programs, and infusion-support coordination. Growth in specialty therapeutics expands revenue potential, especially for chains capable of developing advanced cold-chain logistics and specialized dispensing capabilities.

- For instance, Novartis significantly strengthened its global supply capabilities by operating more than 30 production sites worldwide and manufacturing over 20 billion treatments in 2024, covering small molecules, large molecules, cell & gene therapies, and radioligand therapies — ensuring a robust, diversified output for global markets.

3. Increasing Localization and GCC-Level Pharmaceutical Collaboration

Kuwait benefits from expanding regional cooperation aimed at strengthening pharmaceutical supply chains and reducing import dependency. GCC joint procurement initiatives, harmonized regulatory standards, and support for regional manufacturing create opportunities for retail pharmacies to secure more stable and cost-efficient product flows. As local and regional producers scale output, pharmacies gain access to competitively priced generics, biosimilars, and OTC items. This environment enhances pricing stability, reduces international supply disruptions, and opens opportunities for partnerships between pharmacy chains and emerging GCC-based pharmaceutical manufacturers.

Key Challenges

1. Heavy Dependence on Imported Pharmaceuticals and Supply Chain Vulnerability

Kuwait imports the majority of its prescription and OTC medicines, leaving retail pharmacies exposed to global supply disruptions, currency fluctuations, and geopolitical constraints. Delays in international shipments can cause stockouts, particularly for chronic-care and specialty drugs. Pharmacies must maintain higher inventory buffers and navigate complex procurement processes, increasing operational costs. Limited local manufacturing capacity restricts pricing flexibility and slows product diversification. Dependence on global suppliers also makes pharmacies vulnerable to regulatory changes in exporting countries, impacting long-term supply reliability.

2. Margin Pressure Due to High Operating Costs and Competitive Pricing

Retail pharmacies face increasing margin compression as competition intensifies across chains, independent outlets, and online platforms. High rental rates, labor costs, and stringent regulatory compliance requirements elevate operating expenses. Price-sensitive consumers shift toward generics and promotional OTC products, limiting premium-margin sales growth. Insurance reimbursement structures further restrict pricing autonomy. Pharmacies must invest in technology, delivery fleets, and digital systems, adding financial strain. Sustaining profitability requires operational efficiency, optimized inventory management, and differentiated value-added services to offset narrowing retail margins.

Regional Analysis

North America

North America holds an estimated 31–33% share of global influence on pharmacy retail models relevant to Kuwait, driven by strong innovation in digital health platforms, automated dispensing, and advanced chronic-care management frameworks. Kuwait’s retail pharmacies adopt several U.S. and Canadian best practices, including e-prescription integration, centralized procurement, and omnichannel fulfillment. Partnerships with North American pharmaceutical suppliers strengthen access to specialty drugs and high-quality branded medications. The region’s leadership in wellness retailing, immunization programs, and personalized care models shapes Kuwait’s service expansion, enhancing operational sophistication and customer engagement.

Europe

Europe accounts for 27–29% of the global reference share impacting Kuwait’s pharmacy standards through strong regulatory frameworks, high-quality manufacturing, and wide availability of branded and generic pharmaceuticals. European suppliers play a central role in Kuwait’s medicine imports, supporting product reliability and compliance with stringent quality protocols. The region’s expertise in biosimilars, vaccines, and chronic disease therapies influences purchasing trends across Kuwait’s retail pharmacies. European retail formats emphasizing clinical counseling, preventive health services, and pharmacist-led interventions contribute to Kuwait’s evolving service delivery model and rising consumer expectations around professional pharmacy care.

Asia-Pacific

Asia-Pacific holds approximately 22–24% of global relevance, driven by its robust generics manufacturing base, expanding biotechnology sector, and cost-efficient pharmaceutical ecosystem that strongly influences Kuwait’s sourcing strategies. India, China, and Southeast Asia serve as major supply hubs for generics, OTC products, and essential medicines widely sold in Kuwait’s retail pharmacies. The region’s advancements in digital pharmacy platforms, rapid delivery ecosystems, and teleconsultation technologies inspire Kuwait’s digital transformation. Growing collaborations with Asian manufacturers ensure competitive pricing, improved supply-chain resilience, and broader product availability across chronic-care, acute-care, and wellness categories.

Latin America

Latin America contributes 8–10% to global pharmacy market reference, shaping Kuwait’s retail pharmacy sector through competitive generics production, expanding nutraceutical capabilities, and efficient distribution practices. Brazil and Mexico serve as emerging pharmaceutical export partners, providing select generics and OTC formulations. Kuwait’s pharmacies increasingly evaluate sourcing from Latin American manufacturers to diversify supply chains and reduce dependency on traditional markets. Retail formats in the region—particularly wellness-focused chains and community pharmacy networks—offer operational insights for Kuwait’s growing focus on preventive health, value-oriented product assortments, and neighborhood-based service accessibility.

Middle East & Africa (MEA)

The Middle East & Africa region holds 12–14% of global reference influence, with Gulf countries—especially Saudi Arabia and the UAE—shaping pharmacy network expansion, regulatory alignment, and regional procurement strategies that directly impact Kuwait. Shared health priorities, joint Gulf regulatory initiatives, and collaborative pharmaceutical supply programs improve product availability and pricing stability across Kuwait’s retail pharmacies. Growing regional manufacturing of generics and biosimilars supports affordability. Pharmacy service innovations in the GCC—such as digital prescriptions, wellness clinics, and home-delivery programs—further accelerate Kuwait’s retail pharmacy modernization and consumer-centric service models.

Market Segmentations:

By Type:

By Molecule Type:

- Biologics & Biosimilars (Large Molecules)

- Monoclonal Antibodies

By Product:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Kuwait Retail Pharmacy Market is shaped by leading global pharmaceutical companies such as GlaxoSmithKline plc, Merck & Co., Inc., AstraZeneca, AbbVie Inc., Bristol-Myers Squibb Company, Sanofi, Pfizer Inc., Johnson & Johnson Services, Inc., Novartis AG, and F. Hoffmann-La Roche Ltd. the Kuwait Retail Pharmacy Market is defined by strong interplay between large pharmacy chains, independent community pharmacies, and emerging digital platforms that compete through service differentiation, product depth, and operational efficiency. Retail chains leverage centralized procurement, integrated inventory systems, and broader therapeutic assortments to secure pricing advantages and ensure consistent drug availability. Independent pharmacies maintain competitiveness through personalized counseling, neighborhood accessibility, and flexible service models. The growing influence of e-pharmacy services—supported by mobile ordering, home delivery, and e-prescription workflows—intensifies competition by shifting consumer expectations toward convenience and rapid fulfillment. Market participants increasingly invest in chronic disease management programs, wellness portfolios, and value-driven generics to meet evolving patient needs. Rising insurance penetration, demand for specialty drugs, and expansion of clinical support services further shape competitive dynamics, pushing pharmacies to upgrade digital capabilities and strengthen patient engagement strategies to retain market share.

Key Player Analysis

- GlaxoSmithKline plc

- Merck & Co., Inc.

- AstraZeneca

- AbbVie Inc.

- Bristol-Myers Squibb Company

- Sanofi

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Hoffmann-La Roche Ltd

Recent Developments

- In March 2025, Daiichi Sankyo introduced its DATROWAY is the first ever TROP2 directed medicine to be launched in Japan for HR positive, HER2 negative breast cancer and is the second DXd (HR) positive, HER2 negative (IHC 0, IHC 1+ or IHC 2+/ISH-) unresectable or recurrent breast cancer after prior chemotherapy.

- In January 2025, Walmart Inc. completed the rollout of its same-day non-refrigerated pharmacy delivery service to 49 states, integrating it with existing grocery and general merchandise delivery options. This strategic advancement was developed in response to customer feedback (specifically, over 55% of surveyed customers requested the combined delivery option) and allows for eligible prescriptions to be delivered in a single online order along with other household items.

- In January 2025, AstraZeneca Pharma India Limited launched Breztri Aerosphere to treat Chronic Obstructive Pulmonary Disease (COPD). This triple-combination inhaler is now available for adult patients in India to help relieve symptoms and prevent flare-ups, marking a significant advancement in COPD treatment options in the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Molecule Type, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as chronic disease prevalence increases and drives sustained prescription demand.

- Digital pharmacy adoption will accelerate through e-prescriptions, mobile ordering, and same-day delivery services.

- Retail chains will strengthen dominance by investing in automation, smart inventory tools, and centralized procurement.

- Expansion of private insurance coverage will boost accessibility to higher-value therapies.

- Specialty drug dispensing will grow as demand rises for biologics, oncology medicines, and advanced immunology treatments.

- Pharmacies will diversify revenue through wellness products, preventive health services, and diagnostic self-testing kits.

- Generics adoption will increase as cost efficiency becomes a priority for patients and insurers.

- Regulatory alignment with GCC standards will improve quality assurance and supply-chain stability.

- Pharmacist-led clinical services will expand, including counseling, medication therapy management, and vaccination support.

- Omnichannel retail models will reshape competition by integrating in-store, digital, and home-based pharmacy services.